Today, the cryptocurrency industry is full of diverse financial products that come in all shapes and sizes. If you are an avid crypto enthusiast, you might be actively using multiple digital wallets across different crypto platforms and exchanges.

As such, it can be quite cumbersome to keep abreast with your crypto portfolio at all times.

However, as with all financial holdings – it is crucial that you have a clear idea of what crypto assets you own. This is where crypto tax software provider Koinly aims to help

In this review, I explore what Koinly is, its different features, and how you can make the most of this platform to simplify your crypto tax proceedings.

Track your cryptos with Koinly

Koinly – An Overview

Investing in cryptocurrency does give you the opportunity to target above-average market returns. However, like any other tradable asset, this will also add to your financial liabilities. In other words, depending on where you live – you might be required to pay taxes on any earnings you make on crypto transactions. Unless you live in a crypto-friendly nation, that is.

Understanding your crypto tax obligations can be a bit tricky. This is especially true in today’s context, when the rules and regulations concerning cryptocurrencies seem to be changing every other month.

Therefore, it is paramount that you have resources in place to stay on top of your crypto tax obligations. This is where Koinly comes in. The platform can automatically compile your trades, measure your capital gains, and, most importantly, create reports for your tax purposes.

Put simply, it can help you save a significant amount of time by helping you work out the taxes linked with your crypto activities. What’s more, it can even point out if you can potentially save some money.

Koinly – Features

In simple terms, Koinly is intended to make your cryptocurrency journey more manageable. The tool can help you track, analyze, and generate tax reports on your cryptocurrency holdings.

Whether you are investing in cryptocurrency for the long-term or trading digital assets on a regular basis, you are likely obliged to pay tax to your jurisdiction. Koinly enables you to keep all your cryptocurrency affairs in order by collecting information from your exchange accounts and crypto wallets.

The tool will automatically generate a tax report for you based on your crypto activities in under 20 minutes. Koinly can work out your tax returns for over 6,000 cryptocurrencies – so that’s most bases covered. This includes many ERC-20 tokens to other independent blockchains.

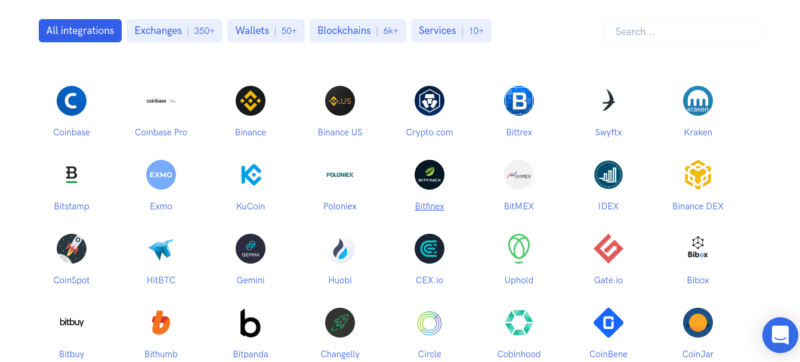

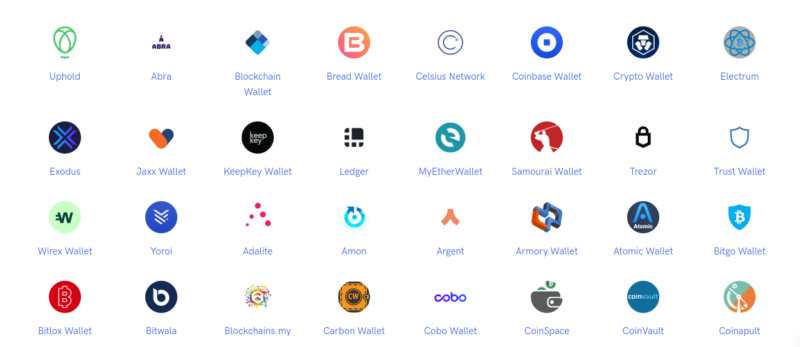

Currently, Koinly supports over 350 exchanges and 50 wallets. Furthermore, the platform also partners with over 20 services such as Nexo, Delta, Lending Block, and more.

Here is a brief overview of the different features offered on Koinly:

Automatically Track Cryptocurrency

Koinly allows you to connect your cryptocurrency exchange accounts and wallets on the platform. In doing so, the software will be able to sync transactions and track all the activities.

In addition, you will also be able to filter and search through your transactions through a single dashboard.

Track Your Holdings and Growth

Apart from transactions, Koinly will also give you a clear overview of your holdings and portfolio growth – across multiple wallets. You can see how much capital you have invested into digital coins and how much returns you are getting.

This will include any income from mining, staking, lending, crypto trades, and any other digital currency endeavors. In order to facilitate this, Koinly has partnered with platforms such as Nexo, YouHodler, and more.

You will not only see your earnings but can also access details of profit and loss, along with any unrealized capital gains.

