Viainvest is a European P2P lending platform that connects investors with borrowers seeking short-term consumer loans. The platform aims to provide investors with an easy and secure way to invest in consumer loans, offering attractive returns and a simple, user-friendly experience.

Launched in 2016 and based in Latvia, Viainvest is part of the VIA SMS Group, which operates in several European countries, including Sweden, Poland, and the Czech Republic. The group has been operating successfully since 2009, and this undoubtedly contributes to Viainvest’s trustworthiness.

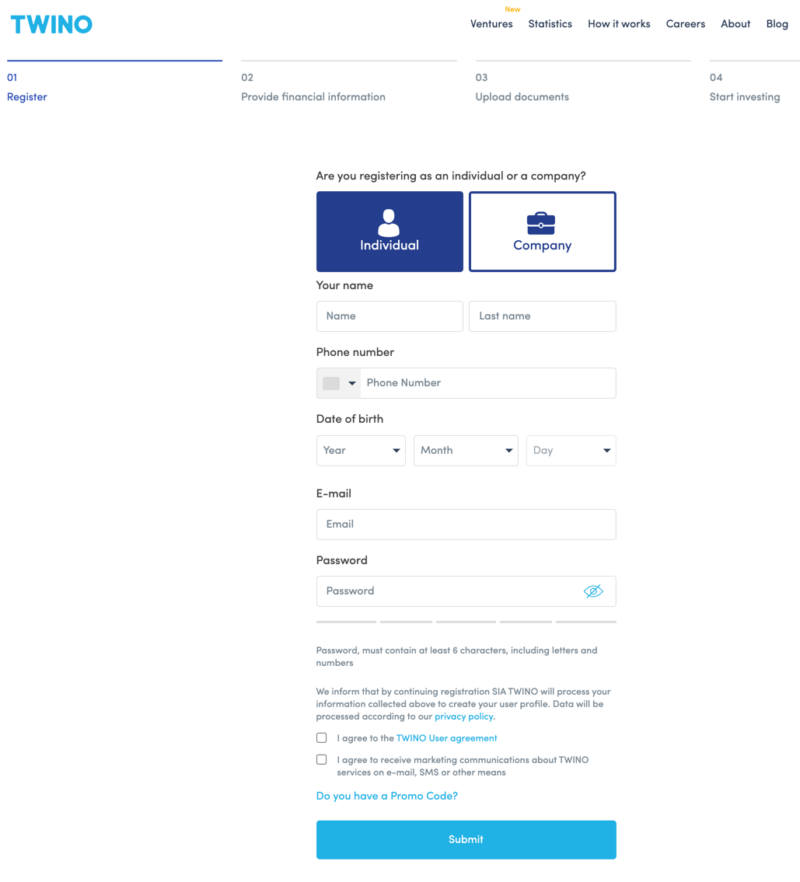

Account Opening and Verification

One aspect of Viainvest that I found appealing was the ease of opening an account. The registration process is straightforward and can be completed within a few minutes. You simply need to provide some personal information, verify your identity, and link a bank account to start investing. This hassle-free process makes it convenient for new investors to join the platform and begin exploring the investment opportunities available.

User Interface and Experience

After my account was verified, I gained access to Viainvest’s platform dashboard. I found the user interface to be clean and easy to navigate, making it simple to manage my investments. The platform offers a seamless user experience, with clear navigation menus and quick access to essential features, such as the loan listings, portfolio overview, and transaction history.

