Finance and investing are some of my main passions these days, and I’ve written extensively about my experiences on this blog.

Many people think that their money is safe at the bank and they don’t need to do anything with their savings. Well, here’s the inconvenient truth: by leaving money in the bank and not investing it, you’re actually losing money every year, to the tune of around 3% in most developed nations. This is due to the effects of inflation.

Here is the way inflation works. One euro today will buy more products than one euro next year, and the effect is compounded over the years.

If you’re 30 years old or over, you will probably remember clearly the times when everything was much cheaper. I remember, for example, the price of a pizza around 25 years ago being just a quarter of what it is now. That means that if I had kept all my money in the bank without investing it, over this period of time it would be worth much less, hence I would have actually lost a lot of value.

The obvious remedy to the problem of inflation is therefore that of investing our savings. Before you rush out and invest everything, make sure you know where you’re putting your money and have a proper strategy in place. I suggest you learn as much as possible about investing, without relying too much on financial advisers, as typically they will be looking after their own interests, not yours.

Apart from traditional investments where you get a yearly return in the shape of dividends, profits or returns on loans, many people are now deciding to convert their fiat currencies into cryptocurrencies such as Bitcoin. The major attraction in Bitcoin is that it is deflationary rather than inflationary. Since it has a limited supply, as time goes by the value of each bitcoin will increase rather than increase. This is the total opposite of fiat currencies, where, as we mentioned earlier, one dollar/euro today will be worth a bit less tomorrow.

How are you fighting the effects of inflation?

I get this question frequently enough from friends and people who land on this blog. To provide a quick reference, if you want to start investing your money through online platforms, there are a few different ways you can do it:

- Cryptocurrencies

- Property crowdfunding

- Peer-to-Peer Lending

- Stock market

- Online properties (websites, apps, etc)

- Forex and day trading

The level of risk and expertise needed to operate in the above markets differs wildly, so I’ll try to give some further pointers as to what to start off from. I will also include the expected level of return per year one should be aiming for.

Cryptocurrencies

This is probably the only current way to make really big profits (or losses) in a relatively short time. You can refer to my post about cryptocurrency resources to learn more about this area. It’s definitely a super interesting way to invest your money, and possibly cryptos will revolutionize our lives in the very near future. At the very least, you should keep yourself informed about what’s happening in this space, even if you don’t invest.

To get started with cryptos, read my guide to investing in Bitcoin and other cryptocurrencies and my opinion on whether you should buy Bitcoin or Ethereum.

Projected returns are hard to predict in such a nascent space. David Fauchier, the founder and chief investment officer at Cambrial Capital, said 20% net returns is the benchmark for him in terms of crypto trading. It’s about being able to achieve those returns even when the overall market is flat, not just in times of volatility.

I think that 20% figure makes sense for a fund, but as an individual investor/trader, the returns can be much higher.

Expected yearly return: 40%+

Property Crowdfunding

Property Crowdfunding or property-based P2P lending is one of the most popular ways to get exposure to real estate from the comfort of your home. I think this is a pretty safe and low-risk investment given that you are purchasing real estate, which historically has held its value very well. As always, you need to be vigilant in what properties you invest in and diversify as much as possible.

I recommend diversifying geographically, having properties in various locations around Europe, including the UK. Germany and the Baltics, in particular, have yielded excellent results for me. You can also diversify on property types, such as buy-to-let, flipping, and even property-backed loans.

These are my favorite platforms:

You can check out my full list of favorite real estate crowdfunding platforms in Europe, where I go into more depth about these platforms and online real estate investment in general.

Expected yearly return: 4-12%

Read my guide on real estate investment

Business and Personal Finance (P2P Lending)

This might initially sound like a fishy area, but really it’s not. After the last financial crisis, banks tightened up their lending procedures, and while that was, in general, a good thing, it also left a lot of people out in the cold and unable to get a loan.

