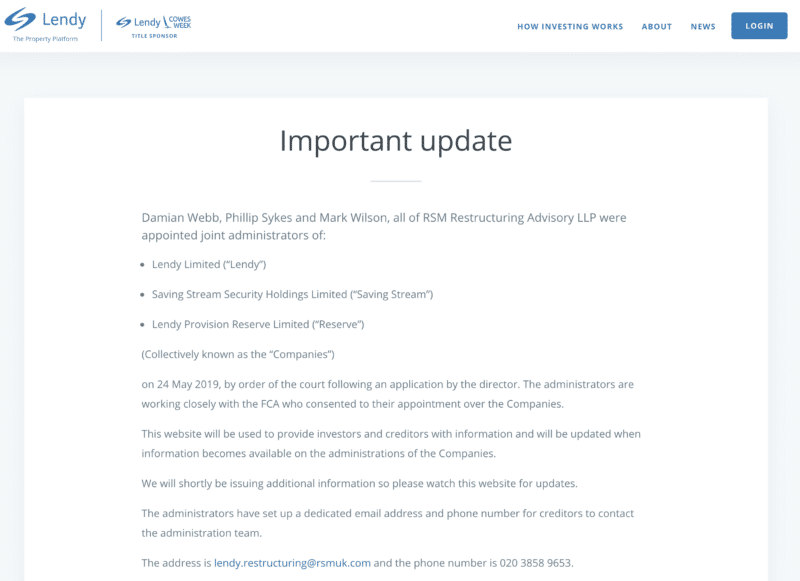

In May 2019, UK lending platform Lendy (previously known as SavingStream) went into administration following an announcement by the FCA.

This didn’t come as much of a surprise to many investors on this platform since things had been going downhill for some time. However, it’s always a sad moment when a platform you’ve invested money in goes out of business, possibly taking with it your money.

It’s also a moment to learn some lessons that will serve us well for future investments.

How did Lendy Work?

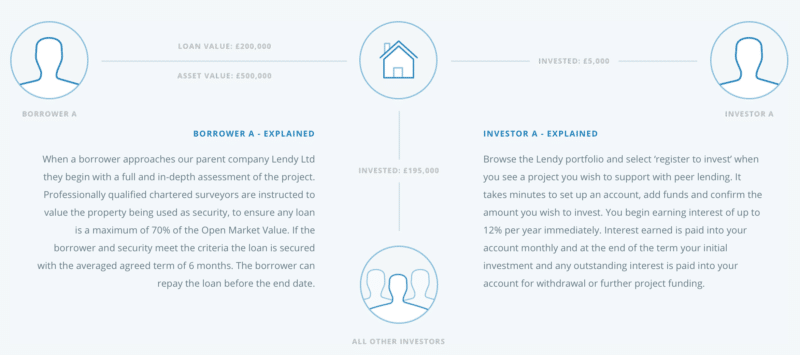

Lendy was a platform where property developers could apply for and obtain bridging and development loans. Most of these loans returned 1% per month and Lendy sometimes paid bonuses on loans that were overdue or simply defaulted. The loans were for the ranges of 3-12 months however many of them ended up defaulting or running for much longer than agreed.

These loans were secured against property or land with LTV ratios of 11-70%. There was also a discretionary provision fund that allegedly held 2% of the entire loan book in reserve.

All loans were secured against property or land. Lendy used to loan against boats and other items but they veered away from these types of loans in favor of property developments. The loan-to-value ratios on the properties and land ranged from 11-70%.

According to estimates, around 20,000 investors were operating on Lendy, with a total of £165m invested in the firm at the time of its closure. The platform had offered returns of upwards of 12% before things went south. It had been operating since 2013.

The money investors had invested in loans on the platform is now in jeopardy. Many investors also had uninvested money on the platform, and there are also doubts whether that part of their funds can be obtained eventually or not.

Concerned investors have launched the Lendy Action Group (LAG) that has the following aims as stated on its website:

ORCA Money’s chief executive Iain Niblock has slammed failed peer-to-peer platform Lendy as a “typical example of poor P2P lending”, as he urged investors to seek out less risky loans.

