Contents

With the growing trend of digital nomadism together with location-independent workplaces, we are seeing an increasing number of high network individuals (HNWIs), freelancers and company owners realize that they have the luxury of choosing a country to be tax resident in and (for company owners) also deciding which country to base their company in.

I’ve personally taken a strong interest in this topic as I’ve spent several years as a digital nomad, before adapting my lifestyle to family life with kids, thus slowing down my travels and using European countries as my base.

I am not a qualified tax consultant; all the information you find below is based on (countless hours of) my own research and chats with lawyers and accountants. Always make sure you talk to several good tax lawyers before you make any moves. Tax structuring and personal residency are topics that should not be taken lightly, and any solution found should take into consideration your current as well as possible future needs (e.g. family, change in job, fluctuations in overall net worth, personal interests and hobbies etc.).

If you’re looking for consultancy on European tax structuring, head straight to my contact page, or read on for more information about the options available.

The Case for Being Based in Europe

I love the diversity and culture of the European continent, and while I have traveled all over the world, I keep returning back to Europe as a base for living and conducting business.

Provided you can pull it off, residing in one European country while owning companies in other European countries typically brings the best flexibility and tax advantages.

Tax laws tend to change quite frequently, as do the relations between countries. For example, the big countries tend to have a blacklist of countries they consider tax havens, and of course, you don’t want to base yourself or your company there. I believe the European Union currently provides the best flexibility in moving around and building an efficient tax strategy, not to mention the best quality of life.

No EU country can blacklist another country, so you have the security of countries playing nicely. You would perhaps be surprised to know that within the EU tax rates vary between countries in a very significant way.

Some European countries have very attractive incentive programs for attracting high-net-worth individuals and entrepreneurs to their shores, which you will want to consider for your family’s residence.

It goes without saying that you should look further than the tax percentage when evaluating different options. For example, it is to be expected that opening a company and doing business in Ireland is much easier than doing so in Bulgaria, and here the language barrier is pretty significant, not to mention the cultural one. This factor is especially true when choosing a country for residence, as the quality of life becomes a major determining factor.

The Best Option – Personal Residence in Portugal and Corporate Structure in Malta

As of 2023, I believe the best tax setup for most working individuals and families to be comprised of Malta for the corporate setup and Portugal for personal residence.

When coming to this conclusion, I’ve not only considered tax rates but also various other factors that affect one’s quality of life, as I believe that while tax optimization is an important exercise to protect your wealth, it should never occur at the expense of lifestyle.

- Lowest effective corporate tax rate in Europe – Malta (5% with a trading and holding company structure)

- Lowest personal taxation in Europe – Portugal (0% under the NHR programme)

In short, with this option, the company taxation would be an effective 5% due to Malta’s 6/7 tax rebates, while the owner resident in Portugal would pay 0% tax on received dividends from the company for the ten years following the establishment of his residency there under the Non-Habitual Resident (confusing name, I know) scheme. In Malta, the setup would usually consist of one or more trading companies, together with a holding company.

If you’re interested in exploring this setup further, do get in touch and I will connect you with my best consultants in Portugal and Malta.

Consultancy on Malta + Portugal setup

Setting Up a Company in Malta (5% Tax)

I’ve written a separate article about Malta’s 5% effective corporate tax rate, as well as an article about moving to Malta if you’re also exploring that option. Read those articles for the full details of how the tax system works in Malta.

If you’ve read a few articles on my site already, you probably know I don’t hold back on my opinions and try to speak the truth, even if it works against my own interests sometimes. Therefore, I feel that I should give you a heads-up about Malta, so that you don’t get any nasty surprises later on. For those of you who are planning to only set up corporate structures there, the following will not be a deal breaker, after all, you won’t actually be living there.

First of all, I’m skeptical about Malta and its general prospects for the future. That’s why I left the country many years ago.

Secondly, corruption and nepotism has reached new highs in recent years. Coupled with a general sense of greed and seeing that the money was flowing, the banks and financial companies got a bit lax, and were subsequently heavily chastised by the European Union, leading to Malta being grey listed. The result, as is usually the case, is that the innocent suffer along with, or more than, the criminals and shady people. So thanks to Moneyval and the grey list, opening a bank account in Malta, for example, is a tortuous, if not impossible task nowadays. Many companies have no option but to resort to using digital banks like Wise and Revolut for their banking.

The country’s main bank, BoV, has become notoriously inept at handling business, refusing transfers that involve crypto exchanges, and they’ve also lost their USD banking partner. Their USD partner nowadays is Western Union, which I guess says it all. Contacting them and having an informed conversation with one of their staff is an ordeal. They’re either suffering the effects of being understaffed or just plain incompetent.

This leads me to the crucial point you need to keep in mind when setting up in Malta: who you work with. Despite my negative view of Malta, it is still a very viable option for those who want to set up a tax-efficient structure, particularly involving Portugal.

So how can you manage it?

Given how difficult it has become for supposedly simple things like opening a bank account, and the frequent inspections being done by the MFSA, it’s essential that you work with someone with significant clout and whom you can trust 100%. Malta has always been a country where it’s who you are and who you know that counts above all. It’s a very small country where everyone knows each other. That’s why corruption and nepotism happen so easily in Malta.

So here’s what happened when Malta became popular for its tax benefits. Many one-man-band lawyers and accountants decided to forego the hard work of dealing with local companies and their issues, and instead focus on attracting foreign companies to Malta, offering boilerplate setups and fixed prices that made everything look super easy. Typically these people will offer the whole package, including virtual office, directors, secretary etc. for a one-time fee plus yearly maintenance costs. This model basically made them rich, and the game was successful for a while. Until it wasn’t.

Nowadays, more than ever, I would advise in favor of going with a long-established consultancy/accountancy/law firm that provides many services apart from incorporations. Make sure you have a reason for setting up in Malta, and are ready to employ some locals, possibly rent an office and find local directors that are separate from the firm that is setting up your company in Malta. Yes, it will cost more, and the costs might be more variable, but you will be much more protected.

Remember, these Maltese corporate setup firms have nothing to lose when they set up your company in Malta. But if/when the tax authorities of the place you live in decide to probe into your setup, they will very quickly identify whether the setup is a sham, because the characteristics are well-known to everyone in the financial industry. Then you’ll face the extra tax and fines due in your country of residency, or at the very minimum have to face the task of explaining why you set up such a structure.

Personal Residency in Portugal (0% Tax)

Portugal’s NHR scheme is very attractive. While in previous years it was most popular with retiree ex-pats, in recent years it is becoming more and more popular with a younger crowd. The holding of the Web Summit conference (the biggest tech conference in Europe) every year in Lisbon has helped young tech entrepreneurs discover the city and the country, and has served to attract some of these entrepreneurs to move to Portugal and benefit from the NHR scheme.

There are more than 20,000 people who are in the NHR program. You need to spend 183 days in Portugal or you should have the Portuguese address be your main address worldwide. This latter option is ideal for digital nomads who might not want to spend 183 days in Portugal. Proof of address can be a residency contract or ownership of property in Portugal.

Portuguese authorities have also confirmed that there are no taxes on long-term holdings of cryptocurrencies such as Bitcoin, which is excellent news for a lot of younger people who hold cryptos and might find themselves with a significantly higher net worth in the near future if they continue to rise in value.

Arriving and registering yourself in Portugal is very easy and can be done in a few days (the contrast with Spain is huge in this area) and you get NHR status for 10 years. You can also leave Portugal for a period and resume your NHR status when you come back, however, the period of 10 years does not get extended under any circumstance.

Since you have till March following the year that you become a resident to become an NHR, you cannot have one spouse be NHR and reserve another NHR for the other spouse in the future. It, therefore, makes sense for both to become NHRs right from the start.

