There are alternatives to using high street banks for converting and sending money abroad.

High street banks are being threatened by leaner fintech companies with better technology that provide a better service at a lower cost. That’s a statement that most of us have heard from one source or another over the past few years.

The two most well-known services are Wise and Currencyfair. Of the two, Wise is my favorite.

Wise

Sending money abroad is deceptively expensive, thanks to the hidden fees we’ve all been forced to pay. Now Wise lets expats, foreign students and businesses transfer money wherever it’s needed, at the lowest possible cost. No hidden fees, no headache.

Let’s see how that translates into a real-life example.

Converting $100,000 to Euros

Let’s say we need to convert $100,000 into euros. We’ll pitch a typical high street bank against two well-known currency conversion services: Currencyfair and Wise.

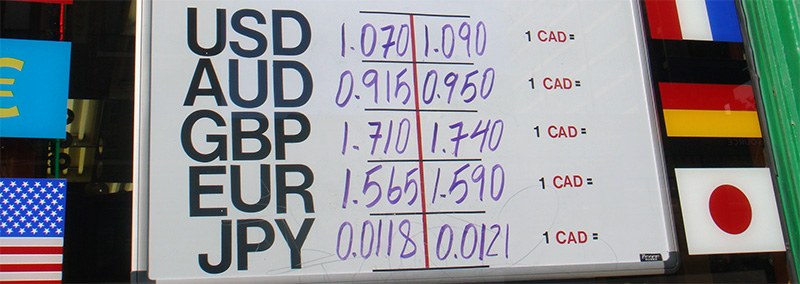

I recently did some research about exchange rates offered by Maltese banks, when making a USD transfer, which automatically gets converted to Euro upon arrival in your bank account.

Interestingly enough, almost all banks offered a rate 0.745 Euro for every 1 USD. Only HSBC offered a worse rate, giving out 0.741 Euro for every 1 USD. I’ve also included the PayPal conversion rate for reference.

| Bank buys USD | |

|---|---|

| HSBC | 1.3504 |

| BOV | 1.3426 |

| APS | 1.3402 |

| Banif | 1.3409 |

| Lombard | 1.3402 |

| PayPal | 1.3636 |

This might not make much difference on small amounts, but when we deal with a few thousand dollars the difference quickly adds up. I monitored the rates over a few weeks and HSBC consistently offered worse rates. I’m not entirely sure why there is this discrepancy and will try to investigate further.

| 1000 USD | 5000 USD | |

|---|---|---|

| HSBC | 740 | 3702.60 |

| BOV | 744 | 3724.12 |

| APS | 746 | 3730.79 |

| Banif | 745 | 3728.84 |

| Lombard | 746 | 3730.79 |

| PayPal | 733 | 3666.67 |

Here are some handy links to the exchange rates offered by the main banks in Malta:

- HSBC Exchange Rates

- Bank of Valletta Exchange Rates

- Banif Exchange Rates

- Lombard Exchange Rates

- APS Bank Exchange Rates

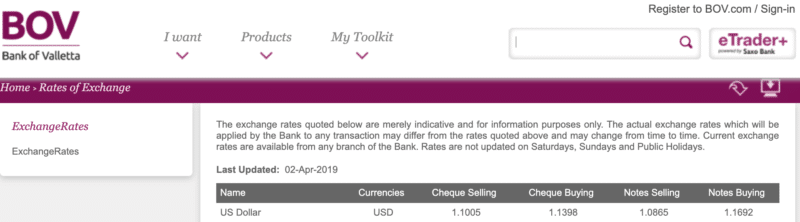

I picked two Maltese banks, HSBC and BOV. Here are their advertised rates:

