Real estate investing needs little introduction. We all know that this asset class has been one of the top choices for investors since time immemorial. Nothing beats owning land and buildings. It’s an asset that you can see, use or rent out. It doesn’t require any technical knowledge so the barrier to entry is very low. And that is why real estate remains the number one place for people to park their money.

I have been dabbling in real estate through various platforms over the years, and this has given me a good idea of what works and what doesn’t. Here’s a quick list of some of my favorite property-based P2P lending and real estate crowdfunding platforms reviewed on this site.

For more information about real estate investing you can head over to my dedicated page on property investments.

REITs vs Real Estate Crowdfunding vs Private Investing

When talking about the real estate market, currently there are three ways of investing:

- Property Crowdfunding

- Real Estate Investment Trusts (REITs)

- Private Investing

There are various pros and cons of each way of investing, so I will describe all three of them in more detail so that you can decide which one is most suitable for your situation and goals.

Property Crowdfunding

Real estate crowdfunding platforms are part of the fintech surge of recent years and have become very popular in countries such as the US, UK, and Spain. A property crowdfunding platform will typically have an attractive and modern website and give the user an experience that is very similar to owning the property directly. As an investor, you will have the opportunity to view properties in exposition phase, where you can read about the location of the property, the developer’s plans and financials, as well as the type of financing to be used (leveraged vs non-leveraged).

Typically, your money will be tied up for a 3-5 year term, although many platforms have now introduced a secondary market where you can put up your shares for sale to other investors.

I have personally invested in several property crowdfunding platforms (such as Rendity and Raizers) and so far I’m happy with the results. I’m convinced that we’ll be seeing many more people making their first entry into property investing via property crowdfunding platforms versus REITs or private ownership.

Real Estate Investment Trusts (REITs)

Let’s now talk about one of the best ways you can diversify your property portfolio; real estate investment trusts (REITs). They started in the USA but are now available in many other countries around the world. A pure REIT represents the shares of an individual real estate company, while a REIT electronically traded fund (ETF) passively track indexes for the larger real estate market. These REIT indexes include a number of different types of REITs as components. The individual performance of REITs can vary widely. Many REITs are traded on major stock exchanges, but there are also a number of private and non-publicly traded REITs.

REITs own many types of commercial real estate, ranging from office and apartment buildings to warehouses, hospitals, shopping centers, hotels and timberlands. Some REITs engage in financing real estate.

The iShares Europe Developed Real Estate ETF is an example of a European real estate ETF that you might want to check out. The ETF seeks to track the investment results of an index composed of real estate equities in developed European markets. You can expect to pay around 0.5% in fees when choosing such an ETF.

The Vanguard REIT ETF (VNQ)is the largest US REIT in the sector and began trading in 2004. It invests in stocks issued by REITs and seeks to track the MSCI U.S. REIT index, the most prominent REIT index.

One thing to consider is that a publicly-traded REIT is usually highly liquid. That means that you can easily sell your investment at any point in time if you need the money or if you’re not satisfied with your investment.

With a REIT you can obtain much wider portfolio diversification with the same amount of money when compared to private investment. You will also be totally detached from the management of these properties, which you might consider to be a bad thing or a good thing, depending on your interest and skills in real estate.

Private Investing

Private investment is the oldest and most well-known form of investing in the property market. An investor would purchase one or more properties and rent them out to obtain a monthly rent payment. To possibly obtain higher returns, the investor could also flip properties. Flipping properties involves buying an older property, fixing it up and selling it again. The whole operation is usually done within 8-12 months and in areas where the price of housing is rising in a fast and consistent manner.

Private investing offers you maximum control over your investment. You can deal with clients personally as well as refurbish the property as you deem fit. If you’re an expert in the local market and have the right contacts, this might be a good opportunity for you. Needless to say, you will need a lot of time to supervise the refurbishment of properties, as well as to make sure that your rented properties are well managed and your clients are properly taken care of whenever they have a problem.

