Debitum is one of the most established platforms in the Peer-to-Peer (P2P) lending arena, forging a conduit between investors and borrowers to channel capital towards businesses. Since its inception in 2018, operating from the vibrant city of Riga, Latvia, Debitum has made significant strides. The platform has garnered a robust base of over 10,000 registered investors, and facilitated the flow of more than 74 million Euros into lucrative loans, marking its territory in the P2P lending landscape.

This comprehensive review aims to unpack the multifaceted aspects of Debitum, analyzing its investment potential, safety measures, and outlining how to start investing through this platform.

Expected Returns on Debitum

The appeal of Debitum lies in its promise of substantial returns, underscored by an impressive XIRR (Internal Rate of Return) of 11.44%. A five-year track record of zero defaults highlights the platform’s adept risk management and caliber of loan originators. The experiences of many investors, including my own, reflect yields around 10%, aligning with returns from others in the sector.

Debitum‘s Safety Measures

Navigating the P2P investment world requires thoroughly evaluating platform safety. Debitum meets this need by directing investments solely into business loans, fortified with tangible collateral. This prudent focus on asset-backed lending, although slightly reducing returns, significantly lowers default risks, creating a safe environment. Debitum’s safety architecture includes a robust 90-day buyback guarantee on all loans, plus a 15% penalty on delayed repayments by loan originators. The platform’s strict 4-step due diligence process for loan originators has prevented defaults. Introducing Asset-Backed Securities (ABS) reduces the risk associated with individual loan defaults, strengthening investment security.

Two-factor authentication (2FA) is also available on Debitum, which is another sign that both the financial and technical security of the platform are being taken seriously.

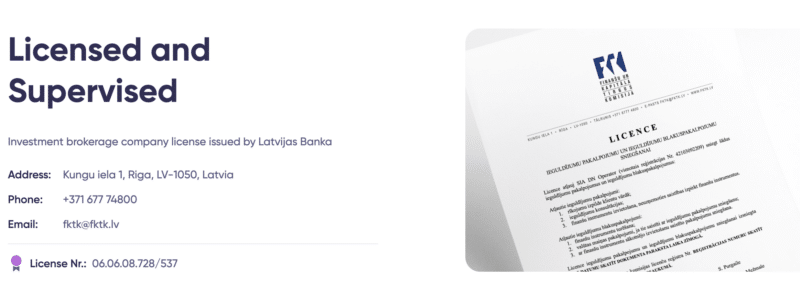

A hallmark of Debitum is its regulatory adherence, epitomized by its distinction as one of only four licensed P2P platforms in Europe, operating under license No. 06.06.08.728/537. This regulatory status not only increases investor fund protection but also sustains appealing returns, instilling reliability among investors.

They dedicate an entire section of their site to explaining very clearly how they protect their investors. They call this framework “Protection Plus”.

Protection Plus: Safeguarding Your Investments on Debitum Network

Protection Plus is the three-tiered security architecture developed by Debitum to ensure the protection of investor funds. Each layer addresses different aspects of investment risk, offering a holistic safety mechanism for individuals and entities looking to invest through the Debitum platform.

1. Platform Level Protection

At the foundational level, Debitum ensures regulatory compliance and financial security. Being a licensed investment brokerage supervised by the Central Bank of Latvia, it adheres to stringent European Union regulations. This compliance instills confidence among investors about the platform’s operational legitimacy.

Additionally, Debitum has an insolvency protection policy. In the rare event of platform insolvency, investors’ funds are shielded up to €20,000 by the Investor compensation scheme authorized by the Republic of Latvia.

The third aspect of platform-level security is the segregation of investor funds. Debitum assures that all invested funds are kept separate from the company’s own financials, ensuring that the investors’ money is not used for any internal business activities or to cover Debitum’s operational costs.

2. Loan Originator Level Safeguards

The second tier addresses the risks associated with loan originators. Debitum requires originators to maintain “skin in the game,” mandating them to hold a portion of the loans on their balance sheet. This ensures they have substantial risk and incentive to oversee the loans effectively.

Moreover, Debitum enforces a rigorous due diligence process on all loan originators, which encompasses business model assessment, financial checks, and ongoing monitoring of performance.

Unique to Debitum’s platform is the “Junior share” concept, which gives loan originators a subordinate position in the cash flow waterfall, prioritizing investor claims in case of defaults or insolvencies.

Furthermore, Debitum uses co-control bank accounts for loans issued by Triple Dragon and Sandbox Funding, maintaining a tight grip on the movement of funds and the quality of the loan portfolios.

