Contents

Real estate crowdfunding is one of the easiest ways to invest in property and one of my favorite forms of investment together with P2P lending.

Until recent years, the only options to enter the real estate market were to either buy property directly or to invest in a REIT.

Now, we have real estate crowdfunding sites, which are somewhat between those two forms of investment. If you want to learn more about the differences between these types of investments in the property market, check out my article on REITs vs Crowdfunding VS Private Investing.

Here’s a quick list of my favorite European real estate crowdfunding platforms:

- Raizers – best for French real estate – my Raizers review

- Fintown – real estate in Prague – see my Fintown review

- LANDE – agricultural real estate – see my LANDE review

How Real Estate Crowdfunding Works

So let’s explore what real estate crowdfunding entails.

There are three basic ways of buying a stake in a real estate crowdfunded property: secured loans, unsecured loans, and equity investment.

Here is a short recap of what each of these means for the investor:

- Secured loan (senior debt) – collateral is offered to secure the loan. The collateral can be real estate or some other asset, including a personal guarantee. With this type of loan the investor is the first in line to receive their payout, and in case of any problems the collateral can be sold to minimize losses. However, the existence of collateral means that the risk (and therefore the yield) is lower and one should definitely investigate the asset that is offered as collateral.

- Unsecured loan (mezzanine loan) – while mortgage holders are usually first in line to receive payments, an unsecured loan means exactly that. It is not secured by collateral. This means that the interest rate offered should be higher than for a loan that is secured. If the project is unsuccessful, there are no assets to sell to recover any funds (i.e small loans). In this case, one should pay a lot of attention to whom they are loaning their funds in and how well the platform is equipped to handle problematic customers.

- Equity investment – with this type of investment one should note the structure of liabilities – the company will pay debts to employees and creditors first and only then investors may receive their payments from the remaining assets of the company. In case of failure, there is a real possibility that the earnings of the investor are reduced to a 0. When the project succeeds, however, employees and creditors usually receive a fixed interest rate while the equity investor earns more. So, in this case, one should make sure that they assess the probability of failure. Is the project understandable? Are the numbers presented in the project realistic?

As a rule of thumb, it is good for an investor to remember – the lower the risk of the project, the lower the expected yield. And if you are considering investing in real estate that offers a 20%+ yield per annum, be sure to be very critical about the contents of the project before investing. Most likely it is not a secured project meaning a significantly higher risk level for the investor.

So, be sure not to look at just the yield but rather the investment. It is important to always know what you are investing in, who you are trusting your money with and to be realistic in terms of expectations.

My Experience with Real Estate Crowdfunding

Before we talk about my favorite real estate crowdfunding sites, let me remind you that I’ve been investing in real estate through online platforms since 2015, and I’ve used many platforms targeting various geographical regions.

On average, my returns have been around 5-7% per year.

The Spanish investments have been my biggest disappointment, largely due to either the incompetence of the platform team or the horrible government legislative changes.

Investments in the UK have also not provided me with much joy, but apart from the Lendy scam, the other platforms have been quite well managed and the big issue with property in the UK has been the Brexit event which was quite unexpected and threw everything off the rails.

On the other hand, the Baltics have provided some excellent returns, and this is what I consider to be the hottest real estate market in Europe at the moment. The German and Austrian markets have also provided me with stable returns – these are mature markets and the platforms in these countries tend to be run by serious and ethical people.

Investing in real estate online can be a daunting prospect to many new investors, as they might not be used to mixing an offline asset like property, with the technology and intangibility of the internet. And that is why I’d like to guide you towards what I feel are the best and most trustworthy platforms.

See also: How to evaluate private real estate investments

Keep in mind that within each platform there are different modalities of real estate investments. I’ve written briefly about these in my article about risk vs yield in real estate investment.

I would love to also invest in the US via top platforms like Fundrise and RealtyMogul, however, unfortunately, these platforms are not open to European residents. Nevertheless, here are the best European alternatives and top platforms.

1. Raizers

Raizers is the platform of choice if you want to invest in French real estate. It’s a platform that has been operating for 5 years with zero defaults. Go ahead and read my Raizers review if you’re looking for investing options in France specifically.

I’ve had the pleasure of discussing Raizers and the French real estate market with Raizers co-founder Maxime Pallain on my podcast, check out that episode if you want to learn more about Raizers. I found Maxime to be very open and knowledgeable and I have no problem trusting this platform based on their track record and solid team.

