NFTs have been one of the most exciting developments in the crypto space in recent years, but they have also introduced a lot of complex scenarios for tax professionals and NFT traders.

Operating in the crypto space typically means you’re going to have to deal with hundreds or thousands of transactions, and this is even truer with NFTs.

Hence, the first thing we need to do is try to automate things.

Best Automated NFT Tax Software

The best software for automated NFT tax calculation that I found is Cointracking. This well-known crypto tax and portfolio software has been updated to understand NFT transactions, and you will see your NFT collection when you add the wallets holding your NFTs to your dashboard.

Other options you can try are Koinly and TokenTax.

Manual Calculation

Because of the nature of NFT transactions, it can be very hard, if not downright impossible, for any software to detect and classify all transactions properly. This is not really a limitation on the software side, but just the way NFTs are traded.

For example, if you do an OTC deal whereby you send ETH to someone and they send you an NFT, the software will not be able to associate the two transactions just by looking at the chain. It could perhaps ask you if the transactions are related if the third-party wallet involved is the same for both transactions, but sometimes the third party will receive your funds in one wallet and send you the NFT from another wallet, which makes it hard for software to match things up.

There are many special cases like this that make things difficult for NFT tax calculation automation.

That is why many NFT collectors just do things manually using a spreadsheet.

Before you start tearing your hair out at the prospect of manually tracking all those transactions, keep in mind that software can still help in this case.

The idea is to start off with an export of all your transactions from a software tool, then manually edit and adjust transactions to reflect the deals you made.

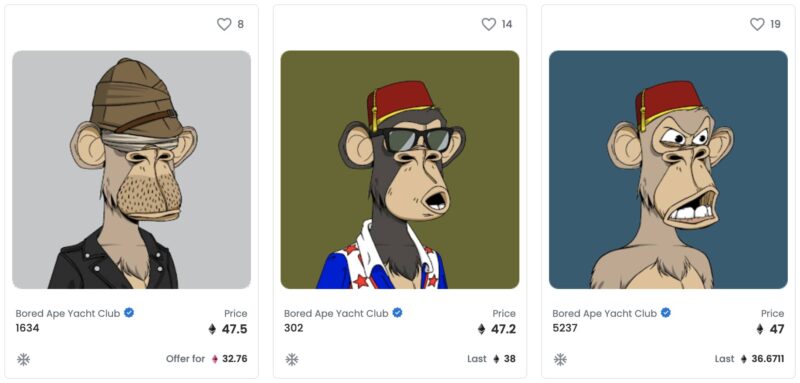

Sell Your NFTs, Harvest the Losses

Tax loss harvesting is a big thing in the USA, and similar strategies can be done in other countries too. An interesting tax loss harvesting service is UnsellableNFTs, which enables you to sell worthless NFTs and gives you a receipt for each sale, which you can then use to lower your overall tax from NFT trading.

Leave a Reply