In March 2020 Bitcoin was priced at ‘just’ under $5,000. And today? The very same digital currency has gone beyond $40,000. Put simply, this means that Bitcoin has increased in value by over 800% since March 2020.

With this in mind, it goes without saying that interest throughout Europe in this cutting-edge cryptocurrency has sky-rocketed in recent months. The good news is that buying Bitcoin these days is actually really simple.

All you need is a good online broker or exchange that accepts your preferred payment method – such as a debit card or bank account. But, with so many options to choose from, knowing which platform to buy Bitcoin from can be daunting.

In this guide, I explain how to buy Bitcoin in Europe in the quickest, safest, and most cost-effective manner. On top of discussing the best online platforms to complete the purchase with, I also provide a simple step-by-step walkthrough on how to buy your first every Bitcoin today.

Here are my top suggestions right away:

Choosing a Bitcoin Trading Platform

First and foremost, if you want to buy Bitcoin in Europe, you will need to open an account with an online trading platform that supports cryptocurrencies.

Before I get the specifics on how to pick a platform that is right for your needs, I should make it clear that Bitcoin ATMs are also an option in Europe. As the name suggests, these are physical ATMs that allow you to buy Bitcoin by inserting cash into the machine.

Although this might sound super-convenient, I should make it clear that Bitcoin ATMs are hugely expensive. In fact – depending on the provider, it is not uncommon to pay a mark-up in excess of 10-20%. As such, I would suggest avoiding Bitcoin ATMs and instead recommend using a trusted online platform.

So that begs the question – how do you choose a platform to buy Bitcoin in Europe? Well, there are several key factors that you need to assess before opening an account with a new cryptocurrency platform, which I outline below.

Reputation and Trust

Before you even think about transferring money from your EU bank account, you first need to explore the credentials of the cryptocurrency platform in question. In an ideal world, the platform will hold a regulatory license of some sort.

With that said, much of the industry still operates in an unregulated manner – not least because Bitcoin is not controlled or governed by any single person or entity. As such, you’ll need to look at other metrics to determine whether the platform can be trusted – such as general feedback in the online domain.

In this respect, a select number of cryptocurrency platforms in Europe have amassed an excellent reputation that spans several years of trading. This includes the likes of Kraken and Coinbase – both of which I will discuss in more detail later on.

Trading Fees

Regardless of which cryptocurrency platform you decide to buy Bitcoin from, you will need to pay a fee to access the market. In most cases, this comes in the form of a trading ‘commission’. This is no different from buying and selling stocks with a traditional share dealing platform.

You will likely find that your chosen platform charges a variable fee. For example, if you buy €1,000 worth of Bitcoin and the platform charges 1%, then you will pay a commission of €10. Then, if you sell your Bitcoin holdings when it worth €2,000 – your 1% commission will amount to €20.

There are other fees that you also need to take into account. For example, some cryptocurrency platforms will charge you a fee when you deposit and/or withdraw funds. Coinbase, for example, will charge you 3.99% to deposit funds with a debit card.

Fortunately, transferring funds via SEPA will usually only cost you a few cents in fees. This payment method also permits larger purchases and is arguably much safer than using a debit card.

Payments and Account Minimums

Leading on from the section above, you also need to ensure that your chosen cryptocurrency platform accepts your preferred payment method. As noted above, most Europeans will opt for a SEPA transfer as it is cost-effective, safe, and usually pretty fast to arrive.

Alternatively, you might want to consider a debit/credit card if you are after an instant deposit. Some platforms – such as eToro, also support e-wallets. This includes Skrill and Neteller. On top of payment method-specific fees, you should also check to see what the platform’s withdrawal policy is.

As I explain in more detail later on, it is all but certain that you will need to provide some ID before you can make a withdrawal. In fact, this will likely be required before you are able to make a deposit – as per European regulations on the countering of money laundering.

