Crowdestor is a platform where investors can invest in business, real estate, transport and startup projects from just 50 Euro.

The platform has around 19,500 investors, with an advertised average interest rate of 19.69% over a total €55.5 million in raised funds so far.

My Results

I have personally achieved an average interest rate of 12.70% on the projects that have concluded. The big problem is that there are many projects that are in debt collection or have been delayed for months/years.

Of course, COVID played a big part, and I was quite unlucky with some of my bigger investments, given that two restaurants I had invested in never even had the chance to open to the public due to lockdowns and a slowdown in the catering industry. This caused them to default.

As I had mentioned in a previous version of this review, I have been very selective of which projects I invest in, as I never felt comfortable evaluating certain types of projects, which in my opinion were always wild bets. We’re talking about movies, video games, castles, etc. In my opinion, not even Crowdestor was able to ever conduct any due diligence on these projects, and I’d never use a platform to invest in this type of project anyway. If anything, it would have to be an investment where I can go in directly and would have a direct line to the creators behind the projects.

In my previous update, I had expressed my worries about the delays and types of projects I was seeing on the platform, and I had been critical of other bloggers that went all out praising the platform for its incredible returns. I had also said that only time would tell whether this is a solid platform or not.

I’ve seen enough to say that I don’t feel confident at all about Crowdestor, so I would not recommend investing in any project on this platform.

Not enough projects have finalized and returned investor money. While the ones that did have complied with their promises, it is simply too early to say that this is a great platform worth investing more money into.

If you’re looking for a quality Peer-to-Peer lending platform with good returns, check out my favorite European P2P lending platforms.

If you’ve already invested in Crowdestor, like me, I hope that the platform manages to turn things around, but I’m not counting on it.

What Crowdestor is and What it Offers

Crowdestor is an Estonian P2P lending platform connecting investors with businesses in need of extra funding.

You can start investing from 50 Euro, and the annual interest rates on offer are 9% and upwards.

Interestingly, the loan security holder for all investments is a separate company named Crowdestor Security Agent. The idea is that if Crowdestor the platform goes out of business or is attacked through litigation or other means, the loan holding would not be affected.

This is quite clumsily explained on their site, but it’s an interesting innovation that investors should feel good about.

Crowdestor claims that it takes part in all projects offered, either as co-financiers or in the role of co-developer. It is not very clear to me what their skin-in-the-game is, however, and whether it varies from project to project.

For example, CROWDESTOR Energy Holding is managed by the CROWDESTOR CEO Janis Timma, where he is a large investor as well. The success of the fund directly affects the manager of the fund (Skin-in-the-game).

Having them put their money into each project would be good for the rest of the investors, while having them being co-developers is not really reassuring to me as an investor, as it may incentivize the platform to use the fact that they can easily obtain capital to go for riskier projects with no financial skin-in-the-game.

The two types of crowdfunding models offered by Crowdestor are the following:

Classic Crowdfunding

Raising capital for business from multiple investors by giving pledges or collateral on it. Most investors would refer to this as giving loans to businesses.

Equity Crowdfunding

Raising capital for business from multiple investors by selling parts of equity off.

Below you can view the major stats for investing activity on the platform over the years.

Projects Available

You will see a very wide range of projects available on this platform. There are platforms that concentrate on one type of business or type of loan, but Crowestor is one of those do-it-all platforms.

I am quite skeptical about the team being able to analyse all these different business types, so I have to assume that due diligence is on the weaker side.

On the other hand, it’s true that when you analyze an investment opportunity there is little difference if you are looking at a fish factory or a furniture factory. The investment analysis is similar across all industries.

Of course, there are some specific projects where CROWDESTOR needs local knowledge input or an advisory and they commission that. But in the majority of cases the lawyers, financial and investment analysts can perform their job in the standard manner, as this is their job. I remain of the opinion that domain experience and knowledge is important, however, so given the choice, I would prefer to have a narrower range of projects.

