Contents

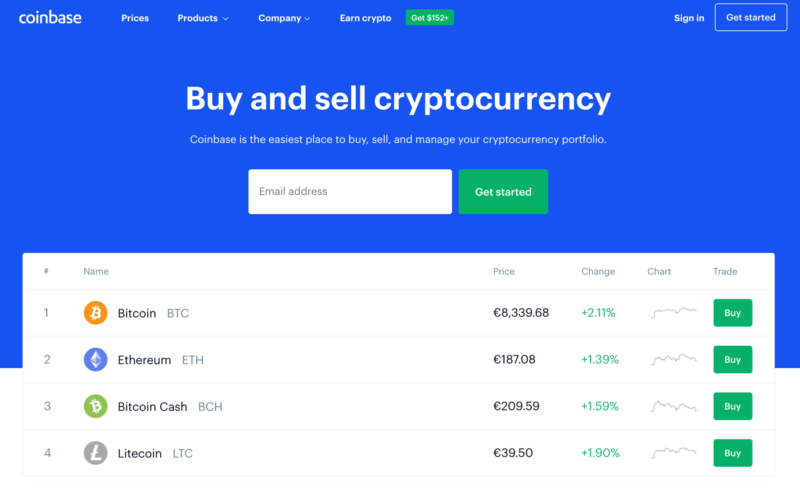

If you’re looking to join the cryptocurrency revolution by buying Bitcoin for the very first time, you’ll likely want to use a platform like Coinbase.

The reason for this is that this broker tailors its website to the newbie investor. For example, it takes just minutes to open a Coinbase account, and you can buy Bitcoin with a debit card or bank account.

With that being said, Coinbase does come with its flaws – especially in the fees department. As such, I would suggest reading my in-depth Coinbase review prior to taking the plunge. I cover factors such as user-friendliness, fees, commissions, safety, and customer support.

What is Coinbase

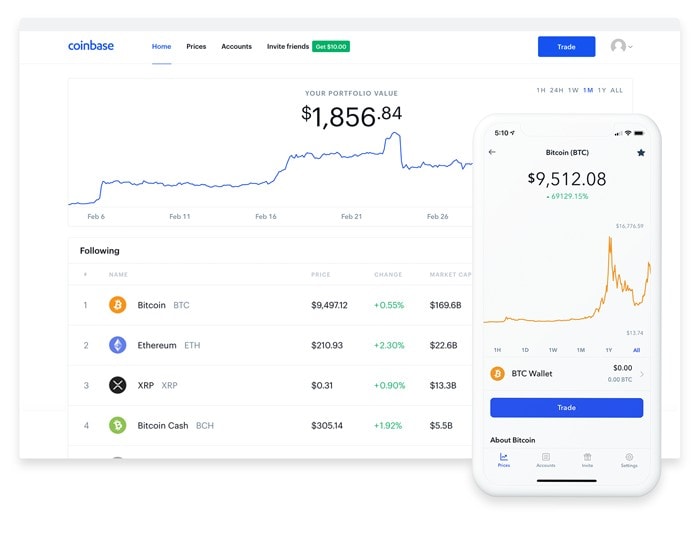

Coinbase is a cryptocurrency broker that allows you to buy and sell a range of digital currencies. On top of popular coins like Bitcoin and Ethereum, you will also find smaller projects like Basic Attention Token, Dash, and Ethereum Classic. The overarching selling point of using Coinbase is that it offers one of the most user-friendly cryptocurrency platforms in the space.

In fact, you simply need to open an account, upload a copy of your ID, deposit some funds and you’re good to go. Crucially, Coinbase offers support for a number of everyday payment methods such as a debit card and bank account – so the platform is ideal for entry-level buyers. To illustrate just how popular Coinbase is as the go-to Bitcoin broker, the platform claims to have served more than 30 million customers since its inception in 2012.