Niblock who also co-founded the P2P investment aggregator and analysis firm said that it was “no surprise that Lendy had gone into administration, citing the platform’s “extremely poor” loan book performance and regulatory issues, which had been a cause for concern among investors for some time.

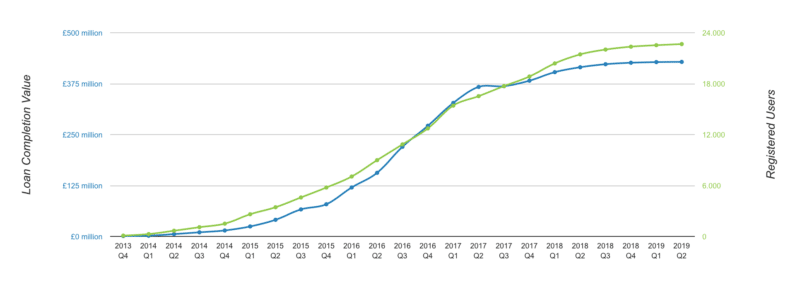

“Disappointingly, the lender was at one time one of the more popular UK P2P platforms with cumulative lending volumes reaching £428m,” Niblock added. “Over 22,661 lenders were attracted to its simple one percent interest per month offering.

“The platform grew rapidly in 2016 with cumulative lending growing from £79m by the end of 2015 to £271m by year end 2016. The company has suffered from extremely poor loan performance with worryingly high numbers of loans in defaults. Currently, on the platform there is £97m worth of loans in default and, only £65m of loans repaying.”

Now that an investigation is underway, it has become apparent that there was foul play by the owners of Lendy, Liam Brooke and Tim Gordon (see video of them further down):

Detailed investigations have been undertaken into the Company’s affairs during the period covered by this report, with the assistance of the Joint Administrators’ instructed solicitors Pinsent Masons LLP. The investigations have included carrying out reviews of the Company’s books and records, performing detailed analysis of the Company’s bank statements and reviewing the results of key word searches of the c480,000 Company emails held by the Joint Administrators. The Joint Administrators have now also carried out interviews with both Liam Brooke and Tim Gordon, the former directors of Lendy. The investigations have been concerned with a number of transactions, most significantly payments of approximately £6.8million that were paid to entities registered in the Marshall Islands for apparent marketing services carried out for Lendy. It is the Administrators’ position, however, that these payments were ultimately for the benefit of Liam Brooke and Tim Gordon. As a result of these investigations, on 1st June 2020 the Joint Administrators made an application to Court for a worldwide freezing injunction to be granted over the assets of Liam Brooke and Tim Gordon, as well as proprietary injunctions on the properties owned by companies linked to the directors, RFP Holdings Limited and LP Alhambra Limited. The Order was granted on the 4 June 2020. Proceedings have now been commenced against Liam Brooke, Tim Gordon, RFP Holdings Limited and LP Alhambra Limited. Owing to the nature of these claims, the Joint Administrators are unable to provide further information at this time. The Joint Administrators are continuing to investigate the affairs of the Company, however again, we are unable to provide further information at this time so as not to prejudice these investigations.

It is quite evident that they were scamming investors, as can also be indicated by this other article.

So let’s talk about those lessons I mentioned earlier. One of the biggest reasons behind my investing in P2P platforms and real estate crowdfunding is to learn how to invest as well as analyze my feelings when an investment is a success or when it tanks. The knowledge I get and the awareness of my feelings will guide my investing decisions further on in life, when being careful with my money will be of even more paramount importance due to aging, lower earning potential, and the necessity to support my children.

An Eye on the Executive Team

The first lesson we can learn from Lendy’s demise is that of keeping an eye on a platform’s executive team. Many of Lendy’s Executive Staff had already left the company before it officially went into administration, including; Robert Kelly and David Gammon (COO’s), Paul Riddell (Communications Officer) and Paul Thompson (Cheif Financial Officer).

High Returns = High Risk

All investors should know this, but many still fall for high interest rates, not fully realizing that there is always a reason why rates are so high. Ultimately Lendy’s failure was due to high default rates which impacted investor returns and its ability to continue operating.

