Contents

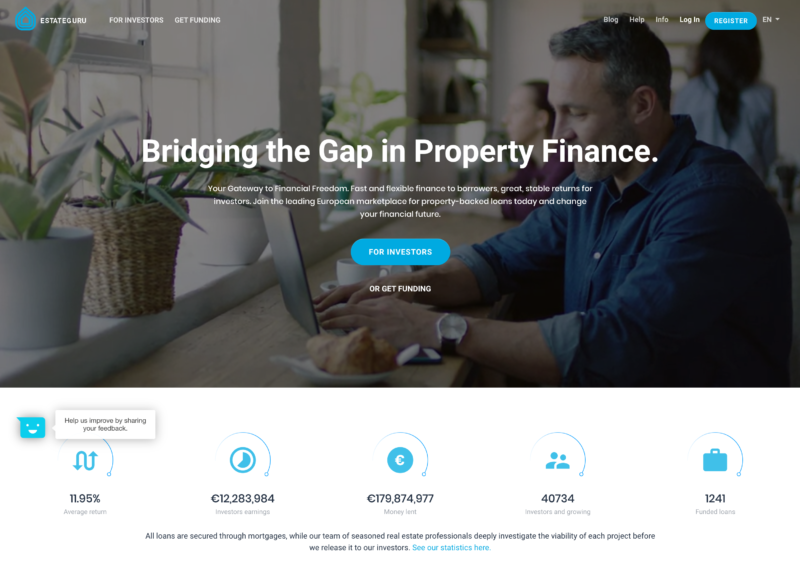

EstateGuru is one of the leading European P2P platforms for short-term, property-backed loans. Founded in Tallin, Estonia, in 2014, Estate Guru now also has satellite offices in Latvia, Lithuania, the UK, and Finland.

EstateGuru is one of the leading European P2P platforms for short-term, property-backed loans. Founded in Tallin, Estonia, in 2014, Estate Guru now also has satellite offices in Latvia, Lithuania, the UK, and Finland.

“A short-term loan from EstateGuru is designed to meet a variety of niche needs with which traditional financial institutions are often unwilling or unable to assist property developers”

The aim behind the company is to provide everyone, regardless of where they come from, with the opportunity to invest in real estate from as little as €50.

What is interesting and different from platforms such as PeerBerry and Swaper is that EstateGuru offers investors and borrowers loans based exclusively on real estate, and more importantly, loans are only given to businesses, not private individuals. At present, only companies registered in and with a bank account in Estonia, Latvia, Lithuania, Spain, Finland, and Ireland are allowed to borrow through the platform.

Over the past 6 years, EstateGuru has developed an average return of 11.95%, on par with Mintos. With over 1,000 funded loans worth over €170,000,000 granted and 48,000 investors worldwide, this platform is certainly one to look out for.

Here are a few notable achievements of this platform:

- EstateGuru has funded more than €200 million worth of real estate backed loans in 7 countries – Germany, Finland, Estonia, Latvia, Lithuania, Spain, Portugal and earned investors €14 million in interest;

- Revenue earned in 2019 is €2.5 million, Q1 2020 revenue is €0.94 million (2.5x growth compared to Q1 2019);

- EstateGuru is operating profitably;

- Successful pre-A round with VC fund Speedinvest in 2018;

- Repetitive investor rate 90%, repetitive borrower rate 50%;

- €100+ million of assets under management;

- Market-leading returns – average historical annual return for platform’s retail investors has been 11.8% and as of today, loss of capital on the platform is €0;

- Successful cooperation with multiple institutional investors, most prominent being Varengold bank from Germany;

- Largest alternative property lender in continental Europe (Brismo.com);

- Having started in Estonia – the most digital society in the world – 90% of EstateGuru’s core processes are automated and digitalized. This helps enable them to cost-efficiently expand business to new markets using agile processes;

- EstateGuru has operating licenses in Lithuania and the UK (FCA p2p lending license);

- First API connection with a traditional bank (LHV) that enables its users to see their EstateGuru profile directly from the LHV banking interface;

- Nominated three years in a row (2017-2019) as top 100 Proptech in Europe by Real Estate Innovation Network;

- EstateGuru was nominated Top 3 Best Fintechs in 2019 by German-Baltic Chamber of Commerce;

- International team of 44 experts.

⚙️ How does EstateGuru Work?

EstateGuru requires a minimum of €50 to start investing in real estate projects operating in 6 countries: Estonia, Latvia, Lithuania, Spain, Finland, and Portugal. This minimum amount is significantly higher than other crowdlending platforms such as Mintos.