In addition to supported payment methods and withdrawal policies, you should also explore what the platform’s account minimums look like. This might be a minimum deposit amount or minimum trade size. Kraken, for example, allows you to buy from just 0.001 worth of a single Bitcoin.

At the time of writing, that amounts to just over €15. This is really useful if you are buying Bitcoin for the first time and wish to start off with really small, inconsequential amounts.

Best Platform to Buy Bitcoin – My Views

Taking all of the above into account, I would argue that a select number of cryptocurrency platforms stand out from the crowd. If you don’t have time to research a platform yourself, it might be worth considering one of the following providers.

1. Coinbase – The Most Well-Known Exchange

Coinbase is potentially the best-known cryptocurrency broker in the industry. Launched in 2012 and now serving over 35 million customers in more than 100 countries, the US-based platform is often the go-to broker for first-time buyers.

This is because Coinbase is super-easy to use. The account opening process takes just minutes, and the platform is often able to verify your ID instantly. You can easily deposit funds with a debit card or SEPA, which makes the purchasing process seamless.

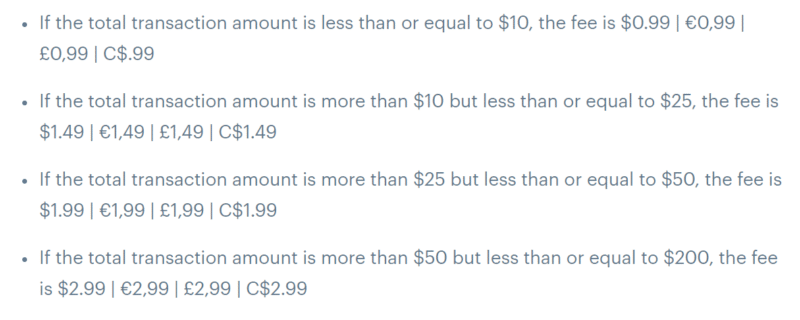

With that said, the overarching drawback of using Coinbase is that its fees are on the high side. As I briefly mentioned earlier, you will need to pay 3.99% if you wish to deposit funds with a debit card. Debit card withdrawals are also costly, with a 2% commission charged at a minimum of €0.55.

If, however, using SEPA, then deposits are free. Withdrawals will cost you a flat rate of just €0.15, too. I should also note that the trading commission charged by Coinbase is not only expensive but somewhat confusing.

For example, the platform charges a variable fee of 1.49%. This means that by buying €500 worth of Bitcoin, you’d end up paying €7.45. Once again, the 1.49% needs to be paid when you cash your Bitcoin out. With that said, a flat commission fee will come into play on smaller purchases.

You can view these fees in the screenshot below:

All in all, while Coinbase is a highly trusted cryptocurrency broker with a great reputation and seamless purchasing process, the platform is not the most cost-effective option in the market.

Read More: You can find my full Coinbase review here.

2. Binance – Biggest Worldwide Exchange

Binance needs no introduction in the cryptocurrency exchange circle – not least because it is responsible for some of the largest trading volumes globally. For example, in the last 24 hours alone Binance has facilitated over $9 billion in trading volume (as per CoinMarketCap).

Binance needs no introduction in the cryptocurrency exchange circle – not least because it is responsible for some of the largest trading volumes globally. For example, in the last 24 hours alone Binance has facilitated over $9 billion in trading volume (as per CoinMarketCap).

One of the stand-out features of Binance is that it offers a significant number of cryptocurrency pairs. In fact, this stands at well over 600 pairs at the time of writing.

This means that you will have access to cryptocurrencies of all shapes and sizes. For example, if you’re looking to trade the likes of Bitcoin, Ethereum, or Bitcoin Cash – you will benefit from heaps of pairs at your fingertips. Alternatively, if you want to access less liquid projects like Troy, Polymath, or Status, Binance also has you covered.

Binance does not offer CFD products. On the contrary, you will be buying and selling cryptocurrencies in the traditional sense. You will, however, still be trading pairs.

