If you’re building an app, digital product, or tool — and want to offer premium features, subscriptions, or supporter perks — you’re faced with a critical decision:

👉 How do you manage payments, entitlements, and gated access without reinventing the wheel?

There are more options than ever before. And while tools like Stripe and Gumroad are well-known, platforms like RevenueCat, Lemon Squeezy, and Buy Me a Coffee offer different trade-offs for developers, creators, and indie hackers.

In this post I break down the leading options, when to use each, and how to choose based on your goals, technical comfort level, and future plans.

👑 What is RevenueCat?

RevenueCat is a platform designed to manage in-app purchases, subscriptions, and feature gating across iOS, Android, and web. It acts as a single source of truth for customer entitlements — meaning you don’t have to build your own subscription logic or integrate directly with Apple and Google SDKs.

🧭 What Are the Alternatives?

Let’s compare RevenueCat to other popular platforms, across key criteria:

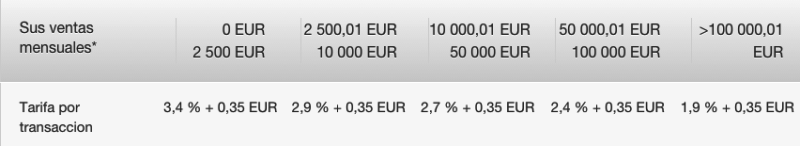

1. Stripe Billing

Best for: SaaS products, web apps, content paywalls, digital tools

- ✅ Highly customizable billing system

- ✅ Clean API and global support

- ❌ You must handle subscription logic and entitlements yourself

Use when: You’re building a web-only product and want full control over plans, usage, and access.

Example: We use this for selling WordPress plugins in combination with an e-commerce plugin for WordPress (WooCommerce or EDD).

2. Gumroad

Best for: Selling digital products like eBooks, templates, and files

- ✅ Fast to start selling

- ✅ Handles taxes automatically

- ❌ Not built for feature gating or subscriptions

Use when: You’re a creator selling downloads or one-time content.

Example: Wrote an ebook you want to monetize? Or a one-time payment to join a digital community? Gumroad is perfect for that.

3. Lemon Squeezy

Best for: Indie SaaS + creators who want a “Stripe + Gumroad” experience

- ✅ Handles taxes, licensing, and subscriptions

- ✅ Clean checkout, no-code options

- ❌ Smaller ecosystem than Stripe

Use when: You want SaaS-like functionality with less legal and tax hassle.

Example: You’re offering a membership, digital service, or software license — Lemon Squeezy makes subscriptions straightforward and also handles EU VAT.

4. Buy Me a Coffee / Ko-fi

Best for: Donations, supporter perks, and lightweight memberships

- ✅ Easiest setup

- ✅ Great for content creators

- ❌ Not for app-based feature gating

Use when: You want a donation button or casual supporter system.

Example: You write a blog and want a way to let your fans support you.

5. DIY (Stripe + Firebase/Supabase)

Best for: Custom flows and full control

- ✅ Build exactly what you want

- ✅ Integrate with any backend or UI

- ❌ You build and maintain everything

Use when: You have technical capacity and want full ownership of the billing and access logic.

6. RevenueCat

Best for: Mobile apps and cross-platform products with premium feature access

- ✅ Works with iOS, Android, and Web

- ✅ Unified API for subscriptions and entitlements

- ✅ Built-in analytics, experiments, and testing tools

- ❌ Doesn’t process payments — you still use Stripe or app stores

Use when: You want to offer paid features or subscriptions across platforms without building custom logic for each one.

🔍 Summary Table

| Platform | Best For | Feature Gating | Mobile Support | Subscriptions | Payment Processor |

|---|---|---|---|---|---|

| da | Mobile & cross-platform apps | ✅ | ✅ | ✅ | App Store / Google Play / Stripe |

| Stripe Billing | Web apps and SaaS | ✅ (DIY) | ❌ | ✅ | Stripe |

| Gumroad | Digital products | ❌ | ❌ | ⚠️ Basic | Gumroad |

| Lemon Squeezy | Creators / licensing / SaaS | ✅ | ❌ | ✅ | Lemon Squeezy |

| Buy Me a Coffee | Donations / lightweight perks | ❌ | ❌ | ⚠️ Minimal | BMAC / Stripe |

| DIY (Stripe + Firebase) | Custom apps and control | ✅ | ✅ (manual) | ✅ | Stripe + custom |

💬 Final Thoughts

There’s no one-size-fits-all solution — but you don’t have to start from scratch either.

Here’s the simple rule of thumb:

- ✅ Use Gumroad or Lemon Squeezy to sell content

- ✅ Use Stripe or RevenueCat to sell access/features

- ✅ Use RevenueCat if you plan to go mobile

- ✅ Start simple — switch later if the project proves itself

If you’re planning monetization, this decision sets the foundation. Choose the tool that saves you time, handles what you don’t want to build, and grows with your product.