If you are looking to buy, sell, and trade cryptocurrencies on your smartphone, you’ll be pleased to know that there are heaps of options in the market. But, with so much choice, this can make it difficult to know which trading app to go with.

For example, are you looking to focus on an app that offers industry-leading fees, or are you more concerned about trading a specific pair? Either way, you need to perform in-depth research before taking the plunge.

Here are my top suggestions right away:

Spot crypto trading apps

- eToro – Best all-round crypto trading app

- Binance – Best range of tradable pairs

- Kraken – most popular exchange in Europe

- Coinbase – most recognised global exchange

Exchange and Earn Interest

Tokenized Stocks

Trading Bots

Buy Gift Cards, Vouchers and Top Up Airtime

Debit cards

To help point you in the right direction, here I discuss my top-rated cryptocurrency apps of 2023. On top of this, I also explain some of the key metrics that you need to look out for prior to selecting a provider.

Choosing a Suitable Platform

Before I delve into the best crypto trading apps, it is worth me quickly outlining what you need to look out for when searching for a broker/exchange that meets your needs.

In my view, the most important metrics are as follows:

Ownership or CFDs?

First and foremost, you need to assess what your short or long-term objective is. For example, are you looking to buy leading cryptocurrencies such as Bitcoin or Ethereum, and then hold on to the coins for several months or years? If so, you might be better suited for a cryptocurrency broker that accepts everyday payment methods.

Alternatively, if you are looking to actively trade cryptocurrencies to make frequent profits from every-changing price movements, you might be more suited for a CFD trading platform. This is because CFD providers typically allow you to trade cryptocurrencies without paying any commissions. As such, it’s only the spread that you need to take into account.

Note: CFDs (Contracts-for-Differences) track the market price of an asset. This allows you to speculate on cryptocurrencies without you owning the coins. Instead, you are speculating on the future price of the cryptocurrency.

Regulation

Regulation is a bit of a grey area in the cryptocurrency trading space. If using a CFD provider, then it is all-but-certain that the platform will be heavily regulated.

For example, the likes of eToro, IG, and Plus500 all hold licenses with the UK’s Financial Conduct Authority (FCA) and the Australian Securities and Investments Commission (ASIC). Other reputable license issuers include the Cyprus Securities and Exchange Commission (CySEC) and the Monetary Authority of Singapore (MAS).

At the other end of the spectrum, conventional cryptocurrency trading exchanges like Binance still operate largely unregulated. This is somewhat surprising when you consider the billions of dollars worth of trading activity that goes through its books each and every day.

Read more: How to buy exposure to Bitcoin through a regular stock broker

However, I would argue that Binance is still worth considering, as it has industry-leading security practices.

Supported Pairs and Financial Instruments

The term ‘Cryptocurrency Trading’ is somewhat of a broad one, not least because it can refer to several financial products. For example, if you’re looking to trade cryptocurrencies against the US dollar, you need to ensure your chosen app supports fiat-to-crypto pairs.

Alternatively, you might be looking to trade crypto-cross pairs. These are currency pairs that contain two digital assets. This might include BTC/ETH or XRP/ETH. If you’re a seasoned crypto trader looking to take things to the next level, then you’ll want to look out for things like margin trading, leverage, and short-selling facilities.

1. eToro – Best All-Round Crypto Trading App

76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Cryptoasset investing is highly volatile and unregulated in some EU countries. No consumer protection. Tax on profits may apply.

Below content does not apply to US users.

So now that you know what factors you should be looking out for when selecting a crypto trading app, I am now going to discuss my number one pick – eToro. Launched in 2007, eToro is home to over 12 million traders around the world. You will have the option of trading via its main desktop site, or through a fully-fledged mobile app. The latter is available on iOS and Android devices.

eToro offers traditional assets as well as CFDs, which gives you ample flexibility.

For example:

- If you want to invest in cryptocurrencies, you can do this at eToro and retain 100% ownership. You can’t, however, withdraw the coins to a private wallet. As such, they will remain on the eToro platform until you decide to cash them out.

- If you want to apply leverage or short-sell cryptocurrencies, this is facilitated via CFDs.

- If you want to trade crypto-cross pairs, this is facilitated via CFDs.

In total, eToro allows you to buy and sell 16 different cryptocurrencies in the traditional sense. This includes Bitcoin, Ethereum, Ripple, Bitcoin Cash, EOS, and more.

You can also trade cryptocurrency pairs – including both crypto-fiat and crypto-crypto. For example, you can trade cryptocurrencies against the USD, GBP, JPY, and EUR. You can also trade cross-pairs like EOS/XLM or BTC/EOS.

Fees and Commissions

On top of its vast offering of tradable cryptocurrency products, the eToro app stands out in the fee department.

Here’s why:

- Deposits: You can deposit funds with a traditional debit/credit card, e-wallet, or bank account without paying any fees. The only cost that is associated with financing your account is a 0.5% currency conversion charge for all non-USD deposits. In comparison to the likes of Coinbase – which charges 3.99% on debit card deposits, this is very competitive.

- Competitive Spreads: Although not industry-leading, the spreads at eToro can be competitive – especially if you are investing in the long-run. You should expect to pay a wider spread when trading less liquid cryptocurrency pairs.