BOV exchange rates

HSBC exchange rates

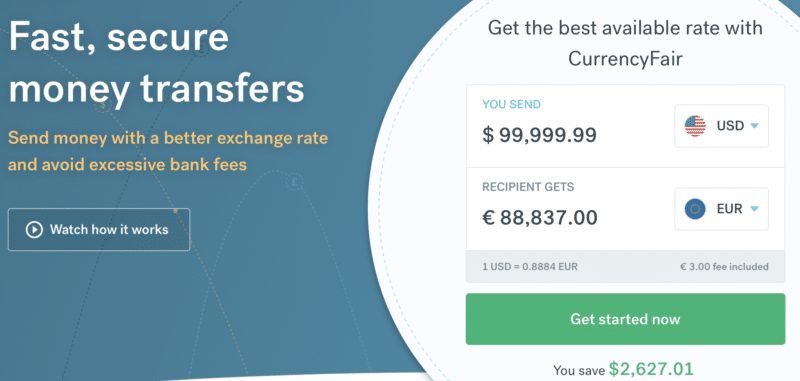

Currencyfair

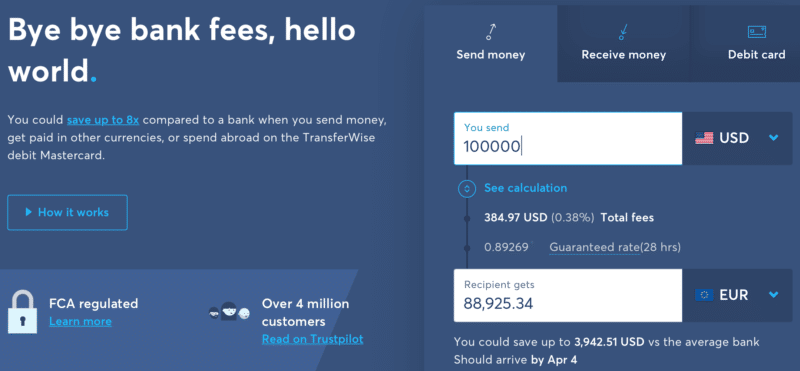

Wise

Having checked all the rates, let’s have a look at the final results.

Here’s what each Maltese bank will give us in return for our USD:

- BOV: €87,734

- HSBC: €87,039

Amazingly, between the two leading banks in Malta, we see a difference of €700 for the same simple service. Pretty bewildering if you ask me. I believe that both banks also charge a fee, although I was unable to locate the pricing for currency conversions on their website.

Let’s move on to the online currency conversion giants:

- Currencyfair: €88,837

- Wise: €88,925

Note that Currencyfair improves on the BOV’s rate by €1,100, and Wise by €1,200. You must also keep in mind that I’ve seen banks that provide much worse conversion rates and extra fees for conversion. Even so, the differences between the fintechs and the Maltese banks are pretty impressive, and I, therefore, see it as a no-brainer to go for either Wise or Currencyfair for currency conversions.

And now let’s look at some more exotic options that can give you even better results with some extra work on your end.

Bonus tip: Negotiate a Better Rate with Your Bank

If you are processing a significant volume of currency conversions every year (I’d say $50,000 and above) it would make sense to reach out to your bank and ask if they are open to negotiating a better rate for you. This is a win-win situation and most banks will be happy to give you a favorable rate.

As an example, I was able to negotiate a special rate with my bank to convert from USD to EUR.

By way of example, for today they quoted a Preferential Rate of 1.0998 when the Official Buying Rate was 1.1138 (Reference or Average Rate was 1.0946).

Just to give you an example of the effect of this concession, let’s take an example transfer of US$ 66,000. The conversion of this amount would work out as follows:

| Interbank rate | US$ 66,000 @ the average rate of 1.0946 = Eur 60,296 |

| Conversion at the Quoted Buying Rate | US$ 66,000 @ the buying rate of 1.1138 = Eur 59,256 |

| Conversion at the Preferential Rate | US$ 66,000 @ the preferential rate of 1.0998 = 60,011 |

This means that I gain the difference between Eur 59,256 and Eur 60,011 or Eur 1,040 and Eur 285 = Eur 755.

How do you manage your currency exchanges?

How to Time PayPal Withdrawals to Get the Best Currency Exchange Rate

This is for all those of you who don’t have a US-based bank account but work online and receive payments via PayPal.

At some point, you will want to transfer your PayPal funds to your local bank account so you can withdraw and use your hard-earned money.

However, you could be making a fundamental mistake during the process of withdrawal. Actually, I’ve been doing it myself for many years. I felt really dumb when I realized.

As you know, exchange rates are always fluctuating, so your aim is to get the best deal when transferring money from PayPal to your bank account.

