As a foreigner living in Spain, you have the dubious pleasure of having to declare all your assets abroad. Welcome to Spain! In this post, I’ll give you more information about this declaration that is known as modelo 720. If you think it’s ridiculous and unjust I’m totally in agreement. However, unfortunately, there is no way around it.

Since I received so many requests about this form and how to fill it in, I have asked my trusted accountant if I can forward requests to him directly, in that way you will get professional advice and help (at a reasonable fee) for this complicated and hugely annoying declaration requirement.

Click here to fill in the form if you want to get in touch with my tax lawyer/accountant. Unfortunately, I am not qualified to assist myself due to the inherent complexities of each individual’s financial setup, so the best idea is to put you in touch with the people I trust myself for submitting my own yearly model 720.

If you want to learn more about model 720 before trusting anyone else with you obligations, please continue reading. My advice is to read as much as you can on your financial and tax matters, but ultimately, given the risks involved, it’s better to pay for professionals to handle such stuff.

Spanish tax resident individuals are obliged to report (720 Form) the following assets and rights (including any investments) located outside of Spain to the Tax Authorities:

- Accounts in which the individual is the titleholder, or in which he is representative, authorized person or beneficiary, or in which he has disposal powers.

- Securities, rights, insurance and life or temporary annuities.

- Real estate or rights on real estate.

There will be no reporting obligation for those assets or rights which value (considered in aggregate for each group of assets listed above) is lower than Euros 50,000. The deadline for filing the 720 Form is from 1 January to 31 March of the year following that for which the information must be reported.

In subsequent years you will need to re-submit the modelo 720 if any of the accounts are closed or if the value in any of these three categories increases by 20,000 Euro or more.

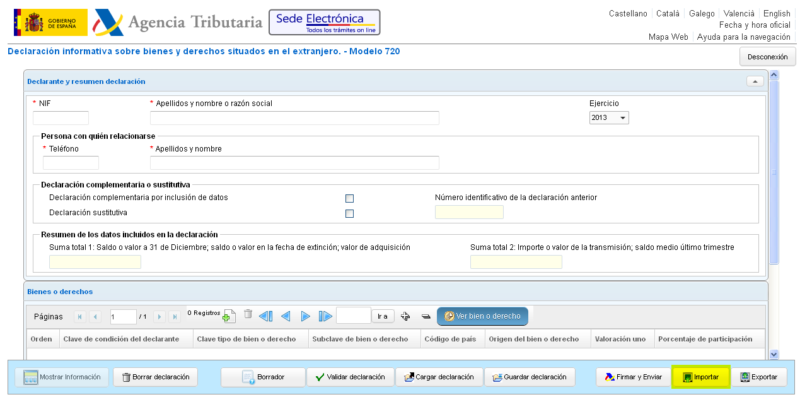

This is a form that is quite tricky to fill in, especially for foreigners, and the fines are ridiculously high in the case of mistakes, late submissions or forgetting to submit it altogether. Hence it’s worth paying close attention to it and making sure you do it right, especially if it’s the first year you’re submitting it. I highly suggest you approach a reputable tax consultant to help you out. Note that many accountants, gestores and tax consultants don’t provide help on this form, as they have relatively low demand for it compared to the other services they provide. Expect to pay between 400 and 500 Euro per declaration if you hire a tax consultant (contact me if you need recommendations in Barcelona) to fill it in for you. You will still need to provide all the documents and details to the consultant, what he will be able to do is guide you on what data is needed and actually fill in and submit the form for you.

Many expats simply do not declare the modelo 720, and many are not even aware of it. Unfortunately, they are exposing themselves to serious trouble and harsh penalties. We have seen several cases of financial ruin in the past years due to failure to declare this form or declaring it with erroneous data. The penalties are so harsh that a Spanish consultancy company has denounced Spain to the European Court a few years ago. There are some indications that Hacienda has been softening its hand in terms of fines after the EU requested them to do so, but the case is ongoing.

