As discussed in previous posts, once you’re using PayPal to sell your stuff online, you will also want to eventually withdraw the money you make into your bank account so that you can actually use it. Here’s where things get a bit nasty, unfortunately.

If you have a US bank account and a US PayPal account, you can stop reading right here. You’re in luck. All you have to do is attach your bank account to your PayPal account and withdraw USD from your PayPal account to your bank account. There are no currency conversions to worry about, and the transfer itself is free from PayPal’s side.

If you are the owner of a non-US PayPal account and you don’t have a US bank account, things are not so pretty.

You are given two options (depending on your home country, it might even be just one option):

- Withdraw to a debit or credit card

- Withdraw to your local bank account.

If you sell online you probably use USD as the main currency on your store and hence your PayPal balance will be in USD. What happens is that since your local credit card or bank account are not in USD, an automatic currency conversion takes place on PayPal’s end as the money is on the way out. The conversion rates are bad, to put it mildly. Hence you’re going to lose a lot of money on that conversion.

Withdrawing your funds from PayPal to a debit or credit card can be annoying if you have significant funds. The reason is that you can only withdraw up to $2,500 at one go, and every time you make a withdrawal you are charged $2,50.

So let’s say you need to withdraw $50,000. You will need to go through the withdrawal process 20 times for a total cost of $60. This sounds ridiculous; a time-wasting activity and also a money-grab by PayPal. It is, there’s no other way of looking at it.

The other way of withdrawing is to send the funds directly to your bank account. There are no limits when compared to withdrawing to a card. Sounds like we solved our problem right?

Well, not so fast.

If your bank account is in a different currency than the funds you have stored on PayPal, be prepared to lose a significant amount of money due to PayPal’s horrible exchange rates. PayPal does not let you send, say, USD directly to a EUR-denominated account. This is a limitation on their end, and I suspect an intentional one to fleece their users. There are no such limitations when using other payment gateways such as 2Checkout.

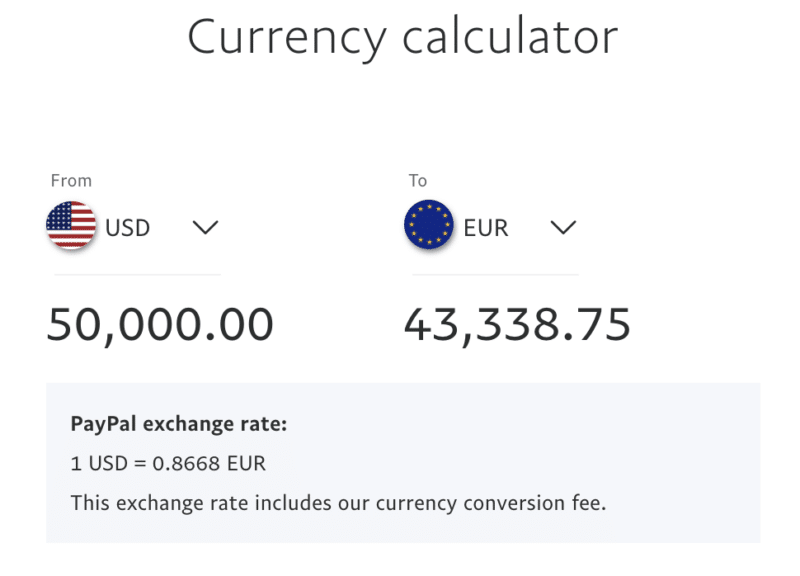

So let’s get back to the $50,000 example. Let’s see what PayPal is ready to offer us in Euros:

So for $50,000 PayPal will offer us €43,338. On the other hand, using the rate from a local bank, I get a significant difference: €43,775. And that’s just a local old-fashioned bank, not one of the dedicated currency conversion companies like Wise.

Wise would, in fact, give us €44,378, more than a €1,000 difference compared to PayPal, while Currencyfair would give us ¢44,332, which is also significantly better than PayPal.

I personally find it unacceptable to drop a thousand euros like that. This is why I will continue to withdraw using the silly method of withdrawing $2,500 at a time, simply because the total cost is still much lower. Using that method, as I showed you in another post, you can get PayPal to send USD directly to your credit card, whatever its currency.

Before we continue, it would be a good move on your end to check whether other services like Wise or Payoneer would be an even better fit for you than PayPal. In general, I recommend trying to find an alternative to using PayPal for whatever you are trying to do, since PayPal has terrible customer support and charges high fees.

Withdrawing to Cards

In the case of cards, you can ask PayPal to switch off automatic currency conversion, and have the conversion happen on your bank’s side, which will give you a better rate. I wrote about how to do this in my earlier post on currency conversion and PayPal. There are still two inconveniences when withdrawing in this manner:

- You will be forced to convert USD to your home currency upon withdrawal.

- There is a limit per transaction of $2,500, and an associated fee per transaction.

These two points are problematic. Let’s say that your home currency is in a weak position and you would therefore store money in USD and convert later when things improve. You cannot do this as you can’t do a straight through USD-USD transfer, given that your card will be denominated in the local currency. You can open a local bank account in USD but you won’t be able to get a card associated with it. At least that’s the case with all the banks I’ve checked so far. If you find a bank that lets you do that, please leave a comment and let me know.