In Europe, this is a big problem in many Eastern European countries as well as other Western European countries like Spain too. With interest rates being as low as they are at the moment, the situation created was that of people in Western Europe having money to invest and on the other hand people in Eastern Europe needing cash for business or personal needs. The resulting opportunity created the rise of loan platforms that are doing so well today.

With these loan platforms, you can choose to diversify your investments over hundreds or thousands of loans across many countries. You can also choose to diversify as to what types of loans you want to invest in. For example business loans, car loans, home refurbishing loans, bridging loans, etc.

My recommended platforms in this space:

You can read more about what I consider to be the best P2P lending platforms in Europe.

Expected yearly return: 8-12%

Stock Market

The stock market is one of the most well-known ways of investing, so I won’t spend much time on it. I will only say that you should really think twice about using financial advisors and investment brokers, as they are mostly just salesmen who make money on the amount of products they manage to sell to you. In other words, they aren’t really on your side.

Research has shown that most index funds perform better than actively managed funds, so you don’t need to be paying hefty commissions every year for someone to manage your funds. You can use index investing to your benefit, especially now that roboadvisors are taking the place of fund managers.

Another great strategy would be to go for dividend growth investing. There are tons of websites of investors who detail their month-to-month earnings using this strategy. I like the idea of dividend growth investing when compared to index investing for the following reasons:

- No yearly commissions to pay (indexing can cost 0.5 to 1% of your total sum invested)

- You choose which companies to put in your portfolio. You can thus avoid companies that you don’t want to support. For example, being a health-conscious person, I don’t want to invest in and support Coca-Cola. So that company would be out of my dividend growth portfolio, even though it has a great track record. The same goes for Mcdonald’s.

- It’s more exciting, depending on your personality, to actually choose which companies you want to be a part-owner of, and track them year over year. On the downside, it also takes more time.

With both strategies, you would then use an online stock broker to purchase your shares or ETFs.

I personally love to pick stocks myself, even though I know that the theoretical odds are stacked against me. Check out my ideas on stock picking and my favorite stocks.

Expected yearly return: 10%+

Read my guide on stock investing

Gold and Silver Bullion

First of all, what the heck is bullion? Bullion is gold and silver that is officially recognized as being at least 99.5% pure and is in the form of bars or ingots rather than coins.

The word bullion comes from the French Minister of Finance under Louis XIII, Claude de Bullion. To create bullion, gold first must be discovered by mining companies and removed from the earth in the form of gold ore, a combination of gold and mineralized rock. The gold is then extracted from the ore with the use of chemicals or extreme heat.

See also: Should you invest in gold right now?

With that out of the way, we can now talk about where to buy, store and sell bullion online. The storage part is key here. Most probably, you won’t want to worry about storing your own gold or silver in a safe place. That’s why platforms like BullionVault take care of storage for you. Of course, you can also buy and sell on the platform.

One important factor to consider with bullion: Gold and silver have no intrinsic value. They aren’t productive assets. Compare them to stocks. When you own a share of stock, you own a piece of a business that produces goods and/or services to consumers. A good business generates a profit. Every year that passes, gold remains sitting in the vault, but the owner of a company such as Apple or Nike might have a giant pile of cash from the profit generated over that same year.

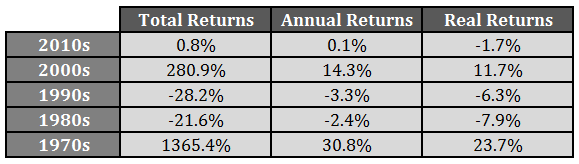

When evaluating the performance of gold as an investment over the long term, it really depends on how long a term one is considering. Over a 45-year period, gold has outperformed stocks and bonds; over a 30-year period, stocks and bonds have outperformed gold; and over a 15-year period, gold has outperformed stocks and bonds.

Gold returns in recent decades

Many investors don’t really consider bullion to be an investment at all. Rather, the precious metal acts as a hedge, or a way to try to protect wealth against the risk of loss in such asset classes as real estate, equities, and bonds. There’s the doomsday scenario reasoning too, which argues that in the case of a global financial collapse or armageddon, gold and silver will be some of the only things with value attached. People will first value food and shelter that cover their basic needs, and soon after demand will start again for gold and silver as people seek to build a store of wealth or impress others.