Once you place an order via the Binance trading app or website, the position will remain open until you decide to close it. Once you do, your profit or loss will be determined by whether you speculated correctly, and by how much.

On top of spot trading pairs, the Binance app also gives you access to more sophisticated products. This includes the platform’s Perpetual Futures Contracts, which allows you to apply leverage.

As the structure of the derivatives offered by Binance falls outside of traditional trading regulations, it is able to offer leverage of up to 1:125. This means that a $200 account balance would permit a maximum trade value of $25,000.

In terms of trading fees at Binance, the platform is largely very competitive.

With that being said, if you plan to deposit fiat currency into Binance with your credit card, this can be costly. This comes out at the higher of 3.5% per transaction or 10 USD.

On the other hand, if you are able to deposit funds with a cryptocurrency, then no fees are charged by Binance. In terms of withdrawing cryptocurrencies, you will pay a charge that is similar to the blockchain mining fee for the respective coin or token.

You can read my full Binance review to learn more about this platform.

3. eToro

** below content does not apply to US users.

eToro is a different kettle of fish from Kraken, not least because much of the platform is focused on traditional assets like stocks and ETFs. The platform also offers a fully-fledged CFD facility, meaning that you can also engage in short-selling and apply leverage of up to 1:2 on your positions.

Regarding the former, this means that you can trade Bitcoin with twice the amount that you have in your account. All in all, eToro certainly comes with its pros and cons. In terms of the positives, eToro supports heaps of payment methods – including but not limited to debit cards, Skrill and bank transfers. eToro also stands out because it holds licenses from three key bodies – notably the FCA, CySEC, and ASIC.

On the flip side, all deposits at eToro made in a currency other than US dollars will attract a 0.5% fee. As such, although you are not paying any commission per-say, this is actually a smidgen more expensive in comparison to Kraken.

The platform also requires a minimum deposit of $200 – or about €170. You can, however, buy from just $25 worth of Bitcoin, which is handy for first-timers.

I would imagine that this is largely a result of newbie traders using too much leverage without having a grasp of the underlying risks. In addition to this, I must also make it clear that eToro does not allow you to withdraw your Bitcoin out to a private wallet.

This is also a practice employed by Revolut. This isn’t necessarily a negative point if you are happy to keep your Bitcoin at eToro until you are ready to cash out. But, for those of you that want to retain full control over your Bitcoin, this may prove problematic.

Read More: You can find my full eToro review here.

Investing in stocks, bonds, and ETFs involves risks including complete loss. Please do your research before making any investment.

Disclaimer: eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Past performance is not an indication of future results. Trading history presented is less than 5 complete years and may not suffice as basis for investment decision.

Copy Trading does not amount to investment advice. The value of your investments may go up or down.

Your capital is at risk.

Cryptoasset investing is highly volatile and unregulated in some EU countries. No consumer protection. Tax on profits may apply.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.

4. Kraken – A Trusted Platform for Europeans

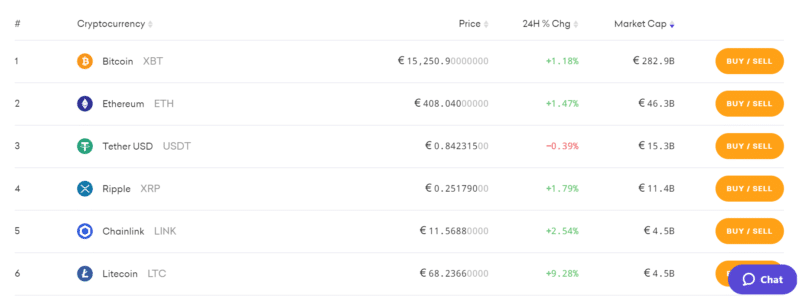

It’s somewhat difficult to get away from Kraken. This is because the platform ticks most of the right boxes for Europeans. In fact, in terms of Euro-based trading volume, Kraken is the largest exchange in Europe.