2. Fintown

Fintown is an investment platform powered by the Vihorev Group, which boasts over a decade of experience in the Czech real estate market. The platform offers investors the opportunity to invest in real estate developments across Europe, with a particular emphasis on Prague, the capital city of the Czech Republic. Fintown’s mission is to make real estate investing more accessible to individual investors, enabling them to diversify their portfolios and benefit from the potential high returns associated with property investments.

The account opening process with Fintown is user-friendly and efficient, requiring basic personal information and identification documents for verification. Once verified, investors can deposit euros—the sole currency accepted on the platform—with a minimum investment threshold of €50. The platform’s dashboard is designed to be clean and intuitive, facilitating easy navigation and management of investments. Key features include daily interest accrual, zero commissions on deposits and withdrawals, and no fees for participating in investments, enhancing the platform’s flexibility and appeal.

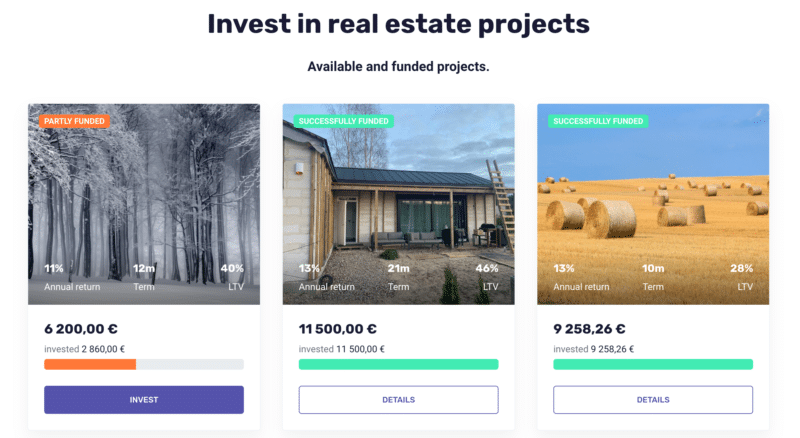

Fintown primarily focuses on real estate investments, offering a variety of opportunities in European property development projects. The platform meticulously vets and selects projects based on factors such as location, potential returns, and overall risk, instilling confidence in the investment opportunities presented. Many projects involve rental apartments in Prague’s Smíchov District, allowing investors to gain exposure to this burgeoning market. The platform requires a minimum investment of €50, with available investments generating annual yields between 9% and 12%, accompanied by monthly interest payments. Notably, the Fintown team invests at least 20% of their own funds in every project, ensuring alignment of interests with investors.

The short-term rental market in Prague has experienced significant changes in recent years. Following the global pandemic in 2020, the market faced a substantial drop in demand due to lockdowns and travel restrictions. However, as restrictions have eased, the market is rebounding, bolstered by Prague’s enduring appeal as a tourist destination and the city’s thriving startup scene. These factors contribute to the attractiveness of investing in short-term rentals in Prague, and Fintown offers a convenient avenue for such investments.

While some may view Fintown’s promotion of its own projects as a potential conflict of interest, this approach can be advantageous for investors. By promoting its own ventures, Fintown ensures it has a direct stake in the success of each project, aligning its interests with those of the investors. This active management and investment in the projects offered create a higher level of accountability and transparency.

The investment process on Fintown is straightforward. After reviewing available projects and selecting one that aligns with their investment objectives, investors decide on the amount to invest and complete the transaction. The platform provides updates on project progress, keeping investors informed about their investments’ performance. Fintown offers two investment formats: mezzanine loans and participative loans, both carrying higher risks compared to loans secured by a mortgage.

Fintown projects typically offer attractive returns, aiming to provide investors with a combination of capital appreciation and rental income, depending on the project’s nature. Each project has a specified minimum term, ranging from 9 to 24 months, indicating the lock-up period for funds. After this period, investors can withdraw their funds at no additional charge. Early exit is possible through a request on the platform, subject to an exit fee based on the remaining term duration.

3. LANDE

LANDE was started in 2019, when two experienced professionals from the secured lending sector Ņikita Gončars and Edgars Tālums became aware that there is a niche in the crowdlending market, as none of the existing market players offered low-LTV investment deals.

LANDE is going after the agricultural loans niche. There is currently a big gap between the financing needs of farmers in Eastern Europe and what’s available to them from banks and other lending providers.

Read more: My full review of LANDE

All projects are first rank mortgage, which is the most secure type of mortgage you can get. Other platforms offer second-rank mortgages which are riskier, but can have higher interest rates.

I would recommend having a look at LANDE as it might be one of the most innovative players in the space going forward. It’s worth mentioning that LANDE also has skin-in-the-game for every project launched.