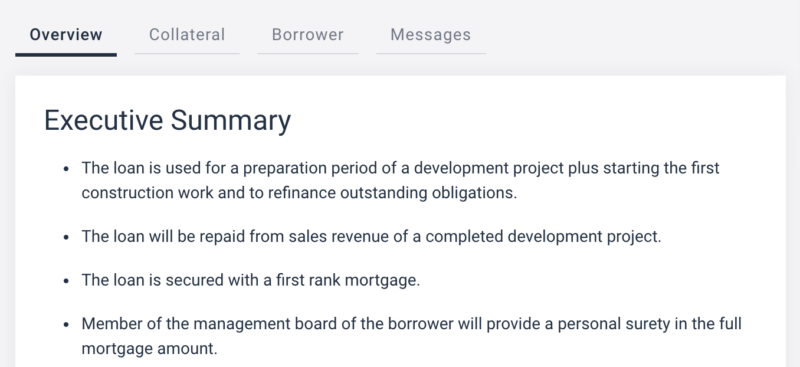

The platform obliges builders, developers or owners to present a business plan and an exit strategy which is reviewed in detail. Once this is approved by EstateGuru’s risk experts, the project is released on the platform and made available to its investors.

Once the loan is fully funded, the contracts are signed and the funds are released to the borrower. Each loan is secured with a mortgage, usually a first rank one (93%).

The upside for borrowers is that through EstateGuru, they get access to funds up to 5 times faster than through traditional banking procedures and at better rates than those provided by standard non-bank lenders.

Should the syndication period, the length of time that a loan can be open to investors on the platform, expire before it reaches its target loan, all funds are returned to the investors’ virtual accounts.

EstateGuru’s business model is to finance projects which have solid collateral, using first-rank mortgages, which is the most straightforward and secure type of funding in real estate lending.

Real estate is currently regarded as the best kind of collateral since it is something utterly physical and visible. EstateGuru also uses residential real estate as collateral. The rationale here is that people will always need a home and place to live, so the demand for real estate is not going to suddenly disappear. The value might fluctuate, but long-term it’s always going to be there. On the other hand, for example, a company can go bankrupt and thus its value will go down to zero with no chances of ever recovering. Hence it is a much weaker form of collateral.

How Does EstateGuru Make Money?

The majority of the company’s revenue (80%) is generated from success fees and administration fees paid by the borrowers upon funding process success and during the loan term. The success fees typically range between 2.5-4% which is calculated from the funded loan volume. The current annual administration fee is in the range of 0.5-1%.

Additionally, the company earns revenue from all transactions that occur on the secondary market – a 2% fee is applied to the investor who sells a claim on the secondary market.

As the company’s strategy entails securing more institutional capital (just under 10% of loan volume in 2019 vs target 40% in 2020), additional revenue is generated from the interest spread, management and success fees paid by these institutions. EstateGuru believes this source of revenue will start producing an equal contribution to their profit margin as that generated by the success fees from borrowers.

As of June 2020 there is now a €1 withdrawal fee. I feel that it is unnecessary and adds an additional friction point for investors. Most other competing platforms offer free withdrawals, and banks themselves all over Europe are waiving these kinds of fees. Understandably, there’s been considerable investor pushback against this move. I’ve reached out to EstateGuru for their views:

Our goal is to always be as transparent as possible in our communication, which is why we made the initial notification regarding the applicable fee already in February of this year. We considered this notice period reasonable and communicated it repeatedly.

The fee actually covers Lemonway’s integration and administration fees, which means that the fee, which is purely legally enforceable, is not a payout but an administration fee. The wording has been agreed with both the service provider and our lawyers. It is important to mention that the applicable fee is symbolic given the total cost of the change (and most of the cost is covered by EstateGuru itself to keep costs for the investor as low as possible). The methodology for determining and measuring the management fee is determined by the portal operator and we have decided to link it to the payout density in this situation in order to measure investor activity (inevitably the higher applied administrative cost is higher for customers with higher payment frequency). Different fees are also applied by other financial institutions (banks, stock exchanges, payment intermediaries and payment service providers), so the applicable fee is not unprecedented in terms of market nature or amount.Just for clarification, that this is not a fee earned by EstateGuru, but we cover the costs of liabilities arising from regulations. As the regulatory environment has changed, hence the change by us too. EstateGuru bears almost 90% of the real cost of the implemented change, the investor solution covers about 10%. At the end of the day, this is the cheapest possible solution for our investors, as Lemonway is the most affordable solution to offer such a service. And since this obligation will soon be the responsibility of all platforms offering such a service, EstateGuru made this change just one of the first.At the same time, we understand that this may not be suitable for our clients, so the investor is free to choose whether he wants to continue investing.The fee will apply to all withdrawals which are made starting from 10.06.2020.

