As Bitcoin goes through its ups and downs over the years, the question on everyone’s mind is whether this is the right time to buy.

“Hey Jean, do you think this is a good time to buy myself some Bitcoin?”

My inbox has been flooded with slight variations of this question, so I wrote this article to help my friends, family, and the general public process this decision and arrive at an informed decision.

I am a strong believer in the long-term future of Bitcoin due to its fundamental properties, which we’ll delve into later in this article. I have therefore been happy to buy at any price point since Bitcoin’s inception, as I think the price has a long way to go still and we’re in the early years of crypto, comparable to watching the dawn of commercial internet usage in the mid to late 90s.

I consider Bitcoin to be the best investment of our lifetime and will do my best to explain why I think so in the rest of this article.

How to Get Started with Bitcoin

I know you might now have time or even sufficient interest to read the rest of this long article, so again, if you’re already convinced about buying, here are my basic recommendations for entering the Bitcoin space.

In the meantime, if you’re already convinced and you came here looking for the best places to buy Bitcoin right away, here’s what you need to do next:

- Sign up at the leading crypto exchange Coinbase

- Transfer money (EUR, USD etc) from your bank to the exchange.

- Buy Bitcoin

- Start thinking about how you prefer to custody your Bitcoin.

There are hundreds of places you can buy Bitcoin from, but I would suggest that you stick to the exchanges that have been established for many years and have a perfect security track record. It’s important that these exchanges are regulated where applicable. These are my recommendations:

- Buy Bitcoin on Binance – the exchange with the biggest volume worldwide) – read my review

- Buy Bitcoin on Coinbase – the most well known exchange – read my review

They are the world’s safest, biggest and most reputable exchanges and you can’t go wrong with them.

I’ve also written a guide on how to buy Bitcoin in Europe where I go into further detail on how you can get your hands on some Bitcoin.

Once you have your Bitcoin, you can purchase a Ledger Nano to store that Bitcoin offline and away from any hackers.

If you just want to hold your Bitcoin while earning good returns, you can check out some crypto platforms that offer a savings account. My favorites at the moment are YouHodler and Nexo,but you can learn more about those options here.

Towards the end of the article, I will again discuss some of the ways that you can make money with Bitcoin.

Waiting to Buy the Dip

By far the most frequent follow-up question I get and the biggest block I see people facing, is this:

“What price should I buy at?”

I don’t believe in timing the market on any investment, unless there is a big macro event like the financial crisis of 2007-2008 and the COVID dip of March 2020.

Therefore, for any investment I make, I’m typically looking 5-10 years ahead and thinking about how much value that investment can generate within that timeframe. The whole crypto space is still in its infancy, and Bitcoin has enormous room for growth, thus any price point is a good entry in my opinion.

I think we’ll be seeing many more similar tweets in the coming months and years:

#Bitcoin is $40,400 right now.

You could have bought it for $29,000 last week. Still waiting for the dip?

— Bitcoin Archive (@BTC_Archive) February 6, 2021

Unfortunately, people are really attracted to the idea of buying the dip. The problem is that the dip may never come, and if you know people who did buy some dip, it’s likely that they were in a position to buy at an even lower price a few months earlier but didn’t have the courage to pull the trigger. If that’s not the case, in 90% of the cases I would attribute managing to buy a dip to pure luck.

Even in the case of the major macro events like the 2007 crisis and March 2020 dip, to make the most of those events you’d have had to have a lot of spare cash lying around and ready to be invested. Again, mostly, a question of luck.

See also: The Best crypto trading apps and exchanges

However, if you feel uncomfortable about choosing a particular price point to make your entry, consider investing a fixed amount periodically, say every month. In that way, you’ll smooth out any drastic price variances and you’ll be building up your Bitcoin portfolio over time. The disadvantage of that strategy is that Bitcoin might make a sharp move upwards in the meantime.

Ok, with those preliminary recommendations out of the way, let’s proceed with the reasons why I think Bitcoin is the best investment of our generation.

Why am I Bullish on Bitcoin?

In 2020, as a response to the COVID fears, Bitcoin dipped heavily in March and I had thought it was a great time to increase one’s Bitcoin holding, as the market was ruled by fear.

Since then, the price has risen steadily, breaking through its former all-time high in a dramatic way. As always, since we are still early, there are wild swings up and down, and that’s to be expected for an emergent asset class.

