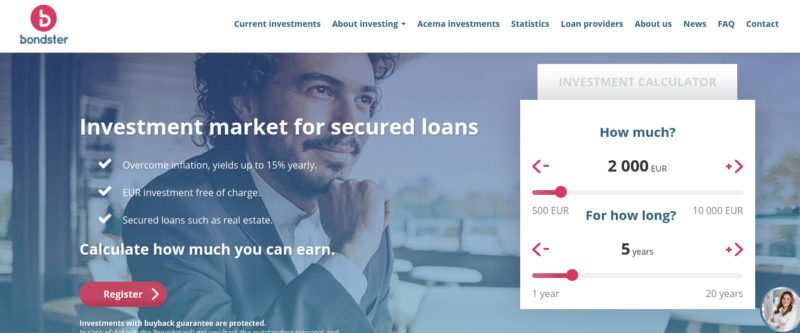

Bondster is an online peer-to-peer (P2P) lending platform that allows you to invest in loans of various types. You will be financing loan originators who in turn will lend the money to the end borrower. All in all, Bondster offers some of the highest yields in this particular space at up to 17% annually.

But, to what extent is your money at risk?

This is exactly what I intend on finding out in my Bondster review. Within it, I cover everything you need to know to determine whether this P2P lending site is right for you. I’ll explain how the Bondster platform works, who you’ll be lending money to, what returns to expect and ultimately – how safe your investments are.

What is Bondster?

In a nutshell, Bondster is a P2P lending platform that allows you to finance loans. Launched as recently as 2017, the provider is based in the Czech Republic. As of September 2020, Bondster claims to have facilitated investments for over 10,000 users.

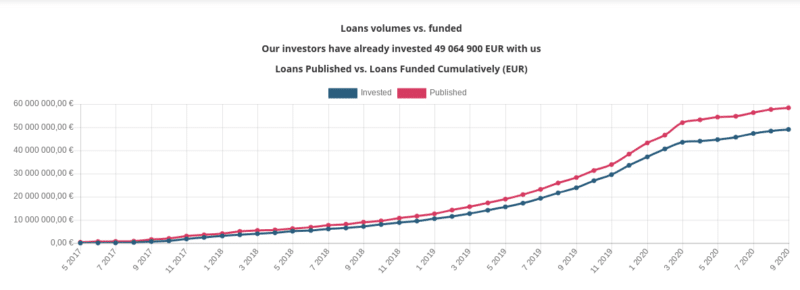

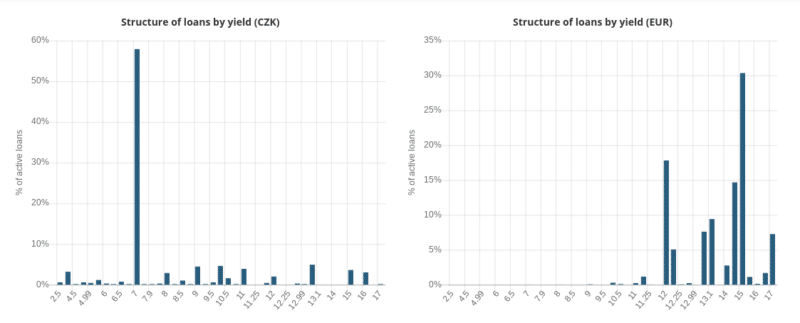

This translates into over €49 million worth of loans, resulting in an average annualized return of 13.91% for those investing in euros. For those opting for deposits in the Czech koruna, this yield drops to 8.35%. Largely, this is because non-euro deposits attract a fee of 1%. More on this later.

In terms of loan types, this typically centres on consumer lending. However, the platform is also known to facilitate business loans and mortgage financing. Bondster notes that some of its loans are backed by collateral – such as a borrower’s home or car. This does, of course, add an additional layer of security on your investment.

