I’ll start right off by saying if you’re not an experienced trader with a firm understanding of how financial derivatives work, then Deribit won’t be for you. But, if you’re a seasoned investor that is looking to trade cryptocurrency futures and options, Deribit is well worth considering.

The online platform offers a huge number of tradable markets in this field – covering financial derivatives on both Bitcoin and Ethereum. You’ll also have access to high levels of leverage, should this be relevant to your trading goals.

But, before signing up with this cryptocurrency trading platform, I would suggest reading my comprehensive review. Within it, I cover everything from how Deribit works, tradable markets, leverage limits, supported payments, and of course – safety.

What is Deribit?

Launched in 2016 by founder John Jansen, Deribit is an online cryptocurrency trading platform that specializes exclusively in financial derivatives. This means that you will be speculating on the future value of your chosen digital currency without taking ownership.

In particular, the platform hosts futures and options markets on both Bitcoin and Ethereum. Other than a few exceptions (including Canada and the US), anyone can open an account with Deribit.

You will, however, need to deposit funds with Bitcoin – meaning no debit/credit cards or bank transfers. Nevertheless, the platform allows you to place sophisticated trades – facilitating both long and short positions.

Additionally, the platform offers leverage of up to 100x. This turns a $50 account balance into a $5,000 trade at the click of a button. Although Deribit is not regulated, it does require all account holders to go through a KYC process. More on this later.

What can you Trade at Deribit?

As noted in the section above, Deribit focuses on futures and options. These two asset classes cover Bitcoin and Ethereum, and each comes with a significant number of markets.

With this in mind, let me break down what the platform offers in more detail.

Deribit Futures

Put simply, futures at Deribit allow you to speculate on whether you think Bitcoin or Ethereum will be worth more or less on the date that the contracts expire.

For example:

- You are trading a 3-month Bitcoin futures contract

- The ‘strike price’ of the contract is $19,000

In the above scenario, if you think that Bitcoin will be worth more than $19,000 in 3-months’ time, you will be placing a ‘long’ order. If you think the opposite, then you are going ‘short’.

Now, at Deribit, each and every market consists of ‘European-style’ futures. For those unaware, this means that you do not have the option of offloading your futures contracts before they expire.

Instead, you need to hold on until the expiry date – so in the example above, that’s 3 months. This could be problematic for those of you that wish to cash in your futures position at Deribit early – making it impossible to apply risk-management strategies.

Nevertheless, Deribit currently offers four contract durations on its Bitcoin and Ethereum futures. At the time of writing, this consists of the following expiry dates:

- December 25th 2020

- March 26th 2021

- June 25th 2021

- Perpetual

Once the December 2020 contract settles, a new futures market will be added – with an expiry of September 2021.

As such, this means that the longest futures market on offer at Deribit is 9-months from the time you enter your position – should you do this on day one of the respective market being added to the platform.

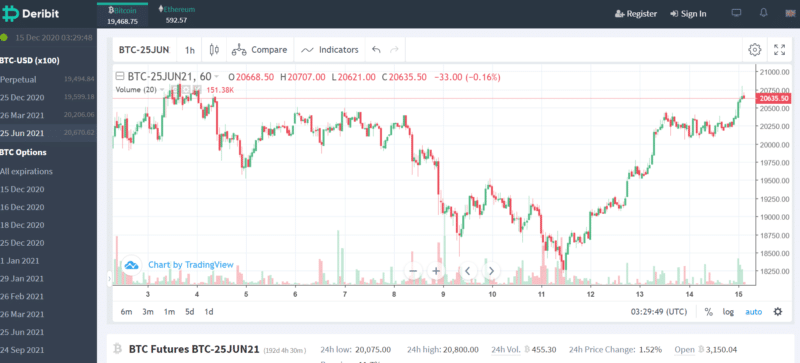

Before I explain what the ‘perpetual’ market relates to, let me dive a little deeper into the June 25th 2021 futures contract at Deribit.

