P2P lending is an alternative investment that comes with its own risks but can provide high returns. I’ve been averaging around 12% across all the platforms I’ve invested in. Expect some portion of your loan portfolio to default at some point, it’s just the nature of this business, but this will usually be compensated by the profits you would have earned.

Here are a few of my favorite P2P lending investment platforms:

I’ve written extensively about this topic, so make sure you head over to my post on the best European peer to peer lending platforms for the range of options available.

P2P stands for Peer-to-Peer, and comes from the world of computing. It refers to a network setup that is not dependent on central coordination.

What some fintechs have essentially done is remove this central coordination from the lending process.

Meaning?

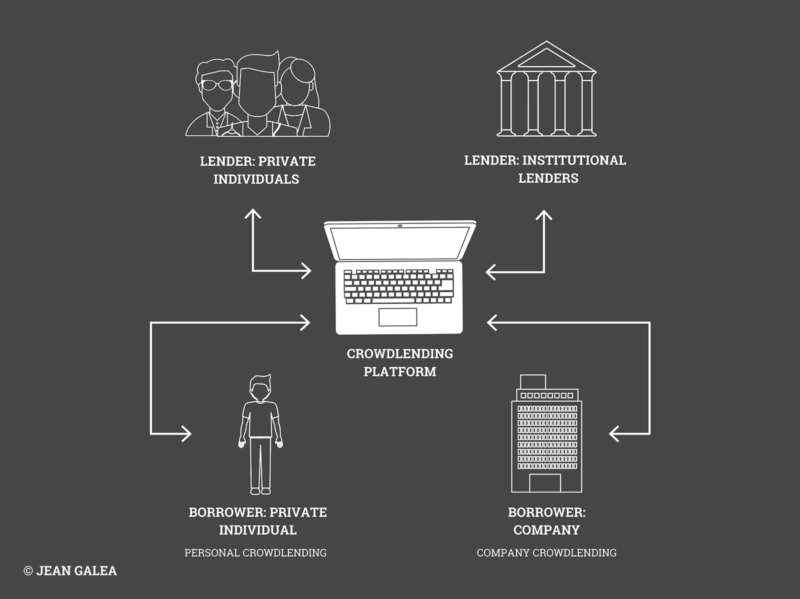

Borrowers and lenders are directly connected through a digital platform, with no traditional financial institution acting as a middleman. The result is the possibility for both sides to access better interest rates than it would be otherwise possible.

Yet, that can bring its own difficulties, since the lenders must actively assess the information available and decide on whether a particular investment is worthy of the risk.

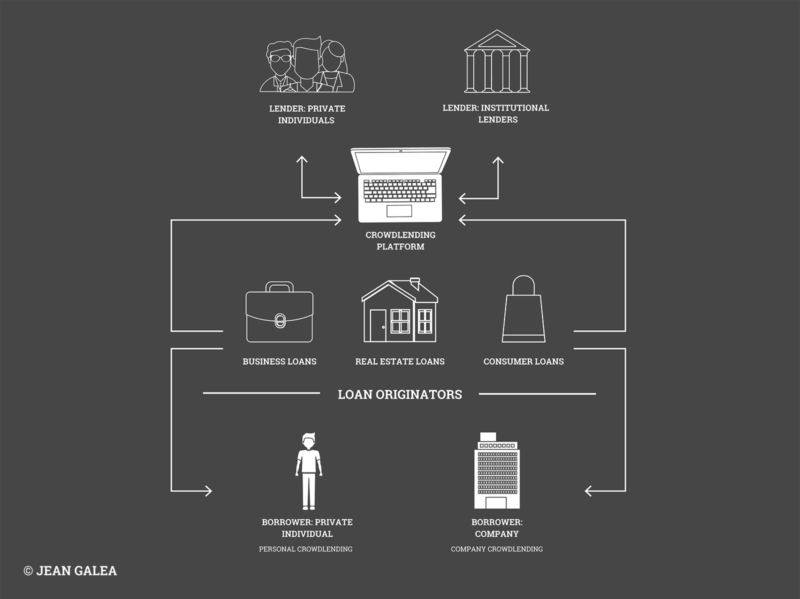

On the other hand, some platforms work on the basis of a four-party model, introducing another player in the relationship: the loan originator, who essentially is responsible for bringing in the borrowers.

View the list of best P2P lending platforms

This can raise some additional concerns. If an outside party is selecting the borrowers and projects to be funded, doesn’t that introduce a new layer of unclarity? As well as what’s in it for them? Why should they care?

Loan originators put down some of their own money into the project, aligning their interests with those of investors. They now have a reason to care: if you lose, they lose.

The amount put down by the loan originator, therefore, becomes a kind of seal of approval, tying your and their results to get the best performance of that loan.

