Over the past few years I’ve been doing a ton of research on investment opportunities and asset classes.

An opportunity that I came across is investing in startups.

However, I haven’t really taken a big dip into this asset class. I’ve conducted some small investments to test the waters, as I always do with any investment I’m considering. I’ve learned quite a bit but I am not convinced that I should be investing a significant portion of my net worth into this.

The idea of investing in startups is not new, but now it’s easier than ever to do so thanks to the many platforms we have available for doing so, as well as some very interesting market analytics tools.

I spoke with some venture capitalists and learned that there is a general pattern that most funds see repeatedly. You can also read about this pattern on many blogs and books, so again it’s nothing new.

Here’s the general pattern that most funds that invest in startups see. Let’s take an example fund with an investment in 10 startups:

- 4 startups will fail entirely

- 4 startups will return the capital invested

- 2 startups will provide very high returns (60% plus)

Having 2 startups that achieve high success is not even a guarantee, but this is a pattern we see in the most successful funds.

As an individual investor with minimal knowledge of the projects you are investing in on the startup crowdfunding platforms, do you really think that you can mimic those results? In my opinion, this is highly unlikely, making this type of investment more akin to gambling or buying a lottery ticket.

Despite the myth that VCs generate phenomenal returns, they typically don’t beat the market. Which means that they don’t know how to pick the winners.

“We analyzed the Kauffman Foundation’s experience investing in nearly 100 VC funds over 20 years. We found that only 20 of our funds outperformed the markets by the 3% to 5% annually that we expect to compensate us for the fees and illiquidity we incur by investing in private rather than public equity. Even worse, 62 of our 100 funds failed to beat the returns available from a small-cap public index.” – Harvard Business Review

The fact is that most of these platforms play on investor emotions. They bank on the investor falling in love with particular startups due to taking a fancy to the product they are launching (no surprise I see so many craft beer startups!). As any good investor knows, the best way to protect your money is to manage the money with your head, not with your heart.

Let’s move on to more problems:

Long timeline

For a startup to achieve market penetration, growth and sustainability takes a long time, usually 5-10 years. Are you ready to wait all those years with your money tied up in these startups and their rollercoaster behavior?

In my case I’m not ready to do that, not when there are other ways of achieving similar rates of return, for example by investing in P2P lending platforms.

Liquidity

While some platforms allow you to sell the shares to other users of the platform, I haven’t yet seen any platforms with highly liquid secondary markets like those I use on P2P lending platforms like Mintos.

For Whom Might Investing in Startups Be Well Suited?

I believe that investing in startups might be a good idea if you have a significant edge in your knowledge and ability to predict trends.

For example, a friend of mine who is an e-commerce expert and runs a multi-million dollar e-commerce store, invested in Shopify early on as he was 100% convinced that this platform would be adopted by millions of online stores and thus experience a soaring stock price.

He was right, but he was only able to make that prediction with a significant degree of confidence because he had 25 years of experience in running e-commerce businesses, something that the typical investor does not have.

I would also add that when Shopify IPOd it was already an established business, and way ahead of the startups we typically see on the crowdfunding platforms in europe and the United States.

Angel investing is a similar concept but generally involves more involvement. Financial Samurai has a good article advising against angel investing which is worth reading. I have several investors who act as angel investors and they are happy although none of them have any big wins to speak of.

With angel investing the motivation usually is that of hanging around young and ambitious people and keep abreast of new technologies and trends, while on the other hand being able to help the startup you’re investing in using your experience and contacts. From what I gather from my friends, it’s more of a hobby and way of staying in the game while investing extra cash that they don’t need.

The fact is that investing in startups, or even founding them, is a risky proposition, but the payoffs can be huge. I believe that investing a small percentage of a sizeable portfolio can make sense for many investors, especially if they are young and have a long investment horizon that will allow the time necessary for these investments to play out.