In terms of the fundamentals, Coinbase is a cryptocurrency broker in its truest form. By this, I mean that Coinbase actually owns and stores the coins that you buy. This is in stark contrast to other cryptocurrency platforms in the space, as more often than not the exchange simply matches buyers and sellers. As such, Coinbase allows you to withdraw your newly purchased cryptocurrencies from the platform as soon as the transaction has been completed.

I should also note that Coinbase also offers a side-platform that it calls Coinbase Pro that is targeted towards advanced traders. The purpose of Coinbase Pro is that it offers traditional trading facilities. This is going to be more suitable for those of you that wish to buy and sell cryptocurrencies on a short-term basis, as opposed to taking a long-term ‘buy and hold’ strategy. As I cover in more detail later on, Coinbase Pro offers more cryptocurrencies and cheaper fees than its Coinbase counterpart.

What Cryptocurrencies Does Coinbase Host?

Unlike a number of other cryptocurrency platforms active in the space, Coinbase is very selective in which digital currencies it chooses to host. With that in mind, there is often a direct correlation between Coinbase announcing the addition of a new coin, with that of the coin’s market value.

In other words, it is not uncommon for a digital currency to go on an upward trajectory after Coinbase announces it is adding the coin to its platform. The main reason for this is that Coinbase has millions of customers using the site, which in turn allows everyday investors to easily purchase the coin in question.

Nevertheless, below I have listed the cryptocurrencies that Coinbase allows you to buy.

- ATOM

- BAT

- BTC

- BCH

- BSV

- DAI

- DASH

- EOS

- ETH

- ETC

- KNC

- LINK

- LTC

- OMG

- OXT

- REP

- USDC

- XLM

- XRP

- XTZ

- ZEC

- ZRX

Some cryptocurrencies can be obtained only via Coinbase Pro. This includes:

- ALGO

- CVC

- DNT

- GNT

- MANA

- MKR

How do Cryptocurrency Investments Work at Coinbase?

The specific investment process at Coinbase depends on which segment of the platform you wish to use. With that in mind, I’ve split the discussion between Coinbase and Coinbase Pro.

Coinbase – Buy and Hold

If you are simply looking to buy a cryptocurrency like Bitcoin, Ethereum, or Litecoin – you will be best suited for the main Coinbase platform. As I noted earlier, Coinbase is a brokerage firm that allows you to buy Bitcoin in exchange for fiat currencies like the US dollar or Euro. So, the first port of call is to open an account with Coinbase and verify your identity (I cover the exact steps later in this review).

Once your account is set up, you can then purchase your chosen cryptocurrency. Unlike the traditional investment process – such as when you purchase stocks and shares, you don’t need to first add funds to your account.

Instead, you can make a direct investment.

For example, let’s suppose that you want to buy $500 worth of Bitcoin.

Once you specify how much you wish to buy, Coinbase allows you to make the purchase instantly with your debit card.

As soon as the card is charged, the Bitcoin will then be added to your Coinbase wallet. You then have the option of withdrawing the Bitcoin to your private wallet or keeping it at Coinbase.

When the time comes for you to sell your Bitcoin back to fiat currency, Coinbase makes the process super-easy. For example, if the coins are being stored externally in your own wallet, you simply need to transfer the coins into your Coinbase wallet.

Then, you would need to exchange the Bitcoin into US dollars or euros, before withdrawing the cash out to your bank account. If you haven’t previously linked your bank account to your Coinbase account, you’ll need to do this before a withdrawal is permitted.

Coinbase Pro – Trading Cryptocurrencies

Coinbase Pro is suited to a completely different clientele to that of the main Coinbase site, as it is a dedicated trading platform. In layman’s terms, this means that you will be buying and selling cryptocurrencies on a short-term basis, with the view of making small, but frequent gains.