In April 2020 CROWDESTOR has launched a new product – SME loans. This type of investment is solely financing the business loans of small and medium-sized businesses. The decision of whether to grant a loan or not is made completely automatically through the proprietary credit scoring model.

Having a look at the active projects in June 2020, I see:

-

- a movie about the “Pussy Riot” band – 115K @ 26%

- a restaurant in Riga – 20K @ 21%

- a karting business – 20K @ 17%

- a beverage distributor – 25K @ 17%

- Dystopia Mobile Game with Connor McGreggor as a brand ambassador and a personage in the game- 400k @32%

- Delivery of Medical Gloves- 800k @32%

- WarHunt Movie- 158k and 153k @24%

I also see an indoor beach volleyball project asking for 15K @ 14%. This caught my eye as this project has been funding in phases on Crowdestor before, including a “final phase” a few months ago. The rationale for this new “final final phase” is that the COVID-19 scuppered plans and the business needs an extra push to get going. This is an excuse that many businesses are using to either delay their payments or to ask for more money. Some are doing it for legitimate reasons while others are taking advantage of the situation. It is impossible to know which one of the two this indoor volleyball business is.

Some of the advertised interest rates seem to be unsustainably high to me, but time will tell if Crowdestor will be able to pull it off or not.

You will also see that there are many repeated projects, meaning that they are raising money several times for the same project in phases. The suspicion here is that they would use the money from the latest raise to pay back an earlier raise and thus delay making the actual payment, perhaps until they are finally profitable. I’ve seen this sort of thing on Housers and it didn’t end well at all.

Liquidity and Automation

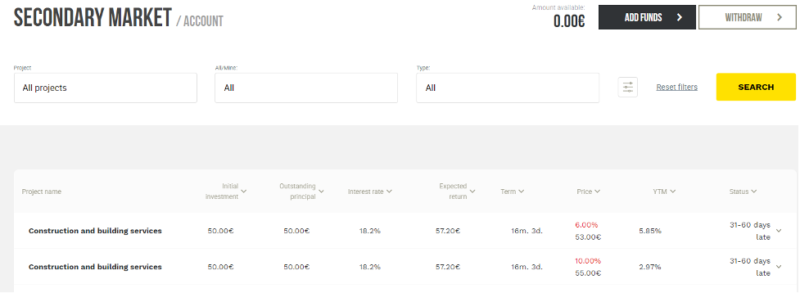

Unfortunately, the Crowdestor platform has no auto-invest functionality but it does have a secondary market.

The Secondary Market was launched in October 2020. There is a possibility to filter offers through the Outstanding principal, interest rate, expected return, term, Price and Yield to Maturity.

Project Details

I would say that the level of information provided on new projects is sufficient, although there is room for improvement.

What I definitely find lacking, however, is the non-existence of any updates on projects that we investors have invested in. For example, I invested in the Kabuki restaurant that was scheduled to open in the new Salaris shopping complex in Moscow. A quick search in Google yields no results, and while on Google Maps I can see that Salaris is open and running, there is no mention of a Kabuki restaurant there.

I would, therefore, have hoped to find reassuring updates on Crowdestor’s project page, but there is absolutely nothing to inform investors of the progress or lack thereof for this project.

As an update, in October 2020 CROWDESTOR redesign the investor’s cabinet and thus the dashboard is now improved and includes updates on the projects that we’ve invested in.

Investor Communications

Out of all the lending platforms, Crowdestor are one of the most active in communicating the latest updates about the platform. Janis Timma, the CEO, frequently sends emails to all investors about Crowdestor’s plans for the future or internal going-ons.

Most communications could use a little proofreading, and from that aspect things look a bit unprofessional, but it’s not the first time nor will it be the last that I’ve found several grammatical and spelling errors in the communications from Baltic platforms. English is not their native language so they struggle sometimes. However, a proofreader doesn’t cost an arm and a leg these days and it would make things look much more professional in my opinion.