So, in order to buy Bitcoin at Kraken, all you need to is a European bank account. The easiest way to make a deposit is to transfer the funds via SEPA. Other banking networks are supported too, such as SWIFT.

With SEPA, you only need to meet a minimum deposit of €1. Best of all, if you have access to Instant SEPA, the transfer should be credited to your Kraken account in just a few minutes. Deposits via SEPA are free too – so far so good.

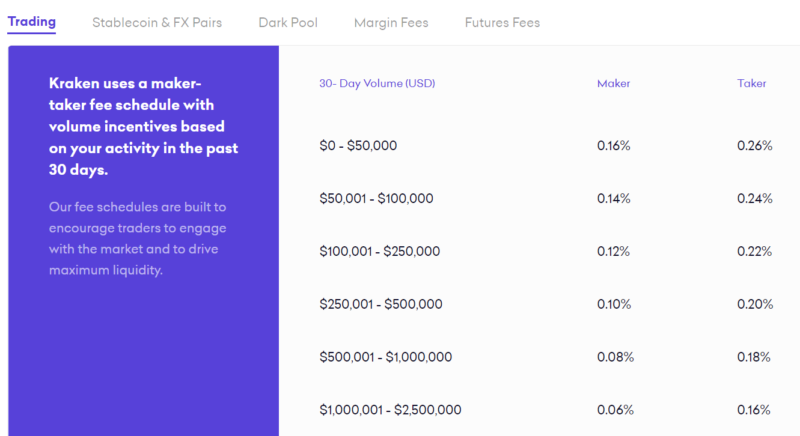

In terms of Bitcoin trading fees, Kraken the platform utilizes a market maker/taker system. If you’re just planning to use the platform to buy Bitcoin, then you are a market ‘taker’. As such, unless you are planning to trade more than $50,000 in a single month, you will pay a commission of 0.26%.

As such, if you were to buy €100 worth of Bitcoin, you would pay a fee of €0.26. Don’t forget, you’ll also pay a 0.26% commission when you eventually get around to selling your Bitcoin. Nevertheless, buying Bitcoin at Kraken can be done in a hugely cost-effective manner.

In terms of regulation, Kraken isn’t licensed in the same way as a traditional online stockbroker or CFD platform. But, launched way back in 2011, the platform is one of the oldest cryptocurrency exchanges in the space.

Crucially, it complies with all European regulations on anti-money laundering, and thus – all users must have their identity verified. Finally, I should also note that Kraken is extremely user-friendly. As such, if this is your first time investing in a cryptocurrency online, Kraken is a good option.

Read More: You can find my full Kraken review here.

Opening an Account With Your Chosen Bitcoin Broker

Once you have decided on which cryptocurrency broker you wish to use to buy Bitcoin, you will then need to open an account. Now, the process is largely the same across all of the brokers that I discussed in the sections below.

With that said, I’ll discuss the specifics with Kraken, one of the most popular options for Europeans looking to buy Bitcoin for the first time.

