Buy ETFs on Saxo | Buy ETFs on DEGIRO

If you’re looking to build a portfolio of stocks, bonds, or other asset classes – you might want to consider an ETF. In doing so, you’ll often be investing in hundreds of financial instruments through a single trade.

As such, you can easily diversify without needing to pick and choose investments on a do-it-yourself basis. This might be particularly attractive for those of you that don’t quite know how to research and analyze the financial markets.

In this guide, I explain everything there is to know about ETFs. This includes the fundamentals of how ETFs work, what assets they give you access to, and which brokers are worth considering.

What are ETFs?

Exchange-traded funds (ETFs) are a popular asset class with investors of all shapes and sizes. In its most basic form, ETFs allow you to invest in a group of assets through a single trade. For example, this might be an ETF that tracks the Dow Jones. In turn, the ETF provider will buy all 30 stocks that form part of the index in question.

This means that your ETF investment will be directly correlated to the performance of the 30 respective stocks. With that being said, ETFs can track virtually any marketplace possible.

In the case of stocks, this includes leading indices like the FTSE 100 or NASDAQ Composite, and even specific equity types like growth stocks, dividend stocks, or emerging stocks. There are also ETFs that track bonds, as well as commodities like gold and silver.

Ultimately, the main attraction with ETFs is that you can build a highly diversified portfolio of assets without needing to place heaps of trades. Instead, as soon as you inject capital, you will own a slice of each asset class – proportionate to the amount you invest.

How do ETFs Work?

The fundamentals of how ETFs work is actually very simple. With that said, there are a few important metrics that you need to be aware of before taking the plunge, which I elaborate on in more detail below.

ETF Providers

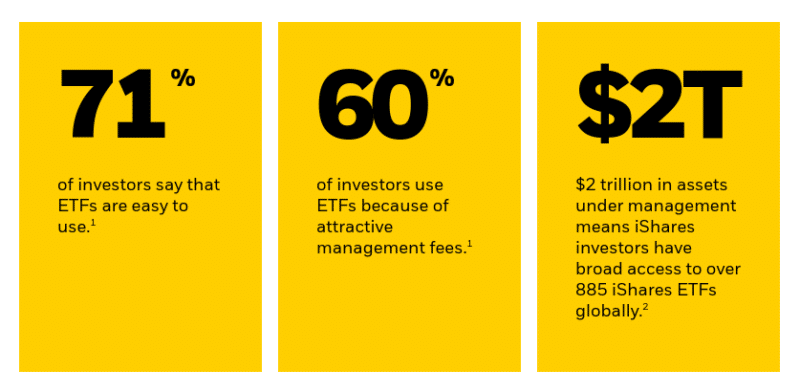

First and foremost, I should note that ETFs are managed by large-scale financial institutions. To give you an idea of some of the names you will likely come across, the largest ETF providers in terms of AUM (Assets Under Management) are as follows:

- Vanguard

- iShares

- SPDR

- Invesco

- Charles Schwab

Most of the providers mentioned above have trillions of dollars under management for clients of all sizes. This gives them a huge advantage in the marketplace, meaning that they can access assets that would otherwise be unavailable to the Average Joe investor.

In terms of how you invest in ETFs, you typically have two options. Some providers allow you to invest directly with them. Albeit, this usually requires a higher minimum investment. Alternatively, you can invest in an ETF via a trusted online broker – providing the platform offers the instrument you are interested in.

ETFs are Listed on Stock Exchanges

ETFs are listed on public stock exchanges like the NASDAQ, NYSE, or London Stock Exchange. This is beneficial for several reasons. For example, being publicly-listed means that it is really easy to invest in ETFs from the comfort of your home.

It is also easy to track the value of your investment. This is because much like traditional stocks, the price of the ETF will go up and down throughout the day.

And of course, the fact that ETFs are listed on public exchanges means that your investment is super-liquid. In other words, you can enter and exit the ETF investment at any given time during standard market hours.

ETFs are Weighted

It is also important to note that ETFs will always have a weighting system in place. In simple terms, this is the break down of assets that it holds within the respective portfolio.

