For the past few years or so, I’ve been practicing intermittent fasting (IF) with practical benefits.

I usually train in the morning, and I feel like I have no problem doing this on an empty stomach. This might or might have something to do with my chronotype, which favors early morning activity.

Advocates of IF report having more energy, trimming fat, and saving time by being able to get straight into their work more quickly in the morning. While I can’t really say if it does help trim fat or not, it helps me to contain my tendency to overeat as I end up eating one meal less right from the get-go. I have found that during lunch and dinner I eat the same amount as before when I used to eat three times a day.

I do feel like I have more energy, especially if I’m going to train first thing in the morning. Working or training on an empty stomach feels great to me. The only exception would be if I have a padel match, and I would usually load up on some energy in the morning and not do intermittent fasting. This is to avoid any energy crashes during the match as the matches tend to be long and intense, unlike training sessions which are usually under one hour.

Another exception I make is when traveling to places that are renowned for their food. If the place I am staying has an amazing breakfast buffet I will definitely indulge myself, so I allow myself to bend the rules every now and then as long as the IF trend is not really affected.

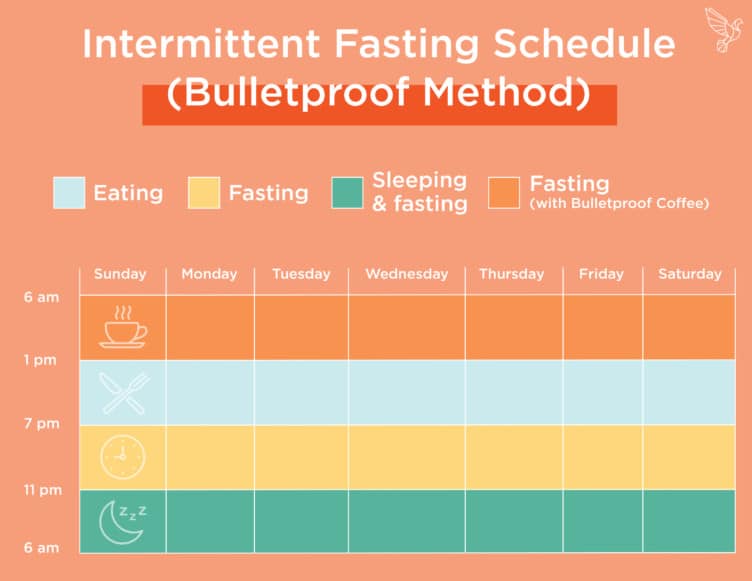

It’s also worth mentioning that I take an espresso in the morning, usually with some coconut oil mixed in, as detailed in my morning routine. I might also drink more teas and coffee during the day.

There are several ways of fasting, and I chose the 16:8 intermittent fasting method as the one that works best for me. That means fasting for 16 hours a day and having an 8-hour eating window, as shown below. I don’t always manage to get the full 16 hours of fasting, but it’s always somewhere between 12 to 16 hours. Even with 12 hours of fasting, I get the benefit of feeling lean and clean. If I don’t practice fasting, I’ll typically be bloated and more sluggish during physical activity.

Some say that adopting intermittent fasting liberates you from the tyranny of thinking you must eat a certain meal frequency. I wouldn’t disagree with that, although I ate whenever I felt like it even before starting intermittent fasting.

Missing breakfast suits me, saves me time, and means that I have more time in the mornings when I am at peak performance due to my chronotype.

Fasting has been linked to benefits for longevity, although I don’t think that at this stage you should be doing it purely for that reason, as the research is still not conclusive.

Click here to learn more about intermittent fasting and a sample diet from the Bulletproof email.

Have you tried intermittent fasting or fasting of any sort?