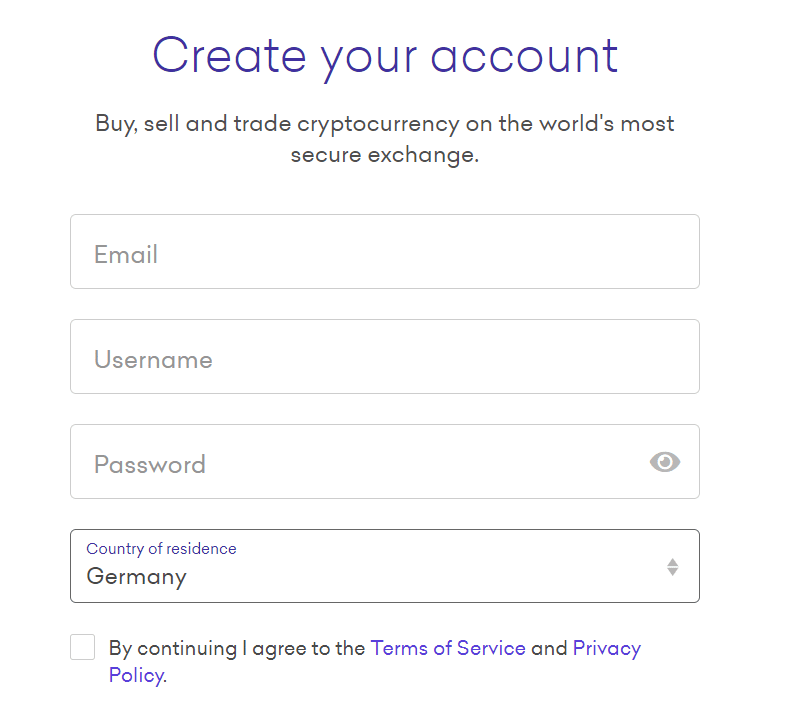

So, the first step is to head over to the cryptocurrency broker and open an account. You will be asked to enter some personal information – such as:

- Full Name

- Country of Residence

- Date of Birth

- Registered Address

- Email Address

- Phone Number

You will also need to choose a username and create a strong password.

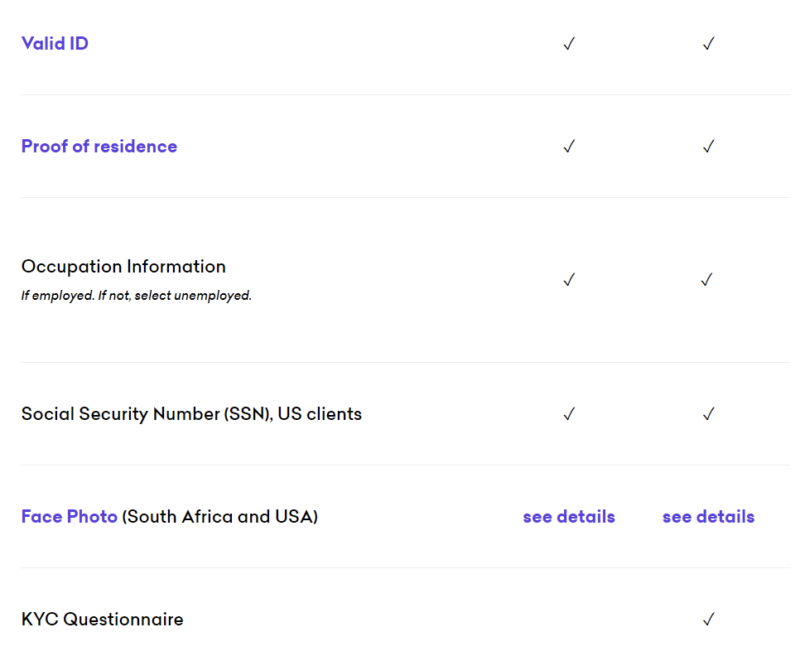

Once you have opened an account, Kraken – and all of the platforms mentioned on this page, will need to verify your identity. In order to do this, you will be asked to upload some documents.

This includes:

- Government-issued ID that is valid

- Proof of residency – like a utility bill or bank account statement

In addition to the above, you’ll need to provide some more information about your financial background. Depending on your country of residence, this might include your occupation, estimated net worth, and national tax identification number.

Although the above might sound somewhat intrusive, it is important to remember that Kraken is required to do this to remain compliant with anti-money laundering laws.

In other words, if you find a cryptocurrency platform that allows you to buy Bitcoin with a fiat currency and it doesn’t ask for any ID – it is operating illegally.

The good news is that in the vast majority of cases, Kraken is able to validate your documents in less than 10 minutes via automated technologies.

Making a Deposit

Once you have successfully had your cryptocurrency trading account verified, you will then be able to make a deposit. If opting for Kraken, the platform allows you to fund your account with SEPA.