The biggest con with private investing, apart from the time requirement, is the lack of diversification. Unless you have millions of euros/dollars to invest and have a deep knowledge of the property market in several countries/cities, you will struggle to diversify your property portfolio. You will thus be at the mercy of the local economy of typically one city/country, as well as the building you invested in.

Another issue is that if you invest in just one or even a few properties, vacant periods will seriously affect your cash flow. It might easily take one or two months to find a new tenant (even assuming strong demand in the rental market) and during that period you will have zero income from your property. Whether this will affect your lifestyle, of course, depends on your particular situation. Imagine a retired person with limited savings who relies on the rent payment from one property to get him through each month. Then imagine the property remains vacant for a few months due to whatever reason. You can understand why that would have a very significant impact on his life.

Personally, I am not a fan of private investing. Dealing with the day-to-day issues that crop up is something that would seriously affect my sense of freedom, and hiring a property management firm would involve more overheads and take away control over the level of service that the clients receive.

Secondly, I am not a property market expert and have little interest in keeping up-to-date with several local markets.

Thirdly, I don’t have the money to purchase several properties in order to diversify, and neither do I fancy taking out loans from the bank to fuel such purchases. Again, I’m only giving some insight on my personal situation to illustrate that every person needs to make his own analysis of his situation and conclude whether one style of investing is ideal for him or not.

To sum this section up, I would say that private investing is ideal for people who are passionate about property, have considerable capital to play around with (or are comfortable with taking out several loans), and want to do this as a part-time or full-time job.

Why I Prefer Real Estate Crowdfunding

As I already mentioned, private investing is definitely not something I’m interested in at this stage. I have zero interest in the day-to-day management of properties, and furthermore, I don’t have the capital nor the wish to take on loans to finance the purchases of property.

My biggest issue with REITs is precisely the fact that you are very detached from the underlying properties.

With property crowdfunding, I find that I can stay free from the annoying parts of managing properties, while at the same time having full access to the properties’ financials, business plans and individual performance. So far I’ve had a go at investing in Spanish property, UK real estate, as well as participating in a German real estate crowdfunding platform. The Baltic real estate platforms were the best performing by far.

Apart from the potential to earn a good return, property crowdfunding is a great educational experience that will probably come in handy in the future if I decide to go for private investing or buy my own property to live in.

Why do Borrowers Obtain Finance from Real Estate Crowdfunding Platforms?

A common question that comes up with investors new to real estate crowdfunding, is why exactly do borrowers go to these platforms when borrowing rates are so low these days? Why don’t they go to the banks directly?

Every entrepreneur and property developer is looking for the best measures to save money and earn a solid profit, so why would they take on debt obligations with an interest rate of 11% per annum?

The answer is not unequivocal as there are several advantages to be taken into account when evaluating financing possibilities on P2P lending platforms and real estate crowdfunding sites:

Speed

When using traditional financing methods, real estate developers often fail to get the desired results within the required timeframe – banks make decisions slowly, the period from application submission to receiving funding may be up to 4-6 months, while P2P lending platforms can provide an indicative offer within 24 hours of submission and money on the borrower’s account within 2 weeks. Developers are happy to use this opportunity as a “bridge” – you can start working on your project while the bank is still evaluating it.

Loan Period

When considering the possibility of using a P2P lending platform for financing your project, it should be taken into account that this is a short-term solution for the sales period of the property, during the development phase of the project or a bridge loan. The major benefit can however be seen in the fact that many of the above platforms allow early repayments with no penalties, so should the borrower sell one of the apartments or establish long-term financing, they can repay the loan earlier if convenient. This means that if the funds were used for 6 months and 6 days, then the interest payment will be calculated for exactly 6 months and 6 days.

No monthly payments

P2P lending platforms normally enable flexible repayment schedules, for example, the possibility to pay both interest and principal at the end of the period – you won’t find this kind of opportunity in traditional financial institutions. This significantly boosts work on a new project by enabling the borrower to fully focus on the project, with no additional liabilities each month. The developer can use the money to actually finance the project, not to pay interest.