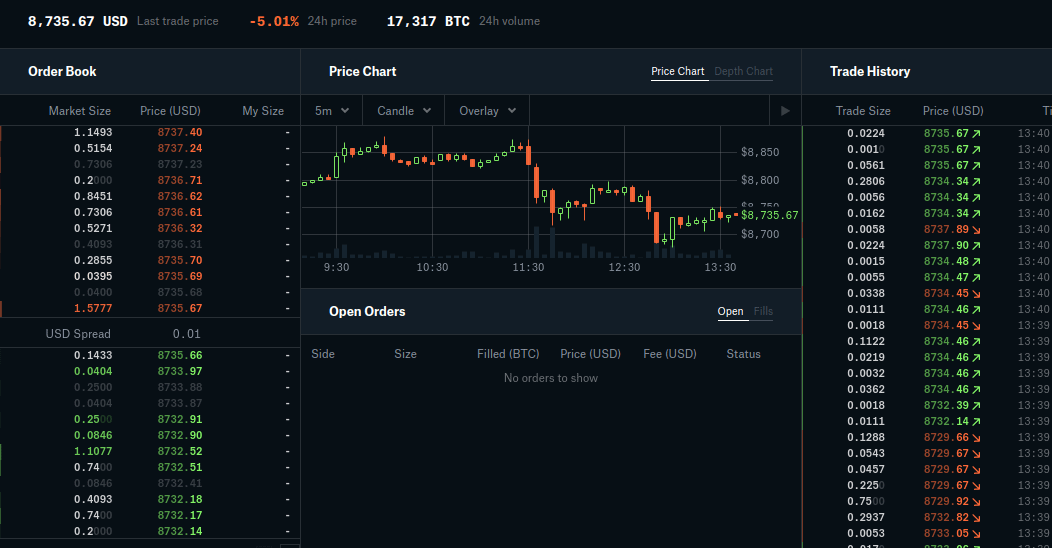

You will have access to significantly more data at Coinbase Pro. As you can see from the screenshot below, you’ll have a pricing chart that displays real-time movements. Candles can be adjusted from just 1 minute up to 1 day. You can also view the trading history and order book for your selected pair.

When it comes to orders, Coinbase Pro once again offers more flexibility than its Coinbase counterpart. This includes the likes of stop-loss and limit orders – which are both crucial if you plan to engage in short-term trading.

Short-Selling Cryptocurrencies

Short-selling means that you are speculating on the price of the asset going down. As such, if you think that Bitcoin is over-priced, or you simply do not believe in the long-term viability of the project – Coinbase Pro allows you to profit from this.

In fact, not only can you short-sell leading cryptocurrencies against the US dollar, but the platform also offers pairs against GBP and EUR. You won’t, however, be able to short-sell cryptocurrencies on the main Coinbase platform. With that said, you can easily transfer funds to and from the two platforms, so this isn’t an issue.

Leverage

When it comes to leverage, Coinbase Pro recently launched a margin trading facility. At the time of writing, this is only available in 23 US states.

This includes: FL, TX, IL, NJ, VA, GA, AR, AK, OR, CT, NH, MA, NE, NC, OK, CO, KS, ME, SC, UT, WI, WY, WV.

The platform notes that it plans on adding more states and jurisdictions further down the line. If you do qualify, Coinbase Pro offers leverage of up to 3x on USD-quoted pairs. This means that a $500 account balance would permit a maximum trade size of $1,500.

You do, however, need to be extremely careful when applying leverage on your trades – especially in a highly volatile marketplace like cryptocurrencies. Crucially, you stand the very real risk of being liquidated by Coinbase Pro if your trade goes against you by a certain percentage.

For example:

- Let’s say that you have $1,000 in your account and you decide to trade ETH/USD

- You decide to place a buy order with leverage of 3x, meaning that the value of your trade is $3,000

- Your $1,000 account balance is subsequently held as margin by Coinbase

- This amounts to 33.3% of your $3,000 trade size

- As such, if ETH/USD goes down by 33.3% or more, your trade will be automatically closed by Coinbase

- In doing so, you would lose your entire $1,000 margin

The only way to avoid being liquidated is to add more funds to your margin account.

Coinbase Fees

As great as Coinbase is for first-time buyers, it is important to note that the platform is expensive – especially if you plan to take advantage of instant debit card payments.