Lisbon is the most popular area for new ex-pats as it is the place with the most activity and entrepreneurship (45% of Portugal’s GDP comes from there). However, Portugal is a relatively small country so you can also live in other cheaper areas without feeling totally isolated.

There are also no wealth taxes in Portugal apart from a similar tax on real estate assets of high value. Neither are there any forced declarations of foreign assets (like modelo 720 in Spain. You only need to inform Portugal about any bank accounts (and not their value) held abroad.

As with any other tax structure, the place of effective management of a company remains of utmost importance, so you cannot just place a company in a low-tax jurisdiction and move to Portugal to obtain tax-free dividends. There should be a strong reason for the company to be placed in that jurisdiction, so as to satisfy the place of management rules and economic substance.

To become an NHR, you will need a rental contract of 6 months or longer, or a property in Portugal in your name. You can move to Portugal at any point during the first part of the year, so as to satisfy the 183 days residency test that most countries use to determine fiscal residency.

Read my comprehensive guide about the NHR programme in Portugal for more information.

Negative Perceptions of Malta and Portugal

Big European countries are typically keen on throwing dirt on the smaller countries that are trying to compete with them via tax advantages. This leads to negative perceptions about countries like Malta, Portugal, Cyprus, Bulgaria etc. that you should be aware of.

Malta is frowned upon by certain people who think that it is some sort of blacklisted tax haven. However, this couldn’t be further from the truth.

Malta was and has consistently been transparent about its tax system: it is aimed at creating an attractive system that provides comparable benefits to domestic and foreign investors. In addition, the European Council has not brought any cases against Malta related to a violation of the “four freedoms” or the principle of non-discrimination. Malta has fully implemented and complied with all of the E.U.’s tax directives, which are unanimously approved by the Member States in E.C.O.F.I.N, and the Maltese tax system has not been found to infringe on the E.U.’s State Aid rules.

Globally, Malta has applied all O.E.C.D. initiatives to combat tax evasion, including the directives on mutual assistance between tax authorities, automatic exchanges of information, and the exchange of tax rulings and advance pricing arrangements in the field of transfer pricing.

Malta is also an early adopter of the Common Reporting Standards and Country-by-Country Reporting obligations. Under Phase II of the O.E.C.D.’s Peer Reviews, Malta has been classified as “largely compliant” in matters of transparency and exchange of tax information. The United Kingdom, Germany, the Netherlands, and Italy received comparable clarification. In June 2016, together with other Member States in E.C.O.F.I.N., Malta approved the Anti-Tax Avoidance Directive (“A.T.A.D.”). Throughout its presidency of the European Commission, all Member States gave approval for the A.T.A.D. 2 in February 2017.

You can listen to a discussion about Malta’s tax advantages between me and CPA Chris Grech on the Mastermind.fm podcast.

Portugal has also been attacked and blamed for unfair competition with Nordic countries, since under the NHR retirees who moved to Portugal paid way less tax than they would in their home country. Portugal has, since 2021, appeased these concerns by introducing a minimal level of taxation for retiree expats in the NHR scheme who receive their pension from abroad. This does not affect the NHR scheme for entrepreneurs with the setup I mentioned in this article.

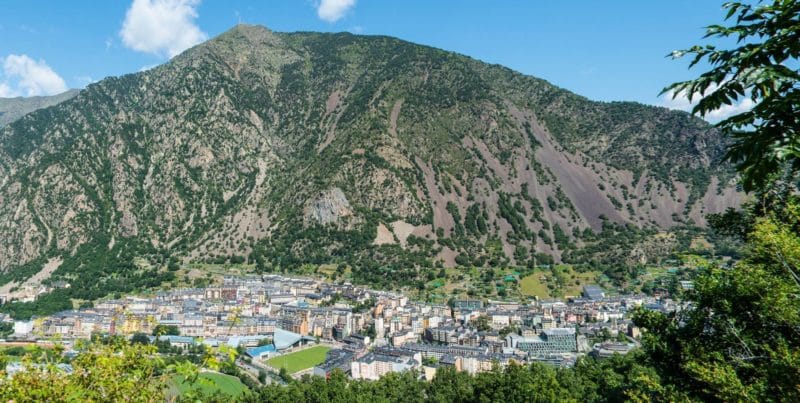

Alternative 1 – Residing in and running a company from Andorra

If you like mountains and a quiet life with a high standard of living, Andorra might be a good option for you.

Andorra is an attractive proposition for many individuals who have high incomes and are seeking a more tax-friendly jurisdiction to reside in.

The new Andorran tax framework has been approved by the OECD and triggers the development of the tax conventions, the first of which have been established with France, Luxembourg and Spain.

Companies in Andorra pay a nominal rate of 10% on corporate revenues. As for individuals, they pay a 10% rate. There is an exemption on the first €3.000 of savings income. There is no wealth tax, inheritance tax, donation tax or property tax.

The strategy of accumulating non-distributed profit in an Andorran company owned by nonresident shareholders is very usual in order to avoid individual taxation in the countries where the shareholders have their tax residency.

The second step to make is some years later, when the shareholders can become Andorran tax residents for one year and perceive the accumulated dividends with a total tax exemption. This is because there is a total exemption for dividends delivered by an Andorran entity to a resident shareholder.

If they decide to re-enter their origin countries as tax residents, they can repatriate their capital without any taxation, due to the fact that the obtained revenue was once subject (but exempt) to the Andorran Personal Income Tax during the distribution year.

A similar strategy can be employed whereby the company owner lives anywhere he wants and withdraws money from his company based in a low-tax jurisdiction, but he would only withdraw enough money to sustain himself year by year. The accumulation of profits is allowed to happen in the holding company. When he needs a big lump sum of cash to make a big purchase, he would move to Portugal for one year, where he would withdraw the cash from the company as a dividend, and pay zero tax. The next year he would be free to move back to his previous country or any other country without any questions and be able to repatriate the money to that country.

With that aside out of the way, let’s continue talking about Andorra. If you don’t want to actually move there and spend most of your time in this tiny state, you can become a non-lucrative resident. This is the more common way of having residency in Andorra, as it gives you most of the important benefits without requiring you to live there. It does come with a few requirements though, and you have to have some decent savings to be able to achieve this type of residency. Here are the requirements:

- Deposit at the INAF (Andorran National Finance Institute) worth 50.000€, recoverable and non-remunerated; Deposit at the INAF worth 10.000€ for each dependent;

Availability of enough resources for the titleholder and dependents’ sustenance in Andorra;

Purchasing or renting a dwelling in Andorra; - Medical, disability and old-age insurance with coverage across Andorra (underage and people over 65 years- old only need medical insurance);

- Minimum of 90 days’ residence per year;

- 400.000€-worth Investment on Andorran assets

Andorra is, therefore, a good option for those with a high net worth. You will find many cyclists, for example, who take up residence in Andorra.

For company owners, I think residing in Portugal is the best right now, although it does require you to actually live there. If you’re more into traveling and being a digital nomad, then Andorran residency is actually better since it only requires you to be physically present in Andorra for three months a year.

I’ve visited Andorra several times and it’s indeed a beautiful place to live in, with the main disadvantages being the colder weather and relative isolation, with the nearest airports in France and Spain being a good drive of around two hours away.

Alternative 2 – Opening a Company in Estonia

Estonia doesn’t tax companies when they make profits but taxes them instead when they distribute dividends. This encourages companies to re-invest in themselves. You definitely shouldn’t confuse that with 0% corporate tax though. Estonia wants you to grow so you can (happily) pay even more taxes in future.