Additional marketing

What is the cost of a new development project’s sales campaign in the media and how effectively can you reach people who are interested in real estate? Many of these platforms have thousands of registered investors from different countries interested in property and development, which gives the developers free publicity for their projects.

Doesn’t the publication of a project’s financial data in a public manner negatively affect the eventual sale of the property?

Not really, although it might initially appear to have that effect. In reality, what happens is that the eventual buyer is looking at the property and comparing the price to other properties in the same area in the same conditions. The buyer is also comparing the price and property to other properties he has shortlisted, even in other areas. Therefore, ultimately these two facts are much more important than the limited downside of the project details being published on the platform.

Many platforms also limit access to the project’s most important financial details to investors themselves, meaning the eventual buyer (unless he is an investor himself) would not have seen those details.

Communication and knowledge

A less important factor might be the opportunity to get another partner on board. A partner who understands the business has evaluated dozens of similar projects. If your project gets rejected, it probably means that there is something seriously off and you can go back to the drawing board to make adjustments. With banks, sometimes getting rejected is just the result of excessive bureaucracy and doesn’t mean there is necessarily anything wrong with your project.

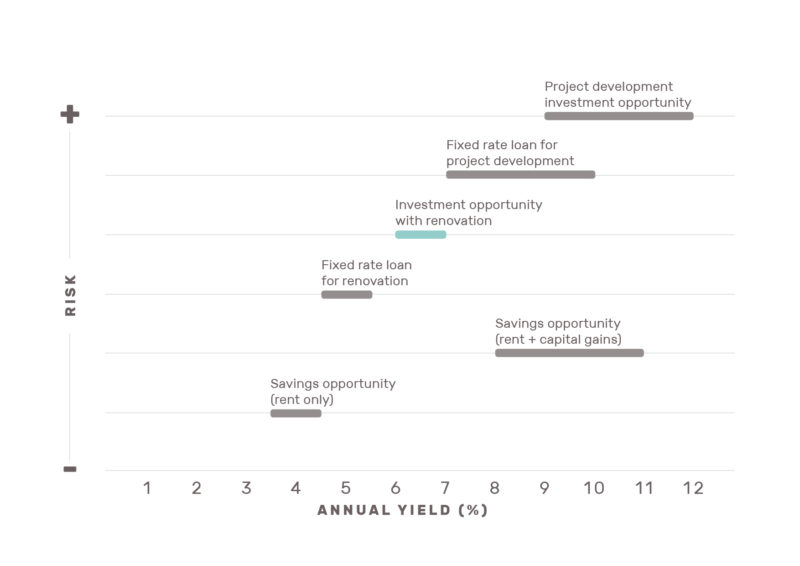

When investing in real estate, there are many ways we can put our money to work. Each type of real estate investment carries its own risk factor as well as yield percentage.

How Property Crowdfunding is Taxed

So how does taxation of property crowdfunding finance work? We can use Property Partner as an example.

Property crowdfunding is a form of indirect property investment. This consists of the investment in shares of a company that owns, develops and manages property on behalf of its shareholders. Investors will hold legal shares in the company that owns a specific property. For each investment, an SPV company is created. Information on the special purchase vehicle (“SPV”) that holds the property can be found on the companies house website. Please type the SPV name into the search box on their site to find out more details.

Each property is held for a fixed term which is specified on each investment page. The investor hopes to receive a financial return in the form of dividends on rent received as well an increase in the value of the property subsequently shown as an increase in share price. The value of investment may go down as well as up and, as with all investments, you may get back less than you have invested. Indirect property investment allows investors to enter property markets without having to provide the full, up-front capital of buying a house or flat.

Your shares are held in a nominee account, registered in the name of Property Partner Nominee Limited. This account is ring-fenced from the assets and liabilities of Property Partner. You, as the beneficial owner, will receive all of the economic benefits including dividends and capital returns. More information on the nominee structure can be found on the Property Partner site.