June 25th 2021 Market at Deribit

At the time of writing in late 2020, the June 25th 2021 futures market at Deribit has a strike price of $20,497. In simple terms, you need to predict whether Bitcoin will be worth more or less than $20,497 on June 25th 2021.

Once again, this is a major benefit of trading futures, as you have the option of going short, as well as long. This isn’t something readily available when you invest in Bitcoin in the traditional sense.

In terms of how this market works, check out the basic example listed below:

- To keep things simple, let’s say you risk $1,000 on this market

- You think Bitcoin will be worth less than $20,497 on June 25th 2021

- As such, you go ‘short’

- When June 25th 2021 comes around, Bitcoin is priced at $14,000

- In percentage terms, this means that it is worth 31% less than the initial strike price

- You went short, so a 31% profit on a stake of $1,000 makes you $310 – less fees

Preputial Contracts Market at Deribit

As the name suggests, the ‘preputial’ market at Deribit consists of a futures contract that never expires. In this sense, it’s pretty much similar to CFD trading. However, as Deribit is not a CFD broker – it does not fall under the remit of traditional regulators.

As such, these contracts are highly appealing to those that like to apply high levels of leverage. The price of the Bitcoin or Ethereum preputial futures contract at Deribit will go up and down on a second-by-second basis. In turn, you can cash out your position whenever you see fit.

On the other hand, and as I cover in more detail shortly, you will be charged a fee for each day that you keep the position open. Once again, this is not dissimilar to conventional CFD instruments – where you always need to pay an overnight financing fee.

Deribit Futures Contracts Specifications

In terms of key specifications that you need to be aware of, check out the following:

- Each Bitcoin futures contract is worth just $10, while with Ethereum it is $1. This is great for trading small amounts.

- Futures are always settled in the respective cryptocurrency. For example, if trading Ethereum futures, the contract will be settled in ETH.

- At the date on which the futures expiry, this will happen at 8 am Universal Time (UTC)

- The minimum tick size on Bitcoin and Ethereum futures is $0.50 and $0.05, respectively

- All futures markets futures at Deribit can be traded 24/7

Deribit Options

So now that I have covered the ins and outs of Deribit futures, I am now going to move swiftly on to its options marketplace.

Before I do, I should note that options are arguably even more complex than futures. This is because there is a lot more to take into account.

For example, options markets at Deribit come with a lot more in the way of contract durations and strike prices. Additionally, you need to have an understanding of how the premium works.

With this in mind, I’ll break down each metric one by one and how this relates to the Deribit options department.

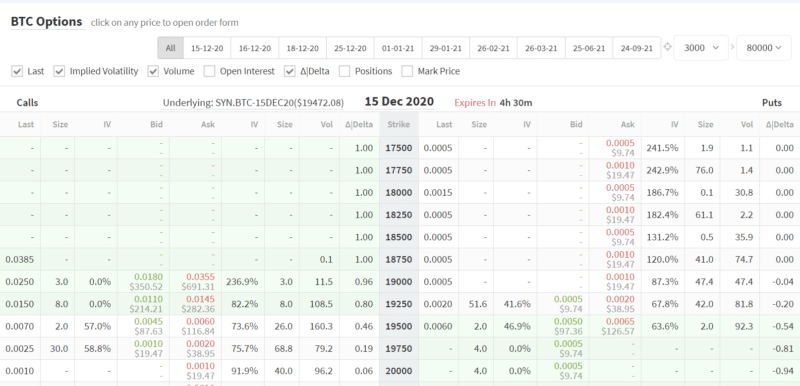

Durations

At the time of writing, Deribit offers options markets on 10 different durations. At the lower end, you can trade options with an expiry of just one day. You then have options contracts that expire in just over 1, 2, 3, 6, and 9 months’ time.

While shorter-term contracts are likely to appeal to day traders, I really like that you can gain exposure to the cryptocurrency options space via a 9-month market.

