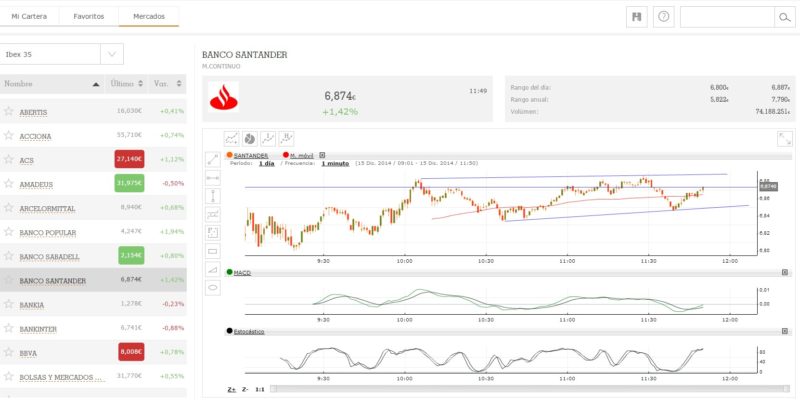

Following my move to Spain, I started searching for a local broker to start investing in stocks.

I’m not a huge fan of Spanish financial institutions, and given the choice, I’d much rather use an international stockbroker. That also makes it easier for me if I eventually move my residence to another country.

There are two main advantages of working with a Spanish broker, on the other hand:

- No need to fill in any foreign asset reporting documents at the end of the year (Spanish Modelo 720 in this case).

- Advantageous commissions (or lack thereof) for the local stock market.

The Modelo 720 form is an absolute drag to compile, but once you get the hang of it or outsource it, this factor becomes less of a deal-breaker. However when the March deadline for that form comes around, it’s a good reminder of how backward the Spanish taxation system is. I invest internationally and not in the Spanish market, so the second advantage is not so important to me.

With that said, here are the best options I’ve found.

eToro – The Best Option for 0% Fee Trading on Stocks

If you’re actively involved in the online trading space, there is every chance that you have heard of eToro. After all, the provider now has 13 million users under its belt – making it one of, if not the largest trading platform around.

eToro offers a wide selection of markets – all of which can be accessed online or via the app. When it comes to traditional ownership, you can buy and sell shares from 17 marketplaces. This includes stocks listed in the US, UK, Canada, Germany, France, and more.

You can also invest in ETFs – such as those backed by Vanguard and iShares. This is good for diversification purposes or gaining exposure to difficult-to-reach markets. You can also buy and sell cryptocurrencies. This covers 16 digital coins – including the big two: Bitcoin, Ethereum.

eToro does not charge any commission on stocks or ETFs, however, spreads do apply. There is no sign-up fee or monthly/annual subscription, either. You will also avoid stamp duty when buying UK stocks, which saves you an extra 0.5%.

You’ll need to first open an account – which you can online or via the app. Then, you’ll need to meet a minimum deposit, which you can instantly fund with a debit/credit card or e-wallet. Bank transfers are also an option, but this can take up to 7 working days.

You can read my full eToro review here, where I delve deeper into why I like this platform, and what you need to be aware of when trading on it.

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

DEGIRO – A Popular Low-Cost Broker

There’s not a lot of online brokers that offer an asset library as extensive as DEGIRO. Whether it’s shares, bonds, ETFs, or funds – you’ll have access to thousands of instruments across 50 markets and 30 exchanges. This ensures that you can build a highly diversified portfolio and thus – mitigate your exposure to a single asset or marketplace.

In terms of the main attraction – fees, this is largely very competitive. In fact, if investing in major marketplaces found in the UK, US, and parts of Europe, the fees are much lower than most brokers out there. However, it is important to remember that the likes of eToro allow you to buy shares in a 100% commission-free environment.

As such, if you really want to focus on keeping your costs to an absolute minimum, eToro might be better. On the other hand, although you might pay a slightly higher fee at DEGIRO, the platform does offer much more in the way of asset diversity.

Finally, I do like the fact that DEGIRO does not have a minimum deposit in place and charges no transaction fees, albeit, it’s a bit frustrating that you can only fund your account via bank wire.

You can take a look at my review of DEGIRO for more information.

DEGIRO – My choice for a buy-and-hold broker

With all the options out of the way, let’s move onto some of my requirements for an ideal buy-and-hold broker:

- Zero fees for custody and account maintenance.

- Low fees on USA share purchases.

- Low fees on transferring holdings outwards to another broker.

