The online crowdfunding arena now touches a vast number of investment sectors. As you likely well know, this covers everything from real estate, consumer and business loans, development financing, and even fine art. With that said, a rather interesting sector that is yet to fully take-off is that of litigation crowdfunding.

This is where you will be – alongside your fellow crowdfunding platform members, financing legal cases. In return – and on the proviso that legal proceedings are financially successful, you as an investor will be entitled to your share.

If you’re keen to find out more about this somewhat innovative crowdfunding opportunity, I welcome you to read my in-depth AxiaFunder Review. I cover each and every metric that I think you should consider before taking the plunge – such as how AxiaFunder works, what types of cases you can invest in, expected returns, and of course – the underlying risks involved.

What is AxiaFunder?

Founded in 2016, AxiaFunder is an online crowdfunding platform that specializes exclusively in litigation finance. Before I go any further, it is relevant for me to quickly outline the fundamentals of what litigation finance actually is – as it might be something you haven’t previously come across.

In its most basic form, litigation finance allows those seeking financial damages through the courts to fund their claim when they are unable to do so themselves.

For example:

- Let’s suppose that you were involved in a major car accident

- Your insurance company offers you a settlement, but you feel it is significantly lower than what you are entitled to

- As such, you want to take the insurance company to court to get what you think you are entitled to. But, unfortunately, you are unable to afford the legal fees

- Therefore, you seek the services of a litigation finance company

- If the respective firm takes the case on, they will cover all of your fees

- If the case is successful, the firm will get a share of any proceeds

- If the case is unsuccessful, you will not owe anything to the litigation finance provider – so from your perspective, it’s a win-to-win situation

The above example, although arbitrary, is a perfect illustration of the niche that AxiaFunder is involved in. However, from your perspective, you will be using the platform as an alternative investment vehicle. That is to say, AxiaFunder will post funding opportunities on its platform, and allow you to invest your own money into the specific case.

AxiaFunder Case Statistics

According to AxiaFunder, the platform has thus far hosted 9 litigation cases on its platform. Of this, 7 cases are still ongoing. The remaining two, as per AxiaFunder, were successful. It notes that each case made a return of 43% and 94%. This figure is based on the ‘net investor return’, meaning that this is after fees.

AxiaFunder says that it only invests in cases that have a favourable expected outcome for investors of at least 70 percent.

Often its cases are settled before they go to trial meaning investors are typically paid before a claimant, further improving returns.

How Does AxiaFunder Work?

The end-to-end investment process is actually relatively straight forward at AxiaFunder. To help clear the mist, below I outline the main steps involved.

Step 1: Vetting Process

First and foremost, AxiaFunder will receive funding requests from the claimant. This will either be directly from the claimant themselves (either an individual or company) or through the claimant’s lawyer. Either way, the team at AxiaFunder will then perform enhanced due diligence on the case. In simple terms, it wants to know whether or not the case has a good chance of winning, and ultimately – whether it is worth taking on.

There are some important metrics involved in the pre-vetting stage carried out by AxiaFunder. For example, the platform notes that it targets a pre-settlement or win probability of 65% or more. It will only take on cases with strong legal merit, and those that are ATE insured.

For those unaware, After-the-Event (ATE) insurance is often taken out by claimants to ensure that they are not liable for adverse court costs. In Layman’s terms, this means that the claimant will not need to pay any costs if the claim is unsuccessful. However, as I briefly cover later, ATE insurance is a 100% guarantee against adverse costs, as there is always the risk of the insurance provider refusing to payout.

The pre-vetting team at AxiaFunder will also look at the credentials of the claimant’s legal team, and whether or not the claim is realistically enforceable. Regarding the latter, this means whether or not the defendant will actually be able to pay the damages if the case is successful. Taking all of the above into account, AxiaFunder claims that just 1 out of every 10 applications it receives makes its way to the platform.

Step 2: Offer of Investment

Once the team at AxiaFunder decides to take a litigation case on, it will then appear on its platform. That is to say, you and your fellow AxiaFunder users will have the opportunity to make an investment into the case. In terms of minimums, AxiaFunder notes that this usually stands at £500, although “this may be higher or lower in certain instances”.

