Contents

Update March 2021:

So far I’ve had a few loans get delayed, SAN ANDRÉS, La Boladilla Village, La Boladilla Beach. I’m not too happy with how things were done on these projects. All investors were called to vote, however, the results of the vote were not announced nor have investors been notified via email about the results. In the case of San Andres, the developer promised to have the project completed before the end of 2019, but then failed to communicate again before the end of the year.

At this point, I have decided to exercise more caution when investing in Spanish properties. I’m going to concentrate on other countries for the majority of my investments, as the Spanish investments have been lacking professionalism in some ways. Development loans, in particular, are quite risky in my opinion.

As of March 2021, 36% of the projects on Housers have been delayed. Rather than address this problem, Housers seems to continue focusing on marketing with great aplomb as if everything is fine. Therefore my respect for this platform has greatly diminished and I will not continue investing in it.

I had written some parts of the review below before the COVID crisis and I’ll keep it here until we know for sure how things turn out with Housers. However, I suggest you avoid this platform for the time being.

If you’re looking for exposure to real estate in Spain, you can use StockCrowdIN.

Housers is the largest online real-estate crowdfunding platform in Southern Europe and allows you to invest in property from any part of the world.

When investing with Housers, your investment is backed by a tangible asset (“brick and mortar”), and hence it is considered a much safer investment than, say, cryptocurrencies. That’s not to say that you shouldn’t invest in cryptocurrencies, but real estate investment is definitely a lower risk investment.

When investing at Housers, you will earn monthly rent and also benefit from capital gains. Properties in southern Europe are currently rapidly rising in value.

You can easily diversify your portfolio. Compare investing in tens or hundreds of properties all over Europe to buying one apartment in your home country. You’re spreading your risk much better if you use Housers.

A great advantage is that all this is hassle-free. Everything relating to the property is taken care of. You won’t receive any calls from tenants asking to fix their broken pipes or have to fight to collect your rent.

The Spanish and Italian markets are recovering very rapidly and are projected to continue rising in the next few years at least. The rental yields in both markets are among the highest in Europe.

When investing in property, you also need to pay more attention to cities rather than countries as a whole. That’s why Housers focuses on high-growth and successful cities such as Madrid, Barcelona and Milan.

Housers itself as a platform has achieved tremendous success. There are more than 115,000 registered users and more than 95 million euros have flowed into the platform to fund properties. The average reported annual yield is 4%.

Exploring one of my projects

To illustrate how Housers works, let me take you through one of the projects I invested in. Note that this is one of the earlier and successful projects, most other projects I had have yet to supply a return and unfortunately this positive project is the exception not the norm.

We’ll be considering the project named Pez; a buy-to-sell opportunity in Madrid. In this case, the legal form of the investment was a loan to the developer.

Here’s how the project timeline went:

- I invested on 22/06/17, the day the funding period started.

- The project was fully financed on 11/07/17.

- The property was acquired on 02/10/17.

- Refurbishment works started on 20/10/17 and completed 20/02/18.

- The project was finally sold on 05/07/18.

- Project fully finalized on 25/07/18 and money sent to investors.

The visual information provided for the project was actually quite scant. As investors, we only got a few standard photos of the area where the apartment is located, the floor plans and two renders of how the refurbished apartment would look like.

We did, however, get some PDFs about the project which gave us more insight into the strategy:

Based on that information I decided to invest in the project, although I would have liked some more photos and plans for the project.

A bit more than a year later, the project was sold.

Once the project was sold, there was some more information available about the internals of the project.

- Average investment per investor: 213.65€

- Number of investors: 412

Pez was a buy-to-sell opportunity with an expected return of 6,59% in 12 months, that ended with an annualized IRR of 4,42%. The yield is the same 4,42% since the project took 12 months from start to finish.

Net Yield from the Sale: Represents the dividends that the investor will receive derived from the sale. (12 months)

IRR: Internal rate of annualized return of the investor. It’s the interest rate or yield offered by this investment. It serves to evaluate the profitability of the project and compare it with other types of investment in the market.

A few days after the project was sold, I received capital and interest in my Housers account, closing off a successful investment.

From the interest paid by the developer, a 10% Housers commission was deducted along with 19% for IRPF (Spanish tax). The net interest was then sent to my account.