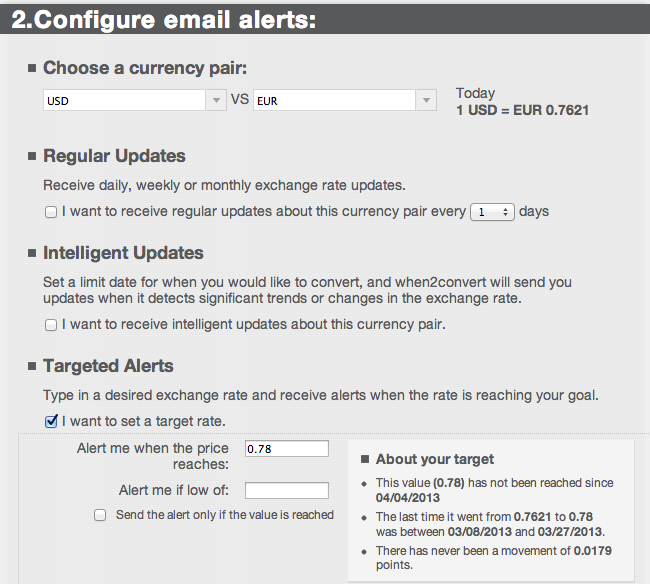

Let’s say we want to transfer US dollars to Euro, which is what I do every so often. What I do nowadays is to first check the exchange rate, and also historical rates via this website. That gives me an idea if today is a good day to make the transfer or not. Looking back at the historical rates of the past 3 months, I then decide on a target rate I want to aim for. At present my target rate is 1 USD = 0.78 EUR.

Historical exchange rates

With that figure in mind, I then head over to XE and set up email alerts. Now as soon as the exchange rate climbs to 0.78 I will immediately get an email and that’s when I will make my withdrawal from my PayPal account to my local bank account.

Setting up email alerts for my desired conversion rate

When2convert is an excellent service in my opinion, because it automates the whole thing and makes it very easy for me. Before I used to check the exchange rates every couple of days (every day is just too tedious), and sometimes I used to miss a good day. So I knew I need an automated shortcut of doing this checking. Luckily I found this site, and I hope you find it useful too.

Update: I found a similar tool (also free) at https://www.specificfeeds.com/Free-Forex-Signal-and-Exchange-Rate-Tracker and there you can not only define strike prices, but you can select to get updated every time the EUR/USD rate changes by 0.02 points or so, so that it’s not a one-time notification, but you always know if there have been significant changes without spending too much time to checking it every couple of days.

Another option is to just withdraw every month on a specific day, and in this way you eliminate the hassle of trying to time the forex market to your benefit. You might lose out sometimes, but it might be more important for you to have money coming in on a regular basis, so you have to factor in the pros and cons.

Do you have any other related tips you’d like to share? Let me know in the comments section below!

Note: If you have any questions after reading this and the several other articles relating to PayPal on this site, please leave a comment or contact PayPal directly. Unfortunately, due to time constraints, I am unable to offer any advice over email so all emails related to PayPal will remain unanswered.

Bitcoin – the Cheapest Way to do International Currency Exchanges and Remittances

Crypto stablecoins as well as Bitcoin can be an ideal way of bypassing the banks entirely for your currency conversions.

Let’s review briefly what is needed in an international currency conversion/money transfer. Suppose my friend/relative/client wants to send me $1,000 from the US. Being in Europe, my bank account is denominated in Euro, so at some point that $1,000 needs to change into Euro. The big question is how many Euro will end up hitting my bank account.

The traditional and most common way of doing international money transfers is to let the banks handle the conversion. This is called an international wire transfer.

Of course, other ways of sending money exist:

- PayPal

- Wise

International wire transfers are expensive, and PayPal is just as expensive or slightly cheaper. Wise have made it their mission to offer cheaper transfers, but they are not as easy to initiate as a bank transfer of PayPal transfer. PayPal is probably the easiest method out of all the ones we’re considering.

Once I was made aware of the possibility of using Bitcoin I decided to try it out. Therefore, I opened an account at the Bitcoin exchange Coinbase, and got myself verified. Coinbase has several levels of verification and I did the Tier 3 verification. You need to do Tier 1 and 2 before you are allowed to get Tier 3 verified. Verification is important due to KYC rules that exchanges need to abide with. Once you are Tier 3 verified you can deposit and withdraw up to $25,000 on a daily basis. The monthly limit for withdrawals/deposits is $200,000. That’s plenty of fiat currency to play with right there.

Opening an account with Coinbase is free. Once the account was open and I was verified (all this was done in a day), I obtained a Bitcoin deposit address and sent it to my friend. He proceeded to send me the equivalent amount of USD in Bitcoin. I received the Bitcoins just a few minutes later. I then converted to EUR and initiated a transfer of the full amount to my local bank account. The Euro amount arrived in my bank account the very next day.

I had checked the spot rate before making the USD to EUR transfer and the money that I got in my bank account was actually higher than the result given at that day’s spot rate, so I ended up making a slight profit of a few euros on the exchange. The most important thing however was that I managed to do away with all the hefty charges that Paypal and the banks charge.