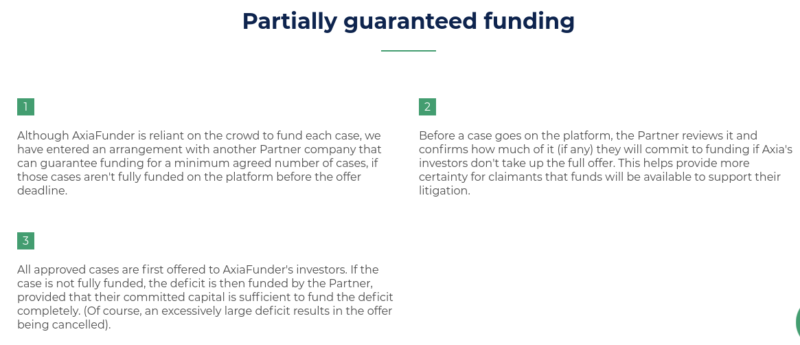

As such, each deal will come with a minimum and maximum investment threshold, so you will need to check this before proceeding. Now, I should note that AxiaFunder hopes to meet the entire funding amount from its members. However, if this isn’t possible, the platform has an agreement with a third-party that is able to cover some of the shortfall.

I say ‘some’, as the third-party is limited in how much it can invest. In other words, if the shortfall is significant, the crowdfunding opportunity will subsequently be canceled.

Step 3: SPV Structure

It is also important that you have a firm understanding of how your AxiaFunder investment is structured. In a similar nature to UK real estate crowdfunding platforms, the team at AxiaFunder have opted for Special Purpose Vehicles – or simply SPVs. In simple terms, SPVs permit ownership across several parties. In fact, if the number of investors surpasses four, SPVs is often the most efficient way forward.

From your perspective as an investor, the SPV is simply a legal document that ensures you get ‘your share’ of any proceedings. That is to say, if the case is successful, you will be entitled to your share of court proceedings – proportionate to the size of your investment into the SPV.

Similarly, the SPV also ensures that were AxiaFunder to go bust, you would still retain proportional ownership of the litigation case in question. After all, AxiaFunder is merely a third-party crowdfunding platform, and NOT a team of lawyers or solicitors that personally take on the initiation cases themselves.

Step 4: The Waiting Game

Once the litigation case has been funded in its entirety, legal proceedings begin. Unfortunately, this is the point where you simply need to forget about your investment, as there really is no knowing how long the case will take to settle. In the vast majority of occasions, AxiaFunder notes that the types of cases that it takes on are typically pre-settled out of court.

This will, of course, ensure that you stand a good chance of getting your money much sooner – as opposed to having to go through the long and drawn-out process of court proceedings. With that said, it is important to remember that not only is there no guarantee that the case will be settled outside of court, but that the case will actually be successful.

As a result, there really is no hard and fast rule as to how long you should expect to wait before getting an update on the case you have invested in. At the very least, AxiaFunder explains that it expects its cases to mature in 24-36 months, but again, it could be much longer than this.

Types of Litigation Cases Taken on by AxiaFunder

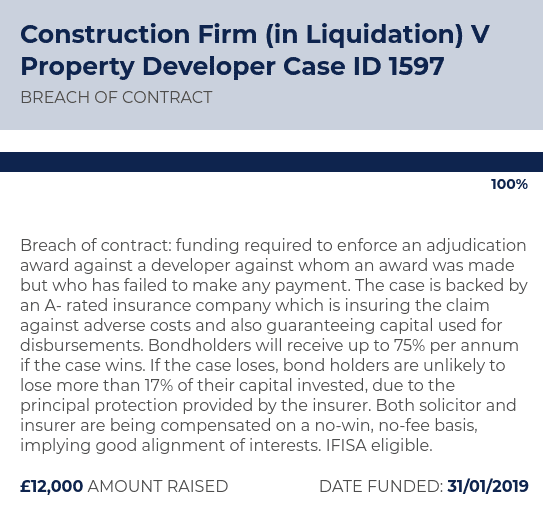

So now that I have covered the ins and outs of how AxiaFunder works, we now need to take a closer look at the types of litigation cases taken on by the platform. As to date, just 9 cases have made it through the door, it makes sense for me to give a few examples of previously funded cases.

Example 1: Alleged Misappropriation of High-Value Property Development Opportunity by Director

- In this particular funding case, the claimants (of which there are 9 in total) allege that a company director misappropriated a property development deal for personal gain.

- The value of the claim stands at £19 million.

- In total, the platform raised the full amount of £500,000 across 46 individual investors

- The case is still ongoing

Example 2: Breach of Employment Contract

- In this particular funding case, the claimant alleges that they sourced more than $200 million worth of capital for an institutional client, which the client is refusing to settle

- With that in mind, the claimant is seeking damages in excess of $10 million

- In total, just £40,000 worth of funding was required from AxiaFunder members, all of which was met

- Just 15 members got a look in on this particular deal

- The case is still ongoing

Example 3: Francovich Claim (breach of EU Law).

- In this particular funding case, the claimant alleges that VAT was inappropriately charged by an EU member state.

- Although the case notes do not outline the total amount of damages being sought, it is likely to be substantial when you consider the funding amount of £209,720.