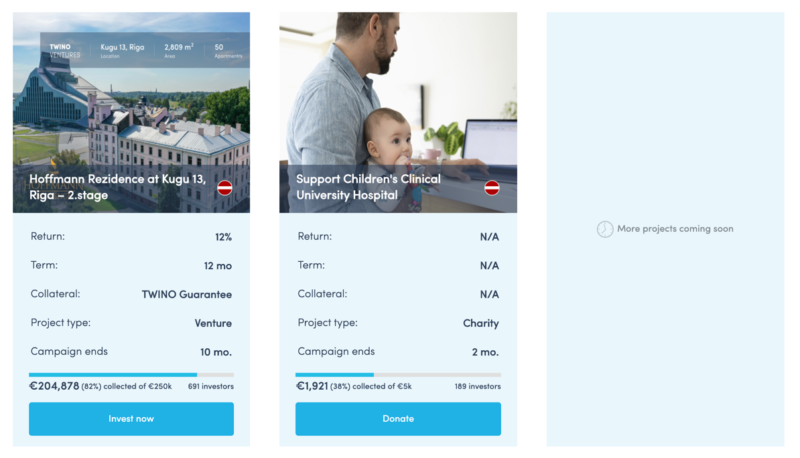

Investment Options

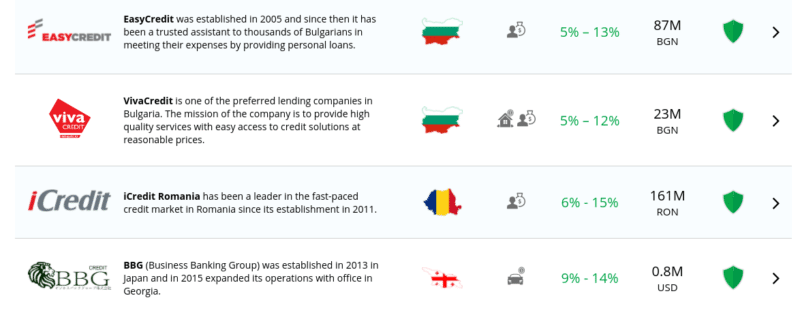

Viainvest focuses on short-term consumer loans, which typically have a duration of 30 days or less. The loans are issued by VIA SMS Group’s lending subsidiaries, ensuring a transparent and easy-to-understand investment process. Most of the loans on Viainvest come with a buyback guarantee, which means that if a loan becomes more than 30 days overdue, the loan originator repurchases the loan from the investor, providing an additional layer of security.

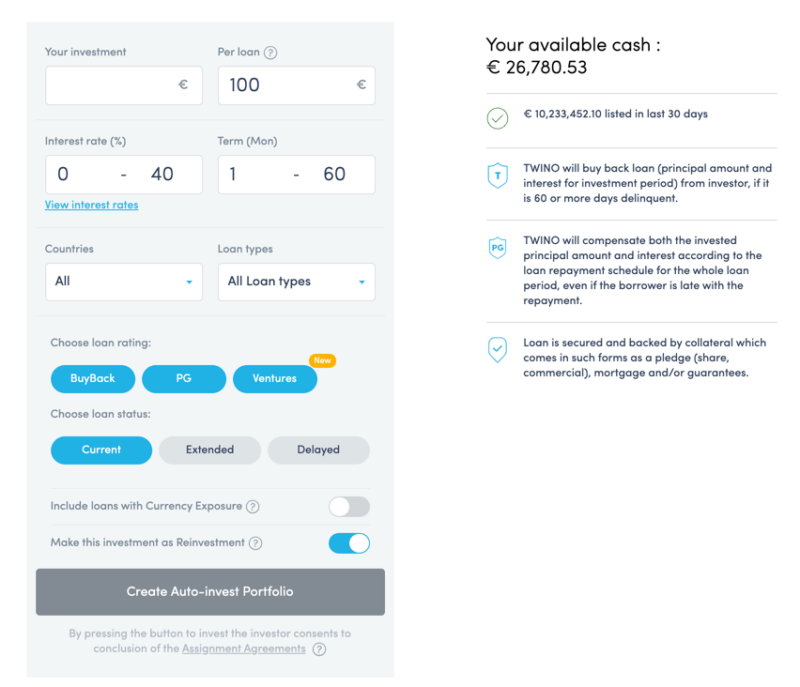

Auto Invest Feature

To simplify the investment process, Viainvest offers an Auto Invest feature that automatically invests available funds according to my chosen criteria, such as loan duration, interest rate, and maximum investment per loan. This feature allowed me to save time and ensure that my funds were consistently invested without the need for manual intervention. Additionally, I could easily adjust my Auto Invest settings whenever I wanted to modify my investment strategy.

