If you want to trade cryptocurrencies online, you might be considering Binance. The exchange is now home to some of the largest trading volumes in the space. Much of this demand is due to this broker’s low commission policy and a vast offering of tradable instruments.

With that said, there are hundreds of cryptocurrency exchanges active in the online space – so it’s best to do some research before taking the plunge. To help you along the way, here I review the ins and outs of Binance. I cover everything from fees and commissions, supported coins, trading tools, and of course – the safety of your funds.

If you want to buy Bitcoin, Ethereum, Polkadot or any other crypto easily read the rest of the review as I explain how Binance works and the process of opening an account with this exchange.

What is Binance?

Binance is a third-party cryptocurrency exchange that allows you to buy, sell, and trade digital coins at the click of a button. Although the platform was only launched in 2017, it is now one of the largest in terms of trading volumes. At the time of writing this Binance review, this stood at well over $4.7 billion in the past 24 hours – as per CoinMarketCap.

The platform itself was founded by well-known cryptocurrency figure ‘CZ’ Changpeng Zhao. One of the main factors driving day and swing traders to Binance is that it offers some of the lowest fees and commissions in the space. This typically starts at a commission of 0.1% – which is charged at both ends of the trade.

With that being said, if you want to reduce your fees even further, you can do this by holding an allocation of Binance Coins (BNB) – which is the platform’s proprietary in-house token. When it comes to its target audience, it should be noted that Binance is more for active traders than long-term investors.

This is because Binance is an ‘exchange’ as opposed to a conventional broker. In other words, if you are simply looking to buy Bitcoin or Ethereum and hold on to the coins for several years – Binance won’t be for you. But, if you are looking to actively engage in the short-term buying and selling of cryptocurrencies with the view of making small, but frequent gains – Binance is well worth considering.

What can you Trade at Binance?

The core product offered by Binance is that of its cryptocurrency exchange arena. In other words, you will be speculating on the future direction of a particular pair.

Let’s take BTC/USDT as a prime example:

- BTC/USDT is a pair that consists of Bitcoin (BTC) and Tether (USDT)

- For simplicity, we’ll say that the pair is priced at $9,300

- By placing a buy order, you are speculating on the exchange rate of the pair increasing

- By placing a sell order, you are speculating on the exchange rate of the pair decreasing

- You place a buy order worth $500, and the pair increases to $9,765

- As this represents an increase of 5%, you will make a profit of $25 when you exit the position

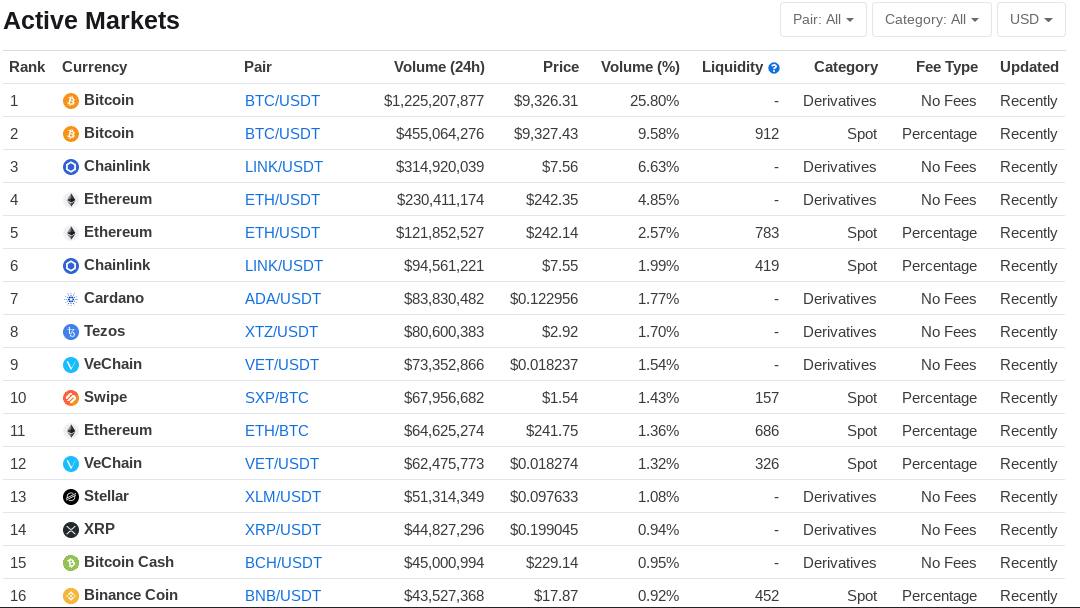

The above is just one example of a pair hosted by Binance. In total, CoinMarketCap states that Binance is home to 602 pairs, which is huge.