Track Transfers Within Your Exchanges

Using the Smart Transfer feature, Koinly employs AI to detect transfers you have made within multiple exchanges. For instance, if you have moved 100 ETH from your Binance account into your Coinbase account – Koinly will identify this and display it as a single transaction.

More importantly, as these transactions occur within your wallets, Koinly will automatically exclude them from your tax reports.

Compliance with Different Jurisdictions

One of the most notable perks of Koinly is that it adapts to the regulations of different countries. The platform collaborates closely with local tax offices to ensure that it is updated with all the applicable tax laws.

You can choose from several account methods such as Average Cost (ACB), First In First Out (FIFO), Last In First Out (LIFO), Shared Pool (UK), Highest In First Out (HIFO), and more.

Koinly can also generate all the necessary forms you need to file your crypto taxes in your resident country.

Here is a list of the types of reports you can download from Koinly:

- End-of-year valuation report to view the value of your holdings and the respective acquisition costs.

- Capital gains disposal report that gives you a detailed account of both your long-term and short-term holdings.

- Income report that reflects all your rewards from airdrops, forks, staking, DeFi, and other transactions.

- Reports of any gift or donations you have made to others in cryptocurrencies can also be added in.

- In case you encounter any losses due to a hack or security breach, you can also format a report to reflect this.

Furthermore, you have the option to import your reports directly into an online tax filing software such as Turbotax, Drake, and TaxACT, among others.

How to Get Started with Koinly

As an automated crypto tax generator, Koinly can swiftly provide you with complete reports with minimal human intervention. That said, it is important to note that the accuracy of the platform depends entirely on what transactions you add to it.

Take a look at how you can go about using Koinly.

Step 1: Set up your Wallets

As we noted earlier, adding your wallets to the Koinly system is the key to generating tax reports. Your Koinly account serves as a container for the transactions from all the other resources.

The tool will create separate wallets with the same name as your exchanges/wallets/services. However, these will only indicate your cryptocurrency holdings and will not have any other functionalities of your chosen service.

Koinly offers support for dozens of popular crypto-wallets. No matter which exchanges or wallets you are using – the chances are you will find it integrated with Koinly.

You can begin by visiting the ‘Wallet’ page and then clicking on the option to add a wallet. From there, you can look for your specific wallet by searching for your provider on the platform.

Note: In case you are unable to find the service you use, you can also create a custom wallet.

Step 2. Import Your Data

When you have found your specific wallet icon, the next step is to import your transaction data into Koinly.

There are four different ways to add an exchange account:

- Using the API keys

- Using a downloaded CSV file

- Using your own custom file

- By manually adding the transactions

By default, Koinly uses a Setup auto-sync option that downloads your transaction history using API keys. This ensures that your Koinly wallet will always stay up-to-date. As evident – this is the recommended option since it eliminates the need for you to manually sync the data every time.

If you are unable to find this option or prefer CSV files, you can always resort to the other options.

Step 3: Wait for Koinly to Complete the Calculation

Once you have imported all your information, Koinly carries out an automated set of actions. This includes fetching the real-time market prices, verifying the transactions, and so on. The tool will also calculate your capital gains from crypto activities at this point.

When this step is completed, you can proceed to check whether Koinly has accurately downloaded all the data.

Step 4: Verify the Data Imported

Although this is not a necessary step, verifying that you have extracted all your data will ensure that your reports are correct. Not every exchange provides complete transaction history through APIs. Some might require you to upload CSV files to obtain access to all the details.

For instance, Binance users will find that they cannot import fiat transaction history through APIs. Meaning – it will not be possible for you to get information about any crypto purchase costs. Similarly, Huobi gives you only the transaction details from the last 90 days. Such discrepancies are common while connecting exchanges through APIs. As such, it is best to cross-check them to ensure that there is no missing data.

You can do this easily by checking the balances on Koinly to that of the actual balances on the respective exchanges. If the amounts match, then the data has been imported correctly. If not, Koinly can offer you further guidance in finding a solution.

With that said, it is common to see minor differences in account balances. Arguably, you only need to concern yourself with any large variances in these amounts.

Note: If you have turned on the auto-sync option, then Koinly will automatically make balance comparisons. In case there are any differences, the tool will display a yellow icon next to the respective wallet.

Step 5: Download the Tax Reports

When Koinly completes the calculation of your gains, you will be notified to refresh the page. After you refresh, you will be able to see an overview of the capital gains and any other earnings on the Tax Reports page.

You will also be able to download any reports you want from this section. Note that these tax calculations are set to your country’s tax regulations by default.

The reports are downloadable in the format of PDF, CSV, and Excel.