Returns and Risks

Viainvest advertises average annual returns of around 12%, which I found to be competitive within the P2P lending market. However, as with any investment, there are inherent risks involved. In the case of P2P lending, the primary risk is borrower default. Viainvest mitigates this risk through its buyback guarantee, which, as mentioned earlier, provides an additional layer of security for investors. It’s essential to keep in mind that the buyback guarantee is dependent on the financial stability of the loan originator, so it’s crucial to assess the overall creditworthiness of the platform and its affiliated lending companies.

Secondary Market and Liquidity

One aspect of Viainvest that I appreciated was the presence of a secondary market, allowing investors to buy and sell their loan investments before the loans reach maturity. This feature can be particularly helpful for those looking for increased liquidity or wanting to adjust their portfolio quickly. However, it’s essential to note that the secondary market’s liquidity depends on the demand from other investors, and there’s no guarantee that you’ll be able to sell your loans immediately or at the desired price.

Transparency

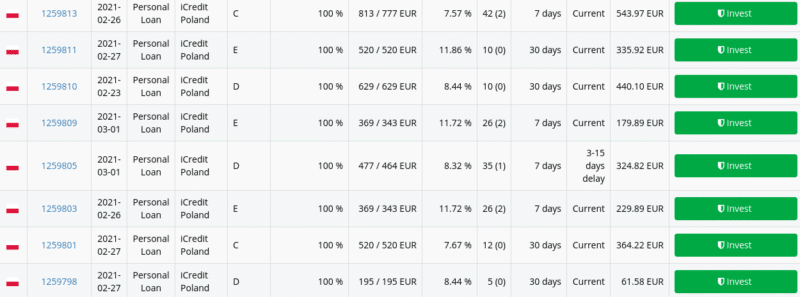

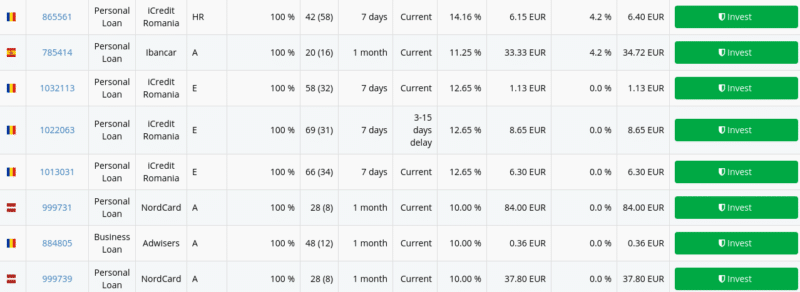

One aspect of Viainvest that I appreciated is the platform’s transparency. Viainvest provides detailed information about each loan, including the loan originator, borrower’s credit score, and loan purpose. This level of detail enables investors to make informed decisions about their investments and helps build trust in the platform.

Moreover, Viainvest is transparent about its fees, which are relatively low compared to other P2P lending platforms. The platform does not charge investors any fees for using its services, which means that you can keep more of your earnings.

Loan Diversification

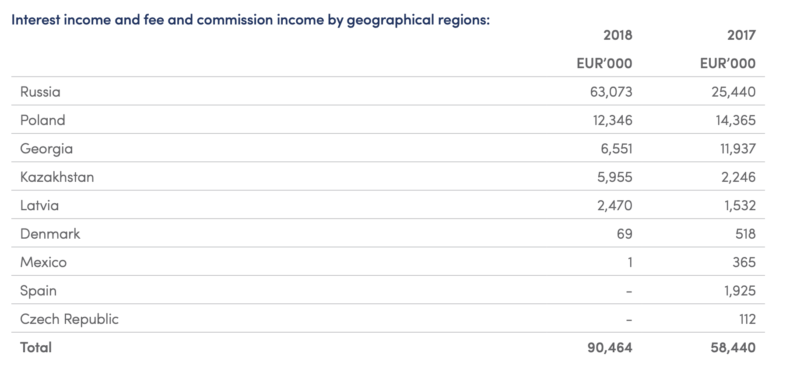

Although Viainvest primarily focuses on short-term consumer loans, I found that there’s still some room for diversification within the platform. Viainvest offers loans from different countries, such as Latvia, Poland, and Spain. By investing in loans from various countries, I was able to spread my risk geographically and reduce the potential impact of local economic fluctuations.

