Online stock trading platforms offer a wealth of convenience for investing at any point in time and also provide lots of information about the market minute by minute, helping you make the best decisions.

For active trading as well as long-term investing these are the best platforms I’ve found:

DEGIRO

There are not a lot of online brokers that offer an asset library as extensive as DEGIRO. Whether it’s shares, bonds, ETFs, or funds – you’ll have access to thousands of instruments across 50 markets and 30 exchanges. This ensures that you can build a highly diversified portfolio and thus – mitigate your exposure to a single asset or marketplace.

In terms of the main attraction – fees, this is largely very competitive. In fact, if investing in major marketplaces found in the UK, US, and parts of Europe, the fees are much lower than most brokers out there. However, it is important to remember that the likes of eToro allow you to buy shares in a 100% commission-free environment, although spreads apply.

As such, if you really want to focus on keeping your costs to an absolute minimum, eToro might be better. On the other hand, although you might pay a slightly higher fee at DEGIRO, the platform does offer much more in the way of asset diversity.

Finally, I do like the fact that DEGIRO does not have a minimum deposit in place and charges no transaction fees, albeit, it’s a bit frustrating that you can only fund your account via bank wire.

You can take a look at my review of DEGIRO for more information.

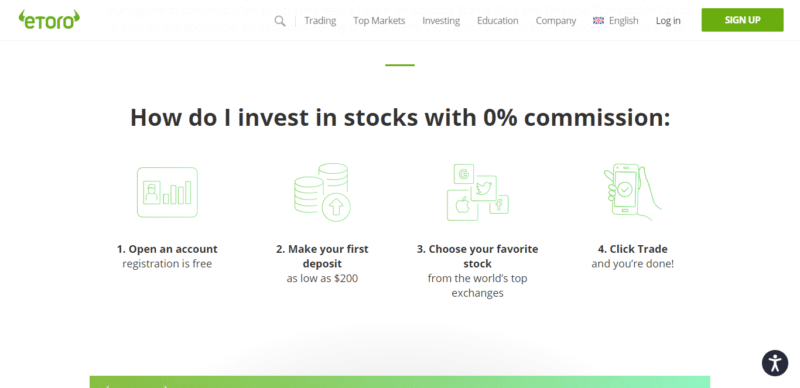

eToro

If you’re actively involved in the online trading space, there is every chance that you have heard of eToro. After all, the provider now has 13 million users under its belt – making it one of, if not the largest trading platform around.

eToro offers a wide selection of markets – all of which can be accessed online or via the app. When it comes to traditional ownership, you can buy and sell shares from 17 marketplaces. This includes stocks listed in the US, UK, Canada, Germany, France, and more.

You can also invest in ETFs – such as those backed by Vanguard and iShares. This is good for diversification purposes or gaining exposure to difficult-to-reach markets. You can also buy and sell cryptocurrencies. This covers 16 digital coins – including the big two: Bitcoin, Ethereum.

With eToro you will not pay any commissions on stocks and ETFs, however, spreads do apply. There is no sign-up fee or monthly/annual subscription, either. You will also avoid stamp duty when buying UK stocks, which saves you an extra 0.5%.

You’ll need to first open an account – which you can online or via the app. Then, you’ll need to meet a minimum deposit, which you can instantly fund with a debit/credit card or e-wallet. Bank transfers are also an option, but this can take up to 7 working days.

You can read my full eToro review here, where I delve deeper into why I like this platform, and what you need to be aware of when trading on it.

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

Saxo Trader

Saxo Trader is a trading platform owned and operated by the Danish bank Saxo Bank. The firm was founded in 1992 in Denmark. It initially began as a brokerage firm but received its European banking license in 2001, enabling it to broaden its financial services. The headquarters of Saxo Bank is located in Copenhagen.

Saxo Trader has carved out a reputation for itself as a reliable and secure trading platform, assuring its users a high level of trustworthiness. As a fully regulated and licensed platform, it operates under strict regulatory oversight, providing users with a strong sense of security.

The platform has in place robust security measures to protect users’ data and financial transactions. With two-factor authentication and encryption, Saxo Trader goes the extra mile to ensure users’ accounts and personal information are secure.

An additional feather in its cap is Saxo Trader’s Stock Lending Program, which I’ve been using successfully ever since it launched. This program allows users to lend out their shareholdings in return for a payment, creating an opportunity for additional income. Importantly, while their shares are on loan, Saxo Bank acts as the borrower, thereby ensuring the shares’ safe return. This aligns with Saxo’s philosophy of risk management and demonstrates their commitment to user protection.

Saxo Trader’s customer support is another aspect that bolsters its reliability. With a dedicated and knowledgeable team on standby, users are provided with prompt and helpful responses to their queries or issues. They offer chat support (the one I use most), and also telephone and email.

I always recommend looking at all the fees and factors, because what works best for me will not necessarily work best for you, depending on your location and investing strategies.

Have you found any other great online trading platforms? Let me know in the comments section.

Investing in stocks, bonds, and ETFs involves risks including complete loss. Please do your research before making any investment.

Past performance is not an indication of future results. Trading history presented is less than 5 complete years and may not suffice as basis for investment decision.

Copy trading is a portfolio management service, provided by eToro (Europe) Ltd., which is authorised and regulated by the Cyprus Securities and Exchange Commission.

