Seasoned traders will tell you that brokers in Europe offer some of the best trading platforms with strict regulatory measures to protect trader’s investment and ever-decreasing transaction fees. As a result, many new brokers are looking to invest in the European trading market.

However, this growing number of traders has also led to a rise in new brokers looking to benefit from the increased traffic. So, how do you differentiate the good legit brokers from those looking to scam your hard-earned cash with ridiculous commission fees on Europe’s trading scene?

Here’s a list of what I consider the best low-commission trading brokers in Europe right now. With this list and plenty of educational material to supplement your research, you’re set to start trading like a pro.

Disclaimer – I do not provide investment advice on Contract for Differences (CFDs) as they are complicated and come with a high risk of losing your money. Around 74-89% of investor accounts lose money when trading CFDs. You must have a higher understanding of how CFDs work and consider whether you can afford the high risk of losing your money.

Best Low Commission European Trading Brokers

Are you looking at the top brokerages serving European traders? Here is a list of the best ones with free commission trading and low or zero withdrawal fees.

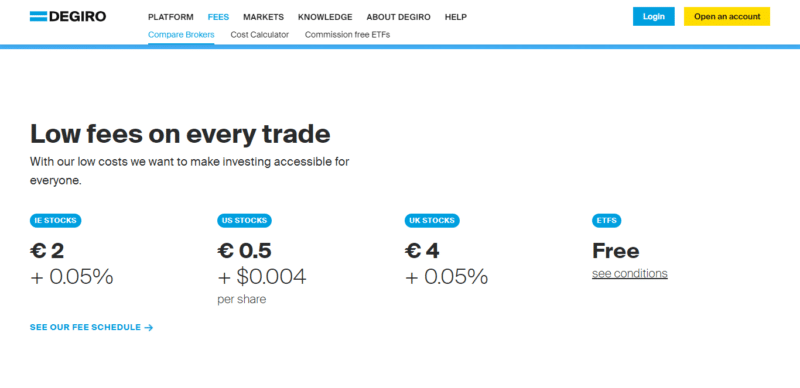

- DEGIRO – Zero commission broker with low fees on trades. DEGIRO offers some of the lowest fees on the market and is regulated by multiple top-tier authorities. It provides a web and mobile platform that is easy to use.

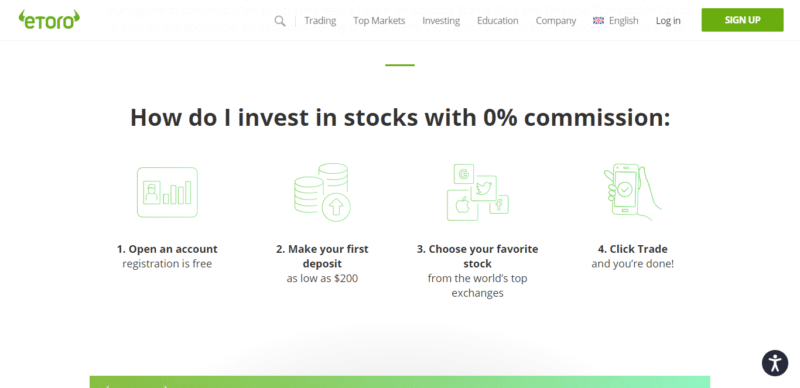

- eToro – Zero commission on stocks makes eToro the largest discount broker for European traders. Regulated by UK Financial Conduct Authority (the FCA), CySEC (EU), and ASIC (AU), the broker has over 12 million active users. Seamless account opening with social trading experience makes eToro a top choice.

DEGIRO – Top online trader and discount trading

DEGIRO is a privately owned discount broker that was founded in 2008 in the Netherlands. The Dutch online trade platform is popular for its low trading fees and free monthly ETF trades.

Some of the top-tier authorities regulating DEGIRO operations include the Dutch Central Bank DNB and Netherlands Authority for Financial Markets AFM. Additionally, the company is duly registered by the Amsterdam-based Chamber of Commerce and Industry.

DEGIRO provides its users with bonds, options, stocks, ETFs, leveraged products, and futures. You will get access to about 50 world exchanges on this platform.