Sounds interesting? Check out my list of best European P2P platforms or read on to understand how these platforms work.

📜 The History of Peer-to-Peer Lending

The peer-to-peer technology concept was first popularised by music file-sharing networks such as Napster, eMule, and most recently torrents. What peer-to-peer means is that we’re removing the intermediary and regular people are sending files to other regular people.

Applied to peer-to-peer lending, it means that we are lending money to other people who need it for something specific. There is no need for a bank to get involved because the money is flowing directly from loan providers to the people requesting the loans.

The traditional way of getting loans was to go to a bank, describe why you needed the loan, show your assets and submit an application. You then had to wait days or weeks until you receive a decision from the bank. They would offer you the terms, including probably the most important factor which would be the interest rate.

After the financial crisis, many banks became much more restrictive in who they give loans to, especially in certain countries. This left a lot of people and businesses in dire straits as they had nowhere to go to in order to obtain much-needed capital to make important purchases or investments. This also created a situation where many investors in Western Europe (e.g. Germany, UK) were flush in cash, and on the other hand, you had people and businesses in Eastern Europe (e.g. Latvia, Lithuania, Georgia) who were suffering due to the difficulties in obtaining financing.

P2P platforms solved these problems by providing an alternative to banks. Investors now have no borders and can easily invest in loans outside of their countries at very good returns, because there is so much demand. In this way, everyone is a winner. The platforms themselves take a cut when loans are re-sold on the secondary market.

How P2P Platforms Link Investors and Borrowers

Typically you will see different kinds of loans, some with no guarantee and others with some kind of guarantee.

For example, if the loans you invest in have BuyBack guarantee, then the highest risk is for the P2P lending platform to go bankrupt, and that can happen because of many reasons – bad management decisions, competition or scam.

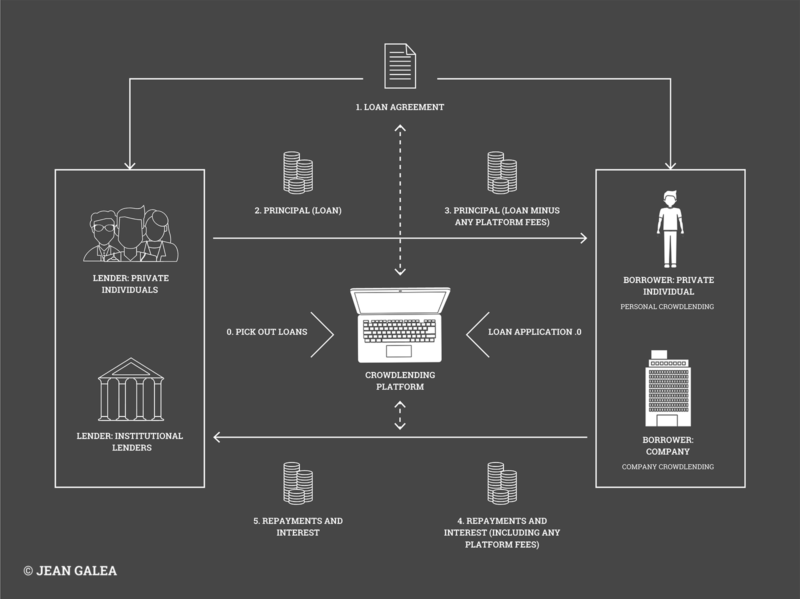

Peer-to-peer platforms service the loans and receive payments from the borrowers. Then the received payment is divided proportionally according to the amount of investment between all investors that have invested in the particular loan.

As soon as the borrower whose loan you have invested in repays his loan, you will start receiving payments of both the principal sum and the interest, for the investment period. They will be automatically transferred to your account. You can reinvest the received money in any available loans or request a payout directly to your personal bank account.

Each loan has a specific date of repayment, so the investor will receive money in his account according to the regularity of payments made by each particular borrower.

🤔 How Do P2P Lending Sites Make Money?

As investors, we should always be very careful about where we invest our money, because as Warren Buffet likes to say:

“The first rule about investing is not to lose money”

Therefore, one of the things I always ask myself when someone offers me some opportunity, is:

“What’s in it for them?

We can, therefore, apply this question to the European P2P lending platforms that we’ve been talking about. How do they make money and what’s the role of all the parties involved in this business?

As we kn0w by now, P2P lending companies or platforms are the intermediaries between l

While in the early days, platforms charged fees to both lenders and borrowers; nowadays I’ve yet to come across a platform that charges any fees to investors/lenders, except on withdrawals or currency conversions. It is simply not good to do so from a marketing point of view. The platforms are better off offering slightly lower rates and thus making money off investors from the spread between the interest rate offered to the borrower and the rate that they offer to the lenders.

