Futures operate in a multi-trillion dollar industry. They are complex financial instruments that allow you to speculate on whether the price of an asset will be higher or lower in the future.

Futures operate in a multi-trillion dollar industry. They are complex financial instruments that allow you to speculate on whether the price of an asset will be higher or lower in the future.

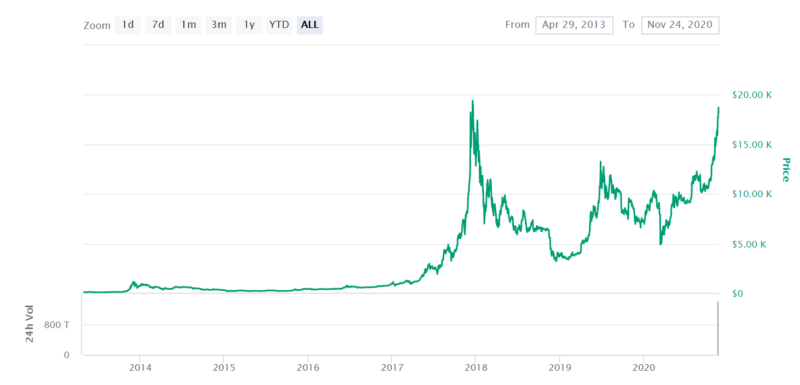

While futures are particularly common when trading commodities like gold, oil, and wheat – they have since reached the Bitcoin scene. Whether or not you should access Bitcoin futures will depend on your financial goals, understanding of the market, and how much risk you seek to take.

See also: Best Exchanges for Spot Trading Crypto

To help clear the mist, this guide will tell you everything you need to know about Bitcoin futures. I’ll explain how this segment of the crypto investment scene works, what potential risks and rewards you need to consider, and how you can get started with a Bitcoin futures trade today.

Here’s a list of the best crypto futures platforms that we’ll be considering in this article:

What are Bitcoin Futures?

Bitcoin futures are sophisticated financial products. As such, it makes sense that I first explain how a futures trade itself actually works.

As the name suggests, by buying or selling a futures contract you are looking to predict the future price of an asset. Whether that’s gold, oil, stocks, or Bitcoin – you need to speculate on whether you think the contract will expire above or below the ‘strike price’.

The strike price is what the markets believe the price of the asset will be when the contracts expire. In most cases, a futures contract will have a duration of three months, although shorter and longer periods are possible.

For example, the current price of Bitcoin might be $17,500 – and a 3-month futures contract might have a strike price of $16,800. That would imply a bearish future sentiment on the price of Bitcoin.

Put simply, it is your job to predict whether the Bitcoin futures contract will close at a price higher or lower than $16,800 in three months’ time. If you speculate correctly, you make a profit. If you don’t, you will make a financial loss.

Let me run through a quick example so that you have a clear idea of what a Bitcoin futures contract looks like:

- You are looking at a 3-month Bitcoin futures contract with a strike price of $18,000

- You think that in three months, Bitcoin will be worth more than $18,000 – so you go ‘long’

- Each futures contract is worth $500 – and you buy 5 contracts in total

- When the futures expire, Bitcoin is worth $20,000

- This is $2,000 higher than the strike price of $18,000

- You were holding 5 contracts in total – so your all-in profit is $10,000

It is important to note that you are obligated to buy or sell the underlying asset when the futures contract expires. However, you can usually offload your futures before they expire, which allows you to trade in a more flexible, risk-averse manner.

For example, you might want to lock in your profit early. Or, you might want to cut your losses on a trade that you feel is all-but-certain to result in greater losses at the point of expiry.

I should also note that futures allow you to go ‘short’. This means that you are speculating on the future value of Bitcoin going down.

Benefits of Trading Bitcoin Futures

Bitcoin futures come with various benefits that allow you to achieve a number of trading goals.

These include:

Hedging

The original purpose of futures trading was to allow producers to hedge against fluctuations in the prices of their products. In particular, this acted as a means for farmers to insure themselves from falling prices.

For example, let’s suppose that the price of wheat is currently trading at above-average levels. In order for farmers to benefit from this increased price for a longer period, they can short-sell some wheat futures contracts.

