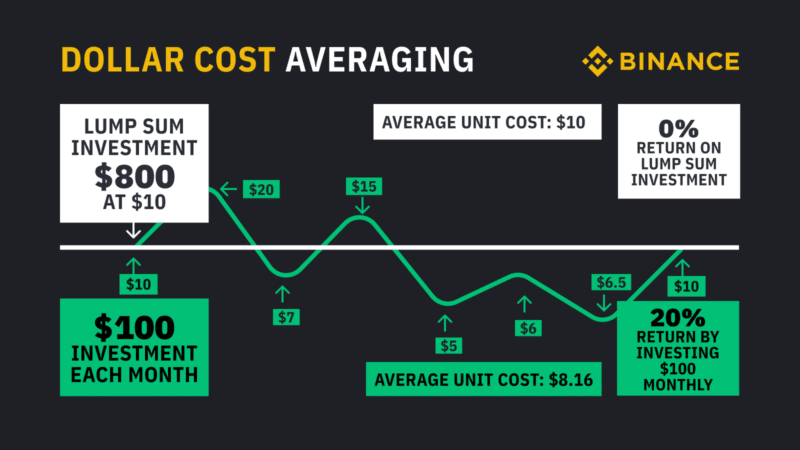

When faced with the volatile nature of cryptocurrencies, investors have an ongoing dilemma – exit the position or ‘HODL’. Those investors in it for the long run, will simply look to hold on to their cryptocurrencies with the hope that in the not-too-distant future they will appreciate and be worth significantly more.

Until then, the coins would typically remain idle in a private wallet – resulting in opportunity costs along the way. After all – and much like gold, Bitcoin and many other cryptos do not yield any income.

With this in mind, Nexo has created an online platform that allows you to earn interest by depositing your digital currencies. In turn, this will then be loaned out to those that wish to engage with crypto-loans. Today, the company presents itself as a crypto-fiat finance service that offers a variety of distinct features to meet the needs of both investors and borrowers.

In my Nexo review, I explore the ins and outs of how the platform works. This will include a breakdown of the interest-yielding service and an analysis of a number of other key features found on the platform.