The limit per transaction poses some obvious problems. Let’s say you are a high-volume seller and you want to withdraw $100k per month from PayPal. You will have to make 40 separate transactions and you will be charged for every single one of them. Of course, all you ever wanted to do is one transaction, if only PayPal let you do that. Apparently, this limit per transaction is dictated by the card providers (for example MasterCard or Visa). Still, it’s not convenient for serious sellers.

If your bank does not provide good conversion rates, remember that some PayPal users have had success linking their PayPal account to digital banks such as Revolut, Wise and N26. They typically provide much better rates than your local bank. You might want to give that a shot since opening an account with these digital banks is free anyway.

Note that as from April 2020 the $2,500 limit seems to have been modified, as I have been able to make significantly bigger transfers to the debit card. I’m not sure if this is a glitch or whether something really changed from PayPal’s end.

Buying Crypto with PayPal

Did you know you can now buy crypto with PayPal? That’s right, you can use Binance since it accepts PayPal deposits. Just hit the links below to get started.

You can also read my full review of Binance to learn more about this crypto exchange.

This withdrawal method is extremely popular at the moment, as people worldwide seek to get themselves some Bitcoin or Ethereum due to their extremely bright future price prospects.

Withdrawing to a Local Bank Account

Withdrawing to a local bank account does not present any limits, so you can pull out that $100k without any problems at one go, however, you will be hit by PayPal’s bad exchange rate plus currency conversion charges. It is usually easy to open a USD account with your local bank, the big problem is that PayPal will not allow you to transfer USD from your PayPal balance into your local USD account if you are based in Europe, as they consider all European bank accounts as Euro-based.

Note that in April 2020 I was able to add a USD account to my PayPal business account, so there seems to be a way to get a non-Euro bank account added. I had to ask PayPal to add it manually, as the link in the dashboard did not let me do it. I will be testing a few withdrawals with this method and will update the section below if I see that it becomes more advantageous to withdraw to the USD bank account instead of the debit card.

Real Example – Withdrawing to Card vs Local Bank Account

As an example at the time of writing this article, if you transferred $10k out of PayPal via a bank transfer to a local bank in Malta (the country where my bank is account is located in), you would have ultimately received €8,839 in the bank account. My bank does not charge any fees for currency conversion.

On the other hand, if you were to withdraw that same $10k out of PayPal to a debit/credit card linked to the same account, you would get €8,911. That amount is after deducting PayPal’s card withdrawal charge ($2.50/€2 per withdrawal, up to a max of $2,500 per withdrawal; hence four withdrawals would be needed in this case to get $10k out).

The local bank was using 0.8921 as the exchange rate between USD and EUR.

PayPal, on the other hand, was using 0.8839, a significantly different rate.

PayPal includes the charges within the exchange rate, so if you accuse them of having a really bad exchange rate their excuse will be that it includes the currency conversion fees.

At the end of the day then, we would be better off when withdrawing to a card by €72.

Not that small of an amount, especially if you start considering transferring higher amounts. The difference would be around €700 on a $100k transfer, which is ridiculous.

Another problem is that PayPal does not send you any kind of bill for the currency conversion fee, hence you cannot expensive it in your company’s books. It is totally hidden within the exchange rate they use so there’s nothing you can do about it from an accounting point of view.

Other Options

The difficulties detailed above affect every country in the world except for Canada. In Canada, users have found a loophole that allows them to perform USD to USD transfers without any charges. See here and here. Once again I had this confirmed by a PayPal support agent, as can be seen in the email excerpt below:

While not being familiar with all of our 200+ countries’ user agreements, I am fairly confident saying that Canada is the only country we have with an exception that allows a local USD denominated bank to be added and used.

I believe this is also related to how the US and Canadian bank network is cooperating. Regardless, this is not something we offer to a Maltese account, other than if you had an actual bank account registered in the US to withdraw USD to.

There are some other options one could explore:

- Use BrainTree instead of PayPal

- Open a non-resident Canadian bank account with RBC

- Open a Canadian PayPal account connected with an HSBC bank account in Malta

- Use Payoneer

- Use Etrade

- Open a US bank account

I’ve written about BrainTree already, so you can refer to my earlier post about the service, although I don’t really consider it a full alternative to PayPal as buyers would need to use their credit card instead of a PayPal account when paying.

Opening a Canadian bank account with RBS is easier than opening a US bank account. I don’t have much experience in this area except checking if it’s possible and confirming that it is. What one would do then is use the routing number of that bank account to add it as a US bank account within PayPal and withdraw money into the RBS account. Then one would use Wise to transfer the funds to a Maltese bank account. I am still checking to confirm 100% whether PayPal would allow this setup on a Maltese bank account or not.

The Canadian PayPal account plus Maltese HSBC USD account is an option that I’m still checking about, so I can’t make any recommendations at this stage.

Until a few months ago it was possible to open a Payoneer account and then add that to PayPal as a bank account via the routing number you are given. The idea was to then withdraw the money into your Payoneer account as you would have done with a US bank account. From then you would then be able to transfer to your local bank account or else pay using the Payoneer Mastercard or even withdraw cash from an ATM. It appears that this is no longer possible, although it’s worth monitoring this option as things may change in the future or an alternative to Payoneer might crop up.

Opening an Etrade account and withdrawing money to it is also another option that I’ve seen being discussed, and again I need to look into it in more detail.

