If you’re interested in trading assets on the move – whether that’s stocks, commodities, forex, or cryptocurrencies, it’s well worth doing so with a broker that offers an app. This will ensure that you can place buy and sell orders at the click of a button no matter where you are.

If you’re interested in trading assets on the move – whether that’s stocks, commodities, forex, or cryptocurrencies, it’s well worth doing so with a broker that offers an app. This will ensure that you can place buy and sell orders at the click of a button no matter where you are.

Additionally, the best trading apps allow you to easily check your portfolio, deposit/withdraw funds, and contact customer support. With that said, most online brokers now offer an app on both iOS and Android devices, meaning you have hundreds of providers to choose from.

In this post, I help clear the mist by discussing my favorite trading apps available in the market right now. I’ll also discuss the many factors you need to consider in choosing a trading app for your personal financial goals.

Why Get a Trading App?

It goes without saying that this post is only going to be relevant if you have a keen interest in trading. But, if you do, I think it’s crucial that you have access to a fully-fledged trading app alongside your primary desktop platform.

However, depending on the type of trading you intend on doing, you might choose to invest purely via your mobile phone. For example, if you are simply looking to buy and sell stocks, this is perfectly feasible.

See also: My guide to the best crypto trading apps

On the other hand, if you are a day trader that likes to perform advanced technical analysis – then you won’t be able to do this on a mobile phone. Instead, you’ll need to revert to the broker’s main online platform or desktop software.

Nevertheless, below I discuss the many reasons why you should consider a trading app if this is a sector you are already involved in or one you are interested in pursuing.

Never Miss a Trade

There might come a time when you spot a potential profit-making opportunity, only to miss the chance to get the trade on because you are away from your laptop or desktop computer.

This can be frustrating if it turns out that the trade would have made you money. This is clearly the biggest advantage of having access to a trading app.

After all, it doesn’t matter where you are – all you need to do is load the app up and you’re good to go.

As such, by having a trading app installed on your phone you will never miss an investment opportunity again.

Close a Position That is Going Down Fast

If you’ve seen my favorite movie The Big Short, you might remember the scene towards the end when everyone’s phone was beeping due to the price of Bear Stearns stocks plummeting at the rate of knots.

While it is hoped that you never experience such a rapid capitulation yourself, it is crucial nonetheless to be able to exit a losing trade at a moment’s notice. Once again, by having access to a trading app, you can do this in seconds.

Alerts and Notifications

I also like the fact that you can elect to receive key notifications when using a trading app.

This covers a range of important events, such as:

- Price Alerts: You can set up specific price alerts on assets you are interested in trading. For example, you might want to enter a position on gold when it hits $1,800/oz or Amazon stocks when they fall below $3,000. Either way, a notification will be sent to your phone in real-time when your specified price is triggered by the markets.

- Volatility Alerts: Equally, the best trading apps will also notify you when the price of an asset moves in a volatile manner. This can be an asset you are watching or one that is in your portfolio. For example, if you are holding Facebook stocks in your portfolio and the social media giant loses more than 5% in a single day of trading, you will likely receive a notification.

- News Alerts: Some of the best trading apps will also allow you to receive relevant financial news stories. These will be news developments that focus on assets you own or elect to follow. This is a crucial feature, especially if a negative story breaks about one of your investments.

As you can see from the above, real-time notifications via a trading app can ensure that you keep abreast of key developments at all times.

Core Account Functions

On top of the benefits listed above, using a top-rated trading app will also give you access to core account features. This means there is no requirement to log in to your brokerage account via the provider’s desktop website.

Instead, by loading up the app, you should be able to:

- Deposit and withdraw funds

- Check the value of your portfolio

- View your historical trades

- Generate trading reports

- Contact customer support via live chat

How to Choose a Trading App for You

So now that I have discussed the many benefits of using a trading app, I am now going to cover the metrics that you need to look out for when choosing a provider.