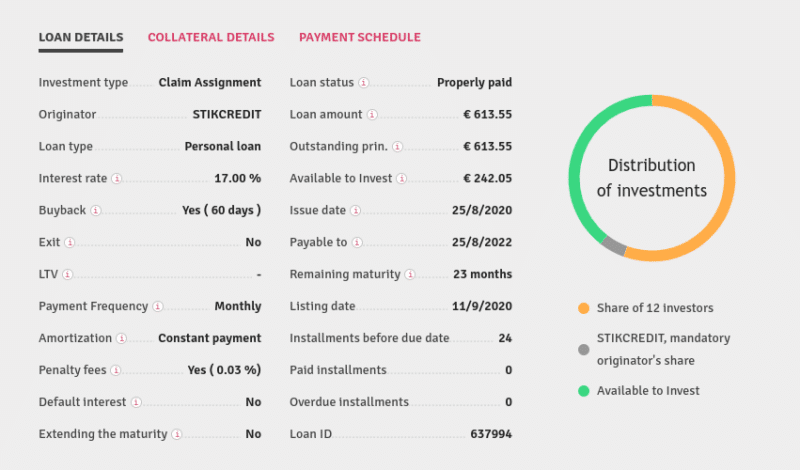

When it comes to yields, Bondster states on its homepage that up 15% per year is on offer. However, there are actually loans that yield 17% – which is offered through Bulgarian originator StikCredit. Finally, most loans at Bondster are backed by a Buyback Guarantee.

Types of Loans at Bondster

The vast majority of loans at Bondster are for the consumer lending space. In other words, you’ll be indirectly lending money to individuals. Additionally, some loans are issued to businesses and real estate financiers.

At the time of writing, borrowers may be situated in one of the following countries:

- Bulgaria

- Colombia

- Czech Republic

- Kazakhstan

- Mexico

- Philippines

- Poland

- Russia

- South Africa

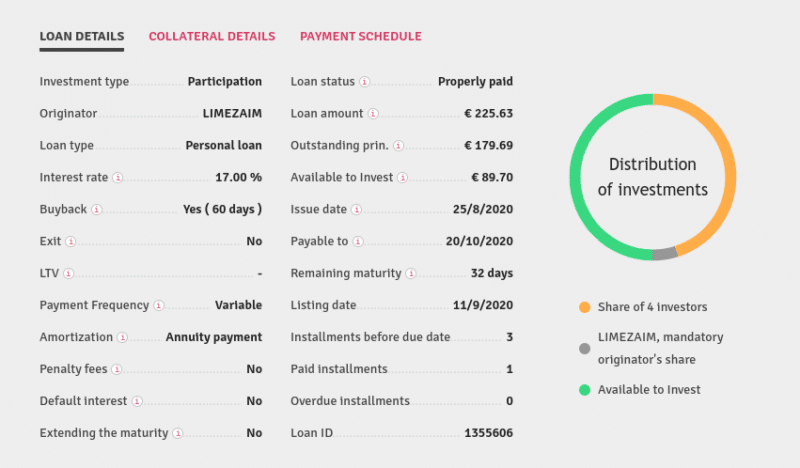

- Spain

When it comes to loan terms, this can vary quite considerably. For example, there are some loans at just 15 days, and others as long as 35 months. Each loan will have a maximum investment amount attached to it. For example, if a loan has €10,000 available and somebody invests €2,000 – this will leave €8,000 for other investors.

Loan Structure

The investment structure at Bondster essentially consists of three stakeholders:

- Investors (you)

- Loan originators

- End borrowers

So, when you deposit funds at Bondster and proceed to invest in a loan, the funds are allocated to the respective originator. This is the lender that the end borrower has applied for a loan with. In turn, it is the originator’s responsibility to collect payment from the borrower, and then forward the funds onto Bondster. Then, Bondster will reflect the payment in your account.

With that being said, it is important to note that each loan agreement is between you and the end borrower. That is to say, if the unfortunate happened and the originator ceased to exist, then the payment would still be owed to you. How this would be facilitated in practice remains to be seen.

Below you will find a list of the loan originators that have partnered with the Bondster platform:

- Acema

- Banknotes

- Bankometer

- Yaris

- StikCredit

- Kviku

- Tezlombard

- CreditGo

- RightChoice

- Limeaim

- AscotFinance

- RapidCredit

- Ibancar

Bondster Yields

When it comes to potential returns, Bondster does offer some attractive yields. As previously noted, this can be up to 17%. The specific amount will, of course, depend on a number of factors.

