Converting from fiat to crypto and vice versa remains one of the big issues for Bitcoin and other crypto adoption, especially in certain countries.

Traditional banks, due to various reasons including government pressure, have been slow to adapt to the new realities of digital assets like Bitcoin and other cryptocurrencies.

Read now: The best crypto debit cards in Europe

I suspect a significant fear of having to cover all their bases for KYC/AML requirements as one of the other reasons that they have been quite wary of their customers transacting with crypto exchanges over the past years.

Unfortunately, this makes it hard for private or corporate crypto investors to find good onramps and offramps to deal with crypto if their banks put up significant obstacles to doing so.

Further reading: The Best Crypto Exchanges in Europe

The United States is currently the place where it’s easiest for citizens to buy and sell Bitcoin and other cryptocurrencies. Not only does it have a long tradition of tech innovation, but it’s the home base of many crypto entrepreneurs, educators and crypto companies.

If you live in the US, you will find that many banks understand crypto and allow you to transfer money to and from exchanges, but things are different in many European countries.

For example, in Malta, the self-proclaimed “blockchain island”, it has become almost impossible to buy any crypto using a local bank account, as most of the limited number of banks available there block transactions to exchanges or threaten to close your account if you did any transfers in the past that they were not able to block.

Not only that, but pretty much all bank employees there seem to have exactly zero knowledge of crypto, including the higher management. All they know is that they don’t work with crypto – it’s basically a mantra based on fear of the unknown.

This is obviously not conducive to Bitcoin adoption by retail investors, let alone the relocation or starting of crypto companies there. We can therefore conclude that the whole “blockchain island” thing was entirely made up.

In other bigger countries, things are better, but it’s still common to see retail investors having problems with their banks when dealing with crypto-related transactions.

It’s also worth keeping in mind that the big digital banks like N26 and Wise all explicitly specify that they disallow transfers to exchanges. Withdrawals are generally accepted.

Wise, for example, has recently softened its stance and now accepts withdrawals from certain exchanges to the Wise Borderless accounts:

“you can send money to your balances with bank details from a platform that deals with Bitcoin or another cryptocurrency — as long as the platform is regulated and/or supervised in the EU or UK.”

Effectively, that means that they will accept transfers from at least the following top exchanges:

This new development from Wise is a good indication of things to come. Banks will start to soften their stances by accepting withdrawals from reputable exchanges, and will ask you for your transaction history. If all you’ve done was simply transfer to such an exchange, make trades over the years and then sell and withdraw, you’ll be good.

Revolut customer support also mentions that they accept up to €50k per day in withdrawals from exchanges, but I don’t know anyone who has tried that yet – it seems a bit optimistic.

So what’s the solution if your bank is currently taking a negative stance towards Bitcoin?

One solution is to use a site like LocalBitcoins to buy Bitcoin, thus avoiding exchanges altogether.

However, if you need a solid banking solution, things get a bit more complicated.

I’ve done some investigation into the current situation and found that there are several crypto-friendly banks that are designed from the ground up to handle the needs of clients that need to buy and sell cryptocurrencies. Several of them offer their own crypto facilities, while others act as normal banks, but don’t block transactions to exchanges.

The List of Crypto-Friendly Banks in Europe

Here are some banking solutions that I’ve found as viable options in Europe, together with some comments where applicable:

- Revolut (Lithuania)

- Solarisbank (Germany) – one of the most forward-thinking banks in Europe, also offers crypto custody

- Amina Bank (Switzerland)

- Bank Frick (Liechtenstein) – well-known crypto-friendly bank and partner of Ledger

- Agribank (Malta) – seem eager to take the business that the bigger banks refuse, but at a price

- Orounda (UK)

- Sparkasse (Germany)

- Swissquote (Switzerland)

- Mister Tango (Lithuania) – provide banking to exchanges like cex.io, itbit, coingate, exmo.

- Bankera (Lithuania) – they have an ICO past and seem a tad shady

- Majestic (Lithuania)

- Simplex (Lithuania)

- Mercuryo (Estonia)

- FinXP (Malta)

- BVNK (United Kingdom)

- Ramp (United Kingdom) – fiat onramp for crypto apps

Etana VS PSPs

Etana is a Financial Custodian: a specialized financial institution whose purpose is the safe keeping of a client’s assets. The client’s assets are always held under the client’s own name, protecting the assets in the event of the custodian or financial institution failing.

Etana uses FDIC-insured banks. Fiat assets are federally insured.

Digital funds are insured from the moment they are custodied to the moment they reach their destination wallet with the Counterparty. Digital wallets are insured up to USD $50m, but you can purchase additional insurance.

You will find several PSPs that profess that they work with crypto, however, these are the lowest rung of financial institutions and I wouldn’t trust serious money with them.