How Things Work

Housers is currently operating in three markets:

- Italy

- Spain

- Portugal

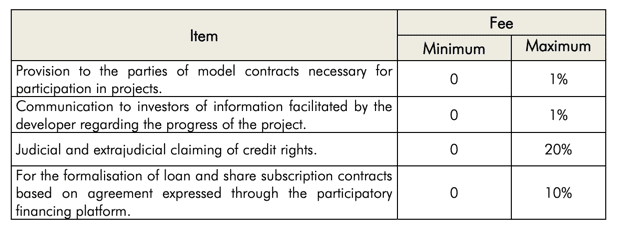

Housers operate an opaque fees structure that is hard to understand. In fact, I have not found a single good explanation of the fees they charge. They started off in the early days saying that they would only earn commissions when the project was successful, taking a chunk out of investors’ profit, but things changed along the way.

I have to be honest and say that after spending 20 minutes trying to figure out the latest fee structures I gave up, but it’s definitely not the best fee structure for investors.

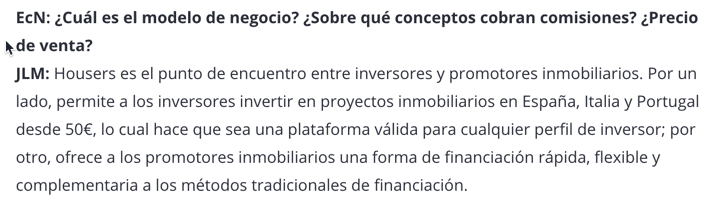

I was also bemused to see how their CMO totally avoided answering a direct question about commissions in a recent interview in Spanish::

Here is more information about Housers fees taken directly from their website:

– Application of fees to investors:

For making the necessary model contracts for participation in the projects available to the parties: a percentage to be determined on the value of the financing project in accordance with the documentary needs of the project in question shall be applied at the time of making the above documentation available. The commission will be charged only once for each project and not for each document or contract made available to the developer.

• For communication to investors of information provided by the developer regarding the progress of the project: a percentage to be determined on the value of the financing project shall be applied in accordance with the documentary needs of the project in question.

• For services of judicial and extrajudicial claiming of the credit rights (forced or unforced): at the time the judicial or extrajudicial claim is presented, the investor must pay a percentage to be determined on the value of the unpaid claims in order to cover related expenses.

• For the service of formalising loan and share subscription contracts, based on agreement expressed through the platform, acting on behalf of investors: In this case a percentage to be determined will be applied on the value invested or lent by each investor when the financing objective has been reached and the loan contract or share subscription is formalised. The accrual and collection of the same is deferred to when investors begin to receive a return derived from and proportional to their investment (both ordinary interests generated by the loan and interest for delay due to breach of contract).

Many projects are designed to attract investors with special promotions like extra interest or cashback. Once the project is funded, typically the interest repayments start going out regularly and later stop abruptly. Once this happens, you will be asked to vote on whether you want to engage a debt recovery company or give the borrower more time to repay. All the projects I was involved in ended the voting with investors giving more time to the borrower and hoping for the best.

Curiously, Housers customer service gets back to life in these events, and are very proactive in calling you to urge you to cast your vote. I’m not sure why they are so motivated to get people to vote, perhaps there is some legal reason behind it, but it definitely feels fishy given they fail to respond to investors’ emails.

Keep in mind that if you live outside these three countries you will incur withholding taxes that are applied by the countries in question. I have not found a way to offset those taxes so it’s a further reduction in returns.

Projects Available

Housers grew very rapidly, and after starting with Spain soon expanded into Portugal and Italy.

They even briefly delved into art projects, although that was a one-off and probably not something they will do again as it requires a totally different set of skills to evaluate, not that Housers do much evaluation on their projects anyway.

You can invest in the following project types:

- Buy-to-let (5 years+ investments with monthly payouts)

- Buy-to-sell (12-24 months window to refurbish and sell)

- Development loans

Investors seem to still be very keen on putting in their money, as all projects are quickly fully funded, but I’m starting to suspect it’s a case of dumb money at this point, as the projects themselves have become more and more speculative over time.

I’ve seen many projects in the south of Spain, mostly around the Malaga and Marbella regions, which by the looks of it seem to have been in some kind of bubble, as more and more development loans kept showing up for grandiose projects, which we now know were never completed due to various reasons/mismanagement cases/excuses.

Housers seem to be branching off into two new lines, Green and Corporate. Green is for sustainable and environmentally friendly projects while Corporate stands for development loans to open new businesses.

Secondary Market

The Housers secondary market seems to be dead at the moment. In fact, it was never really alive so to speak, as it is horribly complicated and very few deals were over struck on it.