Before we continue, let me reiterate that nobody can predict Bitcoin’s price, and neither can I. Even if I had some hunch, I would not want you to blindly follow what I say, because I am against getting financial advice online.

However, I use this blog as my own small space to think about things, and writing is how I best formulate my ideas. As an added benefit, I get to interact with other investors and people whose ideas contrast mine, thus helping me further refine my thoughts.

The way I see it, Bitcoin seems to be following the stock-to-flow model when we view its price over the long term. Proponents of this model had predicted that the price of Bitcoin should reach somewhere between $100k and $200k at some point in the next few years. This is based on an analysis of the demand and scarcity of this asset, and comparing it to other assets like gold.

Read more: The Best Books about Bitcoin and Crypto

This is a very bullish target price, although it does seem realistic given Bitcoin’s ATH. Irrespective of the price swings, I remain very bullish on the Bitcoin network long-term, due to the fundamentals being stronger than ever.

Let’s now consider a few major themes that add to the bullish argument for Bitcoin.

Bitcoin’s track record VS the S&P500

Bitcoin has been the best investment asset within the past 10 years by a long stretch. Take a look at how it outperformed the S&P500 index during the past few years:

However, even with such a historical track record in place, I would suggest looking beyond the charts. The basis for my investment is a philosophical one based on my belief that Bitcoin solves a need as a totally independent store of value that is not at the mercy of any government or company. I am happy to invest some of my net worth in cryptos for this reason, and I know that I’ll be happy about my decision in the future whether prices rise or fall, as it is based on that reasoning and not just speculation.

Bitcoin as a Safe Haven

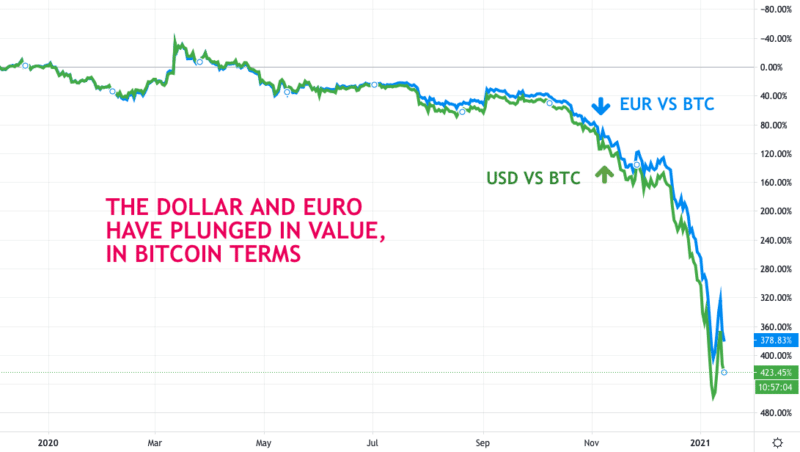

The US federal reserve printed ungodly amounts of dollars in 2020 and then pumped into traditional financial markets last year to keep them from faltering. The European Union followed suit. It’s quite logical that with more money in the system, the value of your existing stash will lose value as money is less scarce than it was before. Bitcoin on the other hand maintains its hard cap on the total amount that can ever be issued.

Hence we get a chart like this, where fiat currencies unequivocally lose value against hard assets like Bitcoin.

Big institutions and corporate entities have understood this very well. In fact, their main play is that of protecting their financial reserves, rather than buying Bitcoin in the hope of exponential growth. They want to protect the store of value they have accumulated over the years, and they know that if they don’t buy a hard asset like Bitcoin that value will be greatly diminished by the effects of money printing and other fiscal policies.

The Great Upcoming Wealth Transfer

Check this report entitled “Inheriting USDs & Acquiring BTCs: How ‘The Great Wealth Transfer’ Will Fuel ‘The Great Bitcoin Adoption.’”

According to the report, if American Millennials were to invest at least five percent of their inherited wealth into Bitcoin (BTC), they could drive the price up to $350,000 in 2044. This would effectively give the generational group almost $70 trillion of value from a $971 billion investment.

With many older Americans on the verge of retirement, the report suggests those in younger generations who are not only more familiar with but more accepting of Bitcoin will have more options investing in the future.

“…a disproportionate percentage of the Millennials and Gen X will continue to be the driving force of adoption [of cryptocurrency] for the foreseeable future. While this can be explained in part by the fact that both generations harness a greater technological competence than their elders, we should also consider that bitcoin’s current volatility is unsuitable for individuals nearing or in retirement.”

