Malta is an attractive destination for setting up companies due to its unique taxation system, which offers several benefits for non-resident and non-domiciled individuals.

Over the years, I’ve delved very deep into the topic of tax optimization, and if you haven’t done so already, I recommend starting off with my article on low tax strategies in Europe, where I cover the basics and also suggest a few different setups involving other countries in addition to Malta.

In this article, I will discuss Malta’s full imputation system, how it impacts both resident and non-resident shareholders, and how to structure companies for maximum tax efficiency.

Malta’s Full Imputation System

Malta is the only country in Europe that operates a full imputation system for corporate taxation. This means that corporate profits are taxed to the company at a rate of 35%.

However, when dividends are distributed to individuals out of taxed profits, the dividend carries an imputation credit of the tax paid by the company on the profits so distributed.

Essentially, this system eliminates the economic double taxation that arises under the classical system.

Implications for Resident Shareholders

In Malta, personal taxation is based on a progressive system, with rates ranging from 15% to 35%.

Therefore, for shareholders who are residents of Malta, since the current rate of income tax applicable to companies is 35% and the maximum rate applicable to individuals is also 35%, the receipt of a dividend out of these tax accounts can never result in a shareholder having to pay additional tax on receipt of the dividend.

Implications for Non-Resident Shareholders

Non-resident shareholders, on the other hand, will not be taxed in Malta on their dividends but would still need to declare the receipt of the dividends in their country of residence and pay tax there.

This creates a situation where it would be very disadvantageous to set up a company in Malta if you’re a non-resident shareholder because you’d have to pay the 35% corporate tax plus the tax on dividends in your country.

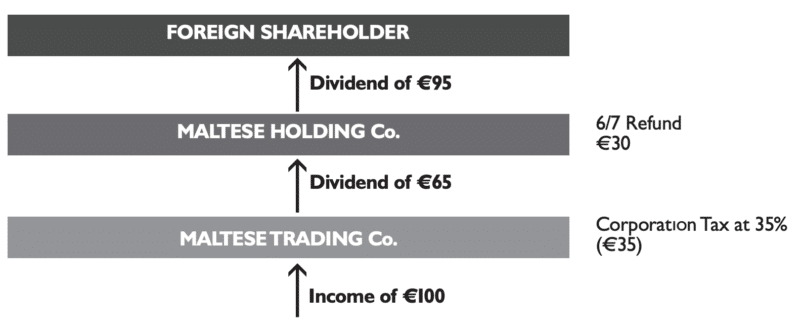

To address this issue, Malta offers a 6/7ths refund on the corporate tax paid in Malta if the shareholder is a non-resident and non-domiciled person. This brings down the effective corporate tax rate in Malta to 5%.

Who is this Setup Good For?

With that basic knowledge of how the full imputation system works and how it affects resident and non-resident company shareholders, let’s dig deeper into who the Malta setup is ideal for. I will list a few eligibility criteria for setting up in Malta.

- Shareholder Structure: The company can be owned by individuals or corporate entities, either resident or non-resident. It’s crucial to understand the tax implications for shareholders in their country of residence, as they may be subject to additional taxes on dividends received from the Maltese company.

- Business Activity: The company must carry out genuine business activities, whether trading, holding, or a combination of both. Purely shell or paper companies without substance are not eligible for the 5% effective tax rate.

- Tax Residency: To benefit from Malta’s tax system, the company must be considered tax resident in Malta. This typically means that the company is either incorporated in Malta or, if incorporated elsewhere, managed and controlled from Malta.

- Compliance with Maltese Regulations: The company must adhere to all relevant Maltese regulations, including company law, tax law, and anti-money laundering regulations. This includes timely submission of tax returns, financial statements, and other necessary documentation.

Optimizing the Company Structure in Malta

To make the most of Malta’s tax system, I recommend the following structure with two companies based in Malta:

- Set up a Maltese Trading Company that generates income from its trading activities.

- The Maltese Trading Company pays Malta Corporate Tax of 35% on net profits.

- Upon distribution of dividends to the Maltese Holding Company, the latter may claim a 6/7 refund of Malta corporate tax paid by the Maltese Trading Company.

- Dividend income and the tax refund received by the Maltese Holding Company are not liable to any further tax in Malta.