The last option would, of course, be to open a USD account with a US bank, something that is easier said than done. Usually, a Social Security Number (SSN) is required, however, some banks allow you to open an account without it when visiting the branch in the US. There might still be limitations though (for example, no bank transfers possible) which would limit the practicality of such an account for my particular desired usage. Some people have also asked me whether it is possible to open a US bank account for their non-US company. As far as I know this is impossible unless you are going to deposit a few million dollars into that account.

If you have found a solution I’d love to know how you managed, please go ahead and leave a comment!

Further reading

Looking for Investment Opportunities?

Here’s a handy widget that will help you sift through a varied collection of platforms. Some of them are based in the U.S. but are also available to international investors.

Hi All,

PayPal Australia have updated their fees and charges from April 5th 2018. After this date, PayPal will charge a withdrawal fee of 2.5% if you transfer your USD balances to a linked USD bank. Does anyone know a work around which will avoid me paying these new fees?

thanks,

Nick

Where did you read this? It still seems to be allowing me to withdraw with 0 fees

PayPal Hong Kong are doing the same.

On top of all the fees they’re charging for selling now we are basically stuffed with the 2.5% over market rate currency conversions whether you want a conversion or not.

We used to send USD to a WorldFirst USD Account and then remit back to our local bank in either HKD or USD as we saw fit. This new fee basically makes this a futile money-saving practice.

Now for us to withdraw money to Hong Kong or the US we’re forced to take a hit which is equally expensive.

Horrible practice.

PayPal Singapore is charging a fixed fee of US$35 for each USD withdrawal to a US bank.

It’s really a horrible business practice !

Have you contacted them to explain why they do that?

They said they have updated the user agreement document… I guess as a customer we do not have a choice 🙁

Having said that, a fixed fee of US35 is still much better than 2.5% fee in some other locations, when the transfer amount is big enough.

Hi Jean. I really enjoyed your article. I have an issue transferring money from my PayPal to my South African bank account. Unfortunately my bank has informed me that PayPal is not one of their products. How do I transfer the funds from my PayPal to my debit card as a screen pops up asking for my US bank account? I would really appreciate your help.

That’s strange practice from your bank. PayPal is of course not one of their products, but they shouldn’t really care where the money is coming from as long as you can prove that it’s not illicit. From the bank’s side all they’ll see is that there is an incoming wire transfer like any other.

Hello, guys,

I own a business type account in EU. I receive funds for services in USD, however it’s not possible to withdraw them in USD to a bank account. PayPal would forcefully convert them to Euro using a terrible rate.

I created a US Transferwise account but my account manager said that it “must be a physical bank account, not an online one”.

Is there any information about that?

If anyone knows, please, share.

Much appreciated

What he told you is correct.

Hello, Jean,

Thank you for your prompt reply.

Could you please assist in such case. Are there working “schemes” where I withdraw funds in USD.

1. Is it possible to somehow withdraw funds from EU PayPal to EU Bank in USD but so the bank converts them to Euro, not PayPal

2. Is it possible to somehow withdraw funds to MasterCard, not just VISA? There are a lot more online systems and banks that issue MC but don’t issur VISA cards

3. Is there a way to connect US bank account to a company registered in EU and hence withdraw money there

I will greatly appreciate if you could at least briefly show me direction where to dig.

Thank you, Jean, and have a good one!

Kind regards, Stanly

Happy to help.

1. Yes, check out my other post.

2. Yes.

3. I believe so if you have an actual US bank account and it’s not a virtual account.

Now I’m stupid and I have messed it up a bit but I think this might work. What I did and where I did messed it up is that I created a US PayPal account and added my Transferwise Borderless US account to it. It worked, I was able to withdraw $10 (just for test) but next day the Borderless Account got removed from my PayPal account (I guess they tried to claw back the verification amounts sent when linking the account, which got denied and raised a red flag) since then every time I try to add the bank account it just says there was an error, so DO NOT DO THIS!!!!!!!!!!

However reading this link: https://www.paypal.com/cgi-bin/webscr?cmd=_display-country-functionality-outside&dispatch=5885d80a13c0db1f8e263663d3faee8dc3f308debf7330dd8d0b0a9f21afd7d3 for Malta,Romania,UK it says you can withdraw to you US Bank account, so I phoned up PayPal and tried adding my Borderless Account to my UK PayPal account, they accepted it imedeiatelly, but the operator was getting an error when trying to add my bank account, she tried 3 times then put me trough a colleague which tried again but she got an error again, I need to call back tomorrow to see if whe can get this sorted, I’m pretty confident if I wouldn’t have linked my Borderless account to my fake US PayPal in the first place and the account woudn’t be removed from PayPal this would not be a problem (stupid me!!!!!)

Anyway if you do have a Borderless account it takes nothing to phone them up and ask them to add you US bank account to your local PayPal account.

Now for those who cannot do this or do not want to move big amounts around I found another way on how you can actually get USD out of your PayPal with a decent rate. Get the Revolut app installed on your smartphone and create a basic account with them. Once account is created and you are verified, you can add as many currencies as you need, make sure you add USD as well. Once you have the currencies sorted, go an create a Virtual Debit card in Revolut. Now link your virtual debit card to PayPal (it will be detected as a GBP card). Once you have linked it, call up PayPal and ask them to change the card denomination to USD. Since the revolut card is a multi-currency card it should hold the money in USD without conversion, then you can convert at a much better rate then banks or PayPal. I have requested a $100 USD withdraw to my card should arrive tomorrow so I will post back to confirm that everything is working as expected. From revolut you can send money to bank account directly, exchange, etc (even buy cryptocurrency if you fancy that kind of stuff). Alternatively you can opt for a real debit card from Revolut and you can use that to withdraw money with a really good exchange rate, but there are some limits on how much you can withdraw and there are also ATM fees in that case.