In terms of what cryptocurrencies you can trade, major players such as Bitcoin, Ethereum, XRP, Bitcoin Cash, and Litecoin are supported. But, the platform really stands out for its offering of low-cap cryptocurrencies, This includes everything from VITE, Siacoin, Enjin Coin, HyperCash, and dozens more.

It is also important to clarify that you can trade cryptocurrencies like Bitcoin against other coins like XRP. Or, like in the example above, you can trade cryptocurrencies against Tether – which is pegged to the US dollar. This ensures that you are able to speculate on the future value of your chosen cryptocurrency against the USD – which is the de-facto benchmark when valuing digital coins.

Listing each and every supported coin and pair is beyond the remit of this Binance review, so you can out the full list here.

Cryptocurrency Derivatives

On top of its core crypto-to-crypto exchange services, Binance has since entered the cryptocurrency derivatives market. This gives experienced traders exposure to the global cryptocurrency scene in a highly sophisticated manner. At the forefront of this is being able to speculate on the future value of three leading cryptocurrencies via leverage.

Known as ‘Binance Perpetual Futures Contracts’, these operate in a similar nature to conventional futures. However, the key difference is that the contracts never expire. As a result, the trade will remain in play indefinitely until you:

- Close it manually

- Your stop-loss or take-profit order is triggered

- You are liquidated (more on this below)

The main draw for experienced traders in the Binance derivative department is that you will be offered super-high leverage levels. For those unaware, this allows you to enter buy and sell positions with more than you have in your account. If you are based in the UK or Europe, leverage on cryptocurrency CFDs is actually capped at 1:2 if you are a retail client (non-professional trader).

However, the derivative products offered by Binance fall outside of these restrictions, not least because you are trading digital contracts that in theory – do not exist. As a result, Binance allows you to trade with leverage of up to 1:125 on Bitcoin futures. This figure is slightly less when accessing futures tied to Ethereum and Bitcoin Cash (1:75), albeit, this is still substantial nonetheless.

To put the aforementioned leverage figures into perspective, let’s look at a quick example. In doing so, I will illustrate how quickly both the risks and rewards can add up.

Example of Leverage at Binance: 1:125

Although everything at Binance is priced in the respective base currency (e.g. Bitcoin), in this example I will use US dollars. Otherwise, it will make it somewhat confusing to assess the reality of the risks.

- You want to access Bitcoin futures at Binance

- You have $500 in your account, and you are prepared to risk the full amount on your trade

- You think that the value will increase so you are going ‘long’ on BTC/USDT futures

- You apply the full leverage limit of 1:125 on the trade

As per the above, by staking $500 with leverage of 1:125, this means that the value of your order amounts to $62,500. In other words, both your profits and losses will be multiplied by a factor of 125x.

- So, if your BTC/USDT futures trade increase by 10%, you would ordinarily have made a profit of $50. This is because you staked $500, and 10% of this is $50.

- But, as you applied leverage of 1:125, your profit actually stands at $6,250. This is because your nominal profit of $50 is multiplied by 125x.

As lucrative as the above trade is, it is important for you to see what happens if the opposite occurred – a 10% loss.

- Ordinarily, at a stake of $500, a 10% reduction in the value of BTC/USDT would have resulted in a loss of $50

- However, we need to multiple this figure by 125x

- This would take your total loss to $6,250.

With that being said, you would only stand to lose this much if you had enough money in your ‘margin account’. This operates like a buffer to cover your potential losses. In most cases, you likely would have had your position closed automatically if the futures contract went against you by 0.8%.

This is because your stake of $500 – otherwise known as the ‘margin’ when trading with leverage, amounts to 0.8% of $62,500 – which is what your order was valued at.

Ultimately, you are best advised to leave cryptocurrency derivatives alone at Binance unless you are a seasoned trader. After all, you could lose a significant amount of money in a very short period of time.

Trading Fees and Commissions at Binance

As is the case with any online trading platform that you are thinking of joining, you first need to spend some time assessing the underlying fee structure. As you may well know, this centers on trading commissions in the cryptocurrency scene.