If a platform is offering fixed yields of 12.0%, then the borrower on the other side of the investment will be paying an even greater interest rate which inherently increases the risk of default.

Don’t change high returns indiscriminately. Most times it’s better to settle for something a bit more conservative but more sensible and less risky.

Watch the News for any Warning Signs

Yes, there were some clear warning signs that Lendy was in trouble, with the company being placed on an FCA watchlist in January 2019 following concerns over its ability to meet the standards required of regulated firms.

As a result of this special supervision, Lendy was required to provide the FCA with weekly reports on its cash flow and loan recovery efforts.

In April 2019, the FCA then restricted Lendy’s actions – “[the firm must not] in any way dispose of, deal with or diminish the value of any of its assets and must not in any way release client money without in either case the prior written consent of the authority“.

At the point of entering administration, Lendy had outstanding loans of £155 million, of which £90 million were in default.

Understand How the Platform Works

Not all P2P lending and crowdfunding platforms work in the same way, and you need to do your homework before putting down your hard earned money into any platform.

Lendy’s model was to allow you to invest in property development and bridging loans, and this can be extremely high risk, but Lendy’s downfall was due to the way they operated, namely high fee generation and poor quality loan offerings. Lendy loaned money at high interest rates with front end fees, and they were unsustainable for the borrowers, thus resulting in frequent defaults. When Lendy started to go through a rough patch, they resorted to low-quality loans in an effort to maintain their advertised 12% per year return rates and thus maintain and grow their customer base.

Be Wary of a Platform’s Claims

Most platforms try to attract new customers with a wonderful origin story describing how they are changing the financial space, providing new opportunities to borrowers and investors, and taking great care with their financial matters. Here’s some text lifted straight out of Lendy’s about page, which is still online although they are in administration.

“We are one of the only profitable P2P platforms. That’s partly because we have taken a cautious approach, scaling up only when we felt the business could sustain the expansion. But we’ve also managed risk carefully, and always striven to strike the right balance between loan supply and investment demand.

We are also privately owned, with no bank debt or venture capital investment. And our employee levels have grown organically — as and when the business warranted. Our agile methods and low overheads enable us to pass the majority of the interest we charge borrowers back to our investors, providing some of the best risk-to-reward ratio returns on the market. For example, the average cash ISA at a bank now only offers annual returns of 0.74%.”

With hindsight, would you agree with their statements, especially the parts I’ve highlighted? I don’t think so. Lesson: take any claims with a pinch of salt.

Be Conscious of the Platform’s Financial Situation

It is very important to monitor the financial stability of peer to peer lending platforms on an ongoing basis.

We all know that this is a niche of the financial industry that is relatively new, and most P2P lenders are not listed on any public exchange, hence their financial reports might not be visible nor audited. Indeed, some platforms are not even regulated. In Lendy’s case it is regulated by the FCA in the UK, however this did not act as a deterrent from them going bust, nor was it supposed to do so.

Many of these platforms are investing heavily in growth, using their seed money in marketing campaigns to attract lenders and borrowers, so they could very well be loss-making with the hope of future profitability. This is all well and good if they can survive their runway period and make into into profitability before they run out of money. Bottom line is we need to have the facts in our hands as investors. I would recommend against investing in any platform that has transparency issues such as not disclosing information about the loans they are listing or not publishing yearly audited accounts.

Have a Good Look at the Founders

When I evaluate any business and especially a startup, I like to have a good look at the people behind the business. It can be a very good indicator of whether this is a business that is going to be around long-term or is just a vehicle for the founders to make some money and move on to another business when the current one fails.

I like to resort to Youtube to find interviews with platform founders. I only came across this one with the Lendy founder now, but if I had done so earlier on I would probably have not invested in Lendy.

I don’t like the cocky way he describes the platform and generally the way he speaks, out of personal preference I prefer to see a co-founder who looks more responsible and cautious given that these platforms are all relatively young and you can’t be sure of anything in this space. Being confident about success is good, but being brash about it is another.

Ultimately the directors of Lendy chose to underwrite loans that shouldn’t have passed the test, passing on unnecessary risk to the investors while pocketing their fees.

Keep an Eye on The Charts

P2P lending and crowdfunding platforms like to display charts showing their performance over the years. They typically show the growth in the number of investors and loan completion value among other things.