In doing so, only one of two things can happen.

- If the value of wheat continues to increase then farmers make higher margins when they sell their produce. But, they will make a loss on their wheat futures trade.

- Or, if the price of wheat falls then farmers will make a smaller profit margin when they sell their produce. But, they will make a profit from their wheat futures trade.

- Either way, the outcome is a break-even situation.

As a result, Bitcoin futures allow you to hedge a position if you feel that the markets might temporarily move against you. By using Bitcoin futures to meet this objective, you only need to put a small margin upfront to hedge your portfolio. More on this later.

You might be wondering how this applies to the Bitcoin space and who would have a big interest to hedge with crypto prices.

The biggest interest in futures for the purposes of hedging comes from Bitcoin miners. These miners, just like agricultural farmers, have invested significant capital in their production facilities and have committed long term to the production of blocks on the Bitcoin blockchain, in return reaping block rewards.

However, since the price of Bitcoin can fluctuate a lot, the dollar equivalent of the block rewards can be very unpredictable. This poses a problem for miners who have fixed running costs every month that they have to pay (electricity, cooling equipment, staff, building maintenance etc). Therefore, they have to use futures to protect themselves from getting into a situation where their costs overrun their income for a sustained period of time, which would lead them into insolvency.

A low-Cost way of Short-Selling

Moving more into the domain of traders rather than producers, we find that short-selling is a popular use-case for futures contracts. If you wanted to short-sell Bitcoin, you would likely need to use a platform that supports Contracts for Difference (CFDs).

This is a fee that is charged on all CFD markets irrespective of the broker or asset class. It is charged for every day that you keep the position open. This means that short-selling Bitcoin via CFDs is only suitable for shorter-term trades.

With that being said, Bitcoin futures offer a more cost-effective way of shorting the digital currency when compared to CFDs. This is because you can keep the futures contract open for the full three months and only pay a settlement fee.

Trade on Margin

An additional characteristic of Bitcoin futures is that you can often access the market with a small amount of capital. This is because you can buy or sell Bitcoin futures on margin.

For those unaware, margin allows you to trade with more than you have in your brokerage account. For example, if the provider allows you to trade Bitcoin with a 10% margin, a $2,000 position would require an available account balance of just $200.

Here’s how margin trading on Bitcoin futures can amplify your gains.

- You want to go long on 3-month Bitcoin futures

- Each futures contract is worth the BTC equivalent of $1,000

- You want to buy 10 contracts – taking your total stake to $10,000

- However, your chosen provider allows you to access Bitcoin futures with a margin of 5%

- This means that of a $10,000 stake – you only need to continue $500

This $500 is the margin that you put forward. It acts as a security deposit, meaning that you can lose it in full if your trade goes against you by a certain amount.

If, for example, your margin amounted to 5%, then you will lose it if your position goes in the red by 5%. This is known as being ‘liquidated’, which is why you need to tread with caution when trading Bitcoin futures on margin.

Exit at Any Time

There is often a misconception that you need to hold onto a Bitcoin futures contract until it expires. This couldn’t be further from the truth – well in most cases anyway. As long as you are trading American-style options, you can cash out your position at any given time. More on this shortly.

What you Need to Know About Bitcoin Futures

Although I have already given you an overview of how Bitcoin futures work – alongside a simplified example, it is important to go a little bit more in depth about the specifics. Once again, this is because futures are complex financial instruments, so it is absolutely crucial that you know what you are doing before parting with your money.

Expiry Date

First and foremost, you need to understand when the Bitcoin futures expire. In the traditional futures scene, contracts usually last for 3 months and are settled on the third Friday of the respective month.

But, it is also possible to trade Bitcoin futures with a shorter duration of 1 week. Additionally, I have also seen Bitcoin futures with a 6-month expiry.

Furthermore, you can actually purchase a futures contract while it is still active. That is to say, you don’t need to enter the market before it goes live.

Strike Price

The strike price is the price of the futures contract set by the markets. In simple terms, this is the mid-point of the contract – meaning you need to determine whether the price of Bitcoin will finish higher or lower than this price.

The strike price will always be different from the current value of Bitcoin. This is because it is the price that markets believe Bitcoin will be worth when the contracts expire – whether that’s in 1,3 or 6 months’ time.