Needless to say, gold and silver are very contentious assets, with strong arguments both for and against. In my opinion, if you have money to spare, it wouldn’t hurt to keep some of your net worth in gold as a hedging mechanism. I would give priority to nailing good investments in some of the other categories above, however.

You can use Bullionvault to invest in gold.

Expected yearly return: Nobody knows really, it could be negative returns to double-digit positive returns. It’s more of a hedging mechanism than something you invest with hopes of a specific rate of return.

Read my guide on investing in gold

Online Properties

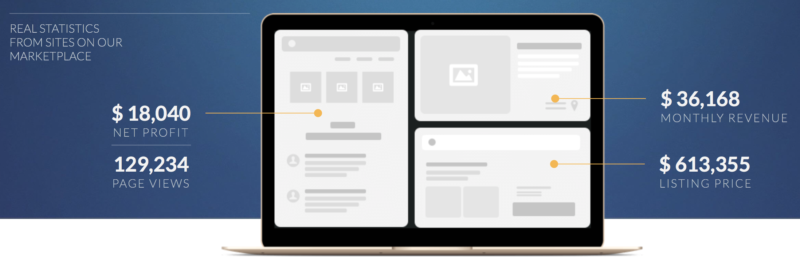

By online properties, I mean websites or mobile apps. Chances are you know of a friend or friend of a friend who has achieved some degree of success by owning a website or a mobile app. This is your chance to do the same, but rather than starting from scratch, you buy an existing up-and-coming website, or indeed one that’s well established and turning a healthy profit.

You need to be careful in evaluating such online properties, but they can give returns of 40% plus per year, which is super attractive compared to other opportunities. If you know what you’re doing, the risk-reward ratio is very much in your favor.

Bew careful about pure Amazon affiliate sites. If you’re relying 100% on Amazon commissions and you think that you’re your own boss – think again. Amazon owns your ass. For example, they recently decided to cut the commissions for a set of categories by up to 80%.

It’s a good business move by them, IMO, and nothing new (link). Diversification is key. Sites that have multiple traffic and revenue sources are the ones that achieve the highest multiples. If you rely on one or two sources, you’re not playing the long-term game. You’re just looking for quick-wins.

To learn more about buying and selling online properties, check out my guide to flipping websites and the Empire Flippers podcast.

Domain Magnate and OnFolio are two platforms that you can use to invest in website group buys where you don’t necessarily have to manage things yourself.

I think that some niches are better than others. I’ve been looking at several niches and so far the best I’ve seen are online marketing, personal finance, investing, and technology. Fitness websites also interest me a lot but it’s really hard to make a decent dime on those without ending up promoting rubbish products.

Expected yearly return: 40%+

Read my guide on website investing

Forex and Day Trading

Forex and day trading are not my favorite way of generating income as they are very hands-on and you need to be monitoring charts daily to buy and sell currencies for profit.

However, that’s not to say that there’s anything wrong with this type of investing. If, unlike me, you seek an intense and high-adrenaline way of investing, and you’re really attracted to and love technical analysis and charting, day trading might be the right choice for you.

I do know several people who are passionate about day trading and make a very decent living out of it. Don’t fall for the internet promises of instant riches in day trading with minimal time investment though. If it sounds too good to be true, it always is.

Like any other kind of investment, day trading requires a high degree of competency, discipline, and daily work to have a chance at being successful. You can achieve an above-average level of wealth in the long run if you put in the effort.

If you want to give it a go, however, check out my deep dives on this topic:

- How to day trade in 2 hours or less (extensive guide)

- CFD trading guide – What are CFDs and should you trade them?

- A guide to the forex markets

Expected yearly return (with a good dose of luck): 30-40%

I hope this short summary will help you get a good idea of all the options available. If you have any questions or would like me to write more in-depth about any of these topics, please let me know.

Is Investing Risky?