- Protection up to 100K.

- No loaning out of shares.

- Ability to keep money in other currencies and transfer USD in and out.

- Good web interface and mobile one too.

Fees and commissions are top on my list as a buy and hold investor, and the only one I found that makes sense for me is DEGIRO.

DEGIRO was founded in 2008 and has been expanding rapidly since then across Europe. The platform has a nice and modern interface that works perfectly fine for my needs.

After having covered my wishlist and some essential information on my shortlisted broker DEGIRO, let’s dig a little deeper.

Asset Protection

Asset protection for DEGIRO is handled by the Dutch DGS. The Deposit Guarantee Scheme (DGS) is a set of rules that guarantees the deposits of bank account holders. If a bank goes bankrupt, the DGS guarantees deposits to a maximum amount of EUR 100,000. The guarantee applies to most account holders and virtually all types of bank accounts. My understanding is that for stock purchases protection is only up to 20,000 Euro. This is not as good as the Spanish FGD which guarantees up to 100,000 Euro. The chances of DEGIRO going bust and clients losing their stock assets is minimal, but possible. I would definitely be more comfortable with a 100K guarantee, but I’m ready to go with the 20K guarantee given the inconvenient commission structures of the Spanish brokers.

Currency Conversions

One of the bigger problems with DEGIRO is that they automatically convert your money to other currencies when required. Let’s explain this further.

Let’s say you put in a thousand euro in your account. Then you decide to invest in a US stock, which is of course denominated in USD. When you purchase, the broker will automatically convert the amount needed from your EUR balance to USD in order to buy the shares.

Secondly, when you receive a dividend from a US stock, or you sell that stock, the proceeds will be in USD, however on arrival at your brokerage account, the money will be converted back to EUR.

Most people forget to take this currency exchange issue into consideration when calculating the costs of operating with a broker.

The DEGIRO FX fee is 0.10% using AutoFX. You can do it manually, but the fee is then €10 + 0.04%. Probably not worth the bother on modest amounts. AutoFX means any sales/dividends will be converted into Euro automatically also. If for example, you would like to buy American shares for USD 3,000, the AutoFX facility will automatically convert the exact amount of EUR required to complete the transaction in USD. This means you do not first have to conduct your own currency conversion.

W8-BEN for US Stocks

If you go with the US exchange, DEGIRO will offer a prefilled W8-BEN online form. It takes a whole minute to review and submit. This reduces the US dividend tax from 30% to 15%. Note: You’re still on the hook for Spanish tax either way on dividends (even if you reinvest them), but can claim the US withholding tax paid as a credit.

Fees and Commissions

With regards to commissions and charges, here’s the important info for DEGIRO:

- Yearly fee per stock exchange used (purchase, sale, or holding): 0.25% of portfolio value, max 2.50 Euro.

- Costs of US stock in DEGIRO: €0.50 + USD 0.004 per share

- Transfer costs from DEGIRO: 10 Euro per position

- Custody fee: None.

DEGIRO offers a selection of 200 commission-free ETFs (conditions applicable).

Conclusions

I’m happy with DEGIRO and would recommend it to anyone living in Spain or other European countries where it’s available.

On the other hand, if you’re more adventurous and want exposure to multiple asset classes including crypto, check out eToro.

Do you reside in Spain and invest in the stock market? I’d love to know your thoughts on which brokers you prefer.

eToro is a multi-asset investment platform. The value of your investments may go up or down.

Your capital is at risk.

Past performance is not an indication of future results. Trading history presented is less than 5 complete

years and may not suffice as basis for investment decision.

Copy Trading does not amount to investment advice. The value of your investments may go up or down.

Your capital is at risk.

It is important to read and understand the risks of this investment which are explained in detail at this

link.

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the

accuracy or completeness of the content of this publication, which has been prepared by our partner

utilizing publicly available non-entity specific information about eToro.

I’m originally from Denmark but live in Spain now. I speak a bit of Spanish, but my level is not exactly amazing.

I’m 40 and I want to invest around €30,000 and just let the money grow over time for my retirement or possibly to buy or build a house one day. I know nothing about investing, so I would like to do something passive. Do you think InBestMe is the best option for me, or would going to ING be better?

Hey Jean. Great article

Do you know of any platform that automatically reports your capitals gains/loss to the authorities here in Spain?

I live in Spain, and im tax resident here, and would like to start investing here. But Im trying to find a platform that will report everything automatically, so I dont need to report gains and losses myself once a year.