See also: Best Crypto-friendly banks in Europe

As previously noted, if you have access to InstantSEPA, your deposit will be processed in less than a few minutes. If you are transferring the funds via the standard SEPA network, then this can take anywhere from 0-3 days.

Buying Bitcoin

As soon as your deposit has been credited by your chosen cryptocurrency platform, you can then proceed to buy Bitcoin.

- If using Kraken, head over to the main dashboard of your account and look out for the ‘Buy’ button – which is located under the ‘Buy Cryptocurrency’ tab.

- Select ‘Bitcoin’ and then enter the amount that you wish to purchase in Euros.

- Upon entering your purchase size, the equivalent amount in Bitcoin will update accordingly.

- Make sure that the ‘market’ tab is selected and not ‘limit’. This will ensure that Kraken completes your Bitcoin purchase instantly at the next available price.

- Finally, click on the ‘Submit Order’ button to complete your Bitcoin purchase

Once you complete the above steps, the newly purchased Bitcoin will be stored in your Kraken wallet. In the next section of my guide, I am going to explain the ways in which you can keep your Bitcoin safe after you complete the investment process at your chosen broker.

Deciding How you Want to Store Your Bitcoin

If you want to keep your money safe, you keep it in a bank account. When buying stocks or ETFs, the financial instrument remains at your chosen stockbroker. But, in the case of Bitcoin, the digital currency is stored in a ‘wallet’. This is simply a piece of digital software that allows you to store cryptocurrencies.

Put simply, if you decide to withdraw your coins out of Kraken, then you will be 100% responsible for their safekeeping. That is to say, if you misplace your private keys or login credentials – nobody will be able to recover your Bitcoin and it will be gone forevermore.

On the flip side, you and only you will have access to your Bitcoin wallet. This means that you never need to worry about a cryptocurrency brokerage hack or collapse, as your coins are being stored independently from any third-party.

Your options in this respect are as follows:

- Desktop Bitcoin Wallet: Store the coins in a downloaded desktop wallet. More secure than a mobile wallet but less convenient when it comes to transferring your Bitcoin out.

- Mobile Bitcoin Wallet: Download and install a mobile Bitcoin wallet to your device via an Android or iOS app. A super convenient way of keeping your Bitcoin safe – and really straightforward when it comes to making transfers.

- Hardware Bitcoin Wallet: Without a shadow of a doubt, the most secure way of safeguarding your Bitcoin. If you are planning to buy a large quantity of Bitcoin and keep hold of it for several months or years, a hardware wallet is well worth the investment.

The wallet-type that you opt for will ultimately depend on what your requirements are. For example, if you are only buying a really small amount of Bitcoin then a mobile wallet is likely to be the most convenient and user-friendly option.

But, and as noted above, if you are looking to invest in larger quantities then a hardware wallet is the most secure option on the table.

With that being said, I should make it clear some a lot of newbies find the whole wallet process somewhat intimidating. This is because you need to have at least a basic idea of how private keys and public addresses work.

Furthermore, and perhaps most importantly, there is always the chance that something will go wrong.

- That is to say, if your wallet was hacked by a third-party and the bad actor subsequently gained access – you can say goodbye to your Bitcoin.

- There is nobody to call if this does happen, as you are 100% for the safekeeping of your funds.

- Additionally, if you somehow lost your private keys and was unable to regain access to your wallet via the recovery passcode that was initially given to you, again, you can likely say goodbye to your Bitcoin.

Taking all of this into account, some Bitcoin investors will leave their coins at their chosen cryptocurrency platform. This means that you can just leave the coins there until you eventually decide to make a cashout.

However – and this is a big however – if the platform in question was hacked, there is every chance that your Bitcoin will have been stolen along the way. There are countless stories of this happening over the past few years, albeit, Kraken is yet to be hacked.

Selling Your Bitcoin Investment

At some point in time, you will want to sell your Bitcoin back to cold-hard cash. Hopefully, you will be doing so at a higher price than you originally paid. If you are a complete newbie to Bitcoin and have no idea how profits and losses work – it’s no different from investing in a traditional asset like stocks and shares.