The EU has in fact taken action against Spain and ordered it to modify the modelo 720’s penalties, although they have also deemed it lawful for Spain to request this information about assets located outside its territories. Many consider this to be a law that goes against the freedom of movement of humans and capital within the EU, and thus a breach of human rights. It is expected that the modelo 720 will either be removed or heavily modified in the coming years to comply with the requests made by the EU. In the meantime, however, it is wise to keep on submitting the modelo 720 as usual if you are required to do so.

The decision of the European Commission to take the Model 720 before the Court of Justice of the European Union should suppose the suspension of all sanctioning procedures that are currently underway. “To force this decision, it is convenient that taxpayers who are in this situation ask the Treasury to agree on the suspension of the deadline to resolve,” according to a legal professional.

Rulings from the Court of Justice of the European Union will usually take effect retro-actively, so in this case that would be going to back to 2012 when the obligation to declare overseas assets on Modelo 720 came into effect. It is expected that a ruling that confirms that the fines are in fact discriminatory and in conflict with the fundamental freedoms in the EU, will open “the path of patrimonial responsibility of the legislative State” (so the possibility to file a claim against the Spanish State) for having approved a regulation that has been declared contrary to the European Union Law. For those who have already been subjected to fines and paid them and also for those who have contested, but lost their appeal.

If you would like to learn more about the modelo 720, refer to the FAQs here or here. There are many questions and answers and your doubts will probably be answered there. Below I have also listed a few common questions and answers that expats, in particular, have when filling in this form. They are not official Q & As, just cases I’ve heard about and how they’re dealt with (as far as I know).

So far the Spanish tax authority has issued fines to 5000 taxpayers since the inception of the modelo 720 in 2013, although the majority of these fines were issued in 2015 (4,321 fines). 71% of the fines were due to declarations that were made late.

In 2019 only 6 fines were issued. Courts such as those of Catalunya have recently revoked fines from the tax agency. In a recent case from May 2019, the tribunal ruled that since there is a ruling by the European Commission on the matter, the Spanish tax agency cannot continue fining people as it used to before, and thus revoked the fine for presenting the form 2 years later than it should have been done.

In all probability, the EU courts will make Spain remove the modelo 720 within the next two years.

Here’s an excerpt from an interview with the lawyer who took Spain to court (in Spanish):

No me cabe ninguna duda de que la Justicia de la UE terminará condenando a España y tumbando ese arma de destrucción masiva contra el fraude fiscal”, expone Alejandro del Campo, abogado del despacho DMS Consulting, que denunció el modelo 720 ante la Comisión Europea en febrero de 2013.

Su actuación provocó el inicio de un procedimiento de infracción contra España en noviembre de 2015, llevando a Bruselas a exigir a España la modificación de la normativa en un demoledor dictamen, emitido en febrero de 2017 y difundido en diciembre de 2018, cuando el letrado Esaú Alarcón logró aportarlo como prueba en un procedimiento ante la Audiencia Nacional. Ante la ausencia de medidas por parte de España, la CE anunció el pasado junio que recurría al TJUE. Mientras, los tribunales españoles vienen frenando buena parte de la aplicación del modelo 720 por defectos de forma. Ahora, el futuro del sistema de declaración de bienes en el extranjero queda en manos de los magistrados de la UE.

Question: Do you need to report money invested in crowdlending platforms like Mintos, Twino, Bondora etc?

Hacienda clarifies that you don’t need to do this. You only need to declare such loans if they are denominated by shares. For example, when you give loans on property crowdfunding platforms like Property Partner, you will be assigned shares pertaining to that loan, and in that case, you would have to declare those participations.

However, if the cash balance in your account on the platform is stored in an omnibus account like Lemon Way and it is directly linked to you, you then need to declare that cash balance as at end of year. The platform should be able to give you this information.

Source (Question 37)

Question: Should your spouse fill in the modelo 720 if the assets are in your name?

If you were married with the community of property regime, then both spouses have to declare the assets. If, say, a bank account is in the name of one of the spouses, that spouse will declare a 100% participation, while the other spouse will fill in the same bank account details (including the same total balance, not half of it), but note down a 50% participation.

Question: Should bank accounts with a balance of zero be declared?