✍🏻 Registering to EstateGuru

EstateGuru’s website is clean, user-friendly and well-designed. It comes in 5 different languages: English, Estonian, Latvian, German and Russian, with an online chat system available in which team members typically reply within 20 minutes.

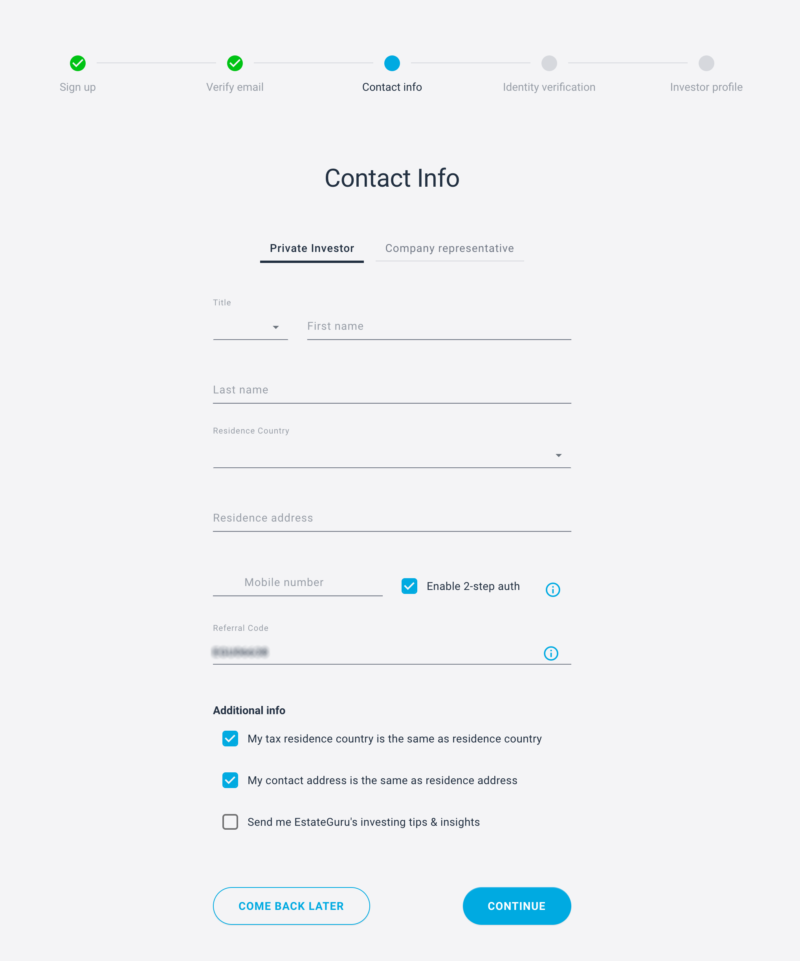

Signing up is fast and requires 5 simple steps to get in and start investing.

The platform allows users to register through email, Facebook or Gmail. I always suggest setting up a specific password for each platform for added security.

Upon verifying the email, simply enter the investor or company representative information. EstateGuru also presents you with the option of 2-step authentication.

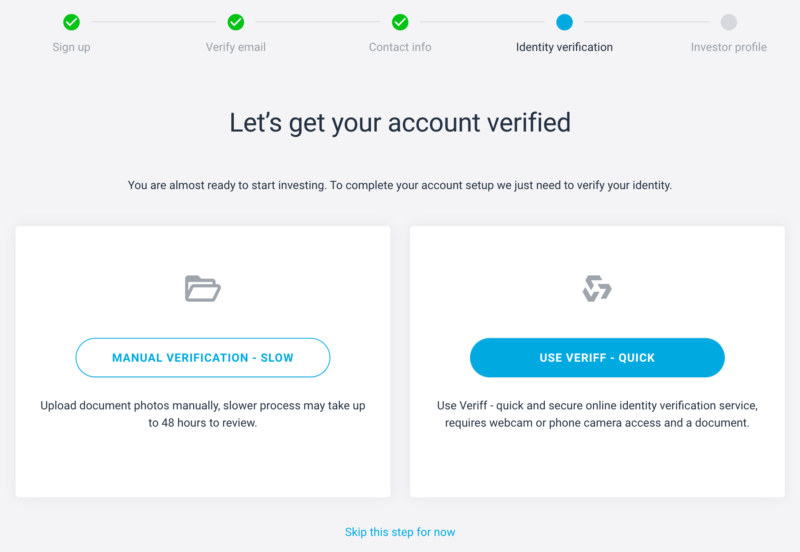

Next, you can either upload your passport, ID card or driving license manually or by using Veriff, an online identity verification system which uses your phone camera or webcam to confirm your identity.