If, for example, the ETF was tracking an index fund, then the weighting system implemented would typically follow the index itself. For example, if Apple has a 3% weighting on the S&P 500, then your chosen ETF will also allocate 3% of the portfolio to Apple shares.

Example of an ETF

Before I move onto the fundamentals of the NAV, dividends, and making capital gains – it makes sense for me to provide a quick example of what an ETF looks like.

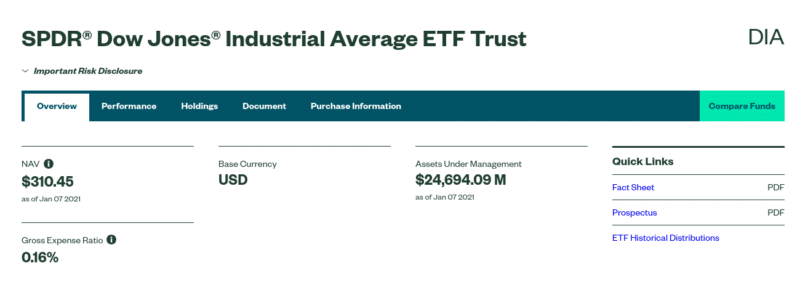

For simplicity, I’ve opted for the SPDR® Dow Jones® Industrial Average ETF.

As the name suggests, this ETF is tasked with tracking the Dow Jones. It is operated by financial powerhouse SPDR, who will personally buy and hold all 30 shares that are listed on the Dow Jones index. As noted above, this will be weighted to ensure it mirrors the Dow Jones as best as possible.

At the time of writing, the top 10 holdings in the SPDR® Dow Jones® Industrial Average ETF look like the following:

- UnitedHealth Group: 7.74%

- Goldman Sachs: 6.18%

- Home Depot: 5.64%

- Amgen: 4.96%

- Microsoft: 4.63%

- Salesforce.com: 4.62%

- Visa: 4.53%

- Boeing: 4.51%

- Honeywell International: 4.51%

- McDonald’s: 4.49%

So, of the ETF’s portfolio, 7.74% of shares are held with UnitedHealth Group. Now that we know the specific weighting, we know that 7.74% of our investment into the SPDR® Dow Jones® Industrial Average ETF will consist of UnitedHealth Group shares.

For example, if we invested $1,000, $77.40 of our capital would be held in UnitedHealth Group. Similarly, we would also own $61.80 (6.18%) in Goldman Sachs stocks and $56.40 (5.64%) in Home Depot. Crucially, this gives us instant access to a diversified portfolio of stocks from a wide range of US sectors.

It is important to note that ETF providers will regularly ‘rebalance’ their portfolios. Not only in terms of the weighting but the specific assets. This is with the view of tracking the respective market as closely as possible – taking into account ever-changing market conditions.

What is the NAV of an ETF?

When investing in ETFs for the first time, it’s important that you have a firm grasp of how the NAV (Net Asset Value) works. This is because it will have a direct impact on how you are able to make money from your investment.

In Layman’s terms, the NAV is the total sum of assets held in the ETF, based on the current market value of each asset. This is usually calculated at the end of each day when the respective market closes.

- For example, let’s suppose that an ETF has a basket of over 100 different shares.

- At the time of your investment, the total value of all 100 shares amounts to $2 billion.

- A few weeks later, all of the shares held by ETF now have a collective value of $2.5 billion.

- As such, the NAV has increased by 25%.

In theory, this means that your investment has also increased by 25%, which will often be reflected in the stock price of the ETF.

However, the NAV of an ETF also needs to take into account other financial metrics. This includes any cash that the ETF has on its books, as well as outstanding liabilities. In turn, the final figure will then be divided by the number of ETF shares in circulation.

Ultimately, there is likely to be a slight deviation in the NAV figure with that of the stock price of the ETF, but is typically minor nonetheless.

Do ETFs pay Dividends?