This allows you to speculate on the future value of Bitcoin or Ethereum by paying a small premium – meaning your outlay and risk is small. More on this shortly.

Strike Prices

This is where Deribit really stands out. In the section above on futures, I noted that there is just one strike price. Therefore, you simply need to predict where the futures will expire higher or lower price than the specified strike price.

However, in the case of options, Deribit offers a significant number of strike prices for you to choose from. Depending on the likelihood of the strike price coming to fruition when the options expire, this will impact the ‘odds’ that you get on the position.

Before I get to that, let me give you a quick example of what you strike price markets are offered by Deribit:

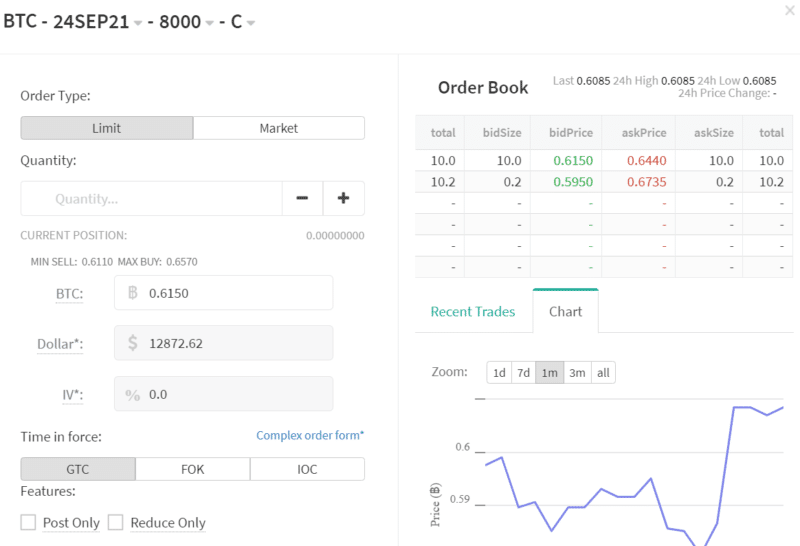

- I’m accessing the Bitcoin options market with an expiry of 24th September 2021. At the time of writing, this is more than 9 months from now.

- In total, Deribit offers 14 different strike prices

- At the lower end, this starts at $8,000. For those of you super-confident on Bitcoin, the highest strike price on offer is $80,000.

Now, based on current prices of $18,500 – $19,500, it goes without saying that the chances of Bitcoin surpassing $80,000 in 9 months is, albeit not impossible, very unlikely. As such, you would only be required to risk a small amount of money to access this market.

This leads us nicely on to the ‘premium’, which I cover in the section below

Premium

The premium is what you need to pay to access your chosen market at Deribit. This could be anywhere from 1% of the options contract value – right up to 50% or more. This will be dictated by the contract duration and strike price that you select.

That is to say, if you are speculating on an options trade that is more likely to be profitable, expect to pay a high premium. For example, on the aforementioned September 2021 market, the premium on Bitcoin being priced at more than $8,000 is 61.1%.

This means that for every 1 BTC position, you would need to put up 0.6145 BTC. Then, if the contract expired and your prediction was wrong, you would lose this premium in its entirety.

However, let’s say that you were super-bearish on Bitcoin and you thought it would be worth less than $8,000 in September 2021.

Because the likelihood of this happening is so low (based on recent price action), the premium amounts to just 1%! This means the most you are risking on a trade worth 1 BTC is just 0.01 BTC.

All in all, you have a significant number of options durations, strike prices, and premiums to ponder over at Deribit. As such, this allows you to speculate on the future value of Bitcoin or Ethereum with great flexibility.

Deribit Options Contracts Specifications

In terms of key specifications on Deribit options, here’s what you need to know:

- All options at Deribit at European-style. Once again, this means they cannot be exercised before the expiry date.

- Although you are viewing prices in US dollars, all options contracts are settled in the underlying currency (BTC or ETH).

- Both calls and puts are available on each and every options market offered.

