Bondora is one of the oldest peer-to-peer lending platforms, and I joined early on in my P2P lending journey, around 2016.

While this platform has been criticized by investors in the past, my portfolio has been chugging along quite well over the years, and my only complaint would be about the graphics and UI of the platform, which I find really ugly.

In this Bondora review, I’ll be sharing my results on this Estonian platform, since many of you have been asking me if you should invest in this platform and if so, how to do it.

You probably know this platform by the very distinctive cartoon characters they employ on the website. I find them a bit old-fashioned, but there’s no question that it gives Bondora a very distinctive and memorable branding.

Alright, so let’s dive straight into it.

Bondora’s slogan is “it just takes a minute to beat your bank”, and I would say that’s true. I sometimes forget I even have an account on Bondora as it was super easy to set up since I used their Go and Grow system all along.

Other investors have had tough times with defaults and delays when using other strategies, and that seems to be the source of most of the bad comments about Bondora.

Bondora assigns a rating to its loans going all the way from AA to HR. HR stands for high risk. Those who invested in the riskier loans chasing high returns got burnt.

On the other hand, everyone seems to agree that Go and Grow has always worked just fine.

I would, therefore, recommend that you use Go and Grow if you want to add Bondora to your diversified set of peer-to-peer lending investments.

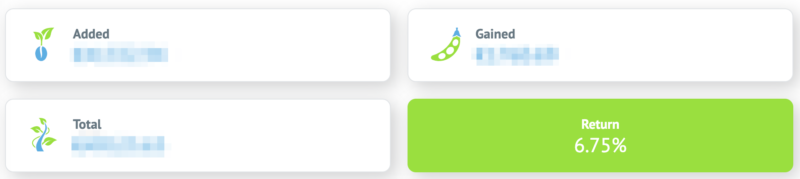

Through this method, I have been able to obtain a 6.75% return over the years, which I’m quite happy with considering the total lack of work involved from my end.

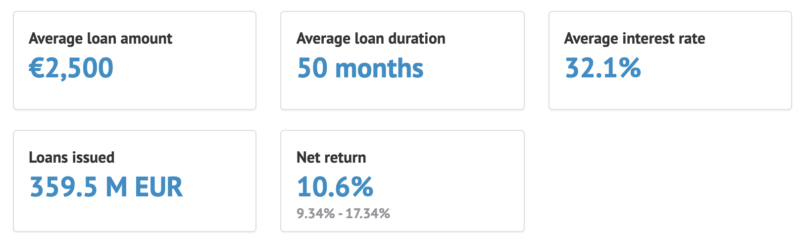

If we take a look at the latest statistics on Bondora (the platform is very transparent about all the major stats, and that’s a very positive thing), we can see that the net average return is 10.6%, but that takes into consideration investors using other ways of investing on Bondora apart from Go & Grow, so it’s expected that the average return is higher than what I managed to achieve.

Bondora is a loan originator itself, so it’s different from other platforms like Mintos, which act as aggregators of loans (and loan originators).

The secondary market is reported to be quite illiquid, although I haven’t tried it myself as I’m happy to let my money grow slowly in the Go & Grow portfolio.

Another thing to keep in mind is that there are no buyback guarantees on loans, so if a loan gets delayed, you might have to wait a long time until it is eventually recovered.

On the other hand, this is one of the oldest platforms, and the chances of it going bankrupt seem pretty slim to me, and that’s a very positive thing. You will also see that the platform has an extremely high rating on Trustpilot, which wouldn’t be the case if it were a bad platform, especially since it has been in business for so many years and had plenty of time to prove its’ worth.

Join Bondora Go & Grow and get a €5 bonus

What are your thoughts on Bondora? Let me know in the comments section below. If you have any questions, do the same, it will help me prioritise your questions as I continue finishing up this article in the coming weeks.

Further reading

Summary

One of the oldest platforms in the P2P lending space, it has built a good reputation and provided solid results over the years for me.

Pros

- Reputable platform

- Secondary market

- Various strategies can be used

Cons

- Ugly graphics

- Hard to navigate the UI in my opinion

Hi do you white label your solution for p2p lending as i need to us it for start-up financing.

br

Zulfiqar

I would not recommend Bondora after being there with a total investment amount of EUR 65,000. In the beginning it looks all fine with net returns up to let’s say 15 to 20%. But over time you most likely see that you go down to around 3% (I’m at 2.79% now after 4 years). I have to be honest, in the beginning I selected manually my own loans (with very low risk) and those have been very profitable. But once you invest more and rely on re-investment of Bondora in their D, E, F, G categories, returns go down month by month. My best case scenario today is that I will get my initial investment back (EUR 29,000 to go) and seems totally unlikely for the moment. Just put your money in a bank account with zero interest, at least you don’t need to worry. Hope this helps some of you.

Hi,

Such a nice review ! I am heavily considering signing up with Bondora. Thanks for writing I had a question regarding buyback guarantees…. If there is no buyback guarantee does the company have to do anything to recover it for us ?? Or can they just let the loan be defaulted and move on

I was lured to your post by the title as I am considering investing in Bondora myself. I missed the “bad things people are saying” in the post itself. Can you elaborate?

You’re right I should have expanded on that. Will updated as soon as I have time, but the main criticisms are a high degree of loan defaults and low interest rates. But the issue with defaults is if you invest via auto invest, I haven’t had any problems with Go & Grow, although I had to settle for lower interest rates since they are safer investments. At this point I would only recommend that people invest with a Go&Grow strategy.

While I have you ‘on the line’, due to the current crisis situation, what would be your advise regarding loans on Mintos ?

1- would you put the auto-invest temporarily in pause ? Or

2- begin to withdraw some money from the platform ?

Thank you in advance 🙂

A separate post on the current situation will be published soon, hopefully I’ll have time to tidy it up and publish later today.

Yes, a communication would be great; because it is unclear to me what to do with my Mintos auto-invest 🙂 Regards,Alain

Thank you Jean ‘

About “there are no buyback guarantees on loans, so if a loan gets delayed, you might have to wait a long time until it is eventually recovered.”

Which means that if the loan is never recovered, your money is lot ?

Correct ?

That is correct.

Caramba… Very risk indeed.