Here are all the fees I incurred:

- Coinbase: Bitcoin deposit – FREE

- Coinbase: Exchanging Bitcoin to EUR – 0.26%

- Coinbase: EUR SEPA Withdrawal to my bank account – €0.09

- Bank: EUR deposit – FREE

Note: If you want to buy Bitcoin from Coinbase there is a commission of 0.16%. So if you convert $1,000 to Bitcoin you will get charged $1.60.

That’s an absolute steal comparing to what banks or PayPal charge. One of the main reasons I wanted to try this out was to verify that this really worked as described and that there would be no hidden charges. I’m pleased to report that it worked exactly as promised.

Coinbase’s fee schedules are tier-based: the higher the volume you trade in your account, the lower your fee on subsequent trades (once the next volume tier for the currency pair is reached). Other fee considerations:

- Fees are charged on a per-trade basis.

- Fees are calculated as a percentage of the trade’s quote currency volume (by default). Certain pairs allow the fee to be calculated based on the trade’s base currency, which can be specified when ordering using the Fee Currency option.

- User fee volume levels are measured using the equivalent market value of the listed “Fee Volume Currency” at the time of the trade. Note that this currency may be different from the pair’s base or quote currency.

- User fee volume levels are measured and applicable for trades occurring in the last 30 days only.

One thing you need to be aware of is the possibility of making a loss/profit due to the volatility of Bitcoin. The few seconds/minutes it takes you to make the conversion from Bitcoin to EUR and to ask for a withdrawal to your bank can be enough for significant changes to take place.

If volatility is an issue for you, you can use stablecoins instead. Most exchanges have stablecoins in the major currencies that are trustworthy enough especially for quick currency conversions.

This method does not work. If you want the best rate from PayPal looking at real time rates on any app/website or elsewhere only tells part of the story. You have to actually watch the PayPal exchange rate as well which does NOT follow actual rates. In fact the Payl exhange rate is only periodically updated. I’m trying to figure that one out. At this point it appears they may update their rate once or twice a day but I am verifying that myself.

Use this method instead: watch for actual rates to rise on your favorite app then watch for PayPal rates to update to follow the rise. PayPal charges 4%. If the actual exchange rate rises and the difference between the posted rate and PayPal’s current rate is more than 4% then you are really being hosed. If PayPal’s rate is only update once or twice a day at least wait till it’s closer to 4% or you are being taken to the cleaners. If the actual rate is on an upswing at least wait till PayPal catches up and updates their rate to get the best actual rate.

Hello Jean,

I’m about to set up an online translation business. While I finally decided what legal setup is best, I’d like to start operating with no register at all, kind of testing the service and the idea.

I guess the most simple is PayPal at first? Apparently Paypal doesn’t allow linking to Transferwise which is a bit of a pain… I was ready to use my Transferwise borderless card but I need a connecting platform such as PayPal to make payments from clients possible. My PayPal is linked to a UK account and also N26 (although they say they do not support virtual banks?) Any recommendation?

I am Spanish citizen, digital nomad with no fixed resident at the moment (latin america), and aiming at setting up this biz mainly for US clients (US).

Stripe only allow registering with an actual company registration – I could do a UK LLC although not sure about the long term tax rate and so on. Or perhaps a US LLC but not ready to make this investment yet (500$ register fee).

Sorry for the long message! just trying to make sure what’s the best option to start out. Thanks

Hola Maria,

I don’t think N26 is treated as a virtual bank since for all intents and purposes it functions like a normal bank account, including having a unique IBAN number.

PayPal, with all its problems, would probably be the easiest way to start for you.

Further on, as you you correctly state, you could set up a US, UK or even Spanish company and accept Stripe payments.

It wouldnt be better to do the money transfer by using transferwise to mintos and there to keep the money 1 month?

That could also be an option. Why do you think it’s better?

If one where to withdraw USD funds from Paypal to local Maltese banks, the funds received in EUR will actually be higher with HSBC than with BOV (I’ve tested this on multiple withdrawals).

But if I’m not mistaken credit card withdrawals use VISA’s exchange rates and not the Bank’s exchange rates. The concerned bank will then add its fees and that explains the difference in funds received.

On regular transfers it’s advantageous to use Transferwise or CurrencyFair.

Hmm, how would you explain the fact that HSBC works best in that case? It has worse conversion rates compared to BoV.