Before I do, it is important for me to clarify that in the vast majority of cases, trading apps are simply an extension of a primary online brokerage account. For example, if you are already using eToro to trade, you simply need to download the app and log in with your account credentials.

With that said, in a small number of cases, the provider might offer an app-only service. This won’t be suitable if you are a day or swing trader looking to perform in-depth chart analysis.

Regulation, Licensing, and Safety

It goes without saying that you should only use a trading app if the respective broker is regulated by the appropriate bodies.

The most reputable regulators active in this space are the FCA (UK), CySEC (Cyrpus), SEC (US), and ASIC (Australia).

You don’t necessarily need to come from the same country as the respective regulator to use the trading app. For example, traders in Germany might decide to use an app that is licensed by the FCA.

Either way, the most important thing to remember is that you should never use a trading app if it is not licensed by a reputable body.

Tradable Assets

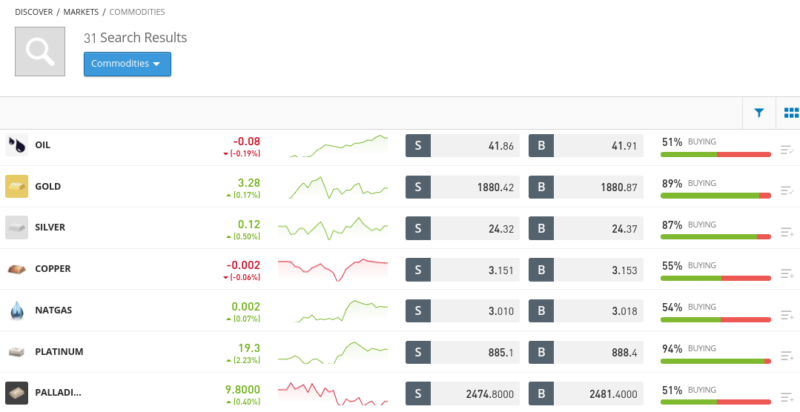

There are tens of thousands of financial instruments that can be traded in the online and mobile space. However, there is often a huge disparity between the number of markets on offer.

For example, while one trading app might give you access to dozens of asset classes across heaps of international markets, others might simply focus on US-listed stocks.

This is why you need to ensure that your chosen trading app supports the assets that you wish to access. You can check this out before opening an account by visiting the broker’s website.

Ownership or CFDs

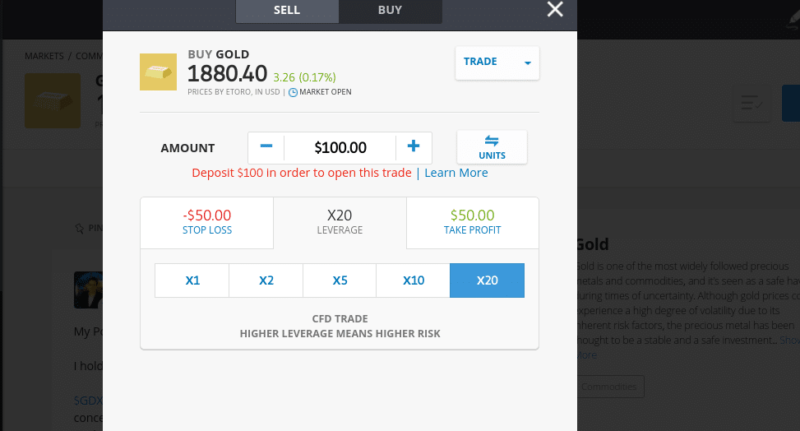

It is also important to understand the type of asset you are trading. For example, some trading apps specialize exclusively in CFDs (contracts-for-differences). This allows you to trade assets without taking ownership. Consequently, you can usually apply leverage and engage in short-selling.

But, CFDs won’t be suitable for everyone – especially Americans as this prohibited by the CFTC. As such, if you want to invest in traditional assets stocks, bonds, mutual funds, or ETFs – make sure the trading app offers this.