3. Underlying Asset Level Assurance

The final layer of Protection Plus is focused on the underlying assets backing the loans. Debitum pledges solid collateral which may include real estate or accrued receivables, adding an extra layer of security.

Debitum has a “Buy Back obligation” policy in place, where if a loan defaults, the loan originator is bound to repurchase the loan, thus safeguarding the investor from a complete loss.

Additionally, Debitum implements late penalty charges for overdue payments, incentivizing timely repayments and adding to the overall security measures.

If default situations escalate, Debitum has partnered with Creditreform, a leading debt collection agency, to manage recoveries efficiently and effectively.

I like how specific and detailed Debitum are with this concept. After all, this is the biggest doubt that investors have before investing in a new platform. Debitum’s Protection Plus stands out as a comprehensive, multi-level investment protection framework designed to minimize risks for investors. By integrating strict regulatory adherence, due diligence, and strong collateral backing, Debitum not only promotes investment security but also demonstrates a deep commitment to its users’ financial well-being. With such measures in place, investors can engage with Debitum’s platform, assured that their investments are shielded through a thoughtful and thorough security apparatus.

Company and Team

At Debitum’s core is a team of seasoned finance industry veterans. The leadership, headed by CEO Henrijs Jansons, adeptly navigates finance, investor/partner relations, and marketing. COO Anatolijs Putņa leads platform development and HR, while CLO Gvido Bajārs oversees legal, regulatory affairs, and risk management, forming a robust operational backbone.

It should be noted that Debitum Network had a change of ownership, which is also reflected in the new way that Debitum now operates.

Specifically, in 2023, there were these changes to the ownership structure of Debitum:

- In July, the controlling ownership structure of SIA DN Operator – the legal entity of Debitum – changed. The existing CEO Henrijs Jansons remained. [reference]

- In September, the ownership changes of Debitum were completed after approval from the Bank of Latvia.

Previously, the ownership of Debitum platform was held by Mārtiņš Liberts. He is no longer involved or responsible in any operational decision-making.

Ready to explore the investment opportunities on Debitum? Click here to get started.

Loan Originators

The strength of a P2P lending platform depends significantly on the quality of its loan originators. Debitum has a transparent and meticulous vetting process for evaluating potential loan originators. This process analyzes the financial stability, growth potential, and professional management expertise of each originator.

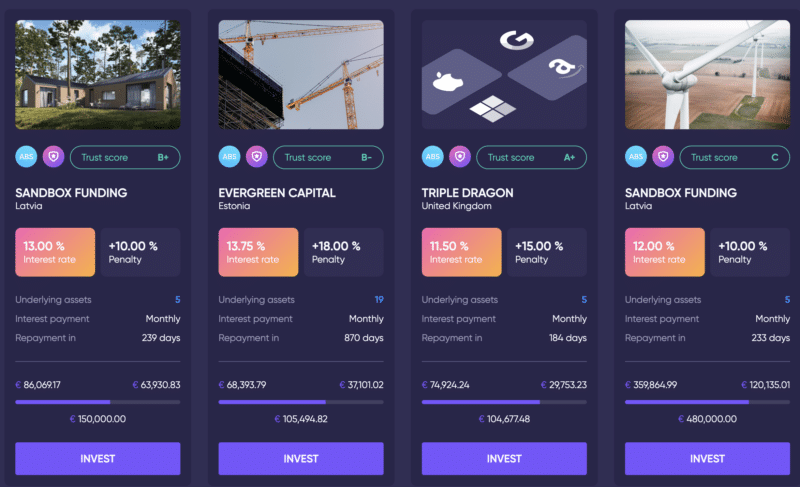

Some of Debitum’s top originators include Evergreen Capital, Tripe Dragon and Sandbox Funding. They currently have loan originators from Estonia, Latvia, and the UK. These originators have passed Debitum’s stringent 4-step due diligence protocol, which reviews business plans, analyses financial statements, evaluates collateral, and conducts background checks on management. This rigorous, ongoing evaluation ensures continued alignment with Debitum’s high standards.

Each loan originator profiled on Debitum comes with a detailed overview, encompassing their operational history, financial performance, and management team. This level of transparency provides investors with a well-rounded understanding, enabling them to make informed investment decisions.

Debitum is regularly adding new loan originators, so you can expect a solid pipeline of investing opportunities.

