Cryptocurrencies have evolved to become one of the highest-growth asset classes that can be held in a financial portfolio. With that said, If you invest in or trade cryptocurrencies, it is crucial that you understand what your tax liabilities are.

However, compiling cryptocurrency transactions and figuring out the associated tax implications can be an overwhelming process – even for the most seasoned trader. This is where tools such as TokenTax come into play.

This crypto tax software can help you compile all your cryptocurrency transactions across multiple platforms, giving you an account of your total capital gains and losses.

In this review, I will examine TokenTax to gain a better understanding of how it works and how you can use it to file your cryptocurrency taxes in 2021 and beyond.

Prepare your taxes with TokenTax

TokenTax – An Overview

If you are new to the cryptocurrency markets, you might be still struggling with its many complexities. In its midst, one might end up overlooking the importance of crypto taxes. In simple terms, cryptocurrencies are taxed in the vast majority of jurisdictions if you are able to sell or exchange them at a profit.

This is potentially applicable even if you are spending your digital coins via online purchases. Meaning, you could owe capital gains taxes even if the digital coins you spent have gained in value compared to what you originally paid for them. Cryptocurrency tax software such as TokenTax aims to simplify this process for you.

It will scan the blockchain to identify crypto transfers between the different wallets you own – and provide you with reports of all transactions within a given tax year.TokenTax was first created by Alex Miles in 2017 – as an entry to the Product Hunt Google Global Hackathon. Not so surprisingly, the product ended up winning first place in the competition, and soon, he was joined by Zac MacClure.

Together, the pair was able to use the funding from the contest and build on the product to release it for the tax season of the same year. Given the broader unawareness regarding cryptocurrency taxes at the time, TokenTax was able to quickly garner attention from crypto traders and investors.

In the course of four years, the team behind TokenTax has managed to add several functionalities and tools that cater to the unique needs of cryptocurrency enthusiasts.

Currently, TokenTax offers four different products to assess your tax situation:

- Crypto Tax Reports

- Crypto Margin Trading Taxes

- Tax Loss Harvesting

- Tax Professional Suite

In fact, TokenTax is one of the few cryptocurrency tax software providers that can handle crypto margin trading and decentralized finance. It is also the only tax firm that offers in-built CPA services for accounting and auditing.

Moreover, TokenTax can be used to generate tax reports for residents across several regions. Whether you are located in the US, UK, Europe, South Africa, or Asia, – you will be able to get access to the full suite of TokenTax products.

How TokenTax Works

Before I take a closer look into the different features of TokenTax, I will explain how this software works. In a nutshell, TokenTax has partnered with several cryptocurrency exchanges in order to make sure that it can extract your cryptocurrency transactions. In fact, you can also find support for DeFi platforms such as yearn.finance, Uniswap, Sushiswap, Synthetic, and more.

You can get started with TokenTax in a few simple steps:

Step 1: Create Your Account on TokenTax

The first step is to set up your user account on TokenTax. Apart from providing your email address and password, the software will also require you to complete your tax profile.

For instance, you will have to fill in your country of residence, your estimated income, your filing status, the method you used for your previous tax filing, and so on. This is to give the tool a better idea of your tax profile.

Step 2: Upload your Cryptocurrency Transactions

TokenTax allows you to integrate your crypto wallets directly through an API. This way, transactions will be synchronized on both platforms. As I mentioned earlier, TokenTax works with a multitude of cryptocurrency exchanges – ensuring that the uploading process will be as smooth as possible.

Alternatively, you can also manually download a CSV file with your transactions and upload it to TokenTax.

Step 3: Choose Preferred Accounting Method

TokenTax offers support for a number of accounting methods such as FIFO, LIFO, minimization, and average cost.

At this stage of the setup process, you can choose which accounting system you want to opt for.

Step 4: Download Tax Forms

Once the platform has finished its calculation process, you will be able to download your tax forms right away. Crucially, TokenTax will automatically fill in your crypto tax forms on your behalf – making it easier for you to file them.

You can also import your completed forms directly to popular tax preparation services, such as TurboTax.

Features of TokenTax

In its simplest form, TokenTax is a software platform that can help you calculate tax on your cryptocurrencies. However, there is a wide variety of crypto investments and trade types and depending on the niche, it can be difficult to calculate net capital gains and losses – such as in margin trading.

This is where TokenTax truly shines. Unlike its counterparts, TokenTax can help you with any type of crypto tax statement. In this section, I will take a closer look at these unique products offered on this platform.

Crypto Margin Trading Taxes

If you are familiar with crypto margin trading, then you are already aware of its many intricacies. As you can imagine, the process of filing taxes on your margin trades can also be quite cumbersome. Generally, most tax rules for cryptocurrencies are identical to that of other assets – such as the likes of stock, forex, or CFD trading.

However, when you are dealing with margin trading, it can be a challenge to get the right data from exchanges in order to accurately report your transactions.In most cases, you will have to contact the exchange directly, requesting bespoke information – which will be provided in a different format.