Etana will make you go through tough KYC and AML checks when you sign up, which might look more onerous than those of the PSPs or even exchanges.

While payment service providers (PSPs) take a fee to transfer your money directly to an exchange’s bank account, Etana’s custody services keep your money in insured, trusted, third-party financial institutions. Etana’s global network of banks ensure the safety of your money by minimizing the risk of exchange hijacking or the exchange going out of business, losing the assets it’s managing. Deposits are also insured by the government of the financial institution; for example the FDIC for US-held deposits. Additionally, Etana can receive deposits and hold them in 11 currencies meaning you will not be looking at expensive foreign exchange conversion fees.

Buying and Selling Crypto with Revolut

A special note about this digital bank. If you’re having trouble getting money from your bank to an exchange, Revolut could save the day. This digital bank allows the purchase and sale of cryptos directly from your account, however, it cannot be used to transfer money to and from exchanges.

Keep in mind, however, that you will not be able to withdraw the Bitcoin. You will have to assume the custodial risk and trust that Revolut really has the Bitcoin that it is selling to you.

What has your experience been with crypto and banks? Would you recommend any other banks in Europe? Let me know in the comments section.

An Alternative to Banks

Stablecoins are the alternative to using banks. If you’re stuck looking for a fiat offramp after selling a cryptoasset, the next best thing might be to hold your Euros, Dollars or GBP in a stablecoin. The biggest stablecoins are denominated in USD and EUR, and you can literally store millions of dollars on your own hardware device, thus negating the need for a bank.

By using a stablecoin, you are removing any volatility risk, and you can thus store your fiat currency securely until you find a bank that accepts your business. Alternatively, you can just spend the stablecoin directly at an online merchant that accepts crypto for payment.

You can purchase stablecoins from any of the top exchanges in Europe like Binance, Bitpanda and Coinbase.

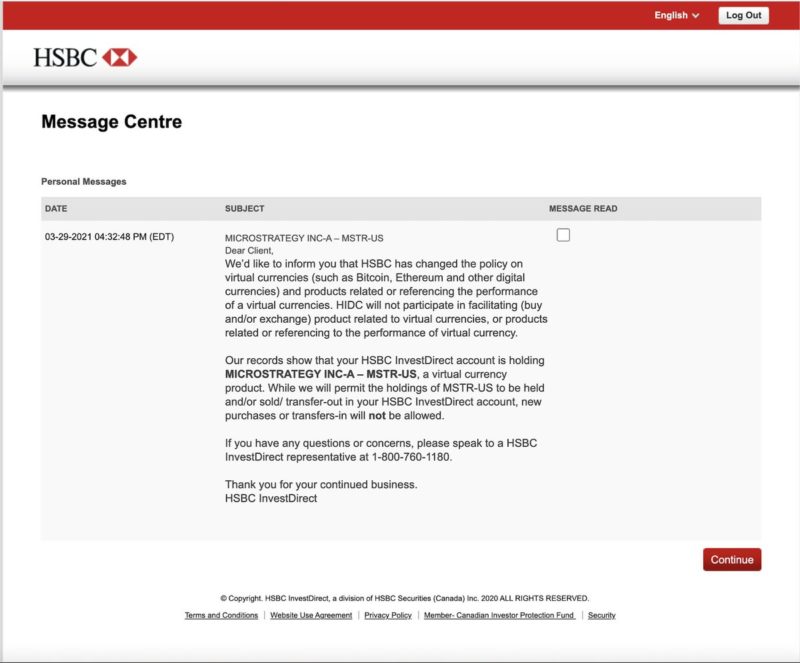

An Example of Unbelievable Bank Behavior

Many people I speak to seem to be unaware of how backward banks are nowadays. For example, people typically don’t expect HSBC, one of the world’s most well-known banks, to send letters like the one below to their customers.

So they’re not only saying that they will not allow transfers to and from crypto exchanges, but they are even prohibiting customers from buying shares of Microstrategy, a publicly listed company on the NASDAQ US exchange. The reason? Microstrategy owns a good chunk of Bitcoin. Simple as that.

Make you want to rethink your relationship with your bank doesn’t it?

Hello Jean,

I have a company in Cyprus and working as a software engineer with some of my activities include payments in crypto. Cyprus banks policies dont accept in their policies, to being paid in crypto and transfer money from an exchange to the bank account. What could I do?

thanks

Thanks a lot for your extended guidance on the matter.

Unfortunately, Paysera is among the entities which are extremely conservative towards any transactions that are related in any way to crypto (the prohibition includes execution of transfers to or receipt from any virtual currency exchangers). Shame on them!

Keep going on, good luck and all the best!

I am looking for IBAN that would allow me to accept payments in FIAT related to cryptocurrencies.

Could you clarify the nature of the transactions?