Platform Interface

I’m not a fan of the current interface. The User Area uses a side menu with icons that really don’t mean much to me, so I end up having to click through all the items in order to finally find what I want.

It should be easier to see what amount investors have invested in each project, but it’s not easy to find out that information unless you click through the individual project’s page, which can be very tedious if you have many investments.

Team

In 2018, the current CEO Juan Antonio Balcázar replaced Tono Brusola, who was one of the co-founders. I’m not sure what led to Mr Brusola stepping down, but things have definitely gone downhill after he left. Perhaps he saw bigger opportunities in the Fintech space as he is now leading Fundsfy, a savings platform. He is a well-known serial entrepreneur in Spain and things were going great at Housers while he was in charge.

I know very little about Mr Balcázar, although a scroll down his Twitter feed doesn’t really provide me with much reassurance. This is just one of many factors I consider, and in this case I was not impressed.

At this point, I believe there are very few people actually running the platform; I don’t believe one bit the idea that Housers has 40+ employees, as they claim.

Customer Support

In the first two years, Housers had very good customer support both over email and via phone. During 2020, support has gone down the drain. Nobody answers emails anymore and phone support, while friendly, basically promises that things will be done and then never get back to you.

One thing that has absolutely diminished my trust in the platform is the use of a tactic in support whereby any finance-related questions are deflected with words along the following lines:

“We’ll pass on your query to the finance department and wait for them to get back to us”.

I’ve seen this tactic one other time, coincidentally (or maybe not) on another Spanish platform, and all it means is that they are never going to get back to you.

This is no way to treat customers. If you have a customer service line open then they should be able to answer any questions within normal limits. Questions related to the status of certain projects or the finances in our accounts should definitely fall under their remit.

Public Reputation and Social Media

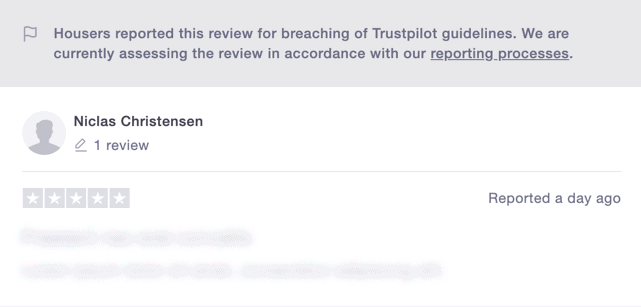

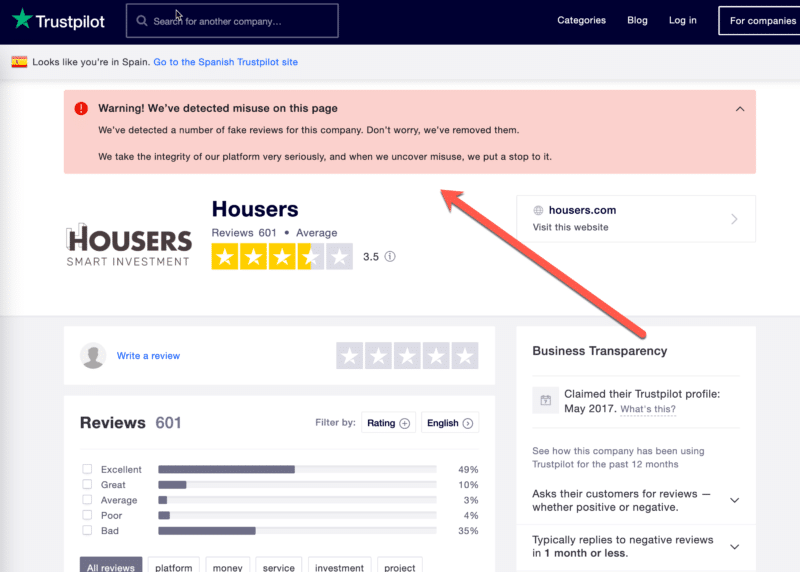

If you take a look at the Housers rating page on Trustpilot you will find many other investors expressing their concerns and disappointment at the way Housers have been handling things.

The same happens on Twitter and Facebook. In most cases, Housers promptly reply asking the investor to contact them privately so that they can look into their case. This is quite ridiculous given that the investor would have typically contacted them several times before and received no reply. It is pretty obvious that they are just trying to politely silence all negative opinions.

Their latest strategy is to delete all negative comments or ask Trustpilot to take them down for supposedly breaking some guidelines. Housers are just trying to silence all negative opinion, but it’s only a matter of time before it becomes obvious to all that Housers is not to be trusted.