- Withdrawals: Getting your money out of the eToro crypto app and back onto your payment method is seamless. Best of all, the platform charges just $5 per withdrawal.

All in all, I think that eToro is very strong when it comes to trading fees and commissions.

Safety and Regulation

**eToro platform is regulated, however cryptocurrencies are unregulated and there is no consumer protection.

When it comes to the safety of your funds, eToro is regulated on three fronts. This includes the FCA, ASIC and CySEC. These three licensing bodies have an excellent reputation in the online brokerage space. They all have strict demands on the brokers and trading platforms that they regulate, such as:

- Requiring platforms to keep client funds in segregated bank accounts

- Performing regular auditors on the provider

- Asking platforms to request ID from all traders

- Clearly add warnings on the risks of trading financial instruments like cryptocurrencies

Other Notable Features

In addition to low fees and a strong regulatory standing, the eToro crypto trading app offers several other features that are worth a quick mention.

This includes:

Copy Trading

The eToro app offers an innovative feature known as ‘Copy Trading’. Put simply, this allows you to browse the eToro platform looking for a cryptocurrency trader that you like the look of. Then, once you find a suitable trader, you get to mirror their portfolio like-for-like.

Past performance is not an indication of future results. Trading history presented is less than 5 complete years and may not suffice as basis for investment decision.

Not only this, but you can elect to copy all ongoing trades. As a result, you get to trade cryptocurrencies without lifting a finger. This is great if you have little to no experience of buying and selling digital currencies, or you simply don’t have the time to actively trade.

Other Asset Classes

I should also note that the eToro app is suitable for those of you that wish to diversify into other asset classes. For example, you can invest in ETFs and over 800+ stocks while retaining full ownership.

If it’s hard-core trading you’re after, you will also have access to indices, forex, hard metals, energies, government bonds, and more. These all come in the form of CFDs, so short-selling facilities are also available.

You can read my full eToro review to learn more about the platform.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Past performance is not an indication of future results. Trading history presented is less than 5 complete years and may not suffice as basis for investment decision.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Cryptoasset investing is highly volatile and unregulated in some EU countries. No consumer protection. Tax on profits may apply.

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.

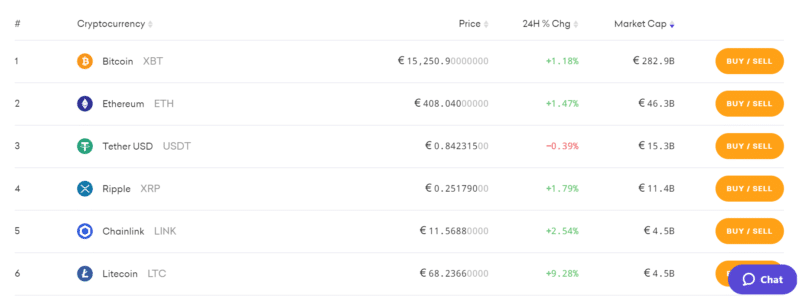

2. Binance – Best Crypto Trading App for Tradable Pairs

Binance needs no introduction in the cryptocurrency exchange circle – not least because it is responsible for some of the largest trading volumes globally. For example, in the last 24 hours alone Binance has facilitated over $9 billion in trading volume (as per CoinMarketCap).

While most traders will buy and sell pairs through the main Binance website, the provider also offers a trading app. This is available to download free of charge, and it’s compatible with iOS and Android devices. Much like in the case of eToro, you will have one central account that you can use across all devices.

One of the stand-out features of Binance is that it offers a significant number of cryptocurrency pairs. In fact, this stands at well over 600 pairs at the time of writing.

This means that you will have access to cryptocurrencies of all shapes and sizes. For example, if you’re looking to trade the likes of Bitcoin, Ethereum, or Bitcoin Cash – you will benefit from heaps of pairs at your fingertips. Alternatively, if you want to access less liquid projects like Troy, Polymath, or Status, Binance also has you covered.

Trading Structure

Binance does not offer CFD products. On the contrary, you will be buying and selling cryptocurrencies in the traditional sense. You will, however, still be trading pairs.

For example,

- You wish to trade Bitcoin against Ethereum. As such, you will need to trade ETH/BTC.

- We’ll then say that the pair is priced at 0.0348. This means that for every 1 ETH, you get 0.0348 BTC.

- Much like real-world currencies, the value of ETH/BTC will go up and down on a second-by-second basis.

- You then need to stipulate whether you think the price of the pair will go up (buy order) or down (sell order).

Once you place an order via the Binance trading app, the position will remain open until you decide to close it. Once you do, your profit or loss will be determined by whether you speculated correctly, and by how much.

On top of spot trading pairs, the Binance app also gives you access to more sophisticated products. This includes the platform’s Perpetual Futures Contracts, which allows you to apply leverage.

As the structure of the derivatives offered by Binance falls outside of traditional trading regulations, it is able to offer leverage of up to 1:125. This means that a $200 account balance would permit a maximum trade value of $25,000.

Fees and Commissions

In terms of trading fees at Binance, the platform is largely very competitive.

For example:

- The highest trading commission charged by the Binance app is 0.1%. This is charged at both ends of the trade. For example, let’s say that you trade $500 worth of BTC/XRP. This would cost you just $0.50 in commission. if you then sold the pair when it was valued at $550, you would pay $0.55 in commission. This is extremely competitive.