Investment Costs are calculated using a First In First Out (FIFO) costing method per share, rounded to the nearest penny.

What income is taxed?

In most countries, you are taxed on capital gains as well as dividends, which are the two ways you can make money with property crowdfunding on platforms such as Property Partner.

With that in mind, you will then have to consult the laws of your country of residence to determine the tax rates for capital gains and dividends.

Please note that I am not an accountant or financial advisor, the above is the fruit of my personal research, and might contain inaccuracies. Before you submit any tax returns, I highly recommend you contact a tax consultant or accountant to check your numbers.

How to Evaluate Real Estate Crowdfunding Investments

With the proliferation of real estate crowdfunding websites over the past years, investors can now invest all over Europe and the UK from the comfort of their homes.

Not all platforms and investments are equally good, however, and while it is good practice to diversify and thus spread the risk, it still makes a lot of sense to have a basic skill set in evaluating real estate investments, before you hit the Invest button.

In general, from my experience, investing in loans tends to be riskier, however, it is the format favored by many projects on these crowdfunding websites, as it is much more straightforward to structure. The alternative is to set up a company that owns the property, but that incurs more costs and is harder to manage. The advantage for an investor, however, is that he would own shares in a property and thus not be at the sole mercy of the developer.

Loan-To-Value

If the deal involves giving a loan to a property developer to build or refurbish a property, a very important metric to look at is loan-to-value, or LTV in short.

The lower the loan amount compared to the value of the property, the safer you are as an investor, as it means that in case of any problems, the chances of recouping the investment are higher.

You have to be extra cautious with this one, and take a close look at what value figure is being taken into consideration.

This can easily be explained by an example. Let’s say the developer puts up a project that involves buying an old and dilapidated building at 500,000 Euro, refurbishing it completely to luxury standard, and selling it off within a year for 1,000,000 Euro. He asks for a loan of 250,000 Euro for the project.

Now, here’s the trick some platforms use. Instead of listing the project as having a loan-to-value figure of 50% (250,000 divided by 500,000), they will use the anticipated value of the finished project, giving a loan-to-value figure of 25% (250,000 divided by 1,000,000).

I would advise staying away from these kinds of projects, as they tend to be much riskier. The price that the project is eventually sold at depends on many factors, including how good of a job the developer does, prevailing market conditions, the buyers’ profile, etc. As investors, we should concentrate on the facts, and therefore look at the value of the property right now, and that is 500,000 Euro in our example.

The fantastical figures that developers provide can lead to investors getting burned, as happened with the Lendy platform, which eventually went bust.

First or Second Rank Mortgage

A mortgage is the collateral of real estate which is pledged against borrowed capital. It is divided into primary and secondary ranks, which indicate which investor or institution is the first to recover the money. Typically, a first-rank mortgage holder in large projects is a bank or other large financial institution, while the second-rank mortgage is held by crowdfunding platforms or other institutions.

In general, you should prefer first rank mortgages. Platforms like LANDE only do first rank mortgages, for example. Other platforms might offer the riskier (but potentially more profitable) second-rank mortgages.

Secondary rank mortgages are quite popular on the German and British real estate crowdfunding platforms, such as Property Partner.

There are nuances, of course.

For example, if the property is already built and has tenants that generate rental income the risk is naturally lower. When assessing the risk in such a scenario, one should look at the property’s profitability.

Consider the case of a €5M property that is generating a net rental income of €350,000 or a 7% annual return, You can check what would be the return for primary and secondary mortgage holders. You can do this with a simple formula: €350,000 (rental profit) / €3,600,000 (sum of primary and secondary mortgages loan values) * 100 = 9.72% net yield.

This step is important to assess the liquidity of the real estate, which helps to understand whether after a takeover of the asset it would be difficult to find a buyer and repay both mortgages to the investors. In this scenario, selling a property that is generating a yield above 9% shouldn’t be complicated.

