Here’s another platform that I don’t trust. When parting with my money for investment purposes, I always make sure that as far as I can see, the investment platform or opportunity checks out 100% and has no red flags.

To be clear, if I find just one red flag, I am not touching that investment.

That’s the case for Monethera. When I checked out this platform recently, I liked the overall design of the website but a recent change raised an important red flag.

I can’t comment on the quality of loans they offer or the people running the platform, because I stopped looking at the platform the moment I came across this buyback guarantee red flag.

Basically, late in December 2019, Monethera announced that they have a deal in place with a third party company, based in Hong Kong, that is willing to cover 95% of any bad loans on the platform.

Here’s an excerpt from their announcement:

We have found an elegant solution for how not to waste time and effort on a refund. We agreed with the private Hong Kong company RICHLY PACIFIC INTERNATIONAL LIMITED on the repurchase of our users’ investments in case of default of a project. Agreements will only apply to new projects marked with a special sign.

The company has a staff of top lawyers specialized in conflict situations with debtor companies. It allows return obligations from borrowers with high probability. We are guaranteed to receive 95% of the funds invested by our users before the court decision.

Naturally, some questions immediately spring to mind:

- Why 95% and not 100%?

- Why doesn’t Monethera cover it’s own bad loans like other platforms do, instead of relying on a Hong Kong company?

- Why would a Hong Kong business get involved with a Latvian business on this type of strange deal?

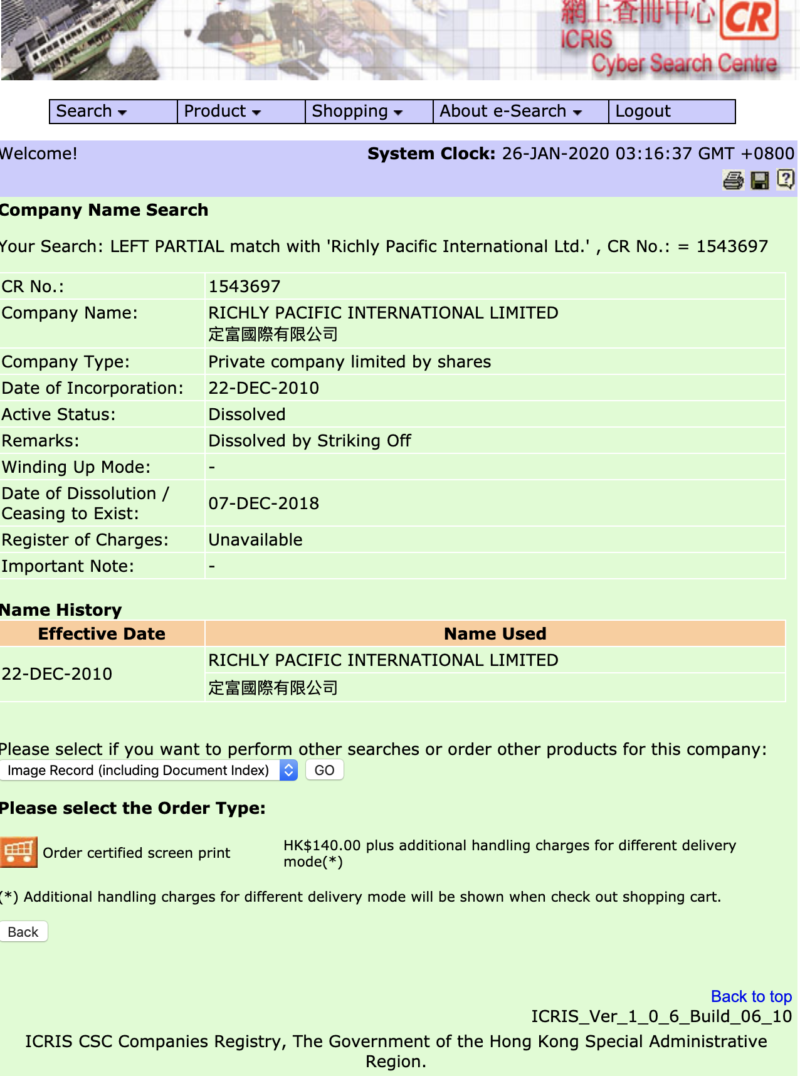

Just out of curiosity, I decided to search for the company details in the official Hong Kong Company Registry, and this is what came up:

As you can see in the screenshot from the Hong Kong companies registry, the company has been dissolved in December 2018. Therefore I don’t understand how a dissolved company can protect Monethera investors with the buyback guarantee.