- You can get your trading fees down to even lower percentage rates if you make use of the BNB Coin. This is Binance’s native cryptocurrency token.

- If you’re keen to trade Perpetual Futures Contracts via the Binance app, this starts at just 0.02%.

With that being said, if you plan to deposit fiat currency into Binance with your credit card, this can be costly. This comes out at the higher of 3.5% per transaction or 10 USD.

On the other hand, if you are able to deposit funds with a cryptocurrency, then no fees are charged by Binance. In terms of withdrawing cryptocurrencies, you will pay a charge that is similar to the blockchain mining fee for the respective coin or token.

Safety and Regulation

Binance is not regulated by any single government entity or national regulator. This means that you can never be 100% sure just how safe your money is. On the flip side, Binance does have an excellent reputation in the space and crucially – is responsible for billions of dollars worth of trading volume each and every day.

Although it operates without a license, there are several safeguards in place to ensure your account remains secure. This includes everything from 2FA (Two-Factor Authentication), address whitelisting, cold storage, anti-phishing tools, and ‘SAFU’.

The last safeguard is Binance’s Secure Asset Fund for Users. This is a reserve pot that grows over time. If the unfortunate happens and Binance is hacked, the pot will be used to compensate victims.

You can read my full Binance review to learn more about this platform.

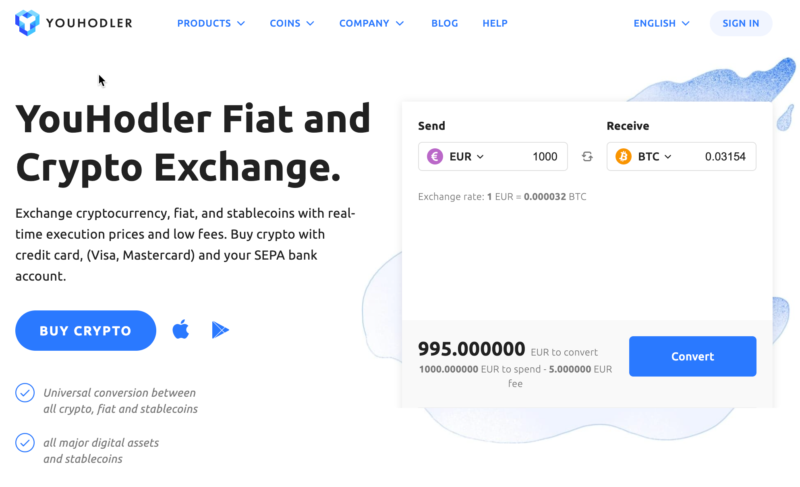

4. YouHodler – Best Crypto Trading App for Earning Interest and Loans

Although not uniquely a trading app, YouHodler is an interesting platform that offers a full range of cryptocurrency-based products. At the forefront of this is the ability to earn interest on your cryptocurrency holdings that otherwise – would be sat idle in your private wallet.

The way it works is as follows. You deposit your chosen cryptocurrency into your unique YouHodler wallet. You can do this directly from within the mobile app. Then, depending on the digital currency you deposit and the length of time you keep the coins locked away, you could earn up to 12% in interest per year.

Bitcoin yields a maximum of 4.8%, albeit, this is still competitive. In addition to being able to earn interest, the YouHodler app also supports cryptocurrency loans. In fact, you can get an LTV (Loan to Value) of up to 90% on the digital currency you deposit, with the proceeds being paid in fiat money.

See also: My in-depth YouHodler review

This might suit those of you that wish to release some of the funds you have tied up in cryptocurrency, without being forced to cash out. In turn, if the value of the coin you deposit goes up while the loan is outstanding, you will still benefit from the upside.

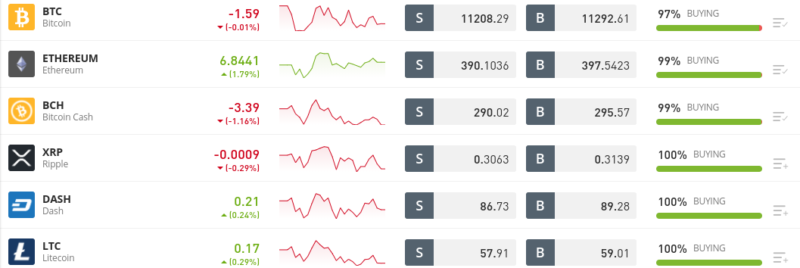

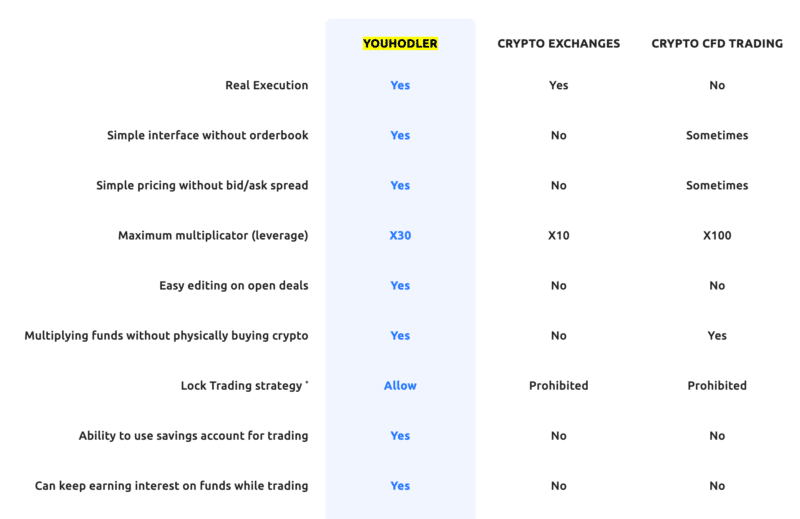

On the trading side, YouHodler has introduced a number of innovative trading features, such as Multi Hodl for crypto margin trading. Turbo loans can also be used to your advantage.