- The Maltese Holding Company can distribute in full both the tax refund and the dividend income received to its foreign shareholder.

- No withholding taxes are applied on dividends paid to the foreign shareholder.

This structure results in a net tax rate of 5% on company profits in Malta (after receiving the 6/7ths tax refund) plus the taxation on dividends received in the shareholder’s country of residence.

Keep in mind that as a shareholder, you will still need to pay taxes on dividends in the country where you are fiscally resident.

For example, if the shareholder is a resident of Spain, he would pay between 19% and 26% of tax on the dividends received from the Maltese company, since no withholding tax was applied at the shareholder level in Malta. As another example, if the shareholder lives in France, he will pay 30% (flat savings tax rate in France) on the net amount of dividends received from the Maltese company.

That is why I think pairing a company structure in Malta with living in Portugal is the perfect combination, since under the NHR program you’d be exempt for paying taxes on dividends for 10 years.

Can You Have Your Holding Company in Another Country?

It is not essential to have the holding company also based in Malta. There are many cases where having the holding company based in another country makes more sense.

The biggest two reasons not to have the holding in Malta would be the following:

- The setup involves a big company that has been operating its holding company in another country for many years. Moving that holding company would be a big hassle, not to mention potentially causing the ire of the local tax authorities and attracting unwanted attention.

- The ultimate beneficial holder might want to establish a presence in multiple countries (perhaps due to his flag theory preferences), or he might want to perform other investments from the holding company that are easier done if the holding company is placed elsewhere not Malta.

When structuring your business this way, the Maltese trading company would operate and generate income from its activities, while the holding company in the other country would own the shares in the Maltese trading company.

To determine the most convenient country for the holding company, consider the following factors:

- Double Taxation Treaties: Check if the chosen country has a double taxation treaty with Malta, as these agreements often help reduce or eliminate withholding taxes on dividends, interests, and royalties. This can enhance tax efficiency when distributing profits from the Maltese trading company to the holding company.

- Tax Regulations: Assess the tax regulations of the holding company’s country of residence, including taxes on dividends received from the Maltese trading company, capital gains tax on the sale of shares, and other relevant taxes. Ideally, choose a jurisdiction with low or no taxes on such income.

- Holding Company Requirements: Some countries have specific legal and regulatory requirements for holding companies, such as minimum capital requirements, local directorship, or annual reporting obligations. Be aware of these requirements and ensure they align with your business plans and resources.

- Substance Requirements: Consider the economic substance requirements in the holding company’s jurisdiction. Some countries may require a physical presence or a minimum level of economic activity to access their tax benefits. Ensure you can meet these requirements to maintain tax efficiency.

- Confidentiality and Privacy: Evaluate the level of confidentiality and privacy provided in the chosen jurisdiction. Some countries offer higher levels of privacy protection for shareholders and company ownership information.

Some popular jurisdictions for holding companies include Cyprus, the Netherlands, Luxembourg, and Singapore. Each jurisdiction has its own set of advantages, and selecting the most suitable one depends on your specific business goals, tax planning objectives, and the relationship between the jurisdictions involved.

Additional Benefits

There are two additional big benefits of operating a corporate structure in Malta, one of them fairly new. Let’s have a look at them.

Tax Payment Deferral

In Malta, companies with most of their income sourced outside of Malta can benefit from a tax deferral mechanism, allowing them to defer their tax payments by up to 18 months. This provision can offer significant cash flow advantages and flexibility for businesses, especially those that rely on reinvestments or are in a growth phase.

Here’s an overview of the tax deferral mechanism in Malta:

- Eligibility: To be eligible for the tax deferral, the majority of a company’s income must be sourced from outside Malta. The company must also meet all other tax compliance requirements, including accurate and timely filing of tax returns and the provision of necessary documentation.

- Tax Deferral Period: The tax deferral allows companies to postpone their tax payments by up to 18 months from the end of the accounting period in which the income was generated. This means that if a company’s accounting period ends on December 31, the tax payment can be deferred until June 30 of the following year, at the earliest.

- Application Process: To benefit from the tax deferral mechanism, companies must apply with the Maltese tax authorities, providing details about their income sources and the reasons for requesting the deferral. The tax authorities may ask for additional documentation to support the application.

