On this P2P lending glossary page you’ll find all the important terms you’ll encounter as an investor in P2P lending platforms around the world, with Mintos being my favorite platform. If there are any other terms I missed out on, let me know and I’ll add them in.

AML – Anti-Money Laundering. It refers to a number of policies that governments, banks, and financial institutions have to abide by. They are obligated to proactively monitor clients and new customers so corruption and money laundry can be prevented. They also have to report any kind of financial crime. When you as an investor are asked to supply picture id, address id and documentation on where the funds you are investing are coming from by e.g. supplying bank statements and copies of your paychecks, this is part of the AML procedures.

Annuity Type Loan – a loan in which both the loan interest and the principal will be paid periodically

Auto Invest – a tool for automated purchases of Claims on the Platform, functioning according to the User’s selected settings and used by the User to purchase Claims on his/her own behalf in accordance with the selected settings.

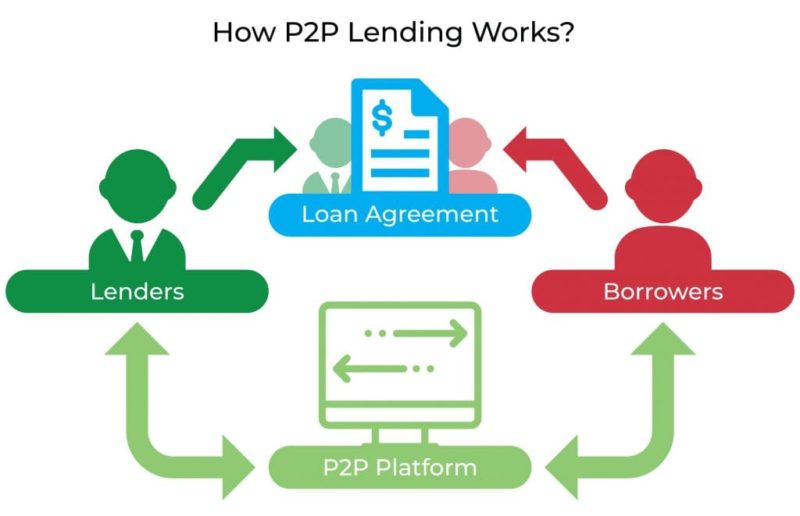

Borrower – a natural person or legal entity, wherewith the Loan Originator has concluded a Loan Agreement

Borrower APR – Annual Percentage Rate (APR) is the cost of credit as a yearly rate. It is designed to accurately disclose the true cost of credit and provide a standard basis of comparison for the costs of credit.

Bridge Loan – a short-term loan used until permanent financing is secured, or current obligations met. It provides immediate cash flow required to achieve a specific target, such as enhancing the value of the property or selling the underlying asset

Bullet Type Loan – a loan in which the loan interest will be paid periodically, with the principal amount being paid at the end of the loan period

Business Loan – a loan used to cover day-to-day expenses of the firm, acquisition of goods or equipment, business expansion, pending obligations, etc.

Buyback Guarantee – a buyback guarantee is a guarantee usually issued by the loan originator to the investor for a particular loan, that confirms the loan originator will repurchase the loan from the investor if that particular loan is delayed by more than a particular number of days, typically 60 days.

Cash Drag – money sitting in your P2P lending account that is not being lent. This is usually due to the platform not being able to offer any loans that match your Auto Invest criteria.

Crowdfunding – financing a project through a crowd of people instead of the traditional route of bank loans.

Crowdlending – a form of investment in which a group of people lend money to individuals or companies in exchange for interest, usually through an online platform.

Default rate / Delinquency Rate – the ratio between the value of defaulted loans and the value of the total loan portfolio.

Development Loan – a loan used to finance the construction or planning process of a project

First ranking mortgage – A lender of a first ranking mortgage is the lender that has the first right to proceeds from the forced sale of the property.