For many people, Multi HODL is better than Margin Trading on Exchanges or CFD Trading.

Multi HODL combines the best of both crypto exchanges and CFD trading into one. It offers a simple and intuitive interface, convenient trade management, and FREE leverage.

You can also use YouHodler to buy cryptocurrencies directly from your account using fiat currencies (EUR, USD, GBP etc).

5. Nexo – Biggest Crypto Lending Platform

When faced with the volatile nature of cryptocurrencies, investors have an ongoing dilemma – exit the position or ‘HODL’. Those investors in it for the long run, will simply look to hold on to their cryptocurrencies with the hope that in the not-too-distant future they will appreciate and be worth significantly more.

Until then, the coins would typically remain idle in a private wallet – resulting in opportunity costs along the way. After all – and much like gold, Bitcoin and many other cryptos do not yield any income.

With this in mind, Nexo has created an online platform that allows you to earn interest by depositing your digital currencies. In turn, this will then be loaned out to those that wish to engage with crypto-loans. Today, the company presents itself as a crypto-fiat finance service that offers a variety of distinct features to meet the needs of both investors and borrowers.

You can also trade crypto pairs on Nexo as you would on any exchange, making the platform a one-stop-shop for those who want to earn interest on their crypto, borrow crypto, and also trade crypto pairs.

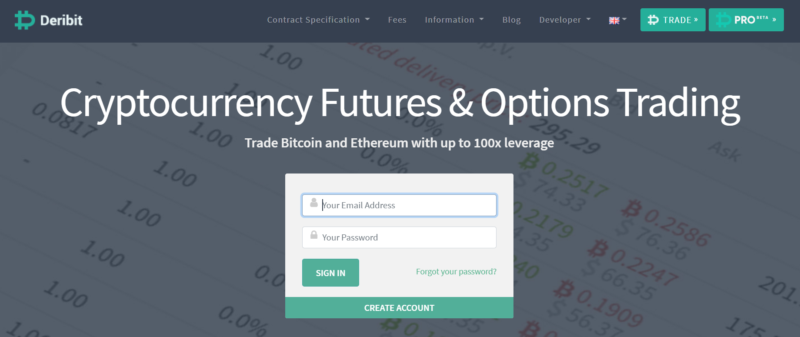

6. Deribit – Best All-Round Bitcoin Options Trading Platform

The real-world screenshot examples I gave above were taken from Deribit. This platform is focused exclusively on cryptocurrency derivatives and offers both Bitcoin futures and options. I like Deribit for several reasons.

In terms of its Bitcoin options markets, the platform offers heaps of contract durations. This runs from daily, weekly, monthly, quarterly, and right up to 10-months. As such, Deribit is great if you want to purchase longer-term options.

Additionally, each of the aforementioned contract durations comes with heaps of strike prices. In the example I gave earlier on 10-month contracts, this varied from $8,000 to $40,000 – which gives you plenty of flexibility to deploy an options trade that meets your requirements.

In terms of minimums, you can purchase from just 0.1 BTC of an options contract. As such, if the premium on your chosen market has a USD-value of $4,000 – you would need to outlay $400. You can, however, also apply leverage to your options trade – meaning that your financial outlay can be reduced by a considerable amount.

There is plenty of liquidity at Deribit, too – so you should never have any issues entering and exiting the market. However, I should make it clear that Deribit also comes with its flaws. At the forefront of this is that the platform only hosts European-style options.

As I mentioned earlier, this means that you need to wait for the contracts to expire before you can realize your profit or loss. In other words, you can’t offload your calls or puts before they expire. Additionally, Deribit does not accept fiat currency deposits. Instead, you need to fund your account with Bitcoin.

If you don’t have any Bitcoin to hand, you will first need to buy some and then transfer it over to your Deribit account. In terms of fees, you will initially pay a commission of 0.03% of the underlying contract value. When the contracts expire, you then pay a settlement fee of 0.015%.

Finally, Deribit is not regulated. After all, it allows you to trade cryptocurrency derivatives with leverage. The platform does, however, note that it keeps 99% of its Bitcoin holdings in cold storage. The balance is kept in hot wallets to facilitate withdrawal requests.

7. CoinSmart – The most accessible crypto exchange in Europe and Canada

CoinSmart takes the cryptic out of crypto. They’ve designed a platform that caters to Europeans with all levels of crypto literacy. If you’re an advanced trader you get all the bells and whistles of an advanced exchange. If you’re just getting started, you’ll love the platform’s ease of use and how everything just falls into place. The best thing I like about CoinSmart is how they don’t shy away from providing actual human support. They offer 24/7 omnichannel live support. CoinSmart is probably one of the very few if not the only exchange that does this.