Unfortunately, until recently, most successful startups tended to be concentrated in the San Francisco Bay area, and if you weren’t based there as an investor you would have been quite excluded from deal flow.

Luckily, we now have several platforms that startups use to raise money via crowdfunding campaigns. Not only that, but we also see platforms that can obtain a slice of capital from early-stage startups that is then distributed among the platform’s investors, in exchange for some kind of commission for that platform.

I have several friends who were able to enter the startups game early and have become wealthy due to those investments. Imagine having invested in companies like Amazon, Facebook, Airbnb before they even had their IPO. Of course, you need to have a good idea and a certain degree of luck, but I’m happy that it’s a game that investors all around the world can now play thanks to these platforms.

Here are some of the best platforms I have found for investing in startups:

Micro Ventures

The MicroVentures platform offers investors a gateway to investment opportunities in pre-vetted early-stage startups and also secondary investment opportunities. Traditionally these investments have required a larger capital commitment. Not anymore. Now you can access private investment opportunities, sometimes for as little as $100.

On this platform, to gain access to Reg D investments, you will have to pass a phone call vetting process to make sure you are an accredited investor. During the call they will ask to confirm that you have an income of over $200K for the previous 2 years, and expected for this year – or a household income of over $300K for the previous 2 years and expected for this year – or a net worth (not including your primary residence) of over $1 million. This will get you access to their Regulation D offerings as an accredited investor.

Regulation D offerings are typically later stage companies, sometimes early stage, with larger investment minimums (generally in the $5,000-$10,000 range). As an accredited investor you will have access to these offerings that are listed after the vetting process.

Seedrs

Invest in the equity of ambitious, growth-focused businesses and receive full voting shares with professional grade investor protections. There are 3 ways you can invest on Seedrs:

Equity – The simplest and most common way to invest and become a shareholder in a business. Starting at £/€10

Funds – Diversify across multiple businesses with a single investment, and become a shareholder in each. Starting at £/€100

Convertible – Invest in a business now and your investment will convert, at a discount to other investors, in the future. Starting at £/€10.

They also have a secondary market for investors who want to dispose of their investments earlier than they had originally planned. This is one of the top benefits of investing through Seedrs.

Republic

Republic was founded by alumni of AngelList — the world’s largest online investment platform for accredited investors. AngelList was instrumental in passing the JOBS Act that enabled equity crowdfunding and remains their strategic partner.

Their mission is to democratize investing and level out the fundraising landscape for founders and investors alike. They’re SEC-registered, FINRA-licensed, and if you’re at all interested in startups, you’ve heard of their past work: Republic is part of a family of startup platforms together with AngelList and Product Hunt — one of the most trusted online startup ecosystems in the world.

They only allow US-based startups onto their platforms at the moment, but investors from anywhere around the world are allowed to invest.

Wefunder

Unlike Kickstarter, you are not buying a product or donating to an artist. Instead, you are investing in a business with the hope of earning a return.

You decide which companies are worthy of funding. If the business does well, you may make money. If it doesn’t do well, you lose all your money.

Either way, you join a community of other investors who seek to help the startup succeed. You sometimes get neat perks from the companies too.

You can invest as little as $100 in your favorite startup.

The amount you may earn depends on the type of investment contract the company is offering.

There are four classes on Wefunder:

- Debt. Some local businesses offer a simple loan or revenue share. A simple loan, just like your car loan, has a fixed repayment schedule known in advance. Unlike a loan, a revenue share returns a fixed amount of money (such as 2X your investment), but the time it takes to repay depends on how well the business does. The faster the business grows revenue, the faster you earn a return, and the higher your effective interest rate.

- Convertibles. Most early-stage technology startups use a Convertible Note or Simple Agreement for Future Equity. These will convert your investment to stock at a later date if the company raises a “priced round” from major investors, most often venture capitalists. At this point, you are a shareholder owning equity, and you earn a return if the value of that stock goes up over time, and you are able to sell it.