How do you have an eToro account if you are not Spanish but pay your taxes in Spain? It does not accept my NIE tax number so it’s basically useless.

Great article Jean. You mentioned in a separate piece that BBVA is a decent option for a Spanish current account. Do you have an opinion on the investment options within the BBVA app?

Thanks James. I don’t use any banking apps for investment purposes so can’t help on that unfortunately.

Hi Jean,

do I understand correctly that if you use DEGIRO as a Spanish tax resident to buy stocks & ETFs etc. this wouldn’t have to go into your modelo 720? I am a bit confused because when I look it up, DEGIRO is based in the Netherlands, therefore outside of Spain.

Thanks for clarification if I misunderstood something

Mike

You’d have to report it in Modelo 720 Mike.

If holding negotiable assets like shares, ETF’s, bonds, etc. with a broker domiciled outside Spain (eg. eToro, DeGiro, etc) then you have to fill in and report Modelo D6 before 31 January … &…. Modelo 720 before 31 March …. & Modelo 100 before 31 June.

Hi Jean,

great article, thank you for sharing it!

One question I don’t yet really get is, how trading via DEGIRO helps to avoid having to fill out the Modelo 720. When I look it up on wikipedia, DEGIRO is a Dutch company, so this would be “outside Spain” and therefore everything I do in a DEGIRO account still needs to go into the modelo 720, so I would still need to file that, correct?

Thanks! Mike

Just because you are trading outside Spain does not mean it is not taxable income. You are taxed where you are living and have tax residence. Trading stocks is income tax as it is produced where you live. So it will be your responsibility to inform the Spanish tax authorities about your trades and income.

Written from my iPhone so don’t expect Tolstoy.

I think there is some confusion here. Mike asked about the modelo 720. This is about a Spanish tax resident holding assets abroad (>50k per asset class). So if you are with DeGiro, which is a subsidiary of the German FlatEx Bank now, and you hold either more than 50k in shares or in cash (they give you a bank account with a German IBAN) then you need to mention that in the modelo 720. I have filled it in and it is not really that big of a deal though.

What Michael refers to is INCOME. As a Spanish tax resident you simply declare this as “ganancia” with fixed tax rates ranging from 19% to 26% (as of 2021, for 2020 the max tax rate is still 23%).

Correct.

My bad. I’ve been trying to find tax country to trade shares from that is not expensive on living expenses and have so far been informed that all trading is taxed as income tax bracket. Quite interested to see those fixed tax percentages which makes Spain interesting.

Written from my iPhone so don’t expect Tolstoy.

I think there are several countries in Europe that have fixed tax brackets for these types of income. E.g., Germany & Netherlands (~25%), Iceland (22%), Portugal (20%), Poland (19%), Moldova (12%), Switzerland (0% if you hold the shares for >6 months and have a low trading volume so you cannot be considered a professional trader)

I’ve been trading with eToro since the end of last year as it was the platform with the lowest fees. Any reason why you chose DEGIRO over eToro? I’m also still looking for a low cost broker with whom I can invest in Vanguard index funds – just in case anyone around here knows one.

Both are good Lisa, but DEGIRO offers a Spanish IBAN and some people prefer having that. They are also oriented to different kinds of investors in my opinion, although you can use eToro for regular trading just like DEGIRO. Why can’t you use DEGIRO for index fund ETFs?

Actually, with eTorro you don’t own the shares outright as you would do with DEGIRO and other stock brokers. And you can transfer your shares to another broker. I do recommend reading the terms of service

Written from my iPhone so don’t expect Tolstoy.

Yes that’s true, so one other reason I prefer DEGIRO for long-term holdings.

1. etoro has a huge hidden commission. look at the spread, it’s humongous there. it might be acceptable if what you wanna do is not to trade but invest buying underlying assets (see n.3). but then the selection is very scarce but probably one doesn’t need much for a simple passive portfolio (please note that simple doesn’t mean bad, for the majority of people it’s actually much better ie gives better returns long-term than a complicated one).

2. etoro’s specificity – working mostly with CFDs (which is why “you don’t own the shares outright”). Therefore you don’t have access to the “usual things” like order book etc.

3. having said that, on etoro you can actualy get some ETFs and cryptos (probably some stocks as well, I’ve not looked into that) that are not CFDs but underlying assets. And among them there are some Vanguard ETFs there are tracking some indices (eg $VOOG $VOOV).