As promised here is the update. The test was successful I have sent $100 from PayPal to my Revolut virtual card, after 3 days I received the $97.50 on my Revolut account ($100 – $2.50 withdraw fee) so for those interested Revolut is a viable more convenient way to withdraw USD from PayPal outside the states. The drawback is indeed the $2500 limit per transaction.

Thank’s Emil! After one-day forum reading your solution maybe can solve my problem. Do you think they change my denomination if my Pay-Pal acc is from Hungary? or I need to make a US or UK PayPal account? (UK because of the Revolut)

1 year ago I try to contact them and they said it is not possible to change the withdraw currency to Hungary due to legal problems, but they working hard to solve this. I think Pay-Pal doesn’t really want to change this because currency exchange is a huge income for the company. That’s why I see my USD in HUF on the top of the site in large black letters.

Szia Janos. I won’t write in Hungarian so others can understand as well.

After writing the comment I had a lot of uphill battle with PayPal for the next 2 weeks, but finally I’ve managed to get to the bottom of it. There are caveats through, PayPal UK account doesn’t allow you to withdraw to a debit/credit card so UK customers sorry but this won’t work for you. I’m lucky enough that I do leave in UK, I’m a dual Hungarian/Romanian citizen and I have a Romanian residency address as well. So I have opened myself a new Romanian PayPal account, because with Romanian account you can withdraw to debit/credit card, so the first thing you need to do is to check if with Hungarian PayPal you are allowed or not to withdraw to Debit/Credit card.

If you are happy days. Now the second thing is that you need to have USD currency active in PayPal, this is easy. Next just download Revolut app and create a new account with your Hungarian address, it will work just fine (it worked for my Romanian one) and get verified in Revolut. Once you are verified and you topped up your Revolut you can create a Virtual Debit card in seconds and also activate the USD currency (or any other currency you might have in PayPal) . Now add the virtual Debit card to your PayPal account. When the card is added phone up PayPal and ask them to change the currency of the card to USD. When they confirmed it’s done, log out log back in to your PayPal account and try to do a fund withdrawal. You should be able to select your PayPal USD funds as the source and your Revolut USD card as the target, here you will see that you are withdrawing USD (not HUF any more) However you might have the nasty surprise to be hit by a $500 daily limit. If your turnover isn’t high enough ($10.000 / year I think) then card withdrawals are limited to $500 / day. It will take 3 (working) days for fund to be transferred from PayPal to Revolut. Once the fund are in Revolut you can either keep them there, either exchange to HUF with a very good rate, either transfer them from there to any USD bank account you may own (even if that is in Hungary), the transfer is free and although it says it will take 3 to 5 days to complete, I always got the money cleared to my Romanian account next working day (and that is without choosing the Turbo transfer in Revolut). The fee PayPal charges for card withdrawals (at least in Romania) is $2.5 which is 0.5% of the $500 so much cheaper then the conversion fee they want to apply.

One key thing if you do not open an USD in PayPal separately then PayPal will do the conversion for you automatically when you receive the money, so if your PayPal is set up in HUF and you haven’t created a USD account as well in PayPal (look for manage currencies) then it’s too late already for the money which is in your account because that was auto-converted on receive.

Hope it’s all clear now.

Thanks for sharing.

While this method with the Revolut-issued card has been proven to work with PayPal Personal accounts, however it didn’t work with our PayPal Business account. The card always triggered some security measures when trying to make a withdrawal from our PayPal account because it was issued in the UK, whereas our business was registered in Romania. So the fix in our case was to request a VISA card in USD currency from the bank (BANCA TRANSILVANIA). Note that this type of VISA card is available only for businesses.

Hi Ivan.

I also have a personal Visa card from Banca Transilvania, but since it’s personal it’s denominated in RON. In case I request withdrawal of USD to it, it will be automatically converted to RON when it hit’s my bank, still better rate then PayPal but not as good as Revolut.

Also as for Revolut I got hit with all kind of “security” checks as well and almost all withdrawals I make are being withed for a couple of days, but after the first few transactions and calls to PayPal, now it seems to work OK (except the pending state for about 72 hours… which is annoying…)

First of all thanks for your Information.I am from myanmar and I am trying to work as an affiliate of foreign country . Company is asking me a paypal I am also trying since 3 month but I didnot get any contact about paypal , If some ways to get a paypal for me (South East Asia) Myanmar(Burma) Yangon city please kindly help and guide me necessary to do my business.

Thanks

You should contact PayPal through their official support channels.

Thanks to all for the very valuable information…..but…..unfortunately I don’t see a way through our situation. We are Australian and our South East Asia based business receives 90% of its income in USD via PayPal and this we can’t change. We send USD from PayPal to our Australian bank account and incur the PayPal fees and rotten exchange rate. We then have to send that money (which is now in AUD) to our local bank to pay our business & personal expenses in USD (more bank fees and rotten exchange rate.