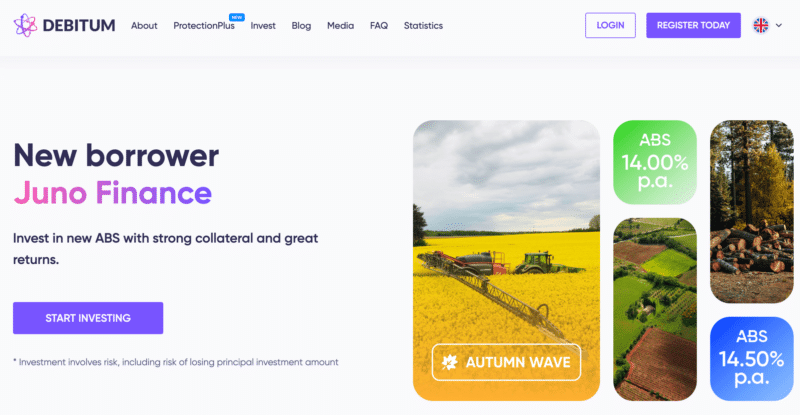

Asset-Backed Securities

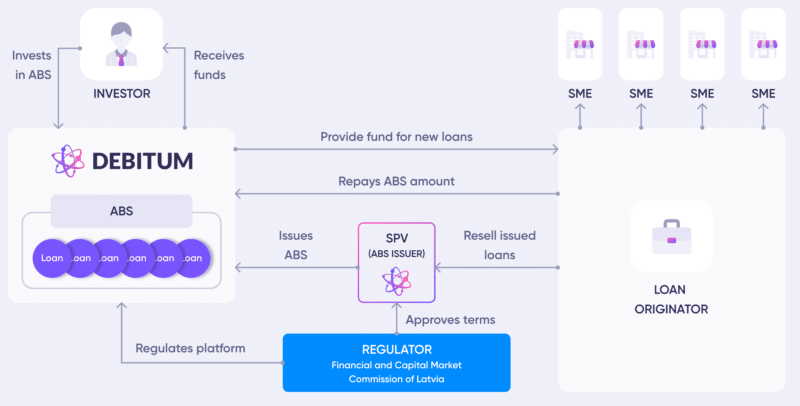

On Debitum, investors can invest in Asset-Backed Securities (ABS), which pool multiple loans into a single asset, providing an extra layer of diversification and security.

An asset-backed security (ABS) represents a financial instrument that gains its value from a pool of loans. The purpose of creating an ABS is to offer investors a secure and predictable investment option with fixed terms and income. By utilizing a pool of loans as collateral, the ABS ensures stability and repayment by replacing loans that mature or become overdue during their lifespan.

The loans included in this pool share similar characteristics, such as the loan originator and type, which may encompass factoring, trade finance, business loans, agro-loans, and car leasing. Although there may be variations in the loans’ start dates, maturity periods, and nominal values, their collective performance directly impacts the investment.

The success of this investment model relies on the performance of all loans in the pool and the loan originator’s expertise in loan origination. Through careful management of these factors, investors can potentially benefit from a reliable and rewarding investment opportunity in asset-backed loans.

Getting Started on Debitum

Getting started investing on Debitum is straightforward:

- Create an account and complete identity verification. This is a quick and simple process.

- Deposit funds via bank transfer. Debitum provides account details to route the deposit quickly.

- Browse current investment options like business loans or ABS. The platform organizes opportunities clearly.

- Select investments that match your criteria and allocate funds. The auto-invest feature (to be reactivated soon) will automate this.

- Manage investments and withdraw profits. The user dashboard provides easy access to monitor performance.

User Interface and Experience

Debitum boasts a user-friendly interface, designed with an intuitive layout to ensure a seamless user experience. The platform provides easy access to vital information, investment options, and account settings, making it easy for both novice and seasoned investors to navigate and manage their investments.

Customer Support

Support is available through the standard phone, email and chat. I typically use chat and email, with a preference for chat when I have a quick and simple question. I’ve had good results whenever I messaged them during European office hours, and outside of those hours an email does the trick, with a reply being received within the next day or two.

Personal Experience and Returns

My investment trajectory on Debitum has been marked by a consistent yield performance, even amidst the economic turbulence induced by the COVID-19 pandemic during 2020 and 2021, where my average annual yields were of around 9%. This narrative underscores the platform’s robustness and its capability to deliver competitive returns, reflecting positively on its long-term viability.

Risks

Debitum is one of the few platforms that clearly spell out the risks to investing in P2P lending, and you can check those out on this page on their site. I’ll try to put it simply here by using analogies.