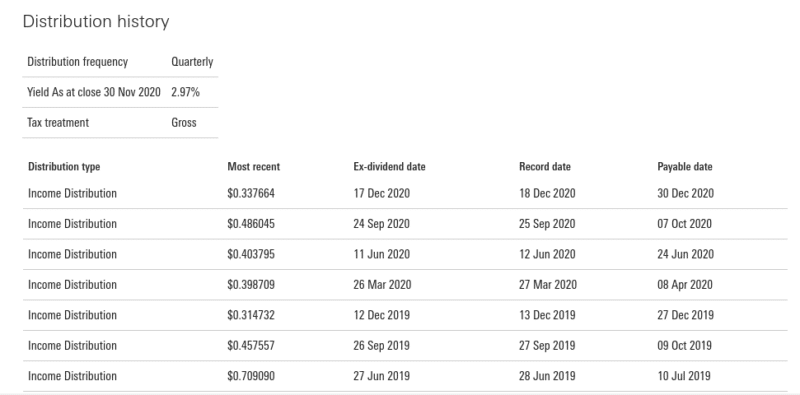

Not only can you make money from an ETF when the value of its assets rises, but also through dividends. This is, of course, on the proviso that your chosen ETF has invested in assets that yield dividends. This will include dividend-paying stocks and also fixed-income bonds.

As an investor, you will be entitled to your share of any dividends that the ETF received. Once again, this will be proportionate to the amount you invest.

For example:

- Let’s suppose that you invest $10,000 into an ETF that holds a basket of US stocks

- 5% of the portfolio is held in Johnson & Johnson stocks

- This means that of your $10,000 investment, $500 is held in Johnson & Johnson stocks

- Over the course of the year, Johnson & Johnson pays an annualized dividend of 3%

- On your $500 Johnson & Johnson holding, this means that you will collect a total dividend payment of $15

It is important to note that you won’t get your dividend payment when the respective company distributes it. After all, the ETF might hold dozens, if not hundreds of dividend-paying stocks. This means that the ETF provider will likely collect dividends on multiple dates throughout the quarter.

It would be a cumbersome and costly process for the provider to keep making individual payments to investors – which is likely to run into the thousands.

As a result, ETFs usually distribute dividends every three months. When they do, this will be paid to the broker that you used to invest in ETF. Or, if you went direct with the ETF provider, this will be reflected in your cash account.

Note: If you are planning to create a long-term investment plan through ETFs, it is worth considering a dividend reinvestment strategy. This means that you will reinvest your dividends back into the ETF as soon as they are paid. In doing so, you can benefit from the long-term effects of compound interest. You will find accumulating and distributing versions of most ETFs. With accumulating ETFs, the dividends are automatically reinvested. Whether you choose accumulating or distributing ETFs depends whether you want regular income from your investment and also the way your country of residence handles the two options taxation-wise.

I personally opt for accumulating funds because I don’t need the regular income, but for my parents, who are retired, I would probably recommend distributing ETFs since they would be investing to supplement their pension payments.

What ETF Markets can you Invest in?

So now that you know the fundamentals of how ETFs work, I am now going to discuss the many markets that you have at your fingertips.

Stock Indices ETFs

Without a doubt, the most common ETF investments are those that track stock market indices. I’ve already discussed the Dow Jones, but there are many others.

This includes:

- S&P 500 (US)

- NASDAQ 100 (US)

- Russell 2000 (US)

- FTSE 100 (UK)

- FTSE All-Share (UK)

- Nikkei 225 (Japan)

- DAX (Germany)

- Euro STOXX 50 (Europe)

- SSE Composite (China)

Crucially, by picking an ETF that tracks a specific index, you can invest in the wider stocks market as opposed to picking individual equities. This is especially the case with ETFs that track the S&P 500 (of which there are many), as you will be investing in 500 of the largest US companies.

Stock ETFs

Not to be confused with stock indices ETFs, it is also possible to invest in a basket of specific stock types. For example, there are ETFs that focus exclusively on dividend stocks. One such example is the iShares Core High Dividend ETF, which gets you a portfolio of 75 US stocks that have a long-standing track record of paying dividends.

Other stock ETFs that concentrate on specific sectors and markets might include:

- Growth Stock ETFs

- Blue-Chip Stock ETFs

- Tech Stock ETFs

- Cannabis Stock ETFs

- Small-Cap Stock ETFs

- Emerging Stock ETFs

Bond ETFs

If you’re looking to invest in markets outside of the stocks and shares arena, you might want to consider a bond ETF. In doing so, you’ll be able to invest in a full range of bond types through a single trade. Crucially, bonds are often difficult to obtain as a retail client.