4. IMHO in the end etoro is not good for trading cause of big spreads (among several other reasons) and it’s not good for investement cause of scarcity of options (among several other reasons). It might (quite arguable) be a good starting point cause it’s very easy to start doing something in terms of registratration/assets and interface but not in terms of what’s behind – CFD is not an entry-level instrument I’d say, it’s quite advanced in my opinion. So you might not notice it as of now when the trend is mega-bullish and as a result getting the nubmers to grow is almost a no-brainer. But when the trend changes…

5. As Jean already mentioned a good way to invest into Vanguard index funds is through ETFs. Beware the for Europe you need to look for UCITS ETFs. There are some commission-free Vanguard ETFs on DEGIRO (ie IE00B3XXRP09 that tracks SP500). A very good ETF screener for europeans is “justetf”, I totally recommend checking it out if you haven’t already

again, all of the above is just my opinion and “not an investment advice” as they’d say, hopefully it somehow helps you figuring out what works best for you.

True. For example with eTorro CFDs Apple AAPL might be listed at $120 per star on the NASDAQ but eTorro will list it at $122 a two dollar difference but if you’re buying ten or thousand shares it makes a difference in how much this spread is costing you $20 or $2000. Then suddenly a broker charging a fixed fee if $2.95 doesn’t seem all that bad. I will always chose a low commission broker than commission free broker

Agreed, nothing comes for free 🙂

Well, Interactive Brokers is not so amazing since you’re paying 4 eur minimum commission per order. if you’re investing monthly (which you should) say 400 euro, then you’re losing 1% on commission right away. and this is only if you invest into one asset, the more assets you choose to invest to the more you losses are. so unless you can invest 4-5 thousands it doesn’t differ much from investing into some mutual fund that will get around the same commission as well but will relieve you the additional pain.

That’s true, IB is for investors with more money to invest, or those who invest it at one go. I don’t mind the fee as I tend to invest it at one go rather than putting in something every month.

I’ll review a few more brokers that are more suitable for this kind of investment, but perhaps you can have a look at DEGIRO too.

yup, I’m using it. DEGIRO’s commission-free ETFs is an extremely nice alternative for investment. for me personally the downside of DEGIRO is that they don’t have a publicly available API. but that’s okay for the majority of retail investors I guess

I see, and you would need the API for use with trading software I imagine, right?

Not necessarily only to connect to the trading software (that as well of course). But even only using it for investment it’s nice to do some rebalancing. And I prefer tolerance bands-based rebalancing over time-based rebalancing. But I don’t wanna go check the account every so often and perform calculations ‘manually’, I’d rather connect a small script that does that for me and notifies me when the rebalancing is needed. And then makes all the calculations and potentially the needed trades. But… it’s not possible with degiro.

Thanks – very interesting. The currency exchange observations/considerations are spot on – do you know which platform will also let me credit directly in Australian dollars?

what are your thoughts on Oanda?

I haven’t tried Oanda, sorry.

Just wasted a couple of hours trying to open a degiro account. The android app just comes up as “unavaiable in your country” when trying yo download the Spanish version, on a Spanish Phone in Spain.

Degiro is available in Spain, I’m not sure why that would have happened. You can easily open an account through the web.

I had this same problem and I might have just solved it after a few days of trying.

The problem here is that Degiro is asking to finish your registration via mobile app… So, the web site is not enough.

I traveled recently and set my Google Play payments profile to other country. When I moved back to where I live I noticed that there is a restriction for only changing countries once a year in Google Play, only God knows why.

So I removed my Google Play profiles except the Spanish one, but it did not fix it. Notice that it is said that you need to add a payment method to activate a profile and it might take up to 48 hours to do so.

Finally today I removed all cache and storage data from my Google Play app and when I entered again, I could find Degiro app and install it normally, no more blocking message.

It took me several days and many tries but I think that the steps above are the ones that mattered, hope it helps.

Great article, thanks, i just started investing this year closed my isa in UK and and moved some funds to an etoro account. Now realising reading this im going to have to fill out this modelo 720, do i still need to declare if gains are below 6000 euro before 31st march? Are there reduced rates like in the us for holding a stock long term? How difficult is this modelo 720 really, is it recommended to hire a gestor/accountant to do it for you?

You need to consider the total value of the investments you have in the UK, not alone shares.

Do not even considering doing the 720 yourself!

You will need to get a statement from the last day of trading in 2020 with a value of all the stocks you have. Each will need to be declared individually. Also any share sales or purchases will need to be declared as separate line items.

SUMMARY OF THE RULES….