If I’m not mistaken this is how it works… Once you withdraw funds to a VISA card the USD funds will get converted to EUR by VISA(an international company that uses up-to-date exchange rates) and then VISA forwards EUR funds to your EUR bank account. So the conversion has already taken place before the funds land in your bank account.

The rates you found are only used by the bank to make currency conversion(bank transfers mainly), in this case the currency exchange is made by VISA and not by the bank.

http://www.visaeurope.com/making-payments/exchange-rates

Right. I’ve checked my account and I can see that there are no charges related to inward transfers via the VISA card. The transaction details the exchange rate used and nothing else.

When I do a SWIFT transfer in USD, BoV charges an inward fee since they charge feeds for incoming USD. This seems to support what you are saying.

What I don’t understand, however, is how doing the transfer to HSBC results in more money in your account versus BoV. If the conversion is done by VISA themselves, then the resulting EUR in the bank account should be the same for both banks, right?

I’m still trying to figure that out. It could be that the conversion is being done by the bank itself but they use exchange rates from VISA and add a conversion fee of their liking on top of the exchange rates.

Hmm, that would be pretty bad, since they are not disclosing any other fee.

You can see all BOV’s fees here – https://www.bov.com/documents/bov-tariff-of-charges.

If you search fees for other banks you’ll find a similar doc.

Yes I know and there are no fees relating to incoming VISA income in Euro.

Very easy to calculate pricing for currency conversion by comparing their buying and selling rates;

BOV: (1.1005+1.1398)/2=1.12015 which is the actual rate they are comparing to

So their charge is (1.12015-1.1005)/1.12015=1.75%

HSBC: 2.5%

Good point, thanks Francarl.

Possibly of interest, Payoneer is using Hyperwallet on their backend. If anyone is looking to build a system like Payoneer, check them out. They have some powerful possibilities. Speaking to that is the fact that they recently got acquired by PayPal in Jun 2018 (iirc). Braintree was acquired by PayPal in Sep 2013, so they might be leading to some mass integration of services soon across all three platforms.

I noticed that neither of the sites mentioned in the article are working today.

So today I found this tool on the site of Transferwise. I also offers email alerts.

https://transferwise.com/tools/exchange-rate-alerts/

Let’s see if it works in the coming weeks.

hello!

im searching in google if is possible change the balance of my paypal in usd to EUR im spanish and sell in dollars but nothing only can do that with the conversion of paypal to buy if possible choose different conversion but to sell not…

maybe im confuse but do you know that info?

thanks!!

Great post, I was wondering why my balance is kept in USD even though i’m in Euro zone.

Hi Jean,

Isn’t there a fee for buying bitcoin in the first place?

You’re right John, in my case I didn’t pay that fee as my friend was sending me money so I received Bitcoin directly.

I updated the fee schedule above to reflect the full cost if you had to transfer USD/CAD to EUR between two of your own accounts.

As you rightly consider, you’d have to pay both the maker and taker fee commission when doing the transfers.

In any case it would still be a very low fee and lower than what banks charge.

Hi there. But you also need to factor in the price to send bitcoin from your friends wallet to yours.

Isn’t it quite expensive to send bitcoin?

Most people use ltc and then convert.

What was the btc transfer fee?

It depends on the current transaction fee levels. They tend to vary. You could even use stablecoins nowadays, but ltc is also an alternative.

Thanks. Works for me (in Australia) 🙂

Still the same “Question” Is there any alternate to the Pay pal for India.(While receiving payments from Canada)

I’ve heard people mention Payoneer for cases like yours, but I’m not an expert on that.

Hi, thanks for your article – its a clever way to make sure you’re not getting ripped off.

I have a specific problem, and I was wondering if you or anyone else could help…

I receive payments from a foreign client in British pounds and usually convert to USD when accepting payment. Thereafter I withdraw the money to my South African bank account (which means another fee to convert it to South African rands). Should I rather keep the funds in the currency they were sent in? Does that mean no conversion is done until I choose to do so?

Any advice would be greatly appreciated.

Lars

If you are using PayPal then yes I’d keep them in GBP and only convert them to South African rands when I want to.

Thank you for advice

Wow great tool! The problem I have is that the 3 month currency conversion ($ to £) looks to be at a high right now of .62 but paypal is only paying .60 today. So is the tool then useless if paypal doesn’t match the current exchange rate?

Read my other post about PayPal exchange rates, PayPal are usually not the best place to have your conversions happen, and I’ve found a way around that.