This is because they often come with large minimum lot sizes that can run into 5 or 6 figures. In turn, this prevents the average investor from getting a look in. But, as ETF providers often have a multi-trillion dollar war chest, they allow you to access bond markets that would otherwise be difficult to reach.

This includes everything from corporate bonds in the US, bonds listed in the emerging markets, US Treasuries, UK Gilts, emerging market government bonds, and even municipal bonds.

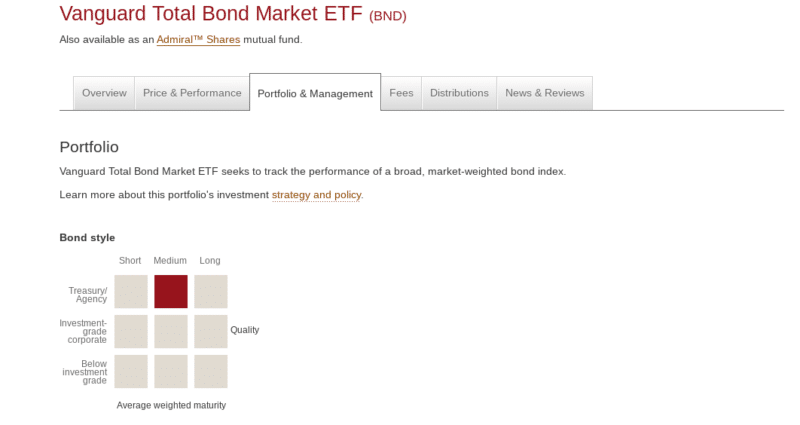

One such example is the Vanguard Total Bond Market ETF. This ETF will get you a stake in over 10,000 individual bond instruments. This covers virtually every bond type possible – from heaps of different markets and risk ratings. For example, while 20.6% of the bonds are held in government-backed mortgages, 18.4% are allocated to industrial bonds.

Stock/Bond Mixed ETFs

Some ETFs will invest in both stocks and bonds. This is a great way to diversify your portfolio. For example, you’ll be able to target capital growth when the value of the stocks increases. But, you’ll also have a solid, predictable form of income from the coupon payments that the bonds yield.

Focused ETFs: An Alternative to Broad Index Funds

If you’re concerned about the lack of control and flexibility in broad index ETFs, focused ETFs might provide a compelling middle-ground solution. Focused ETFs target specific industries, geographies, or investment strategies, allowing you to tailor your portfolio based on your convictions and market outlook. Here are some notable examples:

Dividend Aristocrat ETFs

Dividend Aristocrats are S&P 500-listed companies that have consistently increased their annual payouts for at least 25 years. These companies tend to have stable business models and are exceptionally mindful of cost control, making them reliable choices for income-focused investors.

- SPDR S&P Euro Dividend Aristocrats UCITS ETF (Dist)

- SPDR S&P Global Dividend Aristocrats UCITS ETF

Dividend Aristocrat ETFs are excellent for those seeking consistent income and stability during volatile market conditions.

Commodities ETFs

There are also ETFs that focus on commodities. This is especially useful if you want to invest money into precious metals like gold or silver. In fact, it’s arguably the most convenient and cost-effective way of doing things.

For example, a lot of retail investors will opt for a CFD trading instrument when looking to gain exposure to commodities. However, CFDs are leveraged financial products, meaning that you will need to pay an ‘overnight financing fee’ for each day that you keep the position open.

While this is fine for short-term day and swing traders, it won’t be sufficient for those looking to invest in the long run. On the other hand, if you were to invest in gold via an ETF provider, this is highly conducive for long-term holdings. This is because other than a small annual maintenance fee, there is nothing else to pay.

Gold has historically performed well during times of economic uncertainty, making gold ETFs a solid choice for hedging against market volatility and inflation. Instead of holding physical gold, which offers no yield, gold ETFs invest in gold-mining companies that can pay dividends while benefiting from rising gold prices.