- Stock, No Dividends. When a startup is at a stage where they can afford to pay lawyers tens of thousands of dollars, they will do a “priced round”. Like the stock market, you are buying equity at a fixed price per share (or unit for LLCs). If the company is successful, the value of the stock can increase with each subsequent round of financing, until the company is acquired or goes public. Then you earn a return.

- Stock, Dividends. While a tech startup almost never offers dividends, a later-stage local business – such as a brewery opening a second location – often will. The type of dividend can vary. Some might offer a fixed dividend per share per year. Some might offer a percentage of profits. A common scenario is also to “swap” the dividend after your investment is repaid. For instance, a brewery might share 80% of its profits until the investors are repaid, and then 20% thereafter in perpetuity.

Funderbeam

Funderbeam is a funding and trading platform for high-growth private companies. It helps founders raise funds beyond borders and provides access — and unique liquidity — to early stage equity investors.

Funderbeam was founded in 2013 by Kaidi Ruusalepp and Urmas Peiker.

Kaidi had led Nasdaq Tallinn as CEO since 2005, noticing many inefficiencies in the public markets. Companies list late and at high costs, meaning investors can’t access good growth companies. In addition, many investors have a poor understanding of how to succeed in the market and typically buy high and sell low.

The idea came to create a game to teach young people how to invest, using startups as a more relatable subject than stocks. Even before starting development, the game evolved into what Kaidi and Urmas really saw a need for: A platform where investors could efficiently invest and trade companies while in their growth stage.

In early 2016, Funderbeam Markets launched with the first four companies raising funds, and shortly after they were trading on the secondary market. In August 2018, Funderbeam started operating as a regulated UK entity, Funderbeam Markets LTD, after being authorised by the UK Financial Conduct Authority.

For investors, Funderbeam provides access to a community of ambitious growth companies — and the liquidity afforded by being able to get in and out whenever needed. Each business has a lead investor who will act as an ambassador for the deal.

Equityzen

EquityZen provides alternative investment opportunities in late-stage private technology companies. Accredited investors can get access to pre-IPO companies and proven startups.

EquityZen provides alternative investment opportunities in late-stage private technology companies. Accredited investors can get access to pre-IPO companies and proven startups.

Typical investor profiles are:

- Angel Investors

- High Net Worth Individuals (HNWIs)

- Family Offices

- Registered Investment Advisors (RIAs)

EquityZen’s model leverages the intersection of crowd sourcing and private markets. It bridges a gap in the private equity markets and smaller investors. By allowing a group of investors to act as a fund, EquityZen enables them to act as a larger buyer of private equity. This is key as it creates efficiencies across the entire investment process.

Forge Global

Accredited investors can now access premier investment opportunities, and transact with a wide base of shareholders and pre-IPO companies. Keep in mind that certain companies trade more often than others; the most activity happens in companies that have received late-stage funding (e.g. Series D+) and have enterprise valuations of $2B+.

SharesPost

SharesPost is a leading global marketplace for trading private company shares. They also run the SharesPost 100 Fund.

SharesPost is a leading global marketplace for trading private company shares. They also run the SharesPost 100 Fund.

The historically attractive return profile of many late-stage venture-backed companies has typically only been available to institutional and high net worth investors. With many high-growth companies staying private longer than ever, a significant portion of their value appreciation has typically occurred before their entry into the public markets.

Available for a minimum investment of $2,500 without investor accreditation requirements, the SharesPost 100 Fund, a closed-end interval fund, offers individuals, family offices, and institutions an effective means to access the venture-backed asset class.

Math for Investing in Startups

A very good article about the math behind startup investments.

How to Identify a Disruptor

Investing in startups is all about identifying and betting on disruptors. But what does disruption mean and how can we spot a disruptor early on?

“Disruptive innovation” was originally coined by Harvard Business School’s Clayton Christensen to describe “a process by which a product or service takes root initially in simple applications at the bottom of a market and then relentlessly moves up market, eventually displacing established competitors.”