Many people confuse Estonia’s laws and think that there is no corporate income tax, but that’s not exactly correct, as the 0% tax rate applies only on retained and reinvested profits.

This means that Estonian resident companies and the permanent establishments of foreign entities (including branches) are subject to 0% income tax in respect to all reinvested and retained profits and a 20% income tax only in respect to all distributed profits (both actual and deemed).

Distributed profits include:

- corporate profits distributed in the tax period

- gifts, donations and representation expenses

- expenses and payments not related to business

- transfer of the assets of the permanent establishment to its head office or to other companies

Its tax system is fully OECD-compliant and it boasts an extensive tax treaty network while also exchanging tax-related information with more than one hundred jurisdictions in the world on the basis of the relevant OECD convention, which also means such information exchange is also available to those with whom it has no valid tax treaty.

Estonia still collects a sufficient amount of corporate income tax from its tax on distribution of 20% on sporadic or 14% on regularly distributed profits (7% withholding tax adds to the latter if distributed to natural persons).

I’ve written more about my thoughts on Estonia in my guide about whether freelancers should open up a company in Estonia. In that article, I talk about some of my concerns with this setup, but it remains one of the most popular tax optimisation strategies in Europe, especially for small companies, digital nomads and regular freelancers.

Xolo is a company that I would recommend if you want to get set up easily in Estonia. They handle everything for you with regard to company formation and ongoing administrative processes.

Estonian business setup with Xolo

Alternative 3 – Residing in Cyprus + Company in Malta

Cyprus is very attractive to entrepreneurs via the non-dom scheme. The Cyprus Non-Domiciled Tax Status provides a number of tax advantages, mainly the exemption from capital gain tax on income from dividends and interest.

The minimum stay is 60 days.

An individual enjoys the Cyprus Non-Domiciled Status if he/she is tax resident of Cyprus and has not been a tax resident of Cyprus as per the Income Tax Law for a period of 20 consecutive years prior to the introduction of the law (i.e. prior to 16 July 2015).

The tax payable by a Cyprus resident non-dom on dividend income will be zero.

Cyprus is a nice place to live a relaxed life surrounded by nature and nice beaches, but it’s obviously not an international business hub and it’s farther from central Europe than Malta. Also, if you’re looking for active city life, then I would say Portugal would be a better choice under the NHR scheme.

English is not as widely spoken in Cyprus when compared to Malta, and Cypriot banks have a far worse track record than the Maltese ones. However, these two facts are less of a problem if you opt for only residing in Cyprus, while basing your company elsewhere, for example Malta.

Setting up a company in Malta while taking up residence in Cyprus as a non-dom can offer a combination of tax benefits, provided that the structure is set up correctly and complies with all relevant tax laws and regulations.

Here are some potential advantages of this setup:

- Malta’s attractive tax regime for companies: Malta operates a full imputation system and offers a tax refund mechanism, which can significantly reduce the effective corporate tax rate. When a Maltese company distributes dividends to its shareholders, the shareholders can claim a refund of the Malta tax paid at the corporate level (typically 6/7ths of the tax paid). This can result in an effective corporate tax rate as low as 5%.

- Trading activities in Malta: A Maltese trading company can conduct international trading activities, benefiting from the low effective corporate tax rate, an extensive network of double taxation treaties, and EU membership.

- Holding activities in Malta: Malta’s participation exemption regime allows a Maltese holding company to receive dividends from qualifying foreign subsidiaries and realize capital gains from the disposal of shares in such subsidiaries without being subject to tax in Malta, provided certain conditions are met.

- Cyprus Non-Dom tax benefits: As a Cyprus tax resident with non-domiciled status, you can benefit from the tax exemptions on dividend and interest income received from both local and foreign sources. This can be advantageous if you own shares in the Maltese company and receive dividends from it.

- Cyprus’s favorable personal income tax rates: Cyprus offers competitive personal income tax rates, with progressive rates ranging from 0% to 35%. As a tax resident in Cyprus, you can benefit from these rates while enjoying the non-dom tax exemptions.

- No capital gains tax on the sale of securities in Cyprus: Cyprus does not impose capital gains tax on the sale of securities, such as shares in the Maltese company. This can be advantageous when you decide to sell your shares in the future.

- Double taxation treaty between Cyprus and Malta: Both countries have a double taxation treaty in place, which can help prevent double taxation of income and reduce withholding tax rates on dividends, interest, and royalties.

Get tax advice on Cyprus setup

Alternative 4 – Italy

Italy has a favorable tax regime for High Net Worth Individuals (HNWIs) who choose to become residents in Italy. The regime is commonly known as the “Non-Dom” regime.

Under this regime, HNWIs can become tax residents of Italy while being exempt from taxation on foreign-sourced income (even if remitted to Italy) and assets, provided they meet certain requirements. These include:

- Being a non-Italian tax resident for at least nine of the ten years preceding the date of their first Italian tax return

- Being resident in Italy for at least 183 days per year

- Paying a fixed annual fee of €100,000 for the first 5 years and €25,000 for each additional year

The Non-Dom regime applies to foreign-sourced income and assets, meaning that income and assets sourced in Italy are subject to Italian taxation. The regime also offers other benefits, such as:

- No inheritance tax on assets located outside of Italy

- A fast-track visa process for non-EU citizens

- A streamlined procedure for obtaining a residence permit

- No wealth tax on foreign assets

To qualify for the Italian HNWI scheme, individuals must make an investment of at least €2 million in Italian government bonds or €1 million in an Italian company. Alternatively, they can donate at least €1 million to an Italian charity or cultural project or invest €500,000 in an Italian innovative start-up. It’s important to note that these investments are required for the initial application and to maintain the HNWI status.

After this period, individuals are subject to Italian taxation on their worldwide income and assets.

There are some antiavoidance measures in place, so you’d need to look into those and see if they affect your situations. For example, if you sell a significant holding in a foreign company within the first five years of your residency, any resulting capital gains will be subject to Italian taxation at ordinary rates, rather than being exempt from tax as foreign-source income.

HNWIs that keep foreign entrepreneurial activities (e.g. through holdings) are not subject to CFC (look-through) and place of management rules.

Under the Italian HNWI scheme, individuals can also elect to exclude from the flat tax regime income sourced from selected countries. This is commonly known as “cherry picking.” By doing so, the excluded income becomes fully taxable in Italy, and the individual can benefit from foreign tax credit rules.

Foreign tax credit rules allow taxpayers to claim a credit for foreign income taxes paid on income that is also subject to taxation in their home country. This means that if an Italian HNWI elects to exclude income sourced from a particular country, they can claim a credit for any foreign income taxes paid on that income against their Italian tax liability. This can help to reduce the overall tax burden for the individual.

It’s worth noting that the exclusion of income from the flat tax regime is subject to anti-avoidance rules. This means that the Italian tax authorities will closely scrutinize any attempts to artificially shift income to excluded countries in order to avoid taxation in Italy. The rules are designed to ensure that the HNWI scheme is not used as a tool for aggressive tax planning or tax avoidance.

The HNWI tax regime in Italy is also available to Italian nationals, provided they meet the residency requirements. Individuals must have been resident out of Italy for tax purposes for 9 out of 10 of the previous calendar years to be eligible for the scheme. This means that Italian nationals who have been living abroad for a significant period of time may also be able to benefit from the scheme.

Additionally, the HNWI tax regime in Italy allows for additional family members to be included in the scheme by paying an extra €25,000 in yearly tax for each member. This means that families of Italian nationals who meet the residency requirements may also be able to benefit from the scheme, provided they are willing to pay the additional tax.

Living in Italy is not a bad idea at all, so this is a pretty good option if you are willing to embrace the Italian lifestyle and the conditions of the HNWI scheme are compatible with your needs.