- Cash Flow Benefits: The tax deferral can provide significant cash flow advantages for companies, allowing them to use the funds that would otherwise be paid as taxes for other business purposes, such as reinvestments, expansion, or working capital management.

- Interest and Penalties: It’s important to note that deferring tax payments does not mean avoiding them altogether. Companies must eventually pay the deferred taxes, along with any interest or penalties that may apply if the tax payment is not made within the allowed deferral period.

The tax deferral mechanism in Malta can be an attractive option for companies with income primarily sourced from outside the country.

Consolidated Accounts for Holding and Trading Companies

Starting from 2021, Malta introduced new rules that allow for the submission of consolidated tax statements by Maltese holding and trading companies. This change brought a significant improvement to the Maltese tax system, streamlining the process and providing certain benefits to companies operating under this structure.

Benefits of Consolidated Tax Statements in Malta:

- Simplified Tax Reporting: Under the new rules, holding and trading companies can submit a single consolidated tax statement, rather than filing separate tax returns for each company. This simplifies the reporting process and reduces the administrative burden on companies.

- Faster Tax Refunds: Previously, companies in Malta had to first pay the full 35% corporate tax and then wait for the 6/7ths tax refund, which could take around a year. With consolidated tax statements, the effective tax rate of 5% can be applied directly, eliminating the need to wait for the refund. This allows companies to access their funds more quickly, which can be especially beneficial for reinvestments and cash flow management.

- Reduced Compliance Risks: Consolidated tax statements reduce the risk of errors or inconsistencies in tax reporting between the holding and trading companies. By submitting a single statement, companies can ensure that all relevant information is accurately reported and consistent across both entities.

- Enhanced Transparency: Submitting a consolidated tax statement provides a clearer picture of the overall financial performance and tax position of both the holding and trading companies. This can help business owners, investors, and other stakeholders to better understand the financial health of the group.

- Potential Interest Savings: Since companies no longer need to wait for the tax refund, they can potentially save on interest costs associated with borrowing funds to cover cash flow requirements during the refund waiting period.

This change in the law further enhances the tax efficiency of Maltese companies for non-residents.

Is Malta Right for You?

While setting up in Malta is generally a very good idea to explore, and I know many companies who have gone down this route successfully, I would also like to make it clear that this setup is not for everyone.

There are certain situations where opening a company in Malta may not be a viable or advantageous option:

- Limited Substance: If the company would not have sufficient substance in Malta, such as a physical presence, employees, or genuine economic activities, it may not be considered tax resident in Malta and could face challenges in benefiting from Malta’s tax regime or accessing double tax treaties.

- High-Tax Jurisdictions: For individuals or corporate shareholders residing in high-tax jurisdictions with stringent Controlled Foreign Corporation (CFC) rules, the benefits of Malta’s tax system might be limited. In some cases, the income of the Maltese company could be attributed back to the shareholders and taxed in their country of residence.

- Unfavorable Tax Treaties: If the country of residence of the company’s shareholders or the countries where the company’s income is sourced have unfavorable tax treaties with Malta, it could result in higher withholding taxes or limit the benefits of Malta’s tax system.

- Regulatory Restrictions: In some industries or sectors, regulatory restrictions in either Malta or the company’s country of operation could make it difficult or even impossible to set up a Maltese company. For example, certain financial services, gambling, or cryptocurrency businesses may face stricter licensing requirements or prohibitions.

- Small Business or Sole Entrepreneur: For small businesses or sole entrepreneurs with limited profits, the added complexity and costs of setting up and maintaining a company abroad may outweigh the potential tax benefits. Establishing a company in Malta involves registration fees, annual expenses, and professional service fees for accounting, auditing, and legal support. Additionally, managing cross-border operations can be time-consuming and challenging. In such cases, it may be more beneficial to focus on growing the business domestically before considering international expansion or tax planning strategies.

The most common mistake I see is point number 5, and this doesn’t just apply to Malta. I see too many freelancers and small business owners that try to attempt such a setup prematurely. You will hear many stories of people and companies who are paying low taxes because of their setups, but establishing these structures and keeping them running is no joke. You have to be ready to spend money and deal with the additional complexity (cultural differences, language barriers, different laws etc.) that operating in another jurisdiction bring with them.

