As discussed in previous posts, once you’re using PayPal to sell your stuff online, you will also want to eventually withdraw the money you make into your bank account so that you can actually use it. Here’s where things get a bit nasty, unfortunately.

If you have a US bank account and a US PayPal account, you can stop reading right here. You’re in luck. All you have to do is attach your bank account to your PayPal account and withdraw USD from your PayPal account to your bank account. There are no currency conversions to worry about, and the transfer itself is free from PayPal’s side.

If you are the owner of a non-US PayPal account and you don’t have a US bank account, things are not so pretty.

You are given two options (depending on your home country, it might even be just one option):

- Withdraw to a debit or credit card

- Withdraw to your local bank account.

If you sell online you probably use USD as the main currency on your store and hence your PayPal balance will be in USD. What happens is that since your local credit card or bank account are not in USD, an automatic currency conversion takes place on PayPal’s end as the money is on the way out. The conversion rates are bad, to put it mildly. Hence you’re going to lose a lot of money on that conversion.

Withdrawing your funds from PayPal to a debit or credit card can be annoying if you have significant funds. The reason is that you can only withdraw up to $2,500 at one go, and every time you make a withdrawal you are charged $2,50.

So let’s say you need to withdraw $50,000. You will need to go through the withdrawal process 20 times for a total cost of $60. This sounds ridiculous; a time-wasting activity and also a money-grab by PayPal. It is, there’s no other way of looking at it.

The other way of withdrawing is to send the funds directly to your bank account. There are no limits when compared to withdrawing to a card. Sounds like we solved our problem right?

Well, not so fast.

If your bank account is in a different currency than the funds you have stored on PayPal, be prepared to lose a significant amount of money due to PayPal’s horrible exchange rates. PayPal does not let you send, say, USD directly to a EUR-denominated account. This is a limitation on their end, and I suspect an intentional one to fleece their users. There are no such limitations when using other payment gateways such as 2Checkout.

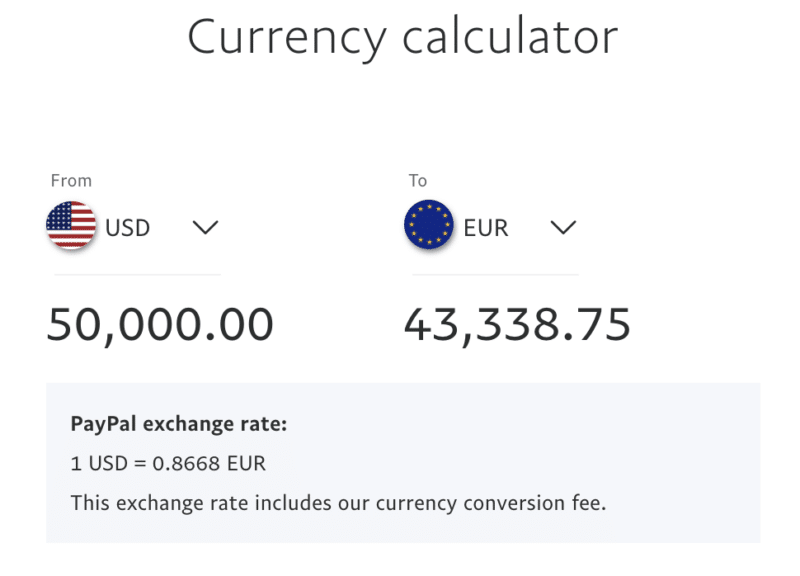

So let’s get back to the $50,000 example. Let’s see what PayPal is ready to offer us in Euros:

So for $50,000 PayPal will offer us €43,338. On the other hand, using the rate from a local bank, I get a significant difference: €43,775. And that’s just a local old-fashioned bank, not one of the dedicated currency conversion companies like Wise.

Wise would, in fact, give us €44,378, more than a €1,000 difference compared to PayPal, while Currencyfair would give us ¢44,332, which is also significantly better than PayPal.