The real estate market is in constant flux due to the numerous factors that affect it, and you, therefore, need to do your homework properly before deciding on an investment. For example, the duration of the investment can be the main differentiating factor between a successful investment and a disastrous one. Some markets offer time-limited but very lucrative investment windows, while other markets have certain properties that make them really stable and thus ideal for long term investments, perhaps at lower rates of return.

I also recommend that you check out my article about the taxation of P2P and real estate platforms in Spain. Although I wrote that article with Spanish residents in mind, the same concepts apply to most other countries in Europe.

Do you know of any other platforms that I have not mentioned? Let me know in the comments section.

Hi Jean, thank you for this review! A year ago, thanks to your review of Reinvest 24, I started to invest via this company. So far, everything goes extremely smooth. However, I didn’t see any audit report of the company on their website. Would that be something you would look at when choosing a crowdfunding company? Would that be a red flag for you?

Thank you in advance for your answer.

Aviv

You’re welcome Aviv! Yes, audit reports are one of the things I look for, but the lack of it is not a red flag for an established platform like Reinvest24. It’s a platform that has earned the trust of investors over the years. I would suggest that you contact them about it, however. They might be able to provided it privately, and if enough investors are asking for it, I imagine they will also be happy to post it on the site.

Hi Jean,

gongrats , excellent job!

Could you please check nibble platform ?

Thanks

hey jean,

I did not see the two biggest ones in germany and europe in your list.

did you have a look at the realized fundings and volumes?

Unfortunately a lot of the German ones are only available in German, so I can’t really use them.

Hi Jean,

Please have a look at Max Crowdfund. We only obtained the approval from the Dutch regulators un July 2020 but the founders of the group, Max Property Group, have been in real estate for decades. Our CTO is also the ex CTO of Collin Crowdfund, which is now the biggest SME crowdfunding platform in the Netherlands.

It would ve great to have a chat with you when you have a moment.

Best regards,

Jan Angel

You really need to look at CrowdProperty – seriously good… I appreciate you say you’re happy with your UK platform, but do a comparison… Oh, and watch the space their in. I don’t believe they’ll be sticking only to the UK, and they’re firing on all cylinders. I’m an investor. Fantastic platform, strong returns, great schemes, very professionally vetted. The auto invest tool has taken off enormously. Best wishes.

Thanks for pointing that out Nick, I’ll definitely check them out.

Hi Jean,

Thank you for sharing such a great article!

I’m from the US, based out of Mallorca, Spain. I’m interested in becoming a promoter as opposed to an investor. Are there any non-Spanish crowdfunding platforms in Europe you can recommend to get a projects funded in Mallorca?

All the best,

Constanza

Hi Constanza,

Could you please contact us as we are looking to expand Max Crowdfund to Spain?

Best regards,

Jan Angel

These are great options!

This is one of the best articles I have come across for getting introduced to some the best crowd funding European real estate sites. Thanks a lot for sharing this valuable information here, very helpful!!

What do you think about CrowdProperty?

I haven’t looked at that yet, but it’s been around for a long time and that’s a good sign. It seems to be a platform focused on UK property. At the moment I’m quite happy with Property Partner for all my UK property investments, so I don’t think I’ll be switching anytime soon.

Dear Jean,

Nice post, thank you for keeping it updated!

I wonder what’s your perspective about these platforms and, in general, about the real estate crowdfunding “industry” in these turbulent times. What would be your suggestion of a good investment strategy for this crisis that is already starting?

Thanks a lot!

You’re welcome Bruno. Over the past years I’ve been growing less and less enthusiastic about certain aspects of real estate crowdfunding. I would stay away from development loans, especially in countries that are less reliable (I’m looking at Spain, Italy and some of the Baltics in particular). In countries with weak business ethics, lots of bureaucracy, and swings in the political climate loans become a dangerous game as these factors highly increase the chance of the project going off course, with loan repayment being delayed significantly, if it ever gets repaid at all.

In the coming year I would keep an eye out for projects that involve buying properties that have all the fundamentals right. There will definitely be a lot of real estate for sale at a discount, and that opens a window of opportunity for thoes platforms that have strong negotiators on their team and expertise in refurbishing and repurposing buildings.

The idea would therefore be to negotiate a great price for a property with good fundamentals, then spend the next months (while the market is down or in the early stages of recovery) hard at work at refurbishing, before putting them back to the market for sale or for rent when the market is in a better shape.

Hi Jean,

nice article as always.