Reasons to consider gold ETFs:

- Global monetary easing and rapid liquidity expansion.

- Record-low bond yields driving investors to alternatives like gold and Bitcoin.

- Heightened fear and uncertainty pushing gold demand.

One of the most popular commodity ETFs in the market is that of the SPDR Gold MiniShares Trust. As the name implies, SPDR will personally purchase and store gold bullion on behalf of its investors. The price of the ETF will go up and down in direct correlation to the value of gold.

Crucially, this ETF comes with an expense ratio of just 0.18%. This offers a hugely cost-effective way to invest in the future value of gold. And like all other ETFs, you can exit your position at any given time during standard market hours.

Utilities ETFs

Utilities-focused ETFs invest in companies providing essential services such as electricity, water, and gas. These companies tend to have consistent revenue streams regardless of economic conditions, making utilities ETFs a relatively safe bet.

- Utilities Select Sector SPDR Fund (NYSEMKT: XLU)

Utilities ETFs are ideal for hedging portfolios while also earning above-average yields, thanks to the stability and regulation of the utility sector.

Semiconductor ETFs

Semiconductor ETFs, like the VanEck Vectors Semiconductor ETF (NYSEMKT: SMH), offer exposure to the rapidly growing technology sector. As 5G infrastructure expands and data consumption rises, chipmakers are positioned to thrive in the coming years. These ETFs are a forward-looking play for investors banking on tech-driven growth.

ETF Fees to Consider

As I mentioned in the section above, ETFs can often be invested in at very competitive fees. With that said, it’s still important to have an understanding of what charges you will be expected to pay before you take the plunge.

ETF Trading Commission

The vast majority of investors will use an online broker to gain exposure to an ETF. In turn, this means that you will all-but-certainly need to pay a commission of some sort.

In most cases, this is charged as a flat fee. For example, your broker might charge you a fee of $10 – which is payable on each ETF investment that you make. Then, you’d also need to pay $10 when you decide to cash out your ETF position.

As I cover in more shortly, there are some really cost-effective brokers in the online space that allow you to invest in ETFs cheaply. DEGIRO gives you access to a selected list of 200-ish ETFs every month that you can also invest in without paying any commission.

ETF Expense Ratio

All ETF providers charge an expense ratio. This is an annual charge that is expressed as a percentage. It includes a range of individual charges that are all packaged together, which in turn, forms the expense ratio fee. This makes it easier for the investor to know what they are paying.

For example, the expense ratio might include the fees associated with opening accounts, processing payments, distributing dividends, and of course – the specific commissions linked to buying and selling assets on behalf of investors.

The good news is that these days, ETF expense ratios are really competitive. In fact, if your chosen ETF provider charges more than 0.50% annually, you can be sure that you are overpaying. The percentage that you are quoted is then multiplied against your total investment amount.

For example, if the average size of your investment over the course of the year is $10,000 and the expense ratio is 0.20%, then you have paid just $20 in fees. This is, however, usually calculated on a monthly or quarterly basis, as opposed to annually.

Why Index ETFs Are a Great Investment Choice

1. Cost Efficiency

Index ETFs generally come with much lower expense ratios than actively managed funds. This is because they track a specific index, eliminating the need for expensive research teams and frequent trading. For European investors, this means keeping more of your returns.

2. Diversification

With a single purchase, an index ETF can provide exposure to hundreds or even thousands of securities. This diversification helps to spread risk and reduces the impact of poor performance by any single asset. Whether you’re targeting European markets, the global economy, or specific sectors, there’s likely an index ETF that meets your needs.

3. Liquidity and Flexibility

ETFs trade on stock exchanges, making them easy to buy and sell throughout the trading day. This liquidity provides an edge over traditional mutual funds, which are priced only once per day. For active investors, the ability to quickly adjust positions is a major plus.

4. Accessibility

European investors now have access to a growing number of ETFs that cater specifically to their region, offering tailored solutions that align with their financial goals and preferences. From major providers like Vanguard, iShares, and Lyxor, the options are extensive and growing.

Best ETF Brokers to Consider

Make no mistake about it – there are hundreds of brokers in the online space that allow you to invest in ETFs. In turn, allows you to choose an ETF trading site that best meets your needs.