- 81 members got a look in on this particular deal

- The case is still ongoing

As you can see from the above, the types of litigation cases brought forward to AxiaFunder are vast. On the flip side, it is somewhat concerning that such little cases have made it on to the platform. The reason I say this is that this is going to limit the number of opportunities that you have at your disposal.

This is especially the case when you see that AxiaFunder suggests that investors should diversify across at least 10 cases. At the time of writing, this wouldn’t be possible as just 9 cases have made the cut!

How Much can you Make (and Lose) at AxiaFunder?

According to AxiaFunder, investors can expect to make between 20-30% per year, which is obviously huge. However, it remains to be seen how such a figure can be presented when there are so few cases to invest in.

With that in mind, you will need to assess the merits of each and every opportunity individually, as opposed to viewing AxiaFunder as an ongoing investment stream.

At the other end of the spectrum, it is important to remember that there is no guarantee that your invested litigation case will be successful. That is to say, if the claimant does win their anticipated damages, you will effectively lose your principal.

AxiaFunder Fees

As is the case with all crowdfunding platforms, AxiaFunder is in the business of making money. It does so in two ways, which I outline below.

- Upfront Fee: Irrespective of whether or not the litigation claim is successful, AxiaFunder always takes an upfront free. This is taken from the amount of money that is raised on the platform – and is typically between 7-10%. For example, if the investment opportunity raises £200,000, and 7% is charged, AxiaFunder will collect £14,000. The platform notes that the variable-rate can exceed 10% if the funding value is small. As such, you will need to check this in the case funding portfolio for the specific deal you are interested in.

- Success Fee: The second fee that AxiaFunder charges is with respect to a successful litigation case. This stands at a whopping 20% of the net returns from a case. For example, if the case yields £1 million after all fees, AxiaFund would collect £200,000. This is taken from the SPV, so anything left will then be distributed to you and your fellow investors. In this example, that would stand at £800,000.

Is AxiaFunder Safe?

In terms of safety, the first risk that you need to consider is that you could lose your entire investment by means of an unsuccessful case.

There are other risks that also need to be considered, too.

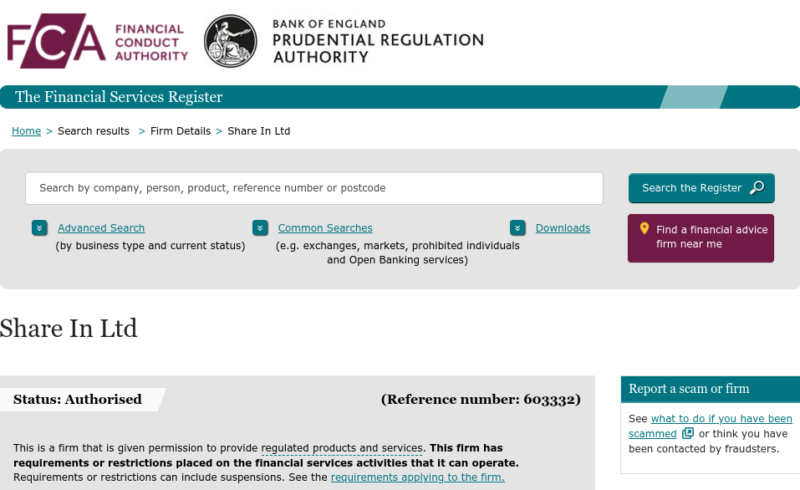

For example, although through its trading name – Champerty Limited (representative of Share In Ltd), the platform is authorized by the UK’s Financial Conduct Authority (FCA), your investments are not covered by the Financial Services Compensation Scheme (FSCS).

This means that were AxiaFunder to go bust, your money could be at risk. However, it is also important to remember that your investment will be injected into an SPV, which does entitle you to ownership of the litigation case in the event of a collapse.

Crucially, there is also the risk that you could lose more than you originally invested if a case is lost. This is because although all claimants are required to obtain ATE insurance (I discuss this in more detail further up), there is always the chance that the respective insurer will refuse to pay out. In the unlikely event that this does happen, AxiaFunder notes that you could be liable for up to twice the amount invested.

All in all, these risks are part-and-parcel with the stated annualized returns of between 20-30%. As such, if you don’t feel comfortable with the possibility of losing money – or even losing more than you initially invested, AxiaFunder is not for you.