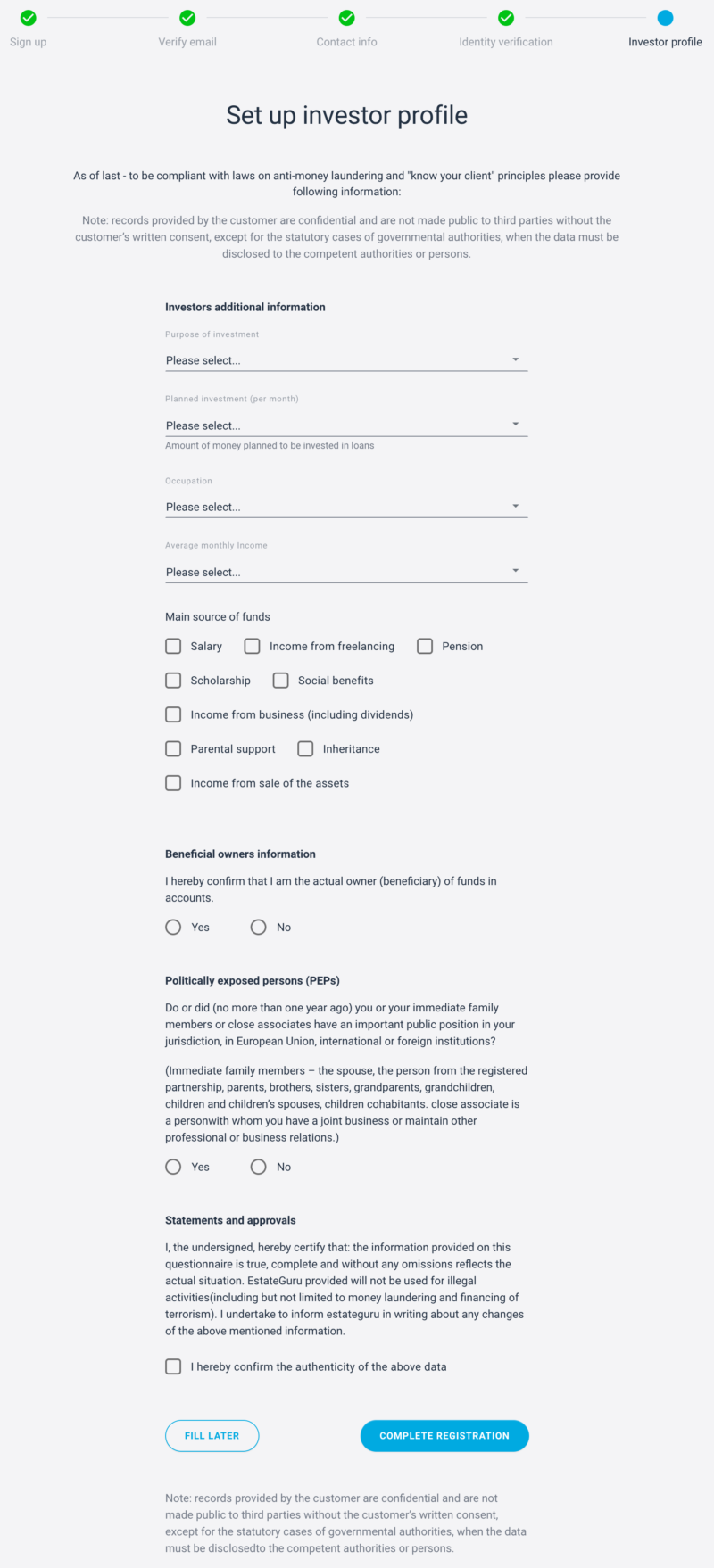

The final step in the registering process is the KYC section. This step is required to be compliant with anti-money laundering laws.