Apply Financial Ratios & Rules

When you are buying a property, or investing through online real estate crowdfunding platforms. it’s a good idea to keep in mind the following ratios that can help you in judging whether this is a good investment or not.

Price/Rent Ratio

Look at the median price and median rent for the area in which you are considering buying a property. You will want to favor lower ratios versus higher ones.

The 50% Rule

The 50% Rule is just a shortcut to estimate the Net Operating Income or NOI of a rental property.

The 50% Rule says that you will only keep 50% of the rent you collect on an average rental after paying for vacancy, management, taxes, insurance, and maintenance.

The 50% Rule and NOI exclude mortgage costs.

Capitalization Rate

The 50% Rule allows us to quickly determine a cap rate so that we can decide to pursue the deal or not.

A capitalization rate is a tool experienced investors use to compare the performance of one property to another.

In some neighborhoods, a 6% cap rate will be a great deal. In other neighborhoods (usually lower-priced ones) a 12% cap rate or more might be needed to make it worthwhile.

The 1% Rule

The 1% Rule states that your gross monthly income from the rent of a property must equal or surpass 1% of the total investment in that property. By total investment, I mean the purchase price plus fees and expenses to refurbish the property before putting it onto the rental market.

As an easy example, if your total investment into a property was €100,000, then you would want to get at least €1,000 a month in gross rental income.

The 2% Rule

This is exactly the same as the 1% Rule, except this time we are looking for a 2% gross return in monthly rent versus the total investment.

When To Apply Each Rule

The obvious question is, therefore: when should we apply each of these rules. The answer is that it is totally dependent on the area you’re considering. There are some areas where a 2% deal is possible from time to time, and other areas where even a 1% deal would be a real stroke of luck.

The key here is to know the yields being produced in the area and the investments needed to produce those yields. Armed with that information you can then decide whether to apply the 1% or 2% rule to your investment options.

Rule Limitations

Like every shortcut, these rules have limitations. The major limitation you should be aware of is that what matters most in buy-to-let is the net rental income.

Here are a few costs that will eat into your gross monthly rental:

- Taxes

- Insurance

- Maintenance

- Management

- Vacancy/Turnover

- Condominium Fees

Some of these costs will inevitably be equal for all properties in a particular area (taxes is one such example), but others may not (for example maintenance). An older building might meet the 1% Rule criteria while a new building wouldn’t, however, the older building will probably have significantly higher maintenance costs. It might therefore very well be the case that the newer property might end up outperforming the older property even though at first glance and based on the 1% Rule the old building looked like a better investment.

Using the Rules

Given the additional intricacies we discussed, the best use of these rules is for quick filtering and comparison. If you’re using crowdfunding property platforms, for example, you’re likely to have several options to consider every month, and having a few quick rules to sort out the wheat from the chaff will be useful in saving precious time. Once you narrow down your options to a handful of properties, you can then dig deeper until you find your perfect investment.

Consider the Platform’s History

Take a look at the history of the platform you plan to invest in. Ideally, it should have been operating for a number of years already with no significant issues. If it’s been through a sideways or downward market and emerge unscathed that’s even better. Everybody can perform well when the market is up, but when the market is not helping many platforms cease to make updates and run into problems.

Property Partner are a good example of how to keep things professional and take care of your investors in a bad market, such as that of the UK during and after Brexit and the COVID crisis.

Read Reviews

While you should always assume that the reviews you read online are biased in some way or another, I still recommend checking out blogs, forums and specialist review websites to get a general feel of whether a platform is trustworthy or not.

Do you use any other criteria when evaluating real estate crowdfunding platforms? Let me know in the comments section.

Yield VS Risk Relationship in Real Estate Investing

Like any financial product, the higher the estimated yields the higher the risks. Investment opportunities with renovation are placed in a balanced position in the real estate investment type chart, almost in the middle, which is also why they are one of the most popular projects on many crowdfunding platforms.