This includes:

- The credit rating of the borrower (determined by the originator)

- The originator behind the loan

- The size of the loan

- The length of the loan term

- Whether or not the loan is secured (real estate or a vehicle)

- The location of the borrower

In terms of the aforementioned yield of 17%, this is available when investing in loans issued by StikCredit. This is an originator based in Bulgaria that specializes in personal loans. From what I can make out, these loans have a term of anywhere between 4 and 23 months.

Interestingly, you can also invest in P2P loans issued by StikCredit at Mintos. The platform notes that the end borrower is charged an annual percentage rate of between 36-50%. As such, this is how you are able to earn huge returns of 17%.

However, what gripes me is the vast disparity between the yield that we as investors get, against that of what the end borrower pays. Sure, there are obviously internal and external costs involved when arranging finance in the consumer lending space. But, this gap is somewhat larger than one would expect. Take note, none of the loans offered by StikCredit are secured.

Secured Loans

Many loans at Bondster are secured. This means that the end borrower has put up collateral in order to get the loan. This will either be real estate or a personal vehicle. One loan originator in particular that focuses exclusively on secured car loans is Ibancar.

The Spanish lender offers annual yields of between 11.25%-12.25%, and you get to view the specific car that has been put up as security. Ibancar loans typically average 17-35 months, so naturally, the funding amount is often larger. According to Bondster, Ibancar has not encountered a single default in five years of trading.

This loan originator, alongside many others at Bondster, also offers a Buyback Guarantee.

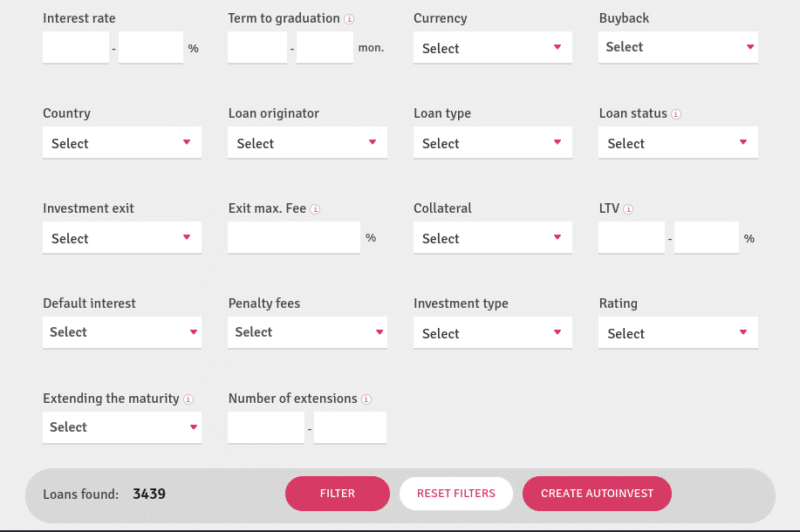

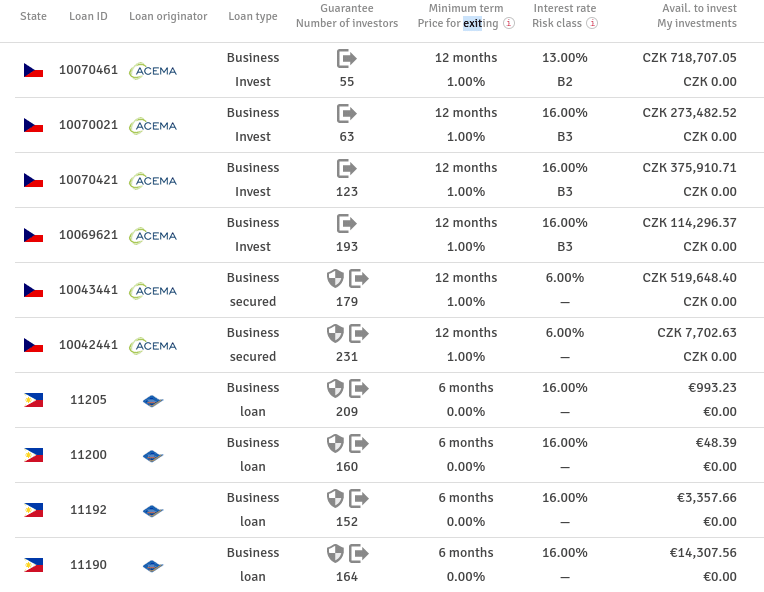

Manual Investing

Once you open an account with the platform, Bondster allows you to view each and every loan that is available to invest in. At the time of writing, there are 3,441 individual investment opportunities on offer. I like the fact that you can personally review each loan and extract key pieces of information. This can help you make an informed decision.