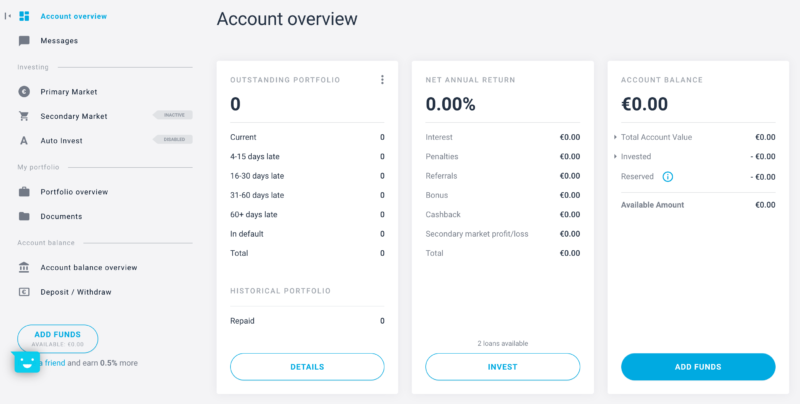

Once your registration is complete, head over to your dashboard for an overview of your portfolio. Here you can submit your first deposit, which must be done via a regular European bank payment transfer (SEPA).

Following your first deposit, EstateGuru allows for transfers via LHV Bank Link, as well as third-party service providers such as Trustly, TransferWise, Revolut, N26, Lemonway, and Paysera.

🏘️ What Can You Invest In?

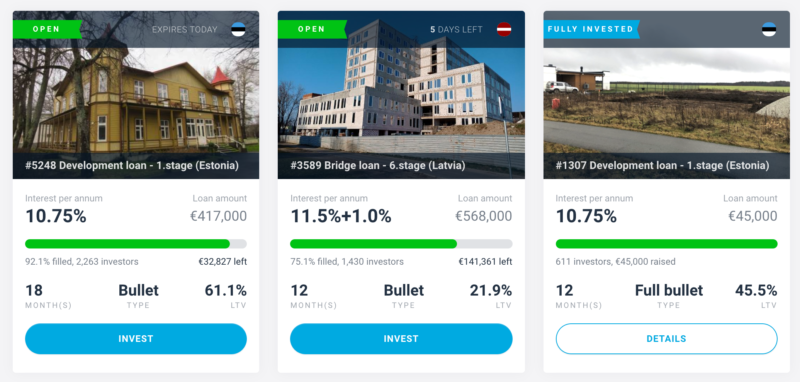

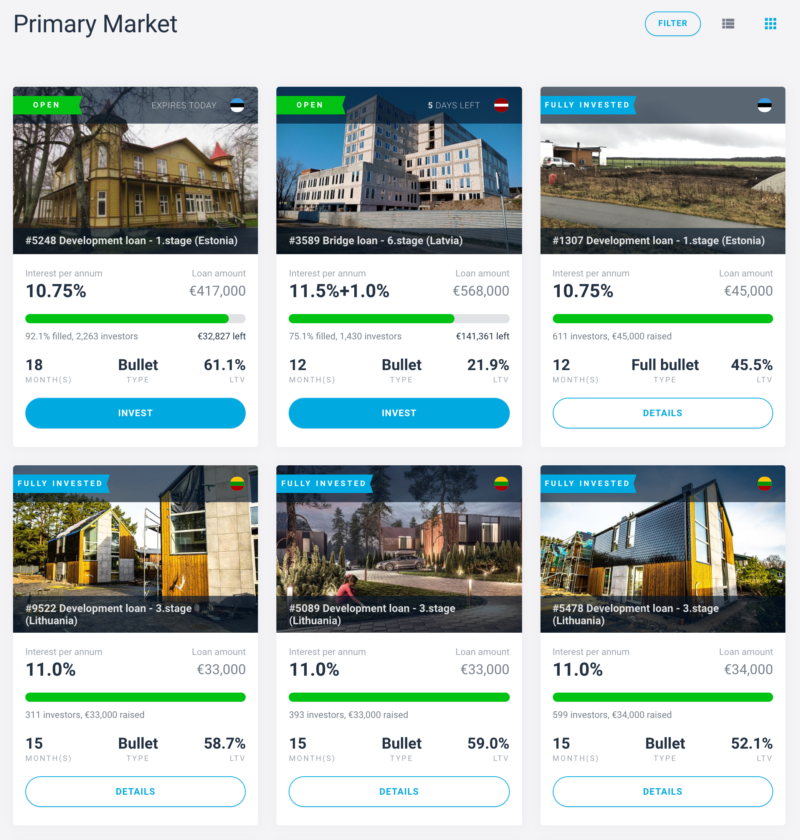

One of the benefits of investing your money in a crowdlending platform such as EstateGuru is that you get to choose which projects you wish to invest in. Their projects are spread over 6 countries and vary between development, bridge, and business loans.

You will notice that certain projects are split up into stages. Since the platform only lends against the current value of the collateral and not the future value, EstateGuru makes use of the stage financing method. By scheduling the project in stages, the borrower can increase the collateral value of the property by developing it further with the acquired funds. In this way, the investment amount increases at each stage of the project, due to the LTV increase.