Disruption has always been a driving force for the economy. Consider the car. Ford’s Model T disrupted the automobile market in 1908. Now, over a century later, this same market is facing another disruption: self-driving cars. From UBER to Tesla to General Motors and Waymo, the race is on to capture what’s predicted to be a $556 billion market by 2026.

Disruption is not just about new ideas and cutting-edge technology. It’s also deeply connected to profits, and today’s disruptive companies are making profits at a much faster and higher rate. This means that investors are getting richer faster than ever before.

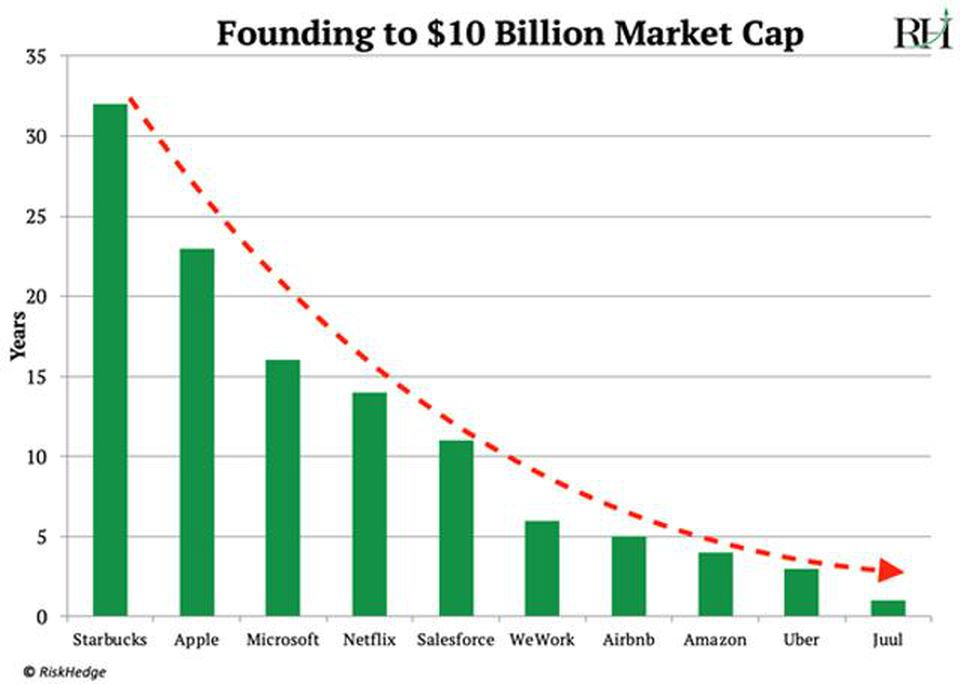

For example, it took Apple over 23 years to reach a $10 billion valuation. Just last year, e-cigarette company JUUL Labs reached $10 billion in under 7 months.

This is just one example. The chart below (originally shared by Forbes) shows how disruptive companies are reaching $10 billion faster than ever.

So how can you spot the next $10 billion company?

- Look at growth. Try to find companies that are generating strong organic growth by creating new markets. You can also look for companies that are causing significant changes in old markets. Ask questions like who is using their product and why?

- Look at consumer behavior. Disruptors are not just creating an innovative service or product for the market, but they are seeking to change human behavior. For example, Netflix completely changed the way people think about and consume television. They’ve eliminated the need for Blockbuster and other physical video stores, and by moving to streaming, they ended the need for their own mail-in video service. In fact, due to Netflix and other streaming services, the traditional cable/satellite TV market is expected to fall an additional 26% by 2030. When looking for a company to invest in, think about how that company is looking to change consumer behavior within a market—what specific actions or activities they will disrupt.

- Look at the founders. It will take extra superhero skills to bring a disruptive idea to market. The founder will need to have the vision, commitment, and resources to succeed. Nathan Lustig, Managing Partner at Magma Partners, shares his top questions to ask when assessing whether a company is worth investing in. You can also read personal interviews with founders as part of our Startup Superheroes series.