Yes, you need to declare all accounts outside of Spain once the sum total is 50,000 euro or higher. Empty accounts will still have to be declared.

Question: Should you declare life assurance accounts held with banks?

Yes, provided that it’s an account where you automatically deposit money every month. These are mixed savings and life assurance accounts, so you declare them. If you’re just paying a monthly or yearly premium to an insurance company for a life assurance policy, then you don’t declare it.

Question: If there is a change of 20,000 euro or more in any category, do you declare all the items in that category or just the particular item that changed its value?

You only need to declare that particular asset that changed its value considerably. If the change was spread over all the items (very common if we’re talking about bank accounts or shares in public companies) then you declare all items.

Question: Should cryptocurrencies be declared?

As of 2021, you are obliged to declare crypto assets held outside of Spain. This could mean those assets held on exchanges, wallets, custody solutions, and even in the possession of third parties (e.g. friends, family, lawyers). The latter applies to those who don’t have their crypto stored anywhere in particular, but who have their private keys (which would serve to unlock the assets) held in secure storage outside of Spain.

Question: A resident in Spain is a partner of a non-resident society (first level) that in turn is a partner of other non-resident societies (second level) What obligations to inform does the resident have with respect to the non-resident organisations and the goods owned by said organisations?

The resident must declare his or her participation in the first non-resident company. The prior must be applied as long as the non-resident companies carry out an economic activity through the corresponding organisation of material resources and staff, that is, that they do not have an instrumental character whose purpose is merely the indirect control of the goods on behalf of the real owner.

Question: Do I need to declare the bank accounts of a foreign corporation in which I am a 100% shareholder?

Yes, since you would be considered the beneficial owner of the bank accounts, even though they are in the name of your company.

Question: Do you need to declare money I have in virtual bank accounts such as TransferWise, N26 or Revolut?

If the virtual account has all the details of a traditional bank account, you should declare it along with the rest of your bank accounts.

Question: Do you need to declare the balance of your PayPal account?

PayPal accounts don’t fit any of the category definitions that apply to the modelo 720 and are thus not included. However, unfortunately, Spanish Hacienda loves to leave grey areas in these matters and have people worry unnecessarily instead of explaining exactly what to include and what not.

In a question that was sent to Hacienda, they hinted that you might need to include PayPal accounts, by replying in the following manner:

Por su parte, el portal de “PayPal” define el servicio que presta del siguiente modo:

“PayPal permite a las empresas o consumidores que dispongan de correo electrónico enviar y recibir pagos en Internet de forma segura, cómoda y rentable. La red de PayPal se basa en la infraestructura financiera existente de cuentas bancarias y tarjetas de crédito para crear una solución global de pago en tiempo real. Le ofrecemos un servicio especialmente pensado para pequeñas empresas, vendedores por Internet, particulares y otros a los que no satisfacen los mecanismos de pago tradicionales.”

Finalmente, respecto de la declaración de la cuenta PayPal, podría entenderse, en su caso, que dicha cuenta debe tomarse en consideración a efectos del Impuesto sobre el Patrimonio, o de la obligación de declarar bienes situados en el extranjero.

In my view, if you have significant amounts of money in your PayPal account and use it as you might use a savings account at a bank, you might want to declare it just to be safe. Having said that, I don’t know how you would actually go about declaring it since PayPal does not give you any account number that you would need to put in on the modelo 720 form. So, in the end, you’re just left with doubts.

Question: How is the value of a foreign company determined, given that it is not quoted on any stock exchange and is hence a private company.

The valuation will be calculated with the rules established in the Spanish Law 19/1991 regarding Wealth Tax. Insofar as it is not a company with representative securities traded on organized markets or other specific features, it is necessary to refer to article 16 on other securities that represent the participation in equity of any type of entity.

“En el caso de que el balance no haya sido auditado o el informe de auditoría no resultase favorable, la valoración se realizará por el mayor valor de los tres siguientes: el valor nominal, el valor teórico resultante del último balance aprobado o el que resulte de capitalizar al tipo del 20 por 100 el promedio de los beneficios de los tres ejercicios sociales cerrados con anterioridad a la fecha del devengo del Impuesto”.

