Many online businesses use Stripe to collect payments for their products, as an alternative to PayPal or other payment gateways.

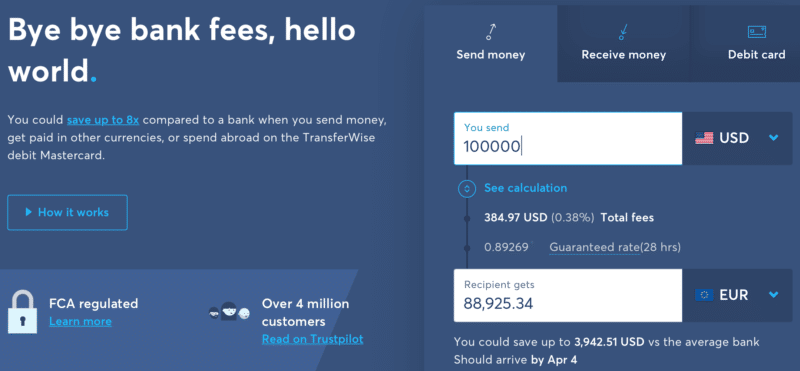

If you’re one of the many online businesses that sells in USD but has its local bank accounts in another currency (such as Euro) you will be losing money every time you transfer due to exchange fees from your bank.

A better alternative would be to set up a Wise Borderless account then link it up to Stripe as your bank account, using the USD account details provided by Wise in your Borderless account.

You can then withdraw USD at any point from Stripe and it will be deposited into your Wise account at no extra charge on either end. Note that for European companies Stripe charges a 1% fee on withdrawals in USD, which I find unnecessary and abusive.

Hi Jean, thank you for this post, was looking for such solution for a while. I have a few questions and would greatly appreciate if you could help, since it’s not quite obvious how to do what you suggest:

1. Do I have to choose an “international wire transfer” option in 2Checkout for that?

2. If yes, what did you use as a bank name? Because in Transferwise borderless account details there is no information about bank itself. It says Transferwise and then goes the address.

3. If it’s still yes, what did you use for Bank Account/IBAN? Cause again in borderless account details there is no such thing per se. I can just guess that it means “Wire transfer number”, but then I don’t know in which field should I paste my “Account number”

I’m just not sure if I’m seeing the same thing you meant in your article.

Thank you.

Sounds good. So, are you sure does 2checkout accept Transferwise? Thank you!

Yes since Transferwise Borderless gives you the US bank account details that you can then input into your 2Checkout account.