And remember—disruptors by nature are a bit of a gamble. When something new and innovative is introduced to a market, there’s no guarantee that it will be a success. It can also take time. New ideas don’t change consumer behavior overnight and some never take hold.

The trick is to invest early. If you spot a disruptive idea, back it with a small investment. This early investment is less risky and could result in exponential gains in the future.

What about the Risks?

The biggest risk you will be facing is that the startup will fail to gain traction in the long run and have to shut down. The majority of startups indeed fail, so you need to be aware of that fact first thing.

- About 80 % survives their first year.

- About 70 % survives their second year.

- About 50 % survives their fifth year.

- About 30 % survives their 10th

These rates are surprisingly consistent over time but vary from country to country and industry to industry.

It’s also worth keeping in mind that you have to be in it for the long run as startup investment returns come from stock value appreciation that takes 3-5 years as a minimum. In those years, you might find the market pretty illiquid, especially if the platform does not have a secondary market where you could resell your shares.

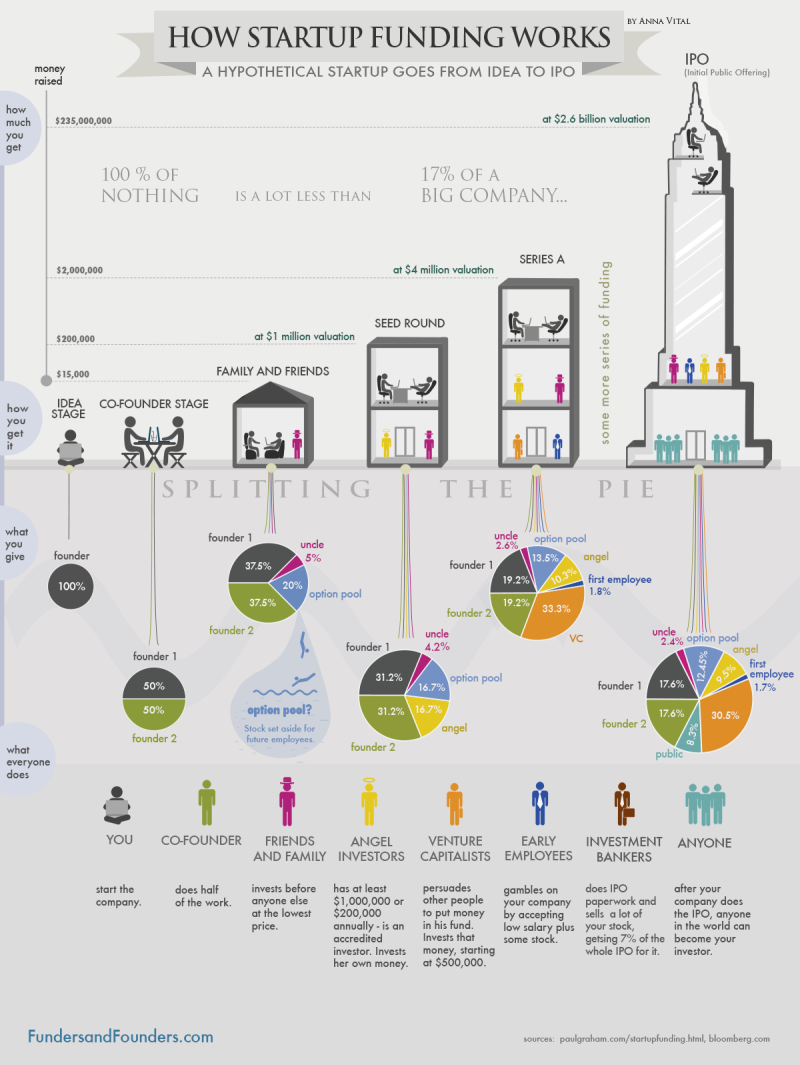

You must also be prepared to accept the fact that your percentage ownership of the companies will get diluted over time. Almost all unlisted startup companies will raise more capital along the way. Normally, this is done by issuing new stock to the new investors. With more stocks outstanding, each existing shareholder will own a smaller percentage of the company. Thus, this will result in a decrease in your ownership percentage.