Below I discuss some of the main fees that you will need to take into consideration when buying cryptocurrencies at the broker.

Deposit Fees

Let’s start with the big one – deposit fees. So, if you’re looking for the fastest and most convenient way of buying cryptocurrency at Coinbase, you’ll likely be thinking about using your debit card. After all, as soon as the payment is processed the coins will be added to your Coinbase wallet.

As seamless as this is, Coinbase will charge you a whopping 3.99%. This means that a $1,000 debit card purchase will cost you $39.99 in fees! In effect, this does make the purchasing process somewhat unviable at Coinbase, especially when you consider that trading fees will also be applicable.

The only saving grace is if you decide to deposit funds with a bank account. For example, if you’re based in Europe and have the capacity to transfer funds via SEPA, then you won’t be charged at all. SEPA transfers can take a few days before they are settled.

With that said, the general consensus in the public domain is that most deposits are processed the next working day. Alternatively, if you’re based in the US you can deposit funds via ACH or wire transfer. While the former is free, the latter will cost you $10.

Trading Fees

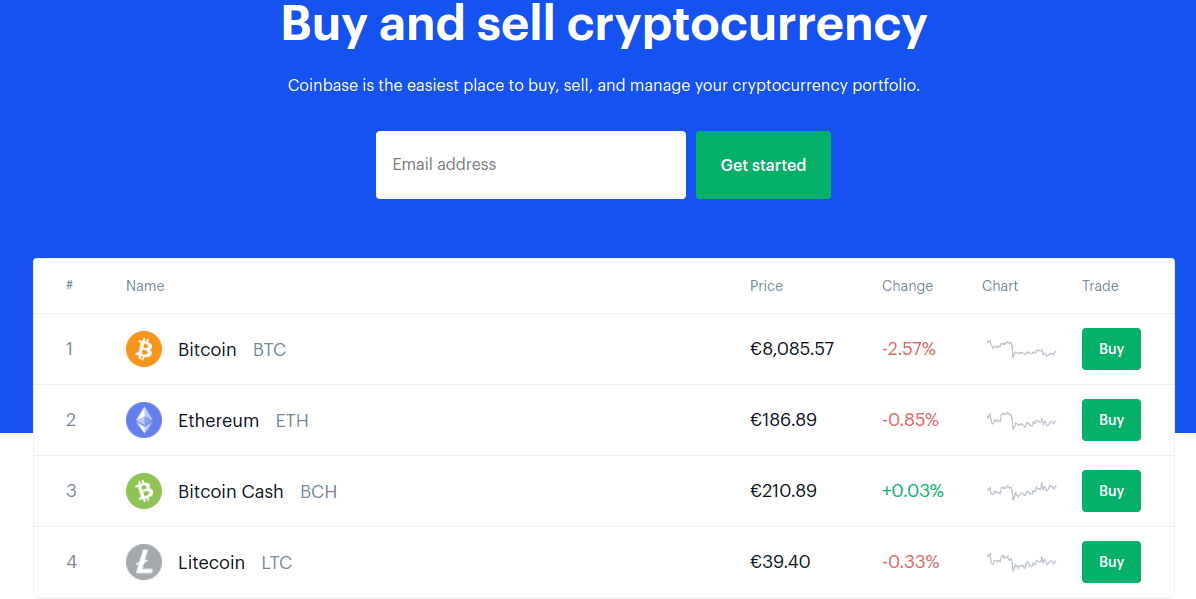

When Coinbase refers to trading fees, this is the fee that you pay every time you buy or sell a cryptocurrency. The platform has a somewhat confusing pricing structure that will vary depending on how much you decide to purchase or sell.

- For example, if the transaction amounts to less than $10, then the fee is $0.99. As is the case with all fees charged by Coinbase, if you’re using pounds or euros, the fee is the same but in your local currency (for example €0,99 or £0.99).

- If the purchase/sale is between $25 and $50, you’ll pay a flat fee of $1.99.

