Contents

Mintos is a peer-to-peer lending platform in Europe. Like many other FinTech companies of this type, it is based in the Baltic region; in Latvia specifically.

Currently, Mintos has four offices employing more than 160 people in Riga, Vilnius, Berlin and Warsaw.

Mintos started operating in 2015 but has experienced rapid growth due to getting many things right and becoming popular with financial bloggers due to its ease of use and transparency.

The average interest rate is around 12%, with close to 500,000+ investors registered worldwide and 600m euros under administration.

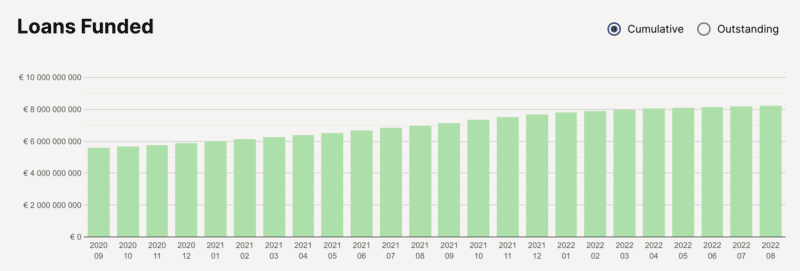

Another important statistic to look at is the loan book growth, and here again, Mintos is doing very well as can be seen in the following screenshot.

The total money invested so far is higher than 8 billion Euros, which is a staggering number for such a young platform. There is no doubt that Mintos is the biggest player in P2P lending in Europe at the moment, with over 50% market share of the total p2p lending market. There are some good competitors, but none of them provide the security and track record that Mintos does.

The management team of Mintos is clearly displayed on the website with links to the Linkedin profiles of each person on the team. Mintos is currently the biggest employer in the P2P lending space.

Being able to view the team and also check out various YouTube videos with their CEO Martins Sulte enhances the feeling of transparency and peace of mind. I am one of those who take a look at these pages on a website and use them when judging whether I should invest on a platform or not. Everything counts.

I have personally interviewed Martins on my podcast Mastermind.fm, so be sure to check out that episode if you like podcasts.

Mintos is a platform that is in line with EU law, so when you invest you won’t have any trouble with your accountant or tax authorities back home in terms of explaining what you are doing.

Finally and very importantly, Mintos as a company is profitable, so they are not only running on investor money but are actually turning a profit, which means that they have a much higher chance of standing the test of time compared to some other competitors that are still in startup mode.

The biggest number of investors come from Germany, Spain and the Czech Republic respectively, but this is mostly a reflection of those countries’ familiarity with this type of investing. There are more than 340,000 investors that have used Mintos and they come from 90+ countries.

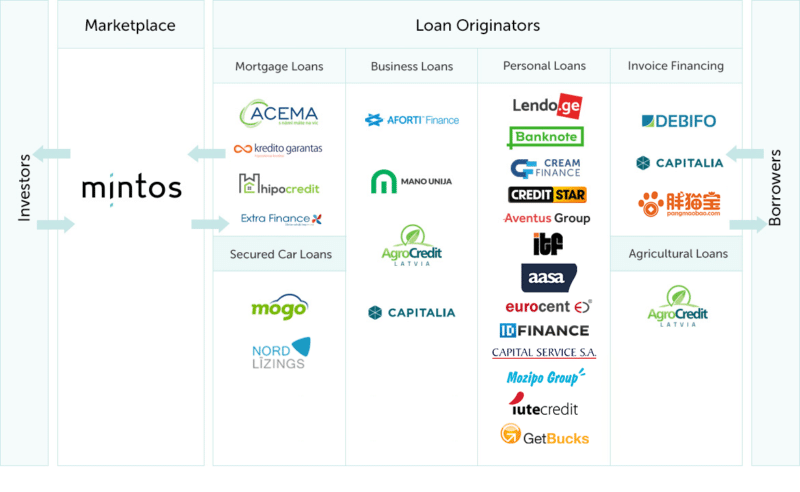

More than 60 lending companies offer their loans on the Mintos platform, with over 25,000 people working at these companies and spread over 33 countries, so you can have a global reach when investing on Mintos.

The company supports 10 languages via its multilingual support team, while the website is available in 6 languages and there are loans available in 10 currencies.

⚙️ How Does Mintos Work?

Mintos is a loan aggregator, which means that it partners with loan originators worldwide to bring in their loans onto the platform. These loans would be pre-funded, which means that the originators themselves have supplied the loan to the end customer, and are now reselling part of that loan to us investors via Mintos.

The people at Mintos conduct their research on each loan originator periodically and assign them a score based on various factors. They also provide information pages on each of these originators so that as an investor you can easily learn more about them. No other platform in Europe currently has anywhere close to the number of loan originators that Mintos has. This contributes to the huge loan pool that Mintos currently has and improves liquidity.

Every loan originator is required to have skin in the game, and many of them also provide a buyback guarantee.

The buyback guarantee means that if a borrower defaults, the loan originator will automatically buy back the defaulted loan from the investors and also pay them interest for the period during which the loan was in default.

Some people have thus asked me where is the risk in investing in Mintos when loans come with a buyback guarantee. We will have a look at the risks later but to answer that question, the risk is that the loan originator itself goes out of business. This has so far happened once, with Eurocent, a Polish loan originator, going bankrupt. As of today the funds I had invested with Eurocent loans have not been recovered, although there is still some hope that some funds will eventually be returned to investors. I personally treat those funds as bad debts and assume they won’t ever be recovered.

Some people have thus asked me where is the risk in investing in Mintos when loans come with a buyback guarantee. We will have a look at the risks later but to answer that question, the risk is that the loan originator itself goes out of business. This has so far happened once, with Eurocent, a Polish loan originator, going bankrupt. As of today the funds I had invested with Eurocent loans have not been recovered, although there is still some hope that some funds will eventually be returned to investors. I personally treat those funds as bad debts and assume they won’t ever be recovered.

There are no costs to investors when using Mintos. Taxes are to be declared and paid in your country of residence and Mintos thus not withhold any taxes. Rest assured though that this won’t be a hassle as it’s pretty straightforward to declare your income from P2P platforms in your tax return. I suggest you consult an accountant the first time you do it, and for the subsequent years, you can do it yourself.

Mintos is therefore just the go-between bringing together loan originators and investors. This allows investors to use one website to diversify their investments across several countries, loan types and even different currencies.