The setup is very smooth and KYC is lightning quick. Their smart trade feature lets you convert one supported coin to any other supported coin without needing to go into Bitcoin first. True one-click trading with very competitive pricing. CoinSmart started in Canada and has quickly grown to Europe.

Euro, USD, CAD supported. Fund through SEPA, Interac, Wire Transfer or buy crypto through credit card.

CoinSmart is safe and secure. In Canada, it is registered with FINTRAC and it also has the necessary licenses in Europe.

If you want to Buy Bitcoin with Euro, give CoinSmart a try.

CFDs are complex instruments and entail a high risk of losing money rapidly due to leverage.

76% of retail investor accounts lose money when trading CFDs with this provider.

You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

TradeSanta – Best app for automated trading

TradeSanta is an automated trading platform that provides a wide range of tools to set up trading bots. TradeSanta is perfect for those just starting out with automated trading thanks to its user-friendly interface. At the same time, it provides a wide range of tools for more advanced traders.

How It Works

To set up a trading bot first you need to choose an exchange to trade on. After you connect the exchange, choose a pair to trade and decide whether you will play on the rise or fall of the coin’s value. Once that is done, choose one of the provided templates or set up the bot’s parameters from scratch.

The bot will place the first order and then a take profit order that will bring you the desired earnings.

Features

- Major exchanges such as Binance, Kraken, Huobi, Okex and HitBTC

- Grid and DCA strategies

- Stop Loss, Trailing Stop Loss and Trailing Take Profit

- Virtual trading

- Manual trading on multiple exchanges in one interface

- Futures trading

Security

To trade via automated bots the only thing you need is an exchange account. TradeSanta connects to the exchanges via API, the withdrawal option is disabled by default. TradeSanta does not have any access to your funds, the bots can only place and cancel trades.

TradeSanta takes security seriously and offers 2FA authentication to further secure accounts.

The Verdict

In summary, there are many crypto trading apps to choose from. No two apps are the same, so you need to spend some time exploring what you are looking to prioritize. As I have discussed in this article, certain crypto trading apps are suited for certain requirements.

For example, if you’re looking for an app that hosts hundreds of crypto trading pairs, then you might be best suited for Binance.

On the other hand, if you’re more concerned with user-friendliness, eToro might be more up your street.

Read more: The Best Books about Bitcoin and Crypto

With the rise of crypto interest platforms like YouHodler and Nexo, you can also hold on to your purchased Bitcoin and earn interest on that crypto. If you haven’t come across these platforms, I would highly recommend you look into them.

Staking is another option for those who have significant crypto assets and want to hold them but at the same time accrue more value.

Spot crypto trading apps

- Kraken – read my review

- Coinbase – most recognised global exchange

- Changelly– read my review

- Swan Bitcoin – great for dollar cost averaging Bitcoin

Exchange and Earn Interest

Buy Gift Cards, Vouchers and Top Up Airtime

Trading Bots

Trading Bots

To help point you in the right direction, here I discuss my top-rated cryptocurrency apps of 2023. On top of this, I also explain some of the key metrics that you need to look out for prior to selecting a provider.

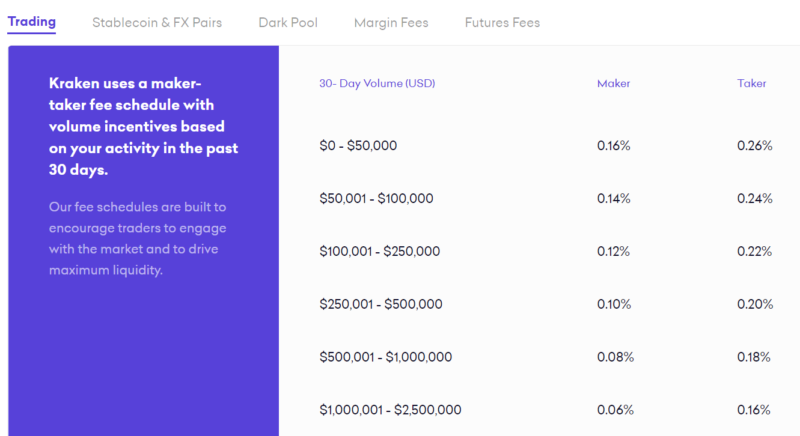

Kraken – Best Trading App

It’s somewhat difficult to get away from Kraken. This is because the platform ticks most of the right boxes for crypto investors worldwide. While Coinbase is the biggest USD-volume exchange, Kraken comes in a close second. It dominates the EUR markets in Europe though.

So, in order to buy Bitcoin at Kraken, all you need to is a bank account. The easiest way to make a deposit in USD is to transfer the funds via FedWire or SWIFT.

You can, of course, also transfer other currencies, including GBP, CAD, EUR, JPY, CHF and AUD.

You only need to deposit a minimum of $1 and deposits are free too – so far so good.

In terms of Bitcoin trading fees, Kraken the platform utilizes a market maker/taker system. If you’re just planning to use the platform to buy Bitcoin, then you are a market ‘taker’. As such, unless you are planning to trade more than $50,000 in a single month, you will pay a commission of 0.26%.