The downside of the majority of the crowdfunding sites in the Baltic region is that there is nothing to invest in at the moment. Most (Reinvest24, Crowdestate, Bulkestate etc.) have only a couple projects running that are already taken and there is no way to take part in it. Unless I’m doing something wrong and am unable to find anything.

That’s true Kris. I’ll try to reach out to some of these platforms to ask why we are seeing a general slowdown in projects available. On the other hand, I’d rather see fewer and better projects than lots of scantly verified projects. If you want an alternative to the Baltics, I would suggest taking a look at the German real estate platforms.

I had a quick look at iFunded. It looks interesting at first glance, but need to dig a bit deeper and also check out other western European platforms.

Btw. would you konw of any website where one can check newly emerging platforms or any other way to keep track of it?

Thanks for all info and quick replies.

Kris

I would suggest bookmarking eurofinanceblogs.com as I will be adding this feature soon.

Looks great. Lots of info. I’ll definitely add that one to my bookmarks. Thanks very much for your help.

All the best

Kris

Hello how i can investment and take profits i your projects?

Can i work with little capital and earn a monthly profit?

I’m not really sure what you mean there, could you explain further?

Hi Jean,

Again great and helpful article! Two questions from my side as a starter in real estate crowdfunding:

– Which platform should I chose to start (‘practice’) on?

– What amount would you advise to invest as a start?

thank you,

Alexander

Or would you advise me to start on the EvoEstate platform? (however it seems very new)

The guys at EvoEstate are also competent and they are introducing an innovative concept. Be aware that real estate crowdfunding and P2P lending carry a certain degree of risk, so it’s impossible for anyone to give you any guaranteed advice. As investors, the best we can do is look at each platform’s track record as well as the management team in place. We can then use our common sense and financial experience to evaluate each deal put forward by the platforms.

EvoEstate tries to help those who are inexperienced or unwilling to commit the time to do their own research on each opportunity, by acting as the curators of projects, with the premise that they will do good research on all opportunities on the market and only bring the best opportunities to their users. It’s a good concept but again you are trusting others.

As you’re learning the ropes, a good strategy to try and avoid getting burnt on bad projects is to diversify as much as possible. In that way, if you make any bad judgment calls, you won’t lose your whole investment, but only say one or two out of fifty small investments. In my Mintos review, for example, I mentioned my losing money on the Eurocent loans when the loan originator went bankrupt. It was a negative episode but since I was very diversified, it meant that I didn’t lose any of my principal and only took a small hit on my overall returns.

Hi Alexander, one of my favorites at the moment is Reinvest24, they’ve got a great track record and the people managing the platform are very competent.

You should decide for yourself how much to invest; don’t trust anyone who makes any suggestions on how much you should invest unless he is your paid and trusted financial advisor. If you’re new to these types of investments and you’re doing this to learn, you can start off with the minimum investment possible on each platform, and that will give you full access to the project details and outcomes with very little risk.

Jean,

Thank you for rapid reply and the tips that you are giving me! As you are stating I will start small, and get to know the platform(s) and learn/understand how it works. Hopefully it will go well and I can grow into it (my learning curve and the investments).

Will not only diversify within property crowdfunding, but also diversify towards P2P lending platforms.

thank you,

Alexander

You’re welcome Alexander, best of luck!

I use Estateguru. They offer business loans & development loans from the 3 Baltic countries and Finland.

Yes they’re very good too and I’m using them as well, will add to the list.

Jean,

how come most of the property crowdfunding sites seem to originate from the baltic countries?

There are several reasons Chris.

Great Article as usual! I am heavily invested on Mintos and wish to try in estate as well….Do these (all or some) have buyback guarantees as well like Mintos? Thanks

Good choice, no they don’t have as the risk is much lower, being property and not personal loans.

Noted 🙂 Thanks

Hi Jean,

Super interesting information, and very well presented! Thank you for sharing.

Best regards from Amsterdam!

Alex

Welcome Alex and thank you for commenting. Are you aware of any platforms for real estate crowdfunding in the Netherlands?

Hi Jean

Thanks for your work on this site.

All the best

Jorge

Welcome Jorge, keep an eye out on my newest project Euro Finance Blogs for the latest news from other blogs and crowdfunding platforms.

Hi Jean

Have you heard about RealT.com? Is it same investment style with those you are reviewed?

Seems to be a broken link unfortunately.

Sorry …. I mean https://realt.co

Got it, I can’t take a platform with that domain seriously unfortunately. It shows me that they don’t have the basics in place. They should have either chosen another brand name or bought the .com.

It might seem strange of me to dismiss a platform based on a technical detail, but it’s one of the shortcuts I use when evaluating platforms.