- Between $50 and $200, the fee is $2.99

Anything above and beyond $200 will be charged at a variable rate of 1.49%. So, a $1,000 Bitcoin purchase would amount to a fee of $14.90. Once again, this is expensive. Don’t forget, you will need to pay the 1.49% trading fee when you get around to cashing your cryptocurrency out for fiat currency. For example, if your $1,000 investment was worth $2,000 at the time of withdrawal, then the fee would amount to $29.80.

Spread

It is also important to take the spread into account. This is the difference between the buy and sell price of your chosen cryptocurrency. In the case of Coinbase, the platform charges an average spread of 0.50%.

For example, let’s say that you purchased $1,000 worth of BTC/USD at a buy price of $9,000. This means that were you to change your mind and place a sell order to exit the position straight away, you would be doing so at $8,955 and not $9,000.

Coinbase Pro

Trading fees at the Coinbase Pro platform are a lot more competitive. Not only does the platform offer tighter spreads, but commissions are reduced to 0.25%. High volume traders that are able to trade surplus of $10 million per month can get this reduced further to 0.15%.

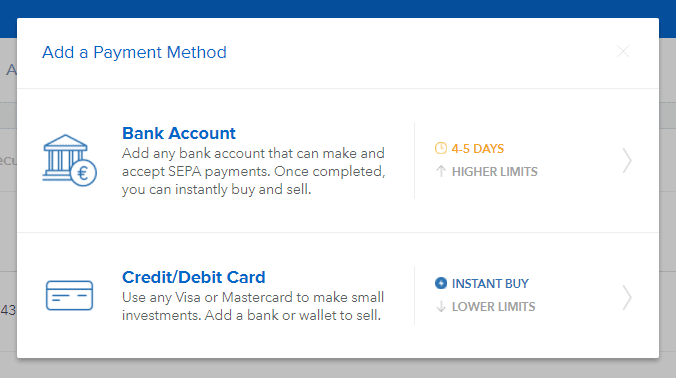

Payments at Coinbase

The two main payment options available at Coinbase are that of a debit card and bank transfer. Credit cards are not accepted. Regarding the latter, this will be through SEPA if you’re based in Europe, and ACH or wire if you’re a US citizen. UK traders will use a local bank transfer.

Much like its pricing structure, the availability of Paypal is super-confusing, as it depends on where you are based. At the time of writing, Paypal is available to withdraw funds – but not deposit, in 32 European countries (including the UK) and the US.

Coinbase does have a habit of changing its payment policies on a regular basis so you are best to check what options are available yo you at the time of the purchase!

Is Coinbase Safe?

When it comes to reputation, it really doesn’t get much better than Coinbase. This covers both its regulatory standing and the security controls employed by the platform, which I discuss in more detail below. Coinbase is right up there with the top exchanges like Binance and Bitfinex when it comes to safety and reputation.

Regulation

In the US – which is where Coinbase has its headquarters, the firm is registered as a money service business with FinCEN. This means that Coinbase adheres to all relevant US regulations on the countering of money laundering and terrorist financing.

In Layman’s terms, this means that each and every person that uses the platform must go through a KYC (Know Your Customer) process. This will require the provision of a government-issued ID. I should also note that Coinbase is hoping to gain approval from the SEC for a fully-fledged brokerage license.

In the UK, Coimbase is registered as an e-money business with the Financial Conduct Authority (FCA). This is the same regulatory body that governs the UK financial sector.

Cold Storage

The general consensus in the cryptocurrency space is that it is much safer to withdraw your coins out of an online exchange/broker and into a private wallet. This then gives you full control over your coins. Alternatively, if you decide to leave your cryptocurrencies at a third-party platform – and it subsequently gets hacked, your coins could get stolen.

But, in the case of Coinbase, the platform actually has some of the most water-tight security controls in the cryptocurrency brokerage arena. At the forefront of this is the broker’s commitment to ‘cold storage’. In fact, 98% of all client crypto-funds are held in cold storage, meaning that the coins remain offline at all times. As such, even if the broker did have its servers compromised, the vast bulk of its coins should remain safeguarded.