For this reason, not every crypto tax software can calculate margin trading tax for you. If you have engaged in crypto margin and derivatives trading on platforms such as BitMEX or Derbit, TokenTax can automatically import your profits and losses from the respective exchanges.

On the other hand, platforms such as Bitfinex are even more complex. For such cases, TokenTax has a team of crypto CPAs and accounting experts that can offer you special guidance. They can help you account for earnings from lending interest and any liquidations involved with crypto margin trading.

Note that this service is reserved for only Pro and VIP level users. I will look at the Tokentax pricing structure later in this review.

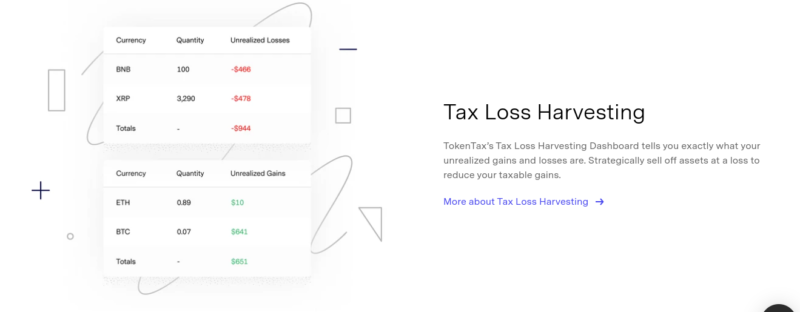

Tax Loss Harvesting

It is common for cryptocurrency traders to sell off the assets they hold at a loss in order to reduce their capital gains liabilities. This method – called ‘tax-loss harvesting’, allows you to decrease the amount of taxes you owe. As such, even if you make a loss when selling your asset, you will be able to offset the capital gains from other investments, such as stocks.

- For instance, say you have made capital gains of $10,000 for this tax year.

- You also have holdings in Litecoin that is currency at a loss of $3,000.

- In such a typical scenario, you will have to pay the full amount of $10,000 in taxes.

- However, if you are able to sell your LTC holdings and harvest the losses – then your taxes will be reduced to $7,000.

TokenTax offers tax-loss harvesting tools that go through your crypto translation history to find out how many assets you hold and which positions are at a loss. This can give you a better idea of any tax-loss harvesting opportunities that you might have in your portfolio.

Not only that, but the TokenTax team itself is always ready to assist you in harvesting your losses to reduce your crypto taxes.

Tax Professional Suite

This TokenTax product is specifically designed for cryptocurrency accountants and accounting organizations. The platform will help your accounting firm build support for cryptocurrency traders using their exclusive features. You will be able to import your clients’ transaction histories, calculate their taxes and complete their tax forms – all in one place.

In effect, accountants will be able to manage your clients’ crypto taxes much more competently. TokenTax will also give you access to additional tools such as performance graphs, tax-loss harvesting, and finding missing extraction histories.

In other words, TokenTax can become your support system for offering cryptocurrency accounting services to your clients. It is also the first crypto tax software to offer tax harvesting and accounting services.

Note: Apart from these services, the TokenTax team also offers additional assistance for those that are facing IRS audits.

TokenTax Pricing

TokenTax has a unique pricing plan for cryptocurrency traders. To start with, it offers two types of services – one only for crypto tax calculations and the other to handle your entire tax filing needs.

Crypto Tax Software Plans

The plans listed below are best suited for those who seek help with filing crypto gains and losses.

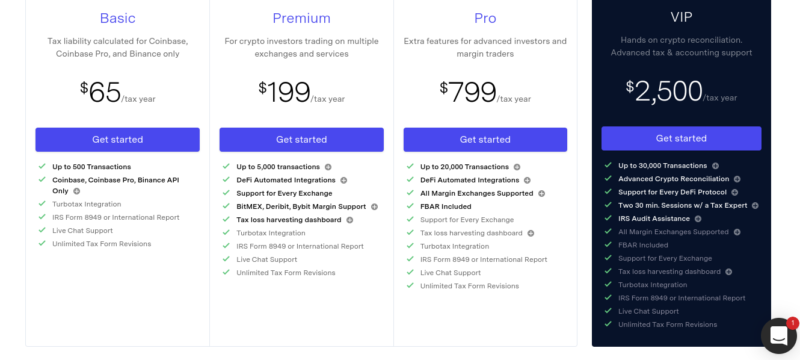

Basic Account – at $65 per year

This account offers you support only for Coinbase, Coinbase Pro, and Binance.

The features include:

- Up to 500 yearly transactions

- Integration with TurboTax

- Support for IRS Form 8949/International Reports

- Unlimited Tax Form Revisions

Premium Account – at $199 per year

This account allows you to gain access to transactions across all supported exchanges of TokenTax.

The features include:

- Up to 5,000 yearly transactions

- Integration with DeFi platforms and margin trading.