Koinly Pricing

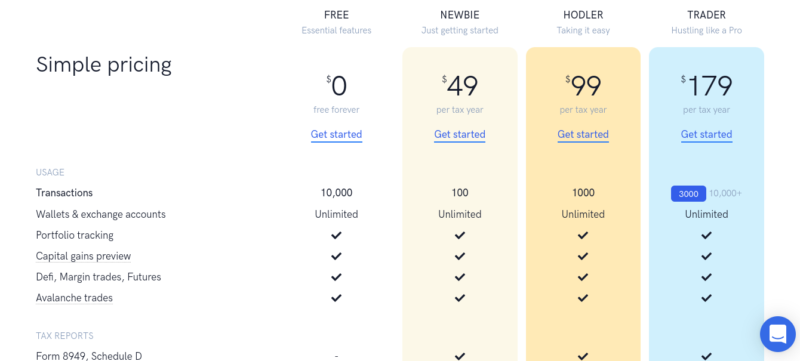

Koinly has a pricing plan that is calculated every year – based on the number of transactions.

Free Plan – at $0

The Koinly Free plan gives you permanent access to the essential features of the software at no cost. This includes tracking your transactions across multiple wallets and getting a preview of your capital gains tax.

Free account users also have a limit of 10,000 transactions per year. However, your access to tax reports will be limited to FIFO, LIFO, shared pool, and other local methods.

Newbie Plan – at $49 per Tax Year

The Newbie plan is more suited for those who are just getting started with cryptocurrency trading or investments. In addition to the tax reports available on the free account, you can also get your hands on international tax reports, and comprehensive audit reports, among other documents.

Furthermore, you will also be able to export your tax reports directly to software such as TurboTax and TaxACT. However, this Newbie plan comes with a restriction of only 100 transactions in a fiscal year.

Hodler Plan – at $99 per Tax Year

The Holder plan will get you the same advantages as that of the Newbie plan. The key difference is that your transaction limit will be increased to 1,000.

Trader Plan – at $179 per Tax Year

The Trader account gives you access to 3,000 transactions per year. Along with the advantages of the Newbie account, you will also be able to unlock priority support from the Koinly team through email.

Pro Plan – at $279 per Tax Year

The Pro plan is primarily targeted at professional cryptocurrency traders and investors. It allows you to get tax reports for 10,000 transactions or more.

Note: If you have a transaction history of over 500k – Koinly can also provide you with a custom pricing plan.

How Koinly Pricing Plans Works

When you purchase a plan for one year on Koinly, you will also need to consider the total number of transactions you have made in the past years.

For instance, let’s say that you have 9,000 transactions in 2019 and only 90 transactions in 2020. In order to get a tax report for 2020 – you will need to sign up for the Pro plan that would get your limit up to 10,000 transactions.

This is because, in order to calculate your gains, Koinly will need to process your transactions for the current and previous years. However, note that this will only get you the tax reports for 2020.

If you need reports for both 2020 and 2019 – then you will need to buy a Pro plan for 2019 and a smaller plan such as the Newbie for your 2020 report. You can also upgrade a plan by paying for the price difference.

Koinly Safety

According to Koinly, the team has gone to great lengths to ensure the safety of client funds. They employ a set of security protocols to secure your accounts against any breaches.

For one, Koinly does not use private keys or directly access your funds on the wallets/exchanges. Instead, it only relies on APIs. Therefore, if you want to be more secure – you can configure the API settings to disable the option to withdraw or trade funds.

In addition, the API keys are also encrypted before they are stored on the platform. Koinly also uses the services of AWS and Heroku for hosting. It also relies on technologies such as Graylog and StreamAlert to conduct regular audits of its infrastructure.

Furthermore, Koinly also employs several other security measures that are detailed on the platform. In summary – Koinly appears to be safe and sound on all fronts. The firm has also not reported any data breaches until now.

Koinly Resources Customer Support

Koinly offers a number of handy tools for free on the platform – including a crypto tax calculator, regional tax guides, and more. It also has a comprehensive help section that provides a detailed account of all its different features.

If you are in need of any further clarifications, you can reach out to the customer support team through live chat or email.

Koinly – A Potential Downside

In the last three years, Koinly has managed to become one of the go-to platforms for crypto tax reporting. Its reputation has allowed it to offer a large list of services for free and it charges reasonable fees for its paid plans.

It wouldn’t be far-fetched to say that Koinly currently dominates the crypto tax market. However, this might be a dealbreaker for some cryptocurrency users – especially since the plans do not leave much room for flexibility.

You might be able to find cheaper alternatives, but you might have to make some compromises in terms of functionalities.

Koinly – Conclusion

Overall, Koinly appears to be a perfectly viable option for cryptocurrency users to streamline their crypto tax filing purposes – making the entire process much easier to handle. The platform is easy to set up and can be configured with minimal effort.

Moreover, it integrates with virtually any cryptocurrency services – allowing you to accumulate all your transactions in one place.

In a nutshell, Koinly has managed to cater to the needs of the emerging crypto market. If you are in need of a crypto tax consultant, Koinly is one of the best tools you can use at the moment.

Do your crypto taxes with Koinly

Summary

Koinly is a crypto tax preparation software that you can rely on to calculate your crypto tax for the year, and you can also use it to keep track of your crypto portfolio across various exchanges and wallets.

I used this walk through to do my 2021 tax return and it was very easy with koinly. https://sharetrading.guru/using-koinly-to-complete-your-australian-tax-return/