Alternative 5 – Greece

Greece has a similar program to Italy, whereby under their non-dom program for HNWI you would pay annual global taxes of €100,000. There are no inheritance or gift taxes on foreign assets. The program can be used for 15 years, and additional family members can be introduced to this scheme for €20,000 each. In order to qualify for the Greek Non-Dom program, applicants are required to make an investment in Greece. The minimum investment amount varies depending on the year and the specific requirements of the program, but it generally ranges from 500,000 euros to 1 million euros. The investment can take various forms, such as real estate, corporate shares, or government bonds. The investment must be maintained for the duration of the non-dom status, which is 15 years. After that period, the applicant may choose to renew their non-dom status or to apply for Greek citizenship.

For retirees, Greece has a 7% tax on foreign pension income earned by non-domiciled individuals who become Greek tax residents. This is a significant benefit for HNWIs who have retired and are receiving foreign pension income.

Greece’s Golden Visa program allows HNWIs to obtain a residence permit in Greece by investing in Greek real estate. This program is aimed at attracting foreign investment into the country and has been particularly popular with HNWIs from China, Russia, and Turkey.

Greece is a nice place to live but there are still serious problems with the country’s financial infrastructure, so it wouldn’t be anywhere near my top choices.

Alternative 6 – Residing in Gibraltar

The tax system in Gibraltar is based on a territorial basis, which means that only income and profits earned in Gibraltar are subject to taxation. There are no wealth, inheritance, or capital gains taxes in Gibraltar.

Gibraltar does not impose any tax on dividends, so you can receive your dividends from your company located elsewhere tax-free.

Individuals who are resident in Gibraltar are taxed on their worldwide income, whereas non-residents are only taxed on income arising from Gibraltar. The current personal income tax rate in Gibraltar is a flat rate of 10%, and there is no VAT or sales tax.

Companies registered in Gibraltar are subject to a corporate tax rate of 10% on their profits, although there are certain exemptions and deductions available. There is also a payroll tax of 20% for employers, which is calculated on the gross salaries and wages paid to employees.

Overall, the tax system in Gibraltar is considered to be favorable for businesses and individuals, which has contributed to the territory’s popularity as a financial center.

Note that Gibraltar’s relationship with Spain is a bit tricky so it’s best not to mix the two.

Brexit has also brought some changes to Gibraltar’s tax system. As a result of Brexit, Gibraltar is no longer part of the EU VAT area, and now has its own VAT regime. This means that businesses operating in Gibraltar are now subject to Gibraltar VAT rules instead of EU VAT rules.

Additionally, as part of the Brexit deal, Spain and the UK reached an agreement on the tax treatment of Gibraltar. This agreement is known as the Tax Treaty, and it sets out the tax rules that will apply to Gibraltar going forward. The Tax Treaty came into effect on January 1, 2021.

Under the Tax Treaty, Gibraltar remains a low-tax jurisdiction with a corporate tax rate of 10%. However, there are some changes to the way that taxes are applied to certain types of income. For example, the Tax Treaty includes provisions to prevent double taxation of dividends and interest income. Additionally, the Tax Treaty includes provisions for the exchange of information between the UK, Gibraltar, and Spain to prevent tax evasion and ensure compliance with tax laws.

Overall, while Brexit has brought some changes to Gibraltar’s tax system, it remains a low-tax jurisdiction with a stable and predictable tax regime. The main downsides are the fact that it’s not the most exciting place to live, and that it is now outside the EU zone.

Alternative 7 – Residing in Sark

Sark is a small island in the English Channel, located just off the coast of Normandy, France. It is known for its idyllic scenery and old-world charm, making it a popular destination for tourists and expats alike. However, what many people don’t realize is that Sark also offers significant tax benefits for those who choose to make it their home.

One of the most notable tax benefits of living in Sark is that the island has no direct taxation. This means that residents do not have to pay income tax, capital gains tax, inheritance tax, or value-added tax (VAT). This makes Sark a popular destination for retirees, entrepreneurs, and investors who are looking for a tax-efficient place to live.

In addition to the absence of direct taxation, Sark also has a low cost of living compared to many other European countries. This means that residents can enjoy a high standard of living without having to spend a fortune. There are also a variety of property options available on the island, ranging from small apartments to large family homes. Another unique aspect of the tax system in Sark is that there are no local property taxes or council taxes. Instead, landowners pay an annual “chief rent” to the landowner of the island, the Seigneur. The chief rent is a nominal fee and is based on the size and location of the land.

Another advantage of living in Sark is that it has a stable and secure financial system. The island is not part of the European Union or the United Kingdom, but it is a British Crown Dependency. This means that it operates under its own system of government and has a separate legal system from the UK. The island also has its own currency, the Sark pound, which is pegged to the British pound.

Sark also offers a high degree of privacy and confidentiality. The island’s strict privacy laws ensure that residents’ financial affairs remain confidential, making it an attractive destination for those who value their privacy. This is particularly important for entrepreneurs and investors who may not want their business dealings to be public knowledge.

However, living in Sark isn’t for everyone. The island is remote, and there are limited opportunities for employment. Those who choose to live on Sark often have to work remotely or run their own businesses. Additionally, the island has a small population and limited infrastructure, so it may not be the best choice for those who are used to the conveniences of larger cities.

In order to become a resident of Sark, you must purchase or rent property on the island and meet certain residency requirements. These requirements vary depending on whether you are an EU citizen or a non-EU citizen. It’s important to seek professional advice from a lawyer or tax advisor before making the move to Sark, as the residency and tax requirements can be complex.

Living in Sark offers a unique combination of tax benefits, privacy, and a high standard of living.

Most people I hear of who have moved to Sark tend not to stay there beyond 2-3 years, mostly due to it being remote and a big change from life in big countries and cities. For most people, the slower pace of life on Sark is a welcome change from the hustle and bustle of city living, and if you’re in need of a reset, it’s a great place to unwind and disconnect from the stresses of modern life.

Here are some of the pros of moving to Sark:

- Living on an island like Sark means that you become part of a tight-knit community. It’s a place where everyone knows everyone, and there’s a real sense of camaraderie and support among the residents.

- The natural beauty of Sark is simply breathtaking. From the rugged coastline to the verdant countryside, there’s no shortage of stunning scenery to explore and enjoy.

- One of the most appealing things about Sark is its unique way of life. With no cars allowed on the island, transportation is done by bicycle or horse-drawn carriage, which adds to the charm and character of the place.

- Although living on Sark can sometimes feel isolated, it’s also incredibly liberating. You’re free from the distractions and noise of modern society, and you can focus on the things that really matter in life – family, friends, and personal fulfillment.

In my view, the main downside is that you’d basically be living in exile in exchange for being free from taxation. I wouldn’t personally love that, but some might want to try that adventure for a few years.

Other Alternatives

If you do some reading, you will undoubtedly come across even more alternatives. I’ve researched a lot of them and even visited the places, and for some reason or another, I don’t consider them a good idea.

Here are some of them:

- Monaco – This article sums up my feelings about the place quite nicely.

- Bulgaria – Too much of an emerging country feel for my tastes, although I know people have successfully set up there with the right experts guiding them.

- Georgia – Same as Bulgaria.

- Dubai – One of the most popular solutions among Europeans looking for tax respite outside Europe. Contact me if you’re interested in this option. Only downside is I wouldn’t live in Dubai.

- Ireland – Good corporate tax rates, but a better deal can be had in Malta or Cyprus, even due to professional fees being much higher in Ireland than in competing jurisdictions.