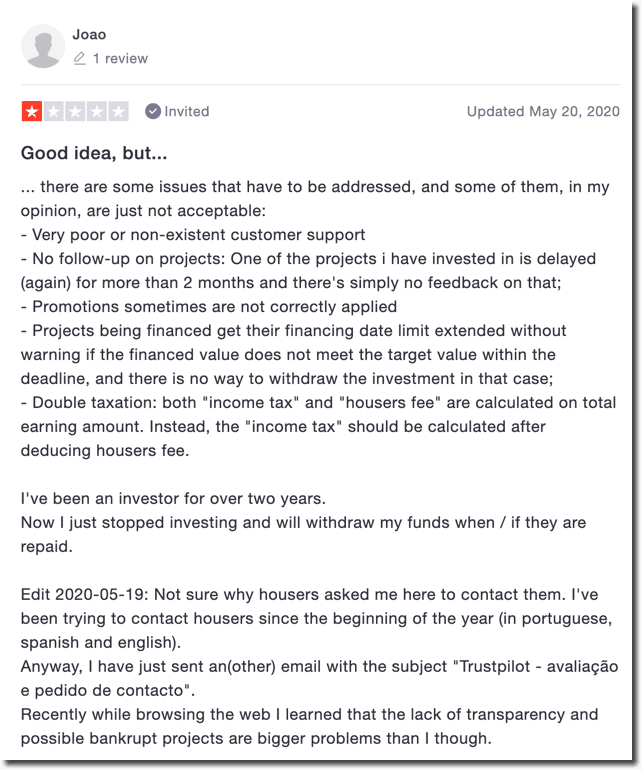

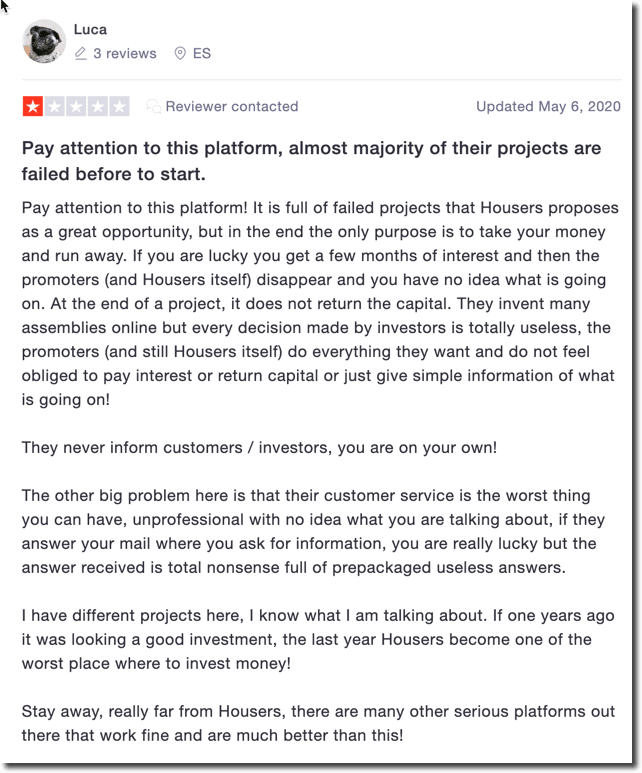

On the other hand, there are also several reviews that have not yet been taken down and clearly share many of the same concerns that I and others do. Here’s are a few:

In January 2021, Trustpilot itself started showing a warning saying that Housers have been caught manipulating the reviews. Basically what they did was to buy a bunch of fake reviews in an effort to counter the many negative reviews that many real users were leaving. Another scammy move from this company; at least Trustpilot called them out on it.

On the Spanish investing forums you will find a lot of feedback about this platform. Some investors even went to their offices to demand explanations for certain things and never got anywhere.

Here’s one of the Google reviews in Spanish for those of you who speak the language, I think it sums up the platform perfectly:

NO INVERTIR AQUÍ

La idea era buena desde que empezaron los proyectos, pero la plataforma nada tiene que ver con la inversión inmobiliaria.

La forma de actuar de Housers es la siguiente:

Lanzan un proyecto con un tipo de interés prometido. Los inversores entran y dejan su dinero. Cuando Housers consigue el dinero objetivo de la financiación, se queda una parte como comisión entre el 8-10% sin haber hecho nada, solo por ser intermediarios.Ese dinero que se va perdiendo por el camino hace que su negocio sea financiar proyectos más que la parte inmobiliaria. Que luego funcionen o no los proyectos eso ya es secundario. Su objetivo es captar inversores.