For example:

- Let’s suppose that you buy €1,000 worth of Bitcoin today

- At the time of the purchase, Bitcoin was worth $17,200

- You hold onto your coins for 5 years

- In 5 years time, Bitcoin is worth $60,000

- This represents an increase of 248%

- As such, your original €1,000 Bitcoin investment is now worth €3,480

As per the above example, as soon as you exchange the Bitcoin back to Euros, the funds will then be available for withdrawal.

However, the ease with which you are able to do this will depend on the platform you are using and whether or not you withdrew the coins out to a private wallet. For example, if you went for the easy option and kept your Bitcoin at Kraken, you can exchange the coins back to Euros at the click of a button.

But, if you decided to withdraw the Bitcoin out to your private wallet, you will first need to transfer the funds to the wallet of your chosen broker. Then, you can make the transfer back to Euros and out to your bank account via SEPA.

How to Buy Bitcoin in Europe: The Bottom Line

By reading this guide from start to finish, you should now have the required knowledge to buy Bitcoin in Europe for the first time.

As I have discussed extensively, much of the battle is finding a suitable cryptocurrency broker for your personal needs. Whether that’s in terms of support payment methods, fees, or user-friendliness, there are plenty of options to choose from.

All of the brokers mentioned (Coinbase, Kraken, Binance and eToro) are reputable and tick most boxes. These platforms have a great reputation in Europe, offer low fees, are easy to use, and ultimately offer a safe and secure environment to buy Bitcoin via SEPA.

Hi Jean

You forgot to mention Bisq as one of the best exchanges…

And since the title is “How to Buy Bitcoin in Europe” you should also mention Relai, the easiest way to buy and sell BTC in the SEPA region.

Cheers,

António

Both of them without the hassle of the KYC…

Hi Antonio,

I don’t think either of these options are ideal for serious amounts of purchases. While there is much talk about KYC, the reality is that right now, it is much better to buy your Bitcoin from a KYC exchange like Coinbase or at least Binance. You will be thankful of having done so when tax time comes and your accountant asks you to provide reports on all your trading activity.

Not to mention that buying from the established exchanges I mentioned in the article is a much more user-friendly experience.

Thanks a lot.

for sharing the knowledge.

You’re welcome.

Nice article.

US here. Use CB pro, dont’ like Coinbase regular.

Many others are too messy and hard to use.

Binance won’t accept my ID.

What time of day do Europeans tend to heavily trade?

We have rushes around 9 pm Central Standard time, especially on Friday and Saturday.

Then another in late evening around 9 pm on many days.

I was wondering when to watch for that European, and even Asian, volume for the buy walls to edge up a little. Thanks

I’d be curious to know that data, it shouldn’t be too hard to find with some research on Google. I don’t really trade using such factors in mind so I never really dug too deep into this topic. Let me know if you find something interesting.

Hello.

I’ve been trying to find this answer myself, but I ended up with some other options: Phemex (not EU, SN – but looks like they accept SEPA transfers, subscription plan provides zero fees) and Bitvavo (NL, lower fees) (and Kraken).

If you have the time can you provide an opinion?

Thx.

HP.

There are loads of smaller exchanges that focus on particular geographies and niches. I’ve heard of these two but never had the need to look into them. In general, I prefer the bigger exchanges for security purposes.

Hi Jean,

It seems to me that you are maltese galea as surname.

Does it take to long to verify my identity with kraken, cause I`m been waiting more than a week or 2.

Great information keep it up.

Frank

Hi Frank, I imagine they have a lot of demand at the moment, but you can ping them via chat to see if your application maybe slipped through the cracks.

Hi Jean – interesting article.

What do you think of Revolut security with regards to BTC?

Cheers,

Raph

I wouldn’t recommend buying BTC from Revolut, as you wouldn’t be owning it directly. You will only be participating in the price action of Bitcoin without actually holding it yourself.