Baby Boomers in the United States currently control approximately 57% of the total wealth, $50 trillion of which will pass to Millennials and Gen Xers in the next two years. This redistribution is referred to as the “Great Wealth Transfer”.

If younger people were to use just 1% of this wealth to then invest in BTC, the price could rise to $70,000 — if not more — in 2044. This is based only on investors in the U.S., meaning the actual numbers could easily be higher.

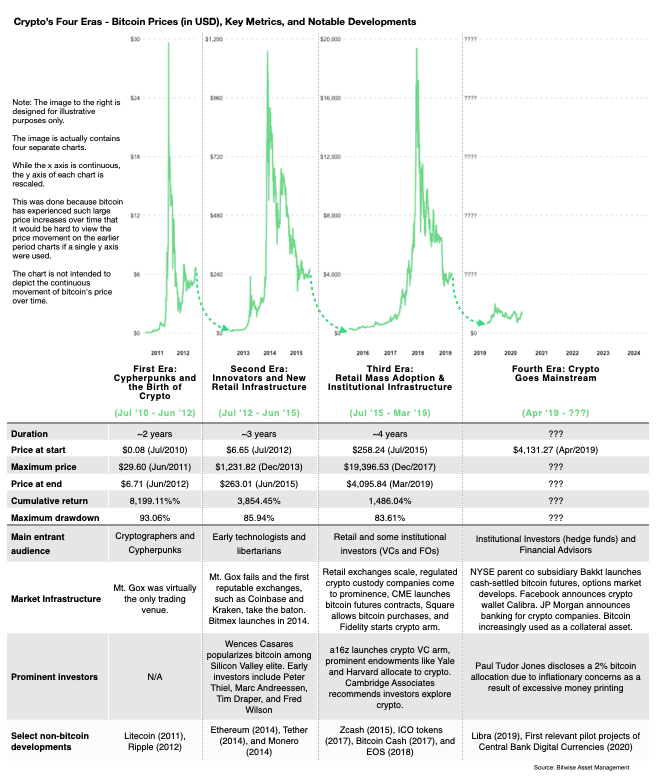

Bitcoin entering the Fourth Era

According to an analysis by Bitwise Asset Management, Bitcoin is entering its fourth era in which it will go mainstream, and if previous eras are anything to go by, we should be seeing a big run-up to $100,000 or more in the next 2 years.

European countries legalizing Bitcoin

As reported by Les Echos, Bitcoin now has the official status of money in France.

Meanwhile, Bitcoin has been qualified as a financial instrument in Germany. Portugal, on the other hand, is well-known as possibly the most crypto-friendly nation in Europe, and does not impose any taxes on crypto gains.

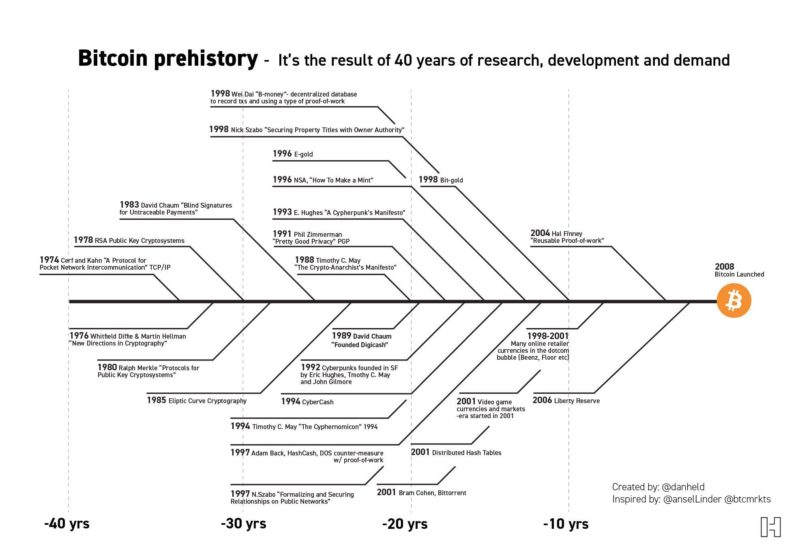

Bitcoin is the result of many previous projects and research

Many people seem to think that Bitcoin is a recent thing, even a bubble, but it can’t be further from the truth. Bitcoin has already been working for more than ten years, while being itself just the latest in a series of projects that tried to achieve the aim of a censorship-resistant and digital money and store of value.