User-Friendliness

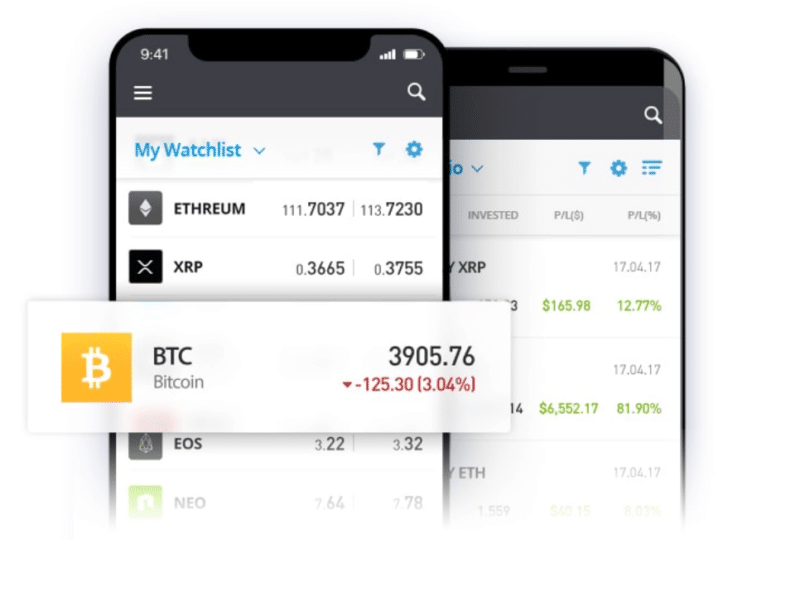

You do, of course, need to choose a trading app that is both user-friendly and responsive. In other words, the process of buying, selling, and trading assets should not be hindered by a small screen. Instead, everything should be 100% optimized for your operating system.

In the vast majority of cases, trading apps are built from the ground-up for both iOS and Android devices.

A good way to gauge whether or not your chosen trading app is user-friendly is to read the public reviews on the Apple or Google Play Store. These will have been written by people who have actually used the app, so it’s a great way to assess the competency of the platform.

Fees and Commissions

Once you have confirmed that the trading app is regulated, user-friendly, and offers your preferred asset class, you then need to look at fees. After all, all brokers and trading platforms charge fees – otherwise they wouldn’t be in business.

The main fees that you need to look out for are as follows:

- Deposit/Withdrawal Fees: Some trading apps will charge you a fee when you deposit or withdraw funds. There might be an additional fee if you are funding your account with a non-supported currency.

- Trading Commissions: Trading commissions can come as a flat or variable fee – albeit, it’s usually the latter. For example, you might pay 0.2% on each buy and sell order you place. Some trading apps – like eToro, charge no commissions at all on real stocks.

- Spreads: Spreads ensure that trading apps always make a profit. It’s simply the difference between the buy and sell price that you see. The wider the spread, the more you are paying to access the market.

- Inactivity Fees: If you leave money in your trading account and fail to use it, you might incur a monthly inactivity fee. For example, after 1 year of inactivity, the app might deduct $10 each month until you trade, withdraw the funds out, or your balance hits zero.

- Foreign-Listed Assets: A lot of trading apps will charge you an additional fee if you attempt to buy or sell a foreign-listed asset. For example, you might be based in the US and looking to buy UK stocks. In doing so, you might need to pay an FX fee.

The best trading apps in the space are very upfront about what fees and commissions they charge. As such, there should be no surprises once you have checked this out for yourself.

Payments

Don’t forget about payments – as you will be required to deposit (and hopefully) withdraw funds when using a trading app. In an ideal world, you will be able to fund your account instantly via the app.

For example, the best platforms allow you to deposit via debit/credit card or an e-wallet like Paypal. Some will also offer support for Google and Apple Pay. These payment methods are simple, easy, and usually something that we all have at least one of.

However, some trading apps are only compatible with bank transfer payments. This is both cumbersome and slow – as you often need to wait a few days for the funds to arrive.

Features and Tools

Depending on how involved you wish to be with your investment endeavors, you might require certain tools and features from a trading app.