Which are your favorite types of real investment? I’m a big fan of renovations that last around 8 months from purchase to an eventual sale. I tend to balance my portfolio with this type of investment together with savings opportunities where I get dividends/rent every month and have a constant flow of income.

Do you invest in real estate? Have you tried out property crowdfunding or other types of investing in property? Let me know in the comments section.

Hola Jean, felicitaciones por la publicación y muchas gracias por su utilidad para quienes, como Yo, apenas estamos conociendo de estos instrumentos de Inversión como el Crowfunding. Por otra parte, me gustaría saber si has invertido y administrado propiedades como para tener una opinión cercana sobre este tipo de opción.

Agradecido.

Great information! While trying to decide which one to choose amongst REITs and Real Estate Crowdfunding, there really isn’t any right or wrong option. It depends on each individual investor’s risk capacity, budget, understanding of the tax implications on dividends earned, and tenure of the investment. For investors who are risk-averse REITs may be a better option that would allow them faster liquidity as compared to real estate crowdfunding. On the other hand, investors with a greater entrepreneurial mindset who are willing to take on certain risks and long-term financial goals could opt for real estate crowdfunding.

Totally agreed.

All good information thanks. Reits are also attractive because national regulations usually force them to issue a huge part of their profits so their dividends are usually very healthy. Yes they are more liquid than owning an actual property but one should invest in a Reit only with a 3 to 5 year plan since the stock price might lose value from time to time and not always rise. You don’t want to sell at a lower stock price. But when you want to get rid of it at a profit it can be done on a day if it’s traded publicly. I agree that buying a Reit is accepting quite a distance from the properties themselves. So far less control than other options. Buying a single property wont always mean high risk because of non diversification..not if you buy in a sought after rental city. But yes its hard work and it can become a part time occupation if not more.

The only thing that worries me about crowdfunding is how to trust the people running it. I have developed a very low trust for humans in the financial industry. But otherwise it seems like the path of least resistance. Just sad that you cannot enough the property you invested in…because you don’t own it fully. Then again a property investment isn’t a financial investment if it becomes your home. Your home should not be considered as part of your investment portfolio.

Agreed, I will soon be experimenting with a kind of hybrid between impersonal web-based crowdfunding and private investment. There are groups of experienced private real estate investors and developers and they invest in properties together, with a maximum number of investors typically in the 5-10 region. This brings you much closer to actually owning the place and giving you a much bigger say in the directions taken, while also allowing you to personally know the other investors and decide how trustworthy they are. It also gives you some of the advantages of crowdfunding since the sum invested is lower, you have a team rather than being alone, and you can diversify.

We have a model that is aimed at ensuring you feel invested enough.property markets in east africa have been on the rise with foreigners taking keen interest to holiday homes,office and large storage blocks and with that the portfolio is diverse. For able investors we do locally offer custodian services and encourage them to have power of attorney over properties we oversee and manage. every thing is transparent and any changes are communicated well in advance. We believe this model is the best approach to bringing fruitful investment and with as little as $200,000 one is able to own a home with a ROI of 5-6%

Great article, clear and syntactic, congrats. I have one question, how do you gather all your investments information from the different platforms you have money in?

It seems like individually go to these platforms can be a pain point.

Hi Lio, that is indeed one of the pain points, but it’s the same with owning several businesses or owning several properties. It seems to me that it is one of those problems in life that there isn’t ever a solution for apart from hiring someone to do the data collection and possibly analysis (based on your parameters) for you.

Great and easy to understand article Jean. By the way did you try to trade your investment share in Spanish and German real estate crowdfunding sites and whats your take on this functionality?

Thanks, so far I have not done any trading but it’s a handy feature to have if you need quick liquidity.

Thank you for the informative article, Jean. I appreciate your taking the time to explain the difference between private investment, REITs, and property crowdfunding. Great work! Peace and best wishes!

You’re welcome Reg.