I personally find it unacceptable to drop a thousand euros like that. This is why I will continue to withdraw using the silly method of withdrawing $2,500 at a time, simply because the total cost is still much lower. Using that method, as I showed you in another post, you can get PayPal to send USD directly to your credit card, whatever its currency.

Before we continue, it would be a good move on your end to check whether other services like Wise or Payoneer would be an even better fit for you than PayPal. In general, I recommend trying to find an alternative to using PayPal for whatever you are trying to do, since PayPal has terrible customer support and charges high fees.

Withdrawing to Cards

In the case of cards, you can ask PayPal to switch off automatic currency conversion, and have the conversion happen on your bank’s side, which will give you a better rate. I wrote about how to do this in my earlier post on currency conversion and PayPal. There are still two inconveniences when withdrawing in this manner:

- You will be forced to convert USD to your home currency upon withdrawal.

- There is a limit per transaction of $2,500, and an associated fee per transaction.

These two points are problematic. Let’s say that your home currency is in a weak position and you would therefore store money in USD and convert later when things improve. You cannot do this as you can’t do a straight through USD-USD transfer, given that your card will be denominated in the local currency. You can open a local bank account in USD but you won’t be able to get a card associated with it. At least that’s the case with all the banks I’ve checked so far. If you find a bank that lets you do that, please leave a comment and let me know.

The limit per transaction poses some obvious problems. Let’s say you are a high-volume seller and you want to withdraw $100k per month from PayPal. You will have to make 40 separate transactions and you will be charged for every single one of them. Of course, all you ever wanted to do is one transaction, if only PayPal let you do that. Apparently, this limit per transaction is dictated by the card providers (for example MasterCard or Visa). Still, it’s not convenient for serious sellers.

If your bank does not provide good conversion rates, remember that some PayPal users have had success linking their PayPal account to digital banks such as Revolut, Wise and N26. They typically provide much better rates than your local bank. You might want to give that a shot since opening an account with these digital banks is free anyway.

Note that as from April 2020 the $2,500 limit seems to have been modified, as I have been able to make significantly bigger transfers to the debit card. I’m not sure if this is a glitch or whether something really changed from PayPal’s end.

Buying Crypto with PayPal

Did you know you can now buy crypto with PayPal? That’s right, you can use Binance since it accepts PayPal deposits. Just hit the links below to get started.

You can also read my full review of Binance to learn more about this crypto exchange.

This withdrawal method is extremely popular at the moment, as people worldwide seek to get themselves some Bitcoin or Ethereum due to their extremely bright future price prospects.

Withdrawing to a Local Bank Account

Withdrawing to a local bank account does not present any limits, so you can pull out that $100k without any problems at one go, however, you will be hit by PayPal’s bad exchange rate plus currency conversion charges. It is usually easy to open a USD account with your local bank, the big problem is that PayPal will not allow you to transfer USD from your PayPal balance into your local USD account if you are based in Europe, as they consider all European bank accounts as Euro-based.

Note that in April 2020 I was able to add a USD account to my PayPal business account, so there seems to be a way to get a non-Euro bank account added. I had to ask PayPal to add it manually, as the link in the dashboard did not let me do it. I will be testing a few withdrawals with this method and will update the section below if I see that it becomes more advantageous to withdraw to the USD bank account instead of the debit card.

Real Example – Withdrawing to Card vs Local Bank Account

As an example at the time of writing this article, if you transferred $10k out of PayPal via a bank transfer to a local bank in Malta (the country where my bank is account is located in), you would have ultimately received €8,839 in the bank account. My bank does not charge any fees for currency conversion.

On the other hand, if you were to withdraw that same $10k out of PayPal to a debit/credit card linked to the same account, you would get €8,911. That amount is after deducting PayPal’s card withdrawal charge ($2.50/€2 per withdrawal, up to a max of $2,500 per withdrawal; hence four withdrawals would be needed in this case to get $10k out).

The local bank was using 0.8921 as the exchange rate between USD and EUR.

PayPal, on the other hand, was using 0.8839, a significantly different rate.

PayPal includes the charges within the exchange rate, so if you accuse them of having a really bad exchange rate their excuse will be that it includes the currency conversion fees.