It is important to note that the strike price itself is determined on a demand and supply basis. That is to say, the exchange hosting the Bitcoin futures market has no say in what the contracts are priced at.

Long or Short

Once you know the contract expiry date and the strike price – you then need to determine whether you want to go long or short.

To reiterate, going long means that you think the futures contract will expire at a higher price than the strike price. And, going short means the opposite – meaning you think the price of Bitcoin will finish lower than the strike price.

American or European

As I briefly noted earlier, American futures contracts are what you should focus on – as they allow you to exit your position at any given time. Well, at any point between the time you buy the futures contract and the date in which they expire.

Now, the value of your futures contract will change on a second-by-second basis. This is no different from buying Bitcoin in the traditional sense or trading it via CFDs. However, the value of the futures contract is based on what the markets believe the price will be at the point of expiry.

In other words:

- You are long on Bitcoin at a strike price of $14,000

- Bitcoin was initially priced at $12,00 when you bought the contracts

- The current price of Bitcoin is now $13,500

- There are 2 weeks left before the futures contract expires

- Then it is likely that the value of your contracts are worth more than what you originally paid

On the other hand, European futures contracts do not afford you the luxury of cashing out before they expire. Instead, your fate is only determined at the point of expiry.

I would suggest avoiding European-style Bitcoin futures as there is no way for you to mitigate your risk. That is to say, your losses are virtually unlimited in the event that the trade goes against you by a considerable amount.

Contract Value

This is where things start to get a bit complex. The value of a Bitcoin futures contract is usually determined in BTC. For example, if you had access to the institutional Bitcoin futures market offered by CME – each contract is worth 5 BTC.

This means that – based on current prices of $18,000-ish, you would need to fork out $90,000 per contract. The good news is that there are a small selection of platforms that are suitable for retail clients that wish to stake smaller amounts.

Calculating Profits and Losses

There are several ways in which you can calculate your profits and losses when trading Bitcoin futures. In my view, the easiest to do this is work out the percentage gain/loss against your initial stake.

Let’s look at how this would work when trading Bitcoin futures at Coinbase.

- Let’s say that Coinbase is offering a 3-month strike price on Bitcoin of $18,000

- You want to go long on this trade and stake $500

- A few weeks before the contracts expire, Bitcoin is priced at $19,800

- This represents an increase of 10% above the strike price of $18,000

- You staked $500 in total, so your profit is $50

Now let’s look at what a losing trade would look like and how you would calculate these losses in real terms.

- This time, let’s say that you went short on Bitcoin – using the same figures as above

- You let the Bitcoin futures expire. When they do, the digital currency is priced at $20,500

- This is 13.8% above the strike price of $18,000

- As you went short, this means that you are 13.8% down

- On a stake of $500, you lost $69

- As such, $431 is returned to your account balance

By using the above calculations to quantify your profits and losses, the number of Bitcoin futures that you hold is somewhat irrelevant.

After all, platforms like Coinbase price the contracts in US dollars as opposed to BTC, which is far easier when it comes to assessing your potential gains.

Trading Bitcoin Futures on Margin

In a similar nature to CFDs, most Bitcoin futures markets allow you to trade on margin. This allows you to stake a lot more than you have available in your brokerage account.

Here’s an example of how combining leverage with Bitcoin futures works in practice:

- You are interested in trading a 1-month Bitcoin futures contract with a strike price of $19,000

- Bitcoin is currently priced at $18,500

- You decide to go long as you think Bitcoin will be worth more than $19,000 when the contracts expire

- You have $1,000 in your brokerage account and use the full amount at leverage of 50x

- This means that you are effectively trading Bitcoin futures with $50,000 worth of capital

Now let’s see what happens if your trade goes to plan:

- You let the Bitcoin futures expire

- When they do, the digital currency is worth $19,900

- This is 4.7% higher than the strike price of $19,000

- On a stake of $1,000, you would have made $47

- However, you applied leverage of 50x – so your total profit is $2,350 ($47 x 50x)

However, leveraged Bitcoin futures trades won’t always go in your favor. In fact, applying this much leverage is super high-risk. This is because you always stand the chance of having your trade liquidated.