Investing on Debitum is a bit like embarking on a treasure hunt where the map is well-detailed but the terrain is unpredictable. Just like any treasure hunt, there’s a chance you won’t find what you’re looking for. Here, the treasure is your potential earnings, and despite having a good map in the form of Debitum’s protective measures, there’s still the chance of running into unexpected trouble.

Think of Debitum’s investments like planting a garden. You’ve got good tools and quality seeds (the protective layers and due diligence), but sometimes nature has other plans. A sudden storm (a loan default) or pests (market volatility) can harm your budding plants (your investments). And if the biggest plant (a loan originator) gets sick and can’t be saved by the garden’s first aid kit (the buyback obligation), it might affect the whole garden’s health.

In short, Debitum sets you up with a safety kit for your investment journey, but it can’t control the weather or the wildlife. You’re more protected than going it alone, but you should only pack into your investment basket what you can afford to adventure with.

External Reviews

Most reviews, especially since the change in ownership, are positive. Many investors like to use Trustpilot as a source of independent reviews. Although I don’t personally put too much weight on Trustpilot reviews, in this case, we can definitely say that the sentiment on Trustpilot about Debitum is a positive one.

Since the change in ownership has been fairly recent, I expect more investor reviews to be available in the coming months, so from this aspect, it’s worth noting that other platforms probably have more independent information and reviews available at the moment.

This is also one of the reasons (I suspect) why Debitum makes a special effort to really describe its offering in the best way possible, also outlining possible risks. This is good for the investor, as investor discontent almost always is the result of either investing in something they didn’t properly understand (and having a negative outcome) or malpractice from the platform’s side, which thankfully has become uncommon in the last couple of years, compared to the wild west early years of P2P lending.

What Sets Debitum Apart

Several key factors differentiate Debitum from other P2P lending platforms:

- Strict focus on asset-backed business loans, enhancing security

- Robust 90-day buyback guarantee and late repayment penalties

- One of only four licensed platforms in Europe currently

- Strong track record of zero defaults over 5+ years

- High XIRR of 11.44% reflecting profitability of its loan portfolio

- Transparent and meticulous vetting of loan originators

The combination of prudent risk management, regulatory compliance, and consistent returns makes Debitum stand out.

Alternatives to Debitum

While Debitum offers a robust and secure platform for P2P lending, investors might also consider exploring other platforms to diversify their investment portfolio. Some notable alternatives include:

- Mintos: A well-established P2P platform known for its wide range of loan originators and investment opportunities.

- PeerBerry: Known for its user-friendly interface and a good variety of short-term loan opportunities.

- Bondora: Offers a range of investment products and has a long-standing history in the P2P lending space.

- EstateGuru: Specializes in real estate-backed loans, providing a different asset class for diversification.

Conclusion

Debitum has all the signs of a reputable P2P lending platform, offering a conducive ecosystem for investors to channel funds into sustainable business loans. The platform’s stringent safety measures, transparent loan originator selection, and dedicated team are its hallmarks, instilling confidence in the investment community.

The yield on Debitum, although slightly trailing some counterparts, is offset by the emphasis on asset-backed lending and robust safety mechanisms, significantly enhancing the security quotient of investors’ funds.

With a simplified onboarding process, a promising outlook on the reactivation of the auto-invest function, and a diversified range of investment options, Debitum is currently looking like one of the most user-friendly and secure investment platforms in Europe. If you’re looking for passive income through higher-risk investments, you should definitely take a look at this platform.

Summary

Debitum is an investment platform that emphasizes investor protection with a robust, tiered risk mitigation system. It operates with a high level of transparency and under strict regulatory scrutiny, which bolsters its credibility. The platform’s key strengths include its diversified investment options, rigorous due diligence processes, and the presence of safety features like buyback obligations and collateralization of loans.

Pros

- Structured Risk Mitigation: Multiple layers of investor protection provide a sense of security.

- Regulatory Oversight: Licensed and regulated operations add a level of credibility and trust.

- Transparency: Detailed due diligence and clear presentation of investment conditions and recovery processes.

- Diversification Options: A variety of loans and originators to choose from, enabling risk spreading.

Cons

- Market and Credit Risk: Despite safeguards, the potential for loan defaults and market volatility remains.

- Recovery Limitations: The €20,000 insolvency protection cap and the possibility of incomplete debt recovery can affect higher investments.

- Complexity for New Investors: The intricacies of loan originations and asset-backed investments might overwhelm new investors.

- Debitum Register: The platform’s performance is tied to the financial health and practices of the loan originators, which can be variable.

Leave a Reply