Who are the angel investors?

- The average investment per Angel is about $38,000 per round

- Each has 10–12 companies in its portfolio

- 32% are 51–60 years old

- 44% are older than 61 years old

- 16% are 41–50 years old

76% of angel investors are over 50 years old.

Does it surprise you?

Further reading

- It’s really hard to make money in VC

- VC Math

- Equity Math for Startups

- The Best way to do cap table math

- How and why I invest in Startups

How do YOU invest in startups?

Have you already invested in startups? I’d love to know how you got started with investing in startups and how things work in your own country.

In Spain, one can invest in startups through clubs like AngelClub, a private platform whose members benefit from being given the opportunity to become early-stage investors in promising Spanish startups. Another one is Bewater funds.

Then there are the startup crowdfunding platforms like Fellow Funders and StartupXPlore.

Two other funds are Lanzame and Itnig. Other countries have similar platforms, and going forward we will surely see other platforms starting up, especially those that combine blockchain technologies with startup investing.

In the UK, a popular platform is Seedtribe.

Investing in Crypto Startups

If you’re especially interested in crypto startups, you have two good options:

Coinlist is focused on bringing you the most promising new blockchain projects before they are publicly available on the main exchanges. I think they bring projects that are at the right point of maturity for regular retail investors to consider investing in.

Angellist, on the other hand, has a ton of traditional startups seeking funding, but you can also follow the syndicates that are especially drawn to the crypto space, and no doubt you will see some crypto projects become available.

Dispelling Myths about Equity Crowdfunding

It wasn’t too long ago when equity crowdfunding (EC) was seen as a funding vehicle that had nothing going for it save for its novelty. Many supposed that it would eventually fizzle out once the hype around it died, and startups would come running back to VCs for funding. Back then, people were fearful about a lot of things like the lack of venture capitalist-support in CF campaigns, since they interfered with the VCs and their direct investments on startups.

It’s a different story today, however, and equity crowdfunding is considered to be just as mainstream as venture capitalist investments. But while the panic that accompanied it is long gone, some of the fears surrounding equity crowdfunding remain, due in part to prominent myths that fuel them today.

Here are 5 of them that possibly even you believe.

-

EC is for Companies with Unpopular Equity

One of the most pernicious, and unfortunately most persistent myths about equity crowdfunding out there is that it’s the last resort for companies that couldn’t raise money offline. The assumption is that companies that partner with EC platforms have failed under the scrutiny of venture capitalists – which means they are, for the lack of a better word, “garbage” startups – and are trying to raise money from people who don’t know any better.

This couldn’t be further from the truth. First of all, EC platforms are alternatives, not replacements, to traditional funding vehicles like VCs and angel investors. In fact, more and more venture capitalists see equity crowdfunding as just another channel to diversify their investments with. While it is true that equity crowdfunding platforms are a disruption to traditional VC investments, VCs themselves do not look down on EC and are actively seeking profitable investments there.

-

Only Unsophisticated Investors Go to Equity Crowdfunding

Another myth that can be traced back to the earliest days of crowdfunding. It just isn’t true, but there are significantly more inexperienced investors to be found on equity crowdfunding platforms. This is part and parcel of the structure of EC, which broadens investment opportunities by allowing small-time and non-accredited investors to invest in companies that are not listed on stock indices.

In that sense, it is true that a good amount of unsophisticated investors flock to EC platforms, but as mentioned earlier, venture capitalists are equally attracted to equity crowdfunding today, especially with the higher-than-average returns promised by startups on EC.