Let’s take a look at Lendy’s chart:

We can see that the glory days were 2015-2017, after which things started to look way less exciting, although good marketing tactics kept the number of registered users on a slightly upward trend. When you see a platform slowing down or even experiencing fast and unnatural growth, it is worth asking questions. Sometimes there is nothing really wrong with such swings and changes, but they can often be an indicator that things are a bit messy underneath the hood.

Beware of the P2P Goldrush

When a new investment opportunity comes onto the market, it is usually the case that it goes through a gold rush period where it suddenly takes off and everyone and his dog wants to invest. A good portion of the investors end up putting their money at stake without actually understanding the underlying investment product. We’ve seen this time and time again in history with the end of the 90s internet bubble, Bitcoin in 2017, and now its time for P2P lending.

We’ve seen various platforms that can’t even keep up with the investors’ thirst for opportunities. For example, while using Privalore and Envestio, just to mention two of them, I’ve seen investment opportunities being fully subscribed in a matter of minutes. And we’re not talking about very small amounts either, but rather opportunities in the ranges of €400,000 to €800,000. To me that suggests that there is a general dearth of good investment opportunities and many people sitting with big cash reserves, and thus they are very ready to put down considerable amounts of cash into these investments, possibly without really understanding them and hoping for the best. Don’t be one of them.

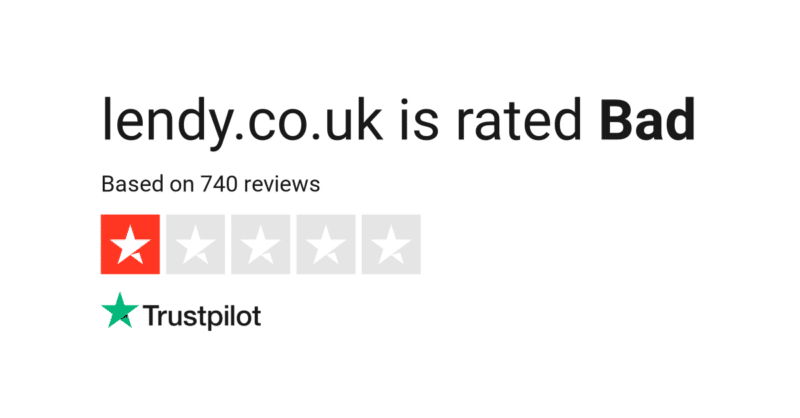

Read Reviews before You Invest

Before you invest your money into a platform, read online reviews about that company. Nowadays you can find many bloggers writing about their experiences with each platform, even including reports on money invested and returns gotten. Be wise and don’t just trust the first review you come across. As a general rule I don’t really care about net worth and income reports because who knows what those bloggers are leaving out or exaggerating? Just read as many reviews as you can and take the aggregate picture.

In terms of Lendy, while initial reviews were quite good, in 2017 we already began seeing many bad reviews, so if you went all in on Lendy during that year, having read the reviews first would have saved you a lot of grief. Here’s the reviews page from Trustpilot, where you can see an obvious “don’t invest” sign begin to emerge after reading the reviews.

Diversify

One of the most important keys to success in investing and specifically the P2P lending space is to diversify your investments. That means using multiple platforms to invest and within aggregator platforms like Mintos to diversify across many loan originators.

That means that when one loan fails, or a loan originator, or a platform fails, you will not lose everything. During my time investing in P2P I’ve had several loans go bad, and now the demise of Lendy, however, I am still running a healthy profit even after discounting the money lost in bad loans and platform bankruptcies.

Conclusions

The demise of Lendy is a blow to the P2P lending and crowdfunding industry in Europe, but I don’t think it will be its downfall. There are several lessons to be learned (both for investors and for other platforms), and if everyone in the space is humble enough to recognize the things that need to be improved, things will be even better than before in the coming years.

As I mentioned earlier in the post, the P2P lending space is still in its infancy, especially in Europe. Nobody really knows where things will be in 5 or 10 years time, but in the meantime, there is this opportunity to obtain high returns compared to other investing options available to us investors at the moment.

