Peer-to-Peer lending creates a marketplace that offers both parties what they seek. On the one hand, the system allows borrowers to avoid the hassle of turning to a bank and oftentimes – benefit from more competitive interest rates.

In the case of lenders, the phenomenon allows you to invest your money into third-party loans that typically offer a much higher yield than that of traditional assets.

Robocash is one such provider that caught my eye. Launched in 2017 – it offers a fully automated financial platform that follows the core principles of the peer-to-portfolio model. The service delivers an opportunity for you to invest in loans facilitated by Robocash Group.

In this review, I explore the ins and outs of how Robocash works, what loans you are investing in, how much you should expect to make, and of course – what risks to consider.

What is Robocash?

Robocash is behind a group of subsidiaries that offer robotic financial services in the lending marketplace, subsequently funding alternative loans. It focuses on providing automated fintech solutions and making international investments accessible to everyone.

The peer-to-peer lending process sits at the core of RoboCash Group. It primarily targets European investors, albeit, plans are being made to expand further afield in the near future.

As an auto-invest platform, it eliminates the need for you to manually control your investments. You can simply specify how you want your funds to be handled, and Robocash will automatically take care of your assets as per your requirements.

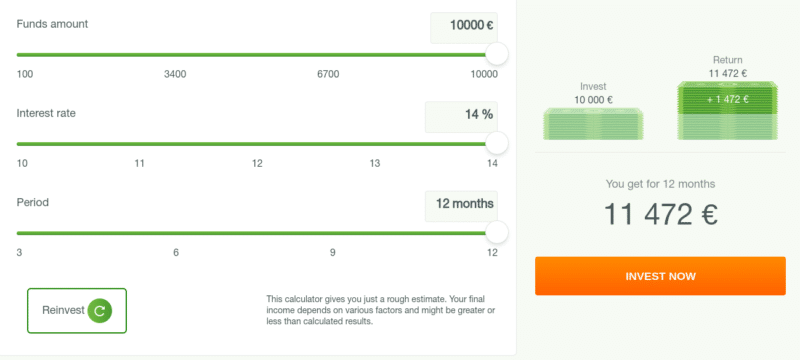

Most of the loans hosted by Robocash offer a return of between 10% to 14%. This is, of course, a significantly higher interest rate than what you will get from traditional savings accounts or even fixed-rate bonds. In turn, you will be taking on a higher element of risk.

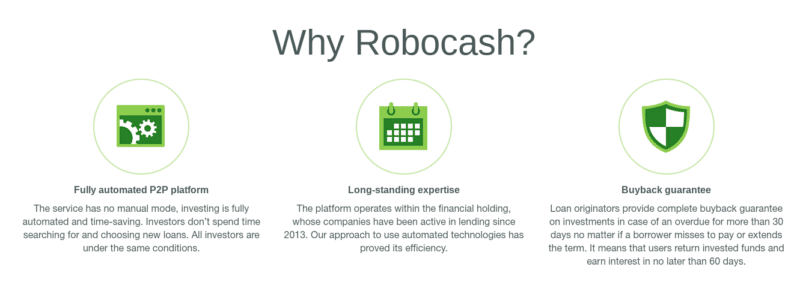

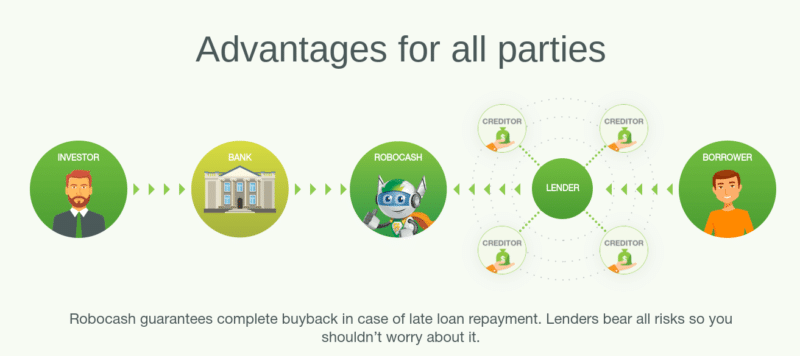

With that said, the platform offers a 100% Buyback Guarantee. This is in place to counter the threat of a borrower defaulting on their loan repayment, meaning the respective subsidiary will repurchase the loan. As such, you should get your money back for as long as Robocash is financially stable.

Who can use Robocash?

Currently, Robocash is facilitating loans in Europe and parts of Asia. Compared to other traditional p2p platforms in this space, this gives you the added advantage of geographical diversification.

In order to be eligible as an investor, you have to be at least 18 years old and be a resident of Europe. In addition, you also need to be in possession of a European bank account to facilitate your deposits and withdrawals.

Not only individuals but companies can also invest with Robocash. If you are a legal entity, you will need to provide a certificate of incorporation and the credentials of your company representative.

How Does Robocash Work?