- The minimum order size is 0.1 contract and 1 contract on Bitcoin and Ethereum, respectively

- Markets operate 24/7

Deribit Fees

So now that I have covered what markets you can trade at Deribit, I am now going to explore what fees you need to be made aware of.

Order Commission

First and foremost, you will always need to pay a commission when you enter an order at Deribit. The only exception to this rule is if you are a ‘market maker’ – meaning you provide the platform with liquidity.

If not, you will pay a ‘market maker’ commission of:

- 0.5% on all futures markets

- The higher of 0.03% or 0.0003 BTC/ETH per options contract

When paying a percentage fee, this is simply multiplied by your total position size. For example, staking $1,000 on a Bitcoin futures contract would cost you just $0.30.

Settlement Fee

As the name implies, you will pay a fee when your futures or options contract settles.

- On futures, this stands at 0.025% of the contract value at settlement

- On options, this stands at 0.015% of the contract value on settlement

Take note, if you are trading daily options at Deribit, you won’t pay a settlement fee.

All in all, whether you are trading futures or options at Deribit, the fees charged by the platform are very competitive.

Deribit Leverage

If you have a higher tolerance for risk, you might be looking to trade financial derivatives on margin. This means that you can trade with much more than you have available in your Deribit account.

The platform offers huge limits, which consist of the following:

- Up to 100x on Bitcoin derivatives

- Up to 50x on Ethereum derivatives

As you can see from the above, Deribit offers huge leverage limits that surpasses what regulated brokerage sites can offer by some distance.

For example, those based in Europe can only trade crypto-CFDs with leverage of up to 2x. But, at 100x, this means that for every $100 staked, you only need to put up $1.

With that said, trading with high leverage limits at Deribit can be dangerous.

For example:

- Let’s suppose that you decided to utilize the full 100x on a $100,000 Bitcoin futures trade.

- In turn, you need to put $1,000 up as margin – which is the most that you can lose

- As your margin amounts to 1% of the total trade size, this is where your liquidation point is

- In other words, if your Bitcoin futures position goes against you by 1%, Deribit will be forced to close the position

- If it does, your $1,000 margin will be lost

All in all, while leverage can amplify your potential profits, it can also result in you losing your stake in its entirety.

In addition to the risks of utilizing leverage, you also need to consider the costs. This is no different from CFD overnight financing fees. The specific rate that you pay will vary wildly depending on the contract specification, how much you have staked, and what leverage ratio you have opted for.

Deribit Demo Account

I was pleased to see that Deribit offers a demo account facility. I think that this is crucial when you consider just how complex crypto derivatives are.

As such, by using the demo account, you can learn the ropes of how Bitcoin/Ethereum futures and options work without risking a single dollar. The Deribit demo account platform mirrors live trading conditions, which is crucial.

This means that you can get a feel for long and short orders, leverage, premiums, puts and calls, liquidation, and anything else that you don’t quite have a firm grasp of yet.

Opening a demo account takes seconds and there is no limit to how long you can use it.

Payments at Deribit

When it comes to funding your Deribit account, you have one option and one option only – Bitcoin. As such, the platform does not support any fiat currency deposits – namely debit/credit cards, bank transfers, or e-wallets.

This could be a major drawback for those of you that prefer the convenience of depositing and withdrawing funds with your local currency. After all, if you don’t have access to any right now, you need to buy Bitcoin before you can trade at Deribit.

With that said, depositing Bitcoin into your Deribit account is relatively simple – and works much the same as adding funds to a cryptocurrency exchange.

For example, you simply need to copy your Deribit wallet address, paste it into your private wallet, and then proceed to transfer the Bitcoin across. After that, the funds should show up in your Deribit account in less than 20 minutes.

There are no account minimums on the platform, so you can deposit as much or as little as you like.

In terms of fees, you won’t pay anything to deposit funds. You will pay a small variable fee when you cash out, albeit, this should be equal to the current fee charged by the Bitcoin network.