Conveniently, EstateGuru allows investors to filter by interest rate, LTV, Country and Schedule Type. Schedule Types come in the forms of Annuity, Bullet or Full Bullet, the latter being the riskiest out of the three.

In an annuity-type schedule, both the loan interest and the principal will be paid periodically. In a bullet-type schedule, the loan interest will be paid periodically, with the principal amount being paid at the end of the loan period. Consequently, in a full bullet type schedule, both the interest and the principal will be paid at the end of the loan period.

At the time of this review, their latest investments were presenting higher loan amounts with Bullet type schedules. This shows an increase in higher-risk investments compared to their previous projects.

EstateGuru presents investors with extensive information regarding each project and the borrower.

This includes:

- A general overview of the project

- Loan terms, including the Loan to Value (LTV) rate

- Collateral information

- A description of the commercial market of the respective country

- Borrower information and any previous projects

The project pages provide images of the development, and in some cases, renders of the proposed finished product.

Another great feature is that the address and map for each project are listed on the right-hand side of each project page. This is coupled with an appraisal report.

You will notice that certain projects have an added 1% bonus to their annual interests. This means that the borrower adds this bonus for any investments of €10,000 or more.

With no fees for investors, it is encouraged to diversify your portfolio as much as possible to mitigate risk and maximize returns.

How Secure are These Investments?

EstateGuru employs a business model that places a high priority on security, a conservative approach to risk, liquidity, a focus on short-term loans, and the fact that the real estate market is most likely to suffer less than other industries in this crisis.

Over 90% of the loans offered on EstateGuru’s platform are secured with a first rank mortgage. This means that, in the rare cases where loans go into default, investors are offered great protection against loss of capital.

As an additional layer of security, the average Loan to Value (LTV) level on the platform is below 60%. This buffer means that even a significant drop in real estate values will not impact investors’ capital or the ability to recover principal loan amounts in the case of defaults.

EstateGuru have always been very conservative in terms of risk. They emphasize the fact that they thoroughly analyze every project (borrower, collateral, business plan) no matter how small the loan amount.

Real estate, by its very nature, makes valuation easy and offers a level of predictability that other markets in the P2P industry cannot match. Sending an independent evaluator with local knowledge to a property to determine the viability of the application offers great transparency when EstateGuru determines LTV rates. In addition, they always double-check using Automatic Valuation Models.

EstateGuru’s LTV rates are calculated on the current value of the property, never the projected future value.

As we are seeing, many of the P2P platforms that are struggling generally act as middlemen between investors and loan originators. This adds a murky third layer to the entire exercise and it can be very hard for investors to know exactly who they are funding.

As the P2P market has grown to become a widespread asset class with a proliferation of platforms vying for investments, the number of companies offering this service has grown exponentially.

For their own security, it is vital that investors have a thorough understanding of how the platform operator of their choice has set up its structure and product, with the focus on how the investors’ assets are actually represented. The key differentiators for EstateGuru are:

- All EstateGuru’s investment opportunities are backed by real estate.

- EstateGuru keeps all investors’ assets fully segregated from the company’s own assets.

- EstateGuru has established all loan contracts directly between the borrower and the investor, ensuring that, should anything happen to EstateGuru, all contracts are valid and ongoing.

- EstateGuru has established a security agent structure, according to which the security agent will represent all investors in the transactions. The security agent is an independent SPV controlled by a law firm. If anything were to happen to EstateGuru, the security agent would find a new platform operator to manage the investments until their maturity.

- All investors’ cash assets on the platform are always available – meaning that this is your own virtual wallet, your funds have not been engaged elsewhere and you can freely access your available funds at all times.

- For the third year in a row, EstateGuru will be publishing an audited financial report to all of its investors. EstateGuru’s auditing partner is Ernst & Young. In addition to that, a monthly public overview of the loan portfolio is available. Moreover, investors can access the full loan book on the platform at any time.