At the end of the day then, we would be better off when withdrawing to a card by €72.

Not that small of an amount, especially if you start considering transferring higher amounts. The difference would be around €700 on a $100k transfer, which is ridiculous.

Another problem is that PayPal does not send you any kind of bill for the currency conversion fee, hence you cannot expensive it in your company’s books. It is totally hidden within the exchange rate they use so there’s nothing you can do about it from an accounting point of view.

Other Options

The difficulties detailed above affect every country in the world except for Canada. In Canada, users have found a loophole that allows them to perform USD to USD transfers without any charges. See here and here. Once again I had this confirmed by a PayPal support agent, as can be seen in the email excerpt below:

While not being familiar with all of our 200+ countries’ user agreements, I am fairly confident saying that Canada is the only country we have with an exception that allows a local USD denominated bank to be added and used.

I believe this is also related to how the US and Canadian bank network is cooperating. Regardless, this is not something we offer to a Maltese account, other than if you had an actual bank account registered in the US to withdraw USD to.

There are some other options one could explore:

- Use BrainTree instead of PayPal

- Open a non-resident Canadian bank account with RBC

- Open a Canadian PayPal account connected with an HSBC bank account in Malta

- Use Payoneer

- Use Etrade

- Open a US bank account

I’ve written about BrainTree already, so you can refer to my earlier post about the service, although I don’t really consider it a full alternative to PayPal as buyers would need to use their credit card instead of a PayPal account when paying.

Opening a Canadian bank account with RBS is easier than opening a US bank account. I don’t have much experience in this area except checking if it’s possible and confirming that it is. What one would do then is use the routing number of that bank account to add it as a US bank account within PayPal and withdraw money into the RBS account. Then one would use Wise to transfer the funds to a Maltese bank account. I am still checking to confirm 100% whether PayPal would allow this setup on a Maltese bank account or not.

The Canadian PayPal account plus Maltese HSBC USD account is an option that I’m still checking about, so I can’t make any recommendations at this stage.

Until a few months ago it was possible to open a Payoneer account and then add that to PayPal as a bank account via the routing number you are given. The idea was to then withdraw the money into your Payoneer account as you would have done with a US bank account. From then you would then be able to transfer to your local bank account or else pay using the Payoneer Mastercard or even withdraw cash from an ATM. It appears that this is no longer possible, although it’s worth monitoring this option as things may change in the future or an alternative to Payoneer might crop up.

Opening an Etrade account and withdrawing money to it is also another option that I’ve seen being discussed, and again I need to look into it in more detail.

The last option would, of course, be to open a USD account with a US bank, something that is easier said than done. Usually, a Social Security Number (SSN) is required, however, some banks allow you to open an account without it when visiting the branch in the US. There might still be limitations though (for example, no bank transfers possible) which would limit the practicality of such an account for my particular desired usage. Some people have also asked me whether it is possible to open a US bank account for their non-US company. As far as I know this is impossible unless you are going to deposit a few million dollars into that account.

If you have found a solution I’d love to know how you managed, please go ahead and leave a comment!

Further reading

Looking for Investment Opportunities?

Here’s a handy widget that will help you sift through a varied collection of platforms. Some of them are based in the U.S. but are also available to international investors.

Hi everyone. Has anyone managed to avoid the PayPal conversion fees? I live in the UK but I get paid in USD and EUR from my clients. I have a USD and EUR bank account set up in the UK, so PayPal automatically converts the money to GBP. I have tried to contact them like you guys have, and I have received the same vague and mixed answers. Absolutely fuming, how can they rob people like that! Please let me know if anyone has found any solutions to this sleazy madness.

Do you know how to transfer my US account balance that I have in PayPal to my Canadian dollar account balance that I also have on PayPal? In other words I am not transferring out of PayPal, just adjusting the balance. By the way my mother’s maiden name was Galea, as are half of my cousins.

I don’t collect no money

Amazing content, thank you!