I have opened a Transferwise account (completing the verification process now) and am hoping that we can send USD from PayPal straight to the TW account (won’t know this until we try it). Then I’m hoping that we’ll be able to send USD from Transferwise account to our local Sout East Asian bank.

The TW website says:

“TransferWise only sends USD to the US. ‘For further credit’ instructions can’t be included. See why”

……so I’m not sure that this exercise will be successful.

Anyone else have a similar situation?

Hey Russell,

Yes, you will be able to send the PayPal USD straight to TW USD account. I do it regularly at NO cost. It’s a straight transfer. I’m saving at least $1500 (probably more) in fees and dodgy exchange fees. I can then transfer cheaply to my Aussie accounts, or the GBP, CAD and any number of other currencies where you’ll get real bank account details so you can transfer in and out.

Where in South East Asia? Had a friend who had excellent success using Transferwise combined with Timo https://timo.vn/en/ to get here money into Vietnam (where I live for much of the time.) for a limited cost. I earn VND while I’m there so don’t need this process but she did it successfully. Although it was sent in as VND not USD but she can now withdraw in local currency. Timo is super easy to set up online. The card is only good for VN though. Most business I’ve dealt with in SE Asia quote USD but will take the local equivalent And it’s law in some countries to do so. Unless of course, you’re in Cambodia…where the $ is king.

The new debit card (currently being rolled out in Europe first) may solve some of your problems. I can’t wait to get mine

Sharyn

Sent with Mailtrack

Hi Sharyn,

Thanks for your reply. You guessed it! We are in Cambodia and let’s just say that NOTHING is easy in this country:-(

If I can get TW to send to our Cambo bank (ABA) then that would solve the problem. I suspect it won’t be that easy.

Next best thing would be to send from TW to our Oz bank account and then back to ABA (still double exchange but lower fees and better ex rate)

Another possibility is that TW might send to our USD account that we have with our Oz bank. None of the Oz banks will accept payments from PayPal but the might take it from TW. Do you have any clues re. this?

Thanks again

Russell

Unfortunately I THINK they only transfer USD to US accounts. I would just contact their support team. They were extremely helpful and knowledgeable. When their debit card is available to us ( very soon its already launched in Europe) that might solve your problem because you should be able to withdraw from your TFW USD account.

Shatyn

Sent from my Samsung Galaxy smartphone.

How to use payooner?

I’m not sure how that question is relevant to this post, but perhaps this post from my friend Marco will help you: https://marcoschwartz.com/amazon-affiliate-payoneer

By the look of it, being in Australia, I cannot withdraw to a debit card (https://www.paypal.com/cgi-bin/webscr?cmd=_display-country-functionality-outside&dispatch=5885d80a13c0db1f8e263663d3faee8d5c97cbf3d75cb63effe5661cdf3adb6d)

Does anyone have any thoughts on actions I can take to minimize the PayPal exchange rate burn?

Hey Steffy, I’m Australian and wrote a post on how Transferwise is saving us heaps v Paypal. I did a full breakdown of the fees and foreign exchange rates. My blog is Catch Our Travel Bug and it’s the first post at the moment. The great news is that Transferwise is bringing out a debit card early 2018. In the meantime, I have a 28-degree credit card for no fee international transactions and I’m about to get a Citibank Plus everyday account which has no ATM fees even overseas. You can transfer your USD to any Australian bank account. But really looking forward to the TRansferwise debit card as I’m headed to the US next year and it will save me even more cash.

Thanks Sharyn. I read your blog but I don’t think it helps me with the NZD that we are collecting in PayPal. Do you have any thoughts on this? Unfortunately we have to use PayPal at this point as we have limited gateways that we can use through our third party software. Using Transferwise as a native collection point isn’t supported.

Can you set up a NZ dollar account in Transferwise? (once you’re verified a new currency account is just a click of a button to get an account number etc). That way it would just be a simple debit or credit card payment from your clients. Is your Paypal account a NZ one? Collect in Paypal in NZ $, transfer directly to the Transferwise NZ account (shouldn’t be fees if it’s a direct transfer with no exchange) and then use the better Transferwise exchange rates to send to whatever bank account you can withdraw from. Or, as I said..Transferwise will have a debit card soon. If you’re Paypal account isn’t NZ, then I presume they are slugging you with big fees for the deposits.

Yeah – we can only use one PayPal account with our gateway and the one we have is Australian. Looks like we have hit a wall and are stuck with the PayPal exchange rates.

The debit card doesn’t help us as Australian PayPal accounts don’t allow withdrawal to a debit card.

Oh well … 🙁

Hi Jean,

first of all thanks for this and other posts, I consistently find your blog very helpful! Keep them coming 🙂 I’ve recently encountered the same issue when trying to transfer € into my TransferWise Borderless (TWB) account, convert them to $ and then send the $ to a Malta-based USD account – the idea being to avoid the horrendous local bank exchange rate. Unfortunately Transferwise can only transfer $ to bank accounts based in the USA.

I’m thinking of using Currency Fair, which you’ve mentioned in previous posts. Have you ever used it for something like this? On their website I can’t find any restrictions on transferring $ to non-US based accounts. In any case, if you send me your CurrencyFair referral code I’ll open an account with them through that and report back 🙂

Cheers amigo!

Daniel

Hi Daniel, glad you find my posts helpful! You can join CurrencyFair through this link and let me know how it goes. I haven’t used it for that purpose yet but I would definitely be interested if the process works.