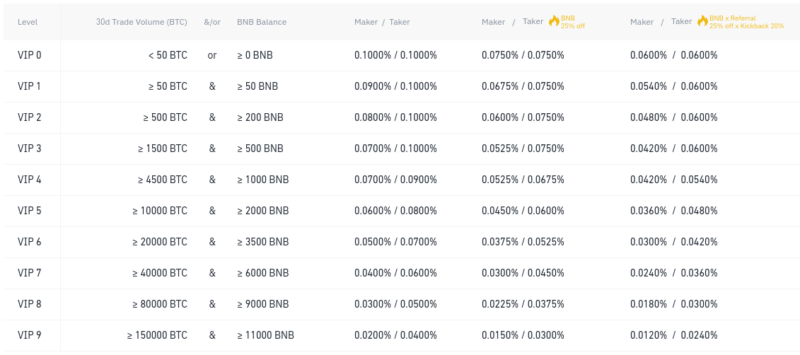

The platform actually uses a progressive fee system – meaning that your commission will go down as you trade more throughout the month.

With that said, unless you are planning to trade the equivalent of 50 BTC per month (which is approximately $467k at the time of writing), then you will pay a standard commission of 0.10%.

This is charged when you open the trade, and again when you close it. Crucially, even at its ‘most expensive’ rate, this makes Binance one of the most cost-effective cryptocurrency exchanges in the space. The lowest ‘market taker’ fee available at the platform is 0.0200%, albeit, you will need to trade over 150,000 BTC within a cumulative 30-day period to get this rate!

There are two other ways in which you can reduce your trading fees at Binance, which are:

- Market Maker: If you provide liquidity for Binance, you are defined as a ‘market maker’. In doing so, you will receive a rebate, based on the amount of liquidity you provide. Once again, this is only going to be an option if you are willing to put up a significant amount of money.

- BNB Token: By holding a balance of Binance Coins in your account, you can reduce your commission by 25%. This used to be 50%, and at a yet to be determined date in the future, will be reduced to 12.5%. Nevertheless, this effectively reduces your commission rate from 0.10% to 0.075%.

If making use of perpetual futures contracts at Binance, you will pay an entry-level commission of 0.0200%. This goes down as you trade more and more. Take note, the BNB Token only reduces your derivative fees by 10%.

Binance Trading Platform

As a highly sophisticated exchange that is tailored to those with the required skills and knowledge to trade online, Binance offers a variety of platforms to choose from.

Most traders will opt for its web-browser trading platform – meaning that you can access it at the click of a button. Alternatively, you also have the option of downloading proprietary software to your Windows or Mac device.

If you are the type of trader that likes to have access to your portfolio around the clock, Binance also offers a fully-fledged mobile app. This is available on Android and iOS mobile/tablet devices.

Deposits, Withdrawals, and Payments

When it comes to funding your account, Binance was originally a ‘crypto-only’ exchange. By this, I mean that you could only deposit and withdraw funds using a cryptocurrency.

However, some users now have the option of using a debit card to deposit funds.

So, if you want to use a Visa card, the following regions are supported as of July 2020:

- European Economic Area (EEA) countries

- Russia

- Ukraine

- UK

If you want to use a MasterCard, the following regions are supported:

- Brazil

- Colombia

- Czech Republic

- France

- Germany

- Indonesia

- Italy

- Latvia

- Luxembourg

- Mexico

- Netherlands

- Norway

- Poland

- Russia

- Slovakia

- Slovenia

- Spain

- Switzerland

- Turkey

- UK

- Ukraine

If you do opt for the Visa/MasterCard route, you will need to pay a fee. This stands at 3.5% of the transaction volume, with a minimum fee of $10 in place. If the underlying currency is anything other than the US dollar or Euro, then additional fees may apply.

On the one hand, this is slightly cheaper than the debit card fee charged by Coinbase, which stands at 3.99%.

When it comes to funding your account with a cryptocurrency, no deposit fees apply. When cashing your cryptocurrencies back out to your private wallet, you will pay a fee that is just above or below the current blockchain mining fee for the respective coin.

Is Binance Regulated?

One of the main questions that people ask of a cryptocurrency exchange is with respect to the safety of their funds. After all, the vast majority of the cryptocurrency trading arena operates in an unregulated manner. In the case of Binance, this is where things get a bit complex.