On the other hand, it’s worth noting that the platform’s focus on short-term consumer loans may limit the extent of diversification across different loan types and industries. If you’re looking for a broader range of investment options, you may want to consider alternative platforms that offer loans across various sectors.

Customer Support

Throughout my experience with Viainvest, I found their customer support to be responsive and helpful. Whenever I had a question or needed assistance, I could reach out to their support team via email or live chat. They were quick to respond and provided clear, concise answers to my queries.

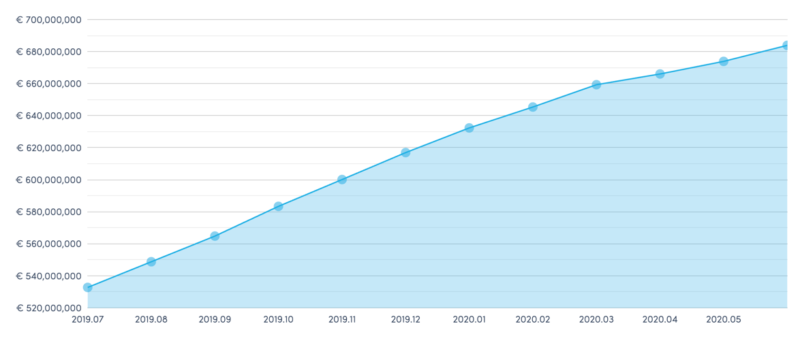

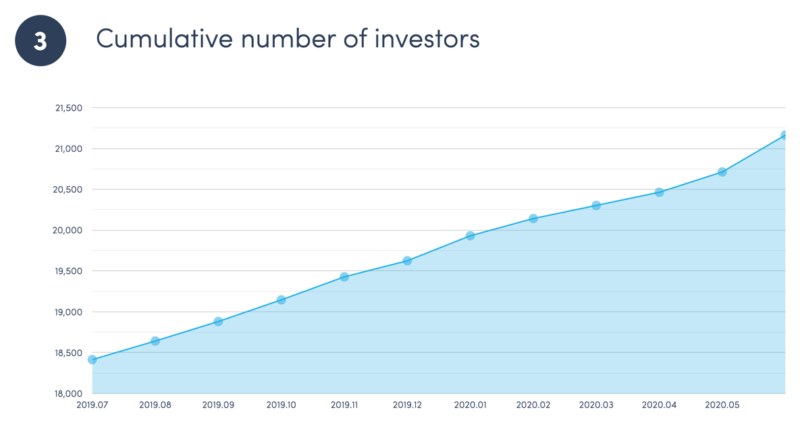

Financial Performance and Growth

An important aspect to consider when evaluating an investment platform is its financial performance and growth. In the case of Viainvest, the platform has demonstrated consistent growth in both the number of investors and the volume of loans funded. This indicates a growing interest in the platform and a strong performance in the P2P lending market.

Furthermore, Viainvest is part of a profitable group, the VIA SMS Group, which has been financially stable since its inception. This stability further reinforces the platform’s reliability and attractiveness for investors seeking a secure investment environment.

Tax Reporting

Viainvest also simplifies the tax reporting process for its investors by providing an annual tax report. This report includes all the necessary information for investors to report their earnings to their respective tax authorities, making tax filing a less daunting task. The convenience of having this information readily available is a valuable benefit for many investors.

What I Like About Viainvest

- User-friendly interface: Viainvest’s platform is easy to navigate and manage, making the investment process smooth and efficient.

- Attractive returns: With average annual returns of around 12%, Viainvest offers competitive returns within the P2P lending market.

- Buyback guarantee: Most loans on Viainvest come with a buyback guarantee, providing an additional layer of security for investors.