Here’s a chart illustrating how far the Bitcoin prehistory goes:

The Biggest Hurdles that Bitcoin Faces

While I firmly believe that Bitcoin is here to stay and that we will see a massive increase in price over the coming years, there are still some big and important hurdles for this new technology to overcome before it can really go mainstream.

Investors in the crypto space should weigh both the benefits and problems of the space when putting their money into any crypto project or asset. The benefits and problems are not set in stone, both can change over time.

Many people believe that Bitcoin has already gone mainstream, but the reality is that outside of the world’s most developed nations and, ironically, some of the most troubled nations (Venezuela, Argentina are two examples) the vast majority of the world’s population has little or no knowledge of Bitcoin, let alone any holdings.

I, therefore, believe that it is still very early days for the crypto space, and that there is enormous potential for growth both in terms of technology and in terms of valuation. However, there are some important hurdles that need to be progressively overcome in order for this crazy experiment to succeed long-term.

These are the big problems that need to be tackled by Bitcoin and other cryptocurrencies in the coming years.

Bitcoin’s Confused Narrative

Bitcoin was created to serve as “a peer-to-peer electronic cash system”, to quote Satoshi Nakamoto in the whitepaper that was released in 2008.

Over time, however, the narrative has mutated and we still don’t have a clear idea of what is really the biggest purpose for holding Bitcoin.

In my view, at the moment, it is clearly the “digital gold” narrative that wins out over all other narratives. The peer-to-peer cash narrative never really took off. People in developed countries nowadays can easily send money to each other using digital banks such as Revolut or N26, and even traditional banks have developed ways for their users to easily send cash to each other. Big transfers remain a good use case for Bitcoin, but most potential users are not really seeking a solution for transferring thousands or millions of dollars between them.

Bitcoin’s Bad Reputation

There are a couple of things that hurt Bitcoin’s reputation, and that of the whole crypto space in general.

- The myth that Bitcoin is mostly used for nefarious reasons (money laundering, arms dealing, drugs etc). This myth has been disproved many times but was popular a few years back and many people still believe it.

- The second myth that Bitcoin is for those who want to hide their monetary activity and evade taxes. The reality is that Bitcoin only offers pseudonymous privacy and there are several blockchain analysis firms that can determine who is behind an account and to whom they are sending and receiving money from.

- Get rich quick schemes, which can be further divided into two:

- The ICO craze of 2017 – many people lost money trying to get rich quick investing in things they didn’t really understand.

- There are many scams that use crypto as a vehicle. They prey on people’s poor financial and technical knowledge by making ridiculous promises and either cheating them out of their precious Bitcoin or else use the lack of regulation within the crypto space to run their scams with impunity.

When people lose money, they tend to turn against whatever and whoever they blame for that loss, and write off that space completely. It is easier to do that than to admit that you went in beyond your head and didn’t know what you were doing.

The rational thing to do would be to double down on your learning and add a new and higher dose of skepticism when evaluating investments. The emotional thing that is most likely to happen is to write off the whole crypto space as money black hole and vow to stay away from it.

Then there are thoes people who are a bit more experienced and have seen their fair share of scams or even have been burned by some of them (not in the crypto space). Crypto enthusiasts tend to talk about their trading and investments in a way that is very similar to the marketing machines used by scams, so that usually puts these experienced guys on the alert. They then proceed to write off the investment due to this and it being “too complicated”.

Holding Bitcoin is Still Complicated, Cumbersome and Prone to Loss

Not your keys, not your Bitcoin, is a phrase we hear over and over in the Bitcoin community. The idea here is that you should take possession of your private keys by pulling your Bitcoin off exchanges and into your hot or cold wallet.

That’s all well and good, however, the majority of people don’t want to deal wit the anxiety, stress and technical complications of self-custody.

Self-custody usually involves a cold storage device such as a Ledger Nano or a Trezor, which has to be bought and set up. Then you have to transfer your crypto from the exchange to your device, which in itself can lead to losing all your Bitcoin if you copy the addresses incorrectly, although this is a relatively small risk.

It’s too easy to lose or misplace a seed phrase. Inheritance of such crypto asset setups can be very complicated, as in many cases only the original owner has clear knowledge of how to access the crypto that was stored in cold wallets. The incentive of the holder is to prevent anyone else to have access to their Bitcoin, which is generally a good incentive but becomes a major stumbling block in an inheritance situation.