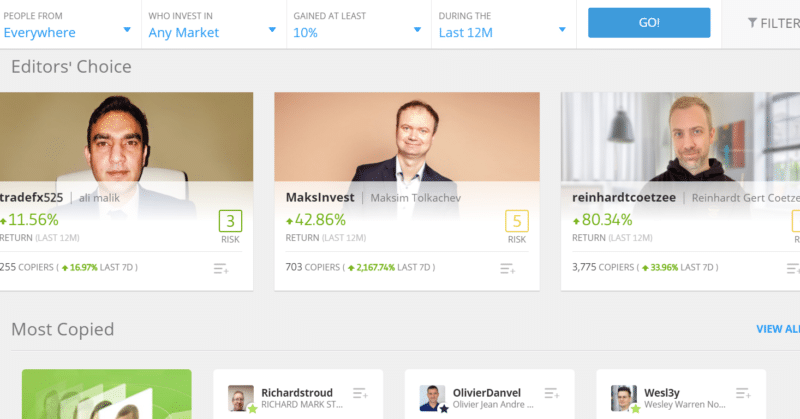

Past performance is not an indication of future results. Trading history presented is less than 5 complete years and may not suffice as basis for investment decision.

Some of the most popular to look out for when choosing a provider are:

- Alerts/Notifications: I discussed the benefits of receiving alerts earlier. This might include price/volatility alerts and financial news notifications.

- Chart Analysis: It can be tough to perform chart analysis on a mobile trading app. However, some people like to do this so nonetheless – so check what’s available.

- Copy Trading: This is a feature I really like. Put simply, copy trading allows you to mirror the trades of a selected trader. You can do this directly on the eToro trading app.

- Fractional Ownership: This is a feature that allows you to invest in a fraction of an asset. For example, instead of investing $3,100 into 1 Amazon share, you might be able to purchase just $20 worth.

- Leverage: If you’re looking to trade with leverage and this is legal in your country of residence, check what limits the trading app offers.

- Short-Selling: Some of the best trading apps in the space allow you to short-sell assets like stocks and cryptocurrencies.

There are many other features and tools offered by trading apps, so think about what you are looking to achieve.

Best Trading Apps – My Top Picks

So now that I have covered the ins and outs of how to choose a trading app yourself, I am now going to divulge my personal favorites.

1. eToro – Best All-Round Trading App With 0% Commission on Stocks

** below content does not apply to US users

If you’re actively involved in the online trading space, there is every chance that you have heard of eToro. After all, the provider now has 13 million users under its belt – making it one of, if not the largest trading platform around.

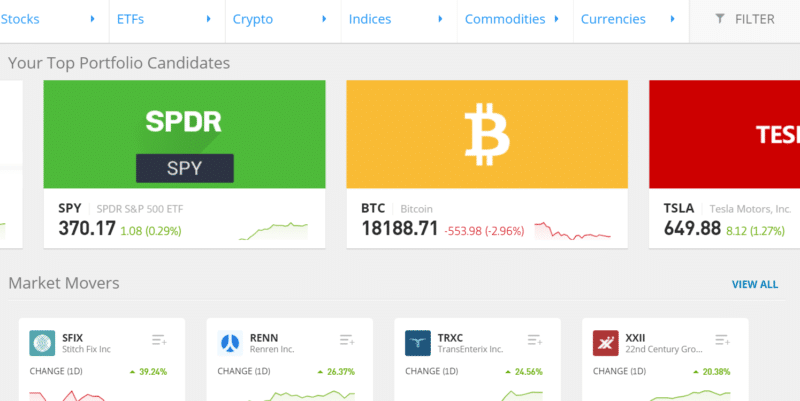

eToro offers a wide selection of markets – all of which can be accessed online or via the app. When it comes to traditional ownership, you can buy and sell shares from 17 marketplaces. This includes stocks listed in the US, UK, Canada, Germany, France, and more.