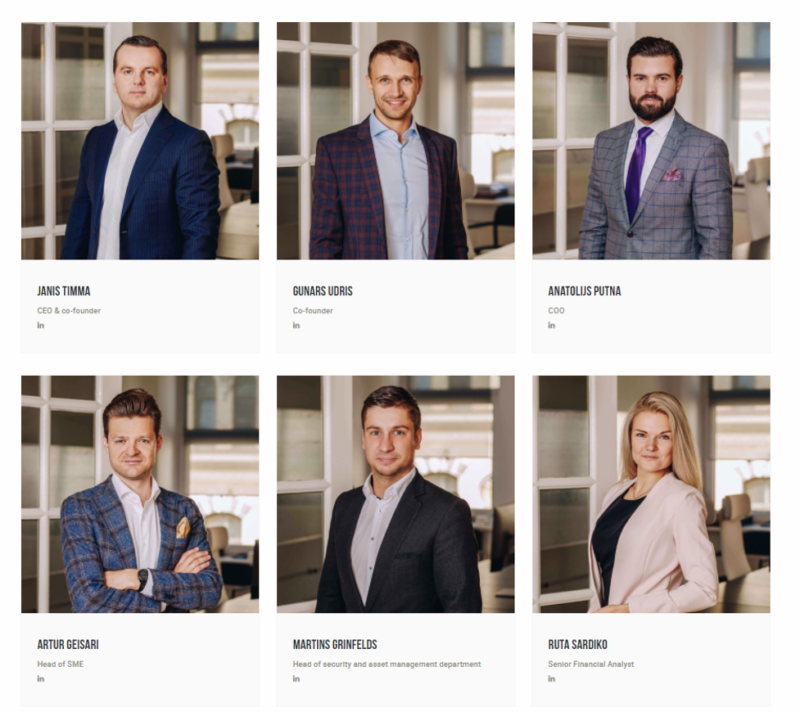

Team

The Crowdestor team is shown on their website, although there is not much information about each person apart from a photo and their position. A nice touch is that they include the personal email address of each person in the management team. This shows that they are open to dialogue with investors and other stakeholders. I haven’t personally emailed any of their people as I never felt the need to do so, so I’m not sure how they respond, but nevertheless it’s a nice and unique touch.

Janis Timma is clearly the driver of the business and he is the person that you are most likely to come across in social media or public announcements. He is one of the two co-founders of Crowdestor, the other being Gunars Udris.

Of some concern is the fact that the team seems to be quite young; I don’t see anyone above the age of 40, judging by their photos. This is not necessarily a negative thing, but I personally get some reassurance when investing in a financial platform that has seasoned people in the team. Young and fresh people can be very motivated to grow a business and communicate with investors, but I’ve found that there is no substitute for experience, especially in the financial sector.

At the end of 2020 CROWDESTOR has appointed the new COO Anatolijs Putna. Anatolijs has joined CROWDESTOR in August 2020 as a Product Owner. During the first months, Mr. Putnja has proven himself a reliable professional with actionable plans and a great sense of what clients really need. Since Mr. Putna has come on board, CROWDESTOR delivered several improvements that many investors were longing for – an improved investor’s dashboard, the launch of the long-awaited Secondary Market, an enhanced website, and many more other seamless but vital changes. Anatolijs Putna has shown skillful team management, facilitating effective collaboration between IT and business sides of the business. The go-to attitude, swift delivery of promised improvements, and exceptional communication skills with investors have made Anatolijs an obvious candidate for the COO position.

Gunars Udris, who until then held this position, has taken the COO position at CROWDESTOR Pay. In August 2020, CROWDESTOR has acquired a payment institution with a license in the Czech Republic intending to develop an integrated payments provider. CROWDESTOR Pay is a strategic project that CROWDESTOR decided to pursue to establish an ecosystem serving both investors and borrowers and becoming a leading crowdfunding platform in Europe. Mr. Udris will work towards smooth rebranding and integration of the acquired payments institution into the CROWDESTOR infrastructure.