Everything in life is risky, it’s a game of probability.

Although we have rules in our modern societies, at the end of the day we remain biologically programmed for self-preservation and protection of our offspring. I try to keep that in mind during my daily life, so as not to expect anyone to look out for my interests and do the job I’m supposed to be doing.

If anyone does happen to act in that way, then it will make my day. But it’s never my default expectation. I learned to think in this way from Stoic philosophy and it has served me very well in the past years when I’ve had to deal with adverse and uncertain situations.

Ultimately, I’ve made peace with risk and even grown to love it. I wake up every day excited to know what opportunities (and risks) I will come across during the day, knowing fully well that I will win some and also lose some.

My aim in business and investing is to be able to look back every five years and ask myself:

Am I significantly wealthier than I was five years ago?

If the answer is yes, then I’m happy with what I’ve been doing during those years. If not, then it’s time to see what I’m doing wrong. Over the long run, it is our actions that determine our destiny, but that is not necessarily the case in the short run. And that is why you need to adopt a long-term approach to not only investing but life in general.

Almost anything can be a good investment, for the right people at the right time. Say you got suckered into a pyramid scheme like Neways, which was popular in Malta when I was in my early twenties. The majority of the people lost their money, but those who got in early made some tidy profits. It all depends on the circumstances of your investment.

It is inevitable that you will make some bad investment decisions along the way. Just like in sport you will have bad performances that will cost you matches and championships. Of course, you should have known better, but that’s how you acted in those circumstances due to all the various factors involved. The only thing you can do is to try to learn a lesson and move on.

Life is such a continuous game of mistakes and lessons learned. A good base of education will ensure that we avoid getting wrecked, but there is no way to avoid making mistakes except not playing at all.

In investment, my approach is to learn as much as I can within a reasonable timeframe, then dive in. If it’s a new asset class that I’m interested in, I will spend 6 months reading everything I can find about the class, then go straight in with small amounts, leave another 6 months and hopefully learn some lessons along the way. After 1 or 2 years I’m ready to take bigger steps.

Make sure you do your own homework before you invest and don’t rely on other people’s advice. Be prepared to lose money and subsequently spend your time analyzing what went wrong and what you can learn rather than complaining or feeling bad and blaming yourself or other people for it.

Market Timing

Most new investors will find themselves investing in some stock or crypto when its price has already peaked, leaving them with little upside and potentially huge losses if the asset is especially volatile.

Professional investors or amateur ones who work hard at the game can spot opportunities due to their immersion and education. Once they spot them, they also have the capital to deploy into an “obvious” opportunity.

Others are blind and oblivious to what’s happening as they are busy with other stuff. Even if a professional investor friend of theirs told them about the massive opportunity and no-brainer trade they would not be comfortable investing any money, and frankly, they shouldn’t unless they happen to have decided to fully follow and piggyback on the investor friend’s knowledge, as you would if you were to join a fund.

What happens later is that they see everyone talking about the opportunity weeks, months, or years later, and then it starts to seem obvious to them too, and they buy into it as well, but too late.

I myself am almost always late by my measures in most investments, typically going in a quarter or midway into an investment’s run, but I’ve also been guilty of going in way too late too. However, that’s usually good enough for me and gives me the right mix of time invested VS returns gained.

Be aware of the pitfalls of trying to time the market. The only way to lessen timing mistakes and avoid going in at the wrong moment is to work hard on understanding the industry and its trends as well as networking and surrounding yourself with other trendspotters and experts.

It’s OK to Miss Out on 1000x Returns

The markets in recent years have been crazy enough that it’s common to see a lot of people feel sorry for themselves for missing out on 1000x+ on Bitcoin, Ethereum, ICOs, Gamestop, some DeFi yield farming trend, NFTs, etc etc.

However, I’m here to say that it’s totally OK to miss out on investing very early in any of these things. The truth of the matter is that the risks of buying into the initial stages of all these projects or trends were extremely high. For every story of riches, there are a thousand others of total ruin.

