I love Spain. Living in Barcelona is the perfect fit for where I am currently in life. Anyone who’s spent their time as a digital nomad or perennial expat will tell you that some countries and cities will suit you if you’re after X, or you’re at Y point in your life.

I love Spain. Living in Barcelona is the perfect fit for where I am currently in life. Anyone who’s spent their time as a digital nomad or perennial expat will tell you that some countries and cities will suit you if you’re after X, or you’re at Y point in your life.

Of course, how much you feel at ‘home’ somewhere is subjective: my experiences are different from yours, and even different from others walking the same path as me. You need to dive into a place to see whether you want to live there and I firmly recommend trying before you buy: spend at least 3 weeks in a place to really get a feel for it.

With all that being said, I feel like it’s time to compare the lifestyles in two countries that are well-known for their fantastic coastlines: Spain and Australia. Previously, I covered living in Spain vs USA, but personally, I believe this match-up is a little more equal.

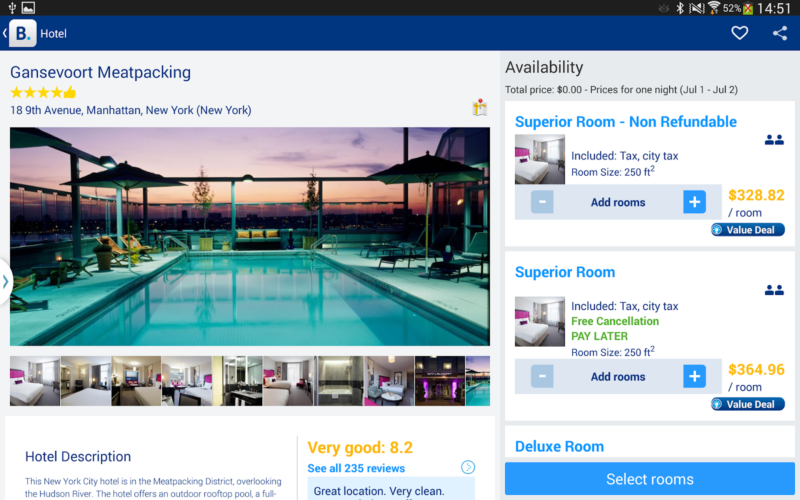

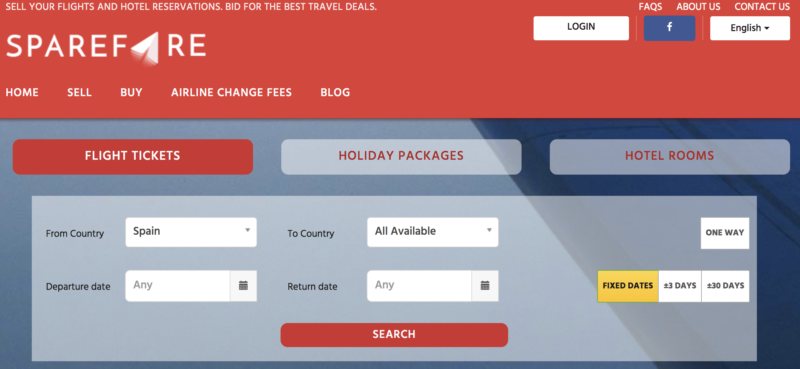

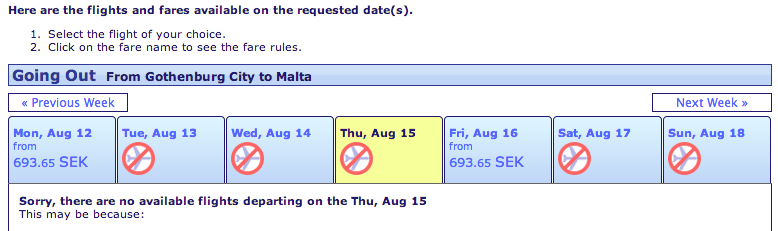

If you’re a discerning traveler and you’re very particular about where you choose to lodge yourself during a trip, you will want to make sure you do your research before booking a hotel.

If you’re a discerning traveler and you’re very particular about where you choose to lodge yourself during a trip, you will want to make sure you do your research before booking a hotel.