I just got a Visa card from Wise which now (this is new) can receive USD when issued in the EU. And I can also add it to Paypal and it shows under payout options where it costs 1% or maximum of $10 per transaction. And it actually lets me select USD. And I called with Paypal and they confirmed it’s there as a USD based credit card. But in the last step it gives me an error which Paypal business support said had internal error code “Unsupported currency for OCT (I think it means original credit transaction)”.

Has anyone experienced this? Any solutions?

Hi everybody and Jean Galea!!!

I’m suffering to from PayPal bad conversions rates. But I got a better solution..,

I am European and I receive my Money in USD on my PayPal account. So I open an account on a FX broker as a trader. Inside the Broker I create an MT4 USD account and another MT4 account in EUR.

Then I deposit my money there with PayPal, it’s like an instant payment in USD to my MT4 USD account. (instant payment) And then I convert my money from the MT4 USD to the MT4 EUR account whit way better conversions rates then PayPal. And even better if involved more money. The only issue is that I have to send it back again to PayPal but in EUR this time, (you have to withdraw from the broker to the same way you deposit the money) And finally withdraw from PayPal to my Wise account in Euros or another Bank account.

Is seems a lot of work, but it’s really easy, sometime I do a small FX trade to justify having an account on a Broker and that’s it.

Best regards to you all

Hey man, that’s great! Which broker did you use for that? Would ba amazing if I could replicate.

Hi!

I’m using ICmarkets, they allow to create internal accounts on many currencies.

I have been using this system over more than 1 year without any issues.

Hi Jose

I followed what you said and opened an ICmarkets account, but they will not allow me two accounts in different currencies or to transfer money from one account to another. Are you still able to operate that way, and how did you manage to set it up like that?

I karla, only today I saw your message. Sorry….

You create only one ICmarkets account, and then inside your account you create a Trading funded account. You have to deposit a minimum of 200$ or 200€ to open a trading account. (mt5 ou Ctrader). In my case I created on in EUR, GBP and USD.

And then I trasnfer/convert money between the trading accounts. The spread is really good, if you convert at least 1000$ or more the spread is only 0.2%. For converting 1000 USD to EUR you will be charged only a 4 or 5$.

https://i.postimg.cc/jjRL6Y5h/Screen-Shot-2022-09-15-at-21-49-02.jpg

Hi Jose, do you have an email I can contact you on regarding this? I have quite a lot of USD in my Paypal account and we’re a UK business. When setting up an account to withdraw from I have to input a UK account. I also just spoke to Paypal and they confirmed that if I withdrew the money to a UK bank account it would be converted at Paypal’s rate. It would be amazing to get more of an understanding of your process. I think it’s disgraceful that Paypal have implemented this with such terrible exchange rates.

Hi Ben

Have you read my last comments, I already said the best way to convert money without suffering to much form the paypal (suck) Rate.

And Its not ilegal, you just open an account on a forex brooker, I use IC markets a very wells stabslished and safe brooker until now, and then internal convert money from a USD account to a GBP account. You only have to open a life account to trade, one in USD and another on GBP (on your case).

I do this all the time, and the brooker I use suporte trade accounts on the principal currencys USD, EUR; GBP, AUD, NZD, CHF, JPY, SGD, CAD, HKD.

I deposit on the brooker with PayPal, then convert form USD to (EUR) and then withdraw to the paywall account again. (on the next day the money is on your PayPal account again).

And, no I don’t win nothing for recommend IC markets, its just the one I use without any problem, and the only one I know that I can use PayPal to deposit and withdraw,

Best regards.

Thank you for this tip! I’ve used this for the last few months with no problems and saved a lot on PayPal fees / terrible conversions

Hey Jose,

I looked into this, and even set up a trading account. I am sure this works for Euros – however, I need Czech Crowns and most FX Brokers do not have this currency.

I wonder if there is an FX Trading platform where you can have CZK?

Regards,

Matt

Hi

I’m selling musical instruments on Reverb.com

I sell my instruments in euro and recieve my money via danish Paypal. I have set the currency on Paypal to euro only but my card and bank account is in DKK (danish kroner). Is this the best way to do this in regards to the (horrible) Paypal conversion rate?

What would be the best way for me to withdraw my money from Paypal?