La prueba está en que la mayor parte de los proyectos siempre tienen problemas y no se cumplen plazos, alegando toda culpa al promotor.

Cuando Housers te vende la idea te dice que ellos solo cobran si el proyecto funciona quedándose el 5% de los intereses generados, pero si fuera así no tendrían ni para pagar las oficinas de Madrid.

Por supuesto, las opiniones con 5 estrellas son tan falsas como decir que Housers es una plataforma seria.

Nada profesionales. No tienen ni idea del negocio, bueno sí, del negocio de la estafa y la publicidad engañosa son los reyes.

I’ve also read reports from architects saying that the project plans and actual photos of the project did not match at all, but I have been unable to confirm that myself.

As of June 2020 there are several Telegram groups you can join, where the discussion centers around whether Housers is a scam or not, and legal proceedings against them.

Here’s a list of all the Housers Telegram groups I know about:

Returns

Most of the money I invested in this platform is still tied up as several development loans have failed to be repaid in time due to various reasons. The developers have not shown any remorse for the delays caused to investors, and as things stand it is quite uncertain whether we will ever get our money back.

I have had some projects exit successfully, but most of my money is still stuck in there, so at the moment, things are looking very grim. The biggest issues seem to be the development loans, with a significant percentage of them being restructured with uncertain outcomes.

Fishy Happenings

Things have been looking very suspicious lately with Housers, with many investors outright calling the platform a scam. It certainly is looking like Housers is becoming so.

Consider the project Puerto de la Torre IV.

The project was meant to close the financing phase on 28/05/20. Last time I checked it was well below 90% of funds needed to close the phase.

At 0:10 on 29/05/20, the project was showing in the list of Non-Financed projects, as expected.

At 09:00 on the same day, the project appeared in the Financed projects list. It appears that someone from Housers manually moved the project.

Housers thus appear to be breaking the law article 68.2 de la Ley 5/2015 de Fomento de la financiación empresarial. The law requires at least 90% financing of such projects, which was clearly not achieved in this case.

I have contacted Housers for an explanation and they replies saying that the 90% applies to the financing of the projects but since there were several phases, they can include the other previous phases in the computation. They are probably right, but it is still misleading to the investor.

There are also developers that have obviously abused the fact that they could easily raise money via Housers, and they have several projects that are delayed for many months with no intention to pay back the investors. ByNok is one of the most shameful developers in this regard. They are supposed to be a luxury developer but their lack of professionalism is incredible.

Here’s another incredible thing that happened in June 2020. It concerns the project Bellevue Green.

In this case, the project developer, Puebloliving, is claiming that the loan was for 24 months and not for 12 months, as it appeared on the website and in the contract signed by all investors. The owner of this company, Morten Ostberg, is claiming that in initial emails with Housers they had discussed 24 months as the timeline. It seems like another obvious scam to me, and another shameless developer trying to defraud investors.

Conclusions

Do they really?

I was really excited about Housers in the early years of the platform, but I cannot honestly recommend it anymore, even though for my own money-preservation reasons I would like it to succeed long-term.

Housers seem to only care about the fact that they get their commission of 8-10 % on the capital raised, and whether the loans ever get repaid is the investors’ problem, they have no skin in the game and hence don’t care. They have the incentive to just keep adding projects to the platform without doing any fact-checking, and this doesn’t augur well for the future.

Housers have also been sanctioned in September 2019 by the CNMV in Spain. A group of investors who have lost their money with Housers has also been formed, and you can join it here. Possibly there will be the chance to get legal recourse at some point.

The platform is already under police investigations in Spain according to the CEO of ByNok, one of the project promoters on Housers, although this is not yet a well-known fact.

There was some news that an individual investor won a case against them, although I don’t have the details on that unfortunately.

The platform has a lot of Spanish investors, so it is not as well known outside Spain, but the Spanish investors and FIRE enthusiasts are livid about the platform.

In order to get back on track, if at all possible, Housers need to get their customer service team back in place, do better due diligence on new projects, and offer better communication about existing projects, especially those with an uncertain future due to severe delays.

At this point, after having spoken with many other investors in the same situation, and given their terrible customer service, continuous promotion of flaky projects, and ridiculous replies to people who reach out to them publicly on social media or on Trustpilot, I have to conclude that this platform is pretty close to being labeled a scam.

