When it comes to peer-to-peer (P2P) lending platforms, the market is packed with options, but only a handful manage to stand out. Hive5 is one of those platforms, and after spending some time testing and diving into the details, I’m confident calling it one of my top 3 P2P platforms right now. It combines simplicity, solid returns, and a promising roadmap in a way that feels tailored to modern investors who don’t want to overcomplicate things.

What is Hive5?

Hive5 is a relatively new player in the P2P space, but it’s already making waves thanks to its transparent structure and high-yield investments. The platform connects investors with short-term loans backed by credible loan originators, focusing mainly on the European market. While many platforms bombard you with too many options or complicated metrics, Hive5 keeps things refreshingly straightforward, which is something I deeply appreciate in today’s over-engineered financial tools.

Key Features That Stand Out

One of Hive5’s standout features is its consistent double-digit returns, typically hovering around 13-15% annualized. They also offer a buyback guarantee for loans, which kicks in if a borrower defaults for more than 60 days. While buyback guarantees aren’t foolproof, they provide a reassuring safety net in a notoriously high-risk space.

Another plus is their focus on trustworthy loan originators. Hive5 only partners with vetted companies, which means you’re less likely to encounter the shady practices that have plagued the P2P industry in the past. This filtering process is a big part of why Hive5 has quickly become a favorite for risk-conscious investors like myself.

Usability and Experience

Let’s talk about usability. The platform design is clean, intuitive, and free of unnecessary clutter. Signing up and navigating through the investment options feels seamless, even if you’re new to P2P lending. They also offer an auto-invest tool, which is a must-have for those of us who don’t want to spend hours micromanaging portfolios. Once configured, it’s a set-it-and-forget-it system that works like a charm.

I also appreciate their focus on transparency. Every loan listing includes detailed information about the borrower, loan originator, and repayment schedule. This openness makes it easier to trust the process and see exactly where your money is going.

The Hive5 Team

Hive5’s success is anchored by a team of seasoned professionals, each bringing a wealth of experience in finance, technology, and marketing. At the helm is CEO Ričardas Vandzinskas, who boasts over 17 years in multinational finance, investment management, and corporate governance. His tenure includes roles such as Supervisory Board Member and Independent Audit Committee Member, providing him with a deep understanding of corporate governance and financial risk management. Vandzinskas is also a mentor at the Kaunas University of Technology, reflecting his commitment to nurturing future leaders.

Complementing this financial expertise is Co-Founder Andrius Rupšys, an entrepreneur with a profound passion for technology and innovation. Rupšys founded Ruptela, a prominent Lithuanian IT company specializing in fleet management and GPS tracking solutions. Under his leadership, Ruptela grew from a single idea into a profitable enterprise, earning accolades such as “CEO of the Year” in Lithuania.

The marketing efforts are spearheaded by Chief Marketing Officer Karolina Tomaševičė, who brings nearly a decade of experience in the field. Her previous role as Head of Digital Marketing at PeerBerry honed her skills in cross-channel strategy and digital communication. At Hive5, Tomaševičė focuses on brand management, customer acquisition, and market research, ensuring the platform’s offerings align with investor needs.

This blend of financial acumen, technological innovation, and strategic marketing forms the backbone of Hive5, driving its growth and fostering trust among its investors.

Performance and Returns

So far, Hive5 has delivered excellent results for me. My portfolio has consistently achieved net returns of around 14%, which aligns perfectly with their advertised rates. Even more importantly, the platform has shown no signs of liquidity issues, a problem I’ve encountered on other P2P platforms over the years.

The loan terms are typically short, averaging 1-3 months, which keeps your capital flexible. This is a big deal for me as I prefer platforms where I can reinvest quickly or withdraw funds without being locked in for long periods.

What Could Be Improved?

While Hive5 is an impressive platform, it’s not without its quirks. For starters, the platform could use more diversification in terms of loan types and geographic reach. Right now, the focus is heavily on short-term loans within a limited number of regions. Adding more variety would make it an even stronger contender.

Additionally, I’d like to see more educational resources on the platform. Although the interface is user-friendly, new investors might appreciate a blog or knowledge base with tips and insights on maximizing their returns.