- Auto Invest feature: The platform’s Auto Invest feature simplifies the investment process and allows for easy portfolio management.

- Secondary market: The presence of a secondary market provides investors with increased liquidity and flexibility.

What Could be Improved at Viainvest

- Limited diversification: Viainvest primarily focuses on short-term consumer loans, which may limit opportunities for diversification across different loan types and industries.

- Dependency on loan originators: The buyback guarantee is dependent on the financial stability of the loan originators, which may pose a risk if the originator faces financial difficulties.

- Currency risk: As Viainvest operates in multiple European countries, investors may be exposed to currency risk when investing in loans denominated in different currencies.

Alternative Platforms

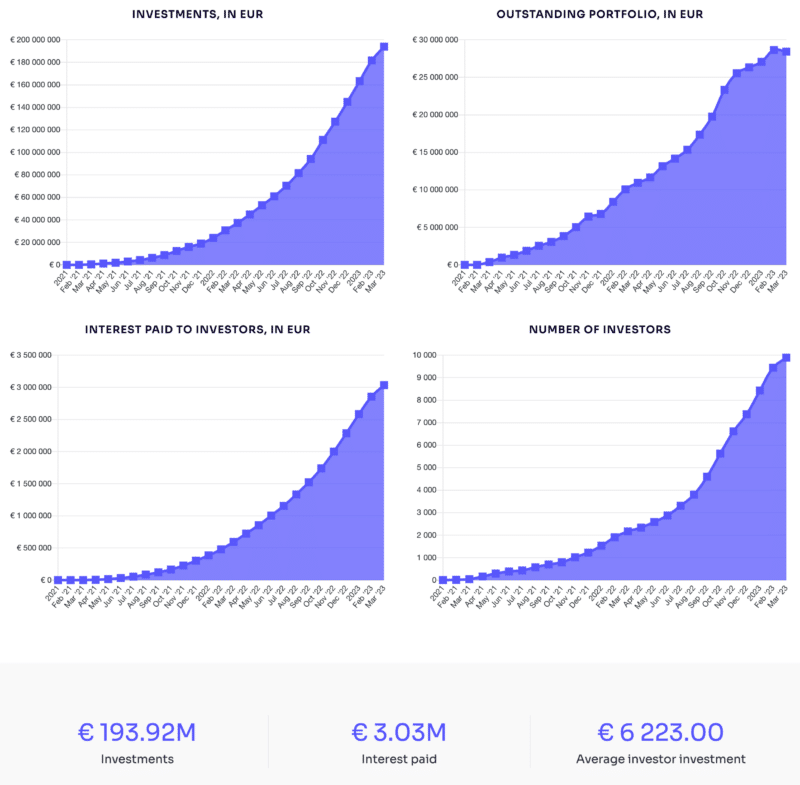

For investors interested in comparing Viainvest with other P2P lending platforms, here are a few alternatives to consider:

- Mintos: Mintos is a leading European P2P lending platform that offers a wide range of investment opportunities, including consumer, business, and real estate loans. With a large number of loan originators and a secondary market, Mintos provides an opportunity for increased diversification and liquidity.

- PeerBerry: PeerBerry is another popular P2P lending platform in Europe that focuses on short-term consumer loans. The platform offers competitive returns, a buyback guarantee, and an Auto Invest feature.

- Bondora: Bondora is an established P2P lending platform that provides investors with various investment options, including consumer loans and a unique “Go & Grow” feature that allows for simple, low-risk investing with instant liquidity.

- Estateguru: For investors looking to diversify into real estate-backed loans, Estateguru is a solid option. The platform offers secured loans with attractive returns and a user-friendly interface.

Conclusion

Taking into account the stability and longevity of Viainvest as part of the VIA SMS Group, the platform’s transparency, and the opportunity for some level of diversification, my experience with Viainvest has been overall positive. While there are some limitations in terms of diversification and dependency on loan originators, Viainvest remains an attractive option for investors looking to explore P2P lending. If you’re considering investing in P2P lending platforms, Viainvest is a solid choice with competitive returns and an easy-to-use interface.