A few years ago, an employee left and I discovered their card was attached to our hosting, three AI tools, and the domain registrar. Cancelling the card triggered a chain of failed payments that took days to untangle. Some services suspended without warning. One nearly deleted our data after a grace period I didn’t know about.

That week I set up a proper card system. It took about an hour and I haven’t had a billing emergency since.

If you run a small online company, you probably pay for dozens of services — hosting, SaaS tools, ad platforms, AI APIs, domain registrars. Payment cards are the plumbing behind all of it, and most people don’t think about them until something breaks. Here’s how to make sure it doesn’t.

Default to Virtual Cards

Physical cards are mostly irrelevant for an online business. Nearly everything you pay for — cloud infrastructure, subscriptions, developer tools, advertising — is billed online.

Virtual cards are better in every way for this. You can create them instantly, freeze them in seconds, and delete them without affecting anything else. If one is compromised, the blast radius is limited to whatever that card was used for.

Setting This Up in Revolut and Wise

The two platforms I’ve used most for this are Revolut Business and Wise Business. Both support virtual cards and work well for this system, but they handle things differently.

Revolut Business is the more polished option for managing multiple cards. You can create virtual cards instantly, assign them labels, set per-card spending limits, and freeze or delete them from the app. Creating the four-card setup described above takes minutes. Revolut also gives you a clearer dashboard for tracking spend across cards, which makes the periodic review easier.

Wise Business supports virtual cards too, but the experience is simpler. You can create cards linked to specific currency balances, which is useful if you pay for services in multiple currencies and want to avoid conversion fees. Wise’s per-card controls are more basic — you can freeze and delete, but spending limits per card aren’t as granular as Revolut’s.

In short: Revolut is better if you want tight control over multiple cards with detailed limits. Wise is better if you deal with multiple currencies and want to hold and pay in each directly. Many small companies end up using both.

If your current bank doesn’t offer virtual cards at all, either of these is a significant upgrade. I’ve written more detailed reviews of both Revolut and Wise if you want to dig deeper.

Don’t Let Cards Depend on People

One of the most common mistakes is letting employees attach their company cards to services. It works fine until they leave. Then you cancel the card, billing breaks, and services start getting suspended — sometimes silently.

Cards should be owned by the company account, not by individuals. Store the details in a password manager like 1Password or Bitwarden, organised by purpose. Team members copy the details when they need to add billing somewhere. When someone leaves, nothing changes.

Segment Cards by Purpose

Using a single card for everything feels simpler, but it’s a trap. When that card expires or gets replaced, you’re updating every service you pay for. Miss one and you find out weeks later when something stops working.

Instead, use a small number of cards, each dedicated to a category:

Infrastructure — hosting, cloud platforms, AI APIs, domains, security tools. These are services where a billing failure actually hurts. This card gets the highest limit and the most attention.

SaaS subscriptions — collaboration tools, project management, analytics, productivity apps. Important but less urgent. If billing lapses for a day, nothing catches fire.

Advertising — Google Ads, Meta, and any other ad platforms. Ad platforms have unpredictable billing behaviour — irregular charge amounts, failed payment retries, sudden spend spikes. Isolating them prevents surprises on your other cards.

Experiments — anything you’re trying out. New tools, free trials that ask for a card, services you’re evaluating. Keep a low spending limit on this one. If a forgotten trial converts to a paid plan or something charges unexpectedly, the damage is contained.

With this setup, replacing a card means updating one category of services, not everything.

Keep One Physical Card for the Real World

Even a fully online company has occasional offline expenses — travel, hardware, team meals, conferences. One physical card for the founder covers this. Just don’t use it for subscriptions or recurring payments. Keep it separate from the system above.

Set Limits and Review Regularly

Most fintech platforms let you set spending limits per card. Use them. A low cap on the experiments card and a reasonable cap on SaaS prevent the slow accumulation of forgotten charges.

It’s also worth reviewing your SaaS card transactions every few months. Tools accumulate. Trials convert. Teams stop using things but nobody cancels them. A quick audit usually turns up a few subscriptions that can be cut.

The Full Setup

For most small online companies, this is all you need:

- 3–4 virtual cards segmented by purpose

- 1 physical card for offline spending

- All cards owned by the company, not individuals

- Details stored in a shared password manager vault

It takes about an hour to set up and saves you from a class of problems that are annoying, disruptive, and entirely preventable.

Malta in 2026 is a strange place. On paper it looks like a success story: one of the richest countries in Europe, the

Malta in 2026 is a strange place. On paper it looks like a success story: one of the richest countries in Europe, the

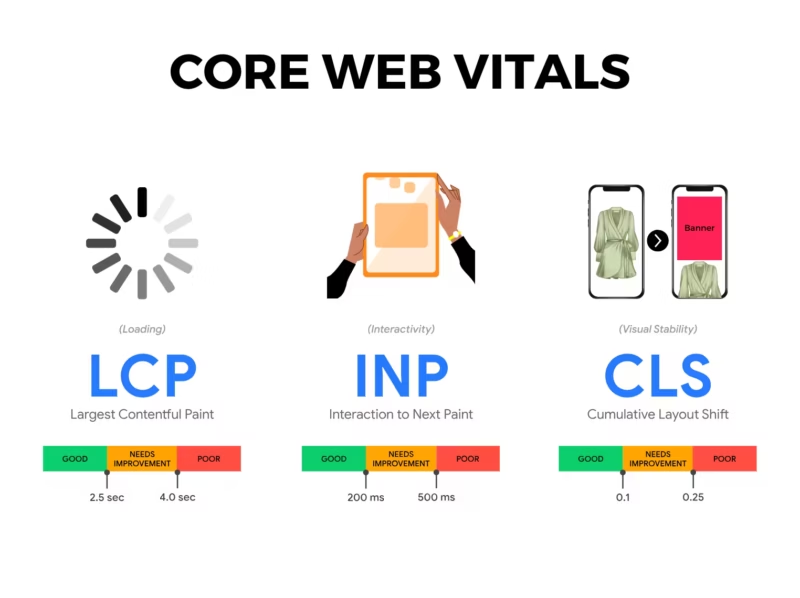

Is your WordPress site failing Core Web Vitals? You’re not alone. Google’s performance metrics have become increasingly important for both SEO and user experience, and many WordPress sites struggle to meet these standards.

Is your WordPress site failing Core Web Vitals? You’re not alone. Google’s performance metrics have become increasingly important for both SEO and user experience, and many WordPress sites struggle to meet these standards.