The most important metrics that you need to look out for before opening an account with the broker are as follows:

- Is the broker regulated by a leading body like the FCA, ASIC, or the SEC?

- What ETF markets does the broker give you access to?

- What fees and commissions will you need to pay once you invest in an ETF?

- What payment methods does the broker support and what is the minimum investment?

- Is the online broker user-friendly and does it offer a good level of customer service?

Taking all of the above into account, I think that the following brokers are worth considering:

DEGIRO – Offers a Significant Number of ETFs at Super Competitive Fees

DEGIRO offers one of the most extensive asset libraries in the online retail investment arena.

In fact, the broker gives you access to dozens of exchanging – covering North and South America, Europe, Asia, Australia, and more. In other words, if your chosen ETF is listed in a market supported by DEGIRO, then it’s likely that you can make an investment at the click of a button.

Degiro is also one of my top picks because of its low-cost commission model. In fact, the broker published a list of 200-ish ETFs each and every month that you can invest in commission-free. If your chosen ETF isn’t on the list, then you will simply pay a commission of € 2.00 + 0.03%. This is payable when you open as well as close the trade.

In terms of regulation, Degiro is supervised in the Netherlands. This includes authorization from both the Netherlands Authority for the Financial Markets (AFM) and the Dutch Central Bank (DNB). When it comes to payments, Degiro only accepts bank transfers. As such, expect to wait 2-3 days for the funds to arrive.

You can read my full DEGIRO review here.

SaxoTrader – A Comprehensive Platform for ETFs

If you’re looking for a robust platform to invest in ETFs, SaxoTrader should be on your radar. This globally recognized broker offers a vast array of ETFs covering markets across North and South America, Europe, Asia, and Australia.

Key Benefits of SaxoTrader for ETF Investors

- Extensive Selection of ETFs: SaxoTrader provides access to thousands of ETFs, including major options like Vanguard, iShares, and SPDR. No matter your investment focus—be it global diversification, sector-specific exposure, or emerging markets—SaxoTrader has you covered.

- Competitive Pricing: While not the cheapest on the market, SaxoTrader offers transparent pricing with low commissions and no hidden fees, making it a reliable choice for long-term investors.

- User-Friendly Interface: The platform is highly intuitive, catering to both novice and experienced investors. From detailed ETF information to advanced trading tools, SaxoTrader ensures a seamless investing experience.

- Strong Regulatory Oversight: SaxoTrader is regulated in multiple jurisdictions, ensuring your investments are secure and compliant with international standards.

- Flexibility in Funding: SaxoTrader supports a wide range of funding options, including bank transfers, debit/credit cards, and more, ensuring easy account management.

Why Choose SaxoTrader?

SaxoTrader is a great choice for European investors due to its extensive ETF library and comprehensive research tools. Whether you’re building a diversified portfolio or seeking specific market exposure, SaxoTrader provides the resources and support you need to make informed decisions.

How to Invest in ETFs Online – Step-by-Step Walkthrough

My guide on ETFs has hopefully cleared the mist for those of your that are new to this investment class. If you like the sound of how ETFs work and you’re wondering how to get started today – follow the steps outlined below.

Step 1: Open an Account With Your Chosen Broker

Your first port of call is to open an account with your chosen broker. As I covered earlier, you need to look at metrics like regulation, supported ETFs, fees, payment methods, and customer support.

Opening an account will require some personal information from you – such as your name, address, date of birth, and contact details.

Step 2: Complete KYC Process

All regulated brokers in the online space are required to comply with KYC (Know Your Customer) regulations. As such, you will now be asked to upload some identification documents.

In most cases, this will be a copy of your:

- Passport or driver’s license

- Proof of residency – bank account statement, utility bill, etc.

The length of time that you need to wait for the broker to validate your submitted documents can vary quite considerably. For example, old-school brokers will typically require 2-3 working days – as they still used manual, paper-based processes.

New-age platforms like Saxo and DEGIRO, however, are often able to validate your documents instantly. This is because they use FinTech systems that can check the authenticity of your documents automatically.