Modelo 720 has three reporting categories, based on bank accounts, investments and immovable property. You have to report all assets in a particular category if the value of your total assets in it amounts to over €50,000. This only applies to assets located outside Spain.

In general, you are obliged to report assets if you are the owner, a settlor of a trust, an effective beneficiary from a trust, authorised signatory, or you have the authority to dispose of the asset. This includes assets held by a company, trust or fiduciary.

You need to report even if your personal share of assets is less than €50,000. With joint assets, each owner needs to declare the full value (not pro-rated) and indicate their percentage of ownership.

In most cases, assets are valued using the wealth tax rules as at 31st December each year. For assets held within financial institutions (eg bank accounts), you also need to declare the average balance over the last three months of the year.

You need to report the value of the assets in Euros, so any investments held in other currencies need to be converted using the official exchange rate as at 31st December of the relevant year.

Agreed, you should definitely contact an expert. Thanks for the additional information.

This is a great post. Thanks for sharing it.

I’m using Ninety Nine (ninetynine.com) and happy so far. Not perfect if you’re 100% buy&hold but has a good balance if you want to buy&sell on a monthly basis and at the same have some positions in a long time.

Ive been using the Freetrade app in the UK, its basic but for someone just buying small amounts as an interest its enough, and it is free to use. Id love to find something like that here, take out the need for a broker and just keep records for my accountant, perhps it is a little too much to wish for!

From my experience ING is much more expensive than GeDiro as there are also hidden fees which they do not mention (such as the fees levied by the stock exchange). I do have an account with them an when I tried to buy an ETF for 50k at Xetra they wanted to charge me 200€ (so essentially double the advertised amount) for a single transaction. I obviously cancelled the order. For comparison, investing 50k in an ETF with DeGiro will cost you 17€ (2€+ 0.03%).

Also, GeDiro has just been bought by FlatEx (a German bank) and therefore offers a normal bank account now that is protected up to 100k. The downside, this account has a negative interest of 0.5% on amounts over 2500€.

Very good article – could not find a comparable summary in Spanish. I happen to be a U.S: Citizen with fiscal residency in Spain (loving the 720). I was very happy with ING as a broker. However, a few years back ING made me close my account due to U.S. Government reporting regulations (FATCA) for U.S. citizen clients of banks “abroad”. i am trying to find a broker that will accept a U.S: citizen without abusive custodial fees (U.S. now has no trading without commisions and here Santander wants 1% custodial fees. Has anyone solved this issue?

You can use CC Trader, they are based in Malta and I think they would accept you given the conditions you describe.

Hi, what a great post. I was looking exactly for this. I’m in the UK and have an account with IG. With Brexit coming up I was thinking about moving to Spain for the better quality of life and sun. I run my own company in the UK but would like trade from Spain. I guess I can either move everything to Spain and trade from there or let everything be in the UK and VPN in from Spain to do all my stuff. If I’m resident in Spain then I need to pay taxes. How are the taxes for shares and dividends? I can’t imagine how you can document thousands and thousands of share dealings to the tax authorities over the year. Is there no other option

You need to declare in Spain if you spend more than 6 months a year in Spain (you then also need to declare earnings from any assets you may still have in the UK). Tax rates start at 19% for capital gains up to €6k but if you have high gains expect 23%. As for: “I can’t imagine how you can document thousands and thousands of share dealings to the tax authorities over the year. Is there no other option”

Welcome to Espanistan!

And what’s more, you need to declare all your shareholdings on the model 720 if they surpass a certain low limit. That can easily mean tens or hundreds of pages of the form, and a corresponding hefty fee from the accountant/lawyer.

When I moved to Spain there was no need to declare my UK shares held with a UK stockbroker to the Spanish government as I was on Beckham scheme (Royal Decree 687/2005). The Beckhams scheme came to an end for me I’ve had to do the 720 declaration since, which has proven to be a complete nightmare! I have over 50 stocks and my accountant regard it as necessary to declare each one of these as a separate item in the 720 return. Additionally, new sales or purchases need to be declared. Stock names also change to add to the confusion along with share issues etc. Given the potentially severe fines that may be imposed with even minor errors in a 720 declaration I would avoid any share service that requires a 720 return. The first time you do the 720 is not so bad but in supsequent years you need to carefully cross check what has changed from one year to another. The Spanish accountant I used made a complete pig’s ear of this and I ended up doing it all myself.

Yes, totally. The possibility for making mistakes is so high that I find it hard to believe that Hacienda even has the resources to check these things. When people are submitting 100-pages worth of declarations with all that minutiae I have to think that this is just another exercise for wasting people’s time instead of helping them be more productive and contribute to growing the economy. Unfortunately, while this is a lovely country, Spanish politics is a mess.