Reverb.com is an american site as far as I know.

Thanks in advance!

– Jesper

Can I withdraw my money from Paypal account to my credit card,then use the credit card to purchase Bitcoin! Is it possible?

Yes this is possible on eToro or Binance. You can buy directly with your PayPal funds.

I have a Paypal UK account and was trying to withdraw the USD funds to a card. I contacted support to disable the automatic currency converter but they said that is not possible! They said the currency conversion is automatic and there is no way to disable this! How did you guys managed to disable the currency conversion when withdrawing to a card? You mentioned support but I contacted them and they say it is not possible.

Thanks.

I was able to transfer from Paypal to a US bank account a few times early this year, with only a flat fee of 35$. However now the fee suddenly jacked up to 3%, which for example : a 10,000 transfer is 300$ 🙁 Has this happened to anyone else?

Thanks for the extensive resourceful article.

I leave and work in Uganda-the pearl of Africa,

But it’s not yet even supported. I opened an account through a friend in some other supported country , but they have diened withdraw.

Keep sharing such information please.

Kind regards,

Niwaha Barnabas

I cannot believe for a moment that PayPal’s new policy can be legal or FCA compliant in the UK. It is extortion, and their terms are vague at best. It’s like heads they win, tails they lose. They are subject to the FCA’s rules and regulations, and this policy is denying their customers from (a) withrawing their own money which they’ve already paid fees on in good faith, and (b) the ability to convert their USD with another better-value provider. This is a class action waiting to happen as it’s anti-competition, it’s denial of fair value to their customers, it’s changing the goal-posts, and their conditions are seriously ambiguous in any case.

Support PayPal dropping the new 3% extra fee for withdrawal to virtual banks (TransferWise / Revolut etc). Non-US freelancers receiving USD are now subject to an extra 3% fee or very, very poor PayPal exchange rates…

http://chng.it/VYW4x52hWy

It’s not merely anti competitive. It’s simply theft. Imagine someone says they will receive international payments for you, and you ask for your balance in cash. He says “sorry, I cannot give you the cash, it has to be in your own currency, loser, don’t ask me why”. Then he trades it for the equivalent money in your currency, and takes off some huge percentage for himself.

When you exchange currency and you get lower than market rate, you are literally losing money. The two denominations are expressed in different units, but what you traded for when you use a bank or Paypal is strictly worth far less than what you traded. I have no idea how anyone can use Paypal internationally, if it’s impossible (it certainly is _nearly_ impossible) to withdraw the money in its actual currency. You are already losing around $100USD for a $5000 transaction.

I spent literally 5 days calling them and trying to get them to escalate or fix my problem of not being able to add my USD bank from the “add USD bank” form. One person I asked to escalate with said “yes, this is level 3”. I’m 99% sure she made that up, because googling “level 3 paypal” gets zero results. The last person I tried to escalate with tried really hard to convince me not to before finally agreeing. Then of course, this new “escalation” person had a completely different story than all the other staff I talked to so far (but still no guaranteed solution, it will be more days of back and forth).

It should be noted as well that Paypal makes interest off your money [1]. Every time your account gets locked or limited because “it was flagged for security”, they are earning more interest. They are financially motivated to add as much fake security BS as possible and be as incompetent as possible. One of the reps told me they do not make interest, giving some “explanation” like “we are not a bank”. So it is indeed true that they lie to you.

The very first day I made this Paypal account, I changed the password and it locked me out because apparently password changing is suspicious behavior. I have not even bothered recovering it until this year, because I knew I’m going to have to sacrifice solid days getting them to do basic tasks and their job. The worst part is, I was on a new phone number, and they let me in the account without giving any proof that I own the account (not even the password). This is also the first time they have heard my voice. The account had zero ID on it of any kind (other than the password), and they let me in to access the $5000 USD stored in there. Only after I had this new access to the account, I added ID.

I’ve used Paypal 11 years ago and they had just as bone headed problems. I would sell software and they would just automatically refund customers based on the BS they come up with (“I did not receive the software”), and not give me any say.