Some P2P lending platforms charge flat fees to borrowers. This is is especially true for bigger loans such as business loans that run into high thousands of euros.

For consumer loans, the lending platforms tend to simply charge a margin in interest percentage (they will charge the borrower an interest rate of 25%, while giving a rate of 15% to the lender and keeping the remaining 10% for themselves).

📈 Is P2P Lending Growing in Europe?

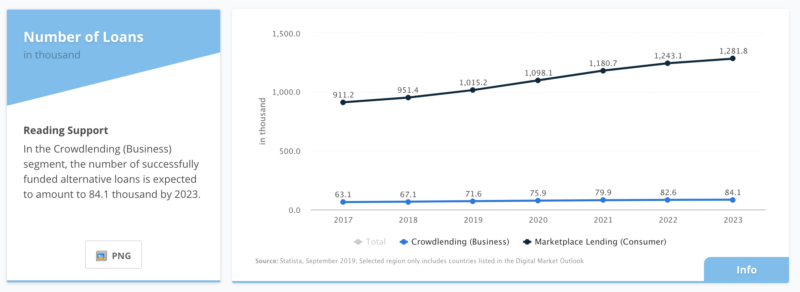

P2P lending volume is growing year on year in Europe and globally. The growth is quite obvious to those of us who have been investing in P2P lending for the past five years or so.

There are three sources that I refer to when it comes to market data for P2P lending platforms and the P2P market in general:

You can usually also find information on each p2p lending platform’s website. If they don’t publicly display this kind of data, I would be inclined to trust them significantly less than if they did.

It’s very important to keep tabs on such data to understand what volumes each platform is generating and whether they are profitable or not.

P2P lending is growing at an incredible rate in Europe and around the world. According to a Mintos statement, the world’s P2P lending market was 26.16 billion USD in 2015, but growth is projected to reach 897.85 billion USD by 2024. If this vision were to come true, the annual growth would be 48.2% in 2016-24, which is nothing short of spectacular.

When we talk about growth, we need to consider both the actual lending volumes and also the confidence and comfort of investors when considering this asset class for investment.

According to a survey by Robo.cash, 64.9 percent of European P2P investors have full confidence in P2P lending. Remarkably, 52.3 percent of the respondents mentioned that P2P loans take a considerable share of their investment portfolio – over 25 percent.

The level of confidence in P2P lending is also observed in the distribution of funds in investment portfolios. It’s no secret that most investors look for diversification by investing in various assets – stocks, bonds, cryptocurrencies etc. It’s quite telling, then, that 52.3 percent of respondents said that investments in P2P loans take more than 25 percent of their portfolios.

While it is a newer class of investment, there is no doubt that it is growing at an increasingly rapid rate, so it’s well worth understanding how things work, even if you’re skeptical at the outset.

💶 What Returns Can You Expect from Peer-to-Peer Lending?

I think peer-to-peer lending sites are one of the best ways to earn passive income. The vast majority of investors are accustomed to using real estate for (mostly) passive income, but in my experience P2P lending can produce better returns while being more passive than real estate.

I’ve been averaging 11% returns per year over the past two years over the various platforms I’ve used.

A common question I receive is about how much return is considered as the minimum acceptable.

My answer is that it is an ever-shifting minimum interest rate. What you want to do is compare any investment return with the risk-free interest rate.

The risk-free rate of return is the theoretical rate of return of an investment with zero risk. It represents the interest an investor would expect from an absolutely risk-free investment over a specified period of time. In theory, the risk-free rate is the minimum return an investor expects for any investment because he will not accept additional risk unless the potential rate of return is greater than the risk-free rate.

In practice, however, the risk-free rate does not exist because even the safest investments carry a very small amount of risk. Thus, the interest rate on a three-month U.S. Treasury bill is often used as the risk-free rate for U.S.-based investors.

At the moment it hovers around the 2.5% figure, so based on that and the risk of loan platforms (note that some carry much more risk than others), I would be looking for anywhere between 9 to 20%.

Let’s have a look at some of the best loan platforms in Europe, based on my experience investing over the past 4 years.

🌍 Who Can Invest in P2P Lending Sites?

European P2P lending sites are open to all European investors, possibly even those outside of Europe in some cases.

The UK-based platforms are typically restricted to investors resident in the UK. CrowdProperty is one such example. It’s been around since 2005 but is restricted to UK-based investors.

The majority of platforms that are open to other countries are based in the Baltic countries. We have leaders such as Mintos and Bondora which have proven to be success stories, and now many other new entrants are fighting to get a piece of the pie.

Many of these platforms are available in more than one language, precisely to cater for the fact that in Europe people speak so many different languages and might not be comfortable investing their money if the site is only available in English. For example, my favorite lending site, Mintos, is available in English, Czech, Spanish, German, Latvian, Polish and Russian.