There are an infinite number of ways to invest your money, so you shouldn’t spend time digging deeper into an opportunity if it feels fishy right from the outset.

It seems that I’m not the only one to feel concerned about this, as there have been some tweets about this on Twitter as well:

Ok, something about Monethera and their mysterious RICHLY PACIFIC INTERNATIONAL LIMITED fund.

— Roasted PeerDuck ☠☠ (@RPeerduck) January 3, 2020

Feel free to check out the Monethera website for yourself, and if you think I’m wrong about this, leave a comment below. I’m always open to changing my mind if I’m proven wrong.

I’ve also reached out to Monethera directly, but so far I have received no response from them. I will update the post if I eventually receive an answer to the concerns expressed above.

What are your thoughts on Monethera?

Hi,

Recently I created an account @ Monethera.

I went through the process of verification and was ready to add funds.

As I did not see IBAN-details I requested more details by mail.

At first I did not get any reply … until I received the following message underneath:

“Dear,

We have changed our bank provider.

Our new bank details are:

TRUSTCOM FINANCIAL UAB

Monethera Group OÜ

IBAN: LT293690023810002231

SWIFT: TRFBLT21XXX

Address: Islandijos g.6, Vilnius 01117, Lithuania

You will be able to find these at Deposit information at your Investor’s cabinet.

PLEASE NOTE! We will not use old bank details anymore.”

As I did not trust it, I started to search for additional reviews and came on your blog. 😉

Seems like you were avoided it right in time. Always try to search for negative reviews of platforms apart from good ones, so you can make an informed decision.

I recently opened an account with Trustcom Financial UAB, and would like to know if it’s a good bank, scam? because the account opened within 24h and I was a bit suspicious.

Thank you in advance

A lot of scammer companies opened on Trustcom, as well they open fastly as they fastly block your funds with an excuse that the police europol is investigating on your. See good buy to your funds

Read the latest blog post 15 by Monethera very carefully https://www.monethera.com/blog/15. None of the contracts provide a physical address for RICHLY PACIFIC INTERNATIONAL LIMITED. They are all signed by the same, unnamed, member of the board. If anyone can read traditional chinese, it would be interesting to know what the characters along the top of Richly’s corporate seal state. In place of any actual names or addresses as evidence of Richly’s existence, Monethera provided two web addresses of hong kong business listings, both of which state at the bottom that they have not been updated since 2018, and each an earlier date than the date of Richly’s delisting on Hong Kong’s corporate registry–this is a curious oversight for a company that prides itself on its “due diligence.” At a minimum, there is no evidence here by which any investor could be confident that an investment guaranteed by Richly is safer than any other on Monethera. Moreover, if read right, Richly appears to have agreed to insure without even being paid a premium, just a transfer of the claim rights on an insolvent party. So, Richly has apparently agreed to repay lenders in the event of a borrowers insolvency, in exchange for a claim on the insolvent borrower. This is unheard of. Also, Monethera states that Richly operates outside of Hong Kong: Why then would both parties give the courts of Hong Kong jurisdiction over this agreement in the event of a dispute? A week after this story broke, Monethera has still not been able to provide any evidence that RICHLY PACIFIC INTERNATIONAL LIMITED is real, and cannot even provide the name of a single director, board member or employee working there (except that it is owned by a Latvian resident). It is also jarring that in their blog post Monethera claims it did not do its normal due diligence on this agreement…This agreement is a contract for a 7 figure insurance arrangement that Monethera publically advertised as evidence that it was safe to invest with them, and they did not do due diligence? None of the documents provided even indicate if Monothera checked to see if Richley actually had the funds in the bank. There are no page numbers. The contract, unusual for one of its type, does not ask for the provision of any proof that Richley actually had 3 million euro at the ready. Why would any company agree to ensure losses on relatively risky business ventures in exchange for the rights to recover money likely to be non-existent? Some might say that behaviour such as this could be very concerning to anyone investing in this platform or thinking about it. It looks sloppy, predatory, or both, making investors think security has been promised when in fact there is none. Transparency is promised, and then supposedly provided, and yet not only do the questions asked remain unanswered, the answers provided raise more alarm bells. The title appears to be almost comically ironically misspelled: It is a “Guarantee Agreement Ensuring the Provision of Investments.” That word should probably be “Insuring,” but the only thing this arrangement will actually do is ensure that investments continue to be provided, by ensuring that hapless investors are still there, comforted by the existence of buyback guarantee for which there are many assurances, but no evidence for whatsoever.