You can deposit either Euros or USD into your Mintos account, and there is a 1% charge for currency conversions. I have actually used Mintos to “save money” on currency conversions, feel free to take a look at my separate post on how to save money with currency conversions.

Mintos is more than a usual P2P lending platform, it is a marketplace for pre-funded loans. Instead of accepting borrowers and listing their own loans, they are working with several loan originators and list loans to the marketplace. This allows investors to diversify the investments between several countries, loan types and currencies. Loan shares are listed on the Mintos marketplace, where the minimum investment is €10 per loan and annual returns as high as 14%.

So, to recap, in simple terms, here’s how Mintos works:

- Lenders place loans on Mintos to finance their operations

- You invest in loans, thus providing financing to lenders

- Borrowers pay back loans in monthly installments

- You get the earnings and invest again or withdraw

Who is Investing on Mintos?

You might think that investing is something exclusive that only very knowledgeable people can partake in, but this is not true. Anyone with a basic knowledge of money and an interest to learn more about it is a good candidate for investing in P2P lending.

I spoke with Mintos and asked them about the typical profiles for their lenders, and they told me that they come from all walks of life and the amounts invested range from a few hundred euros to millions of euros. In the end, it doesn’t matter how much you invest, everyone can get the same returns on their investment in terms of percentage ROI.

You might also be under the false impression that only residents of certain countries are allowed to invest. This is far from the truth, as you can invest from all over the world, with only a few restrictions based on EU regulations. If you’re an EU resident, you can definitely invest.

To give you an idea, the top countries I’m seeing new investors join from after reading my articles or contacting me are the following: UK, USA, Germany, Netherlands, France, Spain, Belgium and Malta.

I’ve also seen strong activity from Asian countries such as India and China. I think Mintos is proving to be an excellent way for non-European investors to gain access and exposure to the European market and earn Euros, which is also a way for them to hedge against currency risks.

Mintos is open to both private and corporate investors. So if you want to invest via your company, you can easily do so.

What Can You Invest in?

At Mintos, investors can invest in different types of loans originated by many different loan originators.

Loans can be of the following types, and you can, of course, limit your investment to specific types when setting up your auto-invest.

- Mortgage Loans

- Car Loans

- Invoice Financing

- Business Loans

- Short-term Loans

- Personal Loans

- Agricultural Loans

In March 2020, Mintos has added Buy Now Pay Later platforms as well. The first one to join is Revo Technologies which is active in Russia, Poland and Romania. For those of you unfamiliar with such platforms, I’ll explain how it works in a nutshell. All across Europe, more and more shops are adopting a microloan facility at checkout, where you are able to buy the product and pay later. These microloans are managed by companies like Revo.

So say I want to buy a Playstation but only have €100 in my bank account; I would be able to choose the buy now pay later option at checkout, then pay it by installments over several months.

Where Can You Invest via Mintos?

Another question is which countries you can invest in via Mintos. To make sure we are well diversified, it’s important that we spread our investments across different countries to reduce our reliance on any one country’s economic performance. We can further add another layer of diversification by investing in loans denominated in several different currencies.

With Mintos, you have the option of investing in 30 different countries and 12 currencies. This makes it the most well-diversified platform that I know about. Over the past two years, Mintos has been expanding the investment opportunities on the marketplace beyond Europe by offering loans in Africa, Latin America, and Southeast Asia.

How I’m Investing in Mintos

I am currently using several auto-invest profiles that I tweak every few months as necessary. If you don’t feel confident setting up all the parameters of auto-invest, you can use one of the three preset strategies offered by Mintos, and I’ll delve into that later in this article.

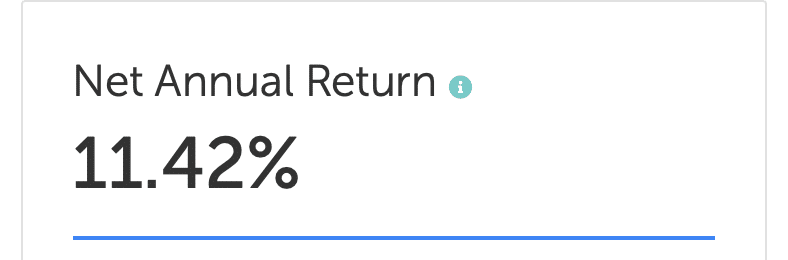

As you can see in the screenshot below, my net annual return is 11.42%, which is a rate I’m very happy with, considering the measly returns obtained if I leave the money in a savings account at the bank. Of course, there is much more risk with P2P loans, but the return rate of more than 11% adequately factors in the added risk.

You might see other financial bloggers report higher returns, which you can certainly achieve if you go for longer-term loans. I tend to stay within the 24-month range for my loans, as I feel it gives me some extra flexibility if I decide to re-allocate my funds to better asset classes at a later point in time.

I’ve been able to achieve 11,42% returns during my two years of investing with Mintos.

I have invested over €150,000 into the platform, and had one loan originator, Eurocent, default. Because I make sure to diversify the funds widely and also use the buyback guarantee feature, I only lost around €600 which is dwarfed in comparison to the profits made so far on Mintos.

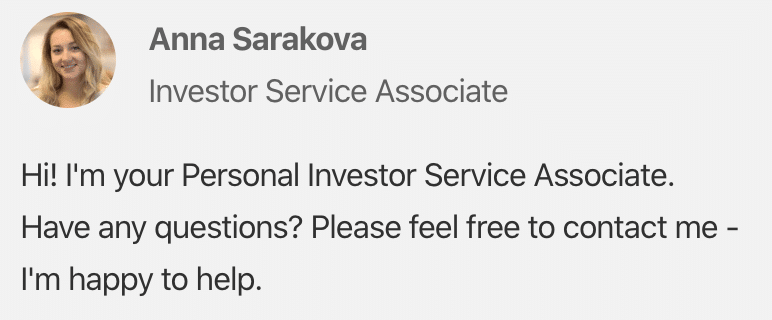

Due to having invested a substantial amount in Mintos, I get to have my own personal contact on the platform, so whenever I have any queries I can bypass the general support system and go to my contact directly. I really appreciated this as it gives me extra peace of mind knowing that there is a specific person who knows me and the way I invest and can answer my queries that same day. Although this is not something that is advertised on the Mintos website, I believe they assign a personal contact once you invest more than 50,000 euros on the platform.