And that way around is?^^

Check out my latest update on this subject https://jeangalea.com/changing-paypal-withdrawal-currency/

Is there any way to just work my way around their horrendous exchange rates? I want to withdraw $582 but I’m losing $17 just because of their outdated rates.

My money is converted into rupees.

PayPal charge me double. Why?

Just fir trying paypal I order some thing that cost 1 us dollars = 60 INR but they charge me 120 INR.

That means 2 dollar. Can anyone tell me why?

Wonderful info! Thank you.

But uhho… PayPal has only auto-withdrawal for India… 🙁

guys, leave PayPal and move to TranferWise whenever you can.

They are really two services with different uses. PayPal is most commonly used for accepting payments online, and there isn’t an easier service than that at the moment.

Great share ! Thanks 🙂

Right now I’m really confuse whether use PayPal or Payoneer to receive my online payment as freelancer.. Currently I use Paypal, since at that time I don’t know about Payoneer.. PayPal takes a lot of money from difference currency exchange rate each time I need to withdraw to my local bank account.. It quite hurts ! :(..

My question is, is Payoneer currency exchange rate is better than PayPal for withdrawing money to local bank ? If yes, is it still worth ? Since Payoneer is charge some fee also as membership subscription base what I know..

PS: My PayPal base currency is USD, and my local bank account is IDR..

Thanks in advance for any advices..

Regards,

Ronny

Welcome! I haven’t used Payoneer lately so I can’t give you any advice on that comparison unfortunately.

That was good. Wish it worked here in India as according to rules here, we have to transfer PayPal balance to bank account within 7 days of receiving money or else PayPal will automatically transfer it on the last day at whatever the exchange rate is then. PayPal is already ripping me off a lot of my money with their ridiculous exchange rates..

I do withdraw USD to EUR just above 100 € so to avoid the 1 EUR fee.

This morning the exchange rate, according to major sites was like this:

$ 138 = € 101.6646

but paypal calculate like this:

$ 138 = €98,89 EUR, and still wanted the 1 EUR fee.

Isn’t this called stealing?

It is. I am wondering, aren’t there alternatives? paypal is becoming so widely used and I don’t understand why when the fees are such. does it mean people don’t see the “price” of the service? no one else can compete?

Paypal have established a footprint so large that it’s hard for anyone else to compete. However there are other ways of accepting payments which are growing more and more popular every day. Check out Stripe, PayMill, 2CheckOut, Avangate.

Awesome tip!! thank you very much mate. I was going to withdraw a couple of minutes ago but smth stopped me this time. I started to google and found your article. Just what the doctor ordered. 🙂

For 2 years, I’ve been transferring USD to Czech Crowns every time I get paid from my freelancing gigs without a second thought. Of course, waiting for the opportune moment to withdraw money is ultimately a bit of a gamble, but this info will likely earn me quite a few extra beers per month. Thanks for the info. 🙂

I’ll be sure to join you for a few beers then when I visit the Czech Republic 😉

thanks for the tip jean 🙂 really useful!

Welcome Matthew!

That’s something I should really do but I just keep the money in USD and then convert it to GBP when I withdraw the money. PayPal’s fees are ridiculous though. I hate the idea of them ripping me off at the conversion stage, especially after taking off a hefty fee.

I was actually referring to the stage of withdrawing the money, where PayPal does not actually charge a fee (as far as I know). Are you referring to occasions when you pay someone in another currency rather than what you have in your account? I keep most of mine in USD too, then they get automatically converted when I withdraw to my bank account.

I’d be interested in some further advice on this matter if you’re still watching this board as of 2015 and the new PayPal changes…

I keep my USD PayPal payments in a USD balance and convert when withdrawing to my (GBP) bank account. However, on doing so, PayPal then converts my balance to GBP itself automatically on withdrawal and applies the same extra 2.5% conversion rate to its exchange rates that it would when converting in any other manner. I’d love my bank to handle the conversion but PayPal refuses to allow me to withdraw USD to a British bank account. I even considered setting my account up as a USD account so that I could handle conversion manually, but apparently, when PayPal is asked to withdraw in USD to a USD account in Britain, it nonsensically converts the currency TO GBP and then converts it BACK again, basically just so it can levy the charges multiple times. So can you think of any way around this?

Well this is exactly what I asked Paypal to change for me and they did it without any problem. It seems to be an arbitrary decision though, depending on who the support tech on the other end is. It could also be that they got newer instructions from above to stop making these exceptions.