- Spain – Many expats use the “Beckham law” which lets them pay 24% tax on their income for a period of 6 years, plus no obligation to pay wealth tax nor fill in the modelo 720. For everyone else, Spain is not a good place due to the many forms of taxation it levies. On the other hand, it is a candidate for the best quality of life in Europe, so you should also keep that in mind. Contact me if you need tax advice in Spain, I know some good tax lawyers there.

The Non-Optimized Alternative

In this article, I have focused on optimization from a tax perspective, but we might also talk about optimizing for other factors, such as overall quality of life, or kids’ education, just to mention two other examples.

I do not recommend focusing only on tax when optimising your life and choosing your flags. Of special emphasis is the place of residence – you want to make sure that it’s a place you love. In my case, I want to live in my favorite city/country on earth irrespective of the tax conditions, and then optimize given that constraint.

Even though some countries might have very inefficient and outright oppressive tax laws, you can still go far with optimization. For example, if you decide to live in a country that imposes high taxes on income, you can give yourself a relatively small salary or amount of dividends, while keeping most of your company’s profits in a tax-efficient country where you would in turn base your company.

The only major problem with this setup is when you need to make big purchases.

Let’s say you want to buy a house to live in with your family. There are two options – you can either buy it in cash or get a loan.

If you want to buy it in cash but don’t have enough savings in your personal bank account, you are going to have to make a potentially big withdrawal from your company via salary or dividends, which means you’re also going to have to pay a good chunk of tax.

The main solution to this problem is to move abroad for a year or two to a country like Cyprus or Portugal, which don’t tax foreign dividends. You would then make the big withdrawals and then go back to your previous country with money in your personal bank account, being free to make the purchase without any tax consequences. It is important to talk to a good tax lawyer if you opt for this option, to make sure that there are clear cut off points in your residency and that no suspicions are raised. However, it is a totally legal option that many people use every year.

I’ve also seen people who are bound to make a big inheritance use this strategy to avoid paying a substantial amount of inheritance tax. Malta, for example, does not levy inheritance tax, but Spain does, so it would make sense for someone to move to Malta for a couple of years if it wouldn’t really disrupt their lifestyles and would result in massive savings on an inheritance.

On the other hand, if you decide that it would be more beneficial to obtain a loan and use your company’s cash reserves for investment purposes, you will encounter another problem. Most if not all banks will not grant you a loan if you are not registered as self-employed or own a company in the same country where you’re living and buying the property. Unless you can show monthly payslips it will be hard to obtain any financing, even though you are the owner of a company in another jurisdiction that has plenty of cash reserves.

Here your options depend on your banking relationships. It might be possible to get a loan anyway, or maybe get a loan from your home country where you have long years of banking relationships. Another option is to buy the property from the company’s side as an investment, in which case you would be able to obtain a loan from a bank to the company. You would then need to rent the house to yourself paying the market rate in rent. You would then pay tax at the company level on that rental income, so it’s not the most elegant solution either. In some countries, there are also disadvantages of buying property via a foreign company setup.

Another possible option would be to obtain a loan by putting up some other type of collateral, for example stocks or even crypto. For big holders of cryptocurrencies, this has become a very attractive option, although crypto borrowing and lending platforms are available to everyone.

Tax planning VS Tax Evasion

If you’re thinking of a move to another country, one of the important things to consider is how your disposable income will be affected. Of course, much of this boils down to taxes.

Tax planning is a lawful process where the individual or company searches for the optimal reduction to the tax burden permitted within the options available in the legal system.

See also: Is it possible for digital nomads to pay no tax?

Consequently, tax planning seeks to prevent, avoid or postpone the taxable event, aiming to reduce or defer the taxpayer’s tax burden as much as possible within the law.

Tax planning is a lawful action by the taxpayer since it exercises the principle of the autonomy of the will established in common legislation and is in accordance with the options that the legal system itself establishes. While some people think that tax planning is for the billionaires, corrupt politicians, and dodgy types, this can’t be further from the truth. Anyone can and should practice tax planning because there is no reason to pay more than you should in taxes.

You should not, however, confuse tax planning with tax evasion, which is a completely different thing, and something neither I nor any serious tax lawyer or accountant would advise.

Place of Effective Management

Opening a company abroad has certain caveats. One important concept is the “place of effective management”. You can’t just open a company wherever tax is lowest and operate from there while living in another country. Your company in a foreign jurisdiction needs to have substance since many countries operate under CFC rules (controlled foreign corporation). I wrote about this topic in my article about digital nomad taxation, as this is the biggest concern for digital nomads or expats when opening companies abroad.

The country where you reside may attempt to tax the profits of an overseas company if such company is deemed to be a resident in its territory because its effective management or/and control is exercised therein.

How do you add substance?

The criteria of “place of effective management” is widely used under many OECD based double tax treaties. The place of effective management is usually considered to be the place where key management and commercial decisions are in substance made. An entity may have more than one place of management but it may only have one place of effective management at any one time. In determining the place of effective management all relevant facts should be considered. These include:

- Where board meetings of directors are held. The frequency of meetings, and whether they actually exercise control over the company are also relevant factors;

- Where senior day-to-day management is carried out;

- Where the company’s headquarters are located;

- Where the company’s accounting records are kept.

Furthermore, you can add more substance to your company’s presence in that country using the following strategies:

- The company’s income & expenditure passes through a bank account in that country;

- The company may possibly employ one or more individuals, possibly a local resident director. According to EU law, social security contributions are normally paid in the place where the worker works: therefore paying social security contributions in that country may possibly help to prove that the particular individual employed by the company (who may be the director) actually works in the chosen country.

- The company rents premises and has other expenditure (e.g. telephone bills, internet connection costs, accountancy costs, etc).

It is very important to consider the effect of any double taxation treaty existing between the chosen country for your company and your country of residency. A double tax treaty is essentially an agreement between two countries that determines which country has the right to tax a person or company in specified situations. Therefore, the main aim of double tax treaties is to ensure that the same income is not taxed twice.

A few more thoughts on this topic

Ultimately, from my experience, the vast majority of companies opening up in tax-friendly jurisdictions have little reason to be doing so besides the tax advantages. There are exceptions of course, and sometimes the tax advantages are the initial hook only. Sometimes it’s about the tax advantages plus the legislation (for example the online casino and gambling companies operating in Malta). Keep in mind that most people have almost zero knowledge about countries like Malta, Liechtenstein, Cyprus, Luxembourg etc. Throughout the process of research and after getting enticed by the tax law in any of these small or emerging countries (Bulgaria as another example), they might realise that, for example, the quality and cost of labor in such country is really good, and it would make sense for them to relocate part of their operations even if there weren’t any tax advantages in play. This ultimately makes it a big win for medium to big companies as they end up lowering their tax bill as well as also lowering their salary expenditure or improving their operations by such a move.

For smaller players, this rarely is the case, especially for solopreneurs who have no need or intention to hire people in the country where they intend to incorporate. This is what John, like many other freelancers and solopreneurs, had in mind. For such cases, ultimately it’s a question of risk tolerance. The theory says that such a setup would not work as the company is actually managed and operated from another country. However, in order to counteract such an eventual argument, the solution is to appoint local directors, rent offices, have the AGM in that country, and a host of other steps one can take to improve the looks of the setup. This is an open secret, and many companies in Malta, Cyprus, etc. actually offer such services (directorships, office space rental, mail management and forwarding, etc). The tax authorities in most countries have a limited budget and the chances of them going after such setups are quite low, in my opinion. They would have to dedicate resources to investigate the resident’s affairs plus his company ownerships in other countries, which is not a very straightforward task. They will be looking at how likely it will be that they will win the fight to relocate the company’s taxation, as well as the potential revenue in terms of extra taxation that their employer (the tax authority) will gain. It doesn’t make sense to go to any trouble for small amounts.