However, even if you don’t have a personal contact at Mintos, you will still be able to get great support via email, phone or their online chat. In fact, whenever I need to check something quick I typically use the online chat facility on their website.

Mintos Preset Strategies

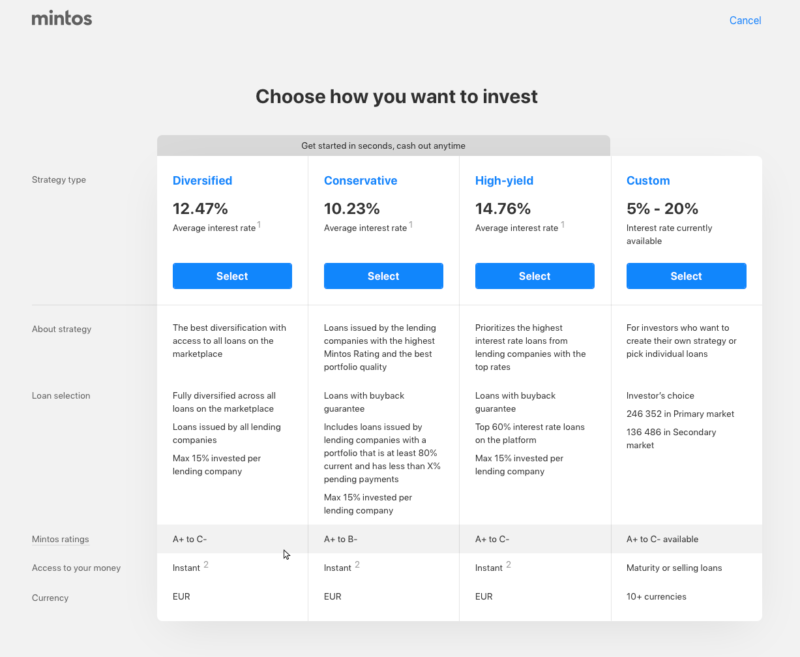

One of the new things Mintos has introduced in 2020 is the Mintos strategies. These are three strategies that have been designed keeping investor feedback in mind and are a convenient way to start investing in Mintos if you don’t have much experience in P2P lending.

Diversified

The Diversified strategy will give you the highest diversification and is the most similar to the new strategies to Invest & Access.

- Fully diversifies your investment across current loans from all lending companies with a Mintos Rating of A+ to C-

- The algorithm prioritizes diversification

- Loans with and without buyback guarantee included – 99% of the loans on Mintos have a buyback guarantee

- Maximum exposure of 15% in each lending company

Conservative

The Conservative strategy invests in loans from lending companies with the best portfolio quality.

- Invests in current loans from lending companies with a Mintos Rating of A+ to B-

- The portfolio of the companies is at least 80% current, and it has less than 10% pending payments

- The algorithm prioritizes risk reduction

- Loans with buyback guarantee

- Maximum exposure of 15% in each lending company

High-yield

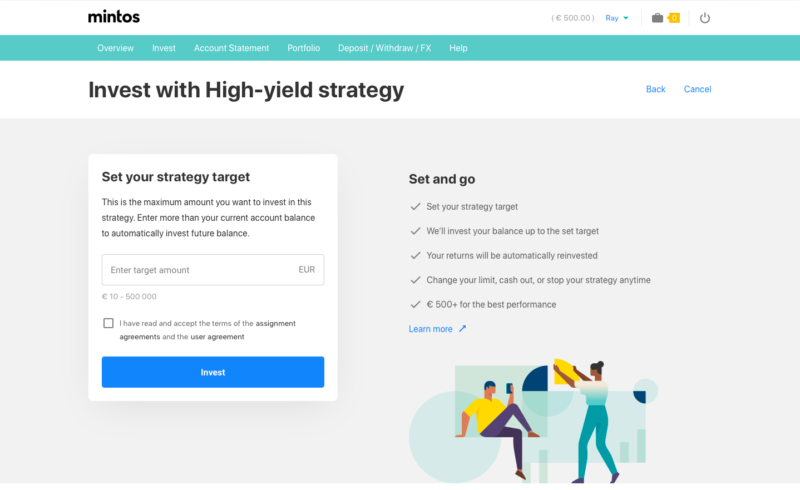

The High-yield strategy invests in loans with the highest interest rates.

- Invests in loans with the top 60% interest rates and a Mintos Rating of A+ to C-

- The algorithm prioritizes returns

- Loans with buyback guarantee

- Maximum exposure of 15% in each lending company

Mintos strategies are a fully automated way of investing. To get started, you just select the amount you want to invest. You’ll get a portfolio of loans that is diversified according to each strategy’s priorities. Your exact portfolio mix automatically adjusts to the market.

These strategies offer additional liquidity: If you want to access your money sooner, they come with a cashout option that lets you access your money faster (subject to market demand).

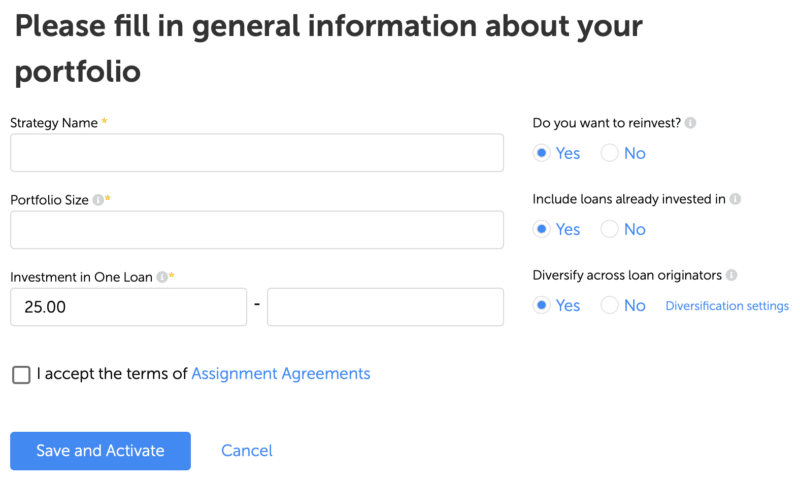

Using Custom Strategies

Obviously manually selecting thousands of loans to comprise your portfolio is a very inefficient way of doing things, although it might be a good way to test the waters if it’s the first time you are dealing with a peer to peer loan platform. It is perfectly OK to invest a set amount and then just wait a month or two to judge the results of your investment and learn how the platform works. Once you’re confident about the platform, you can then set up an auto-invest strategy and be well on your way to passive income.