Thanks for the article. I have some simple questions. For a person who has a trading account in Spain, trades European stocks, could you provide

— a list of all fees? Not necessarily the amounts, but what they are – e.g. Trading fee,

— Is there Stamp Duty – if yes, when buying, selling or both, and if you know, what % is it?

— In Spain, can one buy stocks listed on all EU exchanges?

— If you know, how would compare trading in UK vs Spain, pros/cons?

Thanks.

HI, thank you for the article!

I’m under the beckham law, so basically I wont need to pay taxes in Spain for investment profit outside of spain. In this case, which provider would you suggest to use? is there an easy to way to invest via a place with low capital gains tax (that has an easy to use platform?)

Also – besides pension plans, any other savings device in Spain that can give tax deductions?

Hi YAM,

Just curious if you were able to find a broker for you’re under Beckham law?

btw, from what I know

Thank you

Hi, all I want to do is sell off two shareholdings that I have, but they are certificated. Equiniti will not deal for me as I live in Spain, albeit I have an English bank account. My bank here, (Ciaxa) say they won’t handle my shares because they are certificated (all my shares are in a drip scheme). Any suggestions? I would be most grateful

Unfortunately I don’t have any knowledge in this specific structure so I can’t give you any advice. Perhaps contact a good accounting firm and they might be able to give you some pointers.

I use click trade. Easy to use.

Hi Jean, pretty good article, thanks for this guide.

I am pretty new, I didn’t understand something you wrote: “… but it also requires you to agree that they will loan out your shares, which is where they make a profit.”

I am not 100% sure what this means and why you’d advise against it. However, I read on the comments that you in fact have been using DeGiro, so I assume it is not too bad?

Thanks jor the help

Take a look at this page I think it will answer all your questions about Degiro https://www.reddit.com/r/EuropeFIRE/comments/6j50yz/brokers_you_get_what_you_pay_for/

Fantastic article, thank you so much.

Pretty dumb I couldn’t find this info in Spanish, but here it is in plain English.

Hi Jean –

Thanks for the writeup. Did you end up going with ING? What’s your experience been like so far?

I’ve been looking around for a broker and have been trying their “cartera virtual” account for a week or so. Truth be told, in my opinion, their interface (both web and app) is shockingly bad. Every time I try to use it I find some sort of bug, or the system is just down. (Although I can’t say that I’ve ever used a Spanish bank or broker’s software that I liked, so maybe it’s just me.)

I’ve been wondering if this is just a temporary fluke, or if this is normal operation. Would love to know how it’s been going for you.

Hi Chris, I have focused almost all my attention this year on the crypto currency space and did very little with stocks. I am only using DeGiro at the moment and find it good enough for my basic needs.

Hello,

Thanks for the article.

Do you have any idea if ING, or any other Spanish investment company, works with non residents. I ask as I am a South African but I have most of my savings are in Spain. I would like to invest these savings with a Spanish company and ING sounded pretty good to me, but the problem I keep running into is one related to me being a non resident (whom they cannot work with for some reason). I tried contacting them, cant find an email address on their site, phoning is out of the option as I cant speak Spanish.

Can you offer any advice related to this issue? I would greatly appreciate it.

BTW, I am just looking for a simple index fund, nothing to complicated, I just need to find a company that will let me invest with them.

Thanks

Kyle

Hi Kyle, I’m not sure about that, maybe try Finizens.com, although they might also be limited to residents.

This is a great post. I am so glad I found it. I lived in Spain for sometime and I plan to go back and start looking into this. I will definitely refer to this post when I do. Thanks for sharing!

Welcome Courtney!

Hi,

Thanks for this article.

ING direct doesn’t give access to Canadian market ?

Sincerely

I’m not sure about that, most people focus on European or US markets.

this is a project i would like to start myself when i have some time. right now i am in the middle of some resource-hungry real estate projects, but when i am done with that in a few months, i will seriously look into this. so now i know who to ask for some starter tips 🙂

For sure. I’m also very interested in real estate, I’d be interested to know what you’re up to. I’ll soon be writing a post about crowdfunded real estate platforms.

I use Caixa (have a special deal with them) and ING. Think ING is the best choice. Self Bank you can lend your shares think so, so its good if your going long term, you get your dividends plus some extra% for lending your shares.

Agreed. The other low-cost option is DeGiro as I mentioned.