You can also invest in ETFs – such as those backed by Vanguard and iShares. This is good for diversification purposes or gaining exposure to difficult-to-reach markets. You can also buy and sell cryptocurrencies. This covers 16 digital coins – including Bitcoin and Ethereum.

If you’re able to trade CFDs in your country of residence, this is also supported by eToro. On top of the assets listed above, you can also trade CFDs in the form of hard metals, energies, forex, agricultural products, and indices. Once again, this can be done commission-free, but spread applies.

eToro also offers leverage on its CFD markets – and the ability to go both long and short. In terms of compatibility, the eToro trading app is available on iOS and Android devices. Much like its main desktop website, the app is really easy to use and has been fully-optimized for smaller screens.

Getting started at eToro takes minutes. You’ll need to first open an account – which you can online or via the app. Then, you’ll need to meet a $200 minimum deposit, which you can instantly with a debit/credit card or e-wallet. Bank transfers are also an option, but this can take up to 7 working days.

Finally, I should mention that eToro is heavily regulated. This includes licenses with the FCA, ASIC, and CySEC.

You can read my full eToro review here, where I delve deeper into why I like this platform, and what you need to be aware of when trading on it.

76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

2. DEGIRO – A Low-Cost Stock Trading Broker

There’s not a lot of online brokers that offer an asset library as extensive as DEGIRO. Whether it’s shares, bonds, ETFs, or funds – you’ll have access to thousands of instruments across 50 markets and 30 exchanges. This ensures that you can build a highly diversified portfolio and thus – mitigate your exposure to a single asset or marketplace.

In terms of the main attraction – fees, this is largely very competitive. In fact, if investing in major marketplaces found in the UK, US, and parts of Europe, the fees are much lower than most brokers out there. However, it is important to remember that the likes of eToro allow you to buy shares in a 100% commission-free environment.

As such, if you really want to focus on keeping your costs to an absolute minimum, eToro might be better. On the other hand, although you might pay a slightly higher fee at DEGIRO, the platform does offer much more in the way of asset diversity.

Finally, I do like the fact that DEGIRO does not have a minimum deposit in place and charges no transaction fees, albeit, it’s a bit frustrating that you can only fund your account via bank wire.

DEGIRO offers a selection of 200 commission-free ETFs (conditions applicable).

You can take a look at my review of DEGIRO for more information.

Best Trading Apps – The Bottom Line

Trading apps are an ideal way to take your investment efforts to the next level. Sure, you might not use your chosen trading app to perform chart analysis or in-depth research.

But they are handy for placing last-minute buy and sell orders, checking the value of your portfolio, or receiving real-time notifications. Most apps also allow you to deposit/withdraw funds and contact customer support at the click of a button.

In terms of the best providers active in this space, I think that it’s a toss between eToro and DEGIRO. Both offer a wide selection of asset classes – all of which can be accessed at rock-bottom commissions. Coinbase and Binance are also worth considering if you are looking to trade cryptocurrencies on the move.

Investing in stocks, bonds, and ETFs involves risks including complete loss. Please do your research before making any investment.

Disclaimer: eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Past performance is not an indication of future results. Trading history presented is less than 5 complete years and may not suffice as basis for investment decision.

Copy Trading does not amount to investment advice. The value of your investments may go up or down.

Your capital is at risk.

Cryptoasset investing is highly volatile and unregulated in some EU countries. No consumer protection. Tax on profits may apply.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.

Hi Jean! Thanks for your website! I’m following you for some time already and learning something new everyday. In terms of platforms, what is your opinion on Bitpanda and their newly introduced Bitpanda Crypto Index? Also, what do you think about NinetyNine as a trading app option? I know it’s quite limited in it’s functionality, but I’m a bit concerned about the taxation procedures as I’m a foreigner based in Barcelona and they are a Spanish company.

Hi Nik. Bitpanda is a solid platform. I’m not that interested in any index as in my view Bitcoin and Ethereum are by far the biggest things in crypto if you’re looking at long-term investing. So something like an 80/20 mix of those two will work well in the next 5 years I think.