You have to be careful when setting the auto-invest parameters on Mintos, because the biggest risk you face is that of a loan originator going bankrupt, and that has happened in the past. Check out the Mintos lender ratings post on Explorep2p as well as the Mintos loan scanner to see which are the most trustworthy lenders on the platform.

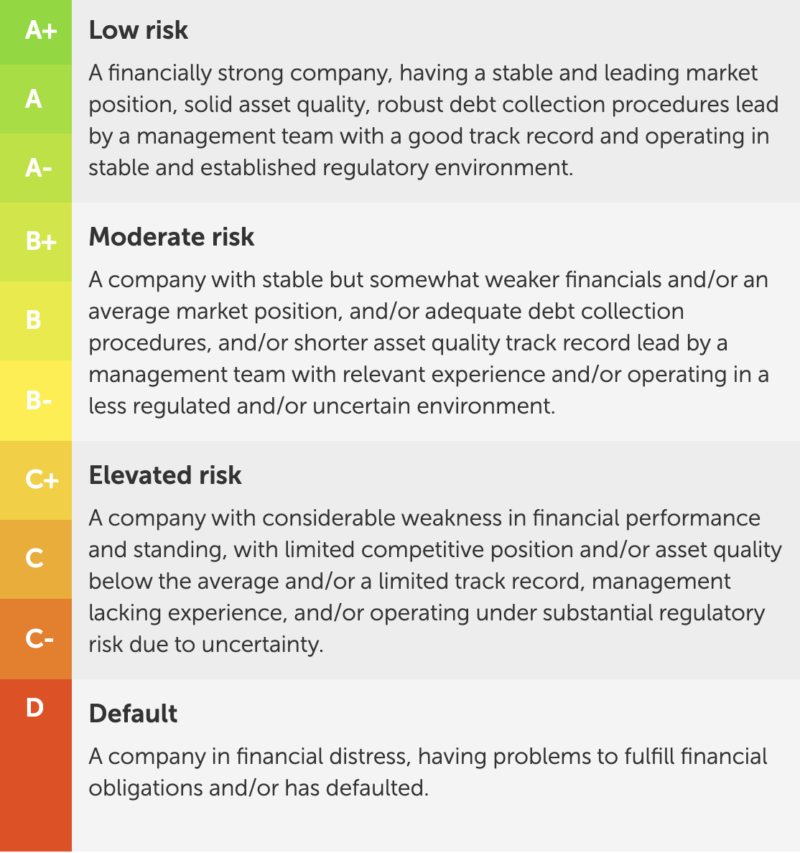

In 2018 Mintos also introduced risk ratings for loan originators offering their loans on the marketplace. The Mintos Ratings are on a scale from “A+” to “D”, representing the lowest and the highest counterparty risk respectively.

Here’s how I go about building a custom strategy.

By setting up auto-invest with a custom strategy, we are looking to combine the benefits of compounding interest with the safety of the buyback guarantee.

The first step when creating a custom strategy is that of choosing the loan originators you want to invest in. Keep in mind that there are several loan originators that are not profitable and are relying on their seed investment runway until they do achieve profitability. I prefer to use those that have already proven that they know what they are doing and are turning healthy yearly profits.

We have to keep in mind that peer to peer loan investing is in itself a risky proposition, so there is no sense in increasing that risk by going for unprofitable loan originators. Once you consider all loan originators, you might end up with 15-20 of them that you are comfortable investing in.

Beyond that, you can set up a bunch of other parameters like the loan duration, rate of return, countries, loan types, whether they have buyback or not etc.

A lot of these parameters will depend on your goals, so there is little sense in telling you my exact parameters, because even then, I go in and change them every now and then depending on what I want to achieve during a particular period.

Real Estate Investment Opportunities with Mintos

Mintos offers a unique opportunity for individuals looking to diversify their investment portfolios with real estate, without the need to purchase entire properties or take on the burdens of property management. Through the Mintos platform, investors can easily participate in rental residential real estate projects, starting with as little as €50. This low entry point makes real estate investment accessible to a broader audience, providing an easy and affordable way to get started in the real estate market.

One of the key advantages of investing in real estate through Mintos is the ability to earn a regular income stream from rent payments. By investing in rental residential properties, investors can receive a share of the rental income collected from tenants, providing a steady and predictable cash flow. Additionally, investors may also benefit from potential capital appreciation, as property values tend to increase over time. This dual income stream helps enhance overall returns, making it a highly attractive investment option.

Mintos also offers liquidity through its Secondary Market, allowing investors to buy and sell their investments if needed. This provides flexibility for those who may need access to their funds before the investment term ends. The platform’s approach simplifies real estate investing, eliminating the complexities of direct property ownership and management while maintaining the benefits of income generation and potential capital growth. This makes Mintos an ideal solution for those looking to diversify into real estate while keeping the process hassle-free.

Investing through Mintos not only provides a way to gain exposure to the real estate market, but it also offers an easy and efficient approach to portfolio diversification. Whether you’re a seasoned investor or just starting out, Mintos provides a straightforward way to access the potential benefits of real estate, with minimal capital requirements and without the headaches typically associated with managing rental properties.