Solutions such as Casa are a move in the right direction, as they eliminate the need for the seed phrase backup and introduce multisig transactions. They introduce a 3 of 5 key setup. If you misplace one of those keys, it can be rotated out and replaced. By putting customer support in place they also hope that people will be more inclined to practice self-custody, as they are never alone in the whole process but have someone to call if they need help in setting things up or if they are having problems transacting or accessing your Bitcoin. This paradigm is much closer to how people think of their relationship with their banks.

Inheritance is also taken care of through Casa covenant. This involves a 3 of 6 key setup. The 6th key is held by your lawyer who holds it until you pass. Two other keys are accessible within the legal system upon your passing. One of them is held by Casa and the other one is held in a safety deposit box. The latter two keys require a court order issued upon the original owner’s passing to access them.

I think that although Casa’s solution is more robust when compared to a DIY setup, it’s still too complicated for the average person, hence adding one more stumbling block to mass adoption of Bitcoin.

Another solution for inheritance is the dead man’s switch, which passes on information about recovering your Bitcoin to someone else unless you take a particular pre-determined action within a pre-established timeframe. The problem, of course, is that if the owner forgets or is impeded by the tribulations of life from taking that action, then that critical information might end up being passed on before it was intended to.

I think Casa’s solution is a step in the right direction, but its cost might be prohibitive for many people, and hence is probably most suitable for people with significant holdings of crypto assets. The overall problem of Bitcoin/crypto custody remains.

The solution to this problem? I think it’s three-pronged.

- I believe there will be a rise of Bitcoin banks in the next few years. These will be licensed and regulated institutions that will be able to hold your crypto assets at a low cost while also insuring those assets against loss. Basically the same way we think of storing our fiat money in banks. This system has been in place for many years and people are used to offloading the responsibility for storing their assets to a third party, so we need to replicate that in the crypto space for mass adoption to take place.

- An improvement in the technology and user experience for hot and cold wallets and multi sig solutions. Once the technical barrier is sufficiently lowered, significant portions of the general population will be open to self custody, especially the younger, more tech-savvy generations.

- Companies like Casa and Unchained Capital will become ubiquitous and provide the sovereignty and non-confiscatory advantages of self-custody while providing the peace of mind and customer support typically associated with banking institutions.

There is probably another possible solution, and that is that the biggest exchanges will in time start having their holdings insured and become as robust as today’s banks in terms of guaranteeing their customers’ crypto holdings. In that case, self-custody will become less important from the point of view of protecting your investment from loss due to security breaches or bad actions on the exchange’s end.

As far back as 2010, Hal Finney had posted about this topic in the bitcointalk forum, saying that he thought the ultimate fate of Bitcoin would be as a reserve currency for banks that issue their own digital cash.

Time will tell, but it’s exciting to see all the different solutions being proposed and implemented at the moment.

Bitcoin’s Correlation with the Stock Market

Although Bitcoin is frequently touted as an uncorrelated asset and this is, in fact, one of its major narratives, we have seen how its behavior has at times mirrored the stock market very closely. It has behaved very similarly to a tech stock.

For those who are specifically looking for an uncorrelated asset, especially if they are looking at Bitcoin as a potential gold alternative, this is a major downer.

I don’t see this correlation as a big issue and expect Bitcoin to become less correlated as it matures.

Electricity Consumption

This topic has been discussed ad nauseum, and I really don’t think it presents any issues, although it is frequently mentioned as a downside or problem with Bitcoin. Read this article and this follow-up.

Safe and Easy Storage Solutions

Cryptos can easily be lost or stolen by inexperienced users; this is one of the biggest problems I see as most people simply find it too technical or daunting to buy and store cryptocurrencies.

For those investors who are technical enough and have the resources to invest heavily, on the other hand, there is the significant headache of storing hundreds of thousands of dollars worth (or even millions) of crypto. Thankfully, we are seeing new crypto custody solutions popping up, but it’s still early days.

Peer-to-Peer Payments are Still Hard to Do

Most banks have implemented systems that allow P2P payments between friends in a really easy fashion. Although Bitcoin was invented to enabled such peer to peer transactions of value of any size, there is still some way to go until we can say that the average person knows how to do that via his smartphone. Transaction prices are still high for lower transfer values (but the lightning network promises to change that).

Bitcoin Payment Acceptance is Low

There was a time where many online sellers and even brick-and-mortar stores were adopting Bitcoin as a method of payment, but I see less of them these days.