As Robocash is automated, you have no control over which borrowers you lend money to. Here is how the process works on the platform:

- You as an investor add funds to your Robocash account and create a portfolio based on your desired criteria.

- On the other side of the transaction, borrowers sign up on the Robocash platform and apply to loan originators for credit. The duration of these loans varies from seven days to one year. Borrowers also have to provide sufficient documentation to prove their credibility.

- Loan requests from the originator in question are assembled via the Robocash marketplace.

- Robocash automatically allocates the loan funds from your account based on the investment setup specified by you.

How to Get Started With Robocash?

Before I go any further, it is important to note that Robocash does not serve as a borrower per-say. Instead, it merely acts as a third-party platform between investors and individual loan originators that have partnered with the Robocash Group.

Nevertheless, let me give you a quick walkthrough on how you can sign up as an investor on Robocash.

Step 1: Create Your Account

Investing in Robocash is a three-step process – starting from signing up to creating your portfolio. In order to activate your account, all you need to do is fill a simple registration form with your personal information. You will also have to submit your passport or national ID card to comply with KYC rules.

In order to proceed, you will have to wait until your account has been verified – which is usually completed within a few hours.

Step 2: Add Funds to Your Account

To start investing with Robocash, you will first need to add funds to your account. This is one aspect where the platform could improve. Currently, you can only deposit funds via a bank transfer, meaning there is no support for debit card payments.

The minimum amount you can invest is just 10 euros. The maximum amount permitted is 15,000 euros per month or 180,000 euros annually.

Note: Once your funds are credited, it will be categorized into two balances – a personal balance and an investment balance. You can add funds to your investment balance from your personal balance as you need when you create a loan portfolio.

Step 3: Create Your Portfolio

As I mentioned earlier, Robocash is an automated platform. As such, you can define the parameters of your investment portfolio, and the system will take care of finding the most suitable loans for you and assign your funds accordingly.

Here are the options you have in defining your portfolio:

- Size of the portfolio

- Minimum and maximum investment to use on a single loan

- Minimum and maximum interest rate

- Period of repayment – maximum up to 367 days

- Investment strategy

- Choice of lenders

Note: If you do not want to set the criteria manually, you can opt for the ‘Maximise Profit’ option. This will enable Robocash to define your portfolio in a way that allows you to target higher returns in a more passive manner.

Investment Strategies

When it comes to exit strategies, you have four different options to decide how you collect your interest and principal amount:

- Balance: this option allows you to withdraw your money from the portfolio balance to your investor funds

- Payout: this will automatically withdraw both your principal amount and the interest directly to your bank account. The minimum amount you should have in your portfolio balance is 50 euros

- Reinvest the principal amount plus interest

- Reinvest only the principal amount.

As I mentioned earlier, you can set an interest rate of between 10% to 14%. That said, it is likely that the borrower is paying a significantly higher interest rate – which is how Robocash makes money and funds the Buyback Guarantee.

Note: In case the loan is repaid earlier than the chosen duration, you will receive interest only for the period of the loan repayment. For instance, if the borrower took out a loan for one month and rapid it in two weeks, your interest will be accounted only for the two weeks – and not for the whole month, which was the original term of the loan.

Selecting the Lenders

While you cannot directly choose which borrowers you lend capital to, Robocash gives you the option to select specific lender companies that work with the platform.

Once you enter your criteria, the platform will tell you how many loans are available that match your conditions. You can also see how much interest you will earn within the next 12 months following this investment strategy.

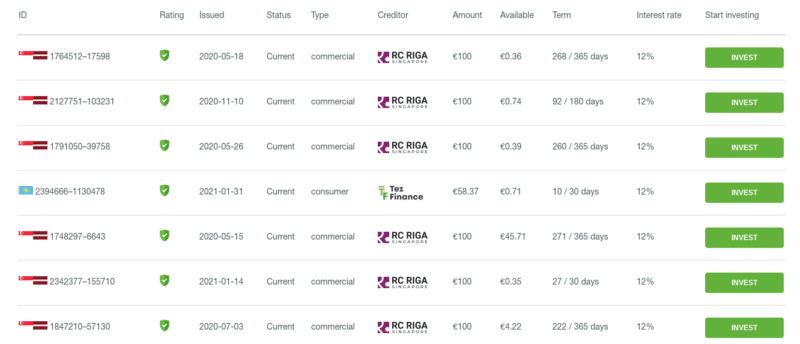

Currently, Robocash lists four different lenders based in Kazakhstan, Singapore, Vietnam, and Spain. If you select all four, we should mention that your portfolio will not be investing equally in all of the respective lenders.

Nevertheless, Robocash will find investment opportunities that are currently available that fit your loan criteria.

If you want to diversify further, you can create individual portfolios for each lender. This will allow you to keep an eye on the performance of each of these partners. That said, it does not necessarily mean you are reducing the risk per-say.