-

EC is Riskier than Direct Startup Investments

Most of the negative coverage of equity crowdfunding campaigns out there almost always focus on their inherent “riskiness,” sometimes highlighting the fact that they are startups that are not subject to venture capitalist scrutiny. In that sense, this myth is built upon the first myth listed above, which we have already addressed.

In reality, equity crowdfunded startups and VC-funded startups are subject to the same amount of risks. Investing in startups is risky, regardless of the funding vehicle, period. It does investors a disservice to arbitrarily hold up traditional venture capitalist investments over EC as if they are not subject to the same market forces that either build or bankrupt startups. It is true, however, that since startups see the convenience of lower overhead offered by equity crowdfunding platforms as feasible, more of them have been coming to EC to leverage their projects in recent years.

-

EC Precludes VC Participation

If it isn’t evident by now, much of the myth-fuelled fears surrounding equity crowdfunding revolves around VC participation. This myth is no different, and it is merely not true.

There is nothing on any securities laws in existence that disallows you to raise funding from venture capitalists directly on top of raising capital from the crowd. Technically speaking, EC is a different beast of a securities offering in that it won’t combine or interfere with your pursuit of other funding vehicles, so, yes, you can raise from VCs while doing equity crowdfunding. The only limitation you have to consider here is that you might not have the time to handle both at the same time, so make sure you exercise due caution!

-

EC Messes Up Your Cap Table

To be fair, this was true at one point. Typically, having a lot of individual investors means more competition should one of them wish to own more shares, which turns many of them off before they even invest. This is no longer the case, however, and it hasn’t been for the longest time.

Before Crowd Safe, careful structuring of you cap tables dealt with the problem efficiently, and so did creating special purpose vehicles, so companies had to deal with one entity, instead of thousands of individual investors. Now that Crowd Safe is a thing, however, you can raise from as many investors as possible and only ever deal with a single line item on your cap table.

Concluding Thoughts

With these types of investments, you would expect your money to be tied up for 5-7 years in an optimistic scenario, and 12-14 years if it’s an earlier stage company. If you’re investing in a number of different startups, which you really should be doing given the risk involved, you would be targeting overall returns of 15-25%.

Unless you have some insider information it’s extremely risky to put money in just one company – a fund or basket of startups of your choice is always a better choice. If you go for a fund, you have to pay fees and I really don’t like the lack of liquidity with these investments, as there is little opportunity to resell on a secondary market type of mechanism. A fund will also typically charge a management fee of 0.25 – 2.0% and a performance fee of 10%. I’ve looked at some funds on EquityZen and the returns are not that impressive really.

From what I’ve seen, these investments tend to be a hobby of investors who are already very rich and successful and have money they absolutely don’t need in the next 10 years. They use this type of investment in startups to learn new things, stay involved in the industry and help other new entrepreneurs. The upside is that they might also end up making a good buck if they’re lucky with their investments.

I certainly would not suggest startup investing for the beginner investor who is trying to grow his wealth and achieve financial independence, however.

Very interesting blog! Having invested in 10+ startups myself its interesting to see how its done in other countries.

In Belgium we have a tax withdrawal of 45% to invest in Belgian startups using certified sites, that I have happily used. At the same time that does make it harder to invest in sites from other countries, even though they could have a bigger potential.

Keep up the good work!

Hi Jean,

VC sounds like a whole other league.

Been following your blog for a while now.

Out of curiosity. At this stage do you write the posts yourself 100% or from time to time you choose to outsource – at least the information gathering part.

Hi Janis, thanks for following! Yes I do write and research things myself.

These are all topics that I spent a lot of time learning myself (and experimenting) myself and only after so I write articles here. It also helps my learning process to formalize my thoughts in a structured way.

Impressive. Do you have some goal in mind? Say 5 posts per week?

I wouldn’t say so. I have periods where I write more and I just spread the posts across the following few months so the actual publishing looks regular. I think at the moment it’s averaging 2 or 3 a week.