Hey, reporting back.

So the CurrencyFair process worked.

I wanted to convert €3.5k into USD without incurring bank conversion rates and fees. On the day I transferred my €, http://www.xe.com gave me a conversion rate of €3,500 = $4,120.01 (€1 = $1.17715; $1 = €0.849512), so I wanted to receive a final qty of $ as close to that as possible.

I first set up a USD account with my bank (everything online, quite easy), and set up a CF account + verified my identity (also easy). Then I was set to go. Before using CurrencyFair (CF) I checked my bank’s market rate for that particular day and calculated that were I to transfer my money from my EURO account to my USD account and rely on my bank to do the conversion, I would get $4,055 or so.

I forgot to record CF’s exchange rate for the day, but the website said I would get $4095 after CF’s $4 conversion fee. Ultimately, I was credited with $4083 in my USD bank account due to the bank’s intermediary fees:

ORIGINAL CURRENCY AND AMOUNT USD4095.20

REMITTANCE AMT USD *4,095.20

LESS COMMISSION *11.77

TOTAL CREDITED USD *4,083.43

Below is a list of the fees charged for converting €3500 into USD:

1) €4 fee for my bank’s “SEPA-EURO transfer to other banks” (i.e. CF’s Irish bank account in Euros)

2) $4 CurrencyFair fee

3) $11.77 bank fee for “inward payment in other currencies credited to non-Euro accounts”

So all in all, a saving of around $28 compared to relying on the bank to do you conversion for you. Not a lot, but it adds up.

On top of that, both Jean and I received €30 in our CF accounts because I used his referral code and converted more than €2000 at one go…

In any case, should this be a useful option for you, please use Jean’s CF referral link above, or mine below, whichever you prefer.

Hope this helped!

D

https://www.currencyfair.com/?channel=RU7481

Excellent Daniel, thanks for your detailed description of the whole process!

TransferWise just launched something called a “Borderless” account. This allows anyone in the world to open up a virtual account in USD, Australian Dollar, Euro, Pound currencies with REAL account and routing numbers specific to the currency’s respective countries.

So, if your PayPal account allows you to add a US Bank account, then your in luck. Furthermore, if TransferWise operates in your local currency, then getting the money to your local bank will be even faster AND cheaper as TransferWise has the best rates.

Hi!

I’m from Philippines and I have a Paypal too. I recently opened a us dollar account here and they provide a Visa card associated to the bank account. I contacted Paypal if there’s a way to actually get the money in USD and not in Philippine Peso and they responded to me with this, “ Currently we don’t have an option for bank withdrawals to let the money stay in USD since our system follows the currency of your country.

What I can suggest for you to keep the money in USD is to withdraw it using a Visa card and we’re going to set the currency of that card to USD. Once that you withdrew the money I can assure you that it will stay in USD.”

Since the bank is still processing my card, I only have my bank account yet. I will update you once I got my card on Tuesday here, and lets see if the money in my Paypal will appear to my bank account and will check the fees and hidden charges too. Hoping for the best cause this is for my work and not my personal income.

Best Regards,

Alyssa

Yes that’s exactly what I have in place myself.

Hi Alyssa,

Could you please give the feedback, did you manage to withdraw money to the card without conversion?

Best regards,

Andrew

Hi Allyssa,

Can you tell me what bank in the Philippines provided you a visa card for your usd savings account.

Best,

AJ

Hi Allyssa,

Can you tell me what bank in the Philippines provided you a visa card for your usd savings account.

Best,

AJ

Hey Jean,

I solved a good part of this problem with a Transferwise borderless account. My Paypal is Australian. I opened an Australian Tranferwise account and then set up a US dollar account. It’s as simple as a click of the button. (I now have a UK account and will set up a CAD account before I head over there next April) I then transfer my USD to Transferwise USD account for no charge and then to my Australian accounts at a competitive exchange rate. I’m a small player and this is still saving me a couple of thousand a year. Not only that, my Irish clients that pay me USD can now do an ACH transfer to my US account for pennies. I blogged about it and have included the link in the website field. Your comments system flags me as spam otherwise 🙁 Hoping this helps your readers. I’m over the moon. And they are bringing out a debit card soon. That’s going to make things even better.

Thanks Sharyn, I had already blogged about the excellent TransferWise Borderless accounts on this blog, and in certain cases, you can use them as an alternative to PayPal. This is mostly in the case that your business accepts infrequent transfers for services rendered. If you have a product business and need to accept multiple daily payments, you still need to use a system like PayPal or a credit card processor.

However, you cannot use TransferWise in conjunction with PayPal by adding it as a withdrawal bank account within your PayPal account. I wish it were possible to do so because that would completely solve this issue.

Well I did. I transferred most of my USD directly from Paypal to the Transferwise USD currency account I set up. Using the account details provided by Transferwise it’s exactly the same as transferring to any USD account. It’s one of my approved bank accounts in my Paypal account now…on the drop-down menu when I go to withdraw. No fees whatsoever. Maybe something has changed since you tried. I then sent the money to my Australian account using Transferwise using their more competitive exchange rates.

Oh in that case that’s awesome, I had tried this and also confirmed that it’s not possible with PayPal themselves. However these things change from country to country, so while in my case it wasn’t possible, in your case it was. I’m looking forward to what other readers will report on this matter.

Perhaps if many others say that it works I would be able to pressure PayPal to make it work for my country as well. Thanks Sharyn.