Step 3: Deposit Funds

Before you can invest in an ETF with your chosen broker, you will need to make a deposit. The minimum deposit will vary depending on the platform. DEGIRO does not have a minimum deposit policy in place.

You do, however, need to remember that DEGIRO does not support any instantly-processed payment methods, as only bank transfers are permitted.

Step 4: Search for ETF

Once you have made a deposit, you are then ready to invest in your chosen ETF.

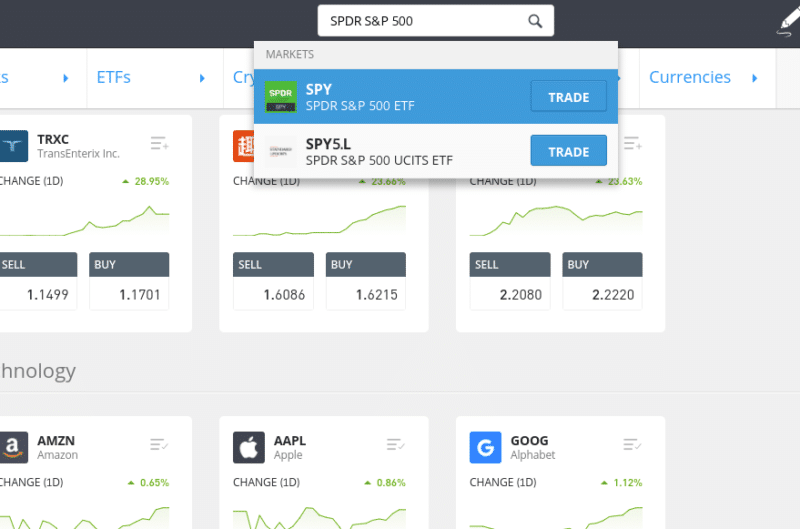

So, if already know which ETF you want to invest in, simply enter it into the search box. In the example below, you’ll see that I am looking to invest in the SPDR S&P 500. When the search result loads, click on the ‘Trade’ button.

If you don’t know which ETF you want to invest in and need a bit of inspiration, click on the ‘Trade Market’ buttons on the left side of the screen. Once you click on ‘ETFs’, you’ll see all 250+ supported markets.

Step 5: Complete ETF Investment

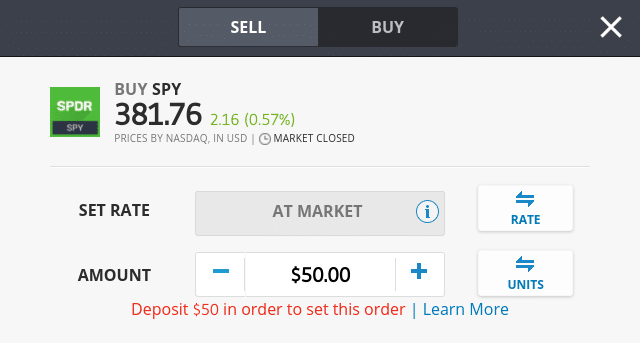

Once you have found the ETF that you want to invest in, it’s then just a case of following in the order form.

As you can see from the above, the minimum investment on the SPDR S&P 500 ETF is just $50.

Then, to complete your investment, click on the ‘Open Trade’ button.

Top Index ETFs for European Investors

For those interested in diving into the world of index ETFs, here are some excellent options to consider:

- Vanguard FTSE All-World UCITS ETF (VWRL)

- Domicile: Ireland

- Expense Ratio: 0.22%

- Size: Over $12 billion in assets

- Case for Investing: This ETF provides exposure to thousands of stocks globally, covering both developed and emerging markets. It’s ideal for investors seeking broad diversification in a single fund. Available on major European brokers like Saxo and Interactive Brokers, it’s a great core holding for long-term growth.

- iShares Core MSCI World UCITS ETF (IWDA)

- Domicile: Ireland

- Expense Ratio: 0.20%

- Size: Over $40 billion in assets

- Case for Investing: Focused on developed markets, this ETF provides broad exposure to large and mid-cap stocks across North America, Europe, and Asia-Pacific. Its low cost and strong track record make it a favorite among European investors.