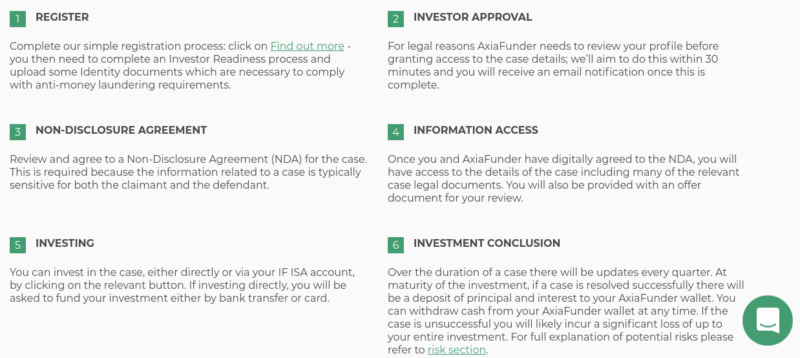

Getting Started at AxiaFunder

If you do like the sound of AxiaFunder and you wish to make an investment, below I explain the required steps that you will need to take.

Register

To get the ball rolling, you will need to visit the AxiaFunder website and register an account. As is standard with all crowdfunding sites, the platform will need to collect some personal information from. you This will be the usual, such as your name, address, date of birth, net worth bracket, and historical experience with investments.

Take note, in terms of eligibility, AxiaFunder specifically mentions the UK, Austria, Belgium, Ireland, Netherlands, France and Germany. However, you might still stand a chance of being approved if you are based in an alternative country. If this is the case, AxiaFunder requires you to contact them directly to see if bespoke arrangements can be made.

Verification

To ensure the platform complies with anti-money laundering laws, all AxiaFunder members are required to submit ID. This will need to be a passport. The platform notes that it is usually able to verify your identity within 30 minutes.

Sign Non-Disclosure Agreement (NDA)

As is standard practice in the litigation finance arena, you will need to sign a non-disclosure agreement (NDA). This is to ensure that you do not divulge sensitive information related to any of the cases hosted at the platform.

Funding

Finally, you will then be asked to add money to your AxiaFunder wallet. You can do this with a debit card or through a bank transfer. It’s best to only deposit the amount that you plan to invest.

AxiaFunder Track Record

AxiaFunder, the UK’s first for-profit litigation funding platform, has so far won two cases.

The platform says it has now been able to return 94 percent of disputed funds to investors.

Despite market volatility in the wake of COVID-19, litigation funding offers retail and institutional investors an opportunity to diversify their investment portfolio. The next case for the platform is against an EU Member state for a breach of EU law and AxiaFunder says investors can expect returns of 5.5x if the case wins at trial.

AxiaFunder’s latest round of cases was fully funded less than 24 hours after the launch of its marketing campaign—a positive sign for the popularity of the platform.

Since its launch in November 2018, the platform has raised £775,000 of litigation funding for six commercial cases and recently closed an equity round of over £250,000 of working capital hosted by the crowdfunding platform Seedrs.

AxiaFunder Review: The Verdict?

In summary, litigation funding is an interesting development in the crowdfunding space. One of its main appeals is that in theory, the success (or failure) of your investment has virtually no correlation to the wider economy. In other words, irrespective of how the stock markets are performing, this should not impact your ability to make money.

Here’s what AxiaFunder CEO Cormac Leech had to say about this lack of correlation with other asset classes:

Unlike equities, litigation funding is uncorrelated to financial markets and the economy, continuing to generate healthy returns to investors while many other assets classes are underperforming in the current economic climate.

On the one hand, AxiaFunder does have the potential to yield very high returns – especially its advisory ROI of 20-30% per year. However, there is, of course, no guarantees that you will make this much. On the contrary, the risks are significantly higher.

After all, you are relying solely on the judgement of the team at AxiaFunder to select suitable cases, as well as the capabilities of the respective legal team. Moreover, with just 9 cases available for funding to date (and none at the time of writing this review), your investment opportunities are going to be limited.

Nevertheless, if you do proceed to join the platform, just make sure that you have a firm understanding of the underlying risks.

So far I have a very good impression of the platform and I like the idea behind it. I also had CEO Cormac Leech on my Mastermind.fm podcast to discuss AxiaFunder and litigation funding as well as the risks involved, so I highly recommend you check that episode out for more information about this platform.

Summary

I found the concept of litigation funding quite fascinating. There is the possibility of helping people to fight big and powerful corporate entities that wronged them, and make money along the way, which sounds like a strong win-win to me.

AxiaFunder itself is quite a new platform, so as the months and years go by they should be able to show a good record of closed cases and start building a more accurate historical rate of return based on their own results with the cases closed.

Pros

- Innovative asset class

- Strong management team

- High potential returns

Cons

- Only UK-based lawsuits, so lacking European-wide diversification

- No secondary market concept- a less liquid investment

it is an excellent compilation made by you .brief and deep,informations,argued,nice job.thanks. I CHOOSE INVESTING