If the company’s claim on their website is anything to go by, they have industry-leading commission rates and a trading platform suitable for beginner trading. If you’re looking to cut on costs while trading, DEGIRO offers an easy-to-use platform worth considering.

Fees

Trading fees on DEGIRO are among the lowest, but you can only enjoy one monthly commission-free ETF irrespective of your trade size.

The good news is that DEGIRO has zero deposit fees and no limit on the account minimums. What’s more, it does not charge you for withdrawing earnings from the platform. DEGIRO is also one of the cheapest platforms for account maintenance – there is zero annual maintenance and custody fee charged.

On the other hand, just like many other brokers, DEGIRO charges a small fee on international ETF trading. The charge includes a €2 cost in addition to 0.03% of the value of your order. The charges on stock trading vary widely, but they’re lower than the industry averages.

For instance, trading stock on the London Stock Exchange will cost you €1.75 and an additional 0.022%. If you were to go for another broker, say Xetra, it would cost you €4.00 and an additional 0.05%.

On DEGIRO, you’ll part with €2.5 as an annual connection fee for each exchange – except for the Irish Stock Exchange – and an extra 0.10% of the traded amount as a currency exchange fee.

DEGIRO features

- Low trading fees

- Products on offer include bonds, options, futures, shares, leveraged products.

- Regulated by AFM

- No minimum account deposits

- No inactivity fee

- 24-hour trading

- Supports EUR, CHF, GBP, NOK, SEK, CZK, PLN, HUF and DKK.

eToro – Zero-commission on Stocks

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

eToro was formed in 2007 and has grown to become the largest international broker with over 12 million traders. It provides EU and UK traders with commission-free trading on stocks and ETFs. The platform offers a wide range of products, including cryptocurrencies, indices, forex, and commodities, at very favorable spreads.

Having been in the industry for over 13 years, eToro stands out as a reputable trading broker. Three top-tier authorities regulate it, including ASIC of AU, CySEC of EU, and FCA in the UK. Due to the Cyprus Securities and Exchange Commission regulation of eToro, investors have up to €20,000 protection. The UK regulator, on the other hand, protects up to €85,000.

Fees

If you’re looking for an investment brokerage with the lowest fees, eToro beats them all. The platform charges zero fees when you open or close a stock trade. This is for the non-leveraged positions.

It is worth noting that eToro’s USD-based accounts incur a flat rate fee of $5.00 on withdrawals. Unfortunately, deposits made in other currencies will have to incur an additional conversion fee.

eToro is a multi-asset platform that allows you to invest in stocks and crypto-assets as well as trading CFD assets.

eToro features

- Zero commission on stocks and low transaction fees

- Wide range of products, including forex, cryptocurrencies, CFDs, stocks, and indices

- Excluding Serbia, all other European countries are supported

- Regulated by FCA, CySEC, ASIC

- Minimum deposit amounts of $200

- Has a demo account for beginner traders to do some training

- Charges a $10 inactivity fee for accounts that stay logged out for a year

- Copy portfolios are designed to minimize your risk long-term while pointing you towards new opportunities

- Copy-trading is available

- Fractional shares are available

Investing in stocks, bonds, and ETFs involves risks including complete loss. Please do your research before making any investment.

Disclaimer: eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Past performance is not an indication of future results. Trading history presented is less than 5 complete years and may not suffice as basis for investment decision.

Copy Trading does not amount to investment advice. The value of your investments may go up or down.

Your capital is at risk.

Cryptoasset investing is highly volatile and unregulated in some EU countries. No consumer protection. Tax on profits may apply.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.

Conclusion

Online trading allows you to invest your money in products whose performance you can track in real-time. Different brokerage firms vary in the way they charge for their services. These charges can be a deal-breaker when it comes to choosing your ideal platform.

DEGIRO is outstanding for its low fees and overall ease of use. eToro has an outstanding reputation as a commission-free platform with a plethora of features.

That said, your favorite platform should be based on your needs. Generally, the brokers mentioned above provide the industry’s best services in Europe.

Investing in stocks, bonds, and ETFs involves risks including complete loss. Please do your research before making any investment.

Leave a Reply