The tax implications of paying for small items with Bitcoin can be big, as in many countries every sale of Bitcoin is a taxable event. So you need to keep track of every item you purchase with Bitcoin during the year (including coffees and other low-value purchases) and calculate the capital gains tax at the end of the year. Few people want to bother with that yet.

Even if we ignore the tax consequences, paying with Bitcoin is still not easy from an app point of view.

In many countries, Bitcoin is not legal tender and cannot be used to purchase big items like a house, car or even pay your taxes. Some states in the US and some countries allow it, but we’re still a long way off.

2017 ICO and Crypto Bubble

Many people still have the 2017 ICO and crypto bubble in their recent memory, where cryptos rose very quickly in value only to come crashing down again a few months later. A lot of people jumped on the bandwagon when the price was rising without knowing what they were getting into, and then logically got burned when the prices declined sharply.

These people are more likely to have written off Bitcoin as they try to stave off the painful memories of losing money. Those who invested in ICOs fared even worse as many ICOs were outright scams.

It’s Not Easy to Get Hold of Crypto

Many banks are still blocking transactions to and from Bitcoin exchanges, and without a way to get their fiat currencies onto an exchange people are thus blocked from getting hold of Bitcoin. The alternative would be to exchange services for Bitcoin, but I personally don’t know anyone who would be ready to pay for services in Bitcoin, so it’s hard to get hold of Bitcoin in this way.

Unclear Legislation

Many countries still have not clearly stated their position with regard to cryptocurrencies, while others have outright banned cryptos. It is important for people to know the following from their governments:

- Whether the buying and selling of cryptos implies a VAT-able transaction.

- Whether there are any capital gains taxes when selling at a profit.

- Whether the holding and usage of crypto is legal or not.

The answers to those questions mostly lies in what financial instrument it considers cryptocurrencies to be. Some treat them as currencies while others treat them as intangible assets; those are the two major categories we’ve seen so far. ICOs, for example, fell into a grey area as what a lot of the companies were selling were actually securities, and they needed to be classified as such.

Some governments also opt not to tax long term capital gains, while others due, implying a huge difference in the ultimate tax bill for investors.

China has banned crypto exchanges from operating in the country while India has announced a ban on the purchase and sale of crypto currencies.

To conclude, while it’s anyone’s guess where the value of Bitcoin will be in a few years time, or whether it will still be the leading cryptocurrency, there’s little doubt that blockchain technology is here to stay, and even institutions like banks and governments are investing huge amounts of money and resources into this technology.

Profiting from Bitcoin

Since I know many people visit this article with the idea of making money from crypto, here are some of the ways you can do so. I purposefully left this section towards the end of the article as it’s very important to educate yourself before you dive in.

Do your own research always, as this is a very volatile space that is in its early stages. Having said that, for those who know what they are doing, the returns can be incredible.

Buy and Hold Bitcoin

If it’s your first time getting into Bitcoin, an easy strategy would be to just buy and hold this crypto. I recommend buying from these exchanges:

I would recommend then storing your Bitcoin and other crypto-assets offline using a Ledger Nano or Trezor. You should store the 24-word seed phrase on a Billfodl or Cryptosteel.

If you want to read more about custodying your Bitcoin, read my in-depth article on that subject.

Need Cash? Take a crypto loan instead of selling

If you need quick liquidity, you typically sell-off some of your assets. Anyone can run into an emergency situation.

But there are alternatives to selling. Crypto backed P2P loan platforms are very popular, big holders of crypto prefer to get loans in fiat currency using their crypto as collateral instead of selling their crypto.

You could also use your crypto to earn interest using platforms like YouHodler.

While buying and holding has traditionally been the easiest and probably best way to profit from the Bitcoin boom, there are several other ways to make money by getting involved with Bitcoin.

Arbitrage Trading Software

A common scam – avoid outright. There are many websites that promote their software that purportedly generates insane daily profits through some proprietary genius trading and arbitrage techniques.

Predictably, they are all scams and Ponzi schemes, and you are sure to find a referral program meant to be the main driver of any returns. Examples include Bitconnect, Arbistar, Mind Capital and Kualian.

Bitcoin’s rise has been truly remarkable to see. However, the crypto market is little more than a decade old and is still very much in its early stages. Now is as good a time as any to enter this space. So, before we talk about how you can buy Bitcoin with Euros, let’s look at the remarkable rise of this revolutionary asset.