Average bank deposit rates in the Eurozone in 2018 were practically zero due to the negative interest rate policy of the ECB. Property performed slightly better, with average house prices increasing by 4.3% across the continent.

On the other hand, I’ve been able to obtain returns of 11-14% across my P2P investments, with my biggest investment being in the Mintos platform. Equities had a pretty poor year as well in 2018, and when we compare stocks versus P2P lending we can see that the latter’s returns were 26% higher.

I don’t know of any other asset class in Europe that performed so well last year. Of course, this can change at any time, but many investors like myself are making real money investing on P2P lending platforms and that means that this asset class should not be discounted.

The bankruptcy of Lendy will definitely not discourage me from continuing to invest in P2P lending and property crowdfunding in Europe. This includes property bridging and development loans. I will, however, approach my next investments with greater care and armed with the knowledge I got from the lessons above, which ultimately makes me a better investor.

What happens next?

Lendy have always provided a page detailing what would happen if the platform ran into problems, so you can read what they say here. At the moment, what we know after the first official communication from the administrators, is that they are doing their best to first recover the funds investors had in their accounts, and distribute them.

Following that, they will have to look at the actual loans and see how much is recoverable from those investments. I think the funds will eventually make their way to the investors, but I don’t have high hopes with regard to recovery of the funds still invested in the various loans I had on the platform.

Getting my Funds Out in May 2020

I have to say that the administrators that were appointed to wind down Lendy’s operations have acted in an extremely professional manner, updating investors every month with the proceedings and encouraging them to submit the KYC documents so that they could process the outflow of funds to investors.

In my case, when Lendy went into administration I had a portion of my investments sitting in the cash account on the platform, meaning that I had returns from investments that I had not yet cashed out but were sitting idle. Since all funds and accounts were subsequently frozen, I could not get the funds out until I provided KYC documents to the administrators and they had verified everything.

The process of going through KYC was relatively straightforward, it took a few months but I eventually got all my money out from Lendy and into my TransferWise account.

It remains to be seen whether any of the money I had that was still invested in active projects will ever be recovered. I have little hope that it will, so I’m happy that at least I was able to recover the cash that was rightfully mine and that had been stuck in my Lendy account.

What are your thoughts on the Lendy situation?

The summary is basically you can never trust a peer to peer platform?

I have had my money locked with them for 4 years and I have no hopes I will ever get it back. I thought being FCA approved I would get my money back, so we cannot trust even the government premisses either.

I read the article and I understand your points, but how can somebody trust any other similar platforms again? There are other safer options.

An important and related point to consider is that the P2P market is imperfect, in the Economic sense of the word.

We operate in an environment with imperfect information and these platforms operate as independent markets – there is no equilibrium found across these disperate markets as they are not well connected for capital to flow between them.

What this means is that a 12% loan on one platform doesn’t necessarily have the same risk profile as a 12% loan on another platform.

High return doesn’t always mean high risk

Low return doesn’t always mean low risk

The key concept here is risk to reward ratio.

It is entirely plausible and possible to make money investing in higher risk assets, as long as;

1) you are sufficiently diversified so that variance doesn’t catch you out

2) the projected gains of the aggregate loan portfolio you invest in are higher than the aggregate losses.

This counts doubly so for Loan originators that offer Buy Back Guarantees.

Our advice is to educate yourself, read as many blogs as you can and learn to spot the good, independent advice and filter out the sugar coated affiliate reviews.

Only listen to advice from those who actually put their money where their mouth is and invest in these platforms.

-Sterling

I agree with all you said Sterling. The only thing I would add is that in my opinion, unless you’re investing P2P lending platforms merely as a learning exercise, it only makes sense to invest if you have sufficient knowledge and capital available.

You make a good point with regard to projected gains being bigger than possible losses, and I would also factor in the cost of the time one would spend investigating platforms and loans into the equation. Only then can you really know if it’s worth going into P2P lending as an investor.

In my case, I’m lucky to have a good chunk of capital to invest after many years of running my own business, plus I really enjoy the financial education I get from investing (and from the mistakes I make along the way) as well as discussions with other experienced investors such as yourself.

Thanks for your opinion Sterling, highly appreciate you stopping by.