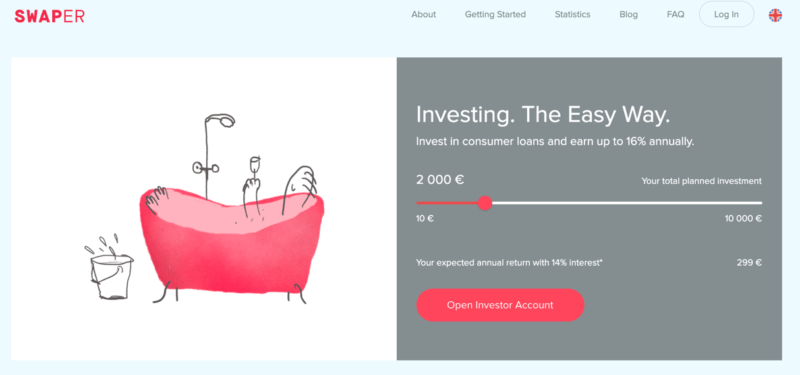

Since its launch in 2013, Kviku has established itself as a relatively successful P2P lending platform. In fact, those that are familiar with fintech solutions – such as Mintos, Peerberry and Swaper, might have already come across the name Kviku.

Since its launch in 2013, Kviku has established itself as a relatively successful P2P lending platform. In fact, those that are familiar with fintech solutions – such as Mintos, Peerberry and Swaper, might have already come across the name Kviku.

To give you an introduction, Kviku Finance is an investment platform that is part of the wider Kviku Group. The lending portfolio of its P2P arm is financed through independentfunds, as well as independentinvestors.

In this review, I take a closer look at what Kviku has to offer. This includes the types of P2P loans you will be financing, what interest yields are available, and crucially – how safe your capital is.