This article indicates that the valuation of this type of shares will be carried out at the theoretical value resulting from the last approved balance, provided that it has been submitted to review by auditors. If this is the case of the company, the valuation must be made in accordance with the last approved and audited balance sheet available. As an aside, note that for wealth tax purposes, you can use either the value of the company as at 31st December of the previous year, or the value of the company as determined by the latest published accounts, even if they were published after the 31/12, as it is deemed that the later accounts would be even more accurate as a valuation method. See this page (in Spanish) where this update is explained.

The theoretical value is obtained by dividing the net equity figure by the number of shares, by performing the following operation:

Theoretical value = Net equity / Number of shares in which the share capital is divided.

However, in case the last approved balance has not been audited, the valuation should be made for the greater value of the following three:

- The nominal value.

- The theoretical value resulting from the last approved balance.

- The result of capitalizing at a rate of 20% the average of the net profits of the three fiscal years closed prior to the date of accrual of the tax.

This is a simplified way of valuing a company, when compared to more complex methods used by investors, but it’s the one we need to use to calculate the value for the modelo 720 form.

Filling in the form yourself VS Hiring someone to do it

Be aware that lawyers and accountants can charge very random fees for helping out with this report. I’ve been given quotations ranging from €150 to €1500 and upwards, and that was sight unseen, not taking into consideration the complexity or lack of for each individual’s declaration. It was hard to find someone that I could trust and that wouldn’t fleece me with charges for what essentially is a simple model to fill in, especially for someone knowledgeable like an accountant or lawyer. If you’re looking for someone to help out with your declaration, contact me and I’ll be happy to put you in touch with my trusted accounting firm in Barcelona.

You could fill it in yourself too, but even though I know how to do so myself, I still prefer hiring a well-known company to do it for me. When you make a submission the form includes the name of the person or company submitting the form. My opinion is that Hacienda is more likely to go after foreign-sounding names who submit the form without any outside help, rather than if they see a form being submitted by a Spanish company.

Make no mistake, I feel that this declaration is a total violation of basic freedoms and is definitely contrary to European freedom of movement legislation, but until it stands, there is no option but to do our best to fill it in properly and thus avoid complications with Hacienda. Keep in mind that even if you get accused unjustly of filling it out wrongly, you will still need to spend a lot of time and hassle to go through the Spanish courts and depend on them to issue the final ruling. It’s better to do it right the first time around.

Note that this is just a summary of my research on the topic and my discussions with various tax consultants. It should not be taken as tax advice. When in doubt, you should always consult a trusted tax consultant to help you fill out this submission. The information could also be out-of-date as new laws and changes to existing legislation happens regularly.

Further reference

- REAF – More questions and answers (in Spanish)

- The latest updates from the company that took Spain to court in the EU

- Latest information about the case from December 2019

- Some example cases to show how ridiculous this can get

- More questions and answers about the declaration

- Latest FAQs from Hacienda

Hello Jean,

Many thanks for your very useful web page. I filed a 720 for 2021 with all the shares I owned, and last year I bought more of one of the shares on 3 occasions, then sold some of the same shares. As an example, I had 100 shares in 2021, then in 2022 bought 10 more 3 times, then sold 5. Do I report the 4 new 2022 transactions separately in the 720, do I report 1 new entry for 25 shares (10 + 10 + 10 – 5), or do I report a modification to the previous 100 entry for 125?

Do I also have to report again all the shares I already had in 2021 even though the total value hasn’t increased by 20,000?

Many thanks,

Balor

HI,

Your information was really useful now that the US company that I work for has granted me some shares. I would like to get in touch with any of the gestures that you suggest that work in BCN.

I will appreciate it if you can share these with me,

Cheers!

Yes shoot me an email and I’ll put you in touch.

I keep coming back to this article every time the dreadful March 31 deadline rolls around. I thought you might want to update this post now that the European court has officially ruled against Modelo 720 penalty regime. Not that this won’t continue be a headache, but at least the penalty is supposedly less scary. 🤷♀️