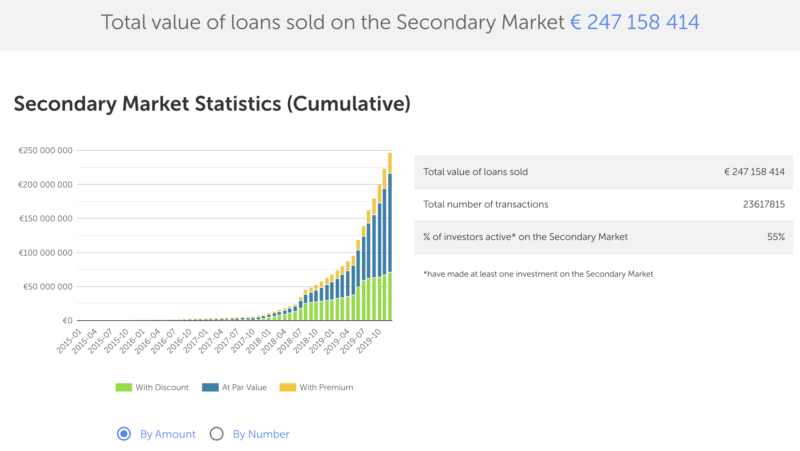

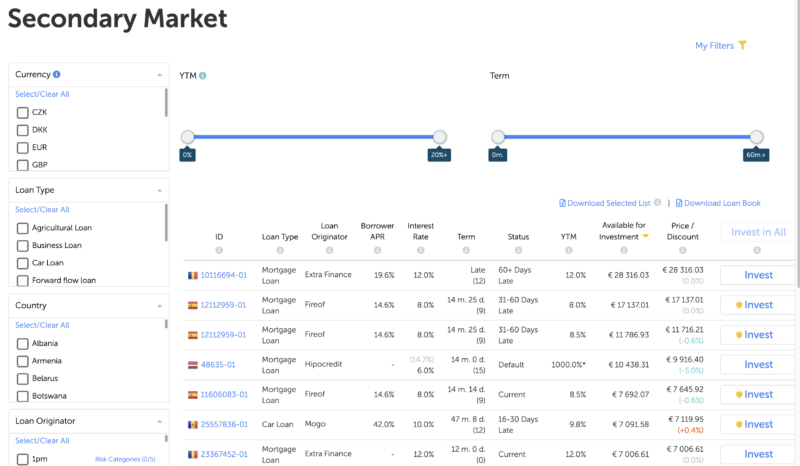

The Mintos Secondary Market

I think the secondary market deserves its own section as it has become such an important part of the platform. The secondary market is what gives Mintos the capability to have such high liquidity for its investors. I know investors who have sold over 1 million euros from their portfolio in just a few days’ time. The way to offload loans if you need cash is to sell them on the secondary market.

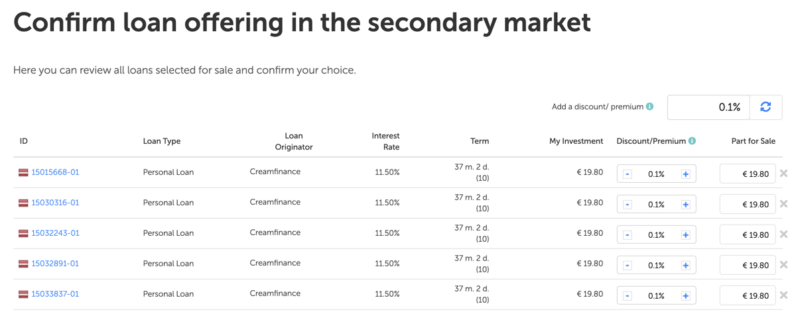

Buying and selling loans on the secondary market is very easy. If you want to buy, you can set up an auto-invest strategy to pick up loans specifically from the secondary market, with the same criteria as you are able to set up for the primary market.

You can also manually buy loans from the secondary market from the dedicated page on the Mintos website (shown above). You can of course filter according to your wishes and then click the Invest button to buy those loans. Many investors try to pick up good loans at a discount and thus improve their rate of return even further.

If you are looking for very quick liquidity, you can select the loans you possess, and then hit the Sell All button to sell them off on the secondary market. Before you do that, it would be a good idea to set a small discount on those loans, as that will make them much more likely to be picked up by other investors looking for bargains and extra profits.

The secondary market is huge on Mintos. As of writing this post, there are in fact more loans available on the secondary market than on the primary market.

There is a small 0.85% fee for selling loans on the Secondary Market. I think it’s a fair and transparent fee that will help Mintos stay profitable, and it’s on par with or below other leading platforms in Europe and the UK. Mintos reports 38% of active investors having used the Secondary Market, and about € 700 000 worth of loans sold each day on average during the last year. This 0.85% fee will apply to investors selling their investment on the Secondary Market, and will be applied after the sale.

The Secondary Market thus offers considerably liquidity to those investors who want to exit an investment early and is a very important component in this platform. If Mintos did not have such a good secondary market, I would not have invested such a big amount of money here.

Depositing and Withdrawing Money

You can withdraw money and deposit it without any delays when using this platform, and there are no costs for doing so. I know a lot of you have reached out to me to ask how they can avoid fees that are charged to them by their banks when withdrawing or depositing money from P2P platforms, and I can offer you a good piece of advice on that front.

I have several digital bank accounts set up that help me avoid any fees and also enable me to do currency exchanges at the best rates.

I currently use the following digital banks:

I can recommend all three of them. They all give you a free debit card as well so you can use it for shopping or when traveling. They work just like your local bank account but will likely have a better user interface, the comfort of online support and no ridiculous fees.

You can check out my post about depositing and withdrawing money from peer to peer lending platforms for more information about the topic.

Mintos Investor Club

A little-publicized aspect of Mintos is the investor club. This is a program that Mintos has created for its most valuable investors. Think of it as VIP treatment for investors.

We created this program to offer greater benefits to the most valuable and influential investors. It’s a way of showing our appreciation for having you on Mintos.

If you invest more than €50,000 on Mintos, you get a personal investor service associate who is available via phone or email to discuss things with you should you have any queries or problems.

I’ve had two service associates so far and they have both provided a fantastic service, responding to my email queries within a day and providing information that was not publicly available on the platform.

Here are all the perks for being in the investor club. Once you reach €50,000 invested, you will see a notification when logging in to Mintos, telling you that you are now part of the club.

- Skip waiting lines and reach your personal Investor Service Associate whenever you need assistance on Mintos Marketplace.

- Be the first to know and try our new features, pre-launch versions of our upcoming products on Mintos, and get to share your feedback.

- Get special deals for fintech events sponsored by Mintos. When possible, join investor meetups with Mintos CEO and team.

- If you need specific data of your current or historic investments on Mintos, we can export custom spreadsheets on your request.

I had, in fact, asked my service associate to send me a weekly report showing the performance of my investments, a request which was duly and rapidly attended to. I find receiving an email report more productive for my workflow than having to login to the platform regularly. I like to keep my investments as hands-off as possible.

In the near future, I don’t think I will need the reports that much, as the mobile app does such a fantastic job, as I detailed earlier.

Mintos Loan Originator Ratings

When you set up an auto-invest strategy, you will notice that all loan originators have been assigned a Mintos Rating. The Mintos Rating is meant to be a gauge for each loan originator’s financial and operational stability. According to Mintos, the loan originator’s ability to service and originate loans is the most important factor when assessing loan originators. In addition, the financial standing of the loan originator is a material factor when the buyback guarantee is provided to investors.