Long term and Short term Loans

According to Robocash itself, the platform facilitates two types of loans:

- Short term loans span between seven to 30 days and are offered for amounts between 14 euros to 420 euros.

- Long term loans are issued for a duration from one to 12 months and ranges from 353 euros to 14,120 euros.

The long term loans are typically commercial loans offered by Robocash Singapore and Robocash Vietnam branches. They are also given out on an installment basis, where you get the interest back at the end of the term.

Access to Secondary Markets

Now that Robocash has introduced long term loans, it has since installed a secondary market. This option allows you to resell already funded loans once the repayment lending has begun.

If you have invested in long term loans from Singapore, with a duration of at least 12 months, you can sell this on after the first six months via the secondary market. You can turn this feature on by simply selecting the ‘Accept Secondary Market’ option while setting up your portfolio.

Once your portfolio is activated, you can see how your funds have been invested and download the individual assignment agreements for each loan. This sums up the legal conditions that define your rights as an investor.

Alternatively, you can also download the loan book or create dedicated charts to get an overview of how your funds are diversified.

Robocash Safety and Risk Management

When it comes to any type of investment – especially in the peer-to-peer lending space, your first concern should be the safety and liability of the specific platform.

The Robocash Group has a proven track record – albeit only since 2017, of reliability and transparency in the online fintech space. You can get individual financial reports of each of your loans, which is a strong point that stresses the legitimacy of the platform.

Additionally, the Buyback Guarantee ensures that your funds are in safe hands, even with the possibility of a defaulted loan defaulted. If the reimbursement is delayed for longer than 30 days, Robocash will cover for the principal and any interest due.

So far, over 12,800 investors have funded over 200 million euros worth of loans through Robocash. In total, this has resulted in 2.6 million euros in earned interest alone. This is an impressive amount that reinforces the success of Robocash and the trust that it gained from its audience.

However, as always, the Buyback Guarantee is only as strong as the loan originators behind Robocash Group. In other words, the originator in question runs into financial problems, there is no guarantee that they will have the required capital to cover the Buyback Program.

Crucially, if you want to earn interest in the region of 10-14% per year, you need to be prepared to take on additional risk. Without or without a Buyback Guarantee, your investment is never 100% safe.

As such, just make sure that you diversify well at Robocash and ultimately – also consider less-risky asset classes such as stocks and ETFs to reduce your exposure to the peer-to-peer arena.

Robocash Fees

You as an investor do not need to pay any fees to use Robocash. The platform covers any expenses that incur while processing payments and the maintenance of the account. However, you will need to verify with your bank to find out whether or not any charges are involved when transferring and receiving funds to and from your Robocash account.

Robocash Customer Support

The platform allows you to reach out to the customer service team either through email or a hotline from 7 am to 3 pm UTC. The email support team is also not overly responsive, as Robocash claims to send you a reply within 72 hours.

Robocash Pros

- Extremely user-friendly interface that allows all skillsets to tap into alternative investment options with no prior experience.

- Buyback Guarantee that offers a safety net in the event of a defaulted loan

- Opportunity to access geographical diversification – which is not common across other popular p2p lending platforms.

- Backed by an established financial holding that offers a high level of transparency and security.

Robocash Cons

- Two out of four loan originators are part of the Robocash Group itself. This means that you have minimal choice when it comes to diversifying your portfolio.

- Although a secondary market is available, it is only accessible for Singapore-based loan providers, and you have to wait at least six months to activate it.

Who Should Invest in Robocash?

Considering the advantages and drawbacks I discussed above, it is evident that Robocash is not an overly innovative peer-to-peer platform. It has a simple interface but very limited options.

On the flip side, you do not have to perform any research on borrowers or concern yourself with choosing your investment options. Instead, Robocash makes the investment process as passive as practically possible.

It is thus ideal to perceive that Robocash is most suited for beginner p2p investors that seek a hands-off approach. The low minimum threshold of 10 euros is another factor that will encourage novice investors to use Robocash.

Robocash Review – My Verdict

Robocash might not be the most extensive p2p platform in the market today. But, it does offer some attractive financial returns in a super-passive nature.

With a solid 10-14% return on offer, the site allows you to grow your money at a much faster rate than you will get at more traditional investment platforms.

If you are based in Europe, then Robocash undeniably offers a viable diversification opportunity. The platform is backed by a solid group and allows you to access liquidity by limiting your loan periods to short-term agreements.

Moreover, if you want to earn passive income, the automation aspect of this platform allows you to benefit from a burden-free investment journey.

As you can start with an investment of just 10 euros, this allows you to test the p2p waters without risking large amounts of capital.

Summary

With a solid 10-14% return on offer, the site allows you to grow your money at a much faster rate than you will get at more traditional investment platforms.

Pros

- Many years of successful operation

- Survived some significant issues, suggesting great leadership

Cons

- Other platforms are able to generate a higher volume of loans

- Not my favorite P2P platform interface

Leave a Reply