- Tax-loss harvesting dashboard

- Includes all features of the Basic Account.

Pro Account – at $799 per year

The Pro account is best suited for advanced investors and margin traders.

The features include:

- Up to 20,000 yearly transactions

- Support for all margin exchanges

- Support for FBAR

- Includes all features of the Premium Account

VIP Account – at $2,599 per year

The VIP account gives you access to full functionalities on the platform, including advanced tax and accounting support.

The features include:

- Up to 30,000 yearly transactions

- Advanced tools for crypto reconciliation

- Integration will all DeFi protocols and cryptocurrency exchanges

- Private sessions with tax experts

- IRS audit assistance

- Includes all features of the Pro Account.

As you might have noticed, some of the exclusive products on TokenTax are reserved for those who sign up for Pro and VIP plans. If you are to benefit from the full functionality of the platform, you will need to pay a hefty fee. But, there is every chance that this will pay for itself – depending on how effective TokenTax is with your tax liabilities.

Full Filing Plans

TokenTax also has dedicated plans for those who want to use their services to file full tax returns, which is inclusive of crypto. You will also be able to work with a Crypto CPA to receive expert assistance.

Bronze Account – at $699 per year

- Best suited for those who only need the essentials of tax filing

- Up to 5,000 transactions

- Up to four tax forms

- Tax returns for one state

- Support for margin trading and tax loss harvesting

Silver Account – at $999 per year

- Best suited for those with multiple income sources

- Up to 5,000 transactions

- Up to 10 tax forms

- Tax returns for two states

- Support for margin trading and tax loss harvesting

- Support for one self-employed business

Gold Account – at $3,000 per year

- VIP tax filing services that offer support for the most advanced tax situations

- Up to 30,000 transactions

- Up to 10 tax forms

- Tax returns for two states

- Private sessions with experts

- IRS audit assistance

- Support for margin trading and tax loss harvesting

- Support for one self-employed business

TokenTax also gives you a 10% discount if you use its service for multiple years. However, one thing worth noting is that TokenTax does not offer any free trails. As such, there is no easy way to assess whether or not the platform is fit for your needs.

You might also have to pay extra if you are to file taxes in multiple states or regions, depending on your country of residence.

Paying for TokenTax in Cryptocurrency

As you can imagine, TokenTax also accepts payment for its services through digital currency. Currently, the platform allows you to make crypto payments in Bitcoin and Ethererum. However, the payment procedure is a bit indirect.

You will have to reach out to the support team, mentioning that you would prefer to pay for your plan using crypto. The TokenTax team will send you a price quote and the amount you have to send.

The address for the BTC and ETH wallet is available on the TokenTax website.

TokenTax Customer Support

TokenTax has a well-curated section on resources and guides – that provides you with all the information you need regarding the different facets of cryptocurrency taxes. You will be able to find extensive guides on the different rules and even find data that are relevant to your country’s tax system.

In addition, if you need customer support, the team is available through live chat or email.

TokenTax Review – My Verdict?

Reconciling all your cryptocurrency transactions across multiple sources can be a daunting task. Undoubtedly, TokenTax can make the entire process easier and convenient for all cryptocurrency traders. The software truly shines in terms of automation and user experience. It can give you a clear account of gains, losses, and more.

Most impressively, if you are in need of an expert’s opinion, TokenTax also has in-house CPA counsel that can offer you all the assistance you need. That said, such exemplary functionalities also come at an expensive price tag. If you opt for a cheaper pricing plan, the features you have access to are very limited.

As such, depending on your tax filing requirements, you might have to pay a high cost to avail of the full services of TokenTax.

Nevertheless, if you have traded cryptocurrencies multiple times across different exchanges, it might be a good decision to use TokenTax. The platform is arguably a market leader in this space and thus – can solve almost any cryptocurrency tax challenge you might be facing.

Summary

TokenTax can make your crypto tax preparation process a breeze. The software truly shines in terms of automation and user experience. TokenTax also has in-house CPA counsel that can offer you all the assistance you need, and this is especially recommended for those with large crypto holdings or those who make a lot of trades and use a diverse set of crypto-related products such as lending, staking, margin trading, CFDs, futures, etc.

Pros

- A trusted player in the crypto tax space

- Professionals available for extra assistance

- Easy-to-use software

- Many integrations

Cons

- Limited features on the free plan

Dear Jean,

Thank you very much for the interesting information. I have a furthermore question to you. If we want to cash out via e.g. Santander Bank which documents are required? Is it necessary to open the exchange account to show all transactions? Is it possible that Santander rejects the transaction? If yes, what are the the major mistakes ?

It would be great if you can help me.

Greetings

Simone

Typically they will want to see all the transaction history and potentially even the source of initial funding.

Some banks prevent their clients from cashing out from crypto exchanges altogether. It’s always best to contact your manager about any cash out plans beforehand to avoid nasty surprises.