Don’t get me wrong, I’m not the type of person to dismiss a trend just because I don’t understand it or because it’s the newest thing. But I do like to understand things, and I know by now that I’m pretty good at going over lots of different sources of information and coming up with sensible conclusions about pretty much any topic. So when I feel that I don’t really know why I would invest in something other than the thing in question going up like a hockey stick or people on Twitter boasting about their massive returns, I tend to sit out. Instead of throwing money into the game, I double down on my efforts to understand the subject in order to come to a sensible conclusion.

Leaving money on the table during the early stages takes away a lot of anxiety and helps me focus on what I’m good at – understanding stuff. And when I do, I take calculated but significant bets on things that might change the world within the next 5-10 years.

And that’s pretty damn fine.

Don’t dismiss the next exciting market without doing your homework, but don’t go all-in on things that are trending but you have no idea about, either.

As in many other areas in life, doing proper research and thinking long-term provides the best holistic results.

Hello everyone,

On the same topic of co-investing, I have recently discovered an app called Diversified (https://www.diversified.fi), an investment platform for rare and profitable products.

Did anyone try this service ?

Thank you,

have a great day !

I found it interesting when you talked about investment opportunities for your needs. In my opinion, everyone should think about their financial future and how to achieve their goals. I believe investing could be the next step for a business owner, and if it were the case, I’d look for professional guidance to get started. Thanks for the information on how to know where to start investing your funds.

Hi, can you advise on the online platforms / apps that allow European citizens to invest in ETF/US stock? Apart from Revolut

Check out my review of DEGIRO.

Hi Jean,

Thanks for lots of useful info!

Do you have any experience with the OnFolio platform? I’ve checked it out after reading your post, and the general idea seems great.. I’m just not sure how reputable the platform is.

Cheers,

Aleksa

Great list! On the property crowdfunding side, I also considered Rendity.

On the same crowd-investing topic for European investors, I have recently discovered an app called Konvi (https://konvi.app/), an investment platform for luxury goods. They have an amazing track record (11% appreciation per year at worst) because they are able to use their expertise when choosing assets 🙂

Welcome. Rendity is a good platform that I’ve also used myself and reviewed here.

I’m not sure how Konvi can have a track record if they haven’t even launched the private beta yet. I wouldn’t invest on that platform for the time being. It feels very experimental.

Online trading is trading in financial markets via the Internet. Previously, all trading was held in the exchange building in person or by phone.

First, you need to learn business fundamental then you should jump business. I would like to suggest you do affiliate marketing.

Hi Jean I totally agree with you, and I followed your advices about cryptocurrencies and Property crowdfunding etc… but I have recently found the best way to invest, for me, it’s “social trading”, it’s not mentioned in your article, why?

I just haven’t tried that yet Marco, could you tell us more about your experience? You’re welcome to write a guest post on the blog too if you wish.

I am using etoro and is working great, it’s 2 months I am study any details about the platform, commission, risks and warranties and I can say it’s the best way I found for investing. As you prefer I can write a guest post or just share with you all the infos I have about that.

You can now find my eToro review on this site as well.

$10k!

That aged well haha (Bitcoin price at the time).

Great article, thanks for sharing

You’re welcome Luke.

Great overview Jean – thanks for sharing! I’ve been toying with investing online but never got around to setting time to read up on the subject – mostly due to the fact that I know that you need some extra effort to really be careful what to read, and which sources to trust since you’re the entering territory where online scammers like to wait for their next target 😉

Glad you like the post Daniel. Since most of these things are relatively new, it’s normal to feel a bit hesitant about trusting your money on these platforms. On the other hand, being an early adopter gives you the opportunity to possibly make higher returns. It’s just a matter of educating yourself as much as possible by reading and asking other people for their experiences. One example of the early adopter advantage can be found in the area of loans. People who started doing loans on platforms like Bondora and Mintos just two to three years ago obtained returns of up to 20% yearly. As the platforms became better known and more investors joined, the returns went down, and now the average is only around 11%.

The platform is very fine and good