Withdrawal times are not stated on the Deribit website.

Deribit Mobile App

If you also want the option of trading cryptocurrency derivatives on your mobile phone, Deribit offers an app. This is available on both iOS and Android devices.

You can access most trading features on the app, albeit, this will be on a much smaller screen size.

The Deribit app has a user rating of 3.7/5 on Google Play, albeit, this is across just 73 ratings.

Things aren’t much better on the Apple Store, with a rating of 3.5/5. However, this is only across 4 individual reviews, so this does need to be taken with a pinch of salt.

Eligibility

Deribit is available to citizens of most countries, apart from the following:

- Canada (province Quebec);

- Cuba;

- Guam;

- Iran;

- Iraq;

- Japan;

- Democratic People’s Republic of Korea;

- Panama;

- Puerto Rico;

- Samoa;

- Sudan;

- Syrian Arab Republic;

- United States;

- Virgin Islands (U.S.).

Is Deribit Safe?

This leads me on to that all-important question – is Deribit safe?

Well, in a nutshell, Deribit is not regulated or licensed by any financial body. On the contrary, it operates without regulatory oversight at all.

Initially, the platform was located in the Netherlands. However, as per the impending European 5th Anti-Money Laundering Directive, Deribit moved its offices offshore to Panama.

This in itself should speak volumes, as Panama isn’t overly selective in who it allows to operate within its borders.

The key problem is that the entire end-to-end investment process is based exclusively on trust. That is to say, you need to trust that Deribit is going to play far, honor withdrawals, and ultimately – remain solvent.

If for whatever reason, the platform ran into financial problems or it experienced a major hack – there is every chance that your funds will be gone.

In terms of safeguards offered by Deribit, the only thing that I can see is that the platform keeps 99% of client funds in cold storage. This means that just 1% remain in hot wallets – and this is to facilitate withdrawals.

However, there is no way to verify the platform’s cold storage reserves, so again, this relies on trust.

On the other hand, and as I cover shortly, all clients using Deribit must bypass a KYC procedure. This at the very least shows that the platform takes its anti-money laundering responsibilities seriously.

KYC Requirements

I was somewhat surprised to see that Deribit has a KYC program in place. After all, platforms that only deal with cryptocurrency deposits and withdrawals rarely ask for this.

In fact, even the likes of Binance allow you to trade anonymously as long as you don’t plan on funding your account with fiat currency, and your daily trading volume does not surpass 2 BTC.

Nevertheless, Deribit requires the following two documents from you:

- Government-issued ID – which can be a national ID card, passport, and/or driver’s license – depending on your country of residence

- Proof of residence, with Deribit accepting a utility bill, bank statement, tax bill or document from a local authority

You can upload the above documents straight into the Deribit website. The platform does not state how long it takes to validate documents.

Deribit Customer Support

If you need to speak with a member of the Deribit support team, you only have one option – email.

As such, there is no telephone or live chat support.

Deribit Review – The Verdict

In summary, Deribit is arguably one of the best cryptocurrency derivative exchanges I have come across – at least in terms of tradable markets. This is because you can trade Bitcoin and Ethereum derivatives via both futures and options.

The latter, in particular, offers a highly significant number of markets for you to choose from – all of which can be traded at competitive fees.

However, my main concern is, of course, regarding regulation. As Panama-based Deribit is not authorized or licensed by a reputable financial body, you will be using the platform at your own risk.

Sure, there is no reason to believe that there is anything unsavory about Deribit as a provider. But, without the backing of a regulatory body, you will have nowhere to turn should the platform cease to exist.

Additionally, it is somewhat inconvenient that the platform only supports Bitcoin deposits and withdrawals. On the flip side, the avoidance of fiat currency means that you will have access to leverage of up to 100x when trading Bitcoin derivatives, and 50x on Ethereum.

Please do article review for “AntiMatter” crypto derivatives decentralized trading platform for perpetual options.

AntiMatter is going to launch it’s mainnet next week (before 14th April 2021).