Ultimately, the Mintos Rating measures the counterparty risk or risk of loss resulting from a loan’s originators’ failure to service and/or transfer the received payments from borrowers to investors or meet other contractual obligations (including but not limited to the buyback obligation). Counterparty risk is capturing operational and default risk of the company acting as a loan originator, servicer of loans and obligor of the buyback guarantee to investors. The materialization of those risks would cause a disruption in loan servicing and the buyback fulfillment which are the core risks related to loan originators on Mintos.

The rating is driven by five core factors characterizing each loan originator: operating environment (10% factor weight), company profile (15%), management and strategy (15%), risk appetite (20%) and financial profile (40%). Additionally, a support factor is incorporated for loan originators who receive guarantees from the group or a related company.

The Mintos Rating is based on information obtained during the initial due diligence process and data from ongoing monitoring. This includes the primary information from loan originators such as management interviews, site visits, audited and interim financial statements, corporate presentation, credit policy and risk control documents. The rating is updated annually, except in certain instances where a loan originator’s rating requires an immediate change. This could be due to a cash injection, positive or negative regulation being implemented in the country of the loan originator and so on.

I would recommend doing your own research in loan originators if you are investing big sums of money, else you can definitely use the Mintos loan originator ratings as your guide for smaller amounts.

💡 Potential Downsides of Investing with Mintos

Let’s have a look at the main risks of investing in P2P lending and Mintos in particular.

Loan Originator Risk

As we have already mentioned, P2P lending is a moderate-risk investment, and you must be aware that loans can default. With Mintos, you get a buyback guarantee as we discussed earlier. Thus the biggest potential downside of investing with Mintos is that a loan originator goes bankrupt, as I described with the Eurocent case above.

The only way to mitigate this risk is to keep an eye on the profitability of the loan originator. Most of them release their financial reports to the public every year, so you can see how they are doing. This is not as easy as it sounds, however.

Only 38% provide audited financial statements. Unaudited financial statements are not as trustworthy when compared to audited ones. You’re basically relying on what the business is saying about itself rather than what a trusted 3rd party (audit firm) is saying.

Almost 45% of loan originators are not profitable. It’s quite normal for new businesses in this space to be unprofitable for the first few years, but you also have to factor in the increased risk of them spending all the investor money before they turn profitable, which leads to complications including bankruptcy.

Around 80% of the loan originators are less than 10 years old, which means that they were founded after the last great world recession and we don’t know how they will perform if another one hits in the coming years. During a world recession, credit companies are some of the hardest hit as borrowers default on their loans due to having lost their jobs or having experienced severe pay cuts.

Interest Rate Risk

One other risk is that interest rates rise in the future, making it harder for you to sell your existing loans with lower interest returns on the secondary market, if you wished to do that. Of course, you could also just let the loans run their course and continue receiving payments until maturity.

When investing on P2P platforms, it’s best to invest money that you can afford to use without running into severe financial troubles. That way, you minimise the chances of having to sell loans prematurely, potentially at a time that is not advantageous.

Cash Drag Risk

Cash drag varies among different P2P lending sites, and thankfully this hasn’t been a problem with Mintos. Mintos is extremely liquid meaning that you can throw thousands of Euros at the platform and see them invested within minutes, and conversely, you can also sell your loans on the secondary market within a day or two.

Although it is not currently a problem, it could become so at any point in time, even though it might only be for a short time. If there is a surge in popularity for P2P lending platforms, we will have a situation where lots of lenders are competing to lend while there are not enough borrowers, which will result in a higher cash drag, because you have to wait your turn.

To put this into practice, let’s say that the interest rates you earn when lending are 10%, but, on average during the year, half your money is sitting as cash in your lending account with no borrowers available. With just half your money being lent and the other half in cash, it means you’re actually earning just 5%.

That’s an extreme example. Cash drag is not usually anything like that much. In fact, it typically reduces a 10% rate down to between 9.4% and 9.8%.

Considering these potential downsides, I think that investing in P2P lending platforms and Mintos, in particular, is a very good deal for investors, because there aren’t any other readily available investment opportunities with such a favorable risk-return profile.

Moreover, Mintos is currently the biggest platform in Europe and has proved itself to be competent by providing great communication with its investors as well as a very liquid primary and secondary market for loans for several years now.

Foreign Exchange Risk (or Opportunity)

You can invest in loans across 12 other currencies apart from EUR, including USD, GBP and RUB. This means that when you convert back to Euro, you might lose money depending on how the rates have moved in the meantime. This could, however, also be an opportunity to make extra returns. I’ve seen investors using currency arbitrage to raise their overall returns to 15-20% which is really impressive.

I like to keep things simple myself so I only invest in Euro. I also use Mintos to minimise the cost of currency conversions.

If you want to invest in other currencies, I would recommend using a platform like Wise; in that way, you’ll avoid the Mintos commission on exchanges.

❓Frequently Asked Questions about Mintos

I’ve spoken to many people about Mintos and I get to hear many questions that investors seem to have in common, so I’ll try to address them in this section. If you have any other questions you’d like me to address, just leave a comment below the post.

How can I reduce the number of late loans? e.g. 1-15, 15-30, 30-60 etc

I don’t think you can really avoid that unless perhaps you study your portfolio’s performance and identify if there are any specific factors that result in loans being regularly late, for example, loans from a particular country or a particular type. This is not something that I’m too concerned about, plus I don’t really get into hyper optimization with my portfolios as I don’t feel it justifies the time investment given the yearly returns. Therefore I haven’t done such a study myself. However, if any of you reading this post do conduct such a study, I’d definitely be interested to know what you find out.

What are pending payments?

In your dashboard, you will sometimes see some money that is marked as pending payment. This means that Mintos is gathering the money and preparing it for distribution.

If this happens, you will be compensated for the delays in settling pending payments.

The interest on pending payments is 1.2x the interest of the loan in question. You can expect to receive the interest weekly, once it’s paid by the respective lending company.

The interest will be calculated for both the principal and interest and the calculation will begin after the settlement period (7 days) has ended.

How are loan returns taxed?

Mintos sends you the returns gross of tax; they don’t withhold any taxes. You will, therefore, have to declare the income in your country of residence, as explained in further detail in my post about P2P lending platform taxation. I’ve also written a post about how crowdlending is taxed in Spain specifically.

Do you recommend just investing in Mintos or do you recommend spreading your money across different platforms?

Mintos is my preferred platform and its where I invest most of my P2P portfolio, but I would always recommend spreading your capital across different platforms.