You can also breakdown the investment suite by making use of the filter feature.

This includes metrics such as:

- Loan type

- Originator

- Interest rate

- Buyback guarantee

- Payment frequency

- Location of borrower

- Secured

- And many others

Alternatively, you can also sort the search results by yield, loan term, the amount left to invest, and more.

Auto Investing

For those of you that don’t have the time to manually browse individual loans, you might like the Auto Invest feature at Bondster. As the name suggests, this allows you to invest in a basket of loans on an automated basis.

The best part about this feature is that you have heaps of variables to choose from. That is to say, you can create a range of pre-defined conditions that must be met in order for the Auto Invest feature to allocate your funds. In effect, these parameters match that of the filter system that I discussed in the section about.

For example, you can elect to only invest in personal loans, loans with a buyback guarantee, or loans that are secured. You can, of course, also specify the amount that you wish to invest in each loan.

Repayments at Bondster

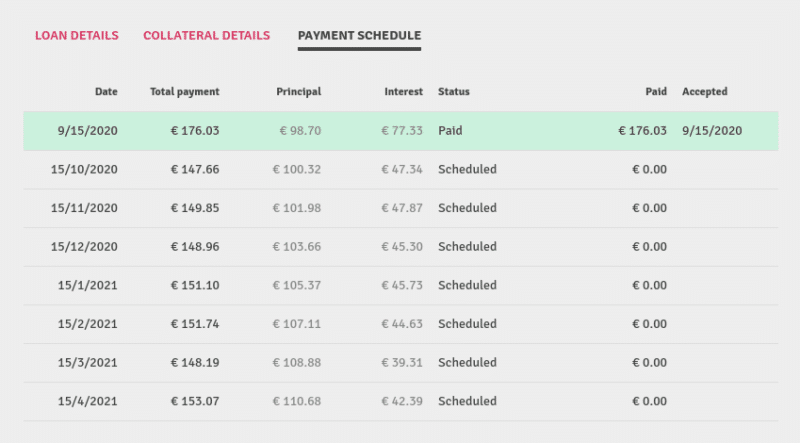

When it comes to getting your investment back – the frequency in which you get paid will depend on the specific loan structure. For example, longer-term personal loans are typically split into monthly repayments.

As and when the end borrower makes a payment to the respective loan originator, the funds will be forwarded to Bondster. The cash will then be placed into your Bondster account. You can elect to reinvest the funds into other ventures or withdraw them back to your bank account.

In the case of short-term ‘payday loan’ style arrangements, you will normally get the full loan amount plus interest at the end of the term. Most loans of this nature have a duration of fewer than 30 days anyway, so this shouldn’t be an issue.

Minimum Investment, Payments, and Fees

First and foremost, Bondster allows you to invest in a loan arrangement from just €5. Not only is this great for those of you that wish to start off with small amounts, but also in terms of diversification purposes. In other words, were you to invest €1,000 into Bondster – you could effectively spread your capital across 200 loans.

In turn, such a diversified portfolio of investments would vastly reduce the risks of being overexposed to a single borrower. In terms of funding, you’ll need to deposit funds from your bank account. Take note, the bank must be registered in the European Union.

Moreover, if you are depositing funds in euros, you will not incur any fees. However, those of you from the Czech Republic that plan to deposit in korunas will incur a 1% fee. To clarify, no investments at Bondster come with a commission or dealing fee of any sort. On the contrary, Bondster makes its money from the loan originators that the platform has partnered with.