🕵️ Transparency

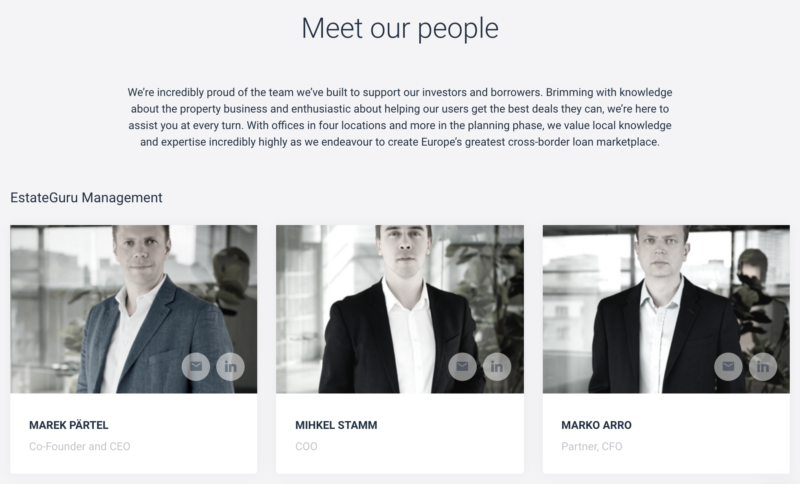

EstateGuru’s CEO and co-founder Marek Pärtel has been involved in the real estate industry since 2002. He is joined by Kristjan-Thor Vähi, who currently acts as a passive co-founder within the platform. Pärtel is also the co-founder of Invego – a property development group, of which Vähi is the Managing Partner.

EstateGuru promotes transparency throughout its website, with statistics and annual reports easily found in their footer section. EstateGuru was very responsive to any questions relating to the people behind the platform, a very good sign for any platform.

The team members behind the platform are all listed, together with their LinkedIn profiles and email addresses. The EstateGuru team consists of finance, banking, IT and real estate experts. Whenever Marek publishes posts on the company’s blog he writes in flawless English and communicates his ideas very clearly. As an investor, I really appreciate having someone like him at the helm of a platform I’m putting my trust in.

🌟 EstateGuru Premium

For investors investing over €100,000 EstateGuru has developed its Premium program. It was created to decrease the syndication period of loans, therefore allowing a loan to be funded much faster. This benefits all investors due to the decrease in cash drag and increase in average return.

Institutional investors in the investing world are usually investors that have big amounts of capital to invest, while retail investors are the rest who invest lower amounts and are not professional investors. EstateGuru demarks the line between the two at €100,000. An institutional investor typically is more demanding and therefore it makes sense for platforms like EstateGuru to have such a premium program. I have been benefitting myself from the Mintos VIP program, after having invested more than €50,000 on that platform.

Here’s what you get when you become a premium investor:

- Pre-notifications of upcoming loans

- Possibility to mark your interest before publishing the loans

- Bonus offers from larger investments

- Free Trustly deposits

- Invitations to EstateGuru’s events

- Personal EstateGuru contact

EstateGuru Premium will not affect the position of the platform’s retail investors – EstateGuru ensures that a suitable proportion of the loan is always leftover for the retail investors.

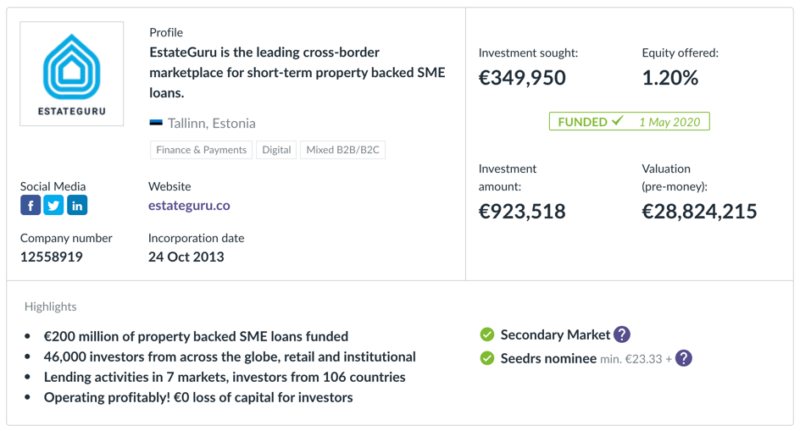

Seedrs Financing Round

In May and June EstateGuru took a bold step to seek funding on the Seedrs platform. They asked for €350,000 but managed to raise €923,518 which is more than 250% the amount asked for. There were over 1,092 investors from 37 countries. The largest number of investors for the financing came from Germany, where EstateGuru also has its largest platform investor community, followed by the UK, Estonia, the Netherlands and Lithuania. The UK is one of the priorities for EstateGuru’s expansion in the near future.

In May and June EstateGuru took a bold step to seek funding on the Seedrs platform. They asked for €350,000 but managed to raise €923,518 which is more than 250% the amount asked for. There were over 1,092 investors from 37 countries. The largest number of investors for the financing came from Germany, where EstateGuru also has its largest platform investor community, followed by the UK, Estonia, the Netherlands and Lithuania. The UK is one of the priorities for EstateGuru’s expansion in the near future.