If you are from the EU you can use Nebeus. They have both IBANs and a crypto side to them so you can make all your crypto payments and send money from one account to the other easily and conveniently.

Hi! One doubt, does anyone know if NURI, or any other accept constant transfers to exchanges as Binance or Kraken?

Because I have had problems with REVOLUT, N26, and WISE between others and I am still trying to get my money back from Wise.

You may have missed Sygnum AG, regulated bank, from the list in Switzerland

I have a quick question about this article. does anyone know Merco Bank? https://mercobank.com/

Is there any information or feedback on whether they are good and where are they reported? I’ve only seen that it’s supposed to be in Sweden or Cyprus but no other information like which country you have a banking license in and who the directors are etc. Your site strikes me as very dubious and when I searched I didn’t find much information. Can anyone help or has experience with them?

Is there a bank that will open business account for alternative fund that is trading crypto? My company is based in EU and I am EU citizen.

Yes, Januar.com

Nebeus 🙂 They have business crypto accounts

Great article! Anyone had any experience of using Nuri (previous Bitwala) for this?

Yes and reviewed it here.

Just want to let you know that today I tried to transfer fiat from my wise account to bitpanda and wise gave a message that they do not transfer to bitcoin or crypto related services. I decided to transfer the money to my regular bank account and do it from there and the transfer is now being checked as an extra security measure. This has never ever happened before so my suspicious mind thinks this has something to do with the failed transfer to bitpanda……

@Laila

yes, but you can do withdrawals in fiat (Euro) from Bitpanda to Wise, and not the other way around. Thanks for a good article Jean 🙂

Oh and to add, the transfer to my normal checking account got cancelled BECAUSE I MENTIONED THE WORD CRYPTOCURRENCY IN THE REFERENCE. I thought it was a fluke, I tried it again and now my account with WISE has been shut down. I kid you not. I am now trying to get my money back which isn’t easy. So whatever you do when you deal with WISE, do not mention crypto!!

Question about Bitwala, do you get an IBAN number?

Yes, IBAN and a visa debit card 😉

That’s why the legacy banking cartel deserves to go extinct. I will shed no tears when they do. They have it coming and they deserve it. Crypto is a movement by the people fueled by the discontent with banks and their attitudes.

Realistically speaking, they will more likely be forced into providing Bitcoin-related services than go extinct.

Well done research. Another tip for liquidation is piixpay and virtual cards from spendl and paywithmoon.

Thank you, the Circle USDC account is also another interesting alternative that can work for some people/businesses.

Unfortunately, spendl closed their sign up. I’ve emailed them and got the following:

> Shane (Spendl)

>

> Aug 12, 2021, 18:45 GMT+3

>

> Dear

>

> We closed sign up.

> Best,

> Shane

BTW, Piixpay is surprisingly good and friendly. Transferwise accepts them as they’re registered in EU. Thank you.

Hi everyone,

Just to let you know that Revolut change their position about exchange.

“As for crypto merchants, we currently support the following list: Xapo, crypto.com, MoonPay, Bitstamp, Kraken, Coinbase, Gemini, and we are reviewing this list on a regular basis.”

https://www.revolut.com/help/making-payments/paying-by-card/which-merchants-are-not-supported-by-revolut

I try today to/from Binance and works.

Hi Matt, I also noticed this on Revolut’s website, but then learned that it only relates to card payments. Check the hyperlink – it has “paying-by-card” in it. Revolut still does not support transfers to Kraken… I was disappointed to learn that.

Hello everybody!

Does anybody know if any of the above institutions would open an account to a non-European citizen. I’m from the U.S.

Thanks in advance.

What would be the best banking solution for a Singapore company trading on crypto exchanges? Which bank would be preferable for such business account?

Transferwise don’t allow SEPA transfer tô Kraken.

I am haver a blocked transfer today.

They should allow the other way round.

I’m trying to find out more about Solarisbank (Germany appeals more to me) but it seems like you can’t open a personal account with this bank?

solaris is not a bank itself afair but other institutions can use them.

if you’re looking for a germany bank look at bitwala.

they are backed by solaris.

Does Bitvala accept Bitstamp payment?

Bitwala operates under Solaris bank and I can also recommend them. You will get a free Visa card, even making your first deposit.

Thanks for recommending Bitwala. Just signed up with them. KYC via a video call. I guess since they operate under Solaris, they’re insured?

Thanks for the valuable info!

Correction about Fidor. They do not accept Italian passport holders, independently of actual country of residence (EU).

Good to know, thanks.

Hello,

what about fidor bank?

Great option but only available to German residents.

Not true sir.

Fidor.de works well for non-germans but they only offer personal accounts in that case, meaning, no corporate accounts for non-germans .. ask their support, they are friendly.

You’re right, thanks for the correction.

Excellent information, thanks

You’re welcome.

Muito bom artigo