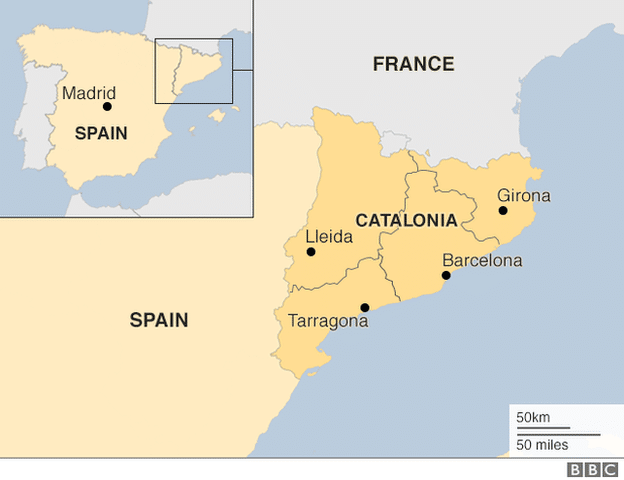

In 2019 I had the opportunity to train at a center here in Barcelona (GlobalPerformance) that specialises in isoinertial training methodology and equipment. It was the first time I did this type of training so I took some notes.

This is a type of training originally developed for outer space use since it doesn’t rely on gravity as the traditional weight machines do.

In the video below, you can observe some exercises that can be done with the pulleys and flywheels used in this type of training.

The nice thing is that the machines could be attached with a monitor that took note of each concentric vs eccentric movement of my muscles and measured the variation between them. In just one session I was able to observe the weak points of my body and that gave me a very good indication of what I need to be working on for gaining further strength while at the same time preventing injury.

This type of training is excellent for tennis and padel training as there’s a lot of emphasis on correct posture and using the whole kinetic chain effectively for every movement, and this can transfer very well to our oncourt performance.

Road accidents are something that people can never prepare for. No matter how cautious a driver you are, there are some things beyond your control that can inevitably lead to a road crash. That being said, an accident on two wheels has potentially more damaging consequences to the driver and its passengers when compared with an accident on a four wheeled vehicle.

Road accidents are something that people can never prepare for. No matter how cautious a driver you are, there are some things beyond your control that can inevitably lead to a road crash. That being said, an accident on two wheels has potentially more damaging consequences to the driver and its passengers when compared with an accident on a four wheeled vehicle.

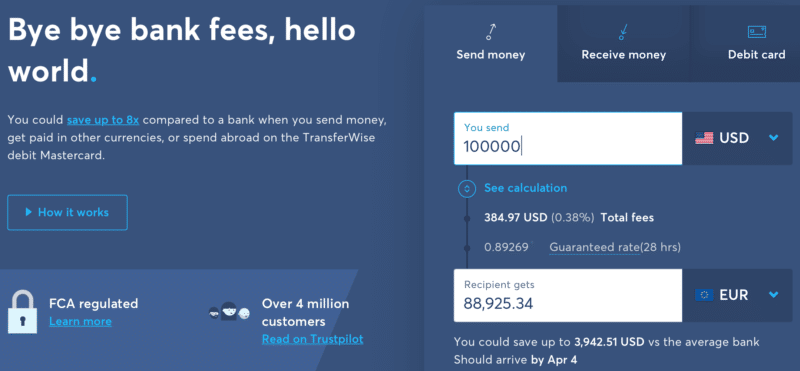

When searching for articles about investment and making money, you will surely come across many bloggers who publish their monthly income reports or also post net worth reports.

When searching for articles about investment and making money, you will surely come across many bloggers who publish their monthly income reports or also post net worth reports.