It never amazes me to see how economically strong Germany is; it seems that investors there are always flush with cash no matter what the economic situation is; and they are always eager for investment opportunities.

As a side note, I think non-German investors would do well to invest in their language skills and learn at least a basic working knowledge of German. I’ve definitely put it on my todo list as I think there are some great opportunities coming up in the next decades and knowing German will definitely give you more access to deals and successful German investors to learn from.

🙋 FAQs

Who can invest in EstateGuru?

Any individual above 18 years of age who has a bank account in any of the EEA member states or Switzerland can invest on the platform.

What is the average LTV?

EstateGuru guarantees an average LTV (Loan to Value) of 60% (max 75%). The LTV is the ratio between real estate value and real estate debt. A property valued at €100,000 with a loan amount of €70,000 results in an LTV ratio of 70%. EstateGuru’s maximum lending rate is 75% and on average it is even lower at around 60%.

What is the project investment period?

Investment periods (the period in which the loan will be repaid) and loan terms for EstateGuru’s selection of real estate projects varies between six months and two years.

What is the difference between a development, bridge, and business loan?

A development loan is a loan used to finance the construction or planning process of a project.

A bridge loan is a short-term loan used until permanent financing is secured, or current obligations met. It provides immediate cash flow required to achieve a specific target, such as enhancing the value of the property or selling the underlying asset.

A business loan is a loan used to cover day-to-day expenses of the firm, acquisition of goods or equipment, business expansion, pending obligations, etc.

All EstateGuru’s loans are secured with a mortgage, regardless of type.

Does EstateGuru have an Auto Invest feature?

Yes, EstateGuru provides an Auto Invest feature starting from €50, with advanced settings available from €250.

Does EstateGuru have a secondary market?

Yes, EstateGuru’s secondary market can be used as a liquidity facility.

Can I invest through my mobile phone?

Although EstateGuru does not have a specifically designed App, the website works well on all devices, so you can keep track of your investments on the go.

Will I be notified of any deal alerts?

EstateGuru allows users to dictate the amount of information being sent through notifications to make the most out of deals on the platform. You can opt for notifications regarding every single investment opportunity that comes up, or take a broader approach with updates at regular intervals. It’s all up to you.

📍Conclusion

EstateGuru is one of the cleanest real estate crowdfunding websites on the scene, and the platform is quite transparent. The number of defaults is quite low and the platform does not show any big red flags, making it a good place to invest in my opinion. It’s a good way to invest in the Baltics, which are a growing market.

It would be an interesting idea to pair EstateGuru (or alternatives like Bulkestate) with property platforms from other countries, such as Rendity in Germany/Austria, Raizers in France, StockCrowdIN and Brickstarter in Spain, and Property Partner and CrowdProperty in the UK, thus obtaining a well-diversified property portfolio.

Summary

EstateGuru is one of the cleanest real estate crowdfunding websites on the scene, and the platform is quite transparent. So far so good with this platform, they have a very low default rate and I think it’s a great option for anyone who wants to build a real estate portfolio by buying through online platforms like this one.

Pros

- Loans are secured by a mortgage registration, with 93% being a first rank mortgage

- Average annual returns of 8-12%

- Broad geographical diversification of development investments in 6 countries

- Auto Invest feature

- Secondary Market

- Transparency

- Great user interface and site design

Cons

- Most recent projects are bullet and full bullet loans, which are riskier than annuity type loans

- €1 withdrawal fee

Hi Jean,

I would not say there are few defaults in this platform, on which figures do you support that statement?

Thank you for your review.

the worst platform I have invested in. lots of late projects…

Late projects can happen on any platform, unfortunately. I am not aware of any malpractice from Estateguru’s side, which is the most important factor for me. When there are late projects, the best way to deal with it is to analyse the reasons for the delays and also speak to Estateguru if you have any concerns about the types of loans they are promoting on the platform.

Please share if you have any concerns that you have discussed with Estateguru and have not received adequate responses to.

Hi Jean!

It would be interesting if you could compare Estateguru to Reinvest24 or as You said, those Baltics platforms with other European platforms.

Thank You for Your blog! Very interesting articles.

Hi Jean

I’d be really interested in an update on strategies. I’ve been investing for 15 months in estateguru, reinvest24, and evoestate (to access primarily rendity and raizers) and I’ve started to up my stake in reinvest and rendity. However estateguru has an alarming amount of late paying loans (note late paying not defaulted). Have you seen this as a trend or is this expected because recovery is good with them?

Thanks Jean, very thoughtful analysis. I’ve been following your reviews about other good investments before (e.g. CoinLoan) and found them well thought-out. Keep up with the good work

Thanks Dario.