- Lyxor MSCI Emerging Markets UCITS ETF

- Domicile: Luxembourg

- Expense Ratio: 0.14%

- Size: Approximately $2 billion in assets

- Case for Investing: For those looking to tap into high-growth emerging markets like China, India, and Brazil, this ETF offers a cost-effective way to gain exposure. It’s a great option for investors seeking higher risk-adjusted returns.

- Xtrackers Euro Stoxx 50 UCITS ETF

- Domicile: Luxembourg

- Expense Ratio: 0.09%

- Size: Over $6 billion in assets

- Case for Investing: A cost-effective way to invest in Europe’s top 50 companies, this ETF is tailored to those prioritizing European exposure. It’s particularly suited for investors who believe in the resilience of the European economy.

- SPDR S&P 500 UCITS ETF

- Domicile: Ireland

- Expense Ratio: 0.07%

- Size: Over $30 billion in assets

- Case for Investing: Tracking the S&P 500, this ETF is a mainstay for investors wanting exposure to the U.S. market. With low costs, liquidity, and significant historical returns, it’s a fantastic choice. Given the U.S. market’s dominance and proven track record, betting on the S&P 500 through this ETF is likely to yield great results in the coming years.

I firmly believe that betting on the S&P 500, with its significant dominance and consistent returns, is one of the best strategies for European investors in the coming years. The low costs and robust growth potential make it a standout choice for anyone looking to build wealth efficiently.

The Bottom Line

In summary, ETFs are a great investment to consider if you have little understanding of how to pick and choose individual assets. This is because the ETF provider will give you access to a highly diversified portfolio of instruments based on your financial goals and appetite for risk.

This covers everything from stocks and bonds to gold and silver. With that said, ETFs are not only suited to inexperienced investors. On the contrary, they are also ideal for those of you without the required time to research and analyze the financial markets.

Best of all, ETF providers rarely charge more than 0.50% per year these days. As such, you can easily create a diversified basket of assets without getting hammered by overly priced commissions.

Buy ETFs on Saxo| Buy ETFs on DEGIRO

Investing in stocks, bonds, and ETFs involves risks including complete loss. Please do your research before making any investment.

Hi Jean, do you know if the entire list of commission-free etf on Degiro change or only a part of them? Thank you

Hi Jean. I am rather confused about buying American ETFs from Malta. I am still very new to this but many were mentioning VOO and QQQ as very “safe” ETFs to invest in. I use CC Trader and manged to buy both VOO and QQQ, but I was very confused to hear later that EU citizens are not allowed to buy US ETFs any more and that we should opt for the EU equivalent ones.

Since CC trader support is offline for the weekend, I wanted to ask:

1. How does CC Trader allow us to buy US ETFs when it is not allowed in the EU?

2. Will I have to pay taxes in the US and again in Malta?

3. Would you advise that I get rid of these US ETFs and invest the money in the EU ones, such as VWCE.?

On another note, I discovered this site by accident and was pleasantly surprised. I look forward to visit regularly.

Thanks for your comments Andrew.

I’m not sure if currently CC Trader allow you to buy those US ETFs directly, they should not allow you since EU regulation has prohibited that as you state. You’ll need to clarify that issue with CC Trader directly.

There is a double taxation treaty between Malta and US, you will pay 15% withholding tax on dividends received from US investments. Then your accountant can see if any further tax is due in Malta.

I wouldn’t get rid of US ETFs if you currently own them, they work just fine.

Thanks for the advice I’ll stick with IB then 🙂

Hi Jean,

I’m currently with Interactive Brokers and have an ETF under 50,000 euros – although I’d like to invest more which would put me above the 50,000 euros amount which would mean submitting the Modelo 720. Do you know if there is/or it would be worthwhile transferring the ETFs to a broker registered in Spain to avoid having to fill in the 720?

Thanks

Hi Paul, I have a general distrust of Spanish financial platforms and would much rather keep my money in a serious platform like Interactive Brokers. Even if that would require me to fill in the modelo 720. The first year might be a bit painful till you get the hang of it, and I would suggest hiring someone to do it, but for subsequent years you could even do it yourself.