What returns can I expect?

Over the past three years, my experience and that of my fellow investor friends have shown that you can achieve anywhere between 10% and 14% returns depending on how you invest. Every platform has its own average return and that also depends on the amount of risk that you are assuming with the loans on that particular platform.

I don’t have as much capital as you to invest, what is the minimum to invest at Mintos or P2P sites in general?

I would say that you can start with as little as €1,000 to see how things work on any of my recommended platforms, but to make any meaningful income you need to invest at least €10,000. Anything less than that is not worth the time and hassle in my opinion. If you have more than that amount to invest, then it’s even better.

Does Mintos allow investments in cryptocurrencies?

No, this is not something that Mintos provides at the moment, but I wouldn’t be surprised if they branch into this area in the future. For now, you could have a look at my article on the best P2P crypto loan platforms.

I am a bit worried about having a significant number of loans that are late. Is it normal?

Yes, it’s normal to have a good portion of your loans being late with their principal and interest payments. Here’s my breakdown in percentages:

- Grace Period: 3.4%

- 1-15 Days Late: 7.5%

- 16-30 Days Late: 12.6 %

- 31-60 Days Late: 6.7%

As you can deduce, around 30% of my loan portfolio is late, but that doesn’t mean I should start to worry, as all my loans are covered with a buyback guarantee.

There should be no loans beyond 60+ Days Late if you’re using buyback guarantee, as that would mean that the loan originator is having problems buying back the loans and is likely going to go bankrupt. The only loans I have in my account that are 60+ Days Late are in fact all the loans belonging to Eurocent, which went bankrupt last year and is currently in administration.

How long would it take for me to sell all my loan portfolio should I need quick liquidity?

From my experience in tests I’ve conducted and also those done by other investors I’ve spoken to, it takes between 24 to 72 hours to sell a complete portfolio. Size doesn’t seem to be a problem, as I know people who have sold 7 figure portfolios on the secondary market in this short timeframe.

Whether you can sell your loans at par or whether you’d need to apply a discount depends on what kind of rates loan originators are offering at the moment you decide to sell versus what rates they were offering when you bought. For example, if you invested in Mogo loans at 11% 6 months ago and the average for Mogo loans is now 12%, nobody is going to buy your loans unless you offer them at a discount.

In the end, you might have to give up an equivalent of a week or two of interest income to sell your loan portfolio, which I think is a good tradeoff.

I see capital gains in my account, how is that calculated?

Mintos calculates the positive gain on a loan-level for investments on the Secondary market. For example, if an investor invested into a loan this year and it will be fully repaid only the next year then in the capital gain of this year the gain will not be calculated as the income from the loan is lower than the invested amount. Unfortunately, it is not easy to calculate as Mintos looks at all the previous years as well.

Here is an example: In 2018 an investor invested 90 EUR in a loan and in that year he received 100 EUR from the borrower and the loan finished. Then for 2018, the capital gain will be 10 EUR.

If however in 2018 an investor invested 90 EUR into a loan and only half of the principal was repaid, then for 2018 the capital gain will be 0 EUR. If the loan will be repaid in full in 2019 and the total funds received will be 100 EUR, then the capital gain for 2019 will be 10 EUR etc.

The data can be found under Account Statement, but then you have to look at all the previous years in which you have earned with Discount / Premium on Secondary market transactions and which loans were fully repaid in 2019.

Mintos Mobile App

The Mintos mobile app, another new addition in 2020, provides a significant differentiator for Mintos when compared to other competitors in the space. It’s extremely well-made from a technical and usability point of view. My background is in creating software so I know a well-made product when I see one. I’ve also used and cursed at a ton of banking apps that had the most horrifying UI and nonsensical errors thrown at their users.

There are no such mishaps with the Mintos app. It has a light and dark mode (white or black background) and it shows you all the most important stats about your investments. You can also withdraw or deposit money directly from the app, and soon you will also be able to operate in the primary and secondary markets.

With that last feature in place, you will most likely never need to login to the website again. Given that most people operate exclusively from their phones these days, it’s an obvious step for platforms such as Mintos as they strive to reach a wider audience and make things easier for their existing investors.

I especially like the stats section as I can quickly check the vital stats on my money, including the countries I’m invested in, the lending companies, the average interest rate, average remaining term and amount of late loans. These are all stats that are also available on the site, but they are not as easily and readily available. Let’s not forget that there is much more friction in sitting down at your desk, opening a website, logging in and navigating to the pages you need, when compared to opening a mobile app that’s always logged in and shows pretty and easy-to-read stats immediately.

What Improvements Would I Like to See from Mintos?

Better Statistics

We can see the cumulative number of investors on the Mintos statistics page, however, there is no clear indication of how many joined users joined every month and more importantly how many of them are even active. Many users can sign up but then never invest, and that is not reflected in the stats.

The same goes for the investment volumes section of the statistics. We can see the cumulative investment growing month by month, but we don’t have information on how many new loans were issued each month. This would give a clearer of volumes month by month.

With regards to loans, Mintos gives us a breakdown of Current vs Delayed loans, but in reality, the term “Current” is not 100% accurate. It is a catch-all for recently issued loans that have not reached their first repayment date, as well as those loans that have been paying back principal and interest successfully. There is obviously more uncertainty and risk with loans that have not started their repayments, so they should not be bundled together with the others that are being repaid already.

Ownership & Related Parties Transparency

There are some long-standing doubts about the ownership of Mintos and its relation to some of the loan originators on the platform. The ultimate beneficiary owner of Mintos is Aigars Kesenfelds. He is currently the true beneficiary of 81 Latvian companies. At the same time, he owns no shares in any company.

This businessman is the true beneficiary in several real estate companies, as well as a firm that offers self-service carwash – SIA Wash and Drive, AS Skanstes Biroju Centres, SIA Mintos Finance and others. Kesenfelds’ interests in those companies are represented by AS ALPS Investments, as well as Malta-based Dyonne Trading & Investments Limited and other companies of this kind.

Since June 2018, the number of businesses in which Kesenfelds is registered as the true beneficiary has increased by a total of 19 companies.

More Details on Loan Originators and Their Loans

I’d like to see more details such as audited statements for each loan originator, as well as a breakdown of loans issued by country, default rates and recovery rates.

