In this post I’ll explain PayPal’s cross border fee system. But first, a short recap on the fees that PayPal imposes in general.

PayPal charges fees whenever a transaction takes place. The one charge that is always present is PayPal’s own fee which goes towards paying off the processing of credit card payments.

Visa, MasterCard and American Express charge PayPal for every payment they process, and so they need to pass this fee on to sellers to cover their costs. They also need to make a profit on each transaction so part of that fee goes towards that purpose.

To recap, these are three instances that will trigger PayPal charges:

- When you receive money from a purchase.

- When you receive payments from outside your country or region.

- When you send personal payments using a credit card. The sender determines who pays the fee.

- When you withdraw money to your debit/credit card.

I am mostly concerned about the accepting payments for your business with PayPal, so I won’t be discussing the third scenario. I’ve also discussed the fourth scenario in previous articles on this site.

We’ve already talked briefly about the first scenario above, and to give you an idea here’s what you would be paying if you were based in the following countries:

- US: 2.9% plus $0.30 USD per transaction

- UK: 3.4% + 20p per transaction

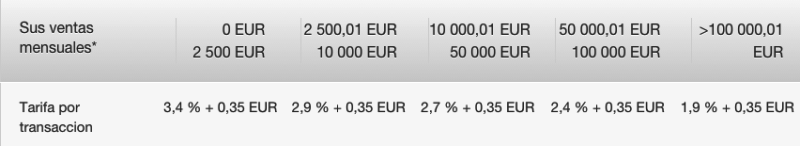

- Spain: 3,4 % + 0,35 EUR per transaction

- Malta: also a Eurozone country, so fees are identical to those of Spain

As a side note, note that is very advantageous to have your PayPal account based in the US from a fee perspective, you get to pay 0.5% less than your European counterparts on the value of the transaction and also a lower fixed fee per transaction.

Moreover, if you are based in Europe but the bulk of your customers are based outside Europe, you will also be paying the cross border fee on top of paying more in basic fees.

On top of that, if you are charging everyone in Euros, you would also be hit by a currency conversion fee from, for example, USD to EUR. More on that later in this article.

It is also worth noting that there are discounts based on volume, so lets take Spain as an example. The screenshot below shows the sales ranges and corresponding tariffs per transaction. It clearly pays to pass more transactions through PayPal every month.

As far as I remember, the bulk transaction discount won’t be automatically applied, you need to ask for it buy opening a support ticket with Paypal.

The above assumes that the sales were made within the same country that you have your PayPal account set up in. So for example a US seller selling to a US customer or a UK seller selling to a UK customer.

Cross border transactions, for example a UK seller selling to a US customer, trigger cross border fees, which is what I want to talk about in this article.

What are cross border fees?

When you receive a payment from a customer in a different country, you are charged a ‘Cross-border’ fee. This fee is to cover the cost of the extra processing required for payments between different countries and regions and varies according to country and currency.

You can view the cross-border fee for your account by following these steps:

- Go to www.paypal.com and log in to your account.

- Click ‘Fees’ at the bottom of any PayPal page.

- Click ‘transaction fee for cross-border payments’.

This cross-border fee does not apply to sellers who are registered with PayPal in a European Union country and who receive payments in Euros from other EU countries.

So if I’m a Maltese seller and I sell a product to a Spanish customer, I would not be charged a cross border fee. However, if I am a Maltese seller and I sell a product to a UK customer I will be charged the cross-border fee since the UK is not in the Eurozone.

Lets talk figures now, how much is the cross border fee?

There is no blanket fee, it varies a lot, however we can break it down to make it more understandable.

Fees for receiving payments from buyers outside your country, are based on the fees for receiving domestic commercial payments with:

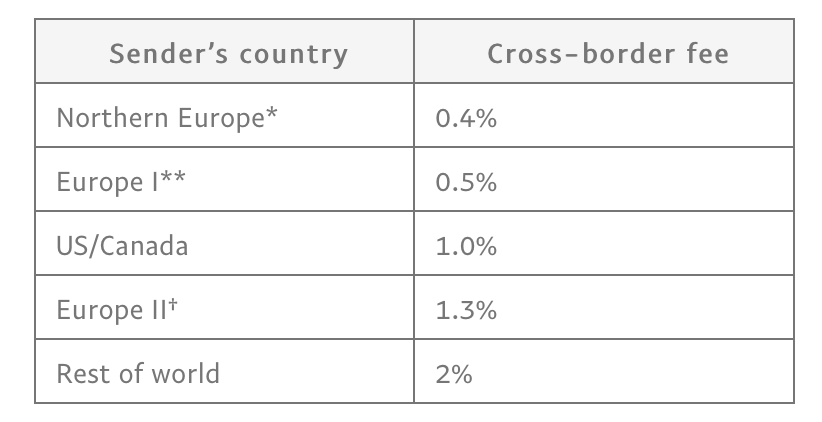

- the percentage based element increased by the Cross Border Fee outlined in the table below.