Cryptoasset investing is highly volatile and unregulated in some EU countries. No consumer protection. Tax on profits may apply.

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.

Thanks for the post Jean, A comment on eToro – this platform is great for small retail investors but if you are thinking of investing more than 10k then be warned. Their compliance resources do appear to be struggling to cope – or the quality of resources employed is not up to par – or a bit of both. Malta being greylisted doesn’t help either presumably.

And what about directa sim? It’s quite famous in Italy, active in the online trading business since the early ’90s

What is the best way to buy vanguard ETFs from Malta if you plan to invest some money every month? Thanks

You can use Interactive Brokers, Saxo Bank or a local broker like CC Trader.

Hi Jean!

I have two comments:

1. Interactive Brokers does not have 10 euro / month for maintenance costs IF you open the account using Tradestation Global as an introducing broker.

2. Degiro is having two accounts : basic and custody. Only for Basic account they could loan your stocks. For the Custody account they cannot, but the fees are a little bigger especially for dividends.

Thank you!

Bogdan

Hi Bogdan,

Thank you, those are two good points.

Do you have any experience with trading212?

Hi Jasper, I have an in-depth review of Trading212 in the works, should be published soon.

cheers both; looking forward to the review then Jean.

Hi Jean, great, interesting site you built!

I would like to point out to everyone to check the insured sum of the investing platform should the company go belly up!

Most repurable US based trading site are insured for hundreds of thousands of USD. CCtrader is covered up to €20k through MFSA so think about that when investing long term, and this does not apply to cash sitting in the account, it includes also securities, stocks, etc

….just my two cents on the subject hoping to help someone.

Hi Jean, Great website, keep it up 🙂 . Do you know whether CC trader have an inactivity fee and/or withdrawal or deposit fees? Also when they say 10 euros per trade [flat fee minimum] and rate of 0.1%, what does that actually mean? I am a beginner investor. Thanks in advance

Hi Jean, very informative. Do CC trader have an inactiviy fee and/or withdrawl or deposit fees? Also what does CCtrader’s 0.1% rate mean (versus flat fee min as per ETFs) in reference to Ben’s request? Thanks in advance,

I am interested in investing in ETF such as Vanguard to buy and hold (interested in around 2 or 3 of them) and not interested in active trading (yet). What would you say is the best? CCtrader seems to be the best for Maltese however they charge 10 euro per trade or 0.1%, whichever is the highest. this would mean that technically it only makes sense to invest EUR 10,001 for it to be “worthwhile” but what do you think?!

Have also looked into eToro but its Israeli origins and mostly involved in CFD trading which is too risky i chose not to use.

Interactive brokers, whislt being the most professional, is probably not worth it for beginning investor as myself investing say once a year in ETF.

What do you think?

Ben, check out Trading212 (they also have an app)

What would you say is the best for just investing in ETF (buy and hold long term) and not be an active trader? CCtrader is probably the best for Maltese, but they have large fees of 10 euro per trade or 0.1%, whichever is the highest. This means it technically would only make sense for investments of above 10,000 to hit the 0.1%.

Have also looked into eToro which is mostly involved in CFD trading which is riskier due to leveraging and plus since its origins is in Israel can raise a few questions. Therfore, I am not really inclined to use this.

Even though interactive brokers is probably the most professional, i am not sure it is suitable for a beginning investor who just wants to invest in ETF and maybe increase it year by year.

What do you think?

I would say try DeGiro or Saxo Bank.

Degiro is unavailable in Malta unfortunately.

Saxo bank, as you explained, has fees on non activity and considering I would be passively investing in these ETF, it doesn’t make sense to use it

Think until revolut release ETF (which in July 2019 they said they will) I will just have to use CCtrader

In that case CCtrader would be a good solution. I’ve used them and they’re decent enough.

U can access degiro even from malta, however u need to have an account abroad to deposit. Revolut is not accepted.

Hi Jean,

Thank you for your great post!

I think of investing in either eToro or DeGiro (mainly stocks but potentially Indiceds and ETFs).

From what I have checked so far in eToro platform, I was not able to find some stocks (listed in Nasdaq and a few in NYSE, mainly related with the fintech and biotech fields), while I will do the same for DeGiro in the coming days.

Do you might know, from your personal experience, if eToro has included all of the stocks listed in Nasdaq and NYSE or if there is a limitation on that?

Thank you!

Hi Nikolas, I haven’t run into this problem myself and unfortunately I don’t have a good answer for you. It’s probably best to contact eToro support and ask them about the specific stocks you’re looking for. I’d be interested to know what they tell you.

Degiro don’t answer emails to open an account, you’re placed in a queue of hundreds of people, their customer service is pretty much unresponsive

And Robinhood is not available for people residing in Europe

I think all brokers are experiencing issues at the moment, Saxo bank had 6 weeks lead time for new accounts last time I checked last week.

Is DEGIRO available in malta? I went on the website and didn’t see Malta on the list

No it is not unfortunately. I’m not sure why.

Great post Indeed!

I would like to know how realiable is finmarket.com

Looks pretty legit to me, but I personally recommend DeGiro.

The hyperlink for degiro links to a Honda (degiro) website.

My mistake, fixed.