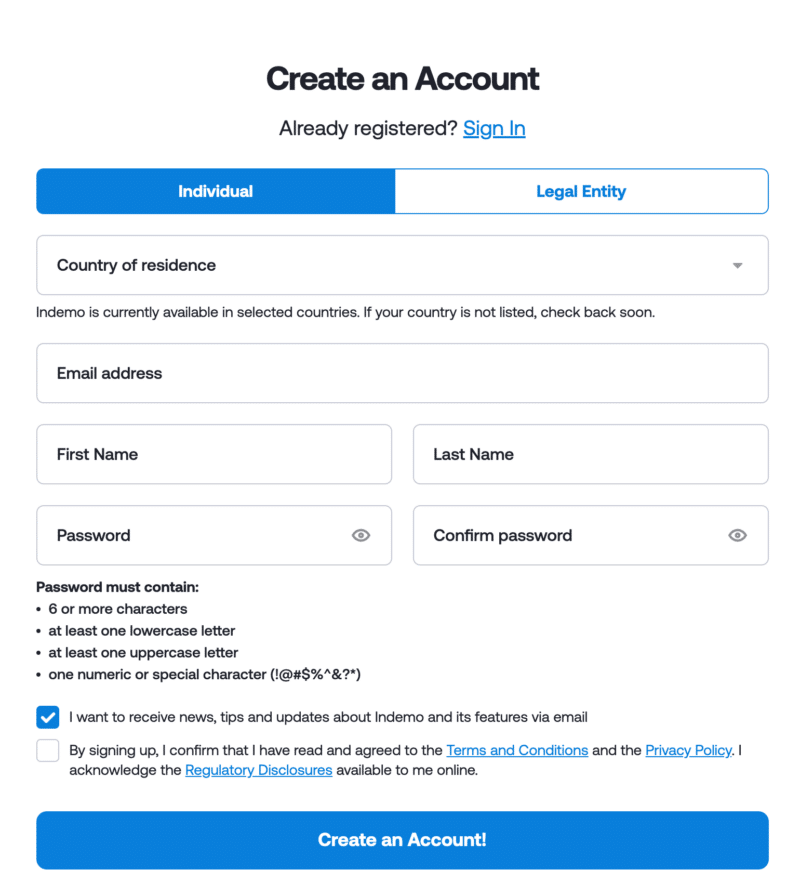

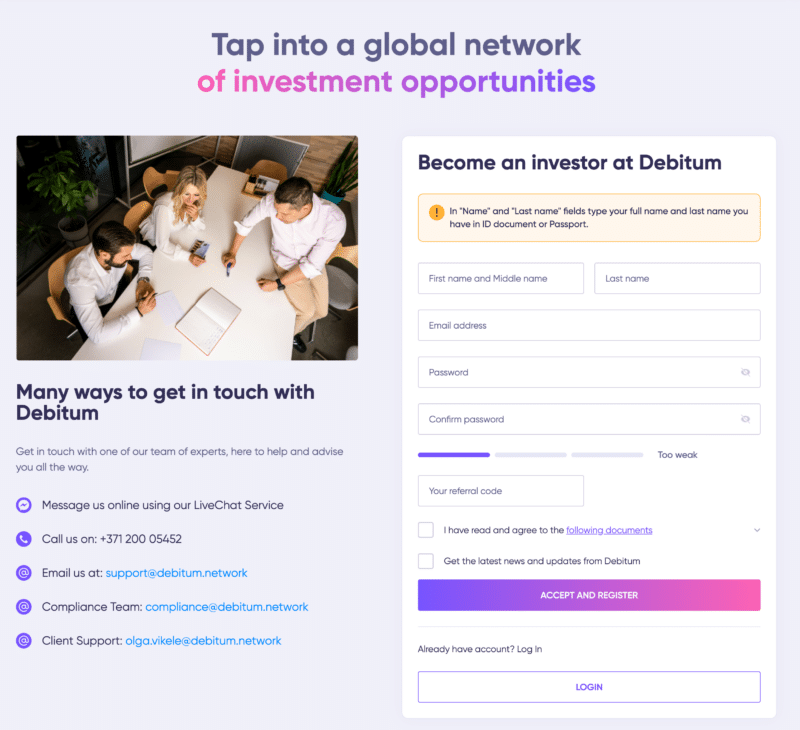

How to Get Started

Getting started with Hive5 is incredibly straightforward, even for beginners. The registration process takes just a few minutes—you’ll need to provide some basic personal information and verify your identity as part of their KYC (Know Your Customer) process. Once your account is set up, you can deposit funds using a variety of payment methods, including bank transfers and online payment systems.

After funding your account, you can start investing right away. You have the choice of manually selecting loans or setting up the auto-invest tool. If you’re like me and prefer a hands-off approach, auto-invest lets you define your criteria, such as loan duration, return rates, and risk levels, and then handles everything for you. Within minutes, you can have your money working for you.

Final Thoughts: A Platform Worth Your Time

Hive5 ticks nearly all the boxes for what I look for in a P2P platform. It’s easy to use, offers competitive returns, and prioritizes trust and transparency. While it still has room to grow, its current performance and user-centric approach make it a standout choice in the P2P lending world.

If you’re looking for a reliable platform to park your funds and generate steady passive income, Hive5 is worth considering. Personally, it’s earned a spot in my top 3 P2P platforms, and I’m excited to see how it evolves in the coming years.