Fuck Paypal and everything they stand for. This must truly be one of the worst internet services in history. This is why cryptocurrencies exist. When I use a cryptocurrency, it does not let someone use my money because they asked some idiot support staff kindly. When I use cryptocurrency, it does not tell me I cannot use my money because it “is in a different country” than me.

1:

>PayPal combines your PayPal funds with the PayPal funds of other PayPal users and invests those funds in liquid investments in accordance with state money transmitter laws. PayPal owns the interest or other earnings on these investments. These pooled amounts are held apart from PayPal’s corporate funds, and PayPal will neither use these funds for its operating expenses or any other corporate purposes nor will it voluntarily make these funds available to its creditors in the event of bankruptcy. [https://www.paypal.com/us/webapps/mpp/ua/useragreement-full]

So I hate Paypal so much. Charges are ridiculous. First they will charge a transaction fee on the pay I got from client then charge a fee for bank transfer then give a bad conversion rate on top of that. I lost so much money in that.

I have a good news though. Transferwise introduced the currencies and accounts like Revolut. I like revolut because they don’t have any hidden fee plus they give live exchange rates but there currency account never worked.

So with TW’s new accounts I opened a local currency account in USD and AUD. I told my friend to transfer a small amount to that Australian account I got from TW. Transfer was instant and I got the same amount in my TW’s AUD account. I can transfer to my bank account directly with minimal amount but you can save that as well. I recharged my Revolut account using TW card(Similar to Revolut card). I recieved the full amount in my Revo account from which I can send to my bank account without any fee. Revo have transfer limit of 2k then they charge a small amount but its still worked.

Now problem I am facing is. My client is so much stuck with Paypal, they gave me another option of payoneer but that is also same as paypal with little less charges. They are doing bank transfer even I don’t know why!!

I added my USD account to PayPal and its accepting it but its charging a amount on the transfer. My paypal account is CZ based and its saying free on bank transfer but with bad conversion its worst that USD transfer.

I want to know. will it be possible for me to convert my account to USD? So my USD transfer become free and then I transfer the amount to my TW’s USD account and never use it again. If it is not possible then I will transfer anyhow and say goodbye. Let me know. I hope the trick I shared may help you. Try it out and save some money!!! 😀

You can add the US bank account to Serbian PayPal and a few others, you can see the list of countries on their fees page or something.

How about transfering money from Paypal to eg. eToro and then transfer them from eToro to your local bank? Have anybody tried that?

I know there is a small withdrawel fee on eToro but no where near Paypal conversion fees!

Interesting idea, I’d be curious to see if anyone has tried that as well.

Also looking into Transferwise, but it looks like I am out of luck when living in Denmark. Maybe someone can confirm that one as well?

For Transferwise you need to a US bank account, I´m not sure if you can add one to a danish Paypal account, I actually dont think so.

Look at my post below for a more detailed explanation.

I`m also very interested in the eToro idea, I also thought about it. Did anyone try it?

I successeded in transfering money through transferwise the other day. Paypal -> transferwise -> DK bank. Paypal -> transferwise was fee free. Transferwise -> DK Bank has fee on both sides.

I also tried eToro. I specified a DK Bank as deposit, but they just returned the money to my Paypal and deducted $5 for handling …

Interesting…how did you get the US-Dollars to your Transferwise account? Is it possible to add a US-bank to your Paypal account in Denmark?

Regarding eToro did you ask their support if it is possible to transfer it to a bank account when you add money with Paypal before? Maybe it is just a automatical preset process

Update and bad news I am afraid.

TransferWise: They only offer a US bank account and I can only get a Danish PayPal account and thus a Danish bank account. Dead end for now. A possibility is that if you know an american citizen, then it might be possible for them to create a Paypal account for you, but then again they can’t have one already.

eToro: They kindly informed me that they only return funds back, the way the funds went in. Meaning that if I transfer from Paypal, it will only be possible to get them back to my Paypal again.

I am just toying with some ideas regarding etoro method, what would happen if I close my paypal account after transferring to etoro and provide etoro with my bank account as alternative way for withdrawal. As a matter of fact, the fund in USD currently sitting in my account was from a withdrawal from etoro. For some reason, previously I have succesfully withdrawn fund from etoro and the fund was deposited into my local bank account that I provided instead of to my credit card/paypal which I have used to deposit funds in the first place.