Two-Step Verification

Coinbase requires all account holders to set up two-step verification. This can either come in the form of an SMS or a third-party app like Authenticator. Either way, you won’t be able to access your account unless you have this set up. You can, however, elect to avoid the two-step verification process for up to 30 days at a time when accessing the platform from the same device.

If you end up losing your phone and thus – you no longer have access to Authenticator of your old mobile number for SMS verifications, you’ll need to submit some ID to reset your credentials.

The Vault

The ‘Vault’ is a really interesting concept that I like. In a nutshell, if you choose to store your cryptocurrencies in the Coinbase Vault, then all withdrawals require 48 hours before they are processed.

This could be the difference between you getting your account hacked and the perpetrator stealing your coins, and you finding out in time to block the withdrawal.

After all, Coinbase will always send you an email when a withdrawal attempt is made, so this is an extra layer of security that is well worth considering.

FDIC Insurance

There is both good and bad news when it comes to insurance on your funds. If you’re based in the US, then you should be protected by the Federal Deposit Insurance Corporation (FDIC). For those unaware, this means that were the platform to go bust, the first $250,000 would be protected by the US government.

Take note, your funds must be stored in your Coinbase US wallet for you to benefit from the FDIC protection. In other words, any digital assets stored at Coinbase are not covered by the FDIC. In this sense, it remains to be seen why you would want to store large cash balances in a cryptocurrency brokerage account, albeit, the protection is there nonetheless.

For those of you based outside of the US, no such insurance scheme is in place.

Coinbase Mobile App

Coinbase offers a fully-fledged mobile app that is available to download free of charge on iOS and Android devices. The application allows you to perform most of the same account functions as the main desktop site.

This includes the ability to buy and sell cryptocurrencies, deposit and withdraw funds, and check the value of your portfolio. If you don’t have an Android or iOS device, the Coinbase mobile website has been fully optimized – so you’re not missing out.

Customer Support

If you need to speak with a member of the Coinbase customer service team, you have two options – telephone support or raising a ticket.

The contact center can be called at:

+1 888 908-7930 (US/Intl)

0808 168 4635 (UK)

1800 200 355 (Ireland)

Although Coinbase teases you with a live chat facility, this is only an automated bot that in most cases, is pretty much useless.

How to Buy Cryptocurrencies at Coinbase?

If you’ve read my Coinbase review up to this point – and you’re keen to get started today, below you will find a handy step-by-step guide on what you need to do. As always, just make sure you perform your own research prior to taking the plunge.

Step 1: Open an Account at Coinbase

To get the ball rolling, visit the Coinbase website and elect to open an account. This will require some personal information from you, such as your:

- First and Last Name

- Nationality

- Country of Residence

- Date of Birth

- Home Address

- Mobile Number

- Email Address

Make sure the above details are entered correctly, as you will need to verify them in the next step. Coinbase will also send you an SMS code to your mobile phone, which you will need to verify.