There are several other bloggers who have raised the issue of Housers being one of the worst platforms in terms of transparency, and they are also very disappointed with Housers. If you’ve also lost money with Housers, I urge you to have your word online, through your social media accounts or through a platform like Trustpilot. I’m well aware of the fact that it would be beneficial for me as an investor to say good things about Housers, but that’s not the purpose of why I write here. Housers are running a despicable business model and they don’t care one bit about investors on the platform. So I want people who are considering investing in this platform to know the truth.

The lessons I draw for myself from this debacle is that I should be more skeptical about online platforms and give them a few years to have a track record in place before investing heavily. In the case of Housers, I invested too much and too soon into projects that I didn’t have the means to properly evaluate.

As I’ve mentioned before, over the past five years I’ve taken some extra risks in my investments as I was investing in many different asset classes at the same time without being an expert in any of those classes. However, I am a firm believer in the idea that you learn things much better and in a deeper way when you have real skin in the game. Yes, these lessons might be expensive, but as a young investor with hopefully several decades ahead these losses can be recouped and the valuable lessons learned now will serve to guide my way towards a better investment strategy in the coming years.

If you’re still feeling positive about Housers, invest at your own risk, and I would strongly suggest staying away from development loans as those have been the source of the biggest problems so far.

Spanish property (and other countries too) is most certainly heading for tough times after the COVID-19 crisis, so I would bide my time before making real estate investments in this country unless there is a better sense of direction from the market. The government and overall political situation in Spain is a circus of incompetence of all sorts at the moment as well, and that’s yet another reason not to continue investing our hard-earned money.

You can find some projects in Spain on the Reinvest24 and Brickstarter platforms.

Have you invested with Housers?

Do you have any questions about Housers or property crowdfunding? Let me know in the comments section and I’ll do my best to answer from my experience.

Click here to check out the Housers website

Summary

The biggest real estate crowdfunding platform in Europe. It used to be an exciting platform but I no longer recommend it due to non-existent support and too much focus on marketing and empty promises. Many loans for their development projects are delayed or in default and they don’t seem to do any due diligence on new projects.

Pros

- Several projects concluded in the past.

Cons

- Things have gone downhill during the past 1.5 years.

- Unresponsive customer support.

- No due diligence on projects.

- No auto-invest

- No secondary market

- Fee structure only incentivizes platform to publish more projects irrespective of quality.

- Withholding taxes on Italian projects.

Hi Jean,

many many thanks for this article, I can confirm all what you wrote.

Fortunately I’ve invested a very very small amount in Housers.

Thank you again.

You’re welcome Davide.

Hi Jean,

I red your article and I found it very helpful. I would like to ask you so aditional questions. If you receive this message you should see my email. If you are available to answer some questions feel free to contact me. Thanks.

Hi Jean,

I agree with each single word of your post. Not sure if you already know about it but we are creating one platform to join our strengths and coordiante class actions against Housers.

http://www.afectadoshousers.com

Excellent, I was looking for something like that.

I have invested in two loan projects and an art project on Housers.

I have not received interested payments since March 2020.

I sent an email to Housers support, email support[at]housers[dot]com on April 29th. I didn’t receive a reply. I tried again on May 7th 2020; again, no reply.

A Spanish-speaking friend of mine reached out to them via phone in the beginning of May. They did talk to him at the time. But later on failed to follow up on the issues that had to look into. My Spanish-speaking friend ended up being ignored as well.

At this point I hope that I recover my capital. But unfortunately I think this is wishful thinking at this point.

Yes, unfortunately, Housers is looking more and more like a scam platform with every day that passes.

Hi Jean

As a digital nomad based in Spain (Canary islands) I do enjoy a lot your posts on investing in the Spanish market. 🙂

Thanks for the support Jonathan, that encourages me to keep writing about this topic.

Looks like you’d get a better return just investing in REITS/ETFs targeting the European real estate market compared to these types of sites/platforms?

This REIT (https://www.ishares.com/us/products/239539/ishares-europe-developed-real-estate-etf) is for example +18% YTD while most of these platforms have annual returns of a maximum of 8-10% (on average) on a yearly basis.

Or am I missing something?

I have addressed this in a separate article Sebastian; it’s a very interesting question.

I do investing in Housers myself. Last year development projects made 10-12% annual return, but the most important thing is that the market prices in Spain rose same 10-12%. I wonder what would have happened, if the prices rose as inflation or even declined.

Not sure I understand the last sentence Andrew, could you explain?