Hi there! It is a very interesting discussion, as it is specific to Danish users. I have seen some people discussing withdrawal methods for Denmark at https://mycrypto.dk/bitcoin.

Did you manage to get something to work?

Morten where do you see those discussion? Can you post a direct link?

Hello,

it seems Paypal tries to close gaps very quickly. I`m from Germany and few years ago it was possible to withdraw to cards but they removed this option. Also it is not possible to add a US-bank account to a german Paypal account at all. I read that in some EU courtries it apparently works if a agent does it manually. But I just read Alex post here and it may not be possible anymore at all whatever agent you get.

This was my last hope, to open another EU Paypal account which uses EUR and you are able to add a US-bank (transferwise). I would transfer my USD from my german Paypal account to the other EU account (should be feeless within EU with family and friend option) and then withdrawl it to the transferwise US-bank account. Honestly I dont think it would work like this or did it work for someone already?

I noticed there is a option that you can do a instant withdraw to bank account OR debit/credit card with a 1% fee but my visa and mastercard didnt work with the error message “the card doesnt support instant payments.” Of course you have to disable to the Paypal sided currency convention for every withdrawal and you have to look at foreign currency fee of the credit card you are using! Did this work for anyone already?

Does someone know if it is worth to buy crypto currency with the USD balance via Paypal and withdrawl it as EUR to a local bank account? There will be fees but are they higher than Paypals? (Sure I wouldnt recommend this for a business seller with a $100k balance or so)

I have a $2700 balance and really dont want to gift Paypal those outrageous fees (after paying already fees for the transactions!)

I am having the same problem (same error). As for the next step I will try transferring money to PayPal accounts in Lithuania and United Kingdom and I hope it will work. Thus far, I tried iCard on Lithuanian account, but it didn’t work. Now, I opened a Revolut business account, that offers also Visa card, so let’s see. Regarding the fees, if you are sending in USD, there is a fee when you are transferring money even as for the family & friends. But at the end, it is still worth the hustle as you can save quite some money.

Hey, did you have any success?

You also have the Transferwise fees beside Paypal to Payal fees. I really hope there is a better solution.

I’m not sure if this applies to other countries, but I’d been using a TransferWise USD account to withdraw my PayPal USD funds to for quite some time, fee free. As of November though, I’ve seen that PayPal now charges a 3% fee to withdraw USD funds to my TransferWise USD bank account on my Australian PayPal account. I’ve also tried an Airwallex USD bank account, but after a review of current PayPal fees it seems to apply to any USD bank account withdrawal. The only way to not pay it is to withdraw to an AUD bank account and pay PayPal’s exchange rate OR leave the USD in PayPal and spend in USD from within PayPal. Alternatively, if you can get an instant card transfer, the fee is only 1%. It seems TransferWise cards are not supported though and it looks like PayPal sees Airwallex multi-currency cards as AUD so PayPal wants to convert using their own exchange rates.

I was outraged too. I had funds in EUR in Paypal, but when trying to withdraw to a card in the local currency, I “would” have gotten robbed of 3%. That means 1% Paypal fee, and 2% how worse the Paypal Exchange rates are.

However, I liked a local bank account in EUR, and when I withdrew some 100s EUR, there was no fee! What?? All the EURs are supposed to go to my local EUR account in 1-3 business days. Then let your local bank deal with the exchange rates.

Can send a check off my pay pal to ask I can’t get money off it my bank account . Cuse my pay is form us market. So am ask for check form paypal to my country jamaica .

Hey Jean,

Thanks for your post.

I’m an experienced PayPal user that is now having issues with avoiding Paypal conversion fees. My PayPal account is a UK one. I receive payments in USD and there’s no other way around it. I’ve had 2 main directions on how I was going to tackle the issue with a horrible conversion rate when withdrawing my funds (Paypal automatically converts USD->GBP).