In practice, if you look at real cases, they’re either involving big companies when the “lost” tax revenue runs into the millions, or it’s quite an obvious case. What would be an obvious case? Well, imagine you’re a rich and famous personality and paparazzi are following you around on a daily basis, hence it is easy to understand where you’re really living and operating from. Let’s say that you now decide to open a company in a low-tax jurisdiction to channel some of your revenue from there. If this comes to light, it is likely that the general population will be angered by the move and it becomes a tabloid soap opera, whereby the tax authorities have all the incentives to enter the fray and not only recoup the lost tax but also send the message to the general public that they are doing a great job at curbing tax evasion. There are a number of famous cases of this sort involving the world’s richest and most famous football players, including Ronaldo and Messi. Even then, where one would think the outcome should be obvious, we see tough and protracted cases where the outcome is uncertain. In such cases, the tax authorities have an ace up their sleeve, in the fact that they know that any court appearance (even if the case is unjust) will damage the personality’s reputation, hence they are likely to use that to their advantage to ultimately cut a deal with the accused person, even if they know the chances of them winning the case in court are slim. I’ve seen a particular case of this type, whereby a TV personality was basically bullied into an out-of-court settlement in order to avoid being dragged to court and thus have his TV career cut short.

To recap, we live in a world where very few things are black or white, it’s all about shades of grey and you need to do a lot of independent thinking in order to arrive at the best solution.

Extra tip: Opening a company in the United States

For some businesses, opening a company in the United States can have important advantages. People I know have used Firstbase to get set up in the US (LLC and SCorp, Delaware and Wyoming for 399$ with Mercury.co account).

One big advantage is the ability to use Stripe for payments, if your country does is not yet in Stripe’s list of supported countries. This was the case for companies based in Malta until Stripe finally opened its doors to them in 2021.

You can get a 5% discount on Firstbase services by using the code GALEA5 at the checkout stage.

Set up a US company with Firstbase (code: GALEA5)

There are many other advantages of having a US company, including tax benefits, an easier way to make investments in the stock market, crypto etc, as well as making better use of the tons of online e-commerce stores and services that only serve US-based customers.

Apart from Firstbase, you can also take a look at Stripe Atlas, which was a service that was set up by Stripe to help foreign companies incorporate in the United States. The benefit for Stripe is that they get access to more companies without needing to go through the regulatory process to register in the countries where those foreign companies are established. It’s a very nice hack by Stripe in order to expand globally in a rapid manner. It will become less important for them as they eventually do go through the regulatory hoops of each individual country where they want to operate. Over the past two years, they have in fact greatly expanded their operations globally.

While these made-for-you services are a nice first step for small businesses or individual entrepreneurs who want to learn more about forming a company in the United States, I would always advise that you consult with a US-based international tax consultant before you implement any such structure. There may be hidden costs or downsides that you need to be aware of, and such an expert will be able to immediately tell you whether your plan is feasible or not, and also help you set things up correctly and manage the yearly filings.

If you want me to connect you to my trusted international tax consultant who specializes in U.S. company formation, just get in touch and I’ll be glad to make introductions.

Get help with U.S. company formation

Flag Theory

If you’re interested in tax optimization and personal freedom and sovereignty, I would highly suggest you read about flag theory.

Flag Theory is all about diversifying your life and staying protected. The Five Flags deal with residency, citizenship, banking, assets, and business. It’s a strategic internationalization process designed to increase your freedom, protect your privacy and grow your wealth in leading jurisdictions.

I learned about flag theory many years ago in my days as a digital nomad, and it has influenced my choices ever since. As I mentioned in my thoughts about nationality, I think we are moving towards a future where people actively choose where they want to live and do business.

This is totally contrary to the traditional view that you are born in a country and being patriotic to that country (even to the point of dying for your country!) forever. I think that many countries are not run efficiently and put an ever-increasing burden on their citizens due to their politicians’ ineptitude and abuses, and that is not acceptable.

The modern workforce is becoming increasingly mobile, and if you’re an entrepreneur especially, you have a lot of freedom that you might not have considered before.

If you want to learn more about flag theory I suggest you open these blogs and just read as many of their blog posts as possible. I bet they will change the way you think about things in a significant way.

- Flag Theory

- Nomad Capitalist

- Tax Free Today

- Freedom Surfer

- Offshore Living Letter

- Escape Artist

- No More Tax

- Offshore Citizen

A good forum worth visiting on the topic is Offshorecorptalk.com.

A word of warning, though. Keep in mind that all these websites are promoting flag theory. It’s an important concept to think about, but you don’t need to go overboard.

Here’s what I think are some of the biggest wins you can get by implementing flag theory and sovereign individual principles:

- separate your business from yourself i.e. create a company

- create the company in a tax-friendly jurisdiction that’s different from where you live

- live in a great country with good weather, culture and economic freedom, low taxation, good air connections, in a convenient timezone

- have bank accounts outside your country of residency

- opt out of fiat money, hold a decent amount of bitcoin and multiple fiat currencies at the minimum

- invest outside your country of residence, in developed economies, keeping an eye on the developing ones too

On Opening Bank Accounts

Bank accounts have become very hard to open and maintain all around the world over the past few years. Be prepared to explain all big incoming and outgoing transfers and have documentation on hand.

You should also know the difference between the so-called “digital banks” and real banking institutions.

For example, two popular app-based digital banks are:

While I’ve used both and they are excellent for what they’re meant to be used for, they should not be mistaken as an equivalent to a bank account.

In fact here is what Revolut itself says about their accounts.

…when we hold Electronic Money for you, us holding the funds corresponding to the Electronic Money is not the same as a Bank holding money for you in that: (a) we cannot and will not use the funds to invest or lend to other persons or entities; (b) your Electronic Money will not accrue interest, and (c) your Electronic Money is not covered by the Financial Services Compensation Scheme.

As an FCA authorised institution, your funds are safeguarded as per FCA requirements, the Electronic Money Regulations 2011 and the Payment Services Regulations 2017.

In the event of an insolvency, you will be able to claim your funds from this segregated account and your claim will be paid above all other creditors. We’re not a deposit taking institution, we’re an E-Money Institution and clients funds are safeguarded pursuant to safeguarding provisions of the Payment Services Regulations (regulation 19 of the PSRs).

More or less the same thing is said by TransferWise:

Your TransferWise multi-currency account is an electronic money account. It’s different from a bank account because:

you won’t be able to get an overdraft or loan

you won’t earn interest on your account

although your bank details are unique, they don’t represent real bank accounts, but simply “addresses” for your electronic money account. You can still use them to receive payments though, like a real bank account

your money is protected and safeguarded, but not guaranteed by the Financial Services Compensation Scheme (FSCS) that you may get with a bank account

The main benefit of using your TransferWise account over traditional accounts is that you won’t be charged international transaction fees or outrageous exchange rates.

You can send, receive and convert currencies all in one account. You’ll always get the real exchange rate and the lowest possible fees.

So while I love and use both of these services, they are not a substitute for a real bank account. If, say you want to open a company in Malta, you will want to open a bank account at one of the few local banks there, and it won’t be easy to open and maintain the account unless your accounts are squeaky clean and everything you do is well-documented.

Conclusions

There are many possible setups for optimizing your tax situation both on a personal and a corporate level. Not discussed in the post above are places like Dubai (zero corporate and personal tax), the Baltics (generally low taxation) and Eastern Europe in general (10-20%). There are many considerations in structuring things and you need to see what’s best for you and your family not only from the taxation aspect but also from other aspects.

In general, I think it is a good idea to separate things as much as possible and have backup plans, and these are part of the flag theory idea. For example, Spain is a horrible place to be if you want to invest outside of Spain, so it might make a lot of sense to conduct your investments through a company in another country while keeping your personal situation plain and simple in Spain. That will reduce your accounting fees and also many headaches.