From my experience, at the moment in Europe the country with the most investors in P2P lending is Germany, leading by a long margin. German investors love P2P platforms. Germany is a country where people have a high purchasing power and they are looking for good returns on their savings, and hence P2P lending platforms are a great match for them.

How to Diversify Across Several P2P Lending Platforms

Diversification is one of the basic tenets of investment, and in general, it’s a good idea to invest.

Rich and successful investors typically diversify across the following:

- Stocks and bonds

- Real estate

- Ownership of businesses

Others might diversify further into commodities, cryptocurrencies, peer-to-peer loans, precious metals, etc. but the above three are the really big ones.

On this blog, I’ve written quite a bit about the high returns that can be obtained on P2P loan platforms, and if you read other European FIRE and finance blogs you will see that platforms like Mintos and Peerberry are all the rage at the moment.

A frequent question that new investors have is the following:

“Should you diversify your investment across many P2P loan platforms?”

Now, if you read some other blogs you will see that these bloggers keep investing in new platforms, claiming that they want to try out more platforms for the benefit of their readers.

However, you should be aware that keeping a handle on your investments is a time-consuming task, and is exponentially more time consuming the more platforms you add.

How to invest €10,000 in P2P Lending

I would, therefore, be of the opinion that you should select a maximum of 5 platforms to invest in, and preferably only if you have a substantial amount to invest, say €100,000. For smaller amounts I would say just start with one platform, and once you learn how things work to expand into two others.

If I had €10,000 I would only put it on one platform, and that platform would be Mintos.

If I had €25,000 I would spread it across 2 or a maximum of three platforms. They would probably be Mintos, and Bulkestate/Peerberry.

Keep in mind that your reporting and tax compliance costs will also increase with each platform you add. At the end of the year, you will most likely engage an accountant to help you prepare your personal tax return, and the accountant will bill you according to the time spent. He will most definitely spend more time on your tax declaration with every platform you add.

If you’re investing through an audited company, every platform you invest money in (irrespective of the amounts invested) will increase the cost of your audit, as the auditors will need to spend time getting to know the platform and performing impairment checks on the loans invested in. Therefore, it doesn’t make sense to invest small amounts in any platform as the audit cost per platform might actually be higher than the expected returns.

If you see bloggers that are invested in more than 10 platforms, you can be pretty sure that the main reason they are doing so is to be able to review all those platforms and land more affiliate commissions from new investors, especially from their monthly reports, where they can land several affiliate clicks and hence affiliate commission.

The aim of these bloggers is, therefore, to make money through affiliate commissions and not from the investments themselves. The potential returns from affiliate commissions are many times the multiple of what they can get from the interest on their meager investments, hence it justifies the long hours spent every month in compiling detailed reports and regular reviews of all these platforms.

Risks of P2P Lending

For each investment class, and indeed every investment you make, you need to carefully consider the risks involved. There’s a lot to say about the safety of P2P lending and what risks you need to consider, so I wrote a separate guide on whether P2P lending can be considered safe that you should find interesting.

Alternatives to P2P Lending

If, like myself, you want to diversify beyond P2P lending, I would suggest you read up on real estate crowdfunding platforms as well as crypto interest accounts. You can obtain similar rates of return (usually 3-4% less than P2P lending) but these other types of investors tend to be safer as they involve collateral.

Questions?

Do you have any questions about peer-to-peer lending? I have been active as an investor in the space for the past 5 years and have learned a lot through experience and interviewing some of the people behind the top platforms on my podcast Mastermind.fm.

I believe that questions and discussions are the best way to learn, so I welcome all your questions and will do my best to give you an answer that is helpful. Please go ahead and leave questions in the comments section below rather than sending me an email. In this way, your question and my answer will benefit all the readers.

Hi Sir,

I have red somewhere that Mintos is not free for a French man.

In other words I cannot invest in Mintos because I am French.

Can you say the same,

Smiling Paul

PS: excuse my bad English!

thax

Why do you recomend Bulkestate? For the level of transparency?

I also like Viainvest for the track record and transparency.

And what´s your opinion for Crowdestor?

I should have probably made a separate category for real estate crowdfunding websites, in which I would also include Reinvest24 and Property Partner.

I’ll update the post.

Thanks for your post. What makes you recommend those 3/4 platforms over the others?

Several factors, I would say these are some of them that are important for me:

Happy to answer other questions you may have and discuss further.

Thanks for your replay Jean. Do you no longer recommend Twino?

Did you try any factoring P2P sites yet? Investly seems interesting and has a low default rate. I’m not sure I understand how it works yet though.

All thes best

Thanks! Happy first advent.