Full Bullet Type Loan – a loan in which both the interest and the principal will be paid at the end of the loan period

Installment Loan – a loan that is repaid through a set number of scheduled payments or installments; the minimum number of payments is usually limited to two. The loan term may last between a few months to 30 years.

Invoice Financing (also factoring) – a way for businesses to borrow money against the amounts due from customers’ invoices. When a business sells a product or service to a customer or another business, it often happens on credit in the form of an invoice with a number of days until the amount owed is due.

KYC – Know Your Customer, alternatively known as know your client or simply KYC, is the process of a business verifying the identity of its clients and assessing their suitability, along with the potential risks of illegal intentions towards the business relationship.

Loan Agreement – a loan, lease, credit agreement or a financial arrangement of different nature concluded between the Loan Originator and the Borrower.

Loan Originator – a lending company which is the Creditor, who, in compliance with the co-operation agreement concluded between the Creditor and the Platform, has authorized the Platform to transfer the Loan Originator’s Claims towards the Borrower, by using the Platform, and on behalf of the Creditor, to take other steps prescribed in the Agreement and in the Assignment Agreement.

Loan-to-Value (LTV) – refers to a ratio between a loan amount and the collateral’s market value. An LTV ratio of 50% would mean that collateral’s value is twice that of the loan.

Payday Loan – a small, short-term unsecured loan which is sometimes referred to as a “cash advance”. Payday loans require the consumer to have a previous payroll or income, employment records, and a checking account. The repayment of these loans is not necessarily linked to the borrower’s payday.

Primary market – market in which we investors purchase loans or shares from the platform or loan originator.

Principal – the amount of money you originally put into your investment and now earn interest on in return. When you borrow money, it refers to the amount of money you borrow, excluding interest payments and fees.

Reverse Auction – In a conventional auction each bidder makes an individual judgement on how much the item is worth to them and bids up to that limit. The item is then won by the person who valuers it highest. In a conventional auction items usually go for above the reserve price; that’s kind of the point. So in a reverse auction for a loan each lender decides the minimum rate they are willing to accept from that borrower and the loan is funded by the lender(s) who are prepared to lend at the lowest rate.

ROI – Return on investment (ROI) is a financial metric used to analyze the efficiency of an investment. ROI = profit from an investment / investment cost, and is usually expressed as a percentage.

Secondary market – a facility that enables investors to trade loans between themselves. The secondary provides a mechanism to quickly sell your shares or loans for quick liquidity, and also provides a place to grab some good deals, since other investors might be offering shares or loans at a discount in order to achieve quick liquidity.

SEPA transfer – short for Single Euro Payments Area. It’s the newest format for cross-border Euro bank transfers. SEPA aims to make cross-border Euro transfers within this area equivalent to a domestic transfer within your own country. You should always use SEPA if available over wire transfers as they are faster and cheaper.

XIRR – a financial function that returns the internal rate of return (IRR) for a series of cash flows that occur at irregular intervals. It is commonly found in spreadsheet programs such as Microsoft Excel.

Thank you for sharing Jean !

In Mintos, I see a field called ‘Borrower APR’.

Could you add it to the list. And also indicate if it is better to invest in high ‘Borrower APR percentages or lower ones?

Thank you in advance

The general theory says that loans with higher interest rates are riskier.

So investors can use this APR as another data point for their decision making. However, I don’t have any data proving that this is the case for Mintos loans.

Thank you Jean!

But then, if there are 2 loans exactly the same (interest, duration, loan originator, country, etc..), where only the Borrower APR percentage differs, from a return on investment point of view, is it better to invest in a high Borrower APR (let’s say 250 %) ? Or in a low Borrower APR (let’s say 80 %) ?

Thank you again for clarifying this 🙂

I would personally choose the lower APR. The borrower APR does not affect you directly, however a higher APR might be an indication that the borrower was in a really bad situation when he took out the loan, possibly meaning that he would be less likely to repay that loan. But it’s not that straightforward anyway.

Cristal clear! Thank you 🙂