This is when your trade goes against you by more than you put forward in margin. In the example above, your margin of $1,000 amounted to 2% of the total trade size (2% of $50,000). As such, if the price of Bitcoin fell 2% below the strike price of $19,000 – your chosen trading platform would be forced to close the position automatically. In doing so, you would have lost your $1,000 margin.

The only way to avoid this is to add more funds to your margin account. In most cases, your chosen broker will send you a ‘margin call’ when you are approaching the liquidation point. This usually comes in the form of an email.

Where to Trade Bitcoin Futures Online

I am hoping that you now have a firm understanding of what Bitcoin futures are, how they work, and what risks you need to consider before taking the plunge.

If this is the case and you are keen to explore the phenomenon further, below I discuss the best platforms to do this with.

Deribit – Leverage of up to 100x and Bitcoin Options Also Supported

An additional platform that is looking to compete in the ever-growing Bitcoin futures scene is Deribit. You can trade Bitcoin futures at a settlement fee of just 0.05% and there are several contract durations to choose from.

As Deribit does not support fiat currency deposits, this does make it somewhat cumbersome if you do not currently have Bitcoin to hand. Each futures contract at the platform is valued at $10 each, which is also fine for low-level traders.

See also: My in-depth Deribit review

After all, your position only needs to move against you by 1% and that’s it – you lose your margin in its entirety. I should also note that Deribit offers Bitcoin options. This is another trading angle to consider when speculating on the future value of Bitcoin.

Binance – Easy Bitcoin Futures

There is little to say about Binance that hasn’t been said already. It’s the exchange with the world’s biggest trading volume, and it also offers futures trading facilities.

See also: My in-depth review of Binance

You can use up to a whopping 125x leverage when trading futures on Binance.

Follow these steps to start trading on the Binance Futures platform:

- Deposit USDT, BUSD into your USDⓈ-M Futures account as margin, and other Coins e.g. BTC into your COIN-M Futures as margin

- Select the level of leverage to your preference

- Choose the appropriate order type (buy or sell)

- Indicate the number of contracts you wish to own

Bitfinex – Unique Bitcoin Futures

Bitfinex holds a reputation for being one of the largest cryptocurrency derivatives platforms in the online space. It is highly rated for offering a wide range of futures contracts for Bitcoin and other digital assets. In fact, Bitfinex was one of the first cryptocurrency exchanges to introduce Perpetual Swaps – which is a futures contract with no expiry.

These copy a margin-based spot market that tethers the contracts to the underlying price of the asset. You can also get higher leverage on Perpetual Swaps – of up to 100x. As for its conventional futures contracts – you can choose between three options:

- A Bitcoin Quanto has a fixed BTC multiplier – regardless of the price of the coin in USDT.

- A Linear contract is expressed in terms of the price of the underlying asset against that of XBT.

- An Inverse contract that is valued at a fixed amount of the quote currency. In the case of Bitcoin futures, this contact will be worth $1 of Bitcoin at all times.

Although leverage is available for these types of Bitcoin futures, limits are much lower when compared to Perpetual Swaps. Coming to commissions, Bitfinex offers -0.0250% as a maker rebate and 0.0750% as a taker fee for all Bitcoin products.

The minimum deposit is calculated based on the initial margin – which will vary based on the current price of BTC. Aside from Bitcoin, Bitfinex also offers support for 12 other cryptocurrencies, including Stellar, Cardano, Dogecoin, Ethereum, and more. The platform also offers access to an indices market – which covers all of its supported digital coins.

As you can see, the financial products offered on Bitfinex are mainly for experienced cryptocurrency traders to explore. If you fall into this category, then this platform offers heaps of potential trading opportunities in the alternative crypto market.

Bitcoin Futures: The Bottom Line

In summary, Bitcoin futures won’t be for everyone. This is because they are complex financial instruments that require an understanding not only of Bitcoin – but the futures market itself.

But, if you are prepared to put the legwork in and wish to access the Bitcoin trading scene in a more sophisticated manner – then futures might be worth considering.

As the contracts are American-style, you can cash out your position at any given time before they expire. Best of all, both the minimum deposit and order size is just $1.

Leave a Reply