Support

You can reach Crowdestor via email, and I’ve personally had no problems communicating with them.

Crowdestor Alternatives

There are plenty of alternatives to Crowdestor, among them platforms like Mintos, Peerberry and Swaper. You can have a look at the top P2P lending platforms and decide for yourself which one you like best.

Final Thoughts

I am no longer recommending investing with Crowdestor. At this point, I have lost trust in the management of this platform and their abilities to deliver results for investors. The investments proposed have been way too risky and this led to many defaults. There are simply better ways to invest your money, even within the P2P space itself.

Do you invest with Crowdestor? What has your experience been like?

Summary

Do not invest in this platform. From what I can see very little due diligence is done on each new project. I don’t believe the platform will survive very long.

Pros

- Interesting projects

- High promised returns

Cons

- Needs more time to prove itself

- Doubts on whether the team can conduct due diligence on such diverse projects.

- Team might lack experience

Withdrawals were honored up until May 2023. Now, they claim banking problems and do not pay.

I don’t like this company. All of my 12 projects are now late or in recovery.

The pandemic can’t be used as excuse since I’ve also invested in groceries and medical supplies.

Borrowers tend to pay only the first installment en then be like: ”Oh, you’ll get your money once we’ve sold this or once we’ve renegotiated that” but I’m getting the impression we, the investors, are at the bottom of their repayment list.

It shouldn’t be like that. If one borrows money paying installments should be top priorty, not last case scenario. If you don’t understand that than you have no business asking money from others.

There are platforms, also ones situated in Eastern European countires, that offer borrowers that pay up recording to schedule and agreement.

So what’s going wrong here?!

Hi Jean, I think it’s good to warn people to be VERY careful with Crowdestor. I am investing there for a year now, and am not that positive as I was anymore. Problems are communication and moreover the fact projects change frequently at the end of the period. I had problems with several projects. I think it is smelly if a projects ends and is due paying Crowdestor states there will be paid After another project of the same borrower has been funded. This is rude and smells like closing one hole with another. We have seen this problems with other type of “investments”. So, make sure your investments pay and are very good diverged before putting too much money into this platform.

Bert, thank you for your comment. CROWDESTOR acknowledges the delays in communications that our clients have experienced recently. The pandemics have affected many businesses presented on the platform, and we had several projects experiencing delayed payments. Clients have written to us regarding their repayments more than before, thus the communication with investors has been delayed too. Of course, this is not an excuse, so we quickly have redesigned the investors’ cabinet, where we place the updates regarding the projects experiencing delays. This has taken some pressure off the Investors’ Relations Specialists.

Regarding your other concerns, please write an email [email protected] to find out more, because the projects do not change at the end of the period, as you stated. Our support will explain in detail the status of the project you have concerns about,

Kind Regards,

CROWDESTOR.

Rating it a 4, Really?

You write how Crowdestor only paid back 2 out of 17 projects so far. From my experience their communication about delays is not up to standards of a company taking the savings of individual investors and the fact that when you contact support there are no names, phone number or address makes it even more shady.

Stop promoting Crowdestor until it’s proven its value and let’s not drive investors into another Envestio.

There are plenty of other projects that are regularly paying out interest as expected. I don’t think you can compare Crowdestor to Envestio. I am personally invested and am happy with my results so far, so I will continue to recommend it.

The people behind Crowdestor are very public, so they’re not trying to hide anything in that respect.

Hi Jean,

thank you for sharing your experience with Crowdestor. Does the link to Crowdestor website on your page contain a referral code? I would like to check their investment opportunities, and having an additional bonus would be a nice start.

P.S. I really enjoy your blog (not only the investment part). Keep up the good work!

Thanks Ivan, the links used are affiliate links, which means that if you invest I get a small commission.