Further reading

Here are two excellent guides about Portugal’s NHR:

Here’s a forum discussion about the NHR and how it applies to freelancers.

Note that this is just a summary of my research on the topic and my discussions with various tax consultants. It should not be taken as tax advice.

If you would like to set up an appointment with a professional to discuss how you can set yourself up using the strategies above, please contact me.

Hey, I wrote my comment earlier, but it seems not published because of a link inside of it, I write it again now without link:

Hey Jean, thanks a lot for your articles, I’m following your blog for a while and it’s really useful. I have a question from you and like to know your input. My accountant in Italy hold a webinar with this title: Pay 0% tax legally for 100% Digital Shops.

So, he introduced a way that is possible Italian (not sure about others), pay 0% tax. But those freelancers who work 100% online and digitally. It was a 250 slide pages presentation.

In summary, he didn’t mention any particular countries (of course needs to pay him to tell us) but his way was this:

1- Completely become separate from Italian tax system by going outside of Italy for more than half of the year, I assume this is because to not be a tax resident of Italy anymore

And signup in this site as you are an Italian that lives abroad:

Anagrafe Italiani residenti all’estero (A.I.R.E.)

2- Get new residency in country X

3- Register company in country Y

He said X and Y could be same or different, based on your situation. And he excluded the blacklist countries. But he said characteristics of these countries. I translated these from Italian so maybe some don’t make sense but here you are:

Here are the 5 characteristics the perfect jurisdiction for the offshore company should have:

1- no corporate income tax

2- no value added tax

3- streamlined and secure bureaucratic system

4- privacy and protection of the confidentiality of the director and shareholders

5- unlimited sharing of profits

Here are the 5 characteristics the perfect jurisdiction for your residence should have:

1- no obligation to stay (so you can choose where to stay freely)

2- no personal tax

3- fast system to obtain residency

4- state modern and efficient and well connected with the rest of the world

5- transparent process with no hidden fees or traps

So, what do you think about this?

Thanks a lot for your time : )

Thank Jean – great article. I’ve moved to Malta and am looking to setup a 2-tier structure, with an overseas holding. There seems some risk around having a UK holding in terms of whether incoming dividends are taxed- the detailed HMRC rules say if dividends are a tax deductible expense at the Malta subsidiary, they will be taxed in the UK. The Malta tax rebate (6/7th is rebated) looks and smells like a tax deduction even though its “technically” a rebate so I feel there is a bit of risk here.

Do you have any thoughts on a Delaware LLC as the holding entity. As I understand it this is cheap to set up and operate and has no tax on incoming dividends, no tax on profits if its not operating in Delware and no tax on distributions. Seems like the perfect “offshore holding” location- but without the stigma of the BVI of caymans. Thoughts appreciated.

Hi Jean,

This post is BY FAR the best resource available on the internet, to be introduced to an effective tax strategy, while simultaneously providing the on ground realities (which is missing from everyone who is trying to sell you a service, so about 99.99% of articles out there 🙂 ) For this, I want to thank you deeply – a truly commendable effort.

We have recently immigrated to Portugal a few months back, with a clear view to set up the exact Live-In-Portugal-Tax-In-Malta setup that you have described. I have a very small online business, and I am looking for someone genuine to help us with incorporation and other services for Malta. Is there someone you can recommend? I intend to also fly to Malta in 2 weeks, to meet with some service providers and start the incorporation process.

I am also looking for a solid, cost effective consultant for personal taxation and NHR help here in Portugal – in case you have a recommendation for that?

Thank you again for this comprehensive article, it was incredibly helpful!

-R

Thank you, glad you found this helpful! As I mention in the article, I am happy to connect any reader with the lawyers I regularly consult with. Just get in touch.

Hi Jean, would you recommend creating a company in Madeira (IBCM)? It seems like a good solution for business owners moving to Portugal under the NHR (5%

Corporate Income Tax applicable to all income earned

outside of Portugal). So I am surprised not to see it mentioned on your page, can you please let me know your thoughts? Thanks in advance, Nico

Yes, Madeira is a very interesting option as well. I have written a separate guide about the NHR programme and included my thoughts on Madeira there. I would always recommend you consult a competent lawyer before you go forward with this setup though, as it’s on the more exotic side.

Hi Jean

I am considering moving to Asia, would it be possible to compare best Asian countries to live in?

Singapore

Thailand

Japan

Vietnam

That would be a fun comparison Lawrence, but they are really different so the article wouldn’t really do them justice.

Here’s my take though. I would choose Singapore if I want a clean and professional setting with lots of networking opportunities, stable politics and a favorable and well-recognized tax regime.

I would spend a few months a year in Japan; it’s an amazing country and probably my favorite place to visit, but also very particular, and as a foreigner I don’t think I could ever fully integrate into Japanese culture. I would, however, immensely enjoy immersing myself into it for a few months every year.

Thailand is a great place to spend the winter months for Europeans and Americans. Lots of things to do and can be a life-changing experience. However, it is not a developed place that is comparable to Western cities and countries. Again, I can’t see myself staying there long-term, but I’ve wintered there on multiple occasions and the stays were memorable and life-changing for me, especially from a personal growth perspective.

I didn’t really vibe with Vietnam that much. I would like to visit again, and the food was definitely spectacular.

Hi Jean,

thanks a lot for this really detailed article, and for your blog, I spent 3 years in Malta and left in 2017 for pretty much the reasons you explained in another blog post…

I read that under the NHR, individuals are taxed at a flat rate of 20%, which can be lowered to 15% for specific professions, such as software developer, artist, etc.

Would it be correct to assume that a software developer working as a freelancer could invoice international clients simply by using a Portugal tax number – no company setup required – and basically pay 15% flat?

And if a company is needed, why not simply create an LLC in Delaware and pay the salaries as dividends, as it’s not taxed in the US, it would still be taxed in Portugal, I guess at 21% – Portugal’s corporate tax rate?

In the case of a small/medium business – say 200k annual turnover – creating a setup such as the Maltese trading & holding companies, and adding substance by paying for an office, hiring 2 employees would probably cost around 60k a year – so it’s a 30% cost. I guess it’s only interesting if the company makes at least 400k profit yearly.

I am happy to pay 15-20% taxes to live in / support a country that I like, I am just trying to find a simple setup.

Thanks in advance, I am looking forward to your feedback.

Hi Nico, I think you also have to consider pension costs in Portugal (that I think you are forced to pay that is around 10%).

I’m in the same boat as you (software working for US and researching Portugal now) if you want to get in touch to share information about this my email is [email protected]

Thanks for the informative article.

I’m from Malta and trying to set up a startup. The product is a game and therefore income would be through royalties from a publisher or payments from stores. The current situation with the banks and grey listing of Malta is making it extremely difficult to accept USD as they are being blocked as soon as they directed to a Maltese bank account. I was looking for options to set up the company abroad, somewhere like in Ireland. So it’s not really for tax optimization but to actually do business smoothly.

I’m still trying to improve my financial education, so I apologize if this is a trivial question:

I know that Ireland’s CT is lower than Malta. However I’m not sure how one could take advantage of that lower CT. AFAIK when getting dividends from the company it would also be taxed by Malta, thus loosing the lower CT advantage of Ireland. I think I am missing some important part of the puzzle. Would be great if you could shed some light on my confusion.

Yes, corporate and personal tax are really two different things, and you must think of both when considering the right setup.

In your case, if it were possible to do so, moving to Portugal and establishing personal residence there on the NHR programme would be the ideal move, since you’d be able to combine the Irish low corporate tax with the 0% tax on dividends in Portugal under the NHR.