Yes, things certainly change rapidly in this space. If you think your readers would benefit from my experience, feel free to drop the link to my blog in the comments.

S

I have a PayPal Thailand account. I tried to add my Transferwise USD borderless account details but got the message “We were unable to process your bank account registration at this time. We apologise for the inconvenience. Please try again at a later date.”

(I tried to use both the wire routing and ACH routing numbers, but neither worked, and I entered “Transferwise” as the bank name.)

Confirmed – it works. I’m from Poland and used to get hit with PP atrocious conversion fee while converting USD. At first when adding my Transferwise bank details (borderless account) system rejected them. I called PP and told them I needed my new U.S. account linked, they asked for name of the bank which is Community Federal Savings Bank (CFSB), it’s key that you simply say “I’ve an U.S. account in CFSB”. You don’t need to mention Transferwise as it’s none of their business it works like with Royal Bank of Canada who will open U.S. accounts for Canadians. Make sure the account holder is the same as with your PP account. After 1 minute on hold my account was fixed and I’ve now my U.S. account properly linked to PP!

Hi

I’m in Africa, Zambia

Can i withdraw Paypal money to my Backlays visa card?

Not sure about that particular case Mark, best to check with PayPal directly.

I also been hearing that Auction Essistance can help us withdraw money as well, but I don’t seem to see any services on their website that they do. I tried contacting them, but haven’t heard a response back.

Do you know anyone who is using such service? I would really need to get money out since I do not have a way to get a USA bank.

Hi Jean!

I live in Croatia (native currency is kuna) and have set up an foreign currency account, in euro, not in kuna, so that i could pay and receive in euros without conversion to kuna. My bank account can’t be associated to paypal, since Croatia, although a member of EU, is not part of eurozone, but i have a visa elecron card issued by bank which is associated paypal account.

Up till recently, I’ve been using paypal mostly to buy on ebay, so i never actually had to withdraw any money. Recently i started receiving payments from my Airbnb guests. When i wanted to withdraw money i saw that i can not withdraw euro (which is my primary paypal currency) to my card without paypal first converting it to my national currency kuna (at a ridiculous rate). Of course than the bank has to re-convert it back to euro, since it is a foreign currency account in euro.

I was furious, and all i want to is close paypal account and say good riddance to bad rubbish. But as i cooled down i wrote them an e-mail so i’ll see what they have to say if they even bother to answer. Also, I’m determined to get my money in full amount.

Since you have much more experience in such matter than i have i’m asking you for an advice. Is there a way to convince them to change settings on my account so i can withdraw money without unnecessary conversion to kuna since my account is in euro? From what i gathered EU members should have an option to link a bank account to paypal (not just credit card), especially if the parent bank is part of the eurozone (Erste-Steiermärkische is actually Austrian, not Croatian bank). Second option would be opening an account in eurozone i guess?

Sorry for the long post:)

Best wishes

Igor

Hello sir…I have USA PayPal that is not link with credit card nor any bank account in USA and the PayPal account is almost 7 months old now..pls how can I withdram my cash in the PayPal account because am not in USA …

I almost thought I had the solution for this with Transferwise’s new borderless account. I just need a bank statement with a US address on it to provide to PayPal and that’s where I got stuck as Transferwise doesn’t provide bank statements. Bummer!!

It does provide them now. 🙂

Hi Chris,

Indeed Transferwise do provide a bank statement. However PP asks for a bank statement, the bank statement provided by Transferwise doesn’t look like a genuine bank statement. Of course, you see ‘Transferwise’ on top of the page and has an UK address for a dollar account. Is this no problem for PP? Do you know a solution for this issue?

You don’t need bank statement to add a bank account to PP. Bank statements are required of fresh clients who need to be verified/underwritten or clients with large turnovers due to money laundering regulations. I had to add a bank statement for the second reason once, never while linking bank accounts to PP, they verify ownership of bank accounts automatically with verification transfers.

Would it be safe to use Auction Essistance to help me withdraw money out of my PayPal account?

That is the first time I hear about the term so I can’t really help you ok this.

Hello Jean, I m new to paypal, how does paypal considers someone as NON-USA, what if I open an account with USA address from India(my country). Then add a Payoneer Card to paypal account. Then withdraw money from Payoneer.

My intention is to sell at Ebay with Paypal.

Doesnt Paypal allow withdrawals to indian local bank accounts?

Hello Jean, I have a locally opened USD bank account (dollar account as we call it) and I am wondering if I can deposit all the earnings I make online. I receive funds through PayPal and Payoneer in USD, what I’d like to happen is I want to receive the money still in USD upon reaching my bank account since it’s a bank account that is on USD denomination. What are the other options I have to make this possible? Thank you.

Hi Jean,

I am about to become an online earner in a few days. I already have a visa debit card linked to PayPal that I use for purchasing. When I begin earning money through PayPal, will there be an issue to withdraw using the visa debit, here in Jamaica? And also, since I’ll be leaving for Japan soon, what problems may occur?

Thanks,

Chungi.

Hey I live in the Caribbean..did you find a solution for this problem because I have a visa debit and cant receive funds?

Hi, No I haven’t. I guess I’ll just have to request a cheque from PayPal. Very disappointed though.

Has anyone used the cash out services from Auction Essistance?

Hi Jean,

Are you any closer to finding a solution?