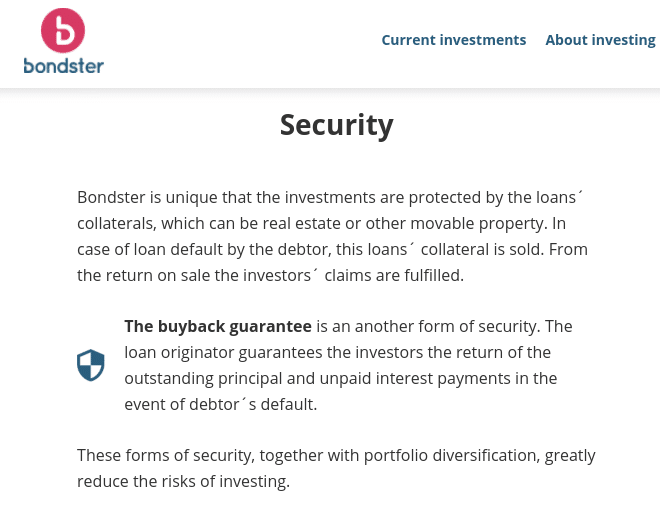

Buyback Guarantee

Bondster is one of many P2P lending platforms that offer a Buyback Guarantee. For those unaware, this is a ‘guarantee’ that is put in place to protect investors from a potential default. This is a default of the end borrower on the loan, and not the originator. More on the latter shortly.

The Buyback Guarantee at Bondster will come into play if and when the borrower is late on their payment by a specific number of days. This is typically 30 or 60 days, but you’ll need to check this in the loan datasheet. Nevertheless, if the Buyback Guarantee does kick in, then you will receive the full investment amount plus any interest that you are owed.

Although this might sound too good to be true, it is important to remember that loan originators will often charge a much higher rate of interest to the end borrow in comparison to what you receive in yield. As I noted earlier, Mintos states that SitkCredit charges up to 50% interest to the borrower, while you as a Bondster investor will receive 17%.

With that said, there are two important things to note when it comes to the Bondster Buyback Guarantee. First and foremost, not all loans on the platform offer this. As such, you should take particular care to assess this before parting with your money. Secondly, the Buyback Guarantee isn’t a 100% safeguard on your investment. After all, the ‘guarantee’ is only as good as the underlying issuer. In this case, that’s the loan originator.

In other words, if the loan originator themselves fell into financial difficulties, the Buyback Guarantee wouldn’t be worth the paper it’s written on. Unfortunately, this is just the nature of the P2P lending space. After all, you’re getting yields that are significantly more lucrative than any traditional asset class can return.

Early Exit

On the one hand, Bondster does not offer a secondary marketplace. However, some loans do come with the option to exit the position early. When I utilized the filter feature to only show me loans that come with the option to exit early, 114 results were returned out of over 3,400 loans. As such, only a small number of loans come with this option.

Furthermore, the only countries where the early exit feature was active was the Philippines and the Czech Republic. On all early exit loans at Bondster, there will always be a minimum holding period and an applicable termination fee.

From the loans available at the time of reviewing the platform, the minimum term was either 6 or 12 months. All loans came with an early exit fee of 1%, which is more than reasonable. After all, by exiting your investment early you will be entitled to the full principal amount that is owed, and get to keep all accrued interest.

Is Bondster Safe?

When you’re looking at potential yields as large as 17%, then you should be aware of the additional risks that this presents. Ultimately, Bondster can talk about due diligence, Buyback Guarantees, early exit fees, and long-standing partnerships with loan originators – but your money is never 100% safe.

For example, the Buyback Guarantee does not protect you in the event a loan originator collapsed. Would Bondster cover the loss? Probably not. Similarly, the early exit feature offers no guarantees, as the loan originator would need to agree to purchase the loan from you.

You also need to consider the risks of Bondster itself. After all, the platform is not regulated by a licensing body of any sort. As such, were the platform to run into financial problems, your capital could be at risk.

Getting Started at Bondster

If you like the sound of Bondster and wish to get started with an investment today, follow the quick-fire steps outlined below.

Step 1: Open an Account

You’ll first need to visit the Bondster website and elect to open an account. You’ll be asked to enter some personal information and contact details.