I am an Italian citizenship residing in Bulgaria for trading activities. By several years, personally I deal also with some virtual brokers on investments for buying and selling stock shares, just few savings. With the increase of my gains I have decided moving my resident status in Cyprus or Malta (both more convenient for this purpose)…unfortunately is very difficult to know someone really with deep experience on which is the right place to incorporate, because these 2 countries do not offer a good standing for these operations. 1) Cyprus is a zero taxes country for trading in stock shares – problem: Banks in Cyprus charge a lot of money on accounts and only few of them works seriously…is not true that they recovered by the financial crisis of the 2013, they are still bandits instead opening their doors to many criminals from Russia. 2) Malta, many troubles for operating outside the country…they change rules many times and nothing is clear for who want a stability future…..problem: Malta remittance basis fight with personal residence in the same island……….Let me know your solution, please not a copy and paste of a lot of millions website in which all repeats the same words words and words…..thanks

Hi Jean!

Very nice post, thank you!

Why do you prefer considering the Holding company in Malta vs Cyprus (0% dividens taxation)?

Thanks

Both are good options for holding companies, I prefer Malta’s reputation (despite the grey listing) and geographical position in Europe as well as the more international vibe there. Also, the setup I describe leads to effective taxation of 5% in Malta with a holding and trading company there, whereas in Cyprus it is 12.5%. Malta does not withhold any tax on dividends either.

Hey Jean, thanks a ton for this article!

I’m a bit confused though, to me being a digital nomad means being location independent and moving to new countries throughout the year. I usually never stay in a single country for more than 2 months and most of these setups seem to rely on staying in a country full time (or at least for over half a year). Am I missunderstanding something?

Hey Jesco, I recommend reading my article about taxation for digital nomads.

Hi Jean

Thank you for your article using a Malta Company and Portugal for residence.

Would Portugal not consider the Malta Company as a Portuguese Company given the fact the Management and control are from Malta?

Yes, unless you have a management structure and team in Malta that would be a possibility.

Hi Jean

I live and run one person consultancy business in the UK. I do it 95% from my home office with occasional business trips/meetings elsewhere. I have been thinking for a while about moving somewhere south where the weather is better and taxes are lower. Portugal would certainly be an option but would it be feasible to have “management structure and team in Malta” for a one man company while living in Portugal? If not then combination of 20% tax and significant social security contributions is not as attractive.

“As of 2021, I believe the best tax setup for most working individuals and families to be comprised of Malta for the corporate setup and Portugal for personal residence.”

1. Do you have any advice for Maltese residents/domiciles please? Does the above hold if you were to move to Portugal?

2. You mention one strategy being to have a company in a low corporate tax jurisdiction and then paying yourself a salary/dividends in your resident jurisdiction (or waiting until you move to a more favourable jurisdiction before you pay yourself real money). Any advice for Maltese residents/domiciles please?

Hi Karl, that setup would not work for Maltese residents or domiciles, but there are other good setups for that case. Contact me privately and I can put you in touch with an international tax lawyer.

Thank you for the overview. I am doing research myself so I know how ward and time consuming it must have been.

My case is that i started investing in stock markets few years ago and it is going pretty good. I am from SK where if I sell after one year of owning the stocks it is tax-free and I pay nothing else(few other countries are the same and I think CZ has 3y period instead of 1). If I would sell sooner it would get taxed at standard 21% and as it would be considered taxable income and I would have to pay healthcare and maybe social security which would bring it up to crazy 50%.

This works for me right now when I am a passive investor and I am building my wealth slowly, but I see two issues: a) I want to move elsewhere for better weather and b) sometimes I would like to sell before the year of ownership passes(I am losing good opportunities on the market) and be a bit more proactive investor.

The problem with moving elsewhere is that if I would spend more than half a year in another country, maybe rent or buy a house, it would become my tax residence and I would lose this advantage of zero tax after one year ownership. Obviously I would not go to a worse jurisdiction than I am right now. Sure, I could travel every few months to avoid the 183 day period but I would prefer to have a choice of travel instead of being forced to travel. Plus you lose the feeling of being actually in your own home.

When you add my second point, I would become full tax payer even at home which would get very expensive.

So I wonder if you have a setup in mind that could work for my use case?

I have some ideas but I don’t want to be spamming this comment section.

Cheerio.

Hi Jean,

We are a UK based company and we plan to start small scale operations in the following 10 European countries (Ireland, Belgium, France, Germany, Switzerland, Italy, Spain, Denmark, Norway and Sweden.) I was wondering what would be the most efficient holding and branch structure from taxation perspective.

We were leaning towards Ireland as the main holding company and branch in each of the rest, also since we will have physical office and 1-2 team members in each of the countries we might fall under permanent establishment and hence might have to report local tax returns in each country as well.

Would love to know your thoughts if we should explore any alternate structure ?

Thanks in advance.

Regards

Priyaj

Hello Priyaj,

In my opinion, the most efficient structure for your case will be:

1. a holding company registered in Cyprus (developed and flexible legislation, tax-free incoming and outgoing dividends, solid network of local service providers)

2. an operational company in Ireland (12,5% corporate tax, compensated by a great selection of professional staff to be hired locally). If you incline towards Eastern Europe, I would recommend looking at Hungary (9% CT) and Bulgaria (10% CT).

Best regards,

Anton

This looks like a solid setup Anton, but why not use Malta at least for the operational company part?

Hi Jean,

Have you heard about Canary Islands’ ZEC zone? If so, what is your opinion about that option?

Cheers

Yes, I have, that’s ideal if you actually want to relocate there. It’s not a bad place but I don’t like the idea of moving somewhere purely for tax purposes. That would be the same problem with places like Sark as well.

Amazing article! Thanks a lot.

Have you ever looked at the Isle of Man? Their corporate tax is 0%. Would a company holding in IoM + residence in Portugal work better than the Malta + Portugal scheme?

Yes, they have a 0% corporate tax rate, but I would qualify it as one of the more exotic options that’s not really worth the trouble in most cases. It’s very well known as being purely a tax haven, and moreover is not in the European Union. I wouldn’t bother with countries that have either little economic and banking stability or are outside the EU. So in my view Malta remains far superior.

Very interesting and informative description.

Could you also cover the CEO taxation? Is there minimum CEO salary levels? can the scenarios be ranked based on non resident CEO taxation?

Hi, thanks for the informative blog post.

I am a Maltese resident and domiciled here and was thinking of moving to portugal both to explore the place and also to get a tax advantage. I will be working remotely (with a maltese company) and registered as a self emplpyed in portugal. Will I be able to benefit from the NHR 0% tax of portugal (after 183 days) and not having to pay any taxes to Malta or will I still need to pay some taxes here even though I ll be a tax resident in portugal?

You will be liable for tax in Portugal and not in Malta as you will be tax resident where you spend most of the year. Whether you get a 0% tax rate depends on how you structure your contract and how your job is classified in Portugal. I can put you in touch with a Portuguese lawyer to give you definite answers, just get in touch.

He Jean Galea,

I am looking to obtain an NHR in Portugal, I already have an existing company structure, but the mother is located in Liechtenstein which is on the blacklist in Portugal. So I am looking for two things a lawyer in Portugal to do my NHR application, I have already been in contact with one, but he is simply too slow. The other thing is wether I can use a Maltese company as a holding company to place my current holdings in. I will have an evaluation on my currents holdings and place them in the Maltese company, these assets should then be concidered as a loan from me personally and I would be able to take this value out as a passive income. Would this be possible in your perspective?

Contact me using the form provided and I can connect you to the right people.

What if your income is purely online content & digital products based, how do you determine if business in done in Malta or Portugal?