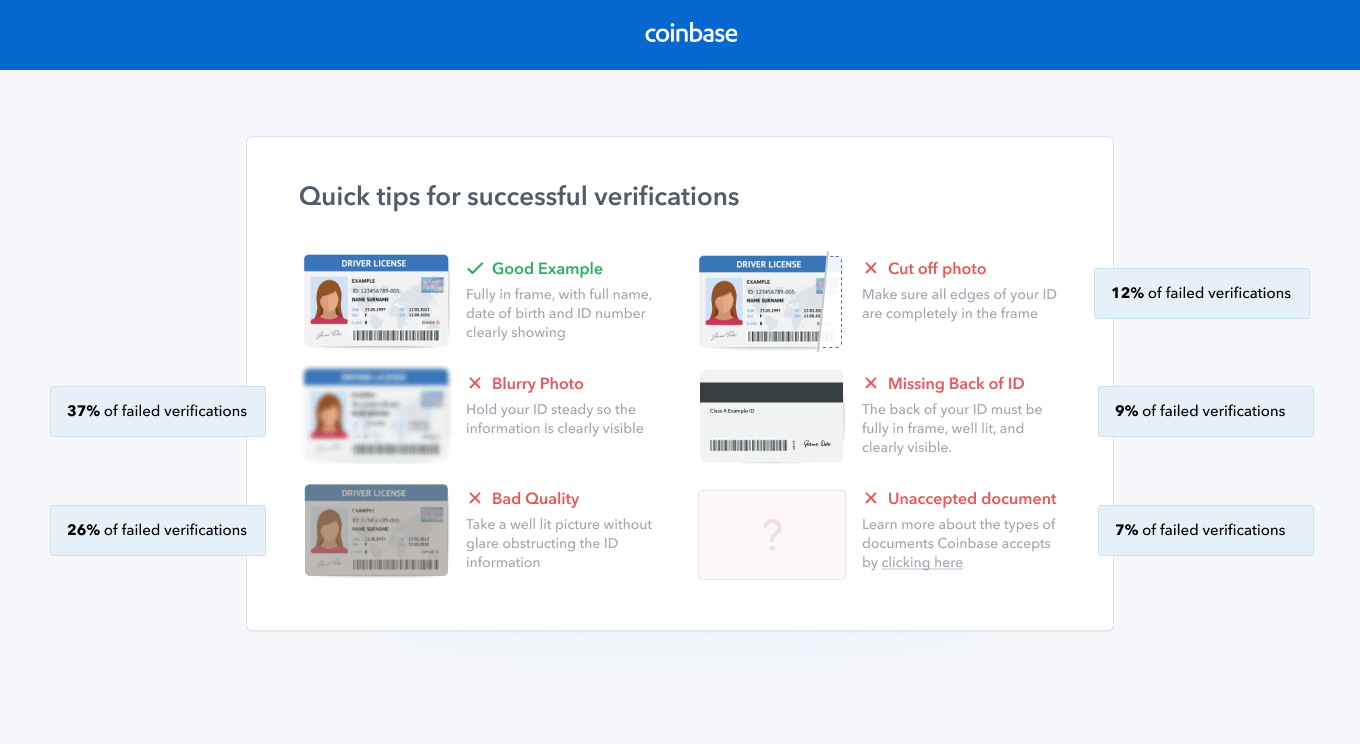

Step 2: KYC Verification

As a regulated cryptocurrency broker, Coinbase is required to identify each and every user that opens an account. As a result, you’ll need to supply a copy of your government-issued ID. Depending on where you live, this can either be your passport, driver’s license, or national ID card.

I should note that the process of uploading your ID can be super cumbersome at Coinbase, as you will need to use a webcam if you are using a desktop/laptop device. If the quality of your webcam is below-par, Coinbase will keep rejecting the document. If this is the case, you might be best to download and install the mobile app, and then use your mobile camera to upload the documents.

Step 3: Link Your Payment Method

You will now need to link a payment method to Coinbase – which can either be a bank account or debit card. If choosing the former, you will need to send a small amount from your bank account into the account of Coinbase. Crucially, you will need to include a unique reference number in the transaction ID. The process can take 3-4 working days.

Alternatively, it might be best to link your debit card if you plan to buy cryptocurrencies instantly. There is no need to bypass a verification process when using a debit card, albeit you will be capped in how much you can buy. This varies from country-to-country, averaging the $750-mark. If you do want higher limits on your card, you’ll need to verify it by confirming two small temporary debits – much like you would with Paypal.