The first method was changing the withdrawing currency of a card linked to the PayPal account and then withdrawing to a card so the conversion process happens on banks side. Everything went well until the last step where PayPal system blocks me from doing the withdrawal attempt by giving me an error. I’ve tried this with different cards, (verified/unverified), some of them were there in an account for longer than a month so shouldn’t be an issue with “how new the card is to a PayPal account” (some bullshit that PayPal agents will tell you).

The second method is adding a US bank account using TransferWise borderless features. I’ve probably called PayPal more than 100 times for the past months asking to add a US bank account to my PayPal account and 99% I got a refusal and some bs from the agents. However, that 1% actually went and tried adding my US bank account to the system, however they all got an error in the end. I’ve read a post where a guy managed to add it through an agent asking the supervisor to remove the block and then adding again. I however didn’t succeed and didn’t get lucky with an agent like that, and when even when they asked their supervisor – they got a straight up answer – You can not longer add USA bank accounts to UK PayPal.

I’m just looking for some suggestions who had a similar experience in avoiding PayPal’s conversion rates and do you think I should still try calling support and try to get lucky or there’s no chance?

It’s Important to note that apparently there was a new regulation implemented within PayPal’s system that doesn’t anymore allow USA bank account to UK PayPal accounts.

I have been able to add a USD transferwise bank account to my Australian paypal account by myself – no need to call paypal.

However, there is now a 3% fee to do this, so its cheaper, afaik, to do paypals currency conversion than it is to withdraw the same currency.

The Paypal Daughter Xoom is also an option for exchanging large amounts of money. I just wonder, why this is more or less unknown…

Hey Jean.

Thanks for your article.

I currently have a UK PayPal account and I’m getting payments in USD. When I try to withdraw to my UK banks, obviously the conversion happens on PayPal’s side. I’ve tried and called PayPal like more than 120 times (I’m serious) asking to add a US bank account (using Transferwise services), however when 2% of the customer support agents agreed to proceed, we got stuck on the very last step because all of them were getting an error from the system. Then, I managed to change the withdrawing currencies on my cards linked to my PayPal account. All good, when finishing the withdrawal – I get a mistake from the system. Called in the support, no help, different vague answers that obviously make no sense. Do you still see an option on how I can avoid the conversions happening on PayPal’s side? I appreciate your articles and been a fan for a while on how to not get screwed by PayPal fees lol.

I’m living the same problem – I feel like it can be legal (but I’m no expert). How can they force me to change dollars I have earned into pounds when I withdraw them?! I’m furious and desperately seeking a solution.

*like it can’t be legal

I’m taking my complaint to the Ombudsman as I’m pretty sure that PayPal is in breach of the FCA Code of Conduct.

They did not give adequate notice. The first I knew about this was when I tried to transfer funds. They are obliged to give “in your face” notice of material changes.

Second, the support has been shocking. Mixed messages, inconsistent answers … They even blocked my phone number at one stage, after just two calls.

I’ll keep everyone informed and get more signatures to join in the petition.

I have linked my USD account that i have in an EU bank, but have not tested yet.

I am trying to do a USD withdrawal form the PayPal USD balance to my local bank’s USD account.

but I suspect that PayPal will convert it to EUR before sending and the bank will convert is to USD when receiving.

What did your tests indicate?

Hey!

I am having the same annoying issues! I receive USD in my Paypal acccount and I have a USD bank account linked to the Paypal account. I live in Romania. Paypal is taking like $35 upon receiving money, then $60 upon transferring funds to my USD account in a bank from my country! And they convert it in EUR when transferring, then my bank will convert it back to USD and I will get half of my initial EARNED money because the are playing the conversion game. Can you give me better options to be able to receive USD , closer to what amount I have initially earned? Thank you!

Kindly I need help, I transfered money on my visa debit card and an in Uganda, many transactions wea complete but never reflected in my account and the local bank says can not trace my transactions, paypal indicated transactions as complete, how can I be helped to recover my monies, paypal has the worst feedback to clients

I’m in Uganda and using PayPal with no issues at all.

Maybe I can help. Reach me on telgram: @ivanTrill