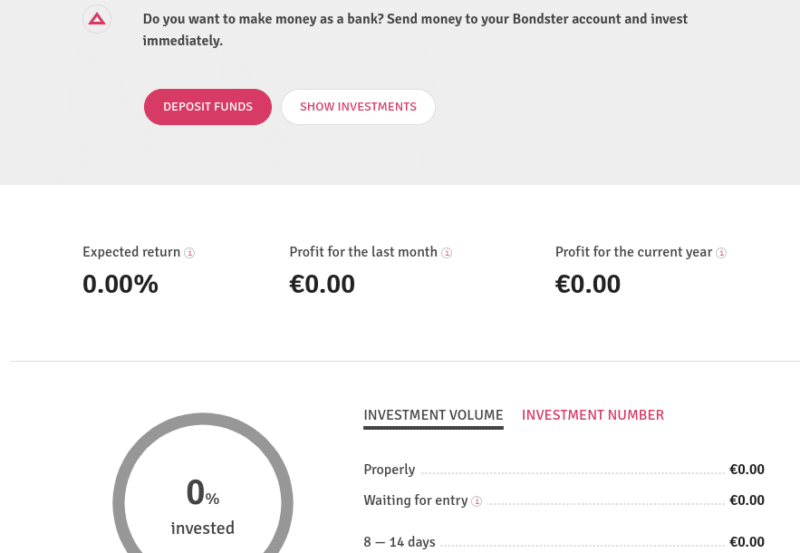

Step 2: Deposit Funds

You will now be able to deposit some funds. You’ll be shown the bank account details of Bondster alongside a reference number that is unique to your account. Proceed to transfer the funds from your bank account.

Step 3: Invest

Once your bank account deposit is credited by Bondster (which can take several working days), you are ready to invest. You can either select individual loans on a manual basis or set up an Auto Invest plan. Either way, the minimum investment amount per loan is €5.

Once you confirm the investment, the funds will be taken from your cash balance and allocated into the respective agreement. You will then receive your loan repayments as per the agreement you entered into.

Bondster Review: The Verdict?

Bondster is an attractive P2P platform for several reasons. The obvious starting point is the yields of up to 17% that it offers. I also like the Buyback Guarantee that is available on most loans, and the early exit feature that is offered on some loans.

Additionally, it is also notable that some of the loans at Bondster are secured with collateral – notably in the form of real estate or a personal vehicle. I also like that you can invest from just €5 per loan and that there are no fees when depositing in euros.

On the flip side, you do need to factor in the risks of investing in a high-yielding platform like Bondster. After all, the Buyback Guarantee is not truly a ‘guarantee’, as you always face the risk of a loan originator collapsing.

Summary

Bondster is a good P2P platform that allows you to diversify your P2P lending portfolio into the Czech market.

Pros

- High interest rates

- Some loans secured by collateral

Cons

- No secondary market

- Fee for early exit

Nice article.

it’s not clear to me this part: the money invested will be locked for the whole time of the loan duration (visible in the schedule)?

Unless the early exit 1% is used.

Have you checked the “investor’s tariffs” on this page : https://bondster.com/en/documents-to-download/ ?

“Opening and operation of an account” is free, ok.

But on the other hand, there’s a “Remuneration for holding a Virtual Account and making User Payments” which is “1% annually from the volume of investments being held. The fee shall be calculated daily and billed monthly on the first day of the following month. ”

The outgoing payement are “Free in case of the first two outgoing payments in a calendar month; any other outgoing payment is

subject to a fee in the amount of CZK 50 / outgoing payment” So, more than two outgoing payment and you have to pay?

There’s also “Sending of a bank statement by post on request” which is EUR 6. That seems normal if it’s the investors asking for a bank statement by post. But what if it’s bondster who require a bank statement? Remember it’s written in the User Agreement that Bondster may asks any additionnal documents at any time. And if the user doesn’t comply, its account is terminated.

And finally “Reimbursement of the Operator’s costs expended on the basis of the Investor’s request for the Provider’s cooperation in activities requested over and above the Terms or a Contract for the Assignment of a Claim” is invoiced 40€ per hour.

It sure doesn’t make you want to know a lot about the companies your invest it…

I don’t know, I feel something’s phishy…