- the fixed fee element based on the currency received or set out in the fixed fee table available on the PayPal site.

To be absolutely clear, as the seller, you are the one who will incur the cross border fee and not the buyer.

* Northern Europe: Denmark, Faroe Islands, Finland (including Aland Islands), Greenland, Iceland, Norway, Sweden.

** Europe I: Austria, Belgium, Cyprus, Estonia, France (including French Guiana, Guadeloupe, Martinique, Reunion and Mayotte), Germany, Gibraltar, Greece, Ireland, Italy, Luxembourg, Malta, Monaco, Montenegro, Netherlands, Portugal, San Marino, Slovakia, Slovenia, Spain, United Kingdom (including Channel Islands and Isle of Man), Vatican City State.

† Europe II: Albania, Andorra, Belarus, Bosnia and Herzegovina, Bulgaria, Croatia, Czech Republic, Georgia, Hungary, Kosovo, Latvia, Liechtenstein, Lithuania, Macedonia, Moldova, Poland, Romania, Russia, Serbia, Switzerland, Ukraine.

The percentage-based element pricing table (and country classification) is also available on the PayPal website.

If the currency of the money you are receiving is different to what your default currency in the PayPal account is, you will also incur a currency conversion fee, which is 2.5% above the wholesale exchange rates. So in total there are three elements that affect the cross border transaction fee. Since it is sounding quite complex by now, it’s best to try to simplify things by providing an example:

Case Study: A Spanish (or Eurozone) based seller selling a product worth $100 to a US based customer.

The first thing to consider is the variable fee of 3.4%, which will be increased by 0.5% since the customer is US-based.

The second thing is the fixed fee which will be $0.30.

Another side note here: PayPal charges you their fee on the total amount of the sale including tax. So if you’re in the EU and you need to charge VAT to your customers then the PayPal fee will be a percentage of the total amount of that sale, including VAT. This might seem as unfair but the credit card processing fee is applied on the total amount so again PayPal is just passing on those fees to you.

You can use this free PayPal fee calculator or the official PayPal fee calculator to calculate the various fees you’d be charged by PayPal for a transaction, including cross border transaction fees and even currency conversion fees.

While we’re at it, you should check out this excellent Payment Processing forum if you have further questions or need to peruse an existing knowledge base which most likely contains answers to your lingering doubts.

I count my transactions and they are different. After about 100 of them I made a query in Excel and found the next:

My account is in Italy and if I receive:

usd: 0.3 + 5.4%

eur: 0.35 + 3.5%

gbp: 0.4 + 3.5%

IF less than ~15 euro/gbp then commission is 5.5% and not 3.5% (no sense for me but something like that)

I hate big USD commissions on small amounts :/

Hi Jean, I’m also Maltese and would kindly like to know further pleasem as I’m a bit confused with all these PayPal fees. If I buy from France through eBay and send money to the seller using PayPal’s ‘Friends and Family’ section, am I right to say that there is a fee of 2.9% plus a fixed fee (?). If I choose the F& F section can I get buyers’ protection?

I am based in South Africa and intend to purchase products in US amounting to around R 5 000.00. As my first cross-border transaction i want to go the PayPal route and do not know what to do to have one.

I do have a credit card with ABSA bank.

Jean, kindly assist.

Greetings Jean Galea,

I would like to know what type of charges am I eligible for if I receive payments from the US using a personal account as a freelancer.

I am very confused about the differences between standard fee, commercial fee and cross-border fee, therefore an explicit explanation would be greatly appreciated.

Thank you very much for your time and effort in making the clarification.

I recently paid a US$ payment with my US Credit Card to Paypal in the US. My bank charged me a cross border fee of 1.5%. They said that though Paypal was a US corporation the ultimate recipient was in China so a cross border fee applied.

In my opinion I was paying a US Corporation and who Paypal paid was not their business. My Bank says that Paypal is only an intermediary and they have to look through the transaction to the final payee in this case Hong Kong and so the Cross Border fee applies.

Please let me know if my bank is right in charging me a Cross Border fee and why does Paypal disclose the ultimate payee to my Bank. The whole purpose of using paypal is that when I make a payment with paypal neither my bank or the payee know where the funds originated or where they were sent to,

I researched many PayPal jurisdictions myself in order to potentially minimise transaction fees. If possible, it might make sense to hold multiple PayPal accounts in different jurisdictions, but this could lead to accounting problems. France seemed to have the lowest fees, but they apparently have fairly stringent banking laws under the guise of “anti-terrorism”. Poland was my favourite choice, since I would be doing business there (as well as other EU coutnries), and fees were also reasonable. Their government and banking policies seem to be aiming in a positive direction. I am still apprehensive with PayPal’s sometimes unpredictable policies and “God” powers (closing accounts, holding funds), so I chose to look for a different payment processer.