Thanks for digging into this. As far as I’m concerned, there is absolutely no reason for me to risk my money with this platform when there are so many other alternatives available in the P2P lending space, not to mention investment opportunities in general.

Considering the climate created by the prosecution of Envestio and Keutzal, Monethera’s actions do not make sense since this story broke: https://thecoinrise.com/monethera-scam-warning-one-scam-after-another-in-europe-p2p-3/. They still have not provided any proof that “RICHLY PACIFIC INTERNATIONAL LIMITED” exists, or that they have an agreement with them, which is what a serious company would have done immediately. Instead, they released a blog post today promising more transparency, but with no dates or timelines. Investors should keep writing about this until they provide evidence of this 3rd party insurer’s existence, and the details of the agreement.

Agreed.

I have only €100 in a 7 month project. At the moment I feel there is a fairly high chance of a negative outcome with monethera , wisefund and fast invest. Be an entertaining few months coming up indeed.

Agreed. I think 2020 will be a year that will see a general shakeup of the market, with the bad platforms falling by the wayside and the emergence of a more mature market with solid players.

En estos enlaces se demuestra que sí está activa la compañía de Hong Kong, quizás te apesuras en publicar rumores y la puedes liar bien gorda

http://www.hongkongcompanylist.com/richly-pacific-international-limited-bfoieeb/#.Xi1OlWhKjIU

https://www.hkgbusiness.com/en/company/Richly-Pacific-International-Limited

You’re right Sergi, some links show it as active but the official Hong Kong company registry says it is dissolved. So it is possible that the other website have not been updated yet.

I have reached out to Monethera for a clarification on this issue, although there are other questions too that should be clarified to investors, as I mention in the post.

My aim on this blog is to simply record my thoughts on various topics, I have nothing against Monethera, and I hope they can clear up these doubts that I have. However, as things stand, I’d rather not risk my money.

Heres what got me this part I copied of their announcement.

Monethera:

We are guaranteed to receive 95% of the funds invested by our users before the court decision.

I get the word users, but aren’t we Investors? Then I think to myself with Envestio they users not investors as well.

Great report. My moneys out of Monethera, I even check their location on google maps.

It seem strange. I dont know what estonia or latvia looks like but if your coporate why are you based where there are only apartments. Thanks

I think I was possibly one of the last ones to use this buyback Jean!

What’s your prognosis for Monethera after the recent events?

Hi Steve, I think there will be a shake up in the industry and the less reputable and well-built platforms will go out of business in some form or another. It’s similar to what we’ve seen in the crypto space in previous years. There’s always a period of furore when a new way to make profits is revealed to the masses, followed by the entrance of opportunists and scammers, followed by a shake up in a couple of years.

I don’t have a crystal ball though, and can’t say what will happen with Monethera. I have reached out to them to see whether they can address the above concerns, and I hope they can, for the sake of those who invested with them and the whole P2P sector.

They’ve said it was an “error” and they are looking into it..

Keep the articles coming!