I say this, as there was a wide-spread misconception that Binance was regulated in the jurisdiction of Malta. That was until February 2020, where the Malta Financial Services Authority (MFSA) released a statement clarifying that Binance is not regulated in the country.

So that begs the question: Is Binance regulated? Well, from what I can make out, it seems that Binance as a group is not overseen by a specific licensing body. On the flip side, it also appears that some of the firm’s country-specific subsidiaries are ‘in the process’ of falling under the threshold of a national regulator.

For example:

- Binance’s UK wing ‘will be operated’ by Binance Markets Limited, which is itself regulated by the Financial Conduct Authorty (FCA).

- Binance Singapore has ‘applied’ for a license from the country’s regulator. CZ stated in February this year that “Binance’s Singapore entity has been in close touch with the local regulators”.

Ultimately, while Binance might claim that it complies with the local laws and regulations of each country that it operates in, it appears that the company itself is not licensed by a single body.

Security at Binance

So now that I have covered the platform’s regulatory standing (or lack of it), I now need to explore what the platform’s internal and external security practices are like.

Below I list some of the safeguards in place that ensure you are able to keep your account secure:

- Two-Factor Authentication (2FA): 2FA is crucial in keeping your Binance account away from the wrong hands. You will first need to set this up via Google Authentication or SMS. Thereon, every time you attempt to perform key account function, you will need to confirm a unique code that is sent/obtained from your phone.

- Authorized Devices: If you attempt to sign in from a device that Binance does not recognize, you will be asked to verify it via email confirmation.

- Address Management: By switching this feature on, you will only be able to withdraw funds to wallet addresses that you have approved. If you then want to add a new one, this needs to be confirmed via email.

- Anti-Phishing Code: To ensure that you are not the victim of phishing, you can pre-select a unique code that should be included in all email notifications. If you don’t see the code, then you can be sure that the email is not genuinely from Binance.

On top of the above, Binance itself has a range of internal security practices that it utilizes to keep your funds safe. This includes:

- Cold Storage: The vast bulk of client funds at Binance are held in cold storage. In simple terms, this means that the funds are stored in offline wallets, meaning that they are never exposed to online servers. The remaining ‘hot’ balance is to ensure that Binance is able to facilitate withdrawals.

- SAFU: The Secure Asset Fund for Users (SAFU) at Binance operates as a reserve pot. That is to say, the firm will allocate a percentage of its profits into the pot, which is there to protect clients in the event of a third-party hack.

- Security Team: The team at Binance has a dedicated security and anti-fraud team that works around the clock. The overarching aim of the team is to detect and prevent suspicious activity, and keep criminality away from the platform.

All in all, the security practices employed by Binance are second-to-none. However, that isn’t to say that the platform is immune from malpractice. On the contrary, Binance was actually hacked for $40 million worth of digital assets in the past.

But, the good news is that no clients lost any personal funds, as everything was covered by Binance. With that said, it is important to remember that your funds are never 100% safe when trading at Binance, so do keep this in mind.

Alternatives to Binance

Binance is one of the world’s biggest exchanges, so it makes sense to compare it with other big exchanges. If you’re looking for Binance alternatives the one I would recommend is Coinbase.

The Verdict?

All in all, Binance is arguably one of the best options out there if you are looking to actively trade cryptocurrencies. You will have access to over 600 pairs, and highly competitive commissions that start at 0.10%.

The platform is home to some of the largest trading volumes in the space, so liquidity should never be an issue – at least in the case of major digital currencies. The only slight caveat is that Binance as a single entity is not regulated.

Summary

Binance is one of the biggest and quickest success stories in the crypto space in recent years, led by the charismatic CEO and founder Changpeng Zhao. While there are questions about how and where the exchange is regulated, it has taken important steps in establishing itself in tightly regulated markets such as those of the United States and United Kingdom in recent months.

Pros

- Huge volumes

- Big list of tradeable assets

- Respects customer privacy

- Several fiat onramps and offramps

Cons

- Not clear where the company is based

- Not regulated

Binance is reliable and safe. due to my experience in trading, i have always have my time to research from experts and public poll, i discovered that am not the only person that love using their platform, most expert bitcoin investment company use binance for crypto trading for their numerous clients in trading so why shouldn’t i do same. Although crypto trading or investment is a high return investment when you deal with the high company that uses the right platform like binance.

Agreed, while there is some obscurity on where the company is really based, there is no doubting the fact that Binance is the world’s biggest exchange by trading volume and that the fees are extremely low.