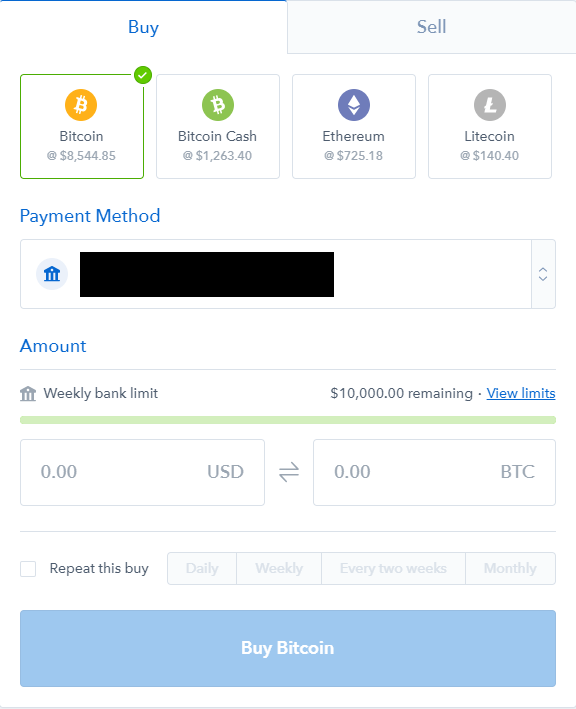

Step 4: Buy Crypto

You will now need to select which cryptocurrency you want to buy from Coinbase. Next, enter the amount that you wish to purchase in your local currency. This will either be USD, EUR, or GBP – depending on where you live. As you type in the amount in fiat currency, the equivalent amount in your chosen cryptocurrency will update.

Finally, click on the ‘buy’ button to complete the transaction. All being well, your debit card should be credited instantly, and the cryptocurrency added to your Coinbase wallet. You can then keep the coins at the platform, or withdraw them to your private wallet.

Coinbase Custody

I am of the opinion that one of the necessary components for the crypto industry to flourish in the coming years is the proliferation of custody solutions for crypto assets.

As we mentioned before, there is a strong culture within the Bitcoin community to be your own bank, with the saying “not your keys, not your crypto” frequently bandied about.

The reality, however, is that the world’s population is now accustomed to holding their money and other financial instruments with trusted organizations. This is the concept of custody. You don’t hold cash under your mattress, but you deposit it in a bank. If you buy stocks, your broker will most probably be your custodian and hold them in your name. Even many gold buyers use custodians such as Bullionvault to store their gold rather than have the headache of trying to store them in their homes securely.

And that is why banks or other custodian organizations will play an important role in the future of Bitcoin by providing secure storage to the general population.

Coinbase Custody is a step in that direction. It is currently only available for institutions that typically hold high values of cryptos, but I would bet that the plan is for Coinbase to be able to offer this service to all their users in the future.

Since the Coinbase Custody service is currently only available for accounts with a minimum balance of $1,000,000+ I won’t be delving deeper into it, but I think it is worth mentioning it as a taste of things to come.

The Verdict?

Coinbase certainly comes with its pros and cons. On the one hand, the platform is potentially ideal if you are an absolute newbie and you want to buy Bitcoin for the very first time. This is because the broker makes the end-to-end buying process super straight forward, and you have the option of using an everyday payment method like a debit card or bank account.

Coinbase is also suited to those of you that are worried about taking full responsibility of your coins in a private wallet – as the broker will keep 98% of client funds in cold storage. On the flip side, I should make it clear that Coinbase is super-expensive. Make no mistake about it – at a debit card transaction fee of 3.99%, and a variable trading commission of 1.49% – there are certainly cheaper options out there.

All in all, if you are happy to pay a higher price for the benefit of convenience, safety, and reliability – Coinbase is likely to be up your street.

Summary

Coinbase is one of the safest and most well-established places to buy and trade cryptocurrencies. While it is probably the number one exchange in the United States, it is also very popular with investors from other parts of the world, who value its ease-of-use and strong security protocols.

Pros

- One of the earlier exchanges.

- Excellent interface and mobile app.

- Suitable for both beginners and pro traders.

- Rewards you for learning about crypto.

- Vault protection.

- Recurring buys for slow and steady investing.

Cons

- Fees can be higher than other exchanges.

Leave a Reply