The Rise and Rise Of Bitcoin

A little over six years ago, cryptocurrencies were looked down upon as scams and shunned by the corporate world. It is pretty hard to believe how far BTC, and the entire crypto market, has come along over the last 2-3 years. Once thought of as the dark web’s favorite mode of payment, Bitcoin has risen to become the premier store-of-value and the perfect hedge against financial fluctuations.

Companies such as MicroStrategy and Tesla have purchased billions of dollars worth of BTC. Investors like Ray Dalio, Stanley Druckenmiller, and Carl Icahn, who handle multi-billion dollar portfolios, have openly discussed holding Bitcoin. Plus powerhouse companies like Paypal, Starbucks, and Yum! Brands (parent company of KFC, Pizza Hut, and others) accept or test bitcoin payments in various territories.

So, if you are ready to dive deep and buy Bitcoins with Euros, read on.

How Can I Start Buying Bitcoin With Euro?

Alright, so you have decided to get your hands on some Bitcoin. Awesome. But this is where the research part begins. You now need to find a cryptocurrency exchange which:

- Offers local funding methods for Euro like SEPA

- Has a simple and straightforward interface which is crucial if you are a beginner.

- Is secure enough to protect your holdings from potential hackers.

- Has done the homework needed to fulfill all regulatory requirements.

- Has low fees and enough liquidity.

Coinbase ticks all these requirements. Use its simple-to-use interface to buy and sell Bitcoin, Ethereum, Litecoin, Ripple, Stellar, EOS, Cardano, Bitcoin Cash, and Tether with EUR. Getting started with Coinbase is very easy. These are the steps you’ll need to follow:

- Create a Coinbase account and complete your KYC verification.

- Deposit EURO into Coinbase using SEPA from your bank account.

- You can also fund your crypto purchases using your credit card or deposit crypto that you already own.

- Buy Bitcoin or the other major cryptocurrencies with your EURO balance.

The deposits are credited to your account the same day they are received. Along with these features, Coinbase has comprehensive tutorials and industry-leading customer support to make cryptocurrency accessible to everyone and anyone.

Concluding Thoughts

I think we should focus on the long term, the big picture. If you have faith in this technology you know this is the worst time to panic sell and the best to keep hodling, or better yet, buy more crypto.

The other alternative is to engage in trading, if you have the right skills to do so. In shaky times like these when the price tends to be quite volatile, trading can be a very profitable endeavor.

Given the huge upside potential and promise for Bitcoin, I think that the easiest and most fool-proof strategy right now is to just buy Bitcoin and store it safely. Wait a few years and if all goes according to the ideas exposed above you will be sitting on a nice increase in your net worth.

I like to use the Whatifihodl tool to figure out how much a current Bitcoin stash will be worth in the future based on price projections. You could also use Hodlcalc to see how much Bitcoins bought in the past would be worth today. It’s a great tool if you fancy ending up kicking yourself for not getting involved earlier than you did 🙂

Alternative Currencies to Buy

While you can profit off trading on many cryptocurrencies, if you want to adopt a buy and hold long-term approach, then there is not much worth investing in beyond Bitcoin and Ethereum.

Taxation

You also need to keep in mind that in most countries crypto trading is taxable. Read about how crypto is taxed around the world or how crypto investors have scored a great deal with Portugal.

If you already know how your country taxes Bitcoin and you just want to find a way to quickly prepare your taxes, I strongly suggest you take a look at Cointracker.

This is a service that only tracks your crypto portfolio across various exchanges and cold storage devices, but can also prepare your taxes for you in a few minutes. They can also execute strategies like tax loss harvesting. If you do any trading or use bitcoin for payments this is an essential tool as you will have many transactions to record for tax purposes, and you can’t afford the possible mistakes that come from the tedious manual work of calculations.

In conclusion, I think that we are seeing a clear trend toward Bitcoin adoption. Whether or not you “believe in bitcoin,” it’s here to stay.

It took 12 years, but it’s gained acceptance and there’s no going back. The companies, asset managers, and governments that stop fighting the rising tide and decide to surf it will be the ones that fare the best.

If you’re ready to buy Bitcoin and cryptos and want to read more about the buying process, do check out my guide to investing in Bitcoin and cryptocurrencies.

Over to You

What are your opinions on Bitcoin and the whole crypto space in general? What are the hurdles that you see going forward, and do you agree with my ideas? Let me know in the comments section below.

Leave a Reply