I have a UK based business with the same issue. I tried payoneer and was able to link the US allocated bank account to my PayPal account by calling up PayPal. This however hasn’t solved the problem.

I am trying to withdraw USD to a UK based USD account to save any transaction fees as I buy my products from HK who also want payment in USD but to a HK based $ account.

I initially opened a USD bank account with Santander that is based in the U.K. but PayPal transfer the $ to £ and then Santander switch it back to $ so two transaction fees if I do that.

This is also the case with payoneer even though on paper it is $ to $ transaction as a withdraw to account option. As a test before I realised this, I transferred $100 from PayPal to Payoneer loosing the 1% fee so $99. From there I withdrew $99 from Payoneer to my UK based USD account with Santander. I did try and cancel this transaction as soon as I realised but was unsuccessful. Balance from that transaction is $88.12! Almost 12 percent lost in one transaction!

Anything you can see that could resolve this issue?

You suggested opening a non-resident account with RBC. Would this be a business account or a personal account?

Thanks for any help!

I think it’s time the world had a fairer single currency!

Kind regards,

Andrew

Hi Andrew, unfortunately, I have made no further progress on this matter. Payoneer does not work for this purpose either. As for an RBC account, it would be a business account.

Hey Andrew I’m also stuck in the same boat as you but the difference is I don’t need to pay for goods in USD so I just lose out once.

I have a solution for you that may help You save some money it’s something I used in my other business when I was paying suppliers in foreign currencies. If you are interested let me know

Mac, as a matter of fact, I searched for similar problem everybody who’s read this post have. More so, I would not have read the response till I got to yours.

We surely do need an answer. So, if you do not mind sharing, tell.

Thanks.

P.S.

I have to commend Jean Galea for this blog. You have done a good job here. So many people are either (too) lazy or simply indifferent.

Hi, Any solution for withdrawing in Bahrain.

Sorry Malini I’m not familiar with the fiscal situation in Bahrain.

I have a USA PayPal and I am based in Turkey since PayPal closed operations here. It has been difficult on trying to cash out. Payoneer used to work with PayPal, but the were banned. I contacted Auction Essistance on ways to cash out, but they are unaware of any other than currency exchange, adding a USA bank or having someone cash out for me for a fee. Any help would be appreciated.

cheap steeler jerrseys cheap nhll jerseys ᥙsa

Hello, where can i find the exact page where can i withdraw my funds with my mastercard? by the way i live in lithuania.

Check this link https://www.paypal.com/selfhelp/article/FAQ921/2

Hey,

I use a US Paypal account, move the money then to a US bank account (Bank of America) and transfer it with transferwise into Euro. Opened the accounts when I was in the States without problem. So far works best for me and didn’t find a better solution yet.

Best,

Tom

That’s great Tom, the main issue for the rest of us is that it’s not easy to open a bank account in the US unless you’re actually living there.

Dear Tom,

Did you establish an LCC or a corporation to do so?

Or did you open it under your name?

Rodney

Hey Rodney

How does creating the company as an LLC determine if they allow you to open a US account without the SSN number or you living in the US?

Not everyone visiting US i guess …

Dear Jean,

I have a business set up in Japan, with a Japanese paypal account. We get hammered with international fees and we do have a presence by means of a branch in the Eurozone. We are exploring our options right now, but do you have any suggestions on the matter? Since the majority of our customers are based outside of Japan, could we set up a eurozone account using the company we have established in the eurozone and just take advantage of the fees our bank there would provide. Similarly, another huge chunk of customers is based in the US. If we could incorporate in the states and set up a local paypal account there, could we do a similar process for our e-commerce site?

Hi Rodney,

If there are other reasons apart from avoiding PayPal’s international fees I would say that opening a company in the eurozone and the states would be a great idea. Possibly the volume of transactions is even high enough to open these companies solely for that purpose. In any case you will then be able to open a USD and a EUR bank account and link them up to PayPal.

If payments are sent manually youd’d be good to go with this setup. The potential pitfall I see is if the payments are done through a website. How will the website know which PayPal account to use for receiving the funds from the customer and avoid the international fees? This is an interesting case and I’d love to know what route you eventually choose for this setup.

Dear Jean,

Thank you for your prompt reply. I will definitely look into it and let you know.

Hi Rodney and Jean,

Did you find a good solution Jean? Is it possible to talk together? 🙂 Dont worry i wont spam you with questions, but im in the same situation.

Regards,

Alex

The best solution I have is to use a debit or credit card and ask PayPal to switch off the automatic currency conversion. Things haven’t changed since I wrote this post. If you do have any other news please share.

Good afternoon Jean,

I am trying to sell an item and the buyer wants to pay via Paypal. However, it is not clear whether I can withdraw the funds to my credit or debit card (my bank accounts are in Malta). From your post, it seems that I can at least withdraw to a credit card, which is fine for me. However, given that this is the first time that I am using it, and you seem pretty proficient in the matter, your confirmation would be much appreciated.

Hi Abigail, you can withdraw to your Maltese bank account’s credit or debit card, as long as it is a Visa, Visa Electron or Mastercard one.

Jean, i have mastercard linked to my paypal account but it doesnt let me withdraw… is that any other kind of problem ? Because every time i click withdraw funds it takes me to wallet page and popup comes with words ‘add your bank account’ :/ if i cancle that then it takes me to the home page again, so not much happening…