However, let’s say that your case is ideal for exploring a corporate setup in Malta. You should also be aware of certain important downsides of setting up a company in Malta:

- Size and Limited Market: Malta is a small island nation with a limited domestic market, which may not be ideal for businesses that rely heavily on local demand. However, its strategic location in the Mediterranean and EU membership can mitigate this issue for companies focused on international trade.

- Regulatory Complexity: Navigating Malta’s tax landscape can be complex, especially for businesses unfamiliar with the country’s tax laws and regulations. It’s essential to seek professional advice and ensure compliance with all relevant requirements when setting up a company in Malta.

- Reputational Risks: In recent years, Malta has faced criticism over issues related to money laundering, corruption, and financial transparency. While the Maltese government has taken steps to address these concerns, businesses operating in Malta should be mindful of potential reputational risks and maintain strong corporate governance practices.

- Limited Local Talent Pool: While Malta has a skilled workforce, its small population size may limit the availability of local talent in specialized fields. Companies in niche industries may need to invest in training or recruit professionals from abroad to meet their staffing needs.

- Increased Reporting Requirements: As a result of the country’s efforts to improve its financial transparency, companies operating in Malta may face increased reporting and compliance requirements. This can lead to additional administrative burdens and costs for businesses.

- Banking Challenges: Opening a bank account in Malta has become increasingly difficult, particularly for non-residents and foreign-owned companies. Due to strict anti-money laundering regulations and compliance requirements, Maltese banks have adopted stringent due diligence procedures, leading to lengthy account opening processes and higher rejection rates. This can pose a significant challenge for businesses seeking to establish a presence in Malta, as access to banking services is essential for smooth operations. It may be necessary to explore alternative banking options, such as international banks or fintech solutions, which could add additional complexity and costs to the company setup.

To finish off, let’s have another rundown of the benefits of setting up in Malta.

- Attractive Tax System: Malta’s full imputation system, combined with the 6/7ths refund mechanism for non-resident and non-domiciled shareholders, results in an effective corporate tax rate of just 5%. This is one of the lowest rates in the European Union, making Malta an attractive destination for businesses seeking tax efficiency.

- Consolidated Tax Statements: Maltese holding and trading companies can submit consolidated tax statements, simplifying tax reporting and enabling businesses to directly apply the 5% effective tax rate without waiting for a refund. This can significantly improve cash flow management for businesses operating under this structure.

- Tax Deferral Mechanism: Companies with most of their income sourced outside of Malta can defer their tax payments by up to 18 months, providing additional cash flow benefits and flexibility for businesses that rely on reinvestments or are in a growth phase.

- EU Membership: Malta is a member of the European Union, which means that Maltese companies can benefit from access to the European single market, free movement of goods, services, and capital, and reduced trade barriers with other EU member states.

- Skilled Workforce: Malta is home to a highly-skilled, multilingual workforce, with many professionals proficient in English, Italian, and other European languages. This can be advantageous for businesses looking to tap into the European market.

- Eurozone Membership: Malta’s membership in the Eurozone, having adopted the euro as its currency in 2008, offers additional benefits for businesses. Operating in a country that uses the euro eliminates currency exchange risks and simplifies cross-border transactions within the Eurozone. As a member of the European Union, Malta enjoys seamless access to the EU’s Single Market, promoting easier trade with other EU countries and enhancing a company’s credibility. This membership also provides the potential for businesses to access EU funding programs and grants, which can be particularly beneficial for startups and small-to-medium-sized enterprises seeking financial assistance.

I hope that I have been able to paint a good picture of what the setup in Malta looks like and who would best benefit from it.

If setting up in Malta sounds interesting, I would recommend getting professional advice early on to determine whether the structure is really suitable for your specific circumstances. The tax landscape can be complex, and it’s essential to understand the implications and compliance requirements before setting up a company in Malta.

To help you navigate this process, I am happy to connect you with my lawyers in Malta for a free consultation. By filling out this form on my website, you can receive personalized guidance on the potential advantages and challenges of establishing a Maltese company, tailored to your unique situation.

I think that Malta remains one of the top places in Europe for corporate setups, especially if the ultimate beneficial owner can move to Portugal to make use of the NHR setup. This gives the best of both worlds, with corporate taxation in Malta at 5% and 0% tax on dividends (for the 1st 10 years under NHR) received in Portugal by the shareholder in Portugal.

Scalable Capital

Scalable Capital