Previous Concerns that Have Been Addressed

I have previously criticized Mintos over its lack of profitability and lack of transparency in the ownership structure. However, both issues are now solved, as Mintos is profitable and has a healthy cash balance in the bank, and the shareholders and original founders are clearly mentioned on the site now.

As for regulation, there is an upcoming European-wide regulation that Mintos will abide by, so I’m not so worried about this aspect.

Mintos Alternatives

Many people are skeptical about P2P lending platforms and prefer to diversify their investments across multiple platforms in case things go south on one of them. While I think Mintos is currently the best platform in Europe, there are others that are right up there vying for that number one position with Mintos. They would be worth looking into and possibly used to diversify your portfolio along with your Mintos investment.

Here are my favorites:

- Peerberry (11.54% average return)

- Swaper

- Lendermarket

Another related sector you can consider for investing at good rates is that of crypto-backed loans. Basically, the idea is that borrowers provided their crypto as collateral when obtaining funding. You can read my review of the best crypto-backed lending sites for more information. YouHodler and Nexo are my favorites.

Final Thoughts on Mintos

I’ve been investing on Mintos for over four years now, and I’ve seen the platform grow from strength to strength.

I think one should be realistic and understand that this is an area of investment with a certain degree of general risk, and I would like to see Mintos to improve in certain areas as mentioned above, however, when I balance the risks versus the return I feel that investing in such platforms, and Mintos in particular, is justified.

I keep a certain part of my net worth constantly invested in P2P lending platforms to take advantage of their fantastic returns, and Mintos by far holds the biggest portion of this investment. I have no plans of changing that in the near future as I have been very happy with the performance so far.

Therefore, we can wrap this up by saying that Mintos comes highly recommended from me. Please leave any questions you have about the platform below and I’ll be happy to answer them.

Summary

I’ve been investing on Mintos for the past four years with great results. I highly recommend Mintos for any P2P lending portfolio.

Pros

- Great liquidity

- Straightforward to start investing

- Well established platform

- Buyback guarantees

- Mobile app

Cons

- Risk of loan originators defaulting

Dont trust any kind of evaluation on this “blog”. This is pretty obviously a paid adverb. Doesnt mention the risks (currency, political), doesnt point the many investors that lots money on Mintos. I am not saying dont invest on Mintos, I am just saying to take this for what it is.

Myself I will come out zeroed out after cca 1 year on Mintos. Lost mostly to Wowwo (nowhere did anyone mention it would be me carrying the currency exhange risks, how did Mintos not check the for the LO) and something in Russia (managed to pull most of it out couple of days before the invasion).

i stopped putting more money in and waiting to see how Mintos handles those two issues. They are suing Wowwo now, and there is probably some hope the Russian debt will be repaid once Ukraine wins the war and money starts flowing again, but definitelly not in full.

Hey Jean,

how much did you have invested in Wowwo in Mintos?

I see they are now suspended.

Best regards,

Steve

I didn’t have anything invested in them.

Hi Jean,

Thanks for your article, very useful !!

I think I mis one risk – aspect;

* What will happen when Mintos defaults?

* I guess it will not be possible to access the platform and therefor not your investment, for a certain periode?

* How are the loans secured, so you will not loose money when that happens?

* Are the loans placed in a separate SPV or legal entity?

Thank you in advance,

Walter

What are your thoughts about adding more cash into Mintos in 2021 as we are slowly coming out of Covid? I am quite diversified already. At the moment Mintos represents roughly about 5% of my total investments (15% is P2P across platforms) with the rest in dividend stocks and ETF’s.

I am optimistic about coming out of Covid. I don’t see any problem with your share of total investments either. Mintos remains a market leader so I can’t recommend not adding more cash to the platform.

Hi Jean – thanks for your guides and information – greatly appreciated. Are you aware that both Mintos (for about a year) and Twino (fairly recently) are no longer accepting new investment money from UK residents? I started investing on Mintos (and Twino) years ago and have been very happy with both of them so this is disappointing. Have you any idea why this is or if it is likely to change? – All good wishes to you.

You’re welcome and yes I’m aware. Both platforms have said that it’s a temporary measure triggered by Brexit and having to set up some different structures in order to be legally operating in the UK. No doubt they will be back in the UK, but I don’t know when.

This article is not accurate, there are a few lending companies that are default and money invested with them is shown under the new title “in recovery”. Mintos is not respecting a buy back guarantee in that case.

I have about 6,000 stuck in that status over 6 months, no change, update or recovery.

I’m pulling out of there.

You can contact me by email, I’ll send you screenshots.

How was your payout? Did you have any dealy. I’m one of thos investors that got stuck in Fastinvest… i have a pending payout of 5 month and 20 days so far. Not sure if i ever will see my money. I can live with the risk of me making a wrong investment. e.g going for high returns = high risk. But delayed payment, or even wors (Holding investors money back on purpose) is something else.

So before i put my money in Mintos, i would like to know how your experience with the payout went 🙂

I never had problems with payouts, 1-2 days at max.

Never put your money on that platform, I invested 2k on that platform in the FINKO company, the company went bankrupt and my money has been blocked for over a year. RUN AWAY from that platform.

That’s a pretty poor reason for someone not to use a platform. It’s like saying don’t use a stock broker because you put all your eggs in one basket with a stock and it went to zero.

I’m not sure how recent or updated this post is, but if you lost 600 out of 150000 that of course negligible.

In my case, 20% of my investment is held “In recovery”. In other words, almost all of my profit over the years. This involves 9 separate lending companies and most of the money is tied in “Capital Service” and “Finko”.

What is your view of the “recovery” process. Is recovery likely at all in your opinion?

Yes that is still current, I only lost 600. I’m sorry to hear about your high percentage of investments in recovery. It’s certainly something that can happen and has happened to a few investors due to higher risk loans or just pure bad luck.

The CEO of Mintos, Martins Sulte, has responded to the question about the recovery process multiple times, you can check the Mintos YouTube videos. Unfortunately, I have no further information beyond what has been provided by Mintos themselves. It’s also good to note that many other lending companies have been having problems recovering funds this year. It’s part of the risk you enter when investing in P2P loans.

Hi Jean,

Thank you for this article.

Do you think it’s ideal to start investing in Mintos during the current Covid-19 pandemic?

Hi Matthew, in these uncertain times it is probably best to diversify across different asset classes (possibly including P2P and Mintos itself) rather than taking a significant bet on a particular class, unless you have domain-specific knowledge that gives you an advantage when compared to the rest of the market players.