As such, if you were to buy $100 worth of Bitcoin, you would pay a fee of $0.26. Don’t forget, you’ll also pay a 0.26% commission when you eventually get around to selling your Bitcoin. Nevertheless, buying Bitcoin at Kraken can be done in a hugely cost-effective manner.

In terms of regulation, Kraken isn’t licensed in the same way as a traditional online stockbroker or CFD platform. But, launched way back in 2011, the platform is one of the oldest cryptocurrency exchanges in the space.

Crucially, it complies with all U.S. regulations on anti-money laundering, and thus – all users must have their identity verified. Finally, I should also note that Kraken is extremely user-friendly. As such, if this is your first time investing in a cryptocurrency online, Kraken is a good option and alternative to Coinbase. It might not be as easy to use as Coinbase, but the fees are lower.

Read More: You can find my full Kraken review here.

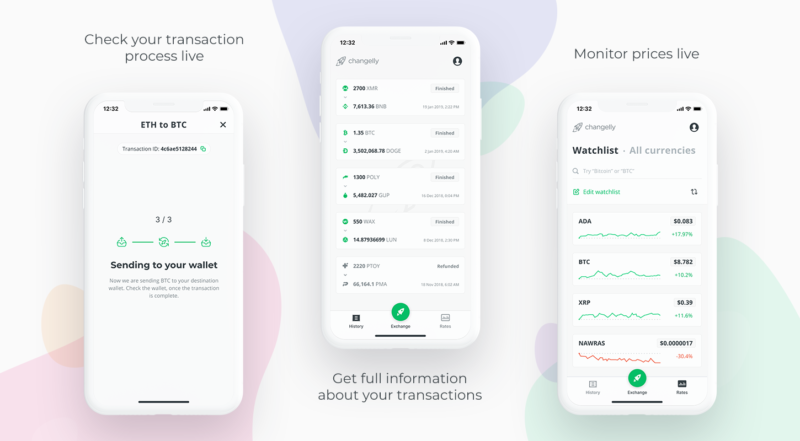

Changelly

Changelly is a cryptocurrency exchange that does things a little bit differently from the status quo. The main concept of this platform is that it will aim to get you the best price possible when you buy cryptocurrencies. It does this through an in-house algorithm that is able to scan major exchanges in real-time.

Changelly offers a good selection of digital currencies – both large and small. For example, if you’re looking for large-cap projects – you’ll find the likes of Bitcoin, Ethereum, Ripple, Chainlink, and Bitcoin Cash.

Further reading: My Changelly review

You will also find a relatively extensive list of less liquid altcoins – such as Energi, BitDegree, Bitcoin Diamond, Numeraire, and Power Ledger.

Swan Bitcoin

Swan is the best way to accumulate Bitcoin with automatic recurring and instant buys using your bank account, or wires up to $10M. The idea behind this product is to slowly but steadily build up your Bitcoin stash, and yes, Swan is all about Bitcoin so you won’t be able to buy any other cryptos on Swan.

On the other hand, Swan Bitcoin is a company that is 100% focused on the Bitcoin mission, and as such they provide a lot of educational materials and even a popular podcast, so if you are only interested in Bitcoin this is a good option for you.

How It Works

A simple savings app does all the work for you.

- Link any US bank account.

- Buy Bitcoin daily, weekly, or monthly.

- Bitcoin automatically delivered to your wallet or stored for free with a secure licensed and regulated custodian.

Buy Bitcoin on Swan and get $10 of free Bitcoin

Nexo – Biggest Crypto Lending Platform

When faced with the volatile nature of cryptocurrencies, investors have an ongoing dilemma – exit the position or ‘HODL’. Those investors in it for the long run, will simply look to hold on to their cryptocurrencies with the hope that in the not-too-distant future they will appreciate and be worth significantly more.

Until then, the coins would typically remain idle in a private wallet – resulting in opportunity costs along the way. After all – and much like gold, Bitcoin and many other cryptos do not yield any income.

With this in mind, Nexo has created an online platform that allows you to earn interest by depositing your digital currencies. In turn, this will then be loaned out to those that wish to engage with crypto-loans. Today, the company presents itself as a crypto-fiat finance service that offers a variety of distinct features to meet the needs of both investors and borrowers.

You can also trade crypto pairs on Nexo as you would on any exchange, making the platform a one-stop-shop for those who want to earn interest on their crypto, borrow crypto, and also trade crypto pairs.

TradeSanta – Best app for automated trading

TradeSanta is an automated trading platform that provides a wide range of tools to set up trading bots. TradeSanta is perfect for those just starting out with automated trading thanks to its user-friendly interface. At the same time, it provides a wide range of tools for more advanced traders.

How It Works

To set up a trading bot first you need to choose an exchange to trade on. After you connect the exchange, choose a pair to trade and decide whether you will play on the rise or fall of the coin’s value. Once that is done, choose one of the provided templates or set up the bot’s parameters from scratch.

The bot will place the first order and then a take profit order that will bring you the desired earnings.

Features

- Major exchanges such as Binance, Kraken, Huobi, Okex and HitBTC

- Grid and DCA strategies

- Stop Loss, Trailing Stop Loss and Trailing Take Profit

- Virtual trading

- Manual trading on multiple exchanges in one interface

- Futures trading

Security

To trade via automated bots the only thing you need is an exchange account. TradeSanta connects to the exchanges via API, the withdrawal option is disabled by default. TradeSanta does not have any access to your funds, the bots can only place and cancel trades.

TradeSanta takes security seriously and offers 2FA authentication to further secure accounts.

The Verdict

In summary, there are many crypto trading apps to choose from. No two apps are the same, so you need to spend some time exploring what you are looking to prioritize. As I have discussed in this article, certain crypto trading apps are suited for certain requirements.

For example, if you’re looking for an app that hosts many crypto trading pairs, then you might be best suited for Kraken.

Read more: The Best Books about Bitcoin and Crypto

With the rise of crypto interest platforms like YouHodler and Nexo, you can also hold on to your purchased Bitcoin and earn interest on that crypto. If you haven’t tried these platforms yet, I would highly recommend you look into them.

First of all thanks for the great overview. I finally decided to go into the crypto space but run to a very bad experience with CB. They could not authorize me in 3 weeks though I submitted everything, being used to european regulations. Their CS is really bad. So I canceled my account and looking for different exchange. I do not expect to trade much and do not expect to use CFDS. You do not recommend in this update Kraken, but has got consistent with eToro. That seems to be a traditional exchange for different financial instruments beyond the crypto world. Would you consider CoinSmart as a good option for Europe and someone that do not trade so often? How they store the crypto? Can I have it an mobile or HW wallet? Or you still think Kraken is a viable option? Regards, Robert

Hi, i’m new to trading Bitcoin and BNB. But i realized Binance app glitches, should i trade on the website instead?

Yes, the website works perfectly well for sure.

I certainly won’t be a millionaire at the end of this bull run, however I had 25K invested 6 months ago in bitcoin, I’m sitting at 525K now with 50% in eth, 75% in Btc and 25% in other alts.

Hello 👋 jean

Please is there any other Bitcoin wallet that’s better and rated with little charges

I do use blockchain but the charges are to much so help me out

Thanks 🙏🏿

Dear Jean,

I’m from Nepal and totally new in cryptocurrency world. I want to buy and hold ADA and Wazirx coin for long time. Which apps (platform) is better for me with minimal cost having both ADA and Wazirx.

Thanks

Hello Jean!

I have just started dealing with cryptocurrency, and please tell me which is better to buy Ethereum or Tezar? I still can’t make up my mind.

I can’t make predictions, but in my opinion Ethereum is way more established and thus it would be my bet.

Dear Jean,

I am completely new in crypto topic. I am looking for buying one Etherum, hold it for a longer period of time and sell once it reaches certain value. No other trading than that. Does it make any sense? Which app would you suggest in this case? I am based in Malta.

Thanks in advance.

Use Coinbase or Binance.

Thanks for the reply.

Just one more question, will I be able to use my BOV account for a transaction of the funds to any of those two? I could do transaction from my APS account too, which one do you suggest? Can I do it by using debit card?

Card is usually better and they shouldn’t have any problems for small amounts, but if you’re concerned you can ask them beforehand.

Please what trading platform will you recommend in Japan

Try Bitfinex.

Hi Jean, have you heared or tried iq options?

I think there are better platforms.

I want to invest in crypto which app is good to invest in

I signed up with etoro and I very much dislike them after only one month and have fully cashed out. For a couple of reasons – their buy/sell spreads are very wide, which is very costly. Also they have ‘maintainence issues’, close markets and closing positions ‘dont register’ everytime there is volatility in the market. Avoid if you invest in anything even remotely volatile or it will cost you

Thanks for your feedback Peter. eToro is a platform that can be quite polarizing, users either love it or hate it. On the other hand, it’s been around for many years and its success has been phenomenal, so I think it deserves its place as one of the best places to trade crypto or stocks if you like what it offers.

EToro has an amazing platform. I think it’s the best in the industry. Please conduct due diligence and read reviews prior to investing.

They have the worst customer service in the industry. No one to talk to or ask for help. If you fill out a help ticket it will be either no response or it takes weeks to months to get any type of response. Currently I’m at two weeks.

Please read many reviews about etoro prior to giving them your money. This is not uncommon.

I had the following problems; they take your money for a week or two and you can’t use it, or you attempt to withdraw your money and you can’t get it for a week to a month.

I missed out on an amazing bull market week. So sad.

Buyer beware.

Hi Jeff, that’s not been my experience, I’m sorry to hear about your problems and hope this is a one-off due to some particular issue. Did you try calling them to see what is taking so long to figure out your issue?

Hello,

Thanks for the information. Was wondering what you think about the AnchorUSD app – some friends have downloaded and purchased some crypto with it recently and I am mulling options. I read some rather bad reviews on several sites but was looking for a more definitive/knowledgeable viewpoint.

Thanks

It’s a new service, I prefer to stick with more established ones.

Binance is all well and good unless you live in the US..in which case it’s worthless, where it used to be awesome. Currently, with terrible help support, and all the troubles, ie low trade volume, terrible verification times, tax reporting, extra fees, etc…, that came along with the very recent shove off of US traders to Binance.US it’s a better idea to avoid it for a better platform IMO. That’s for US based traders only though for most others it’s still awesome platform, and hopefully their .US version will see some much needed improvements.

I would use Coinbase instead if you want something 100% compliant with US laws.

I’m looking for a wallet not to trade. I’ve looked into Coin Base however being regulated in the U.S. takes the client privacy. I’m not looking to avoid laws etcetera but, (I’m a newbie so go easy) isn’t an appeal of crypto to be anonymous from major governments? Also in the comments above you pointed out platforms that have the tell tail signs of a scam, what are those signs?

Thank you for the article and your time, blessings.

Phil

Hi Phil,

I understand that you are looking for an exchange to buy Bitcoin or other crypto and hold it long term rather than trade it, is that right? Hodl Hodl is a good option for you in that case. You can click this link to receive a discounted trading fee of 0.55% for life. That platform enables P2P exchanges so there is no need for KYC.

Bitcoin is not an anonymous system, I would say the appeal of crypto is censorship-resistance and not anonymity. No government can stop you from holding Bitcoin or transacting with others, including big amounts that would usually require multiple enquiries from the banks to put through. Without getting too technical, there are companies that specialise in analyzing blockchains, and if a government wants they have a good chance of identifying who the people behind certain transactions are. It’s still pretty difficult, but still, it’s a possibility to keep in mind. Goverments won’t be using such tools against regular individuals, but big transactions where there is a serious suspicion of ill-intent, as they need to spend money to conduct such an analysis.

With regard to scam platforms, I’ve been in the space for a long time so I can tell a scam platform in a few seconds due to various factors. If you’re new to the crypto space, you can do some reading and not believe anything that looks too good to be true. Scam platforms typically make promises about big profits, have imagery that focuses on getting rich quick etc.

Thanks for this complete and interesting analysis, I didn’t learned much because I’m in cryptos for some time and got here while searching for a good app for trading from my iPad (on kraken or Binance which I use but only provides iPhone apps) anyway I went caught by the article and I wish I found it when I started a few years ago!

Congrats for the great job 👏🏻

Thanks!

I would also like to know your opinion about the Bitcoin era app and the BTC era app?

It has all the marks of a scammy platform. Avoid.

Dear Jean,

I’m interested if the Coinbase is offering a possibility of automatic trading?

You can connect it to a crypto trading bot like Coinrule for automatic trading.

Am really appreciate you for this advise

Glad you found it useful.

Have you tried Voyager ? It’s good and easy. $VGX token gives interest boost

I haven’t tried that Geoff.

Hello,

Thank you for the article. Im new to crypto and Ive joined recently with the idea of buying BTC for a few hundred USD, waiting til it goes 2-3 percent up and then sell, withdraw to my bank account and repeat. Ive found out that this method of crypto trading is called hoarding..? What would be the best platform for hoarding? Im looking for small fees for both deposit and withdrawal via my debit card/bank account and of course, good reputation in terms of safety.

Thank you for your time.

With regards, Jake.

P.S. Ive tried to use Blockchain, but they dont seem to offer simple withdrawals and their fees are quite high i think. Good thing i only deposited 10usd for this trial..

Hey Jake, “hodling” is the usual term that’s used within the crypto space. It means buying Bitcoin and never selling it. Or at least holding it for a long-term.

The strategy you mention sounds good in theory but it’s hard to pull it off. I can almost guarantee you’d be better off just buying Bitcoin and holding it long-term unless you know what you’re doing with trading.

Hi Jean

I’m from South Africa.

I enjoyed your review.

I’m new to Bitcoin Trading and are currently using Altcoin Trader which has been established in 2015.

I’ve chosen Finalmente Global to trade which averages 6.8 % weekly.

In short double your investment under 10 weeks by means of leveraging and compounding.

I would like to hear your comment and view on Finalmente Global ?

Unfortunately, that platform is yet another scam. It’s maddening to see how many scam platforms there are and how they manage to attract users despite all the obvious signs that they’re a scam.

Stick to the ones I mention in the article as they are very well-known and regulated.

What would be the suggested platform(s) for the best of both worlds? Buying to hold/investment and trading to make profit to be used to buy more investment. Obviously low fees and currency ownership being the focus

You might want a broker in that case. I will write an article specifically on brokers/exchanges that one can use for buy and hold purposes and some light trading, but my favorites are Kraken, Coinbase, Bitstamp and Binance.

This is great stuffs. I appreciate all the efforts that has gone into this. The English and analysis is top notch.

Thanks a bunch.

You’re welcome.

Thanks for your guidance

Regards

You’re welcome Selby.

Here is more – a cloud-based software designed to automate your cryptocurrency trading strategy – TradeSanta

They also have an app for iOS and Android.

It can be used by those with some knowledge, it would integrate with the exchanges mentioned in the article.

I enjoyed your article thanks Jean. I am a community worker in Australia helping people with drug & alcohol rehab. I just want to ask you have you heard of Bitcoin Evolution and is it all they state it is ? I had been following Bix Weir on the Road to Roota Youtube channel and he recommends Etherium which I guess these apps trade also ? I do invest in Silver currently. Any pointers appreciated. Thanks, Sincerely Mark

Hi Mark, Bitcoin Evolution is pretty much a sure way to lose money, and as close as you can get to being a scam without being one outright.

My recommendation is to stick with purchasing Bitcoin directly if you want to be exposed to the crypto space. Use a reputable exchange like Kraken.

I will totally go for Binance and eToro whichever suits you. One thing I did was to compare the